Question: Refer to the information presented in M6–

Refer to the information presented in M6–17. Calculate the break-even point if Edgewater’s total fixed costs are $230,000.

Data from M6-17:

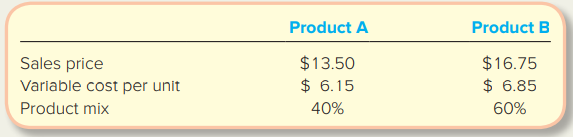

Edgewater Enterprises manufactures two products. Information follows:

> Paradise Corp. has determined a standard labor cost per unit of $12 (0.5 hour × $24 per hour). Last month, Paradise incurred 950 direct labor hours for which it paid $22,325. The company produced and sold 1,950 units during the month. Calculate the direc

> Cambridge Manufacturing Company applies manufacturing overhead on the basis of machine hours. At the beginning of the year, the company estimated its total overhead cost to be $325,000 and machine hours to be 25,000. Actual manufacturing overhead and mac

> Use the following terms to complete the sentences that follow; terms may be used once, more than once, or not at all: Static Flexible Volume Spending Production manager Variable overhead rate Variable overhead efficiency Fixed overhead spending Purchasin

> Refer to the information in M8–8 for Becker Bikes. Each unit requires 3 wheels at a cost of $5 per wheel. Becker requires 20 percent of next month’s material production needs on hand each month. July’s production units is expected to be 450 units. Prepar

> Becker Bikes manufactures tricycles. The company expects to sell 350 units in May and 480 units in June. Beginning and ending finished goods for May is expected to be 95 and 60 units, respectively. June’s ending finished goods is expected to be 70 units.

> Refer to the information in M8–6 for Preston, Inc. Each unit requires 1.75 hours of direct labor, and labor wages average $9 per hour. Prepare Preston’s direct labor budget for July and August. Data from M8-6: Preston, Inc., manufactures wooden shelving

> Preston, Inc., manufactures wooden shelving units for collecting and sorting mail. The company expects to produce 480 units in July and 400 units in August. Each unit requires 10 feet of wood at a cost of $1.50 per foot. Preston wants to always have 300

> Beatrice Company estimates that unit sales of its lawn chairs will be 7,200 in October; 7,400 in November; and 7,100 in December. Prepare Beatrice’s sales budget for the fourth quarter assuming each unit sells for $27.50.

> Classify each of the following budgets as an operating (O) or financial (F) budget: a. Cash budget b. Sales budget c. Direct materials purchases budget d. Selling and administrative expense budget e. Budgeted balance sheet f. Manufacturing overhead budge

> Match each of the terms by inserting the appropriate definition letter in the space provided. Not all definitions will be used. 1. Cash Budget 2. Financial Budgets 3. Short-Term Objective 4. Strategic Plan 5. Budgeted Cost of Goods Sold 6. Budgeted Balan

> Calypso Cal (CC), which manufactures surfboards, has a “Live today, worry about tomorrow later” motto. In keeping with this philosophy, CC has not set any long-term or short-term objectives or budgets for the company. Describe three potential consequence

> Garfield Corp. expects to sell 1,300 units of its pet beds in March and 900 units in April. Each unit sells for $110. Garfield’s ending inventory policy is 30 percent of the following month’s sales. Garfield pays its supplier $40 per unit. Prepare Garfie

> Mulligan Manufacturing Company uses a job order cost system with overhead applied to products at a rate of 150 percent of direct labor cost. Selected manufacturing data follow: Required: Treating each case independently, find the missing amounts for lett

> Crew Clothing (CC) sells women’s resort casual clothing to high-end department stores and in its own retail boutiques. CC expects sales for January, February, and March to be $450,000, $510,000, and $530,000, respectively. Twenty percent of CC’s sales ar

> Lindell Company made direct material purchases of $48,000 and $60,000 in September and October, respectively. The company pays 60 percent of its purchases in the month of purchase and 40 percent is paid in the following month. How much cash was paid for

> Getty Company expects sales for the first three months of next year to be $200,000, $235,000, and $298,000, respectively. Getty expects 35 percent of its sales to be cash and the remainder to be credit sales. The credit sales will be collected as follows

> Fillmore, Inc., expects sales of its housing for electric motors to be $87,000, $81,000, and $92,000 for January, February, and March, respectively. Its variable selling and administrative expenses are 8 percent of sales, and fixed selling and administra

> Winslow Company expects sales of its financial calculators to be $200,000 in the first quarter and $236,000 in the second quarter. Its variable overhead is approximately 19 percent of sales, and fixed overhead costs are $46,500 per quarter. Prepare Winsl

> Refer to the information in M8–8 for Becker Bikes. The company’s variable overhead is $2.50 per unit produced and its fixed overhead is $3,000 per month. Prepare Becker’s manufacturing overhead budget for May and June. Data from M8-8: Becker Bikes manuf

> Refer to the information in M8–8 for Becker Bikes. Each unit requires 1.5 direct labor hours and Becker’s hourly labor rate is $12 per hour. Prepare Becker’s direct labor budget for May and June. Data from M8-8: Becker Bikes manufactures tricycles. The

> Your boss believes that the three management functions of planning, directing/leading, and controlling are unrelated. He also thinks that managerial accounting has no role in any of the functions. Is your boss correct? Explain why or why not.

> More Parts Liquidators specializes in buying excess parts inventories for resale or to incorporate into other products. They recently purchased parts for $100,000 and they have a buyer willing to pay $120,000. The company can also incorporate these parts

> Blowing Sand Company also has the Blast fan model. It is the company’s top-selling model with sales of 30,000 units per year. This model has a dual fan as well as a thermostat component that causes the fan to cycle on and off depending on the room temper

> Wheeler’s Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs and expenses for the coming year follow: Required: 1. Calculate the predetermined o

> Suppose you have just finished your third year of college and expect to graduate with a bachelor’s degree in accounting after completing two more semesters of coursework. The salary for entry-level positions with an accounting degree i

> Suppose that Blowing Sand Company also produces the Drafty model fan, which currently has a net loss of $43,000 as follows: Eliminating the Drafty product line would eliminate $18,000 of direct fixed costs. The $50,000 of common fixed costs would be redi

> Explain how the analysis and decision in M7–5 would have been affected if Blowing Sand were operating at full capacity. Data from M7-5: Blowing Sand Company has just received a one-time offer to purchase 10,000 units of its Gusty model for a price of $2

> Blowing Sand Company has just received a one-time offer to purchase 10,000 units of its Gusty model for a price of $22 each. The Gusty model normally sells for $30 and costs $26 to produce ($17 in variable costs and $9 of fixed overhead). Because the off

> The local summer baseball league wants to buy new uniforms for its teams. The current uniforms are quite old and will require $400 in repairs before they can be handed out to players next week for the upcoming season. The old uniforms will be replaced as

> Isabella Canton is considering taking a part-time job at a local clothing store. She loves the store and shops there often, but unfortunately, employee discounts are given only to full-time employees. If Isabella takes this job, she would have to withdra

> Listed below are a number of activities managers may perform. Identify which of these activities are steps in management’s decision-making process and place those steps into the order in which they should be executed. Activities listed may be used once,

> Refer to the information presented in M7–11. Suppose that Anne has developed a rectangular, medium-size ceramic pot. It requires four hours of kiln time; however, two medium-size pots can fit in the kiln at once. The medium-size pots wo

> Anne Sugar makes large ceramic pots for use in outdoor landscaping. She currently has two models, one square and the other round. Because of the size of Anne’s creations, only one pot can be fired in the kiln at a time. Information abou

> Your roommate, Joe Thompson, has taken a summer intern position at a local manufacturing company. Because he is a junior majoring in accounting, the company expects him to have a grasp of managerial accounting basics. However, Joe didn’t attend class ver

> A number of terms and concepts from this chapter and a list of descriptions, definitions, and explanations follow. For each term listed on the left, choose at least one corresponding item from the right. Note that a single term may have more than one des

> Refer to the information presented in E2–3 for Joyce Caldwell. Required: Prepare a journal entry to record Joyce’s wages. Data from E2-3: A weekly time ticket for Joyce Caldwell follows:

> Refer to the information presented in M6–8. Suppose that the cost of paper has increased and Laguna’s variable cost per unit increases to $0.015 per hanger. Calculate its new break-even point assuming this increase is not passed along to customers. Data

> Laguna Print makes advertising hangers that are placed on doorknobs. It charges $0.04 and estimates its variable cost to be $0.01 per hanger. Laguna’s total fixed cost is $4,500 per month, which consists primarily of printer depreciation and rent. Calcul

> Refer to the information presented in M6–3. Suppose that Juniper’s fixed costs increase to $7,200. What is the new break-even point? Data from M6-3: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and each clock sells for $

> Refer to the information presented in M6–3. Suppose that Juniper’s variable costs decrease by $0.50. What is the new break-even point? Data from M6-3: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and each clock sells for

> Refer to the information presented in M6–3. Suppose that Juniper raises its price by 20 percent, but costs do not change. What is its new break-even point? Data from M6-3: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and

> Refer to the information presented in M6–3. How many units must Juniper sell to earn a profit of at least $5,400? Data from M6-3: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and each clock sells for $24. Calculate Junip

> Juniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and each clock sells for $24. Calculate Juniper’s contribution margin per unit and contribution margin ratio. If the company’s fixed costs total $6,660, determine how many cloc

> Refer to the information in M6–20 regarding Pueblo Company. Determine target sales needed to earn a $25,000 target profit if total fixed costs are $35,000. Data from M6-20: Information for Pueblo Company follows:

> Refer to the information presented for Pueblo Company in M6–20. Determine its break-even sales dollars if total fixed costs are $35,000. Data from M6-20: Information for Pueblo Company follows:

> Information for Pueblo Company follows: Determine Pueblo’s (overall) weighted-average contribution margin ratio.

> A weekly time ticket for Joyce Caldwell follows: Required: 1. Determine how much of the $1,200 that Joyce earned during this week would be charged to Job 271, Job 272, and Job 273. 2. Explain how the time spent doing maintenance work would be recorded.

> Determine the missing amounts in the following table:

> Refer to the information presented in M6–17. Suppose that each product’s sales price increases by 10 percent. Sales mix remains the same and total fixed costs are $230,000. Calculate the new break-even point for Edgewa

> Edgewater Enterprises manufactures two products. Information follows: Calculate Edgewater’s weighted-average contribution margin per unit.

> Complete the following table:

> Seascape Company has two products: Product A has a contribution margin per unit of $4 and Product B has a contribution margin of $6 per unit. Calculate the weighted-average unit contribution margin if Seascape has a 25/75 product mix. Explain how a shift

> Refer to the information in M6–11 for Heather Hudson. Suppose sales increase by 20 percent next month. Calculate the effect that increase will have on her profit. Data from M6-11: Heather Hudson makes stuffed teddy bears. Recent inform

> Refer to the information in M6–11 for Heather Hudson. Determine the degree of operating leverage if she sells 350 bears this month. Data from M6-11: Heather Hudson makes stuffed teddy bears. Recent information for her business follows:

> Refer to the information in M6–11 for Heather Hudson. If she sells 275 bears next month, determine the margin of safety in units, sales dollars, and as a percentage of sales Data from M6-11: Heather Hudson makes stuffed teddy bears. Re

> Heather Hudson makes stuffed teddy bears. Recent information for her business follows: If Heather wants to earn $1,250 in profit next month, how many bears will she have to sell?

> Refer to the information in E2–1 for Oak Creek Furniture Factory. Required: Prepare journal entries to record the materials requisitions, labor costs, and applied overhead. Data from E2-1: Oak Creek Furniture Factory (OCFF), a custom f

> Jasper Company has sales of $185,000 and a break-even sales point of $120,000. Compute Jasper’s margin of safety and its margin of safety ratio.

> Match each of the terms by inserting the appropriate definition letter in the space provided. Not all definitions will be used. 1. Break-even point 2. Break-even analysis 3. Cost-volume-profit analysis 4. Degree of operating leverage 5. Margin of safety

> Sherri’s Tan-O-Rama is a local tanning salon. The following information reflects its number of appointments and total costs for the first half of the year: Prepare a scattergraph by plotting Sherri’s Tan-O-Ramaâ&

> Randy Company produces tennis rackets. If the fixed cost per racket is $15 when 20,000 rackets are produced, what is the fixed cost per racket when 30,000 rackets are produced?

> Castle Inc. has the following information: Indicate whether these costs are variable, fixed, or mixed. Explain your answers.

> Match each of the following terms associated with the least-squares regression method with its appropriate definition: 1. R square 2. Error 3. Intercept 4. Coefficient of the x variable A. Estimate of total fixed cost. B. Vertical distance between the pr

> Indicate whether each of the following statements about the high-low method is true or false: a. The formula for the high-low method is (Highest Cost − Lowest Cost) / (Highest Activity − Lowest Activity) b. The high-low method can be expressed as Change

> Complete each of the following sentences with the appropriate term from the list below: 1. The horizontal (x) axis on a scattergraph plots _______. 2. On a scattergraph, the steeper the slope of the line, the higher the _______. 3. On a scattergraph, the

> Match each of the following costs with its appropriate definition: 1. Fixed cost per unit 2. Fixed costs in total 3. Variable cost per unit 4. Variable costs in total 5. Step costs A. Vary directly and proportionally with changes in volume. B. Varies inv

> Determine whether each the following statements describes variable costing (VC), full absorption costing (FA), or both (B): 1. Measures gross margin as the difference between sales revenue and cost of goods sold. 2. Used primarily for internal decision m

> Letters (a) through (g) represent several recent transactions that were posted to some of Johnson Company’s T-accounts. Required: Assign letters (a) through (g) to the following descriptions to indicate how the transactions would be rec

> Shannon’s Kettle Corn is a small refreshment stand located near a football stadium. Its fixed expenses total $400 per week and the variable cost per bag of popcorn is $0.50. Complete the table for the various activity levels for one wee

> Red Hawk Enterprises sells handmade clocks. Its variable cost per clock is $8, and each clock sells for $18. Calculate Red Hawk’s unit contribution margin and contribution margin ratio. Suppose Red Hawk sells 2,000 clocks this year. Calculate the total c

> Following is relevant information for Snowdon Sandwich Shop, a small business that serves sandwiches: During the month of June, Snowdon sold 600 sandwiches. Using the preceding information, prepare its contribution margin income statement for the month o

> Baker Company produced 1,500 units in May at a total cost of $10,000 and 4,000 units in June at a total cost of $18,000. Compute the variable cost per unit and the total fixed cost using the high-low method.

> Refer to the data for Handy’s Hats in M5–13. Suppose that Handy’s expects to sell 4,000 hats during the month of September and that each hat sells for $2.75. Using this information along with the regr

> Refer to the Handy’s Hats data in M5–13. Suppose Handy performed a least-squares regression and obtained the following results: Put Handy’s results into a linear equation format (y = a + bx) and expla

> Refer to the Handy’s Hats data in M5–13. Using the high-low method, calculate the total fixed cost per month and the variable cost per hat. How does the estimate of fixed cost compare to what you estimated in M5â

> Handy’s Hats makes the world’s best hats. Information for the last eight months follows: Prepare a scattergraph by plotting Handy’s data on a graph. Then draw a line that you believe best fits the dat

> Refer to the Tan-O-Rama regression output given in M5–11. Suppose that the company charges $6 per tanning session. Calculate the unit contribution margin and contribution margin ratio as well as the total contribution margin if the shop

> Refer to the Tan-O-Rama data in M5–9. Suppose Sherri performed a least-squares regression and obtained the following results: Put Sherri’s results into a linear equation format (y = a + bx) and explain what each compon

> Refer to the information presented in E2–15 for Aquazona Pool Company. Required: Prepare journal entries to record cost of goods sold and sales revenue for Job 1324. Assume the total cost of Job 1324 is currently in the Finished Goods I

> Refer to the Tan-O-Rama data in M5–9. Using the high-low method, calculate the total fixed cost per month and the variable cost per tanning appointment. How does the estimate of fixed cost compare to what you estimated in M5â€

> Heather Oak is trying to prepare a personal budget and has identified the following list of monthly costs. Identify each cost as fixed, variable, or mixed. Indicate a possible cost driver for any variable or mixed cost. 1. Rent. 2. Utilities. 3. Car paym

> Refer to the information presented in M4–8. Suppose that Acoma manufacturers only the two products mentioned and they consume 100 percent of the company’s quality inspections. Using activity proportions, determine how much quality control cost will be as

> Acoma Co. has identified one of its cost pools to be quality control and has assigned $125,000 to that pool. Number of inspections has been chosen as the cost driver for this pool; Acoma performs 25,000 inspections annually. Suppose Acoma manufactures tw

> Halsted Corp. has identified three cost pools in its manufacturing process: equipment maintenance, setups, and quality control. Total cost assigned to the three pools is $214,500, $101,400, and $153,000, respectively. Cost driver estimates for the pools

> Match each of the definitions by inserting the appropriate term letter in the space provided. Not all terms will be used. Terms: A. Activity-Based Costing (ABC) B. Activity-Based Management C. Activity Proportion D. Activity Rate E. Appraisal or Inspecti

> Match each of the terms with the appropriate definition. Not all definitions will be used. Terms: 1. Activity-Based Costing 2. Appraisal or Inspection Costs 3. Batch-Level Activities 4. External Failure Costs 5. Facility-Level Activities 6. Just-in-Time

> Use the following terms to complete the sentences that follow; terms may be used once, more than once, or not at all. Activity proportion Activity rate Activity-based management (ABM) Batch-level Cost driver Cost-plus pricing External failure costs First

> For each of the following activities, indicate the appropriate category (unit, batch, product, or facility level) and suggest a possible cost driver for each pool: 1. Factory utilities. 2. Machine setups. 3. Research and development for a new product. 4.

> Patterson makes electronic components for handheld games and has identified several activities as components of manufacturing overhead: factory rent, factory utilities, quality inspections, materials handling, machine setup, employee training, machine ma

> Aquazona Pool Company is a custom pool builder. The company recently completed a pool for the Drayna family (Job 1324) as summarized on the incomplete job cost sheet below. The company applies overhead to jobs at a rate of $15 per direct labor hour. Requ

> Wilson’s Tax Service is tracking costs of quality. Classify each of the following as Prevention (P), Appraisal or Inspection (AI), Internal Failure (IF), or External Failure (EF) costs. 1. Review of tax return for missing items/errors. 2. Training of emp

> Refer to the activities presented in M4–16. Classify each cost as facility, product, batch, or unit level. Data from M4-16: Canterbury Corp. has identified the following activities in its manufacturing process. Indicate whether each activity is value-ad

> Canterbury Corp. has identified the following activities in its manufacturing process. Indicate whether each activity is value-added or non-value-added. ∙ Product design research ∙ Materials handling ∙ Machining ∙ Assembly of components ∙ Finished goods

> Refer to the information provided in M4–13. Using activity proportions, determine the amount of overhead assigned to Controller Services. Data from M4-13: Sunrise Accounting provides basic tax services and “rent-a-con

> Refer to the information provided in M4–13. Barry Gold, a tax client of Sunrise Accounting, requires 20 miles of transportation, 50 hours of processing time, and 3 hours of office support. Using the activity rates calculated in M4â

> Sunrise Accounting provides basic tax services and “rent-a-controller” accounting services. Sunrise has identified three activity pools, the related costs per pool, the cost driver for each pool, and the expected use f

> Refer to the information presented in M4–10. Suppose the Luxury boat requires 4,680 machine hours, 70 batches, and 208 inspections. Using activity proportions, determine the amount of overhead assigned to the Luxury product line. Data

> Refer to the information presented in M4–10. Suppose the Speedy boat requires 2,500 machine hours, 100 batches, and 300 inspections. Using the activity rates calculated in M4–10, determine the amount of overhead assign

> Lakeside Inc. manufactures four lines of remote-control boats and uses activity-based costing to calculate product cost. Compute the activity rates for each of the following activity cost pools:

> Catarina Company is considering a switch from its traditional costing system to an activity-based system. It has compiled the following information regarding its product lines: Explain why the overhead costs for each product could be so different between