Question: Refer to the information reported about Golden

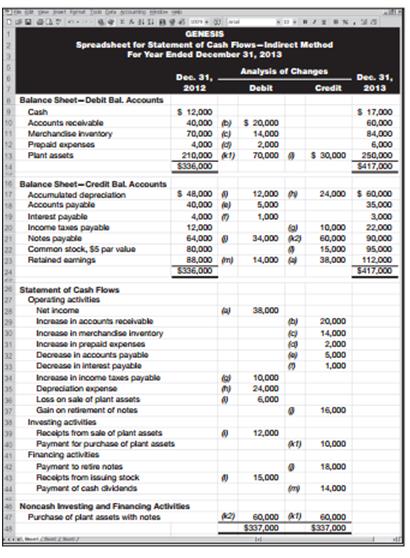

Refer to the information reported about Golden Corporation in Problem 12-4A.

RequiredPrepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A.1; report operating activities under the indirect method. Identify the debits and credits in the Analysis of Changes columns with letters that correspond to the following list of transactions and events.

a. Net income was $136,000.

b. Accounts receivable increased.

c. Merchandise inventory increased.

d. Accounts payable increased.

e. Income taxes payable increased.

f. Depreciation' data-toggle="tooltip" data-placement="top" title="Click to view definition...">Depreciation expense was $54,000.

g. Purchased equipment for $36,000 cash.

h. Issued 12,000 shares at $5 cash per share.

i. Declared and paid $89,000 of cash dividends.

In Problem 12-4A

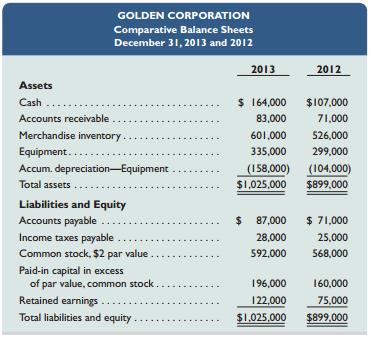

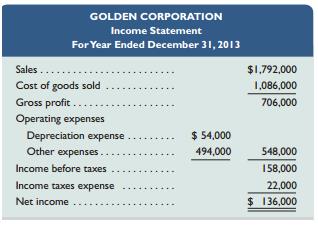

Golden Corp., a merchandiser, recently completed its 2013 operations. For the year,

(1) all sales are credit sales,

(2) all credits to Accounts receivable reflect cash receipts from customers,

(3) all purchases of inventory are on credit,

(4) all debits to Accounts payable reflect cash payments for inventory,

(5) Other Expenses are all cash expenses, and

(6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. The company’s balance sheets and income statement follow.

Additional Information on Year 2013 Transactions

a. Purchased equipment for $36,000 cash.

b. Issued 12,000 shares of common stock for $5 cash per share.

c. Declared and paid $89,000 in cash dividends.

In Exhibit 12A.1

Transcribed Image Text:

GOLDEN CORPORATION Comparative Balance Sheets December 31, 2013 and 2012 2013 2012 Assets Cash. $ 164,000 $107,000 Accounts receivable 83,000 71,000 Merchandise inventory 601,000 526,000 Equipment.. 335,000 299,000 Accum. depreciation' data-toggle="tooltip" data-placement="top" title="Click to view definition...">depreciation-Equipment (158,000) (104,000) Total assets . $1,025,000 $899,000 Liabilities and Equity' data-toggle="tooltip" data-placement="top" title="Click to view definition...">Equity Accounts payable %24 87,000 $ 71,000 Income taxes payable 28,000 25,000 Common stock, $2 par value 592,000 568,000 Paid-in capital in excess of par value, common stock. 196,000 160,000 Retained earnings .... 122,000 75,000 Total liabilities and equity $1,025,000 $899,000 GOLDEN CORPORATION Income Statement For Year Ended December 31, 2013 Sales .... $1,792,000 Cost of goods sold 1,086,000 Gross profit .. 706,000 Operating expenses depreciation expense Other expenses.. $ 54,000 494,000 548,000 Income before taxes 158,000 Income taxes expense 22,000 Net income $ 1 36,000 GENESIS Spreadsheet for Statement of Cash Flows-Indirect Method For Year Ended December 31, 2013 Analysis of Changes Dec. 31, 2012 Dec. 31, Debit Credit 2013 Balance Sheet-Debit Bal. Accounts $ 12,000 40,000 ) $ 20,000 70,000 ) 4,000 Cash $ 17,000 60,000 84,000 6,000 250,000 $417,000 Accounts receivable Merchandise invantory Prepaid expenses Plant assets 14,000 2,000 70,000 A $ 30,000 210,000 ) $336,000 14 Balance Sheet-Credit Bal. Accounts $ 48,000 40,000 12,000 N 5,000 24,000 $ 60.000 35.000 Accumulated depreciation Accounts payable Interest payable Income taxes payable Notes payable Common stock, $5 par value Retained eamings 4,000 0 12,000 1,000 2.000 22,000 10,000 60,000 64,000 O 34,000 A 90,000 15,000 38,000 ఆ,000 95,000 88,000 m) 6336,000 112.000 $417.000 23 14,000 A Statement of Cash Flows Operating activities Net income 38,000 Increase in accounts receivable 20,000 Increase in merchandise inventory Increase in prepaid expenses Decrease in accounts payable Decrease in interest payable Increase in income tawes payable depreciation expense Loss on sale of plant assets 14,000 2,000 5,000 1,000 32 10,000 24,000 6.000 bs Gain on retirement of notes 16,000 Investing activities Racepts from sale of plant assets Paymant tor purchase of plart assets Financing activties Paymant so resre notes Rocepts from issung stock Paymert of cash dividends 12,000 at) 10,000 18,000 15,000 14,000 Noncash Investing and Financing Activities Purchase of plant assets with notes 2) 60,000 at) 60,000 $337,000 $337.000

> What operational and financial measures can a MNC take to minimize the political risk associated with a foreign investment project?

> What are the advantages and disadvantages of FDI as compared to a licensing agreement with a foreign partner?

> Define country risk. How is it different from political risk?

> Researchers found that it is very difficult to forecast future exchange rates moreaccurately than the forward exchange rate or the current spot exchange rate. Howwould you interpret this finding?

> Omni Advisors, an international pension fund manager, plans to sell equitiesdenominated in Swiss francs (CHF) and purchase an equivalent amount of equities denominated in South African rands (ZAR). Omni will realize net proceeds of 3 million CHF at the

> Suppose that Baltimore Machinery sold a drilling machine to a Swiss firm and gavethe Swiss client a choice of paying either $10,000 or SF15,000 in three months. a. In the example, Baltimore Machinery effectively gave the Swiss client a free option tobuy

> Do you think that a country’s government should assist private business in the conduct of international trade through direct loans, loan guarantees, and/or credit insurance?

> Salt Lake Company’s 2013 income statement and selected balance sheet data at December 31, 2012 and 2013, follow. RequiredPrepare the cash flows from operating activities section only of the company’s 2013 statement o

> Refer to Satu Company’s financial statements and related information in Problem 12-4B. RequiredPrepare a complete statement of cash flows; report its cash flows from operating activities according to the direct method. In Problem 12-4

> Refer to the information in Exercise 12-10. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2013. In Exercise 12-10 The following financial statements and additional information are reported. Additional Inform

> Refer to the information reported aboutSatu Company in Problem 12-4B. RequiredPrepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A.1; report operating activities under the indirect method. Identify the debits and credits in t

> Forten Company, a merchandiser, recently completed its calendar-year 2013 operations. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on cred

> Refer to the information in Problem 12-7A. RequiredPrepare the cash flows from operating activities section only of the company’s 2013 statement of cash flows using the direct method. In Problem 12-7A Lansing Company’

> Access the March 30, 2012, filing of the 10-K report (for year ending December 31, 2011) of Mendocino Brewing Company, Inc., at www .sec.gov. Required 1. Does Mendocino Brewing use the direct or indirect method to construct its consolidated statement of

> Hampton Company reports the following information for its recent calendar year. Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . $160,000 Expenses Cost of goods sold . . . . . . . . . . . . . . . . . 100,000 Salaries expense . . . . . . . .

> Use the following information to determine this company’s cash flows from financing activities. a. Net income was $35,000. b. Issued common stock for $64,000 cash. c. Paid cash dividend of $14,600. d. Paid $50,000 cash to settle a note payable at its $50

> Refer to Polaris’s financial statements in Appendix A. Compute its profit margin for the years ended December 31, 2011, and December 31, 2010.

> A company reported average total assets of $1,240,000 in 2012 and $1,510,000 in 2013. Its net operating cash flow in 2012 was $102,920 and $138,920 in 2013. Calculate its cash flow on total assets ratio for both years. Comment on the results and any chan

> Where on the income statement does a company report an unusual gain not expected to occur more often than once every two years or so?

> What does a relatively high accounts receivable turnover indicate about a company’s short-term liquidity?

> What does the number of days’ sales uncollected indicate?

> Satu Company, a merchandiser, recently completed its 2013 operations. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debi

> Why is working capital given special attention in the process of analyzing balance sheets?

> Suggest several reasons why a 2:1 current ratio might not be adequate for a particular company.

> What three factors would influence your evaluation as to whether a company’s current ratio is good or bad?

> Lansing Company’s 2013 income statement and selected balance sheet data at December 31, 2012 and 2013, follow. RequiredPrepare the cash flows from operating activities section only of the company’s 2013 statement of

> Which items are usually assigned a 100% value on (a) a common-size balance sheet and (b) a common-size income statement?

> Explain the difference between financial reporting and financial statements.

> What ratios would you compute to evaluate management performance?

> Visit The Motley Fool’s Website (Fool.com). Enter the Fool’s School (at Fool.com/School). Identify and select the link How to Value Stocks. (Please note the site may ask you to register with your email address. Registration is free and grants access to f

> The following summarized Cash T-account reflects the total debits and total credits to the Cash account of Thomas Corporation for calendar year 2013. (1) Use this information to prepare a complete statement of cash flows for year 2013. The cash provided

> How does inventory turnover provide information about a company’s short-term liquidity?

> Refer to Gazelle Corporation’s financial statements and related information in Problem 12-1B. RequiredPrepare a complete statement of cash flows; report its operating activities according to the direct method. Disclose any noncash inves

> Why is a company’s capital structure, as measured by debt and equity ratios, important to financial statement analysts?

> What is the difference between comparative financial statements and common-size comparative statements?

> Why would a company’s return on total assets be different from its return on common stockholders’ equity?

> You are to devise an investment strategy to enable you to accumulate $1,000,000 by age 65. Start by making some assumptions about your salary. Next compute the percent of your salary that you will be able to save each year. If you will receive any lump-s

> Refer to Golden Corporation’s financial statements and related information in Problem 12-4A. RequiredPrepare a complete statement of cash flows; report its cash flows from operating activities according to the direct method. In Problem

> Assume that David and Tom Gardner of The Motley Fool (Fool.com) have impressed yousince you first heard of their rather improbable rise to prominence in financial circles. You learn of a staff opening at The Motley Fool and decide to apply for it. Your r

> A team approach to learning financial statement analysis is often useful. Required 1. Each team should write a description of horizontal and vertical analysis that all team members agree with and understand. Illustrate each description with an example.

> Access the February 17, 2012, filing of the December 31, 2011, 10-K report of The Hershey Company (ticker HSY) at www.sec.gov and complete the following requirements. Required Compute or identify the following profitability ratios of Hershey for its yea

> As Beacon Company controller, you are responsible for informing the board of directorsabout its financial activities. At the board meeting, you present the following information. After the meeting, the company’s CEO holds a press conf

> Key figures for Polaris and Arctic Cat follow. Required1. Compute common-size percents for each of the companies using the data provided. (Round percents to one decimal.) 2. Which company retains a higher portion of cumulative net income in the company

> Refer to the information reported about Gazelle Corporation in Problem 12-1B. RequiredPrepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A.1; report its operating activities using the indirect method. Identify the debits and

> Your friend, Diana Wood, recently completed the second year of her business and just received annual financial statements from her accountant. Wood finds the income statement and balance sheet informative but does not understand the statement of cash flo

> Jenna and Matt Wilder are completing their second year operating Mountain High, a downhill ski area and resort. Mountain High reports a net loss of $(10,000) for its second year, which includes an $85,000 extraordinary loss from fire. This past year also

> KTM (www.KTM.com), which is a leading manufacturer of offroad and street motorcycles, along with Polaris and Arctic Cat, are competitors in the global marketplace. Key figures for KTM follow (in Euro thousands). Cash and equivalents . . . . . . . . . .

> Adria Lopez, owner of Success Systems, decides to prepare a statement of cash flows for herbusiness. (Although the serial problem allowed for various ownership changes in earlier chapters, we will prepare the statement of cash flows using the following f

> Compute cash flows from financing activities using the following company information. Additional short-term borrowings . . . . . . . . . . $20,000 Purchase of short-term investments . . . . . . . . 5,000 Cash dividends paid . . . . . . . . . . . . . . .

> Compute cash flows from investing activities using the following company information. Sale of short-term investments . . . . . . . . . . $ 6,000 Cash collections from customers . . . . . . . . . 16,000 Purchase of used equipment . . . . . . . . . . . .

> Refer to the data in QS 12-6. 1. How much cash is received from sales to customers for year 2013? 2. What is the net increase or decrease in cash for year 2013? In QS 12-6 CRUZ, INC. Comparative Balance Sheets December 31, 2013 2013 2012 Assets Ca

> Use the following information to determine this company’s cash flows from operating activities using the indirect method. MOSS COMPANY Income Statement MOSS COMPANY For Year Ended December 31, 2013 Selected Balance Sheet Informatio

> Classify the following cash flows as operating, investing, or financing activities. 1. Sold long-term investments for cash. 2. Received cash payments from customers. 3. Paid cash for wages and salaries. 4. Purchased inventories for cash. 5. Paid cash d

> Arundel Company disclosed the following information for its recent calendar year. Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . $100,000 Expenses Salaries expense . . . . . . . . . . . . . . . . . . . . . . 84,000 Utilities expense .

> Use the following financial statements and additional information to (1) prepare a statement of cash flows for the year ended December 31, 2014, using the indirect method, and (2) analyze and briefly discuss the statement prepared in part 1 with specia

> For each of the following separate cases, compute cash flows from operations. The list includes all balance sheet accounts related to operating activities. Case X Case Y Case Z $ 4,000 $100,000 $72,000 Net income . Depreciation expense 30,000 8,000

> Use the following information about the cash flows of Ferron Company to prepare a complete statement of cash flows (direct method) for the year ended December 31, 2013. Use a note disclosure for any noncash investing and financing activities. Cash and ca

> When a spreadsheet for a statement of cash flows is prepared, all changes in noncash balance sheet accounts are fully explained on the spreadsheet. Explain how these noncash balance sheet accounts are used to fully account for cash flows on a spreadsheet

> Review the chapter’s opener involving TOMSand its young entrepreneurial owner, Blake Mycoskie. Required 1. In a business such as TOMS, monitoring cash flow is always a priority. Even though TOMS now has thousands in annual sales and earns a positive net

> Financial data from three competitors in the same industry follow. 1. Which of the three competitors is in the strongest position as shown by its statement of cash flows?2. Analyze and compare the strength of Moore’s cash flow on total

> Golden Corp., a merchandiser, recently completed its 2013 operations. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all deb

> Refer to the data in QS 12-6. Use the direct method to prepare the cash provided or used from operating activities section only of the statement of cash flows for this company. In QS 12-6 CRUZ, INC. Comparative Balance Sheets December 31, 2013 201

> Refer to the data in QS 12-6. 1. How much cash is paid to acquire merchandise inventory during year 2013? 2. How much cash is paid for operating expenses during year 2013? In QS 12-6 CRUZ, INC. Comparative Balance Sheets December 31, 2013 2013 201

> Refer to the data in QS 12-6. 1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2013?2. Assume that no additional notes payable are issued in 2013. What cash amount is paid to reduce the notes payable balanc

> Gazelle Corporation, a merchandiser, recently completed its calendar-year 2013 operations. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on

> Refer to the data in QS 12-6. Furniture costing $55,000 is sold at its book value in 2013. Acquisitions of furniture total $45,000 cash, on which no depreciation is necessary because it is acquired at year-end. What is the cash inflow related to the sale

> Use the following balance sheets and income statement to answer QS 12-6 through QS 12-11. RequiredUse the indirect method to prepare the cash provided or used from operating activities section only of the statement of cash flows for this company.

> The following selected information is from the Princeton Company’s comparative balance sheets. The company’s net income for the year ended December 31, 2013, was $48,000. 1. Compute the cash received from the sale of

> The following selected information is from Ellerby Company’s comparative balance sheets. The income statement reports depreciation expense for the year of $18,000. Also, furniture costing $52,500 was sold for its book value. Compute t

> Complete the following spreadsheet in preparation of the statement of cash flows. (The statement of cash flows is not required.) Prepare the spreadsheet as in Exhibit 12A.1; report operating activities under the indirect method. Identify the debits and c

> The statement of cash flows is one of the four primary financial statements. 1. Describe the content and layout of a statement of cash flows, including its three sections. 2. List at least three transactions classified as investing activities in a statem

> Answer each of the following related to international accounting standards. 1. Which method, indirect or direct, is acceptable for reporting operating cash flows under IFRS?2. For each of the following four cash flows, identify whether it is reported und

> Refer to Forten Company’s financial statements and related information in Problem 12-1A. RequiredPrepare a complete statement of cash flows; report its operating activities according to the direct method. Disclose any noncash investing

> Team members are to coordinate and independently answer one question within each of the following three sections. Team members should then report to the team and confirm or correct teammates’ answers. 1. Answer one of the following questions about the st

> Refer to the information in Problem 12-7B. RequiredPrepare the cash flows from operating activities section only of the company’s 2013 statement of cash flows using the direct method. In Problem 12-7B Salt Lake Companyâ€

> Refer to the information reported about Forten Company in Problem 12-1A. RequiredPrepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A.1; report its operating activities using the indirect method. Identify the debits and credi

> Use the following information to determine this company’s cash flows from investing activities. a. Equipment with a book value of $65,300 and an original cost of $133,000 was sold at a loss of $14,000. b. Paid $89,000 cash for a new truck. c. Sold land c

> Refer to the information about Sonad Company in Exercise 12-6. Use the direct method to prepare only the cash provided or used by operating activities section of the statement of cash flows for this company. In Exercise 12-6 The following income stateme

> Information: The following income statement and information about changes in noncash current assets and current liabilities are reported. Changes in current asset and current liability accounts for the year that relate to operations follow. Accounts r

> For each of the following three separate cases, use the information provided about the calendar-year 2014 operations of Sahim Company to compute the required cash flow information. Case X: Compute cash received from customers: Sales . . . . . . . . . .

> Salud Company reports net income of $400,000 for the year ended December 31, 2013. It also reports $80,000 depreciation expense and a $20,000 gain on the sale of machinery. Its comparative balance sheets reveal a $40,000 increase in accounts receivable,

> Katie Murphy is preparing for a meeting with her banker. Her business is finishing its fourth year of operations. In the first year, it had negative cash flows from operations. In the second and third years, cash flows from operations were positive. Howe

> Fitzpatrick Company’s calendar-year 2013 income statement shows the following: Net Income, $374,000; Depreciation Expense, $44,000; Amortization Expense, $7,200; Gain on Sale of Plant Assets, $6,000. An examination of the company’s current assets and cur

> The following transactions and events occurred during the year. Assuming that this company uses the direct method to report cash provided by operating activities, indicate where each item would appear on the statement of cash flows by placing an x in the

> The following transactions and events occurred during the year. Assuming that this company uses the indirect method to report cash provided by operating activities, indicate where each item would appear on its statement of cash flows by placing an x in t

> Peugeot S.A. reports the following financial information for the year ended December 31, 2011 (euros in millions). Prepare its statement of cash flows under the indirect method. Net income € 784 Cash paid for purchase of treasury stock and other...

> Refer to KTM’s 2011 statement of cash flows in Appendix A. List its cash flows from operating activities, investing activities, and financing activities.

> On June 3, a company borrows $200,000 cash by giving its bank a 90-day, interest-bearing note. On the statement of cash flows, where should this be reported?

> Where on the statement of cash flows is the payment of cash dividends reported?

> Describe the indirect method of reporting cash flows from operating activities.

> Describe the direct method of reporting cash flows from operating activities.

> If a company reports positive net income for the year, can it also show a net cash outflow from operating activities? Explain.

> Key figures for Polaris and Arctic Cat follow. Required1. Compute the recent two years’ cash flow on total assets ratios for Polaris and Arctic Cat. 2. What does the cash flow on total assets ratio measure? 3. Which company has the hi

> Assume that a company purchases land for $1,000,000, paying $400,000 cash and borrowing the remainder with a long-term note payable. How should this transaction be reported on a statement of cash flows?

> When a statement of cash flows is prepared using the direct method, what are some of the operating cash flows?

> What are some financing activities reported on the statement of cash flows?

> What are some investing activities reported on the statement of cash flows?

> Refer to Piaggio’s statement of cash flows in Appendix A. What investing activities result in cash outflows for the year ended December 31, 2011? List items and amounts.

> What is the reporting purpose of the statement of cash flows? Identify at least two questions that this statement can answer.

> Use the following selected data from Success Systems’ income statement for the three months ended March 31, 2014, and from its March 31, 2014, balance sheet to complete the requirements below: computer services revenue, $25,160; net sales (of goods), $18