Question: Refer to the Stockholders’ Equity section of

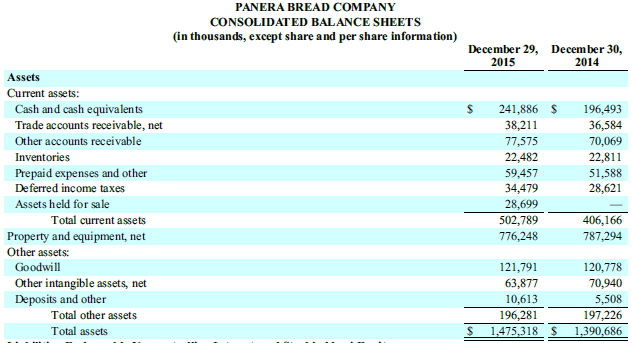

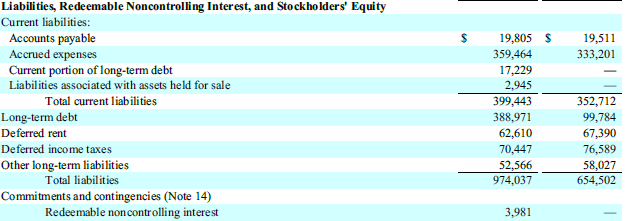

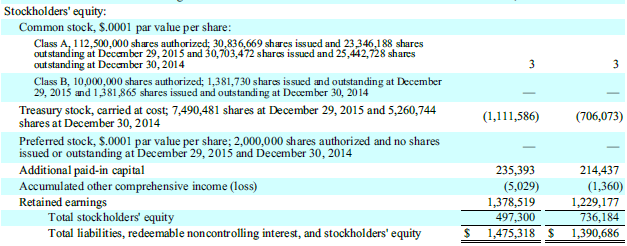

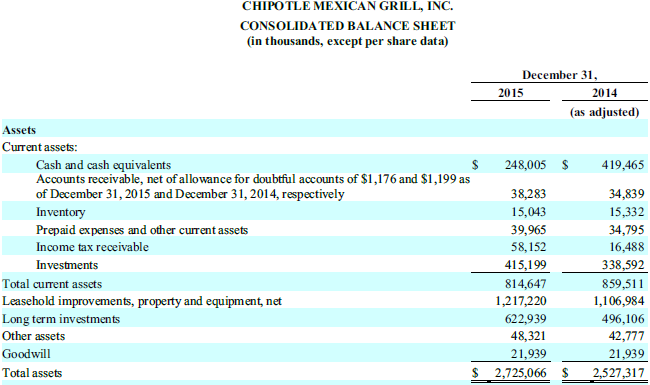

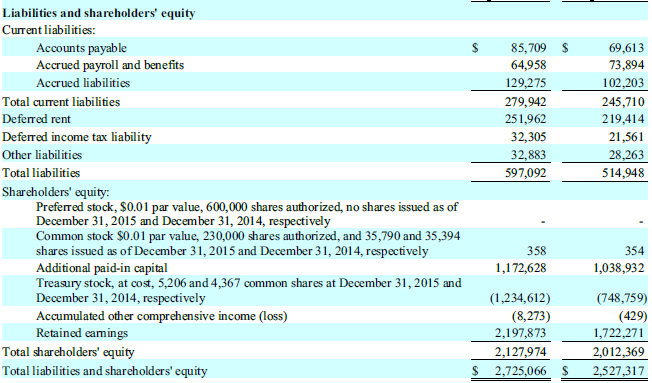

Refer to the Stockholders’ Equity section of the balance sheets of Panera Bread and Chipotle as of December 31, 2015.

Balance sheets of Panera Bread:

Balance sheets of Chipotle:

Required:

1. For each company, what are the numbers of shares of common stock authorized, issued, and outstanding as of the balance sheet date?

2. Did the balance of the Retained Earnings account of each company increase or decrease during the year? What factors can affect the Retained Earnings balance?

3. How does the total stockholders’ equity of each company compare to that of the other company? Does the difference mean that one company’s stock is more valuable than the other’s? Explain your answer.

Transcribed Image Text:

PANERA BREAD COMPANY CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share information) December 29, December 30, 2015 2014 Assets Current assets: Cash and cash equivalents Trade accounts receivable, net 241,886 S 38,211 196,493 36,584 Other accounts receivable 77,575 70,069 Inventories Prepaid expenses and other Deferred income taxes 22,482 59,457 34,479 22,811 51,588 28,621 Assets held for sale 28,699 502,789 776,248 Total current assets 406,166 Property and equipment, net Other assets: 787,294 Goodwill 121,791 120,778 Other intangible assets, net Deposits and other 63,877 70,940 10,613 5,508 Total other assets 196,281 197,226 Total assets 1,475,318 S 1,390,686 Liabilities, Redeemable Noncontrolling Interest, and Stockholders' Equity Current liabilities: Accounts payable Accrued expenses Current portion of long-term debt Liabilities associated with assets held for sale 19,805 $ 19,511 359,464 17,229 2,945 399,443 333,201 Total current liabilities 352,712 Long-term debt 388,971 62,610 70,447 99,784 Deferred rent 67,390 Deferred income taxes 76,589 Other long-term liabilities Total liabilities 58,027 52,566 974,037 654,502 Commitments and contingencies (Note 14) Redeemable noncontrolling interest 3,981 Stockholders' Equity: Common stock, $.0001 par value per share: Class A, 112,500,000 shares authorized; 30,836,669 shares issued and 23,346,188 shares outstanding at December 29, 2015 and 30,703,472 shares issued and 25,442,728 shares out standing at December 30, 2014 3 3 Class B, 10,000,000 shares authorized; 1,381,730 shares issucd and outstanding at December 29, 2015 and 1,381,865 shares issued and outstandi ng at December 30, 2014 Treasury stock, carried at cost; 7,490,481 shares at December 29, 2015 and 5,260,744 shares at December 30, 2014 (1,111,586) (706,073) Preferred stock, S.0001 par value per share; 2,000,000 shares authorized and no shares issued or outstanding at December 29, 2015 and December 30, 2014 Additional paid-in capi tal Accumulated other comprehensive income (loss) Retained earnings Total stock holders' equity Total liabilities, redeemable noncontr olling interest, and stockholders' equity 235,393 214,437 (5,029) (1,360) 1,378,519 1,229,177 736,184 1,390,686 497,300 %24 1,475,318 $ CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED BALANCE SHEET (in thousands, except per share data) December 31, 2015 2014 (as adjusted) Assets Current assets: Cash and cash equivalents Accounts receivable, net of allowance for doubtful accounts of $1,176 and $1,199 as of December 31, 2015 and December 31, 2014, respectively Inventory 248,005 $ 419,465 38,283 34,839 15,043 15,332 Prepaid expenses and other current assets Income tax receivable 39,965 34,795 58,152 16,488 Investments 415,199 814,647 338,592 Total current assets 859,511 Leasehold improvements, property and equipment, net 1,217,220 1,106,984 Long term investments 622,939 496,106 Other assets 48,321 42,777 Goodwill 21,939 21,939 Total assets 2$ 2,725,066 $ 2,527,317 Liabilities and shareholders' equity Current liabilities: 85, 709 Accounts payable Accrued payroll and benefits 69,613 64,958 73,894 Accrued liabilities 129,275 102,203 Total current liabilities 279,942 245,710 Deferred rent 251,962 219,414 Deferred income tax liability 32,305 21,561 Other liabilities 32,883 28,263 Total liabilities 597,092 514,948 Shareholders' equity: Preferred stock, $0.01 par value, 600,000 shares authorized, no shares issued as of December 31, 2015 and December 31, 2014, respectively Common stock $0.01 par value, 230,000 shares authorized, and 35,790 and 35,394 shares issued as of December 31, 2015 and December 31, 2014, respectively Additional paid-in capital Treasury stock, at cost, 5,206 and 4,367 common shares at December 31, 2015 and December 31, 2014, respectively Accumulated other comprehensive income (loss) Retained eamings Total sharcholders' equity 358 354 1,172,628 1,038,932 (1,234,612) (8,273) 2,197,873 (748,759) (429) 1,722,271 2,127,974 $ 2,725,066S 2,012,369 Total liabilities and shareholders' equity 2,527,317

> Worthington Company issued $1,000,000 face value, six-year, 10% bonds on July 1, 2017, when the market rate of interest was 12%. Interest payments are due every July 1 and January 1. Worthington uses a calendar year-end. Required: 1. Identify and analyz

> On July 1, 2017, Moton Company needs exactly $206,400 in cash to pay an existing obligation. Moton has decided to borrow from State Bank, which charges 14% interest on loans. The loan will be due in one year. Moton is unsure, however, whether to ask the

> The following situations involve the application of the time value of money concept: 1. Jan Cain deposited $19,500 in the bank on January 1, 2000, at an interest rate of 12% compounded annually. How much has accumulated in the account by January 1, 2017

> Darlene Page’s grandparents want to give her some money when she graduates from high school. They have offered Darlene the following three choices: a. Receive $16,000 immediately. Assume that interest is compounded annually. b. Receive $2,400 at the end

> Quickster Inc. acquired a patent a number of years ago. The patent is being amortized on a straight-line basis over its estimated useful life. The company’s comparative balance sheets as of December 31, 2017 and 2016, included the follo

> Refer to Walgreens Boots Alliance’s statement of cash flows shown in the chapter opener on page 555 and answer the following questions for the most recent year. Walgreens Boots Alliance’s of cash flows: Required: 1.

> On January 1, 2017, Mansfield Inc. purchased a medium-sized delivery truck for $45,000. Using an estimated useful life of five years and a residual value of $5,000, the annual straight-line depreciation of the trucks was calculated to be $8,000. Mansfiel

> During 2012, Maciel Inc.’s research and development department developed a new manufacturing process. Research and development costs were $350,000. The process was patented on October 1, 2012. Legal costs to acquire the patent were $23,800. Maciel decide

> Wagner Company purchased a retail shopping center on January 1, 2016, at a cost of $612,000. Wagner estimated that its life would be 25 years and its residual value would be $12,000. On January 1, 2017, the company made several expenditures related to th

> The following income statement, statement of cash flows, and additional information are available for PEK Company: Additional information: a. Beginning inventory and purchases for the one product the company sells are as follows: b. During the year,

> Presented here are a statement of income and retained earnings and comparative balance sheets for Gallagher, Inc., which operates a national chain of sporting goods stores. Gallagher, Inc. Statement of Income and Retained Earnings For the Year Ended Dec

> Following are the financial statements for Griffin Inc. for the year 2017: Additional information: Griffin Inc. has authorized 500,000 shares of 10%, $10 par value, cumulative preferred stock. There were 100,000 shares issued and outstanding at all ti

> Berol Corporation sold 20-year bonds on January 1, 2017. The face value of the bonds was $100,000, and they carry a 9% stated rate of interest, which is paid on December 31 of every year. Berol received $91,526 in return for the issuance of the bonds whe

> On January 1, 2017, White feather Industries issued 300, $1,000 face value bonds. The bonds have a five-year life and pay interest at the rate of 10%. Interest is paid semiannually on July 1 and January 1. The market rate of interest on January 1 was 10%

> Erin Company incurred the following costs during 2017 and 2018: a. Research and development costing $20,000 was conducted on a new product to sell in future years. A product was successfully developed, and a patent for it was granted during 2017. Erin is

> On January 1, 2015, Jose Company purchased a building for $200,000 and a delivery truck for $20,000. The following expenditures have been incurred during 2017: • The building was painted at a cost of $5,000. • To prevent leaking, new windows were install

> You are considering making a loan to Kellogg’s (Kellogg Company). The following information is from the statements of cash flows and the notes to the consolidated financial statements included in Form 10-K for fiscal years 2015 and 2014

> The following events occurred at Handsome Hounds Grooming Company during its first year of business: a. To establish the company, the two owners contributed a total of $50,000 in exchange for common stock. b. Grooming service revenue for the first year

> The Operating Activities section of Washburn Company’s statement of cash flows reported an adjustment for a gain on the retirement of bonds of $5,000. The Financing Activities section of the statement reported a cash outflow of $95,000 from the retiremen

> The Operating Activities section of Miller Corp.’s statement of cash flows reported an adjustment for depreciation expense of $25,000, as well as another for a loss on the sale of equipment of $5,000 (the equipment was sold on the last day of the year).

> The following account balances are taken from the records of Martin Corp. for the past two years. Other information available for 2017 is as follows: a. Net income for the year was $200,000. b. Depreciation expense on plant and equipment was $50,000. c

> Jane Bauer has won the lottery and has the following four options for receiving her winnings: 1. Receive $100,000 at the beginning of the current year 2. Receive $108,000 at the end of the year 3. Receive $20,000 at the end of each year for eight years 4

> Comparative balance sheets for Farinet Company for the past two years are as follows: Required: 1. Using the format in Example 13-4, prepare common-size comparative balance sheets for the two years for Farinet Company. Example 13-4: 2. What observa

> Income statements for Mariners Corp. for the past two years are as follows: Required: 1. Using the format in Example 13-5, prepare common-size comparative income statements for the two years for Mariners Corp. Example 13-5: 2. What observations can

> Assume the same set of facts for Berol Corporation as in Exercise 10-16 except that it received $109,862 in return for the issuance of the bonds when the market rate was 8%. Required: 1. Identify and analyze the effect of the sale of the bonds on Januar

> Assume that Bloomer Company purchased a new machine on January 1, 2017, for $80,000. The machine has an estimated useful life of nine years and a residual value of $8,000. Bloomer has chosen to use the straight-line method of depreciation. On January 1,

> Koffman’s Warehouse purchased a forklift on January 1, 2017, for $6,000. The forklift is expected to last for five years and have a residual value of $600. Koffman’s uses the double declining balance method for depreci

> Refer to the statement of cash flows for both Chipotle and Panera Bread for the most recent year and any other pertinent information reprinted at the back of this book. Cash flows for Chipotle: Cash flows for Panera Bread: Required: 1. Which method,

> Assume that Sample Company purchased factory equipment on January 1, 2017, for $60,000. The equipment has an estimated life of five years and an estimated residual value of $6,000. Sample’s accountant is considering whether to use the straight-line or th

> To add to his growing chain of grocery stores, on January 1, 2017, Danny Marks bought a grocery store of a small competitor for $520,000. An appraiser, hired to assess the acquired assets’ values, determined that the land, building, and equipment had mar

> On January 1, 2017, Ruby Company purchased a piece of equipment with a list price of $60,000. The following amounts were related to the equipment purchase: • Terms of the purchase were 2/10, net 30. Ruby paid for the purchase on January 8. • Freight cost

> From the following list, identify each item as operating (O), investing (I), financing (F), or not separately reported on the statement of cash flows (N). _______ Payment of cash dividend on common stock _______ Payment of cash dividend on preferred stoc

> From the following list, identify each item as operating (O), investing (I), financing (F), or not separately reported on the statement of cash flows (N). _______ Repurchase of common stock as treasury stock _______ Reissuance of common stock (held as tr

> From the following list, identify each item as operating (O), investing (I), financing (F), or not separately reported on the statement of cash flows (N). _______ Issuance of common stock for cash _______ Issuance of preferred stock for cash _______ Issu

> Divac Company has developed a statement of stockholders’ equity for the year 2017 as follows: Divac’s preferred stock is $100 par, 8% stock. If the stock is liquidated or redeemed, stockholders are entitled to $120 p

> Assume that you are the accountant for Ellis Corporation, which has issued its 2017 annual report. You have received an inquiry from a stockholder who has questions about several items in the annual report, including why Ellis has not shown certain trans

> Whitacre Company’s Stockholders’ Equity section of the balance sheet on December 31, 2016, was as follows: Common stock, $10 par value, 60,000 shares issued and outstanding …… $ 600,000 Additional paid-in capital ……………………………………………………………………….. 480,000 Re

> Campbell Company wants to increase the number of shares of its common stock outstanding and is considering a stock dividend versus a stock split. The Stockholders’ Equity section of the firm’s most recent balance sheet appeared as follows: Common stock,

> Refer to Panera Bread’s statement of cash flows for the year ending December 31, 2015. Cash flows for Panera Bread: Required: 1. What are the largest sources and uses of cash revealed in the Financing Activities category of the state

> The Stockholders’ Equity category of Worthy Company’s balance sheet as of January 1, 2017, appeared as follows: Common stock, $10 par, 40,000 shares issued and outstanding ………… $400,000 Additional paid-in capital ……………………………………………………………………. 100,000 Reta

> The Stockholders’ Equity category of Jackson Company’s balance sheet as of January 1, 2017, appeared as follows: Preferred stock, $100 par, 8%, 2,000 shares issued and outstanding ……… $200,000 Common stock, $10 par, 5,000 shares issued and outstanding …

> MJ Company has identified the following items. Indicate whether each item is included in an account in the Stockholders’ Equity category of the balance sheet and identify the account title. Also, indicate whether the item would increase or decrease stock

> Koffman and Sons signed a four-year lease for a forklift on January 1, 2017. Annual lease payments of $1,510, based on an interest rate of 8%, are to be made every December 31, beginning with December 31, 2017. Required: 1. Assume that the lease is trea

> Benjamin’s Warehouse signed a six-year capital lease or finance lease on January 1, 2017, with payments due every December 31. Interest is calculated annually at 10%, and the present value of the minimum lease payments is $13,065. Required: 1. Calculate

> Hopper Corporation signed a ten-year capital lease or finance lease on January 1, 2017. The lease requires annual payments of $8,000 every December 31. Required: 1. Assuming an interest rate of 10%, calculate the present value of the minimum lease payme

> On March 31, 2017, Sammonds Inc. issued $250,000 face value bonds at a discount of $7,000. The bonds were retired at their maturity date, March 31, 2027. Required: Assuming that the last interest payment and the amortization of the discount have already

> Reynolds Corporation issued $75,000 face value bonds at a discount of $2,500. The bonds contain a call price of 103. Reynolds decides to redeem the bonds early when the unamortized discount is $1,750. Required: 1. Calculate Reynolds Corporation’s gain o

> Yung Chong Company wants to issue 100 bonds, $1,000 face value, in January. The bonds will have a ten-year life and pay interest annually. The market rate of interest on January 1 will be 9%. Yung Chong is considering two alternative bond issues: (a) bon

> The following terms relate to independent bond issues: a. 500 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments b. 500 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments c. 800 bonds; $1,000 face val

> Refer to the financial statements and notes for Panera Bread Company included at the back of the book. Financial statements and notes for Panera Bread Company: Required: 1. What items does the company list in the Property and Equipment category? 2. Wh

> Talking is something we do every day, so we can be confident that these everyday skills are ready for use in the workplace. Discuss.

> What can you do to improve your listening?

> What might these nonverbal communication behaviors communicate? Think of at least two possibilities for each.

> The people attending a meeting—not the leader—should determine the agenda. Discuss.

> Identify which conflict resolution strategy would work best in the following situations. a. Your team members disagree about whether to conduct a survey or hold focus groups. It’s one of your first big group decisions, so it is important that everyone fe

> What strategies should you use to deliver feedback? Receive feedback? (LO6) When giving feedback, follow these practices: When receiving feedback, follow these practices:

> Explain the principal differences between oral and written reports. What do these differences mean in terms of how you’d need to adapt a written report for presentation to an audience?

> Describe a situation in which you would use short-report format rather than email format for an internal report. Why would you choose the short-report format?

> Explain why some routine report problems require little or no introduction.

> Why does the executive summary include key facts and figures in addition to the analyses and conclusions drawn from them?

> How might people’s definition of “professional behavior” depend on which industry or type of company they’re in?

> Explain how to write the executive summary of a report.

> Describe the role and content of a transmittal message.

> Which of the prefatory pages of reports appear to be related primarily to the length of the report? Which to the need for formality?

> Give examples of report problems that would require, respectively, (a) an ending summary, (b) a conclusion or conclusions section, and (c) a recommendation or recommendations section

> Give examples of long-report problems whose introduction could require historical background or a discussion of the report’s limitations.

> Discuss the pros and cons of including a list of absentees in meeting minutes.

> How might an internal problem-solving report that has been assigned differ from one on the same subject that an employee generated on his or her own?

> Given what you’ve learned about progress reports, suggest a general structure for these reports. What might go into the beginning? What might the middle parts be? What would the conclusion do?

> Describe a situation in which you would prepare a memo report rather than an email report for an internal report. Why would you choose the memo format?

> Discuss the effects of formality and likely length on report makeup as described in the chapter.

> “People need to leave their cultures and values at the door when they come to work and just do business.” Discuss the possible merits and flaws of this attitude.

> Explain the difference between random sampling and convenience sampling. Give an example of when each type of sampling would be feasible and appropriate.

> Explain the difference between quantitative and qualitative research, and describe a sample situation in which each would be appropriate.

> Which databases or other resources would be good sources of information for each of the following subjects? a. A certain company’s market share b. Whether or not a company is being sued c. Trends in a certain industry d. Strategies for a successful job i

> Which of the following are secondary research sources and which are primary? Why? a. Information from The Wall Street Journal about the unemployment rate b. Information from a focus group of potential customers about a new online ordering system c. Infor

> “Disagreements in groups are counterproductive and should be avoided.” Discuss.

> Evaluate this statement: “Collaborative reports are always better than reports written by an individual because they use many minds rather than one.”

> Evaluate this statement: “Reports are written for people who want them, so you don’t have to be concerned about holding their interest.”

> Explain the difference between personal and impersonal writing. Which is “better”?

> When would you use a focus group or personal interview to gather information? What are the advantages and disadvantages of each?

> Why does the controlled before-after design give more helpful information than the before-after design?

> Brainstorm some practices or policies that businesses might develop for using the information rights management (IRM) tool effectively.

> Define experiment as a research technique and give an example of an experiment a company might conduct.

> Define observation as a research technique and give an example of a business problem that might warrant observational research.

> Point out the problems in the following sample survey questions. a. How often do you shower? b. (First question in a phone survey) Which Democratic candidate do you favor, Jean Adams or Seth Rubins? c. Do you consider the ideal pay plan to be one based o

> Assume that you’re preparing a sales mailing that won’t use the reader’s name. Would you still use a salutation (e.g., “Dear Neighbor”)? If so, what would you use? If not how would the message begin?

> What appeals would be appropriate for the following products when they are being sold to consumers? How might the appeals differ depending on the age and/or gender of the target audience?

> Consider ads that you have seen on television, in magazines, or on the Internet. Which ones rely heavily on emotional appeals? Which on logical appeals? Which on character-based appeals? Do the chosen appeals seem appropriate given the product, service,

> Compare persuasive requests and sales messages. What traits do they share? Can you point to some general differences?

> “I don’t need to discuss my readers’ needs in my proposal. They know what their needs are and don’t want to waste time reading about them.” Discuss.

> For what kinds of situations might you select email format for your proposal? Letter format? A longer, report like format?

> Discuss the differences between solicited and unsolicited proposals.

> Discuss the advantages and disadvantages of spelling checkers and grammar and style checkers.

> For what kinds of situations would you prepare email sales messages that have a fair amount of text versus messages that are almost all graphics? Why?

> Many fundraising messages show pictures of children in poverty or with obvious health problems. In what way can the use of such emotional visuals be justified? In what way might they be ethically questionable?

> Examine the call for action in a persuasive request or sales message you’ve received. Do you think it would get results? Why or why not?

> Discuss the relationship between the main sales message and its accompanying support information in an example you’ve seen. What was the purpose of each piece?

> Explain why a persuasive request is usually written in the indirect order. In what kinds of situations might the direct order be appropriate?

> Some business writers explain an adjustment refusal simply by saying that company policy did not permit granting claims in such cases. Is citing company policy adequate? Discuss.