Question: Referring to the revenue arrangement in BE6.

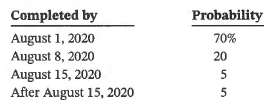

Referring to the revenue arrangement in BE6.9, determine the transaction price for this

contract, assuming (a) Nair is only able to estimate whether the building can be completed by August 1, 2020, or not (Nair estimates that there is a 703 chance that the building will be completed by August 1, 2020); and (b) Nair has limited information with which to develop a reliable estimate of completion by the August 1, 2020 deadline.

Table of BE 6.9

> (a) Outline the objectives and achievements of the EU in the area of financial reporting. (b) Outline the objectives and achievements of the IASB and its predecessor in the area of financial reporting. (c) Do your answers to (a) and (b) suggest movement

> ‘The true and fair view requirement is now established in all European Union countries and so the aim of financial reporting has been harmonised’. Discuss.

> Do international differences in the rules for the calculation of taxable income cause accounting differences or is the influence the other way round?

> Bearing in mind that Section 5.5.2 of this chapter was written in 2019; rewrite it in the context of the time when you read this book.

> Who is supposed to obey accounting standards in the United States? Are they followed in practice?

> On 21 December 20X7, your client paid €10,000 for an advertising campaign. The advertisements will be heard on local radio stations between 1 January and 31 January 20X8. Your client believes that, as a result, sales will increase by 60 per cent in 20X8

> To what extent is the search for relevance of financial information hampered by the need for reliability?

> ‘Neutrality is about freedom from bias. Prudence is a bias. It is not possible to embrace both conventions in one coherent framework’. Discuss.

> Equity investors are major users of financial statements. Identify the general nature of the ‘information needs’ of this group of users. Describe the likely specific uses of company financial information by investors and give examples of information that

> Repeat Exercise 1.4 from Chapter 1. Do you think that users know what to ask for from their accountant or financial adviser?

> Use the information for Landstalker Enterprises in BE7.15 and assume instead that the receivables are sold with recourse. Prepare the journal entry for Landstalker to record the sale, assuming that the recourse obligation has a fair value of $9,000 and t

> On October l, 2020, Alpha Inc. assigns $3 million of its accounts receivable to Alberta Provincial Bank as collateral for a $2.6-million loan evidenced by a note. The bank's charges are as follows: a finance charge of 4% of the assigned receivables and a

> Emil Family Importers sold goods to Acme Decorators for $20,000 on November 1, 2020, accepting Acme's $20,000, six-month, 6% note. (a) Prepare Emil's November 1 entry, December 31 annual adjusting entry, and May 1 entry for the collection of the note and

> Use the information for Battle Tank Limited in BE7.7 and assume instead that the unadjusted balance in Allowance for Doubtful Accounts is a debit balance of $3,000. Based on this, prepare the December 31, 2020 journal entry to record the adjustment to Al

> Battle Tank Limited had net sales in 2020 of $2.3 million. At December 31, 2020, before adjusting entries, the balances in selected accounts were as follows: Accounts Receivable $350,000 debit; Allowance for Doubtful Accounts $4,600 credit. Assuming Batt

> Use the information for Ropers Ltd. in BE7.5, but assume instead that Ropers follows ASPE and records expected outstanding returns to Allowance for Sales Returns and Allowances. Prepare the required adjusting journal entry at the end of the reporting per

> To promote the sale of some specialty goods, Ropers Ltd. began a generous return policy to its customers. Customers can return merchandise for up to three months following the date of the invoice, no questions asked. For the current period, sales of thes

> Staj Co., a clothing manufacturer, is preparing its statement of financial position at December 31, 2020. For each of the following amounts as at December 31, 2020, state whether the amount is (a) current or non-current (b) a trade receivable, a non trad

> Use the information in BE7.20. Assume that Genesis decides (a) to increase the size of the petty cash fund to $600 immediately after the reimbursement, and (b) to reduce the size of the petty cash to $250 immediately after the reimbursement. Prepare the

> The financial statements of BCE Inc. reported net sales of $21,719 million for its year ended December 31, 2016, and $21,514 million for its year ended December 31, 2015. Accounts receivable (net) were $2,979 million at December 31, 2016, $3,009 million

> Dunn Inc. owns and operates a number of hardware stores in the Atlantic region. Recently, the company has decided to open another store in a rapidly growing area of Nova Scotia. The company is trying to decide whether to purchase or lease the building an

> The financial statements of winery Andrew Peller Limited reported net sales of $342,606 thousand for its year ended March 31, 2017. Accounts receivable were $26,973 thousand at March 31, 2017, and $28,223 thousand at March 31, 2016. Calculate the company

> Stowe Enterprises owns the following assets at December 31, 2020: If Stowe follows ASPE, what amount should be reported as cash and cash equivalents? Explain how your answer would differ if Stowe followed IFRS.

> Assume the facts given in BE6.36 for Martin Corp. Prepare the December 31, 2021 yearend journal entry to record any loss from the contract assuming Martin uses the completed-contract method. Assume in BE6.36 for Martin Corp:

> Inexperienced construction company Martin Corp. signed a risky non-cancellable contract to build a research facility at a fixed contract amount of $2 million. The work began in early 2020 and Martin incurred costs of $900,000. At December 31, 2020, the e

> Assume the facts given in BE6.33 for Darwin Corporation. Assume billings for the construction contract were as follows: 2020, $500,000; 2021, $2 million; and 2022, $1. 7 million. Calculate the balance of the Contract Asset/Liability account at the end of

> Assume the facts given in BE6.33 for Darwin Corporation. Calculate the amount of gross profit or loss that should be recognized each year under the zero-profit method. Data of BE6.33:

> During 2020, Darwin Corporation started a construction job with a contract price of $4.2 million. Darwin ran into severe technical difficulties during construction but managed to complete the job in 2022. The contract is non-cancellable. Under the terms

> Guillen Inc. began work on a $7-million non-cancellable contract in 2020 to construct an office building. Guillen uses the completed-contract method under ASPE. At December 31, 2020, the balances in certain accounts were Contract Asset/Liability $715,000

> Turner Inc. began work on a $7-million non-cancellable contract in 2020 to construct an office building. During 2020, Turner Inc. incurred costs of $1.7 million, billed its customers for $1.2 million (non-refundable), and collected $960,000. At December

> Icon Construction Ltd. paid the following costs. For each item listed, determine if the costs are: (a) incremental costs to obtain a contract or (b) fulfillment costs incurred to perform the obligations under a contract. 1. Consulting fee for drafting a

> Assume the same information as in BE3.22 except that the note calls for quarterly instalment payments of $1,000. Before repeating the calculation, try to predict the outcome of the calculation and determine if the total interest will be higher or lower t

> On May 1, 2020, Mount Company enters into a contract to transfer a product to Eric Company on September 30, 2020. It is agreed that Eric will pay the full price of $25,000 in advance on June 15, 2020. Eric pays on June 15, 2020, and Mount delivers the pr

> On June 1, 2020, Mills Company sells $200,000 of shelving units to a local retailer, ShopBarb, which is planning to expand its stores in the area. Under the agreement, ShopBarb asks Mills to retain the shelving units at its factory until the new stores a

> On August 15, 2020, Japan Ideas consigned 500 electronic play systems, costing $100 each, to Yo Yo Toys Company. The cost of shipping the play systems amounted to $1,250 and was paid by Japan Ideas. On December 31, 2020, an account sales summary was rece

> For each of the scenarios noted in BE6.23, when would revenue be recognized under the earnings approach? Data of BE6.23: What is the earnings process under ASPE for each of the following scenarios? a. A manufacturer makes and sells farm equipment. The

> Refer to the revenue arrangement in BE6.20 and BE6.21. Perform step 4 of the five-step process for revenue recognition. Round percentage allocations to two decimal places and final amounts to the nearest dollar and prepare the journal entries for Geraths

> Refer to the revenue arrangement in BE6.20. Prepare the journal entries for Geraths on July 1, September 1, and October 15, 2020. Data of BE6.20: Geraths Windows manufactures and sells custom storm windows for three-season porches. Geraths also provide

> Geraths Windows manufactures and sells custom storm windows for three-season porches. Geraths also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other

> Mauer Company follows IFRS and sells consumer-relationship software to Hedges Inc. to be used for three years. In addition to providing the software, Mauer promises to provide consulting services over the life of the contract to maintain operability with

> Telephone Sellers Inc. sells prepaid telephone cards to customers. Telephone Sellers then pays the telecommunications company, TeleExpress, for the actual use of its telephone lines related to the prepaid telephone cards. Assume that Telephone Sellers se

> During February 2020, Master Massage Ltd. sells $10,000 of gift cards for Valentine's Day gifts. From reliable past experience, management estimates that 103 of the gift cards sold will not be redeemed. By the end of February, $4,000 was redeemed by cust

> Hung-Chao Yu Company issues a six-year, 8% mortgage note on January 1, 2020, to obtain financing for new equipment. The terms provide for semi-annual instalment payments of $112,825. What were the cash proceeds received from the issue of the note? Show c

> Manual Company sells goods to Nolan Company during 2020. It offers Nolan the following rebates based on total sales to Nolan. If total sales to Nolan are 10,000 units, it will grant a rebate of 23. If it sells up to 20,000 units, it will grant a rebate o

> Kristin Company sells 300 units of its products for $20 each to Logan Inc. for cash. Kristin allows Logan to return any unused product within 30 days and receive a full refund. The cost of each product is $12. To determine the transaction price, Kristin

> Use the information for Amodt Ltd. in BE6.13 and assume instead that the company follows ASPE. Follow the same instructions as in parts (a) and (b) in BE6.13. Data of BE6.13 On July 10, 2020, Amodt Ltd. sold GPS systems to retailers on account for a se

> On July 10, 2020, Amodt Ltd. sold GPS systems to retailers on account for a selling price of $700,000 (cost $560,000). Amodt grants the right to return systems that do not sell in three months following delivery. Past experience indicates that the normal

> On March 1, 2020, Parnevik Company sold goods to Goosen Inc. for $660,000 in exchange for a five-year, zero-interest-bearing note in the face amount of $1,062,937. The goods have an inventory cost on Parnevik's books of $400,000. (a) Determine the effect

> On January 2, 2020, Adani Inc. sells goods to Geo Company in exchange for a zero-interest-bearing note with a face value of $11 ,000, with payment due in 12 months. The fair value of the goods at the date of sale is $10,000 (cost $6 ,000). Assume that th

> How does a statement of cash flows prepared using the indirect method differ from one prepared using the direct method?

> Southern Corporation's adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $120,000; Common Shares $700,000; Bonds Payable $100,000; Contributed Surplus $200,000; Preferred Shares $50,000; Goodwill $55,000; and

> Included in Cellin Limited's December 31, 2020 trial balance are the following accounts: Accounts Payable $251,000; Obligations under Lease $175,000; Unearned Revenue $141,000; Bonds Payable $480,000 (due October 31, 2032); Salaries and Wages Payable $12

> James Halabi is a financial executive with McDowell Enterprises. Although James has not had any formal training in finance or accounting, he has a "good sense" for numbers and has helped the company grow from a very small company ($500,000 in sales) to a

> Pine Corporation's adjusted trial balance contained the following asset accounts at December 31, 2020: Prepaid Rent $22,000; Goodwill $50,000; Franchise Fees Receivable $2,000; Intangible Assets- Franchises $47,000; Intangible Assets-Patents $33,000; and

> Lowell Corp.'s December 31, 2020 trial balance includes the following accounts: Inventory $120,000; Buildings $207,000; Accumulated Depreciation-Equipment $19,000; Equipment $190,000; Land Held for Speculation $46,000; Accumulated Depreciation-Buildings

> The following accounts are in Tan Limited's December 31, 2020 trial balance: Prepaid Rent $1,600; FV-OCI (Fair Value-Other Comprehensive Income) Investments $62,000; Unearned Revenue $7,000; Land Held for Speculation $119,000; and Goodwill $45,000. Prepa

> Kahnert Corporation's adjusted trial balance contained the following asset accounts at December 31, 2020: Cash $3,000; Treasury Bills (with original maturity of three months) $4,000; Land $60,000; Intangible Assets-Patents $12,500; Accounts Receivable $9

> Midwest Co. reported the following items in the most recent year: a. Calculate net cash provided (used) by operating activities, the net change in cash during the year, and free cash flow. Dividends paid related to the company's common shares and are tre

> Miller Ltd. engaged in the following cash transactions during 2020: Miller prepares financial statements in accordance with ASPE. Calculate the net cash provided (used) by investing activities.

> At December 31, 2020, the equity investments of Wang Inc. that were accounted for using the FV-OCI model without recycling were as follows: Because of a change in relationship with Ahn Inc., Wang Inc. sold its investment in Ahn for $153,300 on January 20

> Martz Inc. has a customer loyalty program that rewards a customer with one customer loyalty point for every $100 of purchases. Each point is redeemable for a $3 discount on any future purchases. On July 2, 2020, customers purchase products for $300,000 (

> PP&E-Transition to IFRS Howeven Inc. is a private company that expects to "go public" and become publicly traded soon. Accordingly, it expects to be adopting IFRS by 2020. It is a manufacturing company with extensive investments in property, plant, a

> Nickel Strike Mines is a nickel mining company with mines in northern Ontario, Colombia, and Australia.It is a publicly traded company and follows IFRS, and has historically followed industry practice and used units of production as its depreciation poli

> Canadian National Railway Company and Canadian Pacific Railway Limited Two well-known company names in the transportation industry in Canada are Canadian National Railway Company and Canadian Pacific Railway Limited. Go to either SEDAR (www.sedar.com) or

> Canadian Tire Corporation, Limited is one of Canada's best-known retailers. Obtain a copy of Canadian Tire's financial statements for each of the years ended December 30, 2017, and December 31, 2016, through SEDAR (www.sedar.com) or on the company's webs

> Brookfield Asset Management Inc. is a global publicly traded Canadian company. Obtain a copy of Brookfield's financial statements for the year ended December 31, 2017, through SEDAR (www.sedar.com) or on the company's website. Instructions Review the n

> From the SEDAR website (www.sedar.com) choose one company from each of four different industry classifications. Choose from a variety of industries, such as real estate (such as Crombie Real Estate Investment Trust), food stores-merchandising (such as Lo

> Echo Corp., a retail propane gas distributor, has increased its annual sales volume to a level that is three times greater than the annual sales of a dealer that it purchased in 2019 in order to begin operations. Echo's board of directors recently receiv

> Assume that Ames Company's net income of $151,000 in BE5.16 was based on sales of $600,000, cost of goods sold of $200,000, salaries and wages of $157 ,000, depreciation expense of $44,000, and income tax expense of $48 ,000. Prepare the cash flows from

> Kolber Manufacturing Limited designs, manufactures, and distributes safety boots. In January 2020, Kolber purchased another business that manufactures and distributes safety shoes, to complement its existing business. The total purchase price was $10 mil

> Nike, Inc. has had endorsement contracts with some of the world's best-known golfers. For example, Nike has been able to gain the rights to use top golfers' names in advertising promotions and on Nike Golf apparel, footwear, golf balls, and golf equipmen

> Access the annual report for British Airways Plc (BA) for the year ended December 31, 2017, from its parent company's website (www.iagshares.com). British Airways is now a part of the International Airlines Group. Use the amounts in and notes to BA's gro

> Air France-KLM Group and Air Canada are both global airline companies. Both companies report under IFRS. Access the financial statements of Air France-KLM for its year ended December 31, 2017, and Air Canada for the same period, from each company's websi

> When Canadian public companies were required to apply IFRS beginning in 2011, one of the major issues faced by some of them, particularly those whose revenues were regulated by an independent body, concerned the accounting for regulatory assets. This iss

> Hudson's Bay Company's financial statements for its year ended February 3, 2018 (fiscal 2017) can be found at the end of this book. Instructions Refer to the company's financial statements and accompanying notes to answer these questions. a. What busine

> The partner in charge of the James Spencer Corporation audit comes by your desk and leaves a letter he has started to the CEO and a copy of the statement of cash flows for the year ended December 31, 2020. Because he must leave on an emergency, he asks y

> The financial statements of Quebecor Inc. and Thomson Reuters Corporation for their fiscal years ended December 31, 2017, can be found on SEDAR (www.sedar.com) or the companies' websites. Instructions a. What business is Quebecor Inc. in? Is Thomson Re

> Obtain the 2001 and 2017 annual reports of Goldcorp Inc. from SEDAR (www.sedar.com). Instructions Read the annual report material leading up to the financial statement section and answer the following questions: a. Explain how the company's business cha

> The audited annual financial statements of Maple Leaf Foods Inc. for the year ended December 31, 2017, can be found on the company's website or from SEDAR (www.sedar.com). Instructions a. Calculate the liquidity and coverage (solvency) ratios identified

> Ames Company reported 2020 net income of $151,000. During 2020, accounts receivable increased by $15,000 and accounts payable increased by $9 ,000. Depreciation expense was $44,000. Prepare the cash flows from operating activities section of the statemen

> The financial statements for Bombardier Inc. for the year ended December 31, 2017, can be found on the company's website or from SEDAR (www.sedar.com). Instructions a. What form of presentation does the company use in preparing its balance sheet? b. Calc

> The financial statements of Hudson's Bay Company for its year ended February 3, 2018 (fiscal 2017) appear at the end of this book. Instructions a. What alternative formats could the company have used for its balance sheet? Which format did it adopt? b.

> Access the financial statements of BHP Billiton plc (BHP) for the company's year ended June 30, 2017. Also access the financial statements of Newfield Exploration for the company's year ended December 31, 2017. These are available at the companies' websi

> Access the financial statements of Brookfield Asset Management Inc. for the company's year ended December 31, 2017, contained in the company's annual report, available from the company's website (or www.sedar.com). Review the information that is provided

> Access the annual financial statements of Stora Enso Oyj for the company's year ended December 31, 2017. These are available at the company's website, www.storaenso.com. Review the information that is provided and answer the following questions about the

> Access the financial statements of Magna International Inc. for the company's year ended December 31, 2017. These are available at www.sedar.com or the company's website. Review the information that is provided and answer the following questions about th

> From SEDAR (www.sedar.com) or the company websites, access the financial statements of Loblaw Companies Limited for its year ended December 30, 2017, and Empire Company Limited for its year ended May 6, 2017. Review the financial statements and answer th

> Access the annual financial statements of Andrew Peller Limited for the year ended March 31, 2017, on SEDAR (www.sedar.com) or the company's website (www.andrewpeller.com). Instructions Refer to these financial statements and the accompanying notes to a

> Refer to the 2016 and 2017 annual reports of Canadian Tire Corporation, Limited, available at SEDAR (www.sedar.com) or the company's website (www.canadiantire.ca). Note that the company provides a 10-year financial review at the end of its 2016 annual re

> Stora Enso Oyj described itself in its annual report as the "leading provider of renewable solutions in packaging, biomaterials, wooden constructions, and paper globally." Instructions Access the financial statements in the financial report of Stora Ens

> Healey Corporation's statement of financial position as at December 31, 2020, showed the following amounts: Cash $100; Accounts Receivable $600; Land $1,000; Accounts Payable $300; Bonds Payable $500; Common Shares $400; and Retained Earnings $500. Heale

> Hudson's Bay Company (HBC), as described in Note 1 to its financial statements, is a Canadian corporation that "owns and operates department stores in Canada, United States and .. . Europe." HBC's financial statements for its annual period ended February

> From SEDAR (www.sedar.com) or the company websites, access the financial statements of Loblaw Companies Limited for its year ended December 30, 2017, and of Empire Company Limited for its year ended May 6, 2017. Review the financial statements and answer

> Soon after beginning the year-end audit work on March 10 for the 2020 year end at Arkin Corp., the auditor has the following conversation with the controller: Controller: The year ending March 31, 2020, should be our most profitable in history and, becau

> Canadian Tire Corporation, Limited is one of Canada's best-known retailers. The company operates 501 "hard-goods" retail stores through associate dealers, 386 corporate and franchise stores under its subsidiary Mark's Work Wear house, 298 independently o

> Maple Leaf Foods Inc. Access the annual financial statements for Maple Leaf Foods Inc. for the year ended December 31, 2017. These statements are available from the company's website or from SEDAR (www.sedar.com). Instructions a. Explain the securitizat

> Coca-Cola Company and PepsiCo are two of the best-known companies worldwide. Their 2017 financial statements can be found in the investor information sections of their company websites: www.coca-colacompany.com/investors/archives-annual-other-reports an

> Access the financial statements of The Procter & Gamble Company (P&G) for its year ended June 30, 2017, from the company's website (www.pginvestor.com). Instructions Refer to P&G's financial statements and the accompanying notes to answer the following

> Airbus SE, previously known as European Aeronautic Defense and Space Company or EADS NV, is incorporated in the Netherlands and its shares are traded in France, Germany, and Spain. Access the financial statements of Airbus SE for its year ended December

> Access the financial statements of both BCE Inc. and TELUS Corporation for their years ended December 31, 2017, from either the companies' websites or SEDAR (www.sedar.com). Instructions Using the financial statements for BCE and TELUS, answer the follo