Question: Remnant Carpet Company sells and installs

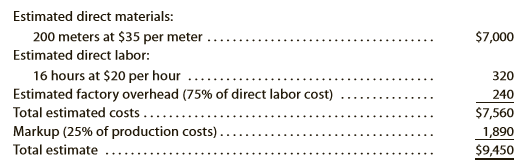

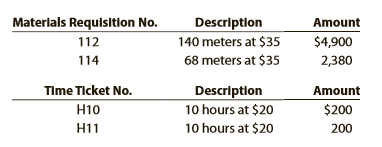

Remnant Carpet Company sells and installs commercial carpeting for office buildings. Remnant Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On October 1, Remnant Carpet Company gave Jackson Consulting an estimate of $9,450 to carpet the consulting firm’s newly leased office. The estimate was based on the following data:

On October 3, Jackson Consulting signed a purchase contract, and the delivery and installation were completed on October 10.

The related materials requisitions and time tickets are summarized as follows:

Instructions:

1. Complete that portion of the job order cost sheet that would be prepared when the estimate is given to the customer.

2. Record the costs incurred, and prepare a job order cost sheet. Comment on the reasons for the variances between actual costs and estimated costs. For this purpose, assume that the additional meters of material used in the job were spoiled, the factory overhead rate has proven to be satisfactory, and an inexperienced employee performed the work.

Transcribed Image Text:

Estimated direct materials: 200 meters at $35 per meter $7,000 Estimated direct labor: 16 hours at $20 per hour Estimated factory overhead (75% of direct labor cost) Total estimated costs ... Markup (25% of production costs). 320 240 $7,560 1,890 Total estimate $9,450 Materials Requisition No. Description Amount 140 meters at $35 68 meters at $35 112 $4,900 114 2,380 Time Ticket No. Description 10 hours at $20 Amount $200 H10 H11 10 hours at $20 200

> Master Chef Appliance Company manufactures home kitchen appliances. The manufacturing process includes stamping, final assembly, testing, and shipping. In the stamping operation, a number of individuals are responsible for stamping the steel outer surfac

> The following selected transactions were completed during March of the current year: 1. Billed customers for fees earned, $54,100. 2. Purchased supplies on account, $1,250. 3. Received cash from customers on account, $43,800. 4. Paid creditors on account

> Jamarcus Bradshaw, plant manager of Georgia Paper Company’s papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following: Jamarcus was concern

> HD Hogg Motorcycle Company manufactures a variety of motorcycles. Hogg’s purchasing policy requires that the purchasing agents place each quarter’s purchasing requirements out for bid. This is because the Purchasing Department is evaluated solely by its

> Zenith Consulting Co. has the following accounts in its ledger: Cash, Accounts Receivable, Supplies, Office Equipment, Accounts Payable, Common Stock, Retained Earnings, Dividends, Fees Earned, Rent Expense, Advertising Expense, Utilities Expense, Miscel

> Identify each of the following accounts of Kaiser Services Co. as asset, liability, stockholders’ equity, revenue, or expense, and state in each case whether the normal balance is a debit or a credit: A. Accounts Payable B. Accounts Receivable C. Cash D.

> The total assets and total liabilities (in millions) of Dollar Tree Inc. and Target Corporation follow: Determine the stockholders’ equity of each company. Dollar Tree $2,772 1,601 Target $44,553 28,322 Assets Liabilities

> The adjusting entry for accrued fees was omitted at October 31, the end of the current year. Indicate which items will be in error, because of the omission, on (A) the income statement for the current year and (B) the balance sheet as of October 31. Also

> Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 8,400

> Kankakee Cosmetics Company is planning a one-month campaign for December to promote sales of one of its two cosmetics products. A total of $150,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The fol

> I Love My Chocolate Company makes dark chocolate and light chocolate. Both products require cocoa and sugar. The following planning information has been made available: I Love My Chocolate Company does not expect there to be any beginning or ending in

> On August 1, Rantoul Stores Inc. is considering leasing a building and purchasing the necessary equipment to operate a retail store. Alternatively, the company could use the funds to invest in $1,000,000 of 4% U.S. Treasury bonds that mature in 15 years.

> Farr Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $560,000 from the planned level of $5,200,000. The president of Farr Industries Inc. has expressed concern about such a small increas

> On October 3, 2018, Regal Company purchased $3,600 of supplies on account. In Regal’s chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. A. Journalize the October 3, 2018, transaction on page 91 of Regal Compan

> The vice president of operations of Recycling Industries is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Instruction

> The Crunchy Granola Company is a diversified food company that specializes in all natural foods. The company has three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended Ju

> Abbeville Fixture Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 90 employees. Each employee presently provides 36 hours of labor per week. Information about a production week is as foll

> CodeHead Software Inc. does software development. One important activity in software development is writing software code. The manager of the WordPro Development Team determined that the average software programmer could write 25 lines of code in an hour

> Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Each unit requires 0.3 hour of direc

> As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Regina Soap Co.: Fac

> The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales

> The budget director of Feathered Friends Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for December: A. Estimated sales f

> The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows: A. E

> For 20Y8, Raphael Frame Company prepared the sales budget that follows. At the end of December 20Y8, the following unit sales data were reported for the year: For the year ending December 31, 20Y9, unit sales are expected to follow the

> The management of International Aluminum Co. is considering whether to process aluminum ingot further into rolled aluminum. Rolled aluminum can be sold for $2,200 per ton, and ingot can be sold without further processing for $1,100 per ton. Ingot is prod

> Valdespin Company manufactures three sizes of camping tents—small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Siz

> Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Instructions: 1. Prepare a table indic

> During the first month of operations ended July 31, Western Creations Company produced 80,000 designer cowboy hats, of which 72,000 were sold. Operating data for the month are summarized as follows: During August, Western Creations produced 64,000 desi

> The demand for solvent, one of numerous products manufactured by RZM Industries Inc., has dropped sharply because of recent competition from a similar product. The company’s chemists are currently completing tests of various new formulas, and it is antic

> During the first month of operations ended August 31, Kodiak Fridgeration Company manufactured 80,000 mini refrigerators, of which 72,000 were sold. Operating data for the month are summarized as follows: Instructions: 1. Prepare an income statement ba

> Pleasant Stay Medical Inc. wishes to determine its product costs. Pleasant Stay offers a variety of medical procedures (operations) that are considered its “products.” The overhead has been separated into three major a

> Data related to the expected sales of laptops and tablets for Tech Products Inc. for the current year, which is typical of recent years, are as follows: The estimated fixed costs for the current year are $2,498,600. Instructions: 1. Determine the esti

> Mello Manufacturing Company is a diversified manufacturer that manufactures three products (Alpha, Beta, and Omega) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller

> For the coming year, Cleves Company anticipates a unit selling price of $100, a unit variable cost of $60, and fixed costs of $480,000. Instructions: 1. Compute the anticipated break-even sales (units). 2. Compute the sales (units) required to realize a

> Darby Company, operating at full capacity, sold 500,000 units at a price of $94 per unit during the current year. Its income statement is as follows: The division of costs between variable and fixed is as follows: Management is considering a plant ex

> Road Gripper Tire Co. manufactures automobile tires. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 tires were as follows: Each tire requires 0.5 hour of direct labor. Ins

> Orange County Chrome Company manufactures three chrome-plated products—automobile bumpers, valve covers, and wheels. These products are manufactured in two production departments (Stamping and Plating). The factory overhead for Orange C

> Arctic Air Inc. manufactures cooling units for commercial buildings. The price and cost of goods sold for each unit are as follows: Price……………â

> Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: Indirect labor……………â€&

> The management of Orange County Chrome Company, described in Problem 1A, now plans to use the multiple production department factory overhead rate method. The total factory overhead associated with each department is as follows: Stamping Department……………

> Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2018, are presented in Problem 5-5A. Instructions: 1. Prepare a single-step income statement in the format. 2. Prepare a retained earnings statement. 3. Prepare b

> Sunrise Coffee Company roasts and packs coffee beans. The process begins in the Roasting Department. From the Roasting Department, the coffee beans are transferred to the Packing Department. The following is a partial work in process account of the Roast

> Hearty Soup Co. uses a process cost system to record the costs of processing soup, which requires the cooking and filling processes. Materials are entered from the cooking process at the beginning of the filling process. The inventory of Work in Process—

> White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging

> Hana Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in proc

> Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting Department, where carpet backing is added at the begin

> I’m Really Cold Coat Company makes women’s and men’s coats. Both products require filler and lining material. The following planning information has been made available: I’m Really

> Ginocera Inc. is a designer, manufacturer, and distributor of custom gourmet kitchen knives. A new kitchen knife series called the Kitchen Ninja was released for production in early 20Y8. In January, the company spent $600,000 to develop a late-night adv

> New lithographic equipment, acquired at a cost of $800,000 on March 1 at the beginning of a fiscal year, has an estimated useful life of five years and an estimated residual value of $90,000. The manager requested information regarding the effect of alte

> Kurtz Fencing Inc. uses a job order cost system. The following data summarize the operations related to production for March, the first month of operations: A. Materials purchased on account, $45,000. B. Materials requisitioned and factory labor used:

> Lamp Light Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Lamp Light prepared the following end-of-period spreadsheet at December 31, 2018, the end of the fiscal year: Instructions: 1. Prepare an inco

> The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2018: Instructions: 1. Prepare a multiple-step income statement. 2. Prepare a retained earnings statement. 3. Prepare a

> Ehrlich Co. began business on January 2. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the mon

> Foxy Investigative Services is an investigative services firm that is owned and operated by Shirley Vickers. On November 30, 2018, the end of the fiscal year, the accountant for Foxy Investigative Services prepared an end-of-period spreadsheet, a part of

> The unadjusted trial balance of Epicenter Laundry at June 30, 2018, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (A) Laundry supplies on hand at June 30 are $3,600. (B) Insurance premiums expire

> The unadjusted trial balance of Lakota Freight Co. at March 31, 2018, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (A) Supplies on hand at March 31 are $7,500. (B) Insurance premiums expired during yea

> Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Standard wage per hr……

> The financial statements at the end of Wolverine Realty’s first month of operations are as follows: Instructions: By analyzing the interrelationships among the four financial statements, determine the proper amounts for A through Q

> For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2018, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time ba

> Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2018, follows: The following business transactions were completed by Elite Realty during April 2018: Apr. 1. Paid rent on o&i

> Rowland Company is a small editorial services company owned and operated by Marlene Rowland. On August 31, 2018, the end of the current year, Rowland Company’s accounting clerk prepared the following unadjusted trial balance: The data

> Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2018, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions: Journalize the

> Reliable Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: • Fees ea

> On October 1, 2018, Jay Crowley established Affordable Realty, which completed the following transactions during the month: A. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stoc

> Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus Architects completed the following transactions: A. Issued common stock to Marjorie Knaus in exchange for $30,000. B. Paid January rent for office and work

> The Lexington Group has the following unadjusted trial balance as of May 31, 2018: The debit and credit totals are not equal as a result of the following errors: A. The cash entered on the trial balance was overstated by $7,000. B. A cash receipt of $8

> On December 31, 2018, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions: 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman

> Mathews Company manufactures only one product. For the year ended December 31, the contribution margin decreased by $126,000 from the planned level of $540,000. The president of Mathews Company has expressed some concern about this decrease and has reque

> On November 1, 2018, Kris Lehman established an interior decorating business, Modern Designs. During the month, Kris completed the following transactions related to the business: Nov. 1. Kris transferred cash from a personal bank account to an account to

> Seth Feye established Reliance Financial Services on July 1, 2018. Reliance Financial Services offers financial planning advice to its clients. The effect of each transaction and the balances after each transaction for July follow: Instructions: 1. Pre

> The amounts of the assets and liabilities of Journey Travel Agency at December 31, 2018, the end of the year, and its revenue and expenses for the year follow. The retained earnings were $1,341,000 on January 1, 2018, the beginning of the year. During th

> Hercules Steel Company produces three grades of steel: high, good, and regular grade. Each of these products (grades) has high demand in the market, and Hercules is able to sell as much as it can produce of all three. The furnace operation is a bottlenec

> Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,500,000 in assets. The costs of producing and selling 5,000 units of flat panel displays are estimated as follows: Crystal Displa

> The administrator of Hope Hospital has been asked to perform an activity analysis of the emergency room (ER). The ER activities include cost of quality and other patient care activities. The lab tests and transportation are hospital services external to

> Dashboard Inc. manufactures and assembles automobile instrument panels for both eCar Motors and Greenville Motors. The process consists of a lean product cell for each customer’s instrument assembly. The data that follow concern only the eCar lean cell.

> Sound Tek Inc. manufactures electronic stereo equipment. The manufacturing process includes printed circuit (PC) board assembly, final assembly, testing, and shipping. In the PC board assembly operation, a number of individuals are responsible for assemb

> Soft Glow, Inc. manufactures light bulbs. Its purchasing policy requires that the purchasing agents place each quarter’s purchasing requirements out for bid. This is because the Purchasing Department is evaluated solely by its ability to get the lowest p

> During 20Y8, its first year of operations, Galileo Company purchased two available-for-sale investments as follows: Assume that as of December 31, 20Y8, the Hawking Inc. stock had a market value of $50 per share, and the Pavlov Co. stock

> The Radiology Department provides imaging services for Emergency Medical Center. One important activity in the Radiology Department is transcribing digitally recorded analyses of images into a written report. The manager of the Radiology Department deter

> Kalyagin Investments acquired $220,000 of Jerris Corp., 7% bonds at their face amount on October 1, 20Y2. The bonds pay interest on October 1 and April 1. On April 1, 20Y3, Kalyagin sold $80,000 of Jerris bonds at 103. Journalize the entries to record th

> Journalize the entries to record the following selected bond investment transactions for Starks Products: A. Purchased for cash $120,000 of Iceline, Inc. 5% bonds at 100 plus accrued interest of $1,000. B. Received first semiannual interest payment. C. So

> On January 1, 20Y9, Valuation Allowance for Trading Investments had a zero balance. On December 31, 20Y9, the cost of the trading securities portfolio was $41,500, and the fair value was $46,300. Journalize the December 31, 20Y9, adjusting journal entry

> The unadjusted and adjusted trial balances for American Leaf Company on October 31, 2018, follow: Journalize the five entries that adjusted the accounts at October 31, 2018. None of the accounts were affected by more than one adjusting entry. Ameri

> We-Sell Realty, organized as a corporation on August 1, 2018, is owned and operated by Omar Farah, the sole stockholder. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations? We-

> A summary of cash flows for Ethos Consulting Group for the year ended May 31, 2018, follows: Cash receipts: Cash received from customers………………………………….$637,500 Cash received from issuing common stock…………………….62,500 Cash payments: Cash paid for operating

> On September 12, 2,000 shares of Aspen Company were acquired at a price of $50 per share plus a $200 brokerage commission. On October 15, a $0.50-per-share dividend was received on the Aspen stock. On November 10, 1,200 shares of the Aspen stock were sol

> Parilo Company acquired $170,000 of Makofske Co., 5% bonds on May 1, 20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 20Y5, Parilo sold $50,000 of the bonds for 96. Journalize the entries to record the fol

> Identify the errors in the following trial balance. All accounts have normal balances. Ensemble Co. Unadjusted Trial Balance For the Year Ending December 31, 2018 Debit Balances Credit Balances Cash 42,900 Accounts Receivable. 123,500 Prepaid Insura

> Imaging Services was organized on March 1, 2018. A summary of the revenue and expense transactions for March follows: Fees earned………………………………..$482,000 Wages expense……………………………..300,000 Rent expense…………………………………..41,500 Supplies expense………………………………3,600

> Feeling Better Medical Inc., a manufacturer of disposable medical supplies, prepared the following factory overhead cost budget for the Assembly Department for October of the current year. The company expected to operate the department at 100% of normal

> Based on the data presented in Exercise 1-16, identify those items that would appear on the income statement. Data from Exercise 1-16: From the following list of selected items taken from the records of Bobcat Appliance Service as of a specific date, i

> The accounts in the ledger of Atlantic Furniture Company as of July 2018 are listed in alphabetical order as follows. All accounts have normal balances. The balance of the cash account has been intentionally omitted. Prepare an unadjusted trial balance

> Based upon the data presented in Exercise 2-13, (A) prepare an unadjusted trial balance, listing the accounts in their proper order. (B) Based upon the unadjusted trial balance, determine the net income or net loss. Data from Exercise 2-13: Napa Tours

> Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted. Data from Exercise 2-13: Napa Tours Co. is a travel agency. The nine transactions recorded by Nap

> Napa Tours Co. is a travel agency. The nine transactions recorded by Napa Tours during April 2018, its first month of operations, are indicated in the following T accounts: Indicate for each debit and each credit: (A) whether an asset, liability, stock

> The investments of Steelers Inc. include a single investment: 33,100 shares of Bengals Inc. common stock purchased on September 12, 20Y7, for $13 per share including brokerage commission. These shares were classified as available-for-sale securities. As o

> At the end of July, the first month of the business year, the usual adjusting entry transferring rent earned to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated, because of the error, on (A) th

> The following table summarizes the rules of debit and credit. For each of the items A through L, indicate whether the proper answer is a debit or a credit. Increase Decrease Normal Balance Balance sheet accounts: Asset A B Debit Liability Stockholde

> On January 4, 20Y6, Spandella Company purchased 175,000 shares of Filington Company directly from one of the founders for a price of $30 per share. Filington has 500,000 shares outstanding, including the Spandella shares. On July 2, 20Y6, Filington paid

> Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24. Acquired 1,000 shares of Tett Co. stock for $85 per share plus a $150 brokerage commi