Question: Review the consolidated income statement, expenses

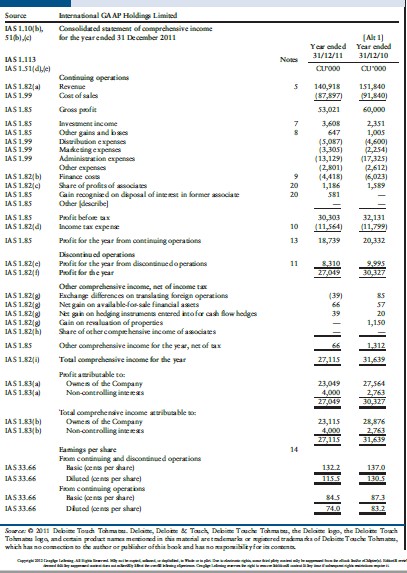

Review the consolidated income statement, expenses analyzed by function (Exhibit 4-12). Comment on similarities and differences to the U.S. GAAP income statement.

Transcribed Image Text:

Source International GAAP Holding Limited LAS L.10(b), Consolidred stasement of comprehensive income for the yearended 31 December 2011 (Alt 1) Year endod Yer ended 31/12/11 31/12/10 LAS 1.113 Noses IAS 151(dje) CU 000 Continuing operations LAS 182(a Revenue 140,918 151,840 IAS 1.99 Cost of sales (87,897) 91,840) LAS 1.85 Cross prafit 53,021 60,000 3,608 647 (5,087) (3,305) (13,129) (2,801) (4,418) 1,186 IAS 18S 2,151 1,005 (4,600) (2,254) (17,325) (2,612) K,023) 1,589 Invesament income Odher gains and baes Disribuion expena Makesingexpenses Adminisraion expenses Oher expenaes Finanoe cos Share of profits of ssocias Cain recognised on daposal of inest in former asociae Odher deseribe IAS 1ES IAS 1.99 IAS 1.99 IAS 1.99 IAS 1.82(b) IAS 1.82(e) IAS 1.85 IAS 1.85 20 20 581 Profit befor ax Income tax expen IAS 1RS 30,303 (11,564) 32,131 (11,799) IAS 1.824) 10 LAS 1.85 Pafit for the year from continuing operasions 13 18,739 20,332 LAS 1.82(e) LAS 1.820 Dscontiu ed operaions Paofit for the year from disconsinueda perationa Pofit kor the year 11 8,310 27,049 9,995 30,327 IAS 1.828 LAS 1.82( IAS 1.82g IAS 1.82 IAS 1.82(h) Oher comprehensive imcome, net of income ta Eachange differences on ranslasing forciga operations Net gain on available-far sale financial asets Ne gain on hodging insramens enered tofar cah fow hodges Cain on revaluasion of properdes Stare of other compe hensive income of asociaes (39) 66 57 39 20 1,150 IAS 1.85 Oher comprehenaive income for the year, net of ax 1312 IAS 182) Toul comprehensive income for the year 27,115 31,639 Prafit amributable ta: LAS 1.8Ma LAS 1.8a) Ownes of the Company Non-controlling inae eas 27,564 23,049 4,000 27,049 2,763 30,327 Total comprehenive income ribuable s Ownes of the Company Non-controlling ine eas 23,115 4,000 27,115 28,876 2.763 31,639 IAS 1.83(b) Famings per share Fam consinuing and disconsinued operations Hasic (cens per skare) Dluted (ens per share) Fram coninuing operations Hasic (cens per hare) Diuted foen per share) 14 IAS33.66 132.2 137.0 IAS33.66 115.5 130.5 IAS 33.66 84.5 87.3 IAS 33.66 74.0 83.2 Scarce: e 2011 Debime Toudh Tahma. Delaie, Deloime & Tauch, Debime Tauche Tahma, the Delaime bge, the Deloim Toah Tohmats laga and cetain pradat name meioned in his mateial aretademaria ar gitered eradmaka of Dekime Tauche Tohmats, which ha no comection bo che athor or pubiher ofthia book and ha no apomiblityfria conten C atleg e EXHBIT 4-12 IFRS Model Consolidated Statement of Comprehensive Income (continued) Source Intemational GAAP Holdings Limited Note: Alt 1 above illustrates the presentation of comprehensive income in one statement. Alt 2 (see next pages) illustrates the presentation of comprehensive income in tuo statements. whichever presentation is selected, the distinction is retained between items recognised in profit or loss and items recognised in other comprehensive income. The only difference between the one-statement and the two-statement approaches is that, for the latter, a total is struck in the separate income statement at 'profit for the year' (this is the same amount as is presented as a sub-total under the one-statement approach). This profit for the year' is then the starting point for the statement of comprehensive income, which is required to be presented imme diately folowing the income statement. Under the two-statement approach, the analysis of profit for the year' between the amount attributable to the ouners of the parent and the amosent attributable to non-controlling interests is preserted at the end of the separate income statement. Irrespective of whether the one-statement or the two-statement approach is followed, for the components of other comprebensive income, additional presentation options are available, as follows. • The individual components may be presented net of tax in the statement of comprehensive income (as illestrated on the previous page), or they may be presented gross with a single line deduction for tax (see Alt 2). Whichever option is selected, the income tax relating to each component of comprehensive income must be disdosed, either in the statement of comprehensive income or in the notes (see note 29). · For redassification adjustments, an aggregated presentation may be adopted, with separate disclosure of the current year ga in or loss and reclassification adjustments in the notes (see previous page and note 29). Alternatively, using a disaggregated presentation, the current year gain or loss and reclassification adjustments are shown separately in the statement of comprehensive income (see Alt 2). IAS 1.90 IAS 1.93 Alt 1 aggregates expenses according to their function.

> The cost of inventory at the close of the calendar year of the first year of operation is $40,000, using LIFO inventory, resulting in a profit before tax of $100,000. If the FIFO inventory would have been $50,000, what would the reported profit before ta

> List three situations in which the liquidity position of the firm may not be as good as that indicated by the liquidity ratios.

> A relatively low sale to working capital ratio is a tentative indication of an efficient use of working capital. Comment. A relatively high sale to working capital ratio is a tentative indication that the firm is undercapitalized. Comment.

> Before computing the current ratio, the accounts receivable turnover and the inventory turnover should be computed. Why?

> Would a firm with a relatively long operating cycle tend to charge a higher markup on its inventory cost than a firm with a short operating cycle? Discuss.

> Discuss why some firms have longer natural operating cycles than other firms.

> Discuss some benefits that may accrue to a firm from reducing its operating cycle. Suggest some ways that may be used to reduce a company’s operating cycle.

> In determining the short-term liquidity of a firm, the current ratio is usually considered to be a better guide than the acid-test ratio, and the acid-test ratio is considered to be a better guide than the cash ratio. Discuss when the acid-test ratio wou

> Both current assets and current liabilities are used in the computation of working capital and the current ratio, yet the current ratio is considered to be more indicative of the short-term debt-paying ability. Explain.

> The following information for Gaffney Corporation covers the year ended December 31, 2012: Required a. Will net income or comprehensive income tend to be more volatile? Comment. b. Which income figure will be used to compute earnings per share? c. Wha

> Discuss how to use working capital in analysis.

> Several comparisons can be made to determine the short-term debt-paying ability of an entity. Some of these are: a. Working capital b. Current ratio c. Acid-test ratio d. Cash ratio 1. Define each of these terms. 2. If the book figures are based on

> Explain the influence of the use of LIFO inventory on the inventory turnover.

> Some firms do not report the cost of goods sold separately on their income statements. In such a case, how should you proceed to compute days’ sales in inventory? Will this procedure produce a realistic days’ sales in inventory?

> Are managers the only users of financial reports? Discuss.

> Suppose you are comparing two firms within an industry. One is large and the other is small. Will relative or absolute numbers be of more value in each case? What kinds of statistics can help evaluate relative size?

> What is trend analysis? Can it be used for ratios? For absolute figures?

> Differentiate between absolute and percentage changes. Which is generally a better measure of change? Why?

> Brown Company earned 5.5% on sales in 2011. What further information would be needed to evaluate this result?

> What does each of the following categories of ratios attempt to measure? (a) liquidity; (b) long-term borrowing capacity; (c) profitability. Name a group of users who might be interested in each category.

> Each of the following statements represents a decision made by the accountant of Growth Industries: a. A tornado destroyed $200,000 in uninsured inventory. This loss is included in the cost of goods sold. b. Land was purchased 10 years ago for $50,000.

> What is a ratio? How do ratios help to alleviate the problem of size differences among firms?

> What source contains a comprehensive reference for products and services, company profiles, and a catalog file?

> Indicate some sources that contain an appraisal of the outlook for particular industries.

> You would like to determine the principal business affiliations of the president of a company you are analyzing. Which reference service may have this information?

> What source includes comprehensive statistics on many industries?

> Indicate some sources that contain a dividend record of payments.

> You want to know the trading activity (volume of its stock sold) for a company. Which service provides this information?

> You are considering buying the stock of a large publicly traded company. You need an opinion of timeliness of the industry and the company. Which publication could you use?

> You want to compare the progress of a given company with a composite of that company’s industry group for selected income statement and balance sheet items. Which library source will aid you?

> You want to know if there have been any reported deaths of officers of a company you are researching. What library source will aid you in your search?

> Uranium Mining Company, founded in 1982 to mine and market uranium, purchased a mine in 1983 for $900 million. It estimated that the uranium had a market value of $150 per ounce. By 2012, the market value had increased to $300 per ounce. Records for 2012

> On July 1, 2010, an initial registration statement on Form 10 was filed with the U.S. Securities and Exchange Commission (“SEC”) in connection with the Company’s separation into two independent, publi

> a. What is the SIC number? How can it aid in the search of a company, industry, or product? b. What is the NAICS number? How can it aid in the search of a company, industry, or product?

> Using The Department of Commerce Financial Report discussion in the text, answer the following: a. Could we determine the percentage of total sales income after income taxes that a particular firm had in relation to the total industry sales? Explain. b.

> Answer the following concerning the Almanac of Business and Industrial Financial Ratios: a. This service presents statistics for how many size categories of firms? b. Indicate some of the industries covered by this service.

> You want profile information on the president of a company. Which reference book should be consulted?

> Using these results for a given ratio, compute the median, upper quartile, and lower quartile. 14%, 13.5%, 13%, 11.8%, 10.5%, 9.5%, 9.3%, 9%, 7%

> Differentiate between the types of inventory typically held by a retailing firm and a manufacturing firm.

> Briefly describe how each of these groups might use financial reports: managers, investors, and creditors.

> Differentiate between horizontal and vertical analysis. Using sales as a component for each type, give an example that explains the difference.

> Sometimes manufacturing firms have only raw materials and finished goods listed on their balance sheets. This is true of Avon Products, a manufacturer of cosmetics, and it might be true of food canners also. Explain the absence of work in process.

> Refer to Exhibits 5-3, 5-4, and 5-5 to answer the following questions: a. For each of the firms illustrated, what is the single largest asset category? Does this seem typical of this type of firm? b. Which of the three firms has the largest amount in c

> The income statement of Jones Company for the year ended December 31, 2012, follows. Required a. Compute the net earnings remaining after removing nonrecurring items. b. Determine the earnings (loss) from the nonconsolidated subsidiary. c. Determine th

> In the future, we should expect few presentations of a “cumulative effect of change in accounting principle.” Comment.

> Why are unusual or infrequent items disclosed before tax?

> A health food distributor selling wholesale dairy products and vitamins decides to discontinue the division that sells vitamins. How should this discontinuance be classified on the income statement?

> Which of the following would be classified as extraordinary? a. Selling expense b. Interest expense c. Gain on the sale of marketable securities d. Loss from flood e. Income tax expense f. Loss from prohibition of red dye g. Loss from the write-do

> What are extraordinary items? How are they shown on the income statement? Why are they shown in that manner?

> Management does not usually like to tie comprehensive income closely with the income statement. Comment.

> Comment on your ability to determine a firm’s capacity to make distributions to stockholders, using published financial statements.

> Melcher Company reported earnings per share in 2011 and 2010 of $2.00 and $1.60, respectively. In 2012, there was a 2-for-1 stock split, and the earnings per share for 2012 were reported to be $1.40. Give a three-year presentation of earnings per share (

> An income statement is a summary of revenues and expenses and gains and losses, ending with net income for a specific period of time. Indicate the two traditional formats for presenting the income statement. Which of these formats is preferable for analy

> The income statement of Tawls Company for the year ended December 31, 2012, shows the following: Required a. Compute the net earnings remaining after removing nonrecurring items. b. Determine the earnings from the nonconsolidated subsidiary. c. For th

> Describe the following items: a. Net income–noncontrolling interest b. Equity in earnings of nonconsolidated subsidiaries

> A balance sheet represents a specific date, such as “December 31,” while an income statement covers a period of time, such as “For the Year Ended December 31, 2011.” Why does this difference exist?

> List the three types of appropriated retained earnings accounts. Which of these types is most likely not a detriment to the payment of a dividend? Explain

> Explain the relationship between the income statement and the reconciliation of retained earnings.

> How does the declaration of a cash dividend affect the financial statements? How does the payment of a cash dividend affect the financial statements?

> Why is the equity in earnings of nonconsolidated subsidiaries sometimes a problem in profitability analysis? Discuss with respect to income versus cash flow.

> Give three examples of unusual or infrequent items that are disclosed separately. Why are they shown separately? Are they presented before or after tax? Why or why not?

> Review the consolidated income statement, expenses analyzed by nature (Exhibit 4-13). Comment on similarities and differences to the U.S. GAAP income statement. Answer: This represents a finer line item disclosure than under U.S. GAAP. Many of the item

> Why is net income–noncontrolling interest deducted before arriving at net income?

> What is the difference in the impact on financial statements of a stock dividend versus a stock split?

> List where each of the following items may appear. Choose from (A) income statement, (B) balance sheet, or (C) reconciliation of retained earnings. a. Dividends paid b. Notes payable c. Income from noncontrolling interest d. Accrued payrolls e. Loss

> What is depreciation? Which tangible assets are depreciated, and which are not? Why?

> What types of inventory will a retailing firm have? A manufacturing firm?

> Differentiate between accounts receivable and accounts payable.

> Differentiate between marketable securities and long-term investments. What is the purpose of owning each?

> Usually, current assets are listed in a specific order, starting with cash. What is the objective of this order of listing?

> Classify the following as (CA) current asset, (IV) investments, (IA) intangible asset, or (TA) tangible asset: a. Land b. Cash c. Copyrights d. Marketable securities e. Goodwill f. Inventories g. Tools h. Prepaids i. Buildings j. Accounts receivable k. L

> Are the following balance sheet items (A) assets, (L) liabilities, or (E) stockholders’ equity? a. Cash dividends payable b. Mortgage notes payable c. Investments in stock d. Cash e. Land f. Inventory g. Unearned rent h. Marketable securities I.

> Name and describe the three major categories of balance sheet accounts.

> Describe the two types of subsequent events under GAAP.

> Assume that a city donated land to a company. What accounts would be affected by this donation, and what would be the value?

> List the statement on which each of the following items may appear. Choose from (A) income statement, (B) balance sheet, or (C) neither. a. Net income b. Cost of goods sold c. Gross profit d. Retained earnings e. Paid-in capital in excess of par f.

> Describe donated capital

> Describe the account Accumulated Other Comprehensive Income.

> Should depreciation be recognized on a building in a year in which the cost of replacing the building rises? Explain

> Which depreciation method will result in the most depreciation over the life of an asset?

> An accelerated system of depreciation is often used for income tax purposes but not for financial reporting. Why?

> What are the three factors usually considered when computing depreciation?

> Describe depreciation, amortization, and depletion. How do they differ?

> How does a company recognize, in an informal or a formal way, that it has guaranteed commitments to future contributions to an ESOP to meet debt-service requirements?

> What are some possible disadvantages of an employee stock ownership plan?

> Why are commercial lending institutions, insurance companies, and mutual funds willing to grant loans to an employee stock ownership plan at favorable rates?

> You were recently hired as the assistant treasurer for Victor, Inc. Yesterday, the treasurer was injured in a bicycle accident and is now hospitalized, unconscious. Your boss, Mr. Fernandez, just informed you that the financial statements are due today.

> Describe employee stock ownership plans (ESOPs).

> Describe quasi-reorganization.

> For level 3 valuation (fair value), the company must include the valuation technique used to measure fair value, a reconciliation of the changes in fair value during the period, and a related discussion. Why the related discussion?

> With fair value the firm selects the highest appropriate level for valuation. Why the direction to select the highest appropriate level of valuation?

> Describe fair value as it relates to assets and liabilities.

> What is redeemable preferred stock? Why should it be included with debt for purposes of financial statement analysis?

> Describe the item Unrealized Decline in Market Value of Noncurrent Equity Investments.

> When would no controlling interest be presented on a balance sheet?

> How is an unconsolidated subsidiary presented on a balance sheet?

> A firm, with no opening inventory, buys 10 units at $6 each during the period. In which accounts might the $60 appear on the financial statements?

> The following information applies to Bowling Green Metals Corporation for the year ended December 31, 2012: Total revenues from regular operations …………………………………..$832,000 Total expenses from regular operations ……………………………………..776,000 Extraordinary gain,

> What is treasury stock? Why is it deducted from stockholders’ equity?

> Many assets are presented at historical cost. Why does this accounting principle cause difficulties in financial statement analysis?