Question: Sanchez incurred the following items. Business

Sanchez incurred the following items.

Business income, exclusive of the following items……………………………$80,000

Tax-exempt interest income……………………………………………………………..40,000

Payment to charity from 2018 Sanchez gross income, paid 3/1/19……….20,000

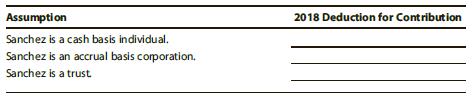

Complete the following chart, indicating the charitable contributions deduction under the various assumptions.

Transcribed Image Text:

Assumption 2018 Deduction for Contribution Sanchez is a cash basis individual. Sanchez is an accrual basis corporation. Sanchez is a trust.

> During the year, Rajeev makes the following transfers: • $1,000 to his mayor’s reelection campaign. • $21,000 to his aunt, Ava, to reimburse her for what she paid the hospital for her gallbladder operation. (Ava is not Rajeev’s dependent.) • $18,000 paid

> In 2001, Mason buys real estate for $1.5 million and lists ownership as follows: “Mason and Dana, joint tenants with the right of survivorship.” Mason dies first, when the real estate is valued at $2 million. How much is included in Mason’s gross estate

> At his death, Andrew was a participant in his employer’s contributory qualified pension plan. His account reflects the following: Employer’s contribution……………………….$1,000,000 Andrew’s contribution……………………………800,000 Income earned……………………………………..500,000 a

> In 2017, Noah and Sophia want to make a maximum contribution to their state’s qualified tuition program (Code § 529 plan) on behalf of their minor granddaughter, Amanda, without exceeding the annual Federal gift tax exclusion. How much can they give away

> In 2017, Christian wants to transfer as much as possible to his four adult married children (including spouses) and eight minor grandchildren without using any unified transfer tax credit. a. How much can Christian give? b. What if Christian’s wife, Mia,

> In 2013 and with $200,000, Alice purchases a CD at State Bank listing title as follows: “Alice, payable on proof of death to Clark.” Alice dies in 2018, and Clark (Alice’s nephew) redeems the CD (now worth $205,000). Disregarding the annual exclusion, wh

> During an interview with an IRS official on Dateline, the interviewer asks, “So how do you decide which Forms 1040 get audited and which do not?” How should the IRS official respond, taking into account that only some of the audit selection process is pu

> Elizabeth, a widow since 2000, made taxable gifts of $3 million in 2016 and $4 million in 2017. She paid no gift tax on the 2016 transfer. On what amount is the Federal gift tax computed for the 2017 gift?

> During 2017, Vasu wants to take advantage of the annual exclusion and make gifts to his 6 married children (including their spouses) and his 12 minor grandchildren. a. How much property can Vasu give away without creating a taxable gift? b. How does your

> With $5 million, Paul’s will creates a trust with the following provisions: life estate to Jacob (Paul’s son) and remainder to Anastasia (Paul’s granddaughter and Jacob’s daughter). Jacob dies when the value of the trust is $8 million. a. Does a generat

> Under Emma’s will, Addison inherits property that generates an estate tax of $800,000. Three years later, Addison dies and the property generates an estate tax of $700,000. To how much of a credit for estate tax on prior transfers is Addison’s estate ent

> Matthew owns an insurance policy (face amount of $500,000) on the life of Emily, with Uma listed as the designated beneficiary. If Emily dies first and the $500,000 is paid to Uma, how much as to this policy is included in: a. Matthew’s gross estate? b.

> Lopez always had taken his Form 1040 data to the franchise tax preparers in a local mall, but this year, his friend Cheryl asked to prepare his return. Cheryl quoted a reasonable fee, and Lopez reasoned that, with finances especially tight in Cheryl’s ho

> Your firm is preparing the Form 1040 of Norah McGinty, a resident, like you, of Oklahoma. You have contracted for the last three filing seasons with a firm in India, Tax Express Bangalore, to prepare initial drafts of tax returns using tax software that

> Blanche Creek (111 Elm Avenue, Plymouth, IN 46563) has engaged your firm because she has been charged with failure to file her 2015 Federal Form 1040. Blanche maintains that the “reasonable cause” exception should apply. During the entire tax filing seas

> You are the chair of the Ethics Committee of your state’s CPA Licensing Commission. Interpret controlling AICPA authority in addressing the following assertions by your membership. a. When a CPA has reasonable grounds for not answering an applicable ques

> Compute the preparer penalty the IRS could assess on Gerry in each of the following independent cases. a. On March 21, the copy machine was not working, so Gerry gave original returns to her 20 clients that day without providing any duplicates for them.

> Review Exhibit 26.1, and identify the following. a. The title of the IRS’s chief executive officer. b. The title of the “IRS’s attorney.” c. The names of the four major operating divisions of the IRS. d. The placement in the IRS organization of the Appea

> Discuss which penalties, if any, might be imposed on the tax adviser in each of the following independent circumstances. In this regard, assume that the tax adviser: a. Suggested to the client various means by which to generate excludible income. b. Sugg

> Christie is the preparer of the Form 1120 for Yostern Corporation. On the return, Yostern claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Christie in each of the following indepe

> Rod’s Federal income tax returns (Form 1040) for the indicated years were prepared by the following persons. Year Preparer 1……………………………………………Rod 2…………………………………………..Ann 3……………………………………….Cheryl Ann is Rod’s next-

> On April 3, 2015, Luis filed his 2014 income tax return, which showed a tax due of $75,000. On June 1, 2017, he filed an amended return for 2014 that showed an additional tax of $10,000. Luis paid the additional amount. On May 18, 2018, Luis filed a clai

> Loraine (a calendar year taxpayer) reported the following transactions, all of which were properly included in a timely filed return. a. Presuming the absence of fraud, how much of an omission from gross income is required before the six-year statute o

> Jane filed her 2016 Form 1040 on April 4, 2017. What is the date on which the applicable statute of limitations expires in each of the following independent situations? a. Jane incurred a bad debt loss that she failed to claim. b. Jane inadvertently omit

> The Leake Company, owned equally by Jacquie (chair of the board of directors) and Jeff (company president), is in very difficult financial straits. Last month, Jeff used the $300,000 withheld from employee paychecks for Federal payroll and income taxes t

> Kold Services Corporation estimates that its 2017 taxable income will be $500,000. Thus, it is subject to a flat 34% income tax rate and incurs a $170,000 liability. For each of the following independent cases, compute Kold’s 2017 minimum quarterly estim

> Trudy’s AGI last year was $200,000. Her Federal income tax came to $65,000, which she paid through a combination of withholding and estimated payments. This year, her AGI will be $300,000, with a projected tax liability of $45,000, all to be paid through

> Kaitlin donated a painting to the local art museum. As she is subject to a 35% marginal tax rate, she needs a large charitable contribution deduction for the year. She engaged Vargas (who was referred to her by the staff of the museum) to provide an appr

> Recently, a politician was interviewed about fiscal policy, and she mentioned reducing the “tax gap.” Explain what this term means. What are some of the pertinent political and economic issues relative to the tax gap?

> The Eggers Corporation filed an amended Form 1120, claiming an additional $400,000 deduction for payments to a contractor for a prior tax year. The amended return was based on the entity’s interpretation of a Regulation that defined deductible advance pa

> Singh, a qualified appraiser of fine art and other collectibles, was advising Colleen when she was determining the amount of the charitable contribution deduction for a gift of a sculpture to a museum. Singh sanctioned a $900,000 appraisal, even though h

> Compute the undervaluation penalty for each of the following independent cases involving the value of a closely held business in the decedent’s gross estate. In each case, assume a marginal estate tax rate of 40%. Reported Value Co

> Compute the overvaluation penalty for each of the following independent cases involving the fair market value of charitable contribution property. In each case, assume a marginal income tax rate of 35%. Taxpayer Corrected IRS Value Reported Valuatio

> Blair underpaid her taxes by $250,000. A portion of the underpayment was shown to be attributable to Blair’s negligence ($100,000). A court found that the rest of the deficiency constituted civil fraud ($150,000). a. Compute the total fraud and negligenc

> Maureen, a calendar year individual taxpayer, files her 2016 return on November 4, 2018. She did not obtain an extension for filing her return, and the return reflects additional income tax due of $15,000. a. What are Maureen’s penalties for failure to f

> Olivia, a calendar year taxpayer, does not file her 2017 Form 1040 until December 12, 2018. At this point, she pays the $40,000 balance due on her 2017 tax liability of $70,000. Olivia did not apply for and obtain any extension of time for filing the 201

> Compute the failure to pay and failure to file penalties for John, who filed his 2017 income tax return on December 20, 2018, paying the $10,000 amount due at that time. On April 1, 2018, John received a six-month extension of time in which to file his r

> Wade filed his Federal income tax return on time but did not remit the balance due. Compute Wade’s failure to pay penalty in each of the following cases. The IRS has not issued a deficiency notice. a. Four months late, $3,000 additional tax due. b. Ten m

> Rita forgot to pay her Federal income tax on time. When she actually filed, she reported a balance due. Compute Rita’s failure to file penalty in each of the following cases. a. Two months late, $1,000 additional tax due. b. Five months late, $3,000 addi

> Your tax client Chen asks whether it is likely that her Form 1040 will be audited this year. You suspect that Chen might modify the information she reports on her return based on your answer. Address Chen’s question, and provide her with a justification

> Gordon paid the $10,000 balance of his Federal income tax three months late. Ignore daily compounding of interest. Determine the interest rate that applies relative to this amount, assuming that: a. Gordon is an individual. b. Gordon is a C corporation.

> On June 15, 2014, Sheridan filed his 2013 income tax return reflecting a tax of $10,500. On October 5, 2015, he filed an amended 2013 return showing an additional $6,400 of tax, which he paid with the amended return. On August 22, 2017, he filed a claim

> Rivera underpaid her income tax by $45,000. The IRS can prove that $40,000 of the underpayment was due to fraud. a. Determine Rivera’s civil fraud penalty. b. Rivera pays the penalty five years after committing the fraudulent act. Her aftertax rate of re

> Marcella (a calendar year taxpayer) purchased a sculpture for $5,000. When the sculpture is worth $12,000 (as later determined by the IRS), Marcella donates it to the Peoria Museum of Art, a public charity. Based on the appraisal of a friend, Marcella de

> Alexi files her tax return 20 days after the due date. Along with the return, she remits a check for $3,000, which is the balance of the tax she owes. Disregarding any interest liabilities, compute Alexi’s total penalties for this period.

> Using PowerPoint slides, list at least three of the Statements on Standards for Tax Services that apply to CPAs. For each standard you choose, provide a short explanation of its content.

> Indicate whether each of the following parties could be subject to the tax preparer penalties. a. Tom prepared Sally’s return for $250. b. Theresa prepared her grandmother’s return for no charge. c. Georgia prepared her church’s return for $500 (she woul

> For three generations, the Dexter family has sent its children to Private University, preparing them for successful professional careers. The Edna Dexter Trust was established in the 1950s by LaKeisha’s late grandmother and has accumulated a sizable corp

> Grinder Ltd. is an S corporation that is wholly owned by Juan Plowright. Because several of Juan’s ancestors have had Alzheimer’s disease, Juan is transferring many of his assets to trusts, and he is funding living wills in anticipation of future medical

> Give the Circular 230 position concerning each of the following situations sometimes encountered in the tax profession. a. Taking an aggressive pro-taxpayer position on a tax return. b. Not having a quality review process for a return completed by a part

> Complete the following chart, indicating the comparative attributes of the typical trust and estate by answering yes/no or explaining the differences between the entities where appropriate. Att ribute Estate Trust Separate income tax entity Controll

> Complete the chart below, indicating the Calvet Trust’s entity accounting income for each of the alternatives. For this purpose, use the following information. Interest income, taxable……â&#

> The Polozzi Trust will incur the following items in the next tax year, its first year of existence. Interest income……………………………………………………..$ 25,000 Rent income……………………………………………………………100,000 Cost recovery deductions for the rental activity…………..35,000 Capi

> Complete the following chart, indicating the comparative attributes of the typical simple trust and complex trust by answering yes/no or explaining the differences between the entities where appropriate. Attribute Simple Trust Complex Trust Trust co

> Each of the following items was incurred by Jose, the cash basis, calendar year decedent. Under the terms of the will, Dora took immediate ownership in all of Jose’s assets, except the dividend-paying stock. The estate received Jose&aci

> The trustee of the Pieper Trust can distribute any amount of accounting income and corpus to the trust’s beneficiaries, Lydia and Kent. This year, the trust incurred the following. Taxable interest income…………………………………………………$40,000 Tax-exempt interest in

> The Dolce Estate reports the following items for the current tax year. Dividend income……………………………………………$ 50,000 Taxable interest income………………….…………………..8,000 Passive activity income……………………………………..30,000 Tax-exempt interest income………………………………12,000 Dist

> The Kilp Sisters Trust is required to distribute $60,000 annually equally to its two income beneficiaries, Clare and Renee. If trust income is not sufficient to pay these amounts, the trustee can invade corpus to the extent necessary. During the current

> Assume the same facts as in Problem 22, except that the trust instrument allocates the capital gain to income. Facts from Problem 22 The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (L

> The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Lucy and Ethel) are entitled to the trust’s annual accounting income in shares of one-half each. For the current tax year, Allwardt re

> Discuss the concept of statutes of limitations in the context of the Federal income tax law. a. Who benefits when the statute applies—the government, the taxpayer, both? b. What happens when the statute is scheduled to expire within two weeks but the IRS

> Using Exhibit 28.4 as a guide, describe the computation of a fiduciary entity’s accounting income, taxable income, and distributable net income. Exhibit 28.4 Accounting Income, Distributable Net Income, and Taxable Income of the En

> Create a fact pattern that illustrates each of the following tax situations. Be specific. a. A simple trust. b. A complex trust with a $300 personal exemption. c. A complex trust with a $100 personal exemption.

> Your college’s accounting group has asked you to give a 10-minute speech titled “Trusts, Estates, and the AMT.” The audience will be students who have completed at least one course concerning Federal income taxation. Develop a brief outline for your rema

> In general terms, describe how the following entities are subject to the Federal income tax. (Answer only for the entity, not for its owners, beneficiaries, etc.) a. C corporations (Subchapter C). b. Partnerships (Subchapter K). c. S corporations (Subcha

> A local bank has asked you to speak at its Building Personal Wealth Conference on the topic of “What Should Your Trust Do for You?” Develop at least four PowerPoint slides, each one listing a function that a trust might be able to accomplish for an indiv

> Comment on the following items relative to tax planning strategies of a fiduciary entity. a. To reduce taxes for a typical family, should income be shifted to a trust or from a trust? Why? b. From a tax planning standpoint, who should invest in tax-exemp

> One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to your classmates as part of the discussion of this chapt

> In year 1, the Helpful Trust agreed to make a $50,000 contribution to Local Soup Kitchen, a charitable organization. Helpful’s board agreed to the gift at a November year 1 meeting, but the check was not issued until February 20, year 2 (i.e., during the

> The Sterling Trust owns a business and generated $100,000 in depreciation deductions for the tax year. Mona is one of the income beneficiaries of the entity. a. Given the following information, compute Mona’s deduction, if any, for the Sterling depreciat

> In its first tax year, the Vasquez Estate generated $50,000 of taxable interest income and $30,000 of tax-exempt interest income. It paid fiduciary fees of $8,000. The estate is subject to a 35% marginal estate tax rate and a 40% marginal income tax rate

> In each of the following cases, distinguish between the terms. a. Offer in compromise and closing agreement. b. Failure to file and failure to pay. c. 90-day letter and 30-day letter. d. Negligence and fraud. e. Criminal and civil tax fraud.

> As a tax professional with a diverse group of clients and tax issues, why is it important that you understand how the IRS is organized and how its personnel are selected?

> Vogel Corporation owns two subsidiaries, Song and Bird. Song, located in State A, generated taxable income of $500,000. During this same period, Bird, located in State B, generated a loss of $100,000. a. Determine Song’s taxable income in States A and B,

> What is the difference between the definition of a proportionate current distribution and a proportionate liquidating distribution? What is the significance of the word proportionate?

> Martinho is a citizen of Brazil and lives there year-round. He has invested in a plot of Illinois farmland with a tax basis to him of $1 million. Martinho has no other business or investment activities in the United States. He is not subject to the alter

> Assume the same facts as in Problem 53. On the first day of the third tax year, the partnership sold the equipment for $150,000. The gain on the sale is allocated equally to the partners. The partnership distributes all cash in accordance with the partne

> Roger Corporation operates in two states, as indicated below. This year’s operations generated $400,000 of apportionable income. Compute Roger’s State A taxable income assuming that State A apportions income based o

> Henrietta transfers cash of $75,000 and equipment with a fair market value of $25,000 (basis to her as a sole proprietor, $10,000) in exchange for a 40% profit and loss interest worth $100,000 in a partnership. a. How much are Henrietta’s realized and re

> Seagull, Inc., a § 501(c)(3) exempt organization, uses a tax year that ends on October 31. Seagull’s gross receipts are $600,000, and related expenses are $580,000. a. Is Seagull required to file an annual Form 990? b. If so, what is the due date?

> Heather sells land (adjusted basis, $75,000; fair market value, $95,000) to a partnership in which she controls an 80% capital interest. The partnership pays her only $50,000 for the land. a. How much loss does Heather realize and recognize? b. If the pa

> Night, Inc., a domestic corporation, earned $300,000 from foreign manufacturing activities on which it paid $90,000 of foreign income taxes. Night’s foreign sales income is taxed at a 50% foreign tax rate. What amount of foreign sales income can Night ea

> Assume the same facts as in Problem 31, except that both states employ a three-factor formula, under which sales are double-weighted. The property factor in A is computed using historical cost, while this factor in B is computed using the net depreciated

> Prepare a PowerPoint presentation (maximum of six slides) entitled “Planning Principles for Our Multistate Clients.” The slides will be used to lead a 20-minute discussion with colleagues in the corporate tax department. Keep the outline general, but ass

> Sante Fe Corporation’s sales office and manufacturing plant are located in State A. Sante Fe also maintains a manufacturing plant and sales office in State B. For purposes of apportionment, State A defines payroll as all compensation pa

> Last year, Lory Corporation, a land development company, acquired land and construction equipment from its sole shareholder in a § 351 transaction. At the time, the land had a basis of $790,000 and a fair market value of $650,000, and the equipment had a

> Chock, a U.S. corporation, purchases inventory for resale from distributors within the United States and resells this inventory at a $1 million profit to customers outside the United States. Title to the goods passes outside the United States. What is th

> Mary, a U.S. citizen, is the sole shareholder of CanCo, a Canadian corporation. During its first year of operations, CanCo earns $14 million of foreign-source taxable income, pays $6 million of Canadian income taxes, and distributes a $2 million dividend

> This year, the Tastee Partnership reported income before guaranteed payments of $92,000. Stella owns a 90% profits interest and works 1,600 hours per year in the business. Euclid owns a 10% profits interest (with a basis of $30,000 at the beginning of th

> Fallow Corporation is subject to tax only in State X. Fallow generated the following income and deductions. State income taxes are not deductible for X income tax purposes. Sales………………………………………………………………………………………………$4,000,000 Cost of sales………………………………………

> Enercio contributes $100,000 in exchange for a 40% interest in the calendar year ABC LLC, which is taxed as a partnership. This year, the LLC generates $80,000 of ordinary taxable income. Enercio withdrew $10,000 from the partnership during the year. Ene

> Keystone, your tax consulting client, is considering an expansion program that would entail the construction of a new logistics center in State Q. List at least five questions you should ask in determining whether an asset that is owned by Keystone is to

> Dillman Corporation has nexus in States A and B. Dillman’s activities for the year are summarized below. Determine the apportionment factors for A and B assuming that A uses a three-factor apportionment formula under which sales, prop

> Use Exhibit 24.1 to compute Balboa Corporation’s State F taxable income for the year. Addition modifications………………&

> On June 1 of the current tax year, Elisha and Ezra (who are equal partners) contribute property to form the Double E Partnership. Elisha contributes cash of $200,000. Ezra contributes a building and land with an adjusted basis and fair market value of $3

> Townsend, the sole shareholder of Pruett Corporation, has a $480,000 basis in his stock. He exchanges his Pruett stock for $600,000 of Rogers Corporation voting common stock plus land with a fair market value of $100,000 and basis of $25,000 that is tran

> What is the difference between a general partnership and a limited liability company? When might each type of entity be used? Why?

> Last year, Pink Corporation acquired land and securities in a § 351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 and a fair market value of $1 million, and the securities had a basis of $110,000 and a fair market value

> Beckett Corporation realized $800,000 of taxable income from the sales of its products in States A and B. Beckett’s activities establish nexus for income tax purposes in both states. Beckett’s sales, payroll, and prope

> Your client, Royal Corporation, generates significant interest income from its working capital liquid investments. Write a memo for the tax research file, discussing the planning opportunities presented by establishing a passive investment company. Suppo