Question: Sawchuk’s Home and Garden Centre in

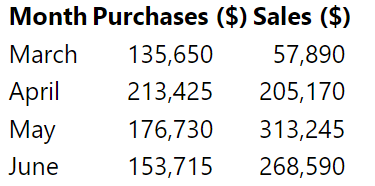

Sawchuk’s Home and Garden Centre in Toronto files monthly HST returns. The purchases on which it paid the HST and the sales on which it collected the HST for the last four months were as follows:

Based on an HST rate of 13%, calculate the HST remittance or refund due for each month.

> Quarterly contributions of $1000 will be made to an RESP for 15 years. Assuming that the investments within the plan grow at 8% compounded quarterly, how much will the RESP be worth after 15 years if the contributions are made: 1. At the end of each quar

> Fay contributed $3000 per year to her RRSP on every birthday from age 21 to 30 inclusive. She then ceased employment to raise a family and made no further contributions. Her husband Fred contributed $3000 per year to his RRSP on every birthday from age 3

> What will be the amount in an RRSP after 25 years if contributions of $2000 are made at the beginning of each year for the first 10 years, and contributions of $4000 are made at the beginning of each year for the subsequent 15 years? Assume that the RRSP

> Johan recently received his annual performance bonus from his employer. He has set up an investment savings plan to which he will contribute $2000 each year from his bonus and $400 per month from his regular salary. Johan will make his initial contributi

> To attract shoppers, retailers occasionally advertise something like “Pay no HST!” Needless to say, neither the federal nor the provincial government is willing to forgo its sales tax. In this situation, the retailer must calculate and remit the HST as t

> At what price would Arrowsmith Lumber be willing to purchase the timber rights described in Problem 4 if it requires a return on investment of 9%? Data from Problem 4: The timber rights to a tract of forest can be purchased for $250,000. The harvesting

> Keiko has already accumulated $150,000 in her RRSP. She intends to continue to grow her RRSP by making contributions of $500 at the beginning of every month. How much will her RRSP be worth 15 years from now if the RRSP earns 8% compounded annually?

> For the past 25 years, Giorgio has contributed $2000 to his RRSP at the beginning of every six months. The plan earned 8% compounded annually for the first 11 years and 7% compounded semiannually for the subsequent 14 years. What is the value of his RRSP

> Many people make their annual RRSP contribution for a taxation year close to the end of the year. Financial advisers encourage clients to contribute as early in the year as possible. How much more will there be in an RRSP at the end of 25 years if annual

> If Hans contributes $1500 to his RRSP on February 1, 1998, and every six months thereafter up to and including February 1, 2025, what amount will he accumulate in the RRSP by August 1, 2025? Assume that the RRSP will earn 8.5% compounded semiannually. Ho

> Monarch Distributing Ltd. plans to accumulate funds for the purchase of a larger warehouse seven years from now. If Monarch contributes $10,000 at the beginning of each month to an investment account earning 4.5% compounded semiannually, what amount (rou

> Annual contributions of $1000 will be made to a TFSA for 25 years. The contributor expects investments within the plan to earn 7% compounded annually. What will the TFSA be worth after 25 years if the contributions are made: 1. At the end of each year? 2

> After 10 1 2 years of contributions of $2000 at the end of every six months to an RRSP, the accumulated amount stood at $65,727.82. What semiannually compounded nominal rate of return and effective annual rate of return were earned by the funds in the RR

> If regular month-end deposits of $200 in an investment account amounted to $7727.62 after three years, what monthly compounded nominal rate and effective rate of interest were earned on the account?

> If $100,000 will purchase a 20-year annuity paying $830 at the end of each month, what monthly compounded nominal rate and effective rate of interest will the invested funds earn?

> Morgan has $500,000 accumulated in her RRSP and intends to use the amount to purchase a 20-year annuity. She is investigating the size of annuity payment she can expect to receive, depending on the rate of return earned by the undistributed funds. What n

> Angie’s Flower Shop charges 13% HST on all purchases. 1. How much HST will she report for a plant priced at $39.45? 2. As of February 4, 2013, if a consumer pays cash and cannot give the exact change, the total amount of the transaction must be rounded u

> Monty is checking potential outcomes for the growth of his RRSP. He plans to make contributions of $500 at the end of each month. What nominal rate of return must his RRSP earn for its future value after 25 years to be: 1. $400,000? 2. $500,000? 3. $600,

> With end-of-month contributions of $251.33, a TFSA is expected to pass $100,000 in value after 15 years and 5 months. Determine the nominal and effective rates of return used in the projection.

> If RRSP contributions of $3030.02 at the end of every six months are projected to generate a plan worth $500,000 in 25 years, what nominal and effective rates of return were assumed in the forecast?

> The present value of an ordinary annuity of $500 per month for 8 3 4 years is $35,820. Calculate the nominal and effective values for the discount rate.

> A Ford advertisement offered “$1250 cash back or 1.9% factory financing over 48 months” to purchasers of new Ford vans. A customer financed $20,000 at the low interest rate instead of paying $18,750 cash (after the $1250 rebate). What was the effective r

> An advertisement for Hyundai cars offered “2.9% 12-month financing or $1000 cash back.” A car buyer financed $17,000 at the low interest rate instead of paying $16,000 cash (after the $1000 rebate). What was the effective rate of interest on the loan if

> Another type of sales promotion for vehicles is to advertise the choice between a “Cash Purchase Price” or “0% Purchase Financing.” The tiny print at the bottom of a GM Canada full-page advertisement included the statement: “The GMAC purchase finance rat

> Vijay purchased a Province of Nova Scotia bond for $1050. The bond will pay $35 interest to Vijay at the end of every six months until it matures in seven years. On the maturity date the bond will pay back its $1000 face value (as well as the interest pa

> A major daily newspaper charges $260 (paid in advance) for an annual subscription, or $26 per month payable at the end of each month to the carrier. What is the effective interest rate being charged to the monthly payment subscribers?

> In an insurance settlement for bodily injury, a court awarded Mr. Goodman $103,600 for two years’ loss of wages of $4000 per month plus interest on the lost wages to the end of the two years. What effective rate of interest has the court allowed on the l

> How much more will a consumer pay for an item listed at $1000 (pretax) in Prince Edward Island than in Manitoba?

> For $150,000, Continental Life Insurance Co. will sell a 20-year annuity paying $1200 at the end of each month. What effective rate of return does the annuitant earn?

> A finance company paid a furniture retailer $1050 for a conditional sale contract requiring 12 end-of-month payments of $100. What effective rate of return will the finance company realize on the purchase?

> If TFSA contributions of $10,000 at the end of every year are projected to generate a plan worth $1,000,000 in 25 years, what effective rate of return was assumed in the forecast?

> What quarterly compounded nominal rate and effective rate of interest are being charged on a $5000 loan if quarterly payments of $302.07 will repay the loan in 5 1 2 years?

> An annuity purchased for $50,000 sustained quarterly withdrawals of $1941.01 for 7 years and 9 months. What nominal rate of return and effective rate of return were the retained funds earning?

> How long will it take an RRSP to grow to $700,000 if it takes in month-end contributions of $1000 and it earns: 1. 4% compounded monthly? 2. 6% compounded monthly? 3. 8% compounded monthly? 4. 9% compounded monthly?

> Monthly payments of $315.49 are required on a $20,000 loan at 5.5% compounded quarterly. What is the term of the loan?

> For how long has William been making end-of-quarter contributions of $1200 to his RRSP if the RRSP has earned 4.75% compounded annually and is currently worth $74,385?

> Rounding up the number of contributions to the next integer, how long will it take an RRSP to surpass $100,000 if it takes in end-of-quarter contributions of $3000 and earns 6% compounded quarterly?

> An endowment fund is set up with a donation of $100,000. If it earns 4% compounded monthly, for how long will it sustain end-of-month withdrawals of $1000? (Include the final smaller withdrawal.)

> Calculate the total amount, including both GST and PST, that an individual will pay for a car priced at $39,500 in 1. Alberta. 2. Saskatchewan. 3. Quebec.

> If money in a new TFSA earns 8.25% compounded monthly, how long will it take for the plan to reach $30,000 in value based on end-of-month contributions of $209.59?

> Harold’s RRSP is already worth $56,000. Rounding n to the next higher integer, how long will it take the RRSP to reach $250,000 if additional contributions of $2000 are made at the end of every six months? Assume the RRSP earns 9.75% compounded monthly.

> Bernice is about to retire with $139,000 in her RRSP. She will make no further contributions to the plan, but will allow it to accumulate earnings for another six years. Then she will purchase an annuity providing payments of $5000 at the end of each qua

> A property development company obtained a $2.5-million loan to construct a commercial building. The interest rate on the loan is 10% compounded semiannually. The lender granted a period of deferral, meaning that the first quarterly payment of $100,000 is

> Helen and Morley borrowed $20,000 from Helen’s father to make a down payment on a house. The interest rate on the loan is 8% compounded annually, but no payments are required for two years. The first monthly payment of $300 is due on the second anniversa

> Novell Electronics recently bought a patent that will allow it to bring a new product to market in 2 1 2 years. Sales forecasts indicate that the product will increase the quarterly profits by $28,000. If the patent cost $150,000, how long after the date

> Twelve years ago, Mr. Lawton rolled a $17,000 retiring allowance into an RRSP that subsequently earned 10% compounded semiannually. Three years ago he transferred the funds to an RRIF. Since then, he has been withdrawing $1000 at the end of each quarter.

> Nancy borrowed $8000 from her grandfather to buy a car when she started college. The interest rate being charged is 4.5% compounded monthly. Nancy is to make the first $200 monthly payment on the loan three years after the date of the loan. How long afte

> For $200,000, Jamal purchased an annuity that delivers end-of-quarter payments of $3341.74. If the undistributed funds earn 4.5% compounded quarterly, what is the term of the annuity?

> $10,000 was invested in a fund earning 7.5% compounded monthly. How many monthly withdrawals of $300 can be made if the first occurs 3 1 2 years after the date of the initial investment? Count the final smaller withdrawal.

> A 60-year-old woman can purchase either of the following annuities from a life insurance company: a 30-year term annuity that will pay $367 at the end of each month or a life annuity that will pay $405 at the end of every month until the death of the ann

> A 65-year-old male can purchase either of the following annuities from a life insurance company: a 25-year term annuity that will pay $307 at the end of each month or a life annuity that will pay $408 at the end of every month until the death of the annu

> Rashid wants to use $500,000 from his RRSP to purchase an annuity that pays him $2000 at the end of each month for the first 10 years and $3000 per month thereafter. Global Insurance Co. will sell Rashid an annuity of this sort with a rate of return of 4

> Finest Furniture sells a television set priced at $1395 for $50 down and payments of $50 per month, including interest at 13.5% compounded monthly. How long after the date of purchase will the final payment be made?

> Bonnie and Clyde want to take a six-month leave of absence from their jobs to travel extensively in South America. Rounded to the next higher month, how many months will it take them to save $40,000 for the leave if they make month-end contributions of $

> What duration of annuity paying $5000 at the end of every quarter can be purchased with $200,000 if the invested funds earn 5.5% compounded semiannually?

> How much longer will it take monthly payments of $1000 to pay off a $100,000 loan if the monthly compounded rate of interest on the loan is 10.5% instead of 9.75%?

> How much longer will it take to pay off a $100,000 loan with monthly payments of $1000 than with monthly payments of $1100? The interest rate on the loan is 10.5% compounded monthly.

> Suppose that you contribute $400 per month to your RRSP. Rounding up to the nearest month, how much longer will it take for the RRSP’s value to reach $500,000 if it earns 7.5% compounded annually than if it earns 7.5% compounded monthly?

> The future value of an annuity consisting of end-of-year investments of $1658.87 earning 5.2% compounded annually is $100,000. How many annual investments were made?

> The total assessed value of property in Brockton has risen by $97 million from last year’s figure of $1.563 billion. The property tax rate last year for city services was $0.94181 per $100 of assessed value. If the city’s budget has increased by $750,000

> How much longer will it take month-end RRSP contributions of $500 to accumulate $500,000 than month-end contributions of $550? Assume that the RRSP earns 7.5% compounded monthly. Round the time required in each case to the next higher month.

> 1. How long will it take monthly payments of $400 to repay a $50,000 loan if the interest rate on the loan is 8% compounded semiannually? 2. How much will the time to repay the loan be reduced if the payments are $40 per month larger?

> If $300,000 is used to purchase an annuity earning 7.5% compounded monthly and paying $2500 at the end of each month, what will be the term of the annuity?

> Farah has $600,000 in her RRSP and wishes to retire. She is thinking of using the funds to purchase an annuity that earns 5% compounded annually and pays her $3500 at the end of each month. If she buys the annuity, for how long will she receive payments?

> How long will $500,000, in an investment account that earns 3.25% compounded monthly, sustain month-end withdrawals of $3000?

> Silas is about to begin regular month-end contributions of $500 to a bond fund. The fund’s long-term rate of return is expected to be 6% compounded semiannually. Rounded to the next higher month, how long will it take Silas to accumulate $300,000?

> Rounded to the next higher month, how long will it take end-of-month deposits of $500 to accumulate $100,000 in an investment account that earns 5.25% compounded monthly?

> How long will it take an RESP to grow to $200,000 if the plan owner contributes $250 at the end of each month and the plan earns: 1. 8% compounded monthly? 2. 8% compounded quarterly? 3. 8% compounded semiannually? 4. 8% compounded annually?

> How long will it take for monthly payments of $740 to repay a $100,000 loan if the interest rate on the loan is: 1. 7.5% compounded annually? 2. 7.5% compounded semiannually? 3. 7.5% compounded quarterly? 4. 7.5% compounded monthly?

> How long will it take for monthly payments of $800 to repay a $100,000 loan if the interest rate on the loan is: 1. 6% compounded monthly? 2. 7% compounded monthly? 3. 8% compounded monthly? 4. 9% compounded monthly?

> The school board in a municipality will require an extra $2,430,000 for its operating budget next year. The current mill rate for the school tax component of property taxes is 7.1253. 1. If the total of the assessed values of properties in the municipali

> Semiannual payments of $3874.48 are made on a $50,000 loan at 6.5% compounded semiannually. How long will it take to pay off the loan?

> Kyle wants to save $15,000 so he can take a trip to Australia when he graduates from college three years from now. How much must he contribute to a savings plan at the end of every month if the plan earns 4% compounded monthly?

> Norman financed the $2800 purchase price of his new washer and dryer with monthly payments at 6.4% compounded monthly made over two years. What will be the amount of each payment?

> What monthly payment is required to pay off a $50,000 loan in seven years if the interest rate on the loan is 7.5% compounded: 1. Annually? 2. Semiannually? 3. Quarterly? 4. Monthly?

> Marissa intends to make contributions to a TFSA such that the account will accumulate $150,000 after 20 years. What end-of-quarter contributions must be made if the TFSA earns 6% compounded: 1. Annually? 2. Semiannually? 3. Quarterly? 4. Monthly?

> Assume that the investments within an RRSP will earn 5% compounded annually. What monthly contribution must be made to the RRSP for it to grow to $750,000 in: 1. 15 years? 2. 20 years? 3. 25 years? 4. 30 years? In each case, also calculate the total earn

> The interest rate on a $100,000 loan is 7.5% compounded monthly. What must be the monthly payment for the loan to be repaid in: 1. 5 years? 2. 10 years? 3. 15 years? 4. 20 years? In each case, also calculate the total interest paid. (Note that a doubling

> Mr. Parmar wants to retire in 20 years and purchase a 25-year annuity that will make equal payments at the end of every quarter. The first payment should have the purchasing power of $6000 in today’s dollars. If he already has $54,000 in his RRSP, what c

> Cynthia currently has $31,000 in her RRSP. She plans to contribute $5000 at the end of each year for the next 17 years, and then use the accumulated funds to purchase a 20-year annuity making month-end payments. 1. If her RRSP earns 8.75% compounded annu

> Jack Groman’s financial plan is designed to accumulate sufficient funds in his RRSP over the next 28 years to purchase an annuity paying $6000 at the end of each month for 25 years. He will be able to contribute $7000 to his RRSP at the end of each year

> The assessed value on a property increased from $285,000 last year to $298,000 in the current year. Last year’s property tax rate was $1.56324 per $100 of assessed value. 1. What will be the change in the property tax from last year if the new tax rate i

> During a one-week promotion, Al’s Appliance Warehouse is planning to offer terms of “nothing down and nothing to pay for four months” on major appliances priced above $500. Four months after the date of the sale, the first of eight equal monthly payments

> A 20-year annuity is purchased for $400,000. What payment will it deliver at the end of each quarter, if the undistributed funds earn: 1. 4% compounded quarterly? 2. 5% compounded quarterly? 3. 6% compounded quarterly? 4. 7% compounded quarterly? In each

> A firm obtained a $3 million low-interest loan from a government agency to build a factory in an economically depressed region. The loan is to be repaid in semiannual payments over 15 years, and the first payment is due three years from today, when the f

> Leslie received a settlement when her employer declared her job redundant. Under special provisions of the Income Tax Act, she was eligible to place $22,000 of the settlement in an RRSP. Fifteen years from now, she intends to transfer the money from the

> As of Brice’s 54th birthday, he has accumulated $154,000 in his RRSP. What size of end-of-month payments in a 20-year annuity will these funds purchase at age 65 if he makes no further contributions? Assume that his RRSP and the investment in the annuity

> Harold, who just turned 27, wants to accumulate an amount in his RRSP at age 60 that will have the purchasing power of $300,000 in current dollars. What annual contributions on his 28th through 60th birthdays are required to meet this goal if the RRSP ea

> Dr. Collins wants the value of her RRSP 30 years from now to have the purchasing power of $500,000 in current dollars. 1. Assuming an inflation rate of 2% per year, what nominal dollar amount should Dr. Collins have in her RRSP after 30 years? 2. Assumin

> Beth and Nelson want to accumulate a combined total of $600,000 in their RRSPs by the time Beth reaches age 60, which will be 30 years from now. They plan to make equal contributions at the end of every six months for the next 25 years, and then no furth

> Four years from now, Tim and Justine plan to take a year’s leave of absence from their jobs and travel through Asia, Europe, and Africa. They want to accumulate enough savings during the next four years so they can withdraw $3000 at each month-end for th

> Ken and Barbara have two children, aged three and six. At the end of every six months for the next 12 1 2 years, they wish to contribute equal amounts to an RESP. Six months after the last RESP contribution, the first of 12 semiannual withdrawals of $500

> Johnston Distributing Inc. files quarterly GST returns. The purchases on which it paid the GST and the sales on which it collected the GST for the last four quarters were as follows: Calculate the GST remittance or refund due for each quarter.

> Elizabeth has been able to transfer a $25,000 retiring allowance into an RRSP. She plans to let the RRSP accumulate earnings at the rate of 5% compounded annually for 10 years, and then purchase a 15-year annuity making payments at the end of each quarte

> On the date of his granddaughter’s birth, Mr. Parry deposited $5000 in a trust fund earning 6.2% compounded annually. After the granddaughter’s 19th birthday, the trust account will make end-of-month payments to her for four years to assist with the cost

> In order to accumulate $500,000 after 25 years, calculate the amounts that must be invested at the end of each year, if the invested funds earn: 1. 6% compounded annually. 2. 7% compounded annually. 3. 8% compounded annually. 4. 9% compounded annually. I

> As of Betty’s 56th birthday, she has accumulated $195,000 in her RRSP. She has ceased contributions but will allow the RRSP to grow at an expected 5.4% compounded monthly until she reaches age 65. Then she will use the funds in the RRSP to purchase a 20-

> The interest rate on a $200,000 loan is 8% compounded quarterly. 1. What payments at the end of every quarter will reduce the balance to $150,000 after 3 1 2 years? 2. If the same payments continue, what will be the balance seven years after the date tha

> Mr. Bean wants to borrow $7500 for three years. The interest rate is 5.5% compounded monthly. 1. What quarterly payments are required on the loan? 2. What will be the balance owed on the loan at the start of the third year?

> n order to purchase another truck, Beatty Transport recently obtained a $50,000 loan for five years at 7.8% compounded semiannually. 1. What are the monthly payments on the loan? 2. What will be the loan’s balance at the end of the second year? 3. How mu