Question: Select the best answer for each of

Select the best answer for each of the questions below and explain fully the reason for your selection.

a. To assure accountability for fixed-asset retirements, management should implement an internal control that includes:

(1) Continuous analysis of miscellaneous revenue to locate any cash proceeds from the sale of plant assets.

(2) Periodic inquiry of plant executives by internal auditors as to whether any plant assets have been retired.

(3) Utilization of serially numbered retirement work orders.

(4) Periodic observation of plant assets by the internal auditors.

b. The auditors may conclude that depreciation charges are insufficient by noting:

(1) Insured values greatly in excess of book values.

(2) Large amounts of fully depreciated assets.

(3) Continuous trade-ins of relatively new assets.

(4) Excessive recurring losses on assets retired.

c. Which of the following is an internal control weakness related to factory equipment?

(1) Checks issued in payment of purchases of equipment are not signed by the controller.

(2) All purchases of factory equipment are required to be made by the department in need of the equipment.

(3) Factory equipment replacements are generally made when estimated useful lives, as indicated in depreciation schedules, have expired.

(4) Proceeds from sales of fully depreciated equipment are credited to other income.

d. Which of the following accounts should be reviewed by the auditors to gain reasonable assurance that additions to property, plant, and equipment are not understated?

(1) Depreciation.

(2) Accounts Payable.

(3) Cash.

(4) Repairs.

e. The auditors are most likely to seek information from the plant manager with respect to the:

(1) Adequacy of the provision for uncollectible accounts.

(2) Appropriateness of physical inventory observation procedures.

(3) Existence of obsolete machinery.

(4) Deferral of procurement of certain necessary insurance coverage.

f. To strengthen internal control over the custody of heavy mobile equipment, the client would most likely institute a policy requiring a periodic:

(1) Increase in insurance coverage.

(2) Inspection of equipment and reconciliation with accounting records.

(3) Verification of liens, pledges, and collateralizations.

(4) Accounting for work orders.

g. Which of the following statements is not typical of property, plant, and equipment as compared to most current asset accounts?

(1) A property, plant, and equipment cutoff error near year-end has a more significant effect on net income.

(2) Relatively few transactions occur in property, plant, and equipment during the year.

(3) The assets involved with property, plant, and equipment ordinarily have relatively longer lives.

(4) Property, plant, and equipment accounts typically have a higher dollar value.

h. For the audit of a continuing nonpublic client, the emphasis of the testing for property accounts is on:

(1) All transactions resulting in the ending balance.

(2) Tests of controls over disposals.

(3) Transactions that occurred during the year.

(4) Performing analytical procedures on beginning balances of the accounts.

i. Audit of which of the following accounts is most likely to reveal evidence relating to recorded retirements of equipment?

(1) Accumulated depreciation.

(2) Cost of goods sold.

(3) Purchase returns and allowances.

(4) Purchase discounts.

j. An effective procedure for identifying unrecorded retirements of equipment is to:

(1) Foot related property records.

(2) Recalculate depreciation on the related equipment.

(3) Select items of equipment in the accounting records and then locate them in the plant.

(4) Select items of equipment and then locate them in the accounting records.

k. Which of the following is not an overall test of the annual provision for depreciation expense?

(1) Compare rates used in the current year with those used in prior years.

(2) Test computation of depreciation provisions for a representative number of units.

(3) Test deductions from accumulated depreciation for assets purchased during the year.

(4) Perform analytical procedures.

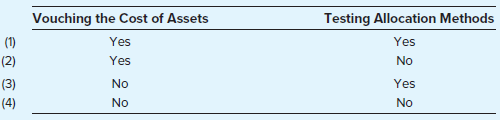

l. The audit of intangible assets typically involves

Transcribed Image Text:

Vouching the Cost of Assets Testing Allocation Methods (1) Yes Yes (2) Yes No (3) No Yes (4) No No 2 2

> You are engaged in the audit of the financial statements of Holman Corporation for the year ended December 31, 20X6. The accompanying analyses of the Property, Plant, and Equipment and related accumulated depreciation accounts have been prepared by the c

> Assume that you are auditing the financial statements of Agee Corporation. During the course of the audit, you discover the following circumstances. 1. Management of Agee has decided to discontinue the production of consumer electronics, which represents

> You are an audit manager of the rapidly growing CPA firm of Raye and Coye. You have been placed in charge of three new audit clients, which have the following inventory features: 1. Canyon Cattle Co., which maintains 15,000 head of cattle on a 1,000-squa

> You are involved in your CPA firm’s first audit of Zorostria, a retailer of artwork, primarily paintings and photographs purchased from artists in Southeast Asia (particularly Vietnam, Cambodia, and Laos). Zorostria has stores in seven cities throughout

> The following are typical questions that might appear on an internal control questionnaire for inventory: 1. Are written procedures prepared by the client for the taking of the physical inventory? 2. Do the client’s inventory-taking procedures include a

> Described below are potential financial statement misstatements that are encountered by auditors in the audit of inventory and cost of goods sold. a. Management of a chain of discount department stores systematically overstates inventory quantities at se

> Katherine Whipple of Food Queen Grocery, In., has asked you and your team to meet with her concerning a possible attest engagement relating to the assertion that Food Queen has the lowest overall prices of all grocery stores in the Salt Lake City area. F

> Williams Pharmaceutical Company produces a number of drugs that are regulated by various agencies, including, in the United States, the federal Food and Drug Administration (FDA). These agencies issue licenses that approve drugs for sale and establish sp

> Described below are potential financial statement misstatements that are encountered by auditors. a. Inventory is understated because warehouse personnel overlooked several racks of parts in taking the physical inventory. b. Inventory is overstated becau

> Under the Single Audit Act, auditors must test for compliance with the specific requirements of all major programs. State whether each of the following is required under that act: Is it Statement required? a. Determine that the organization complles

> Select the best answer for each of the following questions. Explain the reasons for your selection. a. Internal auditing can best be described as: (1) An accounting function. (2) A compliance function. (3) An activity primarily to detect fraud. (4) A con

> Match the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partlal Definition) Term a. A service developed by the AICPA and CICA to provide assurance 1. CBIZ 2. Financl

> For each of the situations (a) through (e), select the CPA engagement that is most likely to be appropriate from the list of services below: 1. Compliance 2. Continuous auditing 3. Forecast 4. Internal control over financial reporting 5. MD&A 6. Prim

> Indicate whether a CPA may provide each of the following services, and whether independence is required, by placing a check in the appropriate box. May Provide; Independence Independence May Not Is Required May Provide; Service Is Not Required Prov

> Following are descriptions of potential needs of clients for various services. For each need, identify the type of service that would best meet the client’s need using the following: ∙ Attestation of prospective financ

> Select the best answer for each of the following and explain fully the reason for your selection. a. A report on an attestation engagement should: (1) State the nature of the client’s control system. (2) State the practitionerâ

> Auditors who audit public and nonpublic companies must be familiar with professional standards developed by a variety of sources. For each of the types of services, indicate the proper source of professional requirements. Each source may be used once, mo

> The following are typical questions that might appear on an internal control questionnaire relating to plant and equipment: 1. Has a dollar minimum been established for expenditures to be capitalized? 2. Are subsidiary ledgers for plant and equipment reg

> Indicate whether a CPA may provide each of the following services, and whether independence is required, by placing a check in the appropriate box. May Provide; Independence Independence Is Required May Provide; Service Is Not Required May Not Provi

> State whether you agree or disagree with each of the following relating to the topic of special-purpose financial reporting frameworks. a. International Financial Reporting Standards are considered a special-purpose financial reporting framework. b. Cash

> Bill Jones, the president of AMTO, a nonpublic audit client of your firm, has come to you and indicated that his company established a subsidiary in the country of Laos this year and that he wants your firm to issue an audit report on that subsidiary for

> The following statements relate to auditor reporting on financial statements prepared using special-purpose financial reporting frameworks. For each, indicate whether the statement is correct or incorrect. Statement Correct Incorrect 1. A speclal-p

> Select the best answer for each of the following and explain fully the reason for your selection. a. Which of the following is not typically performed when the auditors are performing a review of client financial statements? (1) Analytical procedures app

> Match the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partial Definition) Term a. A control deficlency, or a combination of control deficlencles, In Internal contr

> During audits of internal control over financial reporting of various issuers, the auditors encountered the independent situations below. For each situation a through e select from the following list the appropriate audit responses. Each reply may be use

> Bill Jensen, a staff member of Zhan & Co., CPAs, has given you the following list of what he refers to as “internal control deficiencies” for the Zabling Co. audit and has asked you to review each point and make certain that you agree that each is an int

> While performing an internal control audit in conformity with PCAOB AS 2201, the auditors must be able to identify both control strengths and control weaknesses. Items (1) through (11) present various control strengths and deficiencies. For each item, se

> Select the best answer for each of the following questions. Explain the reasons for your selection: a. In an integrated audit, which of the following must the auditors communicate to the audit committee? b. In an integrated audit, which of the followi

> Your client, Summerford, Inc., has a debt agreement with Valley City Bank that includes a number of restrictions and covenants. Violation of any restriction or covenant results in the entire amount of the debt becoming due immediately. For each of the fo

> This simulation, available online, presents a draft of a nonpublic company audit report document and three exhibits. To allow this DRS to stand alone without consideration of other parts of the Keystone Computers & Networks, Inc. (Keystone) case, ass

> Johnson & Barkley, CPAs, audited the consolidated financial statements of Jordan Company (a public company) for the year ended December 31, 20X7. Johnson & Barkley previously have audited and issued standard unqualified audit reports on Jordan Company’s

> For each of the following brief scenarios, assume that you are reporting on a client’s financial statements. Reply as to the type(s) of opinion (per below) possible for the scenario. In addition: ∙ Unless stated otherw

> Items 1 through 5 present various independent factual situations an auditor might encounter in conducting an audit of a nonpublic company. For each situation, assume: ∙ The auditor is independent. ∙ The auditor previou

> For each of the account balances and associated assertions below, select the audit procedure from the list provided that provides the most appropriate audit evidence for the account assertion. //

> Match the following terms to the appropriate definition (or partial definition). Each definition is used once. Term Definition (or Partial Definition) a. Commitment b. Contingent llablity c. General risk 1. A contractual obligation to carry out a tr

> In connection with her audit of the financial statements of Flowmeter, Inc., for the year ended December 31, 20X3, Joan Hirsch, CPA, is aware that certain events and transactions that have taken place after December 31, 20X3, but before she has issued he

> In connection with your audit of the financial statements of Hollis Mfg. Corporation for the year ended December 31, 20X3, your review of subsequent events disclosed the following items: a. January 7, 20X4: The mineral content of a shipment of ore en rou

> The following situations represent excerpts from the responses to audit inquiries of external legal counsel of XYZ Co. during the annual audit of year 1 (“legal response”). For each excerpt, select the most appropriate

> Select the best answer for each of the following and give reasons for your choice: a. Which of the following is least likely to be considered a substantive procedure relating to payroll? (1) Investigate fluctuations in salaries, wages, and commissions. (

> The auditors’ report that follows was drafted by a staff accountant of Williams & Co., CPAs, at the completion of the audit of the financial statements of Lenz Corporation (nonpublic company) for the year ended December 31, 20X1. As

> Match the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partial Definition) Term a. An Institutlon charged with responslblity for avolding 1. Common stock overissuanc

> Select the best answer choice for each of the following, and justify your selection in a brief statement. a. Which of the following is least likely to be an audit objective for debt? (1) Determine the existence of recorded debt. (2) Establish the complet

> This simulation, available online, presents an audit request list document for materials requested of management that has been prepared by an audit team staff member for the Keystone audit. Because this simulation addresses material presented in Chapters

> In applying audit procedures and evaluating the results of those procedures, auditors may encounter specific information that may raise a question concerning the existence of noncompliance with laws and related party transactions. Indicate whether each o

> The auditors of SSC Company, a nonpublic company, are working on both audit objectives for the various accounts and documentation requirements. Parts (a) through (d) of this question relate to objectives, while part (e) addresses documentation. The audit

> The following flowchart depicts the activities relating to the purchasing, receiving, and accounts payable departments of Model Company, Inc. Assume that you are a supervising assistant assigned to the Model Company audit. Joe Werell, a beginning assis

> Select the best answer for each of the following and explain the reason for your selection. a. Which of the following procedures is least likely to be completed before the balance sheet date? (1) Confirmation of receivables. (2) Search for unrecorded lia

> a. Analysis of which account is least likely to reveal evidence relating to recorded retirement of equipment? (1) Accumulated depreciation. (2) Insurance expense. (3) Property, plant, and equipment. (4) Purchase returns and allowances. b. Which of the f

> Hwang Corporation has engaged in a number of expenditures relating to a land acquisition for a future plant. For each of the following, indicate whether you as the auditor of Hwang Corporation would propose an adjusting entry. Assume all transactions are

> Andy Watson, CPA, is a senior auditor on the audit of Carlson, Inc. Andy is reviewing the results of analytical procedures related to inventory. For results (a), (b), and (c), select the explanation that is most likely to be consistent with the change de

> This simulation, also available online, presents an Analytical Procedures/Risk Assessment Analysis document prepared by two members of your audit team—your responsibility is to evaluate various statements included in that document. Back

> a. An auditor most likely would make inquiries of production and sales personnel concerning possible obsolete inventory to address: (1) Valuation. (2) Rights. (3) Existence. (4) Presentation. b. An auditor selects items from the client’s inventory listi

> Auditors often observe the counting of their clients’ inventories. You are working in the area of inventory with a new assistant on the audit of Jilco Inc. The assistant has a number of questions concerning inventory and the observation of inventory. Ple

> The nonpublic company attestation standards provide guidance for three basic types of engagements. Required: a. Describe these three types of engagements. b. Describe the types of procedures performed for each of these three types of engagements. c. Dis

> Other types of assurance services provided by CPAs have developed as a natural extension of the audit function. a. Explain what is meant by the term assurance services. b. Describe the forces that have caused a demand for other types of assurance service

> Andrew Wilson, CPA, has assembled the financial statements of Texas Mirror Co., a small nonpublic company. He has not performed an audit of the financial statements in accordance with generally accepted auditing standards. Wilson is confused about the st

> In connection with a public offering of first-mortgage bonds by Guizzetti Corporation, the bond underwriter has asked Guizzetti’s CPAs to furnish it with a comfort letter giving as much assurance as possible on Guizzetti’s unaudited financial statements

> You have been engaged by the management of Pippin, Inc., a nonpublic company, to review the company’s financial statements for the year ended December 31, 20XX. To prepare for the engagement, you consult the Statements on Standards for Accounting and Rev

> Occasionally, public accounting firms are engaged to report on specified elements, accounts, and items of financial statements. Required: a. Discuss types of reports that may be provided for a nonpublic company for specified elements, accounts, and item

> Schmich and Schmich, CPAs, in Minneapolis, Minnesota, has completed the audit of XYM Co. for the year ended December 31, 20X1. The financial statements for this nonpublic client are prepared following the cash basis of accounting. Note 7 to the financial

> For each of the independent situations described below select the appropriate inherent risk factor described and the effect of the inherent risk factor on the company’s net income using the following: Inherent Risk Factor Effect o

> You have been asked by Ambassador Hardware Co., a small nonpublic company, to submit a proposal for the audit of the company. After performing an investigation of the company, including its management and accounting system, you advise the president of Am

> The CPA firm of Webster, Warren, & Webb LLP issued an adverse opinion on the internal control of Alexandria Financial, a public company, due to a material weakness. The weakness involved the lack of sufficient accounting expertise to evaluate and adopt a

> Tests of controls are ordinarily performed for both financial statement audits and internal control audits. a. What is the objective of tests of controls when performed for internal control audits? b. What is the objective of tests of controls when perfo

> The CPA firm of Carson & Boggs LLP is performing an internal control audit in accordance with PCAOB AS 2201. The partner in charge of the engagement has asked you to explain the process of determining which controls to test. Describe the process, present

> While performing your audit of Williams Paper Company, you discover evidence that indicates that Williams may not have the ability to continue as a going concern. a. Discuss types of information that may indicate substantial doubt about a client’s abilit

> Lando Corporation is a domestic company with two wholly owned domestic subsidiaries. Michaels, CPA, has been engaged to audit the financial statements of the parent company and one of the subsidiaries and to act as the group auditors. Thomas, CPA, has au

> Rowe & Myers audits the financial statements of Dunbar Electronics. During the audit, Ross & Myers engaged Jones & Abbot, a Canadian public accounting firm, as a component auditor to audit Dunbar’s wholly owned Canadian subsidiary. Required: a. Should R

> An accountant of an audit client made the following statement: It is important to read the notes to financial statements, even though they are presented in technical language and are incomprehensible. Auditors may reduce their exposure to third-party lia

> Linda Tanner, CPA, is auditing the Carson Company. For the current year, Carson is presenting December 31, 20X5, financial statements with comparative financial statements for the year ended December 31, 20X4. In the prior year audit, Linda identified an

> On July 27, 20X0, Arthur Ward, CPA, issued an unqualified audit report on the financial statements of Dexter Company for the year ended June 30, 20X0. Two weeks later, Dexter Company mailed annual reports, including the June 30 financial statements and W

> During the year 1 audit of Cellenting Co., the auditor performed various procedures relating to inventory. Match each of the following procedures with the description below: Audit procedures ∙∙ Analytical procedure &ac

> Nolan Manufacturing Company retains you on April 1 to perform an audit for the fiscal year ending June 30. During the month of May, you make extensive studies of internal control over inventories. All goods purchased pass through a receiving department u

> What documentary evidence is usually available to the auditors in the client’s office to substantiate the legal ownership of property, plant, and equipment?

> The auditors’ verification of plant and equipment is facilitated by several factors not applicable to audit work on current assets. What are these factors?

> Once the auditors have completed their test counts of the physical inventory, will they have any reason to make later reference to the inventory tags used by the client’s employees in the counting process? Explain.

> For what purposes do the auditors make and record test counts of inventory quantities during their observation of the taking of the physical inventory? Discuss.

> What are the purposes of the auditors’ observation of the taking of the physical inventory? (Do not discuss the procedures or techniques involved in making the observation.)

> What part, if any, do the independent auditors play in the planning for a client’s physical inventory?

> The client’s cost accounting system is often an important part of the CPAs’ audit of the financial statements of a manufacturing company. For what purposes do the auditors consider the cost accounting system?

> Do you believe that the normal review of purchase transactions by the auditors should include examination of receiving reports? Explain.

> What segregation of duties would you recommend to attain maximum internal control over purchasing activities in a manufacturing concern?

> Enumerate specific steps to be taken by the auditors to ascertain that a client’s inventories have not been pledged or subjected to a lien of any kind.

> What are the three major factors that determine the sample size for an attributes sampling plan?

> Explain the significance of the purchase order to adequate internal control over purchase transactions.

> The controller of a new client company informs you that most of the inventories are stored in bonded public warehouses. He presents warehouse receipts to account for the inventories. Will careful examination of these warehouse receipts constitute adequat

> How do the independent auditors use the client’s backlog of unfilled sales orders in the examination of inventories?

> “If the auditors can determine that all goods in the physical inventory have been accurately counted and properly priced, they will have discharged fully their responsibility with respect to inventory.” Evaluate this statement.

> Darnell Equipment Company uses the LIFO method of valuation for part of its inventories and weighted-average cost for another portion. Would you be willing to issue an unqualified opinion under these circumstances? Explain.

> “A well-prepared balance sheet usually includes a statement that the inventories are valued at cost.” Evaluate this quotation.

> Hana Ranch Company, which has never been audited, is asked on October 1 by its bank to arrange for a year-end audit. The company retains you to make this audit and asks what measures, if any, it should take to ensure a satisfactory year-end physical inve

> A client company wishes to conduct its physical inventory on a sampling basis. Many items will not be counted. Under what general conditions will this method of taking inventory be acceptable to the auditors?

> What charges and credits may be disclosed in the auditors’ analysis of the Cost of Goods Sold account of a manufacturing concern?

> What is meant by a “bill and hold” scheme?

> An auditor is sampling with replacement and, by chance, a particular account has been selected twice. Should it be included two times in the sample?

> When perpetual inventory records are maintained, is it necessary for a physical inventory to be taken at the balance sheet date? Explain.

> Many auditors consider the substantiation of the figure for inventory to be a more difficult and challenging task than the verification of most other items on the balance sheet. List several specific factors that support this view.

> Among specific procedures that contribute to good internal control over the business processes related to accounts receivable are (a) the approval of uncollectible account write-offs and credit memoranda by an executive and (b) the sending of monthly sta

> The accounts receivable section of the accounting department in Wind Power, Inc., maintains subsidiary ledgers that are posted from copies of the sales invoices transmitted daily from the billing department. How may the accounts receivable section be sur

> Comment on the following: “Any voided prenumbered shipping documents should be properly canceled and disposed of to eliminate any possibility of improper shipment of goods.”