Question: Select the correct answer for each of

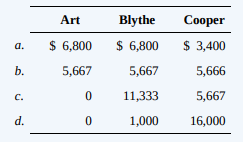

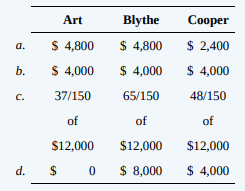

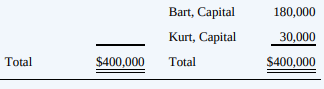

Select the correct answer for each of the following questions.

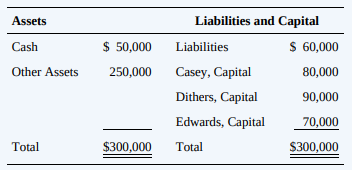

1. On January 1, 20X7, the partners of Casey, Dithers, and Edwards, who share profits and losses in the ratio of 5:3:2, decided to liquidate their partnership. On this date, its condensed balance sheet was as follows:

On January 15, 20X7, the first cash sale of other assets with a carrying amount of $150,000 realized $120,000. Safe installment payments to the partners were made on the same date. How much cash should be distributed to each partner?

2. In a partnership liquidation, the final cash distribution to the partners should be made in accordance with the

a. Partners’ profit and loss–sharing ratio.

b. Balances of the partners’ capital accounts.

c. Ratio of the capital contributions by the partners.

d. Ratio of capital contributions less withdrawals by the partners.

(Note: The following information is for questions 3 through 5.)

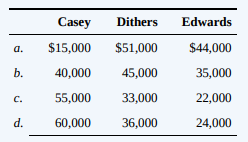

The balance sheet for the Art, Blythe, and Cooper Partnership is as follows. Figures shown parenthetically reflect agreed-upon profit and loss–sharing percentages.

3. If the firm, as shown on the balance sheet, is dissolved and liquidated by selling assets in installments and if the first sale of noncash assets having a book value of $90,000 realizes $50,000 and all cash available after settlement with creditors is distributed, the respective partners would receive (to the nearest dollar)

4. If the facts are as in question 3 except that $3,000 cash is to be withheld, the respective partners would then receive (to the nearest dollar)

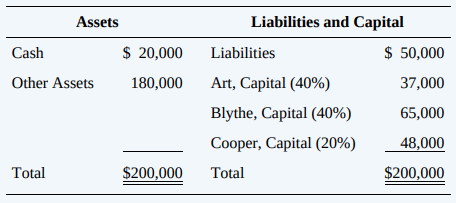

5. If each partner properly received some cash in the distribution after the second sale, if the cash to be distributed amounts to $12,000 from the third sale, and if unsold assets with an $8,000 book value remain, ignoring questions 3 and 4, the respective partners would receive

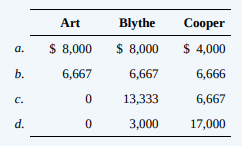

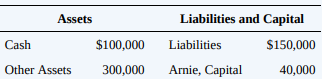

6. The following condensed balance sheet is for the partnership of Arnie, Bart, and Kurt, who share profits and losses in the ratio of 4:3:3, respectively:

The partners agreed to dissolve the partnership after selling the other assets for $200,000. On dissolution of the partnership, Arnie should receive

a. $0.

b. $40,000.

c. $60,000.

d. $70,000.

Transcribed Image Text:

Assets Liabilities and Capital Cash $ 50,000 Liabilities S 60,000 Other Assets 250,000 Casey, Capital 80,000 Dithers, Capital 90,000 Edwards, Capital 70,000 Total $300,000 Total $300,000 Casey Dithers Edwards $15,000 $51,000 $44,000 а. b. 40,000 45,000 35,000 55,000 33,000 22,000 C. d. 60,000 36,000 24,000 Assets Liabilities and Capital Cash $ 20,000 Liabilities $ 50,000 Other Assets 180,000 Art, Capital (40%) 37,000 Blythe, Capital (40%) 65,000 Cooper, Capital (20%) 48,000 Total $200,000 Total $200,000 Art Blythe Сооper $ 8,000 $ 8,000 $ 4,000 a. b. 6,667 6,667 6,666 C. 13,333 6,667 d. 3,000 17,000 Art Blythe Сооper $ 6,800 $ 6,800 $ 3,400 а. b. 5,667 5,667 5,666 с. 11,333 5,667 d. 1,000 16,000 Art Blythe Сооper $ 4,800 $ 4,800 $ 2,400 a. b. $ 4,000 $ 4,000 $ 4,000 C. 37/150 65/150 48/150 of of of $12,000 $12,000 $12,000 d. $ 0 $ 8,000 $ 4,000 Assets Liabilities and Capital Cash $100,000 Liabilities $150,000 Other Assets 300,000 Arnie, Capital 40,000 Bart, Capital 180,000 Kurt, Capital 30,000 Total $400,000 Total $400,000

> The saturation current IS for a p-n junction, Eq. (42.22), depends strongly on temperature. Explain why. From Eq. (42.22): Saturation current - Voltage -Absolute temperature Current through· a p-n junction *I='Is(e•V/kT 1) Boltzmann constant Magnit

> The electrical conductivities of most metals decrease gradually with increasing temperature, but the intrinsic conductivity of semiconductors always increases rapidly with increasing temperature. What causes the difference?

> A student asserts that silicon and germanium become good insulators at very low temperatures and good conductors at very high temperatures. Do you agree? Explain your reasoning.

> The bonding of gallium arsenide (GaAs) is said to be 31% ionic and 69% covalent. Explain.

> Ionic crystals are often transparent, whereas metallic crystals are always opaque. Why?

> Individual atoms have discrete energy levels, but certain solids (which are made up of only individual atoms) show energy bands and gaps. What causes the solids to behave so differently from the atoms of which they are composed?

> Van der Waals bonds occur in many molecules, but hydrogen bonds occur only with materials that contain hydrogen. Why is this type of bond unique to hydrogen?

> The wave functions for a particle in a box (see Fig. 40.12a) are zero at certain points. Does this mean that the particle can’t move past one of these points? Explain. From Fig. 40.12a 40.12 Graphs of (a) 4(x) and (b) |¼(x)|? for

> The quark content of the neutron is udd. a. What is the quark content of the antineutron? Explain your reasoning. b. Is the neutron its own antiparticle? Why or why not? c. The quark content of the Ψ is cc. Is the c its own antiparticle? Explain your

> According to the standard model of the fundamental particles, what are the similarities between quarks and leptons? What are the most important differences?

> According to the standard model of the fundamental particles, what are the similarities between baryons and leptons? What are the most important differences?

> Why can’t an electron decay to two photons? To two neutrinos?

> When a π0 decays to two photons, what happens to the quarks of which it was made?

> The gravitational force between two electrons is weaker than the electric force by the order of 10-40. Yet the gravitational interactions of matter were observed and analyzed long before electrical interactions were understood. Why?

> When they were first discovered during the 1930s and 1940s, there was confusion as to the identities of pions and muons. What are the similarities and most significant differences?

> Given the Heisenberg uncertainty principle, is it possible to create particle–antiparticle pairs that exist for extremely short periods of time before annihilating? Does this mean that empty space is really empty?

> Explain why the cosmological principle requires that H0 must have the same value everywhere in space, but does not require that it be constant in time.

> Assume that the universe has an edge. Placing yourself at that edge in a thought experiment, explain why this assumption violates the cosmological principle.

> A particle in a box is in the ground level. What is the probability of finding the particle in the right half of the box? (Refer to Fig. 40.12, but don’t evaluate an integral.) Is the answer the same if the particle is in an excited level? Explain.

> If quantum mechanics replaces the language of Newtonian mechanics, why don’t we have to use wave functions to describe the motion of macroscopic bodies such as baseballs and cars?

> Penn Corporation purchased 80 percent ownership of State Company on January 1, 20X2, at underlying book value. At that date, the fair value of the non controlling interest was equal to 20 percent of the book value of State. On January 1, 20X4, Penn sold

> Paper Corporation acquired 75 percent of Script Company’s common stock on May 15, 20X3, at underlying book value. Script’s balance sheet on December 31, 20X6, contained these amounts: During 20X7, Paper earned operat

> Purple Company owns 90 percent of the common stock and 60 percent of the preferred stock of Sage Corporation, both acquired at underlying book value on January 1, 20X1. At that date, the fair value of the non controlling interest in Sage common stock was

> Presley Pools Inc. acquired 60 percent of the common stock of Sammy Swim Company on December 31, 20X6, for $1,800,000. At that date, the fair value of the noncontrolling interest was $1,200,000. The full amount of the differential was assigned to goodwil

> Platinum Corporation acquired 10,500 shares of the common stock and 800 shares of the 8 percent preferred stock of Silver Company on December 31, 20X4, at the book value of the underlying stock interests. At that date, the fair value of the non controlli

> Sound Manufacturing Corporation prepared the following balance sheet as of January 1, 20X8: The company is considering a 2-for-1 stock split, a stock dividend of 4,000 shares, or a stock dividend of 1,500 shares on its $10 par value common stock. The c

> Acorn Corporation owns 80 percent of Beet Corporation’s common stock. It purchased the shares on January 1, 20X1, for $520,000. At the date of acquisition, the fair value of the non controlling interest was $130,000, and Beet reported common stock outsta

> In its consolidated cash flow statement for the year ended December 31, 20X2, Plant Corporation reported operating cash inflows of $284,000, financing cash outflows of $230,000, investing cash outflows of $80,000, and an ending cash balance of $57,000. P

> Power Corporation acquired 100 percent of Strip Corporation in a nontaxable transaction. The following selected information is available for Strip Corporation at the acquisition date: Strip Corporation has never recorded an allowance for doubtful accou

> Azure Enterprises acquired 90 percent of Brown Corporation’s voting common stock on January 1, 20X3, for $315,000. At that date, the fair value of the non controlling interest of Brown Corporation was $35,000. Immediately after Azure ac

> The IASB website can be found at www.ifrs.org. Access the website and click on the link at the top of the page for Projects. What are three projects currently on the active agenda that are being addressed by the IASB? What is the timetable identified for

> Parent Corporation owns 70 percent of Sister Corporation’s common stock and 25 percent of Brother Corporation’s common stock. In addition, Sister owns 40 percent of Brother’s stock. In 20X6, Parent, Sister, and Brother reported operating income of $90,00

> On January 1, 20X2, Plier Corporation purchased 90 percent of Saw Company common shares and 60 percent of its preferred shares at underlying book value. At that date, the fair value of the non controlling interest in Saw’s common stock

> Play town Corporation purchased 75 percent of Sandbox Company common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of Sandbox’s common shares held by the no

> Play town Corporation purchased 75 percent of Sandbox Corporation common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of the common shares of Sandbox held

> Pecan Corporation’s controller has just finished preparing a consolidated balance sheet, income statement, and statement of changes in retained earnings for the year ended December 31, 20X4. Pecan owns 60 percent of Sandy Corporation’s stock, which it ac

> Select the correct response for each of the following. 1. Lear Company ceased doing business and is in bankruptcy. Among the claimants are employees seeking unpaid wages. The following statements describe the possible status of such claims in a bankrupt

> Select the correct response for each of the following. 1. A client has joined other creditors of Jet Company in a composition agreement seeking to avoid a bankruptcy proceeding against Jet. Which statement describes the composition agreement? a. It prov

> The following is a list of selected account balances in the operating fund without donor restrictions for Pleasant School: Required: Prepare a statement of activities for Pleasant School’s unrestricted operating fund for the year ende

> Select the correct response for each of the following. 1. On January 2, 20X2, a not-for-profit botanical society received a gift of an exhaustible fixed asset with an estimated useful life of 10 years and no salvage value. The donor’s

> Select the correct answer for each of the following questions. 1. Which of the following statements is correct? I. In the government wide financial statements, internal service fund activities are reported in the Governmental Activities column. II. The

> Select the correct answer for each of the following 1. On December 31, 20X1, Tiffin Township paid a contractor $2,000,000 for the total cost of a new firehouse built in 20X1 on township owned land. Financing was by means of a $1,500,000 general obligati

> On August 1, 20X6, the City of Rockhaven received $1,000,000 from a prominent citizen to establish a private-purpose trust fund. The donor stipulated that the cash be permanently invested and that the earnings from the investments be spent to support loc

> Mountain View City is preparing its government wide financial statements for the year. As of the year-end, the city has determined the following information for its capital assets, exclusive of its infrastructure assets: Cost of capital assets acquired

> Select the correct response to each of the following. 1. The government wide financial statements use the a. Economic resources measurement focus and the accrual basis of accounting. b. Current financial resources measurement focus and the accrual basis

> Prepare journal entries for Iron City’s general fund for the following, including any adjusting and closing entries on December 31, 20X1 (the end of the fiscal year): a. Acquired a three-year fire insurance policy for $5,400 on September 1, 20X1. b. Orde

> Select the correct answer for each of the following items. 1. The primary focus in accounting and reporting for governmental funds is a. Income determination. b. Flow of financial resources. c. Capital maintenance. d. Transfers relating to proprietary a

> Refer to the pre closing trial balance in Exercise 17–10. Assume that the balances on December 31, 20X0, were as follows: Fund Balance—Assigned for Encumbrances ……….$28,000 Fund Balance—Unassigned …………………………………..91,000 Required: Prepare a general fund–

> Select the correct answer for each of the following questions. 1. One difference between accounting for a governmental (not-for-profit) unit and a commercial (for-profit) enterprise is that a governmental unit should a. Not record depreciation expense i

> Select the correct answer for each of the following questions: 1. On December 31, 20X7, Judy is a fully vested participant in a company-sponsored pension plan. According to the plan’s administrator, Judy has at that date the non forfei

> Select the correct answer for each of the following questions. (Note: The following information is for questions 1, 2, and 3.) The balance sheet for the partnership of Joan, Charles, and Thomas, whose shares of profits and losses are 40, 50, and 10 perce

> Select the correct answer for each of the following questions. 1. On May 1, 20X1, Cathy and Mort formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Cathy contributed a parcel of land that cost her $10,000. Mor

> Select the correct answer for each of the following questions. (The following balance sheet is for the partnership of Alex, Betty, and Claire in questions 1 and 2.) Cash …………

> In the GMP partnership (to which Elan seeks admittance), the capital balances of Mary, Gene, and Pat, who share income in the ratio of 6:3:1, are Mary …………………………….$240,000 Gene ……………………………….120,000 Pat …………………………………..40,000 Required: a. If no goodwill

> The partnership agreement of Angela and Dawn has the following provisions: 1. The partners are to earn 10 percent on the average capital. 2. Angela and Dawn are to earn salaries of $25,000 and $15,000, respectively. 3. Any remaining income or loss is to

> Select the correct answer for each of the following questions. 1. Which of the following statements concerning the prospectus required by the Securities Act of 1933 is correct? a. The prospectus is a part of the registration statement. b. The prospectus

> Select the correct answer for each of the following questions. 1. A major impact of the Foreign Corrupt Practices Act of 1977 is that registrants subject to the Securities Exchange Act of 1934 are required to a. Keep records that reflect the transaction

> Select the correct answer for each of the following questions. 1. Form 10-K is filed with the SEC to update the information a company supplied when filing a registration statement under the Securities and Exchange Act of 1934. Form 10-K is a report that

> Select the correct answer for each of the following questions. 1. In the registration and sales of new securities issues, the SEC a. Endorses a security’s investment merit by allowing its registration to “go effective.” b. Provides a rating of the invest

> Select the correct answer for each of the following questions. 1. Two interesting and important topics concerning the SEC are the role it plays in the development of accounting principles and the impact it has had and will continue to have on the accoun

> Select the correct answer for each of the following questions. 1. According to ASC 270 and 740, income tax expense in an income statement for the first interim period of an enterprise’s fiscal year should be computed by applying the a.

> Select the correct answer for each of the following questions. 1. Which of the following is an inherent difficulty in determining the results of operations on an interim basis? a. Cost of sales reflects only the amount of product expense allocable to re

> Match the items in the left-hand column with the descriptions/explanations in the right-hand column. Items Descriptions/Explanations A. Method used to restate a foreign entity's financial statement when the local currency unit is the functional curr

> Select the correct answer for each of the following questions. 1. Barbee Corporation discloses supplementary operating segment information for its two reportable segments. Data for 20X5 are available as follows: Additional 20X5 expenses are as follows

> Following are seven independent cases on how accounting facts might be reported on an individual company’s interim financial reports. 1. Bean Company was reasonably certain it would have an employee strike in the third quarter. As a result, the company s

> Refer to the data in Exercise E12-5, but now assume that the exchange rates were as follows: SFr $ January 1 ………………

> Refer to the data in Exercises E12-5 and E12-7. Required: a. Prepare a proof of the re measurement gain or loss computed in Exercise E12-7. b. How should this re measurement gain or loss be reported on Popular Creek’s consolidated fina

> Refer to the data in Exercise E12-5, but assume that the dollar is the functional currency for the foreign subsidiary. Required: Prepare a schedule re measuring the December 31, 20X1, trial balance from Swiss francs to dollars. Data from E12-5: On Jan

> Refer to the data in Exercise E12-5. Required: a. Prepare a proof of the translation adjustment computed in Exercise E12-5. b. Where is the translation adjustment reported on Popular Creek’s consolidated financial statements and its fo

> On January 1, 20X1, Popular Creek Corporation organized SunTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 60,000. SunTime’s December 31, 20X1, trial balance in SFr is as follows: Addi

> Use the following information for questions 1, 2, and 3. Bartell Inc., a U.S. company, acquired 90 percent of the common stock of a Malaysian company on January 1, 20X5, for $160,000. The net assets of the Malaysian subsidiary amounted to 680,000 ringgit

> Match the items in the left-hand column with the descriptions/explanations in the right-hand column. Items Descriptions/Explanations 1. Remeasurement gain or loss 2. Translation adjustment 3. Current rate method A. The currency of the primary econom

> The following information should be used for questions 1, 2, and 3. Select the best answers under each of two alternative assumptions: (a) the LCU is the functional currency and the translation method is appropriate or (b) the U.S. dollar is the function

> Match the items in the left-hand column with the descriptions/explanations in the right-hand column. Items Descriptions/Explanations 1. Reportable operating segment 2. 10 percent significance rules 3. Revenue test for material foreign country C. Inc

> Indicates that the item relates to “Additional Considerations.” Pole Company sold inventory to South Ltd., an English subsidiary. The goods cost Pole $8,000 and were sold to South for $12,000 on November 27, payable in British pounds. The goods are still

> On December 31, 20X2, your company’s Mexican subsidiary sold land at a selling price of 3,000,000 pesos. The land had been purchased for 2 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S. dollar. The exchange rate for 1 U.S

> Refer to the data in Exercise E12-5, but now assume that the exchange rates were as follows: SFr $ January 1 ………………

> For each of the following seven cases, work the case twice and select the best answer. First assume that the foreign currency is the functional currency; then assume that the U.S. dollar is the functional currency. 1. Certain balance sheet accounts in a

> Harris Inc. had the following transactions: 1. On May 1, Harris purchased parts from a Japanese company for a U.S. dollar equivalent value of $8,400 to be paid on June 20. The exchange rates were 2. On July 1, Harris sold products to a Brazilian custom

> Select the correct answer for each of the following questions. 1. The following information applies to Denton Inc.’s sale of 10,000 foreign currency units under a forward contract dated November 1, 20X5, for delivery on January 31, 20X6

> A indicates that the item relates to Appendix 11A. On November 1, 20X6, Smith Imports Inc. contracted to purchase teacups from England for £30,000. The teacups were to be delivered on January 30, 20X7, with payment due on March 1, 20X7. On N

> Jerber Electronics Inc. sold electrical equipment to a Dutch company for 50,000 guilders (G) on May 14, with collection due in 60 days. On the same day, Jerber entered into a 60-day forward contract to sell 50,000 guilders at a forward rate of G1 = $0.54

> Are there any book-tax differences that may arise in an acquisition that do not require the inclusion of a deferred tax asset or liability in the net identifiable assets acquired?

> Choose the correct answer for each of the following questions. 1. On November 15, 20X3, Chow Inc., a U.S. company, ordered merchandise FOB shipping point from a German company for €200,000. The merchandise was shipped and invoiced on Dec

> Select the correct answer for each of the following questions. 1. Dale Inc., a U.S. company, bought machine parts from a German company on March 1, 20X1, for €30,000, when the spot rate for euros was $0.4895. Dale’s yea

> Suppose the direct foreign exchange rates in U.S. dollars are 1 British pound = $1.60 1 Canadian dollar = $0.74 Required: a. What are the indirect exchange rates for the British pound and the Canadian dollar? b. How many pounds must a British company pa

> Pie Corporation paid $319,500 to acquire 90 percent ownership of Slice Company on April 1, 20X2. At that date, the fair value of the non controlling interest was $35,500. On January 1, 20X2, Slice reported these stockholders’ equity bal

> Pole Manufacturing Corporation issued stock with a par value of $67,000 and a market value of $503,500 to acquire 95 percent of Spencer Corporation’s common stock on August 30, 20X1. At that date, the fair value of the non controlling interest was $26,50

> The following 20X2 consolidated statement of cash flows is presented for Printing Company and its subsidiary, Sons Delivery: Printing acquired 60 percent of the voting shares of Sons Delivery in 20X1 at underlying book value. At that date, the fair val

> Pagle Corporation holds 80 percent of Standard Company’s common shares. The companies report the following balance sheet data for December 31, 20X1: An 8 percent annual dividend is paid on the Pagle preferred stock and a 12 percent di

> Poppy Corporation owns 60 percent of Seed Company’s common shares. Balance sheet data for the companies on December 31, 20X2, are as follows: The bonds of Poppy Corporation and Seed Company pay annual interest of 8 percent and 10 perc

> Poison Corporation holds 70 percent of Snake Company’s voting common shares but none of its preferred shares. Summary balance sheets for the companies on December 31, 20X1, are as follows: Neither of the preferred issues is convertibl

> Polly Corporation owns 80 percent of Sonny Corporation’s stock and 90 percent of Daughter Company’s stock. The companies file a consolidated tax return each year and in 20X5 paid a total tax of $80,000. Each company is

> What is the basis of accounting in the proprietary funds? Why?

> Pond Corporation holds 75 percent of the voting shares of Spring Services Company. During 20X7, Pond sold inventory costing $60,000 to Spring Services for $90,000, and Spring Services resold one-third of the inventory in 20X7. The remaining inventory was

> Pro Corporation purchased 11,000 shares of Schroeder Corporation on January 1, 20X3, at book value. At that date, the fair value of the non controlling interest was equal to percent of Schroeder’s book value. On December 31, 20X8, Schr

> Plant Advertising Corporation acquired 60 percent of Seed Manufacturing Company’s shares on December 31, 20X1, at underlying book value of $180,000. At that date, the fair value of the non controlling interest was equal to 40 percent of

> Peel Corporation purchased 60 percent of Split Products Company’s shares on December 31, 20X7, for $210,000. At that date, the fair value of the non controlling interest was $140,000. On January 1, 20X9, Peel purchased an additional 20

> Pepper Home Builders Inc. acquired 80 percent of Salty Concrete Works stock on January 1, 20X3, for $360,000. At that date, the fair value of the non controlling interest was $90,000. Salty Concrete’s balance sheet contained the followi

> Stake Company reported the following summarized balance sheet data as of December 31, 20X2: Stake issues 4,000 additional shares of its $10 par value stock to its shareholders as a stock dividend on April 20, 20X3. The market price of Stakeâ€