Question: Selected accounts of Shannon Company are shown

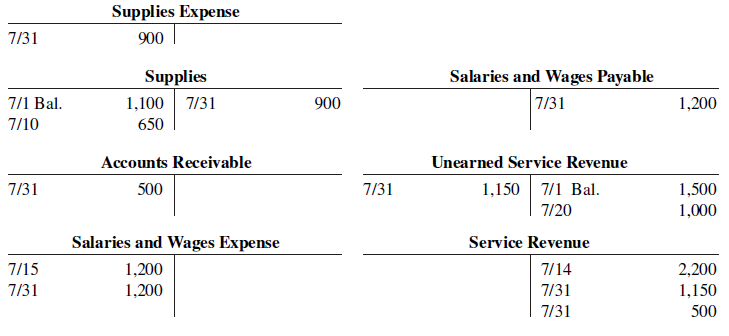

Selected accounts of Shannon Company are shown as follows.

Instructions

After analyzing the accounts, journalize (a) the July transactions and (b) the adjusting entries that were made on July 31.

Transcribed Image Text:

Supplies Expense 7/31 900 Salaries and Wages Payable 7/31 Supplies 7/1 Bal. 1,100 7/31 900 1,200 7/10 650 Accounts Receivable Unearned Service Revenue 7/31 500 7/31 1,150 7/1 Bal. 1,500 7/20 1,000 Salaries and Wages Expense Service Revenue 7/15 1,200 7/14 2,200 7/31 1,200 7/31 1,150 7/31 500

> Could firms identify people with greater capacity for creativity or inventiveness in their hiring procedures?

> Several studies indicate that the use of collaborative research agreements is increasing around the world. What might be some of the reasons that collaborative research is becoming more prevalent?

> What traits appear to make individuals most creative? Are these the same traits that lead to successful inventions?

> What are some of the advantages and disadvantages of a) individuals as innovators, b) firms as innovators, c) universities as innovators, d) government institutions as innovators, e) nonprofit organizations as innovators?

> Can you identify one or more circumstances when a company might wish to delay introducing its product?

> The Medical Committee for Human Rights (Committee), a nonprofit corporation organized to advance concerns for human life, received a gift of shares of Dow Chemical (Dow) stock. Dow manufactured napalm, a chemical defoliant that was used during the Vietna

> M.R. Watters was the majority shareholder of several closely held corporations, including Wildhorn Ranch, Inc. (Wildhorn). All these businesses were run out of Watters’s home in Rocky Ford, Colorado. Wildhorn operated a resort called the Wildhorn Ranch R

> Edward Hellenbrand ran a comedy club known as the Comedy Cottage in Rosemont, Illinois. The business was incorporated, with Hellenbrand and his wife as the corporation’s sole shareholders. The corporation leased the premises in which the club was located

> Southland Corporation (Southland) owns the 7-Eleven trademark and licenses franchisees throughout the country to operate 7-Eleven stores. The franchise agreement provides for fees to be paid to Southland by each franchisee based on a percentage of gross

> Christopher, Melony, Xie, and Ruth form iNet.com, LLC, a limited liability company. The 4 members are all Ph.D. scientists who have been working together in a backyard garage to develop a handheld wireless device that lets you receive and send email, sur

> Angela, Yoko, Cherise, and Serena want to start a new business that designs and manufactures toys for children. At a meeting in which the owners want to decide what type of legal form to use to operate the business, Cherise states: We should use a limite

> Fruehauf Corporation (Fruehauf) is engaged in the manufacture of large trucks and industrial vehicles. The Edelman group (Edelman) made a cash tender offer for the shares of Fruehauf for $48.50 per share. The stock had sold in the low $20-per-share range

> John A. Goodman was a real estate salesman in the state of Washington. Goodman sold to Darden, Doman & Stafford Associates (DDS), a general partnership, an apartment building that needed extensive renovation. Goodman represented that he personally had ex

> Gay’s Super Markets, Inc. (Super Markets), was a corporation formed under the laws of the state of Maine. Hannaford Bros. Company held 51 percent of the corporation’s common stock. Lawrence F. Gay and his brother Carrol were both minority shareholders in

> George Gibbons, William Smith, and Gerald Zollar were all shareholders in GRG Operating, Inc. (GRG). Zollar contributed $1,000 of his own funds so that the corporation could begin to do business. In exchange for this contribution, Gibbons and Smith both

> Commonwealth Edison Co. (Commonwealth Edison), through its underwriters, sold 1 million shares of preferred stock at an offering price of $100 per share. Commonwealth Edison wanted to issue the stock with a dividend rate of 9.26 percent, but its major un

> Martin Stern Jr. was an architect who worked in Nevada. Nathan Jacobson asked Stern to draw plans for Jacobson’s new hotel/ casino, the Kings Castle at Lake Tahoe. Stern agreed to take on the project and immediately began preliminary work. At this time,

> Leo V. Mysels was the president of Florida Fashions of Interior Design, Inc. (Florida Fashions). Florida Fashions, which was a Pennsylvania corporation, had never registered to do business in the state of Florida. While acting in the capacity of salesman

> Hutchinson Baseball Enterprises, Inc. (Hutchinson, Inc.), was incorporated under the laws of Kansas. Some of the purposes of the corporation, according to its bylaws, were to “promote, advance, and sponsor baseball, which shall include Little League and

> Jeffrey Sammak was the owner of a contracting business known as Senaco. Sammak decided to enter the coal reprocessing business. Sammak attended the Coal Show in Chicago, Illinois, at which he met representatives of the Deister Co., Inc. (Deister). Deiste

> Kawasaki Motors Corporation (Kawasaki), a Japanese corporation, manufactures motorcycles that it distributes in the United States through its subsidiary, Kawasaki Motors Corporation, U.S.A. (Kawasaki USA). Kawasaki USA is a franchisor that grants franchi

> Lawrence Gaffney was the president and general manager of Ideal Tape Company (Ideal). Ideal, which was a subsidiary of Chelsea Industries, Inc. (Chelsea), was engaged in the business of manufacturing pressure-sensitive tape. Gaffney recruited 3 other Id

> Ramada Inns, Inc. (Ramada Inns), is a franchisor that licenses franchisees to operate motor hotels using the Ramada Inns trademarks and service marks. In August, the Gadsden Motel Company (Gadsden), a partnership, purchased a motel in Attalla, Alabama, a

> Southland Corporation (Southland) owned the 7-Eleven trademark and licensed franchisees to operate convenience stores using this trademark. Each franchise is independently owned and operated. The franchise agreement stipulates that the franchisee is an i

> Re/Max International, Inc. (Re/Max), is the owner and licensor of Re/ Max trademarks and sells Re/Max franchises. Re/Max, through a subfranchisor, granted a franchise to Re/Max Midtown to operate a Re/Max franchise in Illinois (the franchisee). The Re/Ma

> Ally is a member and a manager of a manager-managed limited liability company called Movers & You, LLC, a moving company. The main business of Movers & You, LLC, is moving large corporations from old office space to new office space in other buildings. A

> Juan, Min-Yi, and Chelsea form Unlimited, LLC, a limited liability company that operates a chain of women’s retail clothing stores that sell eclectic women’s clothing. The company is a manager-managed LLC, and Min-Yi has been designated in the articles o

> Harold, Jasmine, Caesar, and Yuan form Microhard.com, LLC, a limited liability company, to sell computer hardware and software on the internet. Microhard.com, LLC, hires Heather, a recent graduate of the University of Chicago and a brilliant software des

> Dale C. Bone was a member of Roscoe, LLC, an LLC organized under the laws of North Carolina. Roscoe, LLC, purchased 2 acres of land near the town of Apex, North Carolina. Apex approved Roscoe, LLC’s plan to construct and operate a propane gas bulk storag

> The state of Wisconsin enacted an antitakeover statute that protects corporations that are incorporated in Wisconsin and have their headquarters, substantial operations, or 10 percent of their shares or shareholders in the state. The statute prevents any

> Mobil Corporation (Mobil) made a tender offer to purchase up to 40 million outstanding common shares of stock in Marathon Oil Company (Marathon) for $85 per share in cash. It further stated its intentions to follow the purchase with a merger of the two c

> Over a period of several years, the Curtiss-Wright Corporation (Curtiss-Wright) purchased 65 percent of the stock of Dorr-Oliver Incorporated (Dorr-Oliver). CurtissWright’s board of directors decided that a merger with Dorr-Oliver would be beneficial to

> Jon-T Chemicals, Inc. (Chemicals), was an Oklahoma corporation engaged in the fertilizer and chemicals business. John H. Thomas was its majority shareholder and its president and board chairman. Chemicals incorporated Jon-T Farms, Inc. (Farms), as a whol

> The adjusted trial balance columns of the worksheet for Nguyen Company, owned by C. Nguyen, are as follows. Instructions a. Complete the worksheet by extending the balances to the fi nancial statement columns. b. Prepare an income statement, owner&acir

> The trial balance columns of the worksheet for Warren Roofing at March 31, 2020, are as follows. Other data: 1. A physical count reveals only $480 of roofing supplies on hand. 2. Depreciation for March is $250. 3. Unearned revenue amounted to $260 at M

> Gabriel’s Graphics Company was organized on January 1, 2020, by Gabriel Medina. At the end of the first 6 months of operations, the trial balance contained the following accounts. Analysis reveals the following additional data. 1. The

> On November 1, 2020, the account balances of Hamm Equipment Repair were as follows. During November, the following summary transactions were completed. Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries. 10 Received

> A review of the ledger of Gina Company at December 31, 2020, produces the following data pertaining to the preparation of annual adjusting entries. 1. Prepaid Insurance $10,440. The company has separate insurance policies on its buildings and its motor v

> Alena Co. was organized on July 1, 2020. Quarterly financial statements are prepared. The unadjusted and adjusted trial balances as of September 30 are shown below. Instructions a. Journalize the adjusting entries that were made. b. Prepare an income s

> Hank’s Hotel opened for business on May 1, 2020. Its trial balance before adjustment on May 31 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Hank’s Hotel also con

> On December 1, 2020, Rodriguez Distributing Company had the following account balances. During December, the company completed the following summary transactions. Dec. 6 Paid $1,600 for salaries and wages due employees, of which $600 is for December a

> Tiff any Lyons was just hired as the assistant treasurer of Key West Stores. The company is a specialty chain store with nine retail stores concentrated in one metropolitan area. Among other things, the payment of all invoices is centralized in one of th

> Logan Krause started her own consulting fi rm, Krause Consulting, on May 1, 2020. The trial balance at May 31 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Krause Consulting also contains the follow

> Rusthe Management Services began business on January 1, 2020, with a capital investment of $120,000. The company manages condominiums for owners (Service Revenue) and rents space in its own office building (Rent Revenue). The trial balance and adjusted t

> The trial balances before and after adjustment for Renfro Company at the end of its fiscal year are presented below. Instructions Prepare the adjusting entries that were made. Renfro Company Trial Balance August 31, 2020 Before After Adjustment Adj

> Greenock Company has the following information available for accruals for the year ended December 31, 2020. The company adjusts its accounts annually. 1. The December utility bill for $425 was unrecorded on December 31. Greenock paid the bill on January

> Action Quest Games Co. adjusts its accounts annually. The following information is available for the year ended December 31, 2020. 1. Purchased a 1-year insurance policy on June 1 for $1,800 cash. 2. Paid $6,500 on August 31 for 5 months’ rent in advance

> On December 31, 2020, Waters Company prepared an income statement and balance sheet, but failed to take into account three adjusting entries. The balance sheet showed total assets $150,000, total liabilities $70,000, and owner’s equity $80,000. The incor

> The ledger of Armour Lake Lumber Supply on July 31, 2020, includes the selected accounts below before adjusting entries have been prepared. An analysis of the company’s accounts shows the following. 1. The notes payable pays interest

> A partial adjusted trial balance of Frangesch Company at January 31, 2020, shows the following. Instructions Answer the following questions, assuming the year begins January 1. a. If the amount in Supplies Expense is the January 31 adjusting entry and

> The income statement of Lundeen Co. for the month of July shows net income of $1,400 based on Service Revenue $5,500, Salaries and Wages Expense $2,300, Supplies Expense $1,200, and Utilities Expense $600. In reviewing the statement, you discover the fol

> The trial balance for Pioneer Advertising is shown in Illustration 3.3. Instead of the adjusting entries shown in the textbook at October 31, assume the following adjustment data. 1. Supplies on hand at October 31 total $500. 2. Expired insurance for the

> Lorena Manzone, D.D.S., opened a dental practice on January 1, 2020. During the first month of operations, the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31, $785 of such services were pe

> How does income measurement differ between a merchandising and a service company?

> The ledger of Passehl Rental Agency on March 31 of the current year includes the selected accounts, shown below, before adjusting entries have been prepared. An analysis of the accounts shows the following. 1. The equipment depreciates $400 per month.

> Mendoza Company accumulates the following adjustment data at December 31. 1. Services performed but unbilled total $3,000. 2. Supplies of $300 have been used. 3. Utility expenses of $552 are unpaid. 4. Services performed of $260 collected in advance. 5.

> Devin Wolf Company has the following balances in selected accounts on December 31, 2020. All the accounts have normal balances. The information below has been gathered at December 31, 2020. 1. Devin Wolf Company borrowed $10,000 by signing a 9%, one-ye

> Luong Corporation encounters the following situations: 1. Luong collects $1,300 from a customer in 2020 for services to be performed in 2021. 2. Luong incurs utility expense which is not yet paid in cash or recorded. 3. Luong’s employees worked 3 days in

> Carillo Industries collected $108,000 from customers in 2020. Of the amount collected, $25,000 was for services performed in 2019. In addition, Carillo performed services worth $36,000 in 2020, which will not be collected until 2021. Carillo Industries a

> The adjusted trial balance columns of the worksheet for Auburn Company are as follows. Instructions Complete the worksheet. Auburn Company Worksheet (partial) For the Month Ended April 30, 2020 Adjusted Trial Balance Income Statement Balance Sheet

> Chloe Davis has prepared the following list of statements about the time period assumption. 1. Adjusting entries would not be necessary if a company’s life were not divided into artifi cial time periods. 2. The IRS requires companies to fi le annual tax

> Financial Statement Presented below is information for Kaila Company for the month of March 2020. Cost of goods sold $215,000 Rent expense $ 30,000 Freight-out 7,000 Sales discounts 8,000 Insurance expense 6,000 Sales returns and allo

> Presented below is information related to Hoerl Co. for the month of January 2020. Instructions a. Prepare the necessary adjusting entry for inventory. b. Prepare the necessary closing entries. $ 12,000 Ending inventory per perpetual records Ending

> Tim Jarosz Company had the following account balances at year-end: Cost of Goods Sold $60,000, Inventory $15,000, Operating Expenses $29,000, Sales Revenue $115,000, Sales Discounts $1,200, and Sales Returns and Allowances $1,700. A physical count of inv

> The completed financial statement columns of the worksheet for Bray Company are shown as follows. Instructions a. Prepare an income statement, an owner’s equity statement, and a classified balance sheet. b. Prepare the closing entries

> The following accounts were taken from the financial statements of Giles Company. ________ Interest revenue ________ Owner’s capital ________ Utilities payable ________ Accumulated depreciation—equipment ________ Accounts payable ________ Equipment

> Hanson Company has an inexperienced accountant. During the first month on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made. 1. The purchase of supplies for $650 cash was debited to Equipment

> Paloma Company shows the following balances in selected accounts of its adjusted trial balance. Prepare the closing entries at December 31. Supplies $32,000 Service Revenue $108,000 Supplies Expense 6,000 Salaries and Wages Expense 40,000 Accounts R

> Ming Company was organized on April 1, 2020. The company prepares quarterly financial statements. The adjusted trial balance amounts at June 30 are as follows. a. Determine the net income for the quarter April 1 to June 30. b. Determine the total asset

> Fiske Computer Services began operations in July 2020. At the end of the month, the company prepares monthly financial statements. It has the following information for the month. 1. At July 31, the company owed employees $1,300 in salaries that the compa

> The ledger of Milton, Inc. on March 31, 2020, includes the following selected accounts before adjusting entries. An analysis of the accounts shows the following. 1. Insurance expires at the rate of $400 per month. 2. Supplies on hand total $1,600. 3. T

> Jordan Carr is preparing a worksheet. Explain to Jordan how he should extend the following adjusted trial balance accounts to the financial statement columns of the worksheet. Service Revenue Accounts Receivable Notes Payable Accumulated Depreciation

> Financial Statement The following information is available for Berlin Corp. for the year ended -December 31, 2020: Other revenues and gains $ 12,700 Sales revenue $592,000 Other expenses and losses 13,300 Operating expenses 186,000 Co

> The trial balance of Beads and Bangles at December 31 shows Inventory $21,000, Sales Revenue $156,000, Sales Returns and Allowances $4,000, Sales Discounts $3,000, Cost of Goods Sold $92,400, Interest Revenue $5,000, Freight-Out $1,800, Utilities Expense

> Assume information similar to that in DO IT! 5.2. On October 5, Wang Company buys merchandise on account from Davis Company. The selling price of the goods is $4,800, and the cost to Davis Company is $3,100. On October 8, Wang returns defective goods wit

> Susan Hardy, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. If Hardy’s law firm prepares monthly financial statements, when should it recognize revenue from this engagement? Why?

> On October 5, Wang Company buys merchandise on account from Davis Company. The selling price of the goods is $4,800, and the cost to Davis Company is $3,100. On October 8, Wang returns defective goods with a selling price of $650 and a fair value of $100

> Indicate whether the following statements are true or false. If false, indicate how to correct the statement. 1. A merchandising company reports gross profi t but a service company does not. 2. Under a periodic inventory system, a company determines the

> Presented below is the format of the worksheet using the periodic inventory system presented in Appendix 5B. Indicate where the following items will appear on the worksheet: (a) Cash, (b) Beginning inventory, (c) Accounts payable, and (d) Ending invent

> Assume the same information as in BE5.12 and also that Morgan Company has beginning inventory of $60,000, ending inventory of $90,000, and net sales of $730,000. Determine the amounts to be reported for cost of goods sold and gross profit. Information t

> Assume Kupfer Company has the following reported amounts: Sales revenue $510,000, Sales returns and allowances $15,000, Cost of goods sold $330,000, and Operating expenses $90,000. Compute the following: (a) net sales, (b) gross profit, (c) income from o

> At Raymond Company, the following errors were discovered after the transactions had been journalized and posted. Prepare the correcting entries. 1. A collection on account from a customer for $870 was recorded as a debit to Cash $870 and a credit to Serv

> The following selected accounts appear in the adjusted trial balance columns of the worksheet for Ashram Company: Accumulated Depreciation, Depreciation Expense, Owner’s Capital, Owner’s Drawings, Service Revenue, Supplies, and Accounts Payable. Indicate

> The ledger of Walters Company includes the following unadjusted balances: Prepaid Insurance $3,000, Service Revenue $60,000, and Salaries and Wages Expense $25,000. Adjusting entries are required for (a) expired insurance $1,800, (b) services performed

> The balance sheet debit column of the worksheet for Jolie Company includes the following accounts: Accounts Receivable $12,500, Prepaid Insurance $4,500, Cash $4,100, Supplies $5,200, and Debt Investments (short-term) $7,600. Prepare the current assets s

> Eckholm Company records all prepayments in income statement accounts. At April 30, the trial balance shows Supplies Expense $2,800, Service Revenue $9,200, and zero balances in related balance sheet accounts. Prepare the adjusting entries at April 30 ass

> Define two generally accepted accounting principles that relate to adjusting the accounts.

> Financial Statement Partial adjusted trial balance data for Miller Company is presented in BE3.9. The balance in Owner’s Capital is the balance as of January 1. Prepare an owner’s equity statement for the year assuming net income is $14,200 for the year.

> Financial Statement The adjusted trial balance of Miller Company at December 31, 2020, includes the following accounts: Owner’s Capital $16,400, Owner’s Drawings $7,000, Service Revenue $39,000, Salaries and Wages Expense $16,000, Insurance Expense $2,00

> Using the data in BE3.5, journalize and post the entry on July 1 and the adjusting entry on December 31 for Mesa Insurance Co. Mesa uses the accounts Unearned Service Revenue and Service Revenue.

> On July 1, 2019, Major Co. pays $15,120 to Mesa Insurance Co. for a 4-year insurance contract. Both companies have fi scal years ending December 31. For Major Co., journalize and post the entry on July 1 and the annual adjusting entry on December 31.

> At the end of its first year, the trial balance of Wolowitz Company shows Equipment $30,000 and zero balances in Accumulated Depreciation—Equipment and Depreciation Expense. Depreciation for the year is estimated to be $3,750. Prepare the annual adjustin

> Schramel Advertising Company’s trial balance at December 31 shows Supplies $6,700 and Supplies Expense $0. On December 31, there are $2,100 of supplies on hand. Prepare the adjusting entry at December 31, and using T-accounts, enter the balances in the a

> Gee Company accumulates the following adjustment data at December 31. Indicate (a) the type of adjustment (prepaid expense, accrued revenue, and so on), and (b) the status of accounts before adjustment (for example, “assets understated and revenues under

> The ledger of Althukair Company includes the following accounts. Explain why each account may require adjustment. a. Prepaid Insurance. b. Depreciation Expense. c. Unearned Service Revenue. d. Interest Payable.

> Financial Statement Nelson Company provides the following information for the month ended October 31, 2020: sales on credit $280,000, cash sales $95,000, sales discounts $5,000, and sales returns and allowances $11,000. Prepare the sales section of the i

> Brueser Company has the following account balances: Sales Revenue $195,000, Sales Discounts $2,000, Cost of Goods Sold $117,000, and Inventory $40,000. Prepare the entries to record the closing of these items to Income Summary.

> a. How does the time period assumption affect an accountant’s analysis of business transactions? b. Explain the terms fiscal year, calendar year, and interim periods.

> At year-end, the perpetual inventory records of Gutierrez Company showed merchandise inventory of $98,000. The company determined, however, that its actual inventory on hand was $96,100. Record the necessary adjusting entry.

> From the information in BE5.4, prepare the journal entries to record these transactions on Opps Company’s books under a perpetual inventory system.