Question: Sentry, Inc., acquires for $2,300,000

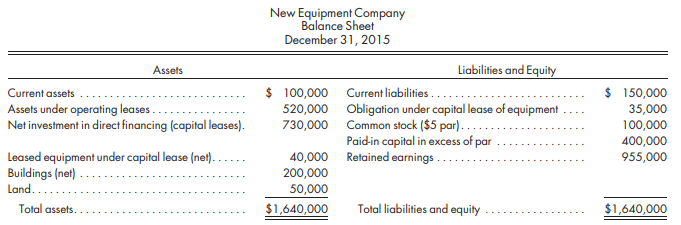

Sentry, Inc., acquires for $2,300,000 in cash, the net assets of New Equipment Company. The acquisition is made on December 31, 2015, at which time New Equipment has prepared the following balance sheet:

The following information is available concerning the assets and liabilities of New Equipment:

a. Current assets and liabilities are stated fairly. No payments resulting from leases are included in current accounts, since all payments are due each December 31 and payment for 2015 has been made.

b. Assets under operating leases have an estimated value of $580,000. This figure includes consideration of remaining rents and the value of the assets at the end of the lease terms.

c. The net investment in direct financing leases represents receivables at their discounted present values. All leases except one are based on the current market interest rate of 12%. One equipment lease is included at an amount of $199,636. This lease includes five and of the year payments of $50,000 present valued at an 8% interest rate. This lease should be adjusted to its real fair value using a 12% annual interest rate.

d. The buildings and land have appraised fair values of $400,000 and $100,000, respectively.

e. The leased equipment under the capital lease pertains to a computer used by New Equipment. The obligation under the capital lease of equipment includes the present value of five remaining payments of $9,233 due at the end of each year and discounted at 10%. Title transfers to the lessee at the end of the lease term. The current interest rate for this type of transaction is 12%. The fair value of the equipment under the lease is $60,000.

f. New Equipment has expended $100,000 on R&D leading to new equipment applications. Sentry estimates the value of this work to be $200,000.

g. New Equipment has been named in a $200,000 lawsuit involving an accident by a lessee using its equipment. It is likely that New Equipment will be found liable in the amount of $50,000.

Required

Record the acquisition of New Equipment Company by Sentry, Inc. Carefully support your entry. You may assume that the price will allow goodwill to be recorded.

Transcribed Image Text:

New Equipment Company Balance Sheet December 31, 2015 Assets Liabilities and Equity $ 100,000 Current liabilities ... 520,000 Obligation under capital lease of equipment 730,000 Common stock ($5 par).. 150,000 35,000 100,000 400,000 955,000 Current assets Assets under operating leases. Net investment in direct financing (capital leases). Paid-in capital in excess of par Leased equipment under capital lease (net). . Buildings (net) 40,000 Retained earnings.. 200,000 50,000 Land..... Total assets. $1,640,000 Total liabilities and equity $1,640,000

> A parent company acquired an 80% interest in a subsidiary on July 1, 2015. The subsidiary closed its books on that date. The subsidiary reported net income of $60,000 for 2015, earned evenly during the year. The parent’s net income, exclusive of any inco

> Parker Company acquires an 80% interest in Sargent Company for $300,000 on January 1, 2015, when Sargent Company has the following balance sheet: The excess of the price paid over book value is attributable to the fixed assets, which have a fair value

> What is the noncontrolling share of consolidated net income? Does it reflect adjustments based on fair values at the purchase date? How has it been displayed in income statements in the past, and how should it be displayed?

> A parent company paid $500,000 for a 100% interest in a subsidiary. At the end of the first year, the subsidiary reported net income of $40,000 and paid $5,000 in dividends. The price paid reflected understated equipment of $70,000, which will be amortiz

> The trial balances of Charles Company and its subsidiary, Lehto, Inc., are as follows on December 31, 2017: On January 1, 2015, Charles Company exchanges 20,000 shares of its common stock, with a fair value of $20 per share, for all the outstanding sto

> It seems as if consolidated net income is always less than the sum of the parent’s and subsidiary’s separately calculated net incomes. Is it possible that the consolidated net income of the two affiliated companies could actually exceed the sum of their

> Pillow Company is purchasing an 80% interest in the common stock of Sleep Company for $800,000. Sleep’s balance sheet amounts at book and fair value are as follows: Use a valuation analysis schedule to determine what will be the amoun

> Pillow Company is purchasing an 80% interest in the common stock of Sleep Company. Sleep’s balance sheet amounts at book and fair values are as follows: Use valuation analysis schedules to determine what adjustments to recorded values

> Pillow Company is purchasing a 100% interest in the common stock of Sleep Company. Sleep’s balance sheet amounts at book and fair values are as follows: Use valuation analysis schedules to determine what adjustments to recorded values

> Paulos Company purchases a controlling interest in Sanjoy Company. Sanjoy had identifiable net assets with a book value of $500,000 and a fair value of $800,000. It was agreed that the total fair value of Sanjoy’s common stock was $1,200,000. Use value a

> What is meant by date alignment? Does it exist on the consolidated worksheet under the following methods, and if not, how is it created prior to elimination of the investment account under each of these methods? a. The simple equity method b. The sophist

> Jacobson Company is considering an investment in the common stock of Biltrite Company. What are the accounting issues surrounding the recording of income in future periods if Jacobson purchases: a. 15% of Biltrite’s outstanding shares. b. 40% of Biltrite

> Company P owns 90% of Company S’s shares. Assume Company S then purchases 2% of Company P’s outstanding shares of common stock. When consolidating, what happens to the 2% holding in the consolidated financial statements?

> The trial balances of Parker and Sargent companies of Exercise 3 for December 31, 2016, are presented as follows: Parker Company continues to use the simple equity method. 1. Prepare all the eliminations and adjustments that would be made on the 2016

> Company A owns 80% of Company B. Company B owns 60% of Company C. From a consolidated viewpoint, does A control C? How will $10,000 of Company C income flow to the members of the consolidated firms when it is distributed at year-end?

> Quail Company purchases 80% of the common stock of Commo Company for $800,000. At the time of the purchase, Commo has the following balance sheet: The fair values of assets are as follows: Cash equivalents . . . . . . . . . . . . . . . . . $120,000 In

> Subsidiary Company S had the following stockholders’ equity on January 1, 2018, prior to issuing 5,000 additional new shares: Common stock ($1 par), 100,000 shares issued and outstanding . . . . . . . $ 100,000 Paid-in capital in excess of par . . . .

> Subsidiary Company S had the following stockholders’ equity on January 1, 2018, prior to issuing 20,000 additional new shares to noncontrolling shareholders: Common stock ($1 par), 100,000 shares issued and outstanding . . . . . . . $ 100,000 Paid-in c

> Subsidiary Company S had the following stockholders’ equity on December 31, 2017, prior to distributing a 10% stock dividend: Common stock ($1 par), 100,000 shares issued and outstanding . . . . . . . $ 100,000 Paid-in capital in excess of par . . . .

> Company S has the following stockholders’ equity on January 1, 2019: Common stock ($1 par, 100,000 shares). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $100,000 6% preferred stock ($100 par, 2,000 shares) . . . . . . . . . . .

> Company P purchased an 80% interest (8,000 shares) in Company S for $800,000 on January 1, 2015. Company S’s equity on that date was $900,000. Any excess of cost over book value was attributed to equipment with a 10-year life. On January 1, 2019, Company

> Company P purchases an 80% interest in Company S on January 1, 2015, for $480,000. Company S had equity of $450,000 on that date. Any excess of cost over book value was attributed to equipment with a 10-year life. On July 1, 2020, Company P purchased ano

> Company S has 4,000 shares outstanding and a total stockholders’ equity of $200,000. It is about to issue 6,000 new shares to the prospective parent company. The shares will be sold for a total of $650,000. Will there be an excess of cost over book value

> Company S is an 80% owned subsidiary of Company P. On January 1, 2015, Company P sells equipment to Company S at a $50,000 profit. Assume a 30% corporate tax rate and an 80% dividend exclusion. The equipment has a 5-year life. The question is, would taxe

> Company S is an 80% owned subsidiary of Company P. For 2015, Company P reports internally generated income before tax of $100,000. Company S reports an income before tax of $40,000. A 30% tax rate applies to both companies. Calculate consolidated net inc

> Parker Company acquires an 80% interest in Sargent Company for $300,000 in cash on January 1, 2015, when Sargent Company has the following balance sheet: The excess of the price paid over book value is attributable to the fixed assets, which have a fai

> On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. On this date, Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net in

> Refer to the preceding common information for Paulcraft’s acquisition of Switzer’s common stock. Assume that Paulcraft pays $440,000 for 80% of Switzer common stock. Paulcraft uses the simple equity method to account f

> Libra Company is purchasing 100% of the outstanding stock of Genall Company for $700,000. Genall has the following balance sheet on the date of acquisition: Appraisals indicate that the following fair values for the assets and liabilities should be ack

> Refer to the preceding information for Paulcraft’s acquisition of Switzer’s common stock. Assume that Paulcraft pays $480,000 for 100% of Switzer common stock. Paulcraft uses the cost method to account for its investme

> On January 1, 2015, Port Company acquires 8,000 shares of Solvo Company by issuing 10,000 of its common stock shares with a par value of $10 per share and a fair value of $70 per share. The price paid reflects a control premium. The market value of the s

> Use the preceding information for Palto’s purchase of Saleen common stock. Assume Palto purchases 100% of the Saleen common stock for $400,000 cash. Palto has the following balance sheet immediately after the purchase: Required 1. Pre

> Use the preceding information for Palto’s purchase of Saleen common stock. Assume Palto purchases 100% of the Saleen common stock for $500,000 cash. Palto has the following balance sheet immediately after the purchase: Required 1. Pre

> Using the data given in Problem 2-6, assume that Aron Company purchases 80% of the common stock of Shield Company for $320,000 cash. The following comparative balance sheets are prepared for the two companies immediately after the purchase: Required 1.

> On December 31, 2015, Aron Company purchases 100% of the common stock of Shield Company for $450,000 cash. On this date, any excess of cost over book value is attributed to accounts with fair values that differ from book values. These accounts of Shield

> On March 1, 2015, Collier Enterprises purchases a 100% interest in Robby Corporation for $480,000 cash. Robby Corporation applies push-down accounting principles to account for this acquisition. Robby Corporation has the following balance sheet on Februa

> On March 1, 2015, Penson Enterprises purchases an 80% interest in Express Corporation for $320,000 cash. Express Corporation has the following balance sheet on February 28, 2015: Penson Enterprises receives an independent appraisal on the fair values o

> On March 1, 2015, Carlson Enterprises purchases a 100% interest in Entro Corporation for $400,000. Entro Corporation has the following balance sheet on February 28, 2015: Carlson Enterprises receives an independent appraisal on the fair values of Entr

> Using the data given in Problem 2-1, assume that Roland Company exchanged 14,000 of its $45 fair value ($1 par value) shares for 16,000 of the outstanding shares of Downes Company. Required 1. Record the investment in Downes Company and any other purcha

> Woolco, Inc., purchased all the outstanding stock of Paint, Inc., for $980,000. Woolco also paid $10,000 in direct acquisition costs. Just before the investment, the two companies had the following balance sheets: Appraisals for the assets of Paint, In

> Use the preceding information for Purnell’s purchase of Sentinel common stock. Assume Purnell exchanges 16,000 shares of its own stock for 100% of the common stock of Sentinel. The stock has a market value of $50 per share and a par val

> Use the preceding information for Purnell’s purchase of Sentinel common stock. Assume Purnell exchanges 22,000 shares of its own stock for 100% of the common stock of Sentinel. The stock has a market value of $50 per share and a par val

> Use the preceding information for Palto’s purchase of Saleen common stock. Assume Palto purchases 80% of the Saleen common stock for $300,000 cash. Palto has the following balance sheet immediately after the purchase: Required 1. Prep

> Use the preceding information for Palto’s purchase of Saleen common stock. Assume Palto purchases 80% of the Saleen common stock for $400,000 cash. The shares of the noncontrolling interest have a fair value of $46 each. Palto has the f

> On July 1, 2016, Roland Company exchanged 18,000 of its $45 fair value ($1 par value) shares for all the outstanding shares of Downes Company. Roland paid acquisition costs of $40,000. The two companies had the following balance sheets on July 1, 2016:

> Use the preceding information for Purnell’s purchase of Sentinel common stock. Assume Purnell exchanges 10,000 shares of its own stock for 80% of the common stock of Sentinel. The stock has a market value of $50 per share and a par valu

> Use the preceding information for Purnell’s purchase of Sentinel common stock. Assume Purnell exchanges 19,000 shares of its own stock for 80% of the common stock of Sentinel. The stock has a market value of $50 per share and a par valu

> Duko Corporation is acquiring the net assets, exclusive of cash, of Weber Company as of January 1, 2015, at which time Weber Company’s balance sheet is as follows: Duko Corporation feels that the following fair values should be used f

> Hanson Company issues 10,000 shares of $10 par common stock for the net assets of Marcus Incorporated on December 31, 2016. The stock has a fair value of $65 per share. Acquisition costs are $10,000, and the cost of issuing the stock is $3,000. At the ti

> Flom Company is considering the cash purchase of 100% of the outstanding stock of Vargas Company. The terms are not set, and alternative prices are being considered for negotiation. The balance sheet of Vargas Company shows the following values: Apprai

> Garman International wants to expand its operations and decides to acquire the net assets of Iris Company as of January 1, 2016. Garman issues 10,000 shares of its $5 par value common stock for the net assets of Iris. Garman’s stock is

> On July 1, 2015, Faber Enterprises acquired Ann’s Tool Company. Prior to the merger of the two companies, each company calculated its income for the entire year ended December 31, 2015. (It may be assumed that all Ann amounts occurred e

> Heinrich Company, owned by Elennor and Al Heinrich, has been experiencing financial difficulty for the past several years. Both Elennor and Al have not been in good health and have decided to find a buyer. P&F International, after reviewing the finan

> Holt Corporation is contemplating the acquisition of Sambo Company’s net assets on December 31, 2015. It is considering making an offer, which would include a cash payout of $225,000 along with giving 15,000 shares of its $2 par value c

> Tweeden Corporation is contemplating the acquisition of the net assets of Sylvester Corporation in anticipation of expanding its operations. The balance sheet of Sylvester Corporation on December 31, 2015, is as follows: An appraiser for Tweeden determ

> Jack Company is a corporation that was organized on July 1, 2015. The June 30, 2020, balance sheet for Jack is as follows: Liabilities and Equity Current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,475,000 Common stock ($

> Kiln Corporation is considering the acquisition of Williams Incorporated. Kiln has asked you, its accountant, to evaluate the various offers it might make to Williams Incorporated. The December 31, 2015, balance sheet of Williams is as follows: The fol

> Moon Company iscontemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires Yount, it will pay $730,000 in cash to Yount and acquisition costs of $20,000. The January 1, 2015, balance sheet of Yount, Inc., is anticipated to be as fo

> Bar Corporation hasbeen looking to expand its operations and has decided to acquire the assets of Vicker Company and Kendal Company. Bar will issue 30,000 shares of its $10 par common stock to acquire the net assets of Vicker Company and will issue 15,00

> Born Corporation agrees to acquire the net assets of Wren Corporation on January 1, 2015. Wren has the following balance sheet on the date of acquisition: An appraiser determines that in-process R&D exists and has an estimated value of $20,000.The

> Glass Company is thinking about acquiring Plastic Company. Glass Company is considering two methods of accomplishing control and is wondering how the accounting treatment will differ under each method. Glass Company has estimated that the fair values of

> The Primary Company and the VIE Company had the balance sheet shown in Problem SA2-1 above on the date control was achieved. The Primary Company guaranteed the 5% bond payable issued by the VIE Company. The Primary Company also loaned the VIE Company $30

> The Primary Company and the VIE Company had the following balance sheet on December 31, 2015, the date control was achieved: The Primary Company guaranteed the 5% bond payable issued by the VIE Company. The Primary Company also loaned the VIE Company $

> On January 1, 2016, Ashland Company purchases a 25% interest in Cramer Company for $195,000. Ashland Company prepares the following determination and distribution of excess schedule: The following additional information is available: a. Cramer Company

> Assume the same information as for Problem SA1-1. Instead of using the equity method, Schinzer uses the fair value option to record the investment in Fowler. The fair value of the investment in Fowler is as follows: Date.................................

> Schinzer Company purchases an influential 25% interest in Fowler Company on January 1, 2016, for $300,000. At that time, Fowler’s stockholders’ equity is $1,000,000. Fowler Company assets have fair value similar to boo

> On January 1, 2017, Heckert Company purchases a controlling interest in Aker Company. The following information is available: a. Heckert Company purchases 1,600 shares of Aker Company outstanding stock on January 1, 2016, for $48,000 and purchases an add

> On January 1, 2015, Parson Company purchases 80% of the common stock of Salary Company for $450,000. On this date, Salary has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $140,000, and $220,000, respectively. An

> Shelby Corporation purchases 90% of the outstanding stock of Borner Company on January 1, 2015, for $603,000 cash. At that time, Borner Company has the following stockholders’ equity balances: common stock, $200,000; paid-in capital in

> The following diagram depicts the relationships among Mary Company, John Company, and Joan Company on December 31, 2018: Mary Company purchases its interest in John Company on January 1, 2016, for $204,000. John Company purchases its interest in Joan

> Henderson Window Company was a privately held corporation until January 1, 2015. On January 1, 2015, Cool Glass Company acquired a 70% interest in Henderson at a price well in excess of book value. There were some minor differences between book and fair

> Santos Corporation is considering investing in Fenco Corporation, but is unsure about what level of ownership should be undertaken. Santos and Fenco have the following reported incomes: Fenco paid $15,000 in cash dividends to its investors. Prepare a p

> Barstow Company is contemplating the acquisition of the net assets of Crown Company for $875,000 cash. To complete the transaction, acquisition costs are $15,000. The balance sheet of Crown Company on the purchase date is as follows: The following fair

> Overall, Steve Edwards, vice president of Marketing at Dittenhoefer’s Fine China, is very pleased with the success of his new line of Gem-Surface china plates. Gem-Surface plates are different from regular china in that the plates have

> Figure 4.21 shows the swim lane process map for a patient undergoing a lumpectomy (the surgical removal of a small tumor from the breast). Nine parties, including the patient, were involved in the process. For many of the steps in Figure 4.21, a box has

> Manufacturing and Service Processes: Loganville Window Treatments Introduction For nearly 50 years, Loganville Window Treatments (LWT) of Loganville, Georgia, has made interior shutters that are sold through decorating centers. Figure 3.20 shows some of

> NETFLIX, at almost 20 years old, has more than 44 million subscribers worldwide and is now the most popular subscription media business in the United States.14 In the fourth quarter of 2013, Netflix had estimated total revenue of nearly $1.2 billion.15 B

> A supply chain consists of a network of companies linked together by physical, information, and monetary flows. When supply chain partners work together, they are able to accomplish things that an individual firm would find difficult, if not impossible,

> Myrtle loaned Sven $150,000 for his gardening supplies company. A drought occurred during the year. Because Sven was unable to repay the loan, Myrtle accepted the following plan to extinguish Sven’s debt. Sven is to pay cash of $3,000 and transfer owners

> Use the citator to update the decision in United States v. Textron Inc., 507 F. Supp. 2d 138 (D.R.I. 2007). Determine whether any case has cited this decision or any subsequent decisions in this case. What topic does this important case address that impa

> What deduction does Section 162(a)(2) specifically authorize? What Code provision in another section disallows some of those deductions? Explain.

> Use a tax service such as “United States Tax Reporter”, to answer the following questions: a. Assume a public university provides a $20,000 athletic scholarship to an athlete to cover tuition, books, a computer, and extra tutoring costs, does the athlete

> Illustrate the potential use of data analytics for an accountant using a legal database.

> Find the legal case SEC v. Wyly, 56 F. Supp. 3d 260 (S.D.N.Y. 2014) [Note that chapter 7 discusses case citations]. Discuss the court’s decision in that case.

> Locate and identify two recent Accounting and Auditing Enforcement Releases by the SEC that address fraud. Explain how you conducted the research.

> Find the title of a recent article from the Journal of Accountancy that discusses “money laundering.”

> Go to the Global EDGE resource desk and identify at least two international business resources recommended for statistical sources.

> Assume that the taxpayer has a tax issue in which the only authorities on point are the following: (a) an unfavorable circuit court of appeals case from the same circuit as the taxpayer’s residence and (b) a favorable decision from a district court in

> Joseph Josephs, CPA is auditing the Elder Company’s current year’s annual financial statements and notices that the Company has violated the 2.1 to 1.0 current ratio requirements as part of its debt agreement with the Sunshine Bank. The company’s curren

> Locate a revenue ruling that defines a married couple. What is the citation for that revenue ruling? How and why does the revenue ruling define a married couple?

> Find the industry ranking in the music business. Who are the largest three companies in the music industry? What database did you use? Provide a financial comparison of these three companies.

> What does the Statement of Federal Financial Accounting StandardNo.49discuss? When was Standard No.49 promulgated? What was the purpose of the Standard?

> What is the title of GASB Concept Statement No. 6? What is the purpose of the reporting discussed in the Concept? When was GASB Concept Statement No. 6 last modified?

> Summarize what tax was at issue in the Direct Marketing Association case mentioned in this chapter. Explain what happened on its appeal to the Supreme Court. Provide a proper citation including both the Supreme Court’s decision and the 2016 decision in t

> Find the title of GAAP Concept Statement No. 5. What is the purpose of the reporting discussed in the Concept? When was this Concept Statement last modified?

> Locate Ballard v. Commissioner, 544 U.S. 40; 95 AFTR 2d 1302 (2005). What was the main issue before the Supreme Court? What did the Supreme Court do with the appellate court’s decision?

> Examine an analyst report on Ford Motor Company. Who wrote the report? Outline the major contents of that analyst report. Where did you find this analyst report?

> Find the growth rate for Yahoo! from January 2015 until it was sold to Verizon in 2016. What helps to explain the change in the company’s stock price during that time period?

> Locate the insurance company State Farm Group. Using an appropriate database available to you, summarize the key financial ratios that you can find on the company. Compare that information to any information provided on the company’s website.

> Hugo Crossman, CPA, issued a review statement for the CUNY Company for last year and a compiled statement for them in the current year. During the current year, Hugo purchased some CUNY securities, which made him lose his independence—a fact noted in his