Question: Shannon, Inc., has two divisions. One produces

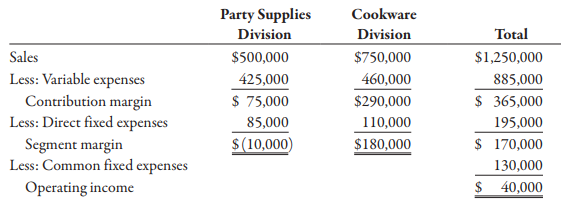

Shannon, Inc., has two divisions. One produces and sells paper party supplies (napkins, paper plates, invitations); the other produces and sells cookware. A segmented income statement for the most recent quarter is given below:

On seeing the quarterly statement, Madge Shannon, president of Shannon, Inc., was distressed and discussed her disappointment with Bob Ferguson, the company’s vice president of finance.

MADGE: “The Party Supplies Division is killing us. It’s not even covering its own fixed costs. I’m beginning to believe that we should shut down that division. This is the seventh consecutive quarter it has failed to provide a positive segment margin. I was certain that Paula Kelly could turn it around. But this is her third quarter, and she hasn’t done much better than the previous divisional manager.â€

BOB: “Well, before you get too excited about the situation, perhaps you should evaluate Paula’s most recent proposals. She wants to spend $10,000 per quarter for the right to use familiar cartoon figures on a new series of invitations, plates, and napkins and at the same time increase the advertising budget by $25,000 per quarter to let the public know about them. According to her marketing people, sales should increase by 10 percent if the right advertising is done—and done quickly. In addition, Paula wants to lease some new production machinery that will increase the rate of production, lower labor costs, and result in less waste of materials. Paula claims that variable costs will be reduced by 30 percent. The cost of the lease is $95,000 per quarter.â€Upon hearing this news, Madge calmed considerably and, in fact, was somewhat pleased. After all, she was the one who had selected Paula and had a great deal of confidence in Paula’s judgment and abilities.

Required:

1. Assuming that Paula’s proposals are sound, should Madge Shannon be pleased with the prospects for the Party Supplies Division? Prepare a segmented income statement for the next quarter that ref lects the implementation of Paula’s proposals. Assume that the Cookware Division’s sales increase by 5 percent for the next quarter and that the same cost relationships hold.

2. Suppose that everything materializes as Paula projected except for the 10 percent increase in sales—no change in sales revenues takes place. Are the proposals still sound? What if the variable costs are reduced by 40 percent instead of 30 percent with no change in sales?

> Carreker, Inc., has a number of divisions, including the Alamosa Division, producer of surgical blades, and the Tavaris Division, a manufacturer of medical instruments. Alamosa Division produces a 2.6 cm steel blade that can be used by Tavaris Division i

> Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The

> Ignacio, Inc., had after-tax operating income last year of $1,196,500. Three sources of financing were used by the company: $2 million of mortgage bonds paying 4 percent interest, $4 million of unsecured bonds paying 6 percent interest, and $9 million in

> Refer to Brief Exercise 10-1. Forchen, Inc., requires an 8 percent minimum rate of return. Required: 1. Calculate residual income for the Small Appliances Division. 2. Calculate residual income for the Cleaning Products Division. 3. What if the minimum r

> Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. ROI 2. For the Cleaning Products Division, calculate

> Mangia Pizza Company makes frozen pizzas that are sold through grocery stores. Mangia developed the following standard mix for spreading on premade pizza shells to produce 16 giant-size sausage pizzas. Mangia put a batch of 2,000 pounds of direct materia

> Standish Company manufactures consumer products and provided the following information for the month of February: Units produced 131,000 Standard direct labor hours per unit 0.20 Standard fixed overhead rate (per direct labor hour) $2.50 Budgeted fixed o

> Refer to Brief Exercise 9-6. Required: 1. Calculate the variable overhead spending variance using the formula approach. (If you compute the actual variable overhead rate, carry your computations out to five significant digits and round the variance to th

> Standish Company manufactures consumer products and provided the following information for the month of February: Units produced 131,000 Standard direct labor hours per unit 0.20 Standard variable overhead rate (per direct labor hour) $3.40 Actual variab

> Yohan Company has the following balances in its direct materials and direct labor variance accounts at year-end: Unadjusted Cost of Goods Sold equals $1,500,000, unadjusted Work in Process equals $236,000, and unadjusted Finished Goods equals $180,000. R

> Kavallia Company set a standard cost for one item at $328,000; allowable deviation is ± $14,500. Actual costs for the past six months are as follows: June $330,500 July 343,000 August 346,800 September $314,000 October 332,000 November 323,000 Required:

> Guillermo’s Oil and Lube Company provided the following information for the production of oil changes during the month of June: Actual number of oil changes performed: 980 Actual number of direct labor hours worked: 386 hours Actual rate paid per direct

> Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The

> Guillermo’s Oil and Lube Company provided the following information for the production of oil changes during the month of June: Actual number of oil changes performed: 980 Actual number of quarts of oil used: 6,020 quarts Actual price paid per quart of o

> Refer to Brief Exercise 9-9. Required: 1. Calculate the yield ratio based on the standard amounts given. 2. Calculate the standard cost per pound of the yield (rounded to the nearest cent). 3. Calculate the standard yield for actual input of 2,000 pounds

> Mangia Pizza Company makes frozen pizzas that are sold through grocery stores. Mangia uses two types of direct labor: machine operators and packers. Mangia developed the following standard mix for spreading on premade pizza shells to produce 16 giant-siz

> Guillermo’s Oil and Lube Company is a service company that offers oil changes and lubrication for automobiles and light trucks. On average, Guillermo has found that a typical oil change takes 24 minutes and 6.2 quarts of oil are used. In June, Guillermo’

> Green Earth Landscaping Company provides monthly and weekly landscaping and maintenance services to residential customers in the tri-city area. Green Earth has no variable administrative expense. Fixed administrative expenses for June, July, and August i

> The external auditors for Heart Health Procedures (HHP) are currently performing the annual audit of HHP’s financial statements. As part of the audit, the external auditors have prepared a representation letter to be signed by HHP’s chief executive offic

> Emery Manufacturing Company produces component parts for the farm equipment industry and has recently undergone a major computer system conversion. Samson Achebe, the controller, has established a troubleshooting team to alleviate accounting problems tha

> Silverado, Inc., is a closely held brokerage firm that has been very successful over the past five years, consistently providing most members of the top management group with 50 percent bonuses. In addition, both the chief financial officer and the chief

> Emily Henson, controller of an oil exploration division, has just been approached by Tim Wilson, the divisional manager. Tim told Emily that the projected quarterly profits were unacceptable and that expenses need to be reduced. He suggested that a clean

> John Rodriguez and Patty Jorgenson are both cost accounting managers for a manufacturing division. During lunch yesterday, Patty told John that she was planning on quitting her job in three months because she had accepted a position as controller of a sm

> Jade Shultz is a junior majoring in hotel and restaurant management. She wants to work for a large hotel chain with the goal of eventually managing a hotel. She is considering the possibility of taking a course in either financial accounting or cost mana

> Timothy Donaghy has developed a unique formula for growing hair. His proprietary lotion, used regularly for 45 days, will grow hair in bald spots (with varying degrees of success). Timothy calls his lotion Hair-Again and is selling it via the telephone a

> The U.S. division of MegaBig, Inc., has excess capacity. MegaBig’s European division, located in Lisbon, has offered to buy a component that would increase the U.S. division’s utilization of capacity from 70 to 80 percent. The component has an outside ma

> The following are the exchange rates of various currencies for $1 on July 1 and on October 1. Required: 1. Indicate whether the dollar has strengthened or weakened against the euro, the Canadian dollar, and the yen. 2. A U.S. company purchases merchandis

> Langford Woodworks, Inc., manufactures custom window shutters on a job-order basis. Langford has invested heavily in precision woodworking equipment. As a result, the company has a reputation for producing excellent quality interior shutters. Sales are m

> Paladin Company manufactures plain-paper fax machines in a small factory in Minnesota. Sales have increased by 50 percent in each of the past three years, as Paladin has expanded its market from the United States to Canada and Mexico. As a result, the Mi

> Bountiful Manufacturing produces two types of bike frames (Frame X and Frame Y). Frame X passes through four processes: cutting, welding, polishing, and painting. Frame Y uses three of the same processes: cutting, welding, and painting. Each of the four

> Pratt Company produces two replacement parts for a popular line of Blu-ray disc players: Part A and Part B. Part A is made up of two components, one manufactured internally and one purchased from external suppliers. Part B is made up of three components,

> Middleton Company produces two different metal components used in medical equipment (Component X and Component Y). The company has three processes: molding, grinding, and finishing. In molding, molds are created, and molten metal is poured into the shell

> Calen Company manufactures and sells three products in a factory of three departments. Both labor and machine time are applied to the products as they pass through each department. The nature of the machine processing and of the labor skills required in

> Desayuno Products, Inc., produces cornf lakes and branf lakes. The manufacturing process is highly mechanized; both products are produced by the same machinery by using different settings. For the coming period, 200,000 machine hours are available. Manag

> Patz Company produces two industrial cleansers that use the same liquid chemical input: Regular Strength and Heavy Duty. Regular Strength uses two quarts of the chemical for every unit produced, and Heavy Duty uses five quarts. Currently, Patz has 6,000

> Refer to Brief Exercise 8-6. Required: 1. Calculate the total budgeted cost of units produced for Play-Disc for the coming year. Show the cost of direct materials, direct labor, and overhead. 2. Prepare a cost of goods sold budget for Play-Disc for the y

> Rahimi Company produces two types of gears: Model 12 and Model 15. Market conditions limit the number of each gear that can be sold. For Model 12 no more than 15,000 units can be sold, and for Model 15 no more than 40,000 units. Each gear must be notched

> Bateman Company produces helmets for drivers of motorcycles. Helmets are produced in batches according to model and size. Although the setup and production time vary for each model, the smallest lead time is six days. The most popular model, Model HA2, t

> Ashley Thayn, president and owner of Orangeville Metal Works, has just returned from a trip to Europe. While there, she toured several plants that use robotic manufacturing. Seeing the efficiency and success of these companies, Ashley became convinced th

> Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers t

> Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production pr

> Okmulgee Hospital (a large metropolitan for-profit hospital) is considering replacing its MRI equipment with a new model manufactured by a different company. The old MRI equipment was acquired three years ago, has a remaining life of five years, and will

> Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be $2,250,000, but it would produce after-tax savings of $450,000 per year in labor costs. The estimated life of the new system is 10 years, with no sa

> Kent Tessman, manager of a Dairy Products Division, was pleased with his division’s performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of

> Ron Vargas, the CEO for Sunders Manufacturing, was wondering which of two pollution control systems he should choose. The firm’s current production process produces a gaseous and a liquid residue. A recent state law mandated that emissi

> Sweeney Manufacturing has a plant where the equipment is essentially worn out. The equipment must be replaced, and Sweeney is considering two competing investment alternatives. The first alternative would replace the worn-out equipment with traditional p

> Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following manufacturing costs: Direct materials $1.67 Direct labor 0.56 Variable overhead 0.72 Fixed overhead 1.80 Total unit cost $4.75 For the coming year, Play-Disc

> Heaps Company produces jewelry that requires electroplating with gold, silver, and other valuable metals. Electroplating uses large amounts of water and chemicals, producing wastewater with a number of toxic residuals. Currently, Heaps uses settlement ta

> Pittsburgh-Walsh Company (PWC) is a manufacturing company whose product line consists of lighting fixtures and electronic timing devices. The Lighting Fixtures Division assembles units for the upscale and mid-range markets. The Electronic Timing Devices

> Olin Company manufactures and distributes carpentry tools. Production of the tools is in the mature portion of the product life cycle. Olin has a sales force of 20. Salespeople are paid a commission of 7 percent of sales, plus expenses of $35 per day for

> Fred Morton has just purchased a life insurance policy from Porter with premiums equal to $1,500 per year. Required: 1. Assume Fred holds the policy for one year and then drops it. What is his contribution to Porter’s operating income? 2. Assuming Fred h

> Porter Insurance Company has three lines of insurance: automobile, property, and life. The life insurance segment has been losing money for the past five quarters, and Leah Harper, Porter’s controller, has done an analysis of that segment. She has discov

> Alydar, Inc., manufactures and sells automotive tools through three divisions: Eastern, Southern, and International. Each division is evaluated as a profit center. Data for each division for last year are as follows: Alydar, Inc., had corporate administr

> Dantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an a

> Bill Fremont, division controller and CMA, was upset by a recent memo he received from the divisional manager, Steve Preston. Bill was scheduled to present the division’s financial performance at headquarters in one week. In the memo, Steve had given Bil

> Dana Baird was manager of a new Medical Supplies Division. She had just finished her second year and had been visiting with the company’s vice president of operations. In the first year, the operating income for the division had shown a

> Johnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. In the coming year, Johnston expects to powder coat 120,000 units.

> Gasconia Company produces three models of a product. Actual results from last year are as follows: Gasconia had budgeted the following amounts: Required: 1. Calculate the contribution margin variance. 2. Calculate the contribution margin volume variance.

> Sulert, Inc., produces and sells gel-filled ice packs. Sulert’s performance report for April follows: Required: 1. Calculate the contribution margin variance and the contribution margin volume variance. 2. Calculate the market share var

> Haysbert Company provides management services for apartments and rental units. In general, Haysbert packages its services into two groups: basic and complete. The basic package includes advertising vacant units, showing potential renters through them, an

> San Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system

> Jellison Company had the following operating data for its first two years of operations: Variable costs per unit: Direct materials 4.00 Direct labor $ 2.90 Variable overhead 1.50 Fixed costs per year: Overhead 180,000 Selling and administrative 70,350 Je

> The following information pertains to Vladamir, Inc., for last year: Beginning inventory, units 1,320 Units produced 100,000 Units sold 101,000 Variable costs per unit: Direct materials $ 8.00 Direct labor $ 9.50 Variable overhead $ 1.25 Variable selling

> Snyder Company produced 90,000 units during its first year of operations and sold 87,000 at $21.80 per unit. The company chose practical activity—at 90,000 units—to compute its predetermined overhead rate. Manufacturing costs are as follows: Direct mater

> Jorell, Inc., manufactures and distributes a variety of labelers. Annual production of labelers averages 340,000 units. A large chain store purchases about 30 percent of Jorell’s production. Several thousand independent retail office supply stores purcha

> Quencher Beverage is a large regional retail establishment. Quencher recently decided to start selling one of its most popular products—Coca-Cola 10-packs—at a loss (i.e., a loss leader) in order to entice consumers to purchase other items in greater amo

> Garcia Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. The density gauge uses a subassembly that is purchased from an external supplier for $25 per unit.

> The School of Accounting (SOA) at State University is planning its annual fundraising campaign for accounting alumni. This year, the SOA is planning a call-a-thon and will ask Beta Alpha Psi members to volunteer to make phone calls to a list of 5,000 alu

> Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The

> KarlAuto Corporation manufactures automobiles, vans, and trucks. Among the various KarlAuto plants around the United States is the Bloomington plant, where vinyl covers and upholstery fabric are sewn. These are used to cover interior seating and other su

> Pharmaco Corporation buys three chemicals that are processed to produce two popular ingredients for liquid pain relievers. The three chemicals are in liquid form. The purchased chemicals are blended for two to three hours and then heated for 15 minutes.

> Apollonia Dental Services is part of an HMO that operates in a large metropolitan area. Currently, Apollonia has its own dental laboratory to produce two varieties of porcelain crowns— all porcelain and porcelain fused to metal. The uni

> Brandy Dees recently bought Nievo Enterprises, a company that manufactures ice skates. Brandy decided to assume management responsibilities for the company and appointed herself president shortly after the purchase was completed. When she bought the comp

> St. John’s Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMC’s Cath Lab. Each technician is paid a salary of $36,000 and is capable of conducting 1,000 procedures per year. The c

> Two brothers, Enzo and Pietro, opened the Italian House Restaurant several years ago. The restaurant offers a variety of culinary dishes that are divided into two main product offerings: Primi (pasta first dishes) and Secondi (nonpasta meat and vegetaria

> Fiorello Company manufactures two types of cold-pressed olive oil, Refined Oil and Top Quality Oil, out of a joint process. The joint (common) costs incurred are $92,500 for a standard production run that generates 30,000 gallons of Refined Oil and 15,00

> Devern Assurance Company provides both property and automobile insurance. The projected income statements for the two products are as follows: The president of the company is considering dropping the property insurance. However, some policyholders prefer

> Norton Products, Inc., manufactures potentiometers. (A potentiometer is a device that adjusts electrical resistance.) Currently, all parts necessary for the assembly of products are produced internally. Norton has a single plant located in Wichita, Kansa

> Good Scent, Inc., produces two colognes: Rose and Violet. Of the two, Rose is more popular. Data concerning the two products follow: The company uses a conventional costing system and assigns overhead costs to products using direct labor hours. Annual ov

> Refer to Brief Exercise 8-2 for the production budgets for practice balls and match balls. Every practice ball requires 0.7 square yard of polyvinyl chloride panels, one bladder with valve (to fill with air), and 3 ounces of glue. Smart Strikeâ

> Salem Electronics currently produces two products: a programmable calculator and a tape recorder. A recent marketing study indicated that consumers would react favorably to a radio with the Salem brand name. Owner Kenneth Booth was interested in the poss

> Aubrey Company produces a single product. Last year’s income statement is as follows: Sales (12,000 units) $1,218,000 Less: Variable costs 365,400 Contribution margin $ 852,600 Less: Fixed costs 300,000 Operating income $ 552,600 Required: 1. Compute the

> Ironjay, Inc., produces two types of weight-training equipment: the Jay-f lex (a weight machine that allows the user to perform a number of different exercises) and a set of free weights. Ironjay sells the Jay-f lex to sporting goods stores for $200. The

> Mahan Consulting is a service organization that specializes in the design, installation, and servicing of mechanical, hydraulic, and pneumatic systems. For example, some manufacturing firms, with machinery that cannot be turned off for servicing, need so

> Katayama Company produces a variety of products. One division makes neoprene wetsuits. The division’s projected income statement for the coming year is as follows: Sales (65,000 units) $15,600,000 Less: Variable expenses 8,736,000 Contribution margin $ 6

> Rahm Company produces a single product. The projected income statement for the coming year, based on sales of 160,000 units, is as follows: Sales $2,000,000 Less: Variable costs 1,400,000 Contribution margin $ 600,000 Less: Fixed costs 450,000 Operating

> Cassius produces and sells novelty items for resort gift shops. Last year, Cassius sold 99,200 units. The income statement for Cassius, Inc., for last year is as follows: Sales $992,000 Less: Variable expenses 545,600 Contribution margin $446,400 Less: F

> Nealon Company runs a driving range and golf shop. The budgeted income statement for the coming year is as follows. Required: 1. What is Nealon’s variable cost ratio? Its contribution margin ratio? 2. Suppose Nealon’s

> Consider the following information on four independent companies. Required: Calculate the correct amount for each question mark. Be sure to round any fractional breakeven units up to the next whole number.

> More-Power Company has projected sales of 75,000 regular sanders and 30,000 mini-sanders for next year. The projected income statement is as follows: Required: 1. Set up the given income statement on a spreadsheet (e.g., Excel®). Then, substit

> Refer to Brief Exercise 8-1, through Requirement 1. Smart Strike requires ending inventory of product to equal 25 percent of the next month’s unit sales. Beginning inventory in January was 2,400 practice soccer balls and 400 match socce

> Aliyah Brown and two of her colleagues are considering opening a law office in a large metropolitan area that would make inexpensive legal services available to those who could not otherwise afford these services. The intent is to provide easy access for

> In 20x1, Fleming Chemicals used the following input combination to produce 55,000 gallons of an industrial solvent: Materials 33,000 lbs. Labor 66,000 hrs. In 20x2, Fleming again planned to produce 55,000 gallons of solvent and was considering two differ

> Khan Company produces handcrafted leather purses. Virtually all of the manufacturing cost consists of materials and labor. Over the past several years, profits have been declining because the cost of the two major inputs has been increasing. Lila Khan, t

> Richins Company is considering the acquisition of a computerized manufacturing system. The new system has a built-in quality function that increases the control over product specifications. An alarm sounds whenever the product falls outside the programme

> Continuous improvement is the governing principle of a lean accounting system. Following are several performance measures. Some of these measures would be associated with a traditional standard-costing accounting system, and some would be associated with

> Bradford Company, a manufacturer of small tools, implemented lean manufacturing at the end of 20x1. The company’s goal for the year was to increase the ROS to 40 percent of sales. A value stream team was established and began to work on

> Renlund Company is transitioning to a lean manufacturing system and has just finalized two order fulfillment value streams. One of the value streams has two products, and the other has four products. The two-product value stream produces precision machin

> After some detailed polling among the 60, four types of eaters were identified: two types of light eaters and two types of heavy eaters. The consumption patterns for each group are given (slices of pizza, glasses of root beer, and bowls of salad): Light

> Sixty employees (all CPAs) of a local public accounting firm eat lunch at least twice weekly at a very popular pizza restaurant. The pizza restaurant recently began offering discounts for groups of 15 or more. Groups would be seated in a separate room, s