Question: Sharma Corporation has decided that, in preparing

Sharma Corporation has decided that, in preparing its 2017 financial statements under IFRS, two changes should be made from the methods used in prior years:

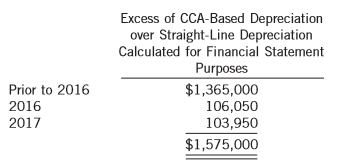

1. Depreciation. Sharma has used the tax basis (CCA) method of calculating depreciation for financial reporting purposes. During 2017, management decided that the straight-line method should have been used to calculate depreciation for financial reporting purposes for the years prior to 2017 and going forward. The following schedule identifies the excess of depreciation based on CCA over depreciation based on straight-line, for the past years and for the current year:

Depreciation is charged 75% to cost of sales and 25% to selling, general, and administrative expenses.

2. Bad debt expense. In the past, Sharma recognized bad debt expense equal to 1.5% of net sales. After careful review, it has been decided that a rate of 1.75% is more appropriate for 2017. Bad debt expense is charged to selling, general, and administrative expenses.

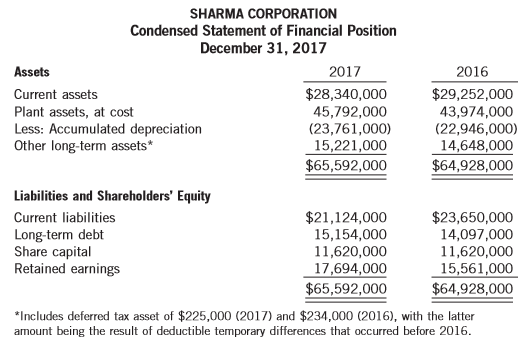

The following information is taken from preliminary financial statements, which were prepared before including the effects of the two changes.

The condensed statement of financial position as at December 31, 2015 included the following amounts (excluding the effects of the changes above): current assets $28,454,000; plant assets, at cost $42,568,000; accumulated depreciation $22,429,000; other long-term assets $14,282,000; current liabilities $26,603,200; long-term debt $13,540,000; share capital $11,620,000; and retained earnings $11,111,800. Dividends of $1,321,500 were declared on December 31, 2017; however, no dividends were declared in 2015 or 2016.

There have been no temporary differences between any book and tax items prior to the above changes except for those that involve the allowance for doubtful accounts. For tax purposes, bad debts are deductible only when they are written off. The tax rate is 30%.

Instructions:

(a) For each of the items that follow, calculate the amounts that would appear on the comparative (2017 and 2016) financial statements of Sharma Corporation after adjustment for the two accounting changes. Show amounts for both 2017 and 2016, and prepare supporting schedules as necessary.

1. Accumulated depreciation

2. Deferred tax asset/liability

3. Selling, general, and administrative expenses

4. Current income tax expense

5. Deferred tax expense

(b) Prepare the comparative financial statements that will be issued to shareholders for Sharma’s year ended December 31, 2017.

Transcribed Image Text:

Excess of CCA-Based Depreciation over Straight-Line Depreciation Calculated for Financial Statement Purposes $1,365,000 106,050 103,950 Prior to 2016 2016 2017 $1,575,000 SHARMA CORPORATION Condensed Statement of Financial Position December 31, 2017 Assets 2017 2016 $28,340,000 45,792,000 (23,761,000) 15,221,000 $65,592,000 $29,252,000 43,974,000 (22,946,000) 14,648,000 $64,928,000 Current assets Plant assets, at cost Less: Accumulated depreciation Other long-term assets* Liabilities and Shareholders' Equity $21,124,000 15,154,000 11,620,000 17,694,000 $65,592,000 $23,650,000 14,097,000 11,620,000 15,561,000 $64,928,000 Current liabilities Long-term debt Share capital Retained earnings *Includes deferred tax asset of $225,000 (2017) and $234,000 (2016), with the latter amount being the result of deductible temporary differences that occurred before 2016. SHARMA CORPORATION Condensed Income Statement Year Ended December 31, 2017 2017 2016 $80,520,000 54,847,000 $78,920,000 53,074,000 Net sales Cost of goods sold 25,673,000 25,846,000 Selling, general, and administrative expenses 19,540,000 18,411,000 6,133,000 1,198,000 7,435,000 1,079,000 Other expense, net Income before income tax 4,935,000 6,356,000 Income tax 1,480,500 1,906,800 $ 4,449,200 Net income $ 3,454,500

> At December 31, 2017, Lawton & Border Inc. (L&B) is involved in a lawsuit. Under existing standards in IAS 37, (a) prepare the December 31 entry assuming it is probable (and very likely) that L&B will be liable for $700,000 as a result of this suit. (b)

> Kea Limited provides a defined contribution pension plan for its employees. The plan requires the company to deduct 5% of each employee’s gross pay for each payroll period as the employee contribution. The company then contributes 7% of the gross pay for

> Wynn Corp. offers a set of building blocks to customers who send in three codes from Wynn cereal, along with $1. Wynn purchased 100,000 building block sets in 2017 for $2.50 each, and paid for them by cash. During 2017, Wynn sold one million boxes of cer

> In July 10, 2017, Nguyen Ltd. sold $1.7 million worth of compressors to retailers on account. Nguyen had paid $960,000 for these compressors. Nguyen grants the right to return compressors that do not sell in three months following delivery. Past experien

> Discuss whether and how financial instruments are disclosed under IFRS, and the reason for the disclosure requirement.

> Explain how options pricing models are useful in determining fair value. What are the inputs to such models?

> Penner Corp. is preparing the management discussion and analysis portion of the annual report to shareholders. It wishes to provide a visual depiction of the proportion of the total revenue each segment uses. Using Excel, graph the seven industry segment

> Yuen Corporation shows the following financial position and results for the three years ended December 31, 2017, 2018, and 2019 (in thousands): For each year, calculate the current ratio, quick ratio, and days payables outstanding ratio, and comment on

> Referring to the research study mentioned in this chapter (in the section “Limitations of Financial Statement Analysis”), discuss some limitations of the financial statement analysis done in BE23-21. Include in your an

> formerly British Sky Broadcasting Group plc, is a pan-European pay television giant and multimedia content company whose common shares trade on the London Stock Exchange. The company produces financial statements in accordance with IFRS. Access the compa

> Condensed data from the comparative statement of financial position (SFP) of Legros Inc. follow: (a) Using vertical (common-size) analysis, calculate the various SFP categories as a percentage of total assets for Legros Inc. for each of 2015, 2016, and

> The income statements of Dwayne Corporation show the following amounts: Using vertical (common-size) analysis, analyze Dwayne Corporation’s declining profit before tax. 2017 2016 2015 $800 $770 530 $720 468 Net sales Cost of goods

> Refer to E18-7 for Sayaka Tar and Gravel Ltd., and assume the same facts as in E18-8 for the fiscal year ended December 31, 2018, except that the enacted tax rate for 2019 and subsequent years was reduced to 20% on September 15, 2018. Instructions: (a)

> What is the difference between an auditor’s unmodified opinion and a qualified opinion?

> Nortel Networks experienced one of the most notorious Canadian bankruptcies. Nortel’s financial statements contained misrepresentations resulting in top executives meeting bonus targets. Eventually there was a distribution of funds obtained from selling

> Indicate in general journal form how the following items would be entered in a work sheet to prepare the statement of cash flows where payments for dividends are classified as financing activities. Indicate within the journal entries any items that impac

> Tonoma Inc., a company that follows IFRS, is preparing its December 31, 2017 financial statements. The following two events occurred after December 31, 2017: (1) A flood loss of $80,000 occurred on March 1, 2018. (2) A liability, estimated at $140,000 at

> The following information was described in a note of Cruton Packing Co., a public company that follows IFRS: “During August, Bigelow Products Corporation purchased 212,450 shares of the Company’s common shares, which constitutes approximately 35% of the

> How would the transaction in BE23-13 be recorded if the individual shareholder owned only 40% of the shares of each company? Assume that there is independent evidence to support the value of the robotic equipment. Discuss and prepare journal entries. Use

> Papadopoulos Limited (PL) sells retail merchandise in Canada. The company was incorporated last year and is now in its second year of operations. PL is owned and operated by the Papadopoulos family, and Iris Papadopoulos, the company president, has decid

> Crown Inc. (CI) is a private company that manufactures a special type of cap that fits on a bottle. At present, it is the only manufacturer of this cap and therefore enjoys market security. The machinery that makes the cap has been in use for 20 years an

> Locate and review Brookfield Asset Management’s statement of changes in shareholders’ equity in its financial statements for the fiscal years ended December 31, 2014 and 2013, at the end of Volume 2 of this text. Instructions: (a) Identify the sharehold

> The executive officers of Coach Corporation have a performance-based compensation plan that links performance criteria to growth in earnings per share. When annual earnings per share (EPS) growth is 12%, the Coach executives earn 100% of a predetermined

> Refer to E18-7 for Sayaka Tar and Gravel Ltd., and assume the same facts for the fiscal year ended December 31, 2017. For the second year of operations, Sayaka made progress on the construction of the road for the municipality. The account balances at De

> Delmar Manufacturing Inc. is a provincial manufacturer of electronics. It has been in operation for over 25 years under ownership of the same two private shareholders. It has always offered its employees a very generous defined benefit (DB) pension plan

> Baker Company Limited (BCL) was founded in 2015. Its first year of operations turned out to be a good one, as start-up years go, because the company not only broke even but actually showed a very small profit. Just as the company was getting established

> Canton Products Inc. has been in business for quite a while. Its shares trade on a public exchange and it is thinking of expanding onto the New York and London Stock Exchanges. Recently, however, the company has run into cash flow difficulties. The CEO i

> Air Canada is Canada’s largest domestic and international airline, providing scheduled and charter air transportation for passengers and cargo. The airline industry has suffered many difficulties and financial setbacks in the past decade. The high costs

> Kitchener Mechanical Incorporated is looking to expand its manufacturing facilities and buy more equipment to meet raised customer demand. The company’s strategy is to build an add-on to the current facility, and bring in new equipment that will increase

> ABC Airlines carried more than 11.9 million passengers to over 160 destinations in 17 countries in 2017. ABC is the descendant of several predecessor companies, including AB Air and BC Airlines. The amalgamated company was created in 1999. In the years t

> “You can’t write up assets,” said Nick Toby, internal audit director of Nadir International Inc., to his boss, Jim Majewski, vice-president and chief financial officer. “Nonsense,” said Jim, “I can do this as part of a quasi-reorganization of our company

> Soron Limited is a private company that uses derivatives to mitigate a variety of risks. The ethical accountant, Leon Price, has just been hired as the new controller and has recently met with the CEO. The CEO has just explained to him the following deri

> CopMin Inc. is a private enterprise that is involved in copper mining operations. The company currently owns two operating mines. It is January 1, 2017, and CopMin has recently entered into two types of contracts. For its Papula Mine, it has entered into

> Locate and review Brookfield Asset Management’s financial statements, including selected notes to its financial statements for the year ended December 31, 2014, located at the end of Volume 2 of this text. Alternatively, the full set of its annual financ

> MFI Holdings Inc. follows IFRS and applies the FV-OCI model with recycling and has adopted the option to show dividends received as operating activities. MFI’s statement of financial position contained the following comparative data at

> Kelly’s Shoes Limited used to be a major store in Canada before it went bankrupt and was bought by Bears Shoes Limited. Many of the stores were anchor tenants in medium- to large-sized retail shopping malls. This space was primarily leased under non-canc

> In June 2018, the board of directors for Holtzman Enterprises Inc. authorized the sale of $10 million of corporate bonds. Michelle Collins, treasurer for Holtzman Enterprises Inc., is concerned about the date when the bonds are issued. The company really

> Wagner Inc. is a large Canadian public company that uses IFRS. A lease for a fleet of trucks has been capitalized and the lease amortization schedule for the first three lease payments appears below. The trucks have an economic life of eight years. The l

> The following selected account balances are taken from the financial statements of Mandrich Inc. at its calendar year end prepared using IFRS: At December 31, 2017, the following information is available: 1. Mandrich Inc. repurchased 2,000 common share

> Each of the following items must be considered in preparing a statement of cash flows (indirect method) for Bastille Inc., which follows IFRS, for the year ended December 31, 2017. 1. Equipment that cost $40,000 six years before and was being depreciated

> MacAskill Mills Limited, which follows IFRS, and has a calendar year end, and adopted the policy of classifying interest paid as financing activities engaged in the following transactions in 2017. 1. The Land account increased by $58,000 over the year: L

> The following accounts appear in the ledger of Tanaka Limited, which uses IFRS, and has adopted the policy of classifying dividends paid as operating activities: Instructions: Show how the information posted in the accounts is reported on a statement o

> The following selected account balances were taken from the financial statements of Blumberg Inc. concerning its long-term investment in shares of Black Inc. over which it has had significant influence since 2014: At December 31, 2017, the following in

> Angus Farms Ltd., which follows ASPE, had the following transactions during the fiscal year ending December 31, 2017. 1. On May 1, a used tractor was sold at auction. The information concerning this transaction included: Original cost of the tractor…………

> The following are selected statement of financial position accounts of Pavicevic Ltd. at December 31, 2016 and 2017, and the increases or decreases in each account from 2016 to 2017. Also presented is the selected income statement and other information f

> There are many interesting company programs and circumstances that relate to the definition, recognition, and measurement of liabilities. Examples include customer loyalty programs, retail gift cards, corporate restructuring obligations, air miles progra

> The following accounts appear in the ledger of Samson Inc. Samson’s shares trade on the Toronto and New York stock exchanges and so the company uses IFRS. Samson has chosen to account for shares held in Anderson Corp. as FV-OCI and to r

> †P22-1 Jeopardy Inc.’s CFO has just left the office of the company president after a meeting about the draft statement of financial position at April 30, 2017, and income statement for the year ended. (Both are reprodu

> Conduit Corporation has 45 current employees: 5 managers and 40 non-managers. The average wage paid is $250 per day for non-managers. The company has just finished negotiating a new employee contract with the non-managers that would see this increase by

> On December 31, 2017, before the books were closed, management and the accountant at Flanagan Inc. made the following determinations about three depreciable assets. 1. Depreciable asset A (building) was purchased on January 2, 2014. It originally cost $5

> The founder, president, and major shareholder of Dewitt Corp. recently sold his controlling interest in the company to a national distributor in the same line of business. The change in ownership was effective June 30, 2017, halfway through Dewittâ

> You are the auditor of Maglite Services Inc., a privately owned full-service cleaning company following ASPE that is undergoing its first audit for the period ending September 30, 2017. The bank has requested that Maglite have its statements audited this

> As at December 31, 2017, Kendrick Corporation is having its financial statements audited for the first time ever. The auditor has found the following items that might have an effect on previous years. 1. Kendrick purchased equipment on January 2, 2014 fo

> Holtzman Company is in the process of preparing its financial statements for 2017. Assume that no entries for depreciation have been recorded in 2017. The following information related to depreciation of fixed assets is provided to you. 1. Holtzman purch

> Leader Enterprises Ltd. follows IFRS and has provided the following information: 1. In 2016, Leader was sued in a patent infringement suit, and in 2017, Leader lost the court case. Leader must now pay a competitor $50,000 to settle the suit. No previous

> At a recent conference on financial accounting and reporting, three participants provided examples of similar accounting changes that they had encountered in the last few months. They all involved the current portion of long term debt. 1. The first parti

> On May 5, 2018, you were hired by Gavin Inc., a closely held company that follows ASPE, as a staff member of its newly created internal auditing department. While reviewing the company’s records for 2016 and 2017, you discover that no a

> You have been assigned to examine the financial statements of Picard Corporation for the year ended December 31, 2017, as prepared following IFRS. Picard uses a periodic inventory system. You discover the following situations: 1. The physical inventory c

> City Goods Limited (CG) is a sports clothing and equipment retailer that has a chain of 10 stores across Canada. You have just been hired as the new controller for the company. You are currently meeting with the CFO to discuss some accounting-related top

> It is December 2017 and Wagner Inc. recently hired a new accountant, Jodie Larson. Although Wagner is a private company, it follows IFRS. As part of her preparation of the 2017 financial statements for Wagner Inc., Jodie has proposed the following accoun

> Both the management of Kimmel Instrument Corporation, a small company that follows IFRS, and its independent auditors recently concluded that the company’s results of operations will be reliable and more relevant in future years if Kimm

> Nadeau Company, a small company following ASPE, is adjusting and correcting its books at the end of 2017. In reviewing its records, it compiles the following information. 1. Nadeau has failed to accrue sales commissions payable at the end of each of the

> The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electronics Ltd., a lessee, for a computer system: The collectability of the lease payments is reasonably predictable, and there are no imp

> Your employer, Wagner Inc., is a large Canadian public company that uses IFRS 16. You have collected the following information about a lease for a fleet of trucks used by Wagner to transport completed products to warehouses across the country. The trucks

> Ramey Corporation is a diversified public company with nationwide interests in commercial real estate development, banking, copper mining, and metal fabrication. The company has offices and operating locations in major cities throughout Canada. With corp

> Synergetics Inc. leased a new crane to Gumo Construction Inc. under a six-year, non-cancellable contract starting February 1, 2017. The lease terms require payments of $21,500 each February 1, starting February 1, 2017. Synergetics will pay insurance and

> LePage Manufacturing Ltd. agrees to lease equipment to Labonté Ltée. on July 15, 2017. LePage follows ASPE and Labonté is a public company following IFRS 16. The following information relates to the lease agreement. 1. The lease term is seven years, with

> Refer to the information in P20-3. Instructions: (a) Prepare the journal entries that Situ would make on January 1, 2017 and the adjusting journal entries at December 31, 2017, to record the annual interest income from the lease arrangement, assuming th

> On January 1, 2017, Hunter Ltd. entered into an agreement to lease a truck from Situ Ltd. Both Hunter and Situ use IFRS 16. The details of the agreement are as follows: Carrying value of truck for Situ Ltd…………………………………………………………………….$20,691 Fair value of

> Instructions: Access the financial statements of Air Canada and WestJet Airlines Ltd. for their years ended December 31, 2014 through SEDAR (www.sedar.com) or the companies’ websites. Review the financial statements, including the notes, and then answer

> You have just been hired as the new controller of SWT Services Inc., and on the top of the stack of papers on your new desk is a bundle of draft contracts with a note attached. The note says, “Please help me to understand which of these leases would be b

> Lanier Dairy Ltd. leases its milk cooling equipment from Green Finance Corporation. Both companies use IFRS 16. The lease has the following terms. 1. The lease is dated May 30, 2017, with a lease term of eight years. It is non-cancellable and requires eq

> Jennings Inc., which uses IFRS 16, manufactures an X-ray machine with an estimated life of 12 years and leases it to SNC Medical Centre for a period of 10 years. The machine’s normal selling price is $343,734, and the lessee guarantees a residual value a

> Assume the same data as in P20-15 and that Provincial Airlines Corp. has an incremental borrowing rate of 8%. Instructions: Answer the following questions, rounding all numbers to the nearest dollar. (a) Discuss the nature of this lease in relation to t

> CHL Corporation manufactures specialty equipment with an estimated economic life of 12 years and leases it to Provincial Airlines Corp. for a period of 10 years. Both CHL and Provincial Airlines follow ASPE. The equipment’s normal selling price is $210,4

> Dubois Steel Corporation, as lessee, signed a lease agreement for equipment for five years, beginning January 31, 2017. Annual rental payments of $41,000 are to be made at the beginning of each lease year (January 31). The insurance and repairs and maint

> Lee Industries Inc. and Lor Inc. enter into an agreement that requires Lor Inc. to build three diesel-electric engines to Lee’s specifications. Both Lee and Lor follow ASPE and have calendar year ends. Upon completion of the engines, Lee has agreed to le

> At the end of the December 31, 2016 fiscal year, Yin Trucking Corporation, which follows IFRS 16, negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the com

> Assume the same information as in P20-9. Instructions: Answer the following questions, rounding all numbers to the nearest dollar. (a) Assuming that Woodhouse Leasing Corporation’s accounting period ends on September 30, answer the fol

> Assume the same information as in P20-9. Follow the instructions assuming that McKee Electronics follows IFRS 16. Data from P20-9: The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electron

> DBRS is a large bond-rating agency in Canada that develops credit ratings for companies as a whole and also for its specific securities. Instructions: Access the agency’s website at www.dbrs. com and, under the “About Ratings” heading, locate and invest

> Interior Design Inc. (ID) is a privately owned business that produces interior decorating options for consumers. ID follows ASPE. The software that it purchased six years ago to present clients with designs that are unique to their offices is no longer s

> Dela Corporation initiated a defined benefit pension plan for its 50 employees on January 1, 2017. The insurance company that administers the pension plan provides the following information for the years 2017, 2018, and 2019: There were no balances as

> Bouter Corporation Limited (BCL) began operations in 1996 and in 2006 adopted a defined benefit pension plan for its employees. By January 1, 2017, the defined benefit obligation was $510,000. On January 2, 2017, for the first time, BCL agreed to a new u

> Manon Corporation applies ASPE and sponsors a defined benefit pension plan. The following pension plan information is available for 2017 and 2018: The pension fund paid out benefits in each year. There were no actuarial gains or losses incurred on the

> Brawn Corporation sponsors a defined benefit pension plan for its 100 employees. On January 1, 2017, the company’s actuary provided the following information: Pension plan assets (fair value)………………………………………$1,040,000 Defined benefit obligation…………………………

> You are the controller of a newly established technology firm that is offering a new pension plan to its employees. The plan was established on January 1, 2017, with an initial contribution by the employer equal to the actuarial estimate of the past serv

> The following information is available for HTM Corporation’s defined benefit pension plan: On January 1, 2017, HTM Corp. amended its pension plan, resulting in past service costs with a present value of $78,000. Instructions: (a) Cal

> D’Eon Corporation reports the following January 1, 2017 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $460,000; defined benefit obligation, $460,000. Other data relating to three years of

> Dungannon Enterprises Ltd. sells a specialty part that is used in widescreen televisions and provides the ultimate in screen clarity. To promote sales of its product, Dungannon launched a program with some of its smaller customers. In exchange for making

> Mullen Music Limited (MML) carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and sheet music. MML uses two sales promotion techniques—warranties and premiums—to attract customers. Musical instruments and sound e

> Instructions: Access the financial statements for Loblaw Companies Limited for the year ended January 3, 2015 and Empire Company Limited for the year ended May 2, 2015, through SEDAR (www.sedar. com) and then answer the following questions. (a) Calculate

> The Hwang Candy Corporation (HCC) offers a mini piggy bank as a premium for every fi ve chocolate bar wrappers that customers send in along with $2.00. The chocolate bars are sold by HCC to distributors for $0.30 each. The purchase price of each piggy ba

> To increase the sales of its Sugar Kids breakfast cereal, KW Foods Limited (KW) places one coupon in each cereal box. Five coupons are redeemable for a premium consisting of a child’s hand puppet. In 2017, KW purchases 40,000 puppets at $1.50 each and se

> Renew Energy Ltd. (REL) manufactures and sells directly to customers a special long-lasting rechargeable battery for use in digital electronic equipment. Each battery sold comes with a guarantee that the company will replace free of charge any battery th

> Smythe Corporation sells televisions at an average price of $850 and they come with a standard one-year warranty. Smythe also offers each customer a separate three-year extended warranty contract for $90 that requires the company to perform periodic serv

> Brooks Inc. sells portable computer equipment with a two-year warranty contract that requires the corporation to replace defective parts and provide the necessary repair labour. During 2017, the corporation sells for cash 400 computers at a unit price of

> The following are selected transactions of Pendlebury Department Store Ltd. (PDSL) for the current year ending December 31. PDSL is a private company operating in the province of Manitoba. 1. On February 2, PDSL purchased goods having cash discount terms

> Lindall Limited (LL) has a 10-year loan issued by the bank that is due in five years. The VP Finance feels that the company is carrying too much debt on its statement of financial position and would like to repay the loan early. Unfortunately, the early

> Newfoundland University recently signed a contract with the bargaining unit that represents full-time professors. The contract agreement starts on April 1, 2016, the start of the university’s fiscal year. The following excerpt outlines the portion of the