Question: Sharon Electronics, an electronics supply company,

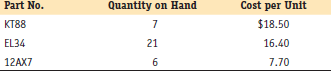

Sharon Electronics, an electronics supply company, uses the perpetual inventory system with a subsidiary inventory ledger to maintain control over an inventory of thousands of electronic parts. The quantities and costs for three of the parts in the inventory follow:

Your job is to do the following:

1. Enter the beginning balances in the inventory record forms; beginning inventory is $520.10

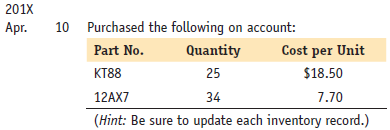

2. Journalize and post the following transactions.

11 Sold 5 number KT88 units for cash at a selling price of $28.50 each.

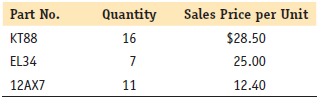

13 Sold the following for cash:

15 A customer brought back 1 of the KT88 units bought 2 days ago because they did not work.

16 Sharon Electronics sent back to the vendor the faulty KT88 units that the customer brought back.

Transcribed Image Text:

Part No. Quantity on Hand Cost per Unit кт88 7 $18.50 EL34 21 16.40 12AX7 7.70 201X Apг. 10 Purchased the following on account: Part No. Quantity Cost per Unit КТ88 25 $18.50 12AX7 34 7.70 (Hint: Be sure to update each inventory record.) Part No. Quantity Sales Price per Unit КТ88 16 $28.50 EL34 7 25.00 12AX7 11 12.40

> Post the journal entries in Figure 3.31 to the ledger of Kramer Company. The partial ledger of Kramer Company is Cash, 111; Equipment, 121; Accounts Payable, 211; and A. Kramer, Capital, 311. Please use four column accounts in the posting process. Figur

> From the trial balance of Hugo’s Cleaners in Figure 2.5, prepare the following for July: • Income statement • Statement of owner’s equity • Balance sheet HUGO

> Complete the following table. For each account listed on the left, fill in what category it belongs to, whether increases and decreases in the account are marked on the debit or credit sides, and on which financial statement the account appears. A sample

> From the following account balances, prepare in proper form for November (a) an income statement, (b) a statement of owner’s equity, and (c) a balance sheet for Frederick Realty. Cash $4,800 S. Frederick, Withdrawals $ 120 Accounts

> Record the following transactions in the expanded accounting equation. Do not calculate a running balance. a. Black invested $60,000 in a computer company. b. Bought computer equipment on account, $7,000. c. Black paid personal telephone bill from comp

> From the following, prepare a balance sheet for Rideout Co. Cleaners at the end of November 201X: Cash, $71,000; Equipment, $12,000; Accounts Payable, $15,100; B. Rideout, Capital.

> Pete went to an auto dealer to buy a new Jeep. The salesperson told Pete that cars really appreciate in value. He cited antique cars as a perfect example. The dealer went on to tell Pete that buying a car represents some great tax savings. He told Pete t

> Record the following into the general journal of Remy’s Auto Shop. 201X May 1 Remy Tarsia invested $150,000 cash in the auto shop. 5 Paid $6,000 for auto equipment. 8 Bought auto equipment from Littleton Co. for $4,000 on account.

> Prepare journal entries for the following transactions that occurred during April: 201X April 1 Jamie Moore invested $110,000 cash and $12,000 of equipment into her new business. 3 Purchased building for $70,000 on account. 12 Purchased a truck from

> From the trial balance in Figure 25.20 and the provided year-end information, prepare a worksheet for Jenks Corporation (assume no adjustments). Figure 25.20: Year-End Figures Raw materials inventory ……â&#

> As the bookkeeper of Queen Manufacturing, you are to record the following transactions in the general journal for the month of November: a. Raw materials of $74,000 were issued from the storeroom. b. Charged $60,000 of direct labor to production. c. Supp

> An analysis of the accounts of Payson Manufacturing reveals the following data for the month ended April 30, 201X: Costs Incurred: Raw materials purchased, $120,000; direct labor, $133,000; manufacturing overhead, $49,700. These specific overheads incl

> Greer Company requested that you (1) assign indirect expenses to its jewelry and shoes departments as appropriate and (2) prepare an income statement for August 201X showing departmental contribution margins along with net income. Assume a 30% tax rate.

> From the following partial data, prepare an income statement showing departmental income before tax along with net income for Jay’s Corporation for the year ended December 31, 201X. Net Sales, TVs …â€&brv

> Given the following information about the clothing and hardware departments of Eustis Company, prepare a departmental expense allocation sheet showing expenses by department. Allocation Basis Rent and Insurance: …â€&brvb

> From the following data, prepare in proper form an income statement showing departmental gross profit (assume a 22% tax rate) for Speedy Stop for the year ended December 31, 201X. Cash ……………………………………………………………………………….. $10,000 Accounts Receivable …………………

> The Stevens Company uses a voucher system and records invoices at gross. Record the following transactions in the voucher register and/or check register as appropriate: 201X Aug. Voucher no. 450 was prepared for the purchase of $3,800 worth of merch

> Identify where each title is placed on the worksheet. a. Direct labor b. Ending finished goods inventory c. Beginning finished goods inventory d. Ending raw materials inventory

> Janus Corporation has been using a voucher system for several years and records invoices at gross. Prepare entries in the voucher register and check register for the following transactions: 201X Sept. Purchased merchandise inventory on account from

> Saffron Corporation uses a voucher system and records invoices at gross. Record the following transactions in the voucher register and/or check register as appropriate: 201X July Purchased merchandise on account for $1,600 from Dallas Company; terms

> From the information about Valdemar Corporation in Figures 22.16 and 22.17, do the following: Figures 22.16: Figures 22.17: a. For each year calculate its current ratio and acid test ratio. b. For each year prepare the income statement in common-siz

> From the income statement and balance sheet of Anderson Company (Figures 22.14 and 22.15), compute the following for 2016: (a) current ratio, (b) acid test ratio, (c) accounts receivable turnover, (d) average collection period, (e) inventory turnover, (f

> From the comparative income statement of Carney Company in Figure 22.13, do the following: Figure 22.13: a. Prepare a horizontal analysis with the amount of increase or decrease during 2016 along with the percent increase or decrease during 2015 (to t

> From the comparative balance sheet of Hesler Corporation in Figure 22.12, do the following: (a) Prepare a horizontal analysis of each item for the amount of increase or decrease as well as the percent increase or decrease (to the nearest tenth of a perce

> From the financial statements and additional information provided in Problem 21B-1 for Cygan Company, prepare a statement of cash flows using the direct method. Problem 21B-1: From the following income statement (Figure 21.14), balance sheet (Figure 21

> From the following income statement (Figure 21.14), balance sheet (Figure 21.15), and additional data for Cygan Company, prepare a statement of cash flows using the indirect method. Figure 21.14: Figure 21.15: Additional Data 1. All Plant and Equipme

> On April 1, 201X, Plimpton Corporation issued $210,000 of 10%, 5-year bonds for $227,126, yielding a market rate of 8%. Interest is paid on October 1 and April 1. Plimpton Corporation uses the interest method to amortize the premium. 1. Prepare an amort

> On January 1, 201X, Austin Corporation issued $300,900 of 11%, 10-year bonds for $252,958, yielding a market rate of 14%. Interest is paid on July 1 and December 31. Austin uses the interest method to amortize the discount. 1. Prepare an amortization sc

> Calculate the contribution margin for each department and income before taxes, based on the following: Dept. A 1,000 square feet Dept. B 2,200 square feet Net Sales $6,100 $11,000 Cost of Goods Sold 1,700 6,000 $ 950 (40% directly related to Dept. A

> On May 1, 201X, Lance Corporation issued $900,000 of 15%, 20-year bonds at 102. The interest is payable on November 1 and May 1. The premium is amortized by the straight-line method. Prepare an amortization schedule for the first three semiannual periods

> On January 1, 201X, Langston Corporation sold $450,000 of 9%, 10-year bonds at 97. Interest is to be paid on June 30 and December 31. The straightline method of amortizing the discount is used. Prepare (1) an amortization schedule for the first three sem

> The following is the stockholders’ equity of Pierotti Corporation on October 1, 201X: 1. Journalize the transactions in general journal form. 2. Prepare the stockholders’ equity section of the balance sheet using the

> At the beginning of January 201X, the stockholders’ equity of Plain View Corporation consisted of the following: 1. Record the transactions in general journal form. 2. Prepare the stockholders’ equity section at year

> Racette Corporation has 390,000 shares of $7 par-value common stock issued and outstanding. Record the following entries into the general journal for Racette: 201X July 2 Declared a cash dividend of $0.60 per share. Aug. 1 Paid the $0.60 cash divide

> The stockholders’ equity of Lock Company is as follows: Given a redemption value of $104 per share for the preferred stock, calculate the book value per share of preferred and common stock, assuming the following: a. No preferred divi

> From the following partial mixed list, select the appropriate titles and prepare a stockholders’ equity section using the source-of-capital approach as shown in the Blueprint example for Helium Corporation on July 31, 201X. Office Equipment ………………………………

> Kirk Corporation has 22,500 shares outstanding of $7 par value, 9% preferred stock, and 45,000 shares outstanding of $7 par-value common stock. In its first 5 years of operation, the company paid the following dividends: 2011, $0; 2012, $14,175; 2013, $4

> The following is the Paid-In Capital section of stockholders’ equity for the Kodokan Corporation on June 1, 201X: Paid-In Capital: Preferred Stock, $92 par, authorized 21,000 shares, 6,000 shares issued …â

> The partnership of Josephson, Ramirez, and Smith is being liquidated. All gains and losses are shared in a 3:2:1 ratio. Before liquidation their balance sheet looks as follows: Journalize the entries needed in the liquidation process under the followin

> From the following, calculate departmental income before tax. Assume a tax rate of 35%. Dept. A Dept. B Net Sales $4,600 $6,300 Cost of Goods Sold 2,500 2,400 Delivery Expense 630 870 Advertising Expense 540 620 Depreciation Expense 330 380

> Jeremey, Matthew, and Grace are partners. On July 30, 201X, the balance sheet was as follows: The partners agree to share all losses and gains in a 2:2:1 ratio. Grace is withdrawing from the partnership. From the following independent situations, journ

> Bob North and Whitney Adam are partners with capital balances of $1,500 and $600, respectively. They share all profits and losses equally. From the following independent situations, journalize the admission of the new partner, Jack Wilcox: Situation 1: W

> a. The partnership of Sandy and Gary began with the partners investing $4,200 and $2,500, respectively. At the end of the first year, the partnership earned net income of $8,500. Under each of the following independent situations, calculate how much of t

> Journalize the following transactions for the Robe Company and show all calculations: 201X Sold a truck for $1,350 that cost $6,650 and had accumulated depreciation of $5,900. Jan. 1. Feb. 10 A machine costing $2,800 with accumulated depreciation of

> On January 1, 2014, a machine was installed at Garrity Factory at a cost of $58,000. Its estimated residual value at the end of its estimated life of 4 years is $16,000. The machine is expected to produce 168,000 units with the following production sched

> Record the following transactions (all paid in cash except on March 24) in the general journal of Green Company: 201X Feb. Purchased land for $94,000. The $94,000 included attorney's fees of $5,700. 18 Green Company decided to pave the parking lot f

> Over the past four years the gross profit rate for Otterson Company was 34%. Last week a fire destroyed all of Otterson’s inventory. Luckily, all the records for Otterson were in a fireproof safe and indicated the following facts: Inventory (January 1,

> Nash Company uses the retail method to estimate the cost of ending inventory for its monthly interim reports. From the following facts, estimate Nash’s ending inventory at cost for the end of January. (Round the cost ratio to the nearest tenth percent.)

> Ashley Company uses a perpetual inventory system. From the following information, prepare an inventory record form (a) assuming that the FIFO method is in use and (b) assuming that the LIFO method is in use. Assume on January 1, 201X, a beginning invento

> From the data given calculate the following. (Round to the nearest hundredth or hundredth of a percent as needed.) a. Current ratio b. Acid test ratio c. Asset turnover ratio d. Gross profit rate Net Sales ……………………………………………….... $270,000 Current Assets

> Given the following, prepare the book value per share for preferred and common stock: • Preferred Stock $96,000; 1,400 shares issued. • Common Stock $172,000; 1,600 shares issued. • Retained Earnings, $9,800. • Preferred Dividends in Arrears, $5,400. • P

> The Auburn Company uses the perpetual inventory system. Record the transactions in a two-column journal. All credit sales are n/30. 201X Aprг. 5 Purchased merchandise on account totaling $2,200; terms n/30. 6 Sold merchandise on account to Tommy Dub

> Journalize the following transactions for Dixey Company: 201X 18 Received a $11,000, 85-day, 10% note from Frank Hall in payment of account past due. Apr. Wrote off the Joe Halmark account as uncollectible for $580. (Dixey uses the Allowance method

> Journalize the following transactions for Joliot Company: 201X June 18 Joliot Company discounted its own $40,000, 30-day note at Nixon Bank at 14%. July Paid the amount due on the note of June 18. (Be sure to record interest expense from Discount on

> On May 1, 201X, Bird Company received a $25,000, 65-day, 9% note from Robertson Company dated May 1. On June 20, 201X, Bird discounted the note at Acorn Bank at a discount rate of 10.50%. 1. Calculate the following: a. Maturity value of the note b. Numb

> Journalize the following entries for (1) the buyer and (2) the seller. Record all entries for the buyer first. Both companies use the periodic inventory method. 201X June 11 Lewis Company sold $9,500 of merchandise on account to Reed Company. July L

> Seay Company completed the following transactions: From these transactions as well as the following additional data, complete a–c: a. Journalize the transactions. The company uses the periodic method. b. Post to Allowance for Doubtf

> T. J. Radar Company uses the direct write-off method for recording Bad Debts Expense. At the beginning of 2015, Accounts Receivable has a $118,000 balance. Journalize the following transactions for T. J. Radar: 2015 Wrote off S. Rosenberg's account

> Given the information presented in Figure 13.13, do the following: a. Prepare on December 31, 2015, the adjusting journal entry for Bad Debts Expense. Balances: Cash, $25,000; Accounts Receivable, $173,000; Allowance for Doubtful Accounts, $300; Merchand

> LaPaglia Co. has requested that you prepare journal entries from the following (this company uses the Allowance for Doubtful Accounts method based on the income statement approach): 2015 Dec. 31 Recorded Bad Debts Expense of $13,000. 2016 7 Wrote of

> Using the ledger balances and additional data given, do the following for Crew Lumber for the year ended December 31, 201X. 1. Prepare the worksheet. 2. Prepare the income statement, statement of owner’s equity, and balance sheet. 3. J

> Using the data from Concept Check 2 plus the additional information in Figure 21.11, compute net cash flows from operating activities using the direct method. Concept Check 2: From the following, calculate the net cash flow from operating activities us

> From the partial worksheet for Justin’s Supplies in Figure 12.18, do the following: 1. Complete the worksheet. 2. Prepare the income statement, statement of owner’s equity, and classified balance sheet. (Note: The amou

> Prepare a statement of owner’s equity and a classified balance sheet from the worksheet shown for Jager Company in Figure 12.17. (Note: Of the Mortgage Payable, $200 is due within 1 year.) Figure 12.17: JAGER COMPANY PARTIAL WORKS

> Prepare a formal income statement from the partial worksheet for Wright Co. in Figure 12.16. Figure 12.16: WRIGHT CO. PARTIAL WORKSHEET FOR YEAR ENDED DECEMBER 31, 201X Income Statement Account Titles Dr. Cr. Income Summary 41000 230 00 Sales 28500

> Jeanne’s Toy Shop completed the following merchandise transactions in the month of April: Jeanne’s Toy Shop accounts included the following: Cash 101; Accounts Receivable 112; Merchandise Inventory 120; Office Equipm

> Abby Ellen opened Abby’s Toy House. As her newly hired accountant, your tasks are to do the following: 1. Journalize the transactions for the month of March. Use the periodic method. 2. Record to subsidiary ledgers and post to the gener

> Wendy Johnson operates a wholesale computer center and has hired you as her bookkeeper to record the following transactions. She would like you to (1) journalize the following transactions, (2) record to the accounts payable subsidiary ledger and post to

> As the accountant of Trina’s Natural Food Store, (1) journalize the following transactions into the general journal (p. 2), (2) record and post as appropriate, and (3) prepare a schedule of accounts payable. If using working papers, be

> Rasheed Chase recently opened Rasheed’s Skate Shop. As the bookkeeper of the company, use the periodic method to journalize, record, and post when appropriate the following transactions (account numbers are Store Supplies 115; Store Equ

> Al Franklin opened Al’s Cosmetic Market on December 1. An 8% sales tax is calculated and added to all cosmetic sales. Al offers no sales discounts. The following transactions occurred in December: Required: 1. Journalize, record, and

> Max Peney owns Peney’s Sneaker Shop. (Balances as of August 1 are provided for the accounts receivable and general ledger accounts as follows: Donovan, $375 Dr.; Littler, $900 Dr.; Pry, $750 Dr.; Zamora, $350 Dr.; Cash, $16,500 Dr.; Acc

> From the following, calculate the net cash flow from operating activities using the indirect method: 2013 2014 Accounts Receivable $ 570 $ 830 Merchandise Inventory 2,100 4,000 Prepaid Insurance 625 300 Accounts Payable 1,025 770 Salaries Payable 58

> The following transactions of Jack’s Auto Supply occurred in January (Balances as of January 1 are given for general ledger and accounts receivable ledger accounts: Nonack, $1,400 Dr.; Seth, $50 Dr.; Corner, $200 Dr.; Accounts Receivabl

> Sandra Hills has opened Macchiato and More, a wholesale grocery and coffee company. The following transactions occurred in June: Required: 1. Journalize the transactions. 2. Record to the accounts receivable subsidiary ledger and post to the general le

> The following is the monthly payroll for the last three months of the year for Turner’s Sporting Goods Shop, 2 Boat Road, Lynn, Massachusetts 01945. The shop is a sole proprietorship owned and operated by Bill Turner. The EIN for Turner

> The following is the monthly payroll of White Company, owned by Dale White. Employees are paid on the last day of each month. White Company is located at 2 Square Street, Marblehead, Massachusetts 01945. Its EIN is 29-3458822. The FICA tax rate for S

> You gathered the following data from time cards and individual employee earnings records. Your tasks are as follows: 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA OASDI, FICA Medicar

> From the following, record the transactions in Kona’s auxiliary petty cash record and general journal as needed: 201X A check was drawn (no. 444) payable to Harold Hauer, petty cashier, to establish a $220 petty cash fund. Oct. 1 P

> The following transactions occurred in April for Jolly Co.: Your tasks are to do the following: a. Record the appropriate entries in the general journal as well as the auxiliary petty cash record as needed. b. Replenish the petty cash fund on April 30

> From the following statement, please (1) complete the bank reconciliation for Jackie’s Deli found on the reverse of the following bank statement and (2) journalize the appropriate entries as needed. a. A deposit of $2,500 is in transit

> Work.com received a bank statement from Waldorf Bank indicating a bank balance of $7,800. Based on Work.com’s check stubs, the ending checkbook balance was $8,320. Your task is to prepare a bank reconciliation for Work.com as of July 31, 201X, from the f

> As the bookkeeper of Palmer’s Plowing, you have been asked to complete the entire accounting cycle for Palmer from the following information. Use the following chart of accounts. Chart of Accounts Assets …â&

> Facts: Bond issue: $95,000, 13%, 35-year bonds; selling price of bonds $191,805; market rate 6%. Use the interest method. Calculate the following: a. Carrying value at beginning of period b. Interest paid to bondholders each 6 months c. Interest expense

> Enter the beginning balance in each account in your working papers from the Trial Balance columns of the worksheet (Figure 5.26). From the worksheet, (1) journalize and post adjusting and closing entries and (2) prepare from the ledger a post-closing tri

> Consider the data in Figure 5.25 for Deb’s Dance Studio: Figure 5.25: Adjustment Data a. Insurance expired, $500. b. Dance supplies on hand, $400. c. Depreciation on dance equipment, $1,200. d. Salaries earned by employees but not du

> The trial balance for Don’s Repair Service appears in Figure 4.28. Figure 4.28: Adjustment Data to Update Trial Balance a. Insurance expired, $400. b. Repair supplies on hand, $2,900. c. Depreciation on repair equipment, $350. d. Wag

> Update the trial balance for Kyle’s Moving Co. (Figure 4.27) for October 31, 201X. Figure 4.27: Adjustment Data to Update Trial Balance a. Insurance expired, $600. b. Moving supplies on hand, $800. c. Depreciation on moving truck, $5

> The following transactions occurred in April 201X for A. French’s Placement Agency: The chart of accounts for A. French Placement Agency is as follows: Your task is to do the following: a. Set up a ledger based on the chart of accou

> On April 1, 201X, Beth Orth opened Beth’s Art Studio. The following transactions occurred in April. Your tasks are to do the following: a. Set up a ledger based on the following chart of accounts using four column accounts. b. Journal

> Jimmy Cook operates Jimmy’s Cleaning Service. As the bookkeeper, you have been requested to journalize the following transactions: The chart of accounts for Jimmy’s Cleaning Service is as follows: Chart of Acco

> The chart of accounts of Aikman’s Delivery Service is as follows: Chart of Accounts Assets ………………………………….……………………………….. Revenue Cash 111 ……………………..……………….. Delivery Fees Earned 411 Accounts Receivable 112 ……………………………………….. Expenses Office Equipment 121…

> From the trial balance of Gretchen Lyman, Attorney-at-Law, given in Figure 2.8, prepare (a) an income statement for the month of January, (b) a statement of owner’s equity for the month ended January 31, and (c) a balance sheet at Janua

> Bill Palu opened a consulting company, and the following transactions resulted. A. Bill invested $30,000 in the consulting agency. B. Bought office equipment on account, $5,000. C. Agency received cash for consulting work that it completed for a client,

> Facts: Bond issue: $150,000, 9%, 13-year bonds; selling price of bonds $129,569; market rate 11%. Use the interest method. Calculate the following: a. Carrying value at beginning of period b. Interest paid to bondholders every 6 months c. Interest expen

> John Thildore, a retired army officer, opened Thildore’s Catering Service. As his accountant, analyze the transactions listed and present them in proper form. a. The analysis of the transactions by using the expanded accounting equatio

> Jeanette Wu, owner of Wu Home Decorating Service has requested that you prepare from the following balances (a) an income statement for June 201X, (b) a statement of owner’s equity for June, and (c) a balance sheet as of June 30, 201X.

> From the following T accounts of Breck’s Cleaning Service, (a) foot and determine the ending balances, and (b) prepare a trial balance in proper form for May 31, 201X. Cash 111 Accounts Receivable 112 Office Equipment 121 (A) 15,00

> Brad Sealy is the accountant for Sealy’s Internet Service. From the following information, his task is to construct a balance sheet as of November 30, 201X, in proper form. Can you help him? Building $ 50,000 Cash 55,000 Accounts P

> The following transactions occurred in the opening and operation of Bob’s Delivery Service. A. Bob O’Brien opened the delivery service by investing $25,000 from his personal savings account. B. Purchased used delivery trucks on account, $12,000. C. Rent