Question: Shown below in T-account format are

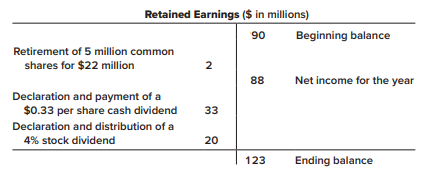

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2024? At January 1, 2024, the corporation had outstanding 105 million common shares, $1 par per share.

Required:

1. From the information provided by the account changes you should be able to re-create the transactions that affected Brenner-Jude’s retained earnings during 2024. Reconstruct the journal entries which can be used as spreadsheet entries in the preparation of a statement of cash flows. Also indicate any investing and financing activities you identify from this analysis that should be reported on the statement of cash flows.

2. Prepare a statement of retained earnings for Brenner-Jude for the year ended 2024. (You may wish to compare your solution to this problem with the parallel situation described in Exercise 18–17.)

> Descriptors are provided below for six situations involving notes receivable being discounted at a bank. In each case, the maturity date of the note is December 31, 2024, and the principal and interest are due at maturity. Required: For each situation,

> Evergreen Company sells lawn and garden products to wholesalers. The company’s fiscal year end is December 31. During 2024, the following transactions related to receivables occurred: Required: 1. Prepare the necessary journal entries

> Swath more Clothing Corporation grants its customers 30 days’ credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amoun

> Citation Builders, Inc., builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10–20 homes and are typically so

> Complete the requirements of P 6–10, assuming that Westgate Construction’s contract with Santa Clara County does not qualify for revenue recognition over time. Curtiss Construction Company, Inc., entered into a fixed-p

> In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Westgate recognizes revenue over time accord

> Tran Technologies licenses its functional intellectual property to Lyon Industries. Terms of the arrangement require Lyon to pay Tran $500,000 on April 1, 2024, when Lyon first obtains access to Tran’s intellectual property, and then in the future to pay

> Assume the same facts as P 6–6. Required: 1. Assume that Super Rise anticipates it will earn the performance bonus, but is highly uncertain about its estimate given unfamiliarity with the building and uncertainty about its access to the elevators and re

> Assume that Adams Industries holds 40,000 shares of FedEx common stock, which is not a large enough ownership interest to allow Adams to exercise significant influence over FedEx. On December 31, 2024, and December 31, 2025, the market value of the stock

> Since 1970, Super Rise, Inc., has provided maintenance services for elevators. On January 1, 2024, Super Rise obtains a contract to maintain an elevator in a 90-story building in New York City for 10 months and receives a fixed payment of $80,000. The co

> Supply Club, Inc., sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During July 2024, it started a loyalty program through which qualifying customers can accumulate points and redeem thos

> Assume the same facts as in P 6–2, except that customers must pay $75 to purchase the extended warranty if they don’t purchase it with the $50 coupon that was included in the Protab Package. Creative estimates that 40% of customers will use the $50 coupo

> Fit & Slim (F&S) is a health club that offers members various gym services. Required: 1. Assume F&S offers a deal whereby enrolling in a new membership for $700 provides a year of unlimited access to facilities and also entitles the member to receive a v

> Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated’s i

> American Surety and Fidelity buys and sells securities expecting to earn profits on short-term differences in price. For the first 11 months of 2024, gains from selling trading securities totaled $8 million, losses from selling trading securities were $1

> The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2024. The company buys equity securities as noncurrent investments. None of Ornamental’s investments are large enough to exe

> The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2024. The company buys debt securities, not intending to profit from short-term differences in price and not necessarily to hold debt securiti

> The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2024. The company buys debt securities, intending to profit from short-term differences in price and maintaining them in an active trading por

> Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2024. Management intends to have the investment available for sale when circumstances warrant. When the company purchased the bon

> Lance Brothers Enterprises acquired $720,000 of 3% bonds, dated July 1, on July 1, 2024, as a long-term investment. Management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 4% for bonds of simi

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are provided in Connect. This ma

> Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2024. Management intends to have the investment available for sale when circumstances warrant. For bonds of similar risk and matu

> Fuzzy Monkey Technologies, Inc., purchased as a short-term investment $80 million of 8% bonds, dated January 1, on January 1, 2024. Management intends to include the investment in a short-term, active trading portfolio. For bonds of similar risk and matu

> Stewart Enterprises has the following investments, all purchased prior to 2024: 1. Bee Company 5% bonds, purchased at face value, with an amortized cost of $4,000,000, and classified as held-to-maturity. At December 31, 2024, the Bee investment had a fai

> Feherty, Inc., accounts for its investments under IFRS No. 9 and purchased the following investments during December 2024: 1. Fifty of Donald Company’s $1,000 bonds. The bonds pay semiannual interest, return principal in eight years, and include no other

> On January 1, 2024, Ithaca Corp. purchases Cortland Inc. bonds that have a face value of $150,000. The Cortland bonds have a stated interest rate of 6%. Interest is paid semiannually on June 30 and December 31, and the bonds mature in 10 years. For bonds

> Indicate (by letter) the way each of the investments listed below most likely should be accounted for based on the information provided.

> On January 2, 2024, Miller Properties paid $19 million for 1 million shares of Marlon Company’s 6 million outstanding common shares. Miller’s CEO became a member of Marlon’s board of directors during the first quarter of 2024. The carrying amount of Marl

> Northwest Paperboard Company, a paper and allied products manufacturer, was seeking to gain a foothold in Canada. Toward that end, the company bought 40% of the outstanding common shares of Vancouver Timber and Milling, Inc., on January 2, 2024, for $400

> Companies can choose the fair value option for investments that otherwise would be accounted for under the equity method. If the fair value option is chosen, the investment is shown at fair value in the balance sheet, and unrealized holding gains and los

> On January 4, 2024, Runyan Bakery paid $324 million for 10 million shares of Lavery Labeling Company common stock. The investment represents a 30% interest in the net assets of Lavery and gave Runyan the ability to exercise significant influence over Lav

> On September 30, 2024, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2025, and the program was available for release on April 30, 2025.

> On January 4, 2024, Runyan Bakery paid $324 million for 10 million shares of Lavery Labeling Company common stock. The investment represents a 30% interest in the net assets of Lavery and gave Runyan the ability to exercise significant influence over Lav

> Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2024. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the

> The property, plant, and equipment section of the Jasper Company’s December 31, 2023, balance sheet contained the following: The land and building were purchased at the beginning of 2019. Straight-line depreciation is used and a residua

> The following information concerns the intangible assets of Baez Corporation: a. On June 30, 2024, Baez completed the acquisition of the Johnstone Corporation for $2,000,000 in cash. The fair value of the net identifiable assets of Johnstone was $1,700,0

> In 2024, the Marion Company purchased land containing a mineral mine for $1,600,000. Additional costs of $600,000 were incurred to develop the mine. Geologists estimated that 400,000 tons of ore would be extracted. After the ore is removed, the land will

> On March 31, 2024, the Herzog Company purchased a factory complete with vehicles and equipment. The allocation of the total purchase price of $1,000,000 to the various types of assets along with estimated useful lives and residual values are as follows:

> The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2022. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this

> On April 1, 2022, the KB Toy Company purchased equipment to be used in its manufacturing process. The equipment cost $48,000, has an eight-year useful life, and has no residual value. The company uses the straightline depreciation method for all manufact

> For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2024, using the following depreciation methods and useful lives: Depreciation is computed to the nearest month and whole dollar amount, and no residual

> At December 31, 2023, Cord Company’s plant asset and accumulated depreciation and amortization accounts had balances as follows: Depreciation is computed to the nearest month and residual values are immaterial. Transactions during 2024

> Early in 2024, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2024 at a cost of $6 million. Of this amount, $4 million was spent before technological feasibility was established. Excali

> On April 1, 2024, Titan Corporation purchases office equipment for $50,000. For tax reporting, the company uses MACRS and classifies the equipment as five-year personal property. In 2024, this type of equipment is eligible for 60% first-year bonus deprec

> On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a mineral mine in New Mexico for $10 million. Additional costs and purchases included the following: After the minerals are removed from

> At the beginning of 2022, Metatec Inc. acquired Ellison Technology Corporation for $600 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired: The plant and equipment are depreciated over

> Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,000,000. This cost figure included the following expenditures: The company estimated an eight-year useful life for the equipment. No residual value is an

> Described below are three independent and unrelated situations involving accounting changes. Each change occurs during 2024 before any adjusting entries or closing entries are prepared. a. On December 30, 2020, Rival Industries acquired its office buildi

> The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can make it difficult for a financial analyst to compare periodic performance from firm to firm. Suppose you were a financia

> The comparative balance sheets for 2024 and 2023 and the income statement for 2024 are given below for Arduous Company. Additional information from Aldous’s accounting records is provided also. Additional information from the accounting

> Portions of the financial statements for Parnell Company are provided below. Required: 1. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. 2. Prepare the cash flows from

> The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Microsoft Corporation. Required: Prepare the cash flows from operating activities section of the statement of cash flows (direct me

> Mondale Winery depreciates its equipment using the group method. The cost of equipment purchased in 2024 totaled $425,000. The estimated residual value of the equipment was $40,000 and the group depreciation rate was determined to be 18%. (1) What is the

> The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Mike Roe Computers. Required: 1. Calculate each of the following amounts for Mike Roe Computers: a. Cash received from customers du

> Comparative balance sheets for 2024 and 2023 and a statement of income for 2024 are given below for Meta globalize Industries. Additional information from the accounting records of Meta globalize also is provided Additional information from the accountin

> The comparative balance sheets for 2024 and 2023 and the statement of income for 2024 are given below for Dux Company. Additional information from Dud’s accounting records is provided also. Additional information from the accounting rec

> The comparative balance sheets for 2024 and 2023 and the statement of income for 2024 are given below for National Inferable Company. Additional information from NIC’s accounting records is provided also. Additional information from the

> Refer to the data provided in the P 21–11 for Arduous Company. Required: Prepare the statement of cash flows for Arduous Company. Use the T-account method to assist in your analysis.

> Refer to the data provided in the P 21–5 for Meta globalize Industries. Required: Prepare the statement of cash flows for Meta globalize Industries. Use the T-account method to assist in your analysis.

> Refer to the data provided in the P 21–4 for Dux Company. Required: Prepare the statement of cash flows for Dux Company. Use the T-account method to assist in your analysis.

> Refer to the data provided in the P 21–11 for Arduous Company. Required: Prepare the statement of cash flows for Arduous Company using the indirect method.

> Refer to the data provided in the P 21–5 for Meta globalize Industries. Required: Prepare the statement of cash flows for Meta globalize Industries using the indirect method.

> Refer to the data provided in the P 21–4 for Dux Company. Required: Prepare the statement of cash flows for Dux Company using the indirect method.

> On December 31, 2024, management of Jines Construction committed to a plan for selling an office building and its related equipment. Both are available for immediate sale. The building has a book value of $800,000 and a fair value of $900,000. The equipm

> Digital Telephony issued 10% bonds, dated January 1, with a face amount of $32 million on January 1, 2024. The bonds mature in 2034 (10 years). For bonds of similar risk and maturity the market yield is 12%. Interest is paid semiannually on June 30 and D

> The comparative balance sheets for 2024 and 2023 are given below for Surmise Company. Net income for 2024 was $50 million. Required: Prepare the statement of cash flows of Surmise Company for the year ended December 31, 2024. Use the indirect method to p

> Following are selected balance sheet accounts of Del Conte Corp. at December 31, 2024 and 2023, and the increases or decreases in each account from 2023 to 2024. Also presented is selected income statement information for the year ended December 31, 2024

> The comparative balance sheets for 2024 and 2023 and the statement of income for 2024 are given below for Wright Company. Additional information from Wright’s accounting records is provided also. Additional information from the accounti

> At the beginning of 2024, Wagner Implements undertook a variety of changes in accounting methods, corrected several errors, and instituted new accounting policies. Required: Indicate for each item 1 to 10 below the type of change and the reporting appro

> Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2024 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 25% in all years. Any tax eff

> In 2024, the William Jesse Company purchased land containing a mineral mine for $1,600,000. Additional costs of $600,000 were incurred to develop the mine. Geologists estimated that 400,000 tons of ore would be extracted. After the ore is removed, the la

> During 2022 and 2023, Faulkner Manufacturing used the sum-of-the-years’-digits (SYD) method of depreciation for its depreciable assets, for both financial reporting and tax purposes. At the beginning of 2024, Faulkner decided to change

> Fantasy Fashions had used the LIFO method of costing inventories, but at the beginning of 2024 decided to change to the FIFO method. The inventory as reported at the end of 2023 using LIFO would have been $20 million higher using FIFO. Retained earnings

> The Straws-Morris Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1985. In 2024, the company decided to change to the average cost method. Data for 2024 are as follows: Additional Informati

> On July 15, 2024, Cottonwood Industries sold a patent and equipment to Roquemore Corporation for $750,000 and $325,000, respectively. On the date of the sale, the book value of the patent was $120,000, and the book value of the equipment was $400,000 (co

> Shown below are net income amounts as they would be determined by Roberti Steel Company by each of three different inventory costing methods ($ in thousands). Required: 1. Assume that Roberti used FIFO before 2024, and then in 2024 decided to switch to a

> The Cochin Company has used the LIFO method of accounting for inventory during its first two years of operation, 2022 and 2023. At the beginning of 2024, Cochin decided to change to the average cost method for both tax and financial reporting purposes. T

> The CARES Act allows some companies to (1) save more taxes and (2) obtain those savings faster. How does the Act enable those benefits?

> George Young Industries (GYI) acquired industrial robots at the beginning of 2022 and added them to the company’s assembly process. During 2024, management became aware that the $1 million cost of the equipment was inadvertently recorde

> What are the primary ways in which the CARES Act changed accounting for the tax effects of NOLs?

> You are internal auditor for Shannon Supplies, Inc., and are reviewing the company’s preliminary financial statements. The statements, prepared after making the adjusting entries, but before closing entries for the year ended December 3

> Conrad Playground Supply underwent a restructuring in 2024. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2024 before any adjusting entries or closing entries are prepared. a.

> Suppose the Environmental Protection Agency is in the process of investigating Ozone Ruination Limited for possible environmental damage but has not proposed a penalty as of December 31, 2020, the company’s fiscal year-end. Describe the two-step process

> Whaley Distributors is a wholesale distributor of electronic components. Financial statements for the years ended December 31, 2022 and 2023, reported the following amounts and subtotals ($ in millions): In 2024, the following situations occurred or came

> What transactions are included in income from continuing operations? Briefly explain why it is important to segregate income from continuing operations from other transactions affecting net income.

> Funseth Farms Inc. purchased a tractor in 2021 at a cost of $30,000. The tractor was sold for $3,000 in 2024. Depreciation recorded through the disposal date totaled $26,000. (1) Prepare the journal entry to record the sale. (2) Now assume the tractor wa

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2009 by two talented engineers with little business training. In 2024, the company was acquired by one of its major customers. As part of an internal audit, the fol

> What are the three main types of sustainability disclosures? How can those disclosures provide information to shareholders and stakeholders?

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2012 by two talented engineers with little business training. In 2024, the company was acquired by one of its major customers. As part of an internal audit, the fol

> How does IFRS differ from current U.S. GAAP with respect to accounting for impairments?

> The Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,000,000. This cost included the following expenditures: The company estimated an eight-year useful life for the equipment. No residual value is antic

> Answer Q 12–26 but assume that the investment is classified as AFS.

> You have been hired as the new controller for the Ralston Company. Shortly after joining the company in 2024, you discover the following errors related to the 2022 and 2023 financial statements: a. Inventory at 12/31/2022 was understated by $6,000. b. In

> When market rates of interest rise after a fixed-rate security is purchased, the value of the now-below-market, fixed-interest payments declines, so the market value of the investment falls. How would that drop in fair value be reflected in the investmen

> The Cecil-Booker Vending Company changed its method of valuing inventory from the average cost method to the FIFO cost method at the beginning of 2024. At December 31, 2023, inventories were $120,000 (average cost basis) and were $124,000 a year earlier.

> Northwest Carburetor Company established a fund in 2021 to accumulate money for a new plant scheduled for construction in 2024. How should this special purpose fund be reported in Northwest’s balance sheet?

> Refer to the situation described in BE 11–2. Calculate depreciation expense for 2024 and 2025 using sum-of-theyears’- digits, assuming the equipment was purchased on (1) January 1, 2024, and (2) March 31, 2024.

> Comparative Statements of Retained Earnings for Renderer Corporation were reported as follows for the fiscal years ending December 31, 2022, 2023, and 2024. No preferred stock or potential common shares were outstanding during any of the periods shown.

> Superior Company owns 40% of the outstanding stock of Bernard Company. During 2024, Bernard paid a $100,000 cash dividend on its common shares. What effect did this dividend have on Superior’s 2024 financial statements?

> On December 31, 2023, Ainsworth, Inc., had 600 million shares of common stock outstanding. Twenty million shares of 8%, $100 par value cumulative, nonconvertible preferred stock were sold on January 2, 2024. On April 30, 2024, Ainsworth purchased 30 mill