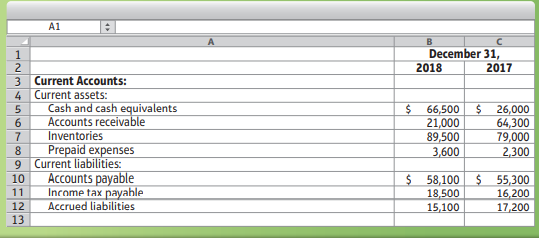

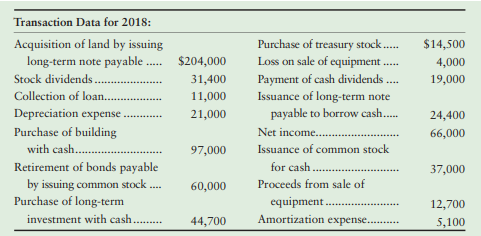

Question: Smither Software Corp. has assembled the following

Smither Software Corp. has assembled the following data for the years ending December 31,

2018 and 2017.

Requirement:

1. Prepare Smither’s statement of cash flows using the indirect method to report operating

activities. Include a schedule of noncash investing and financing activities

> Connors Company paid $700 cash to make a repair on equipment it sold under a one-year warranty in the prior year. The entry to record the payment will debit a. Accrued Warranty Payable and credit Cash. b. Operating Expense and credit Cash. c. Warranty Ex

> What was Lakeside’s gross profit for January? a. $7,500 b. $ – 0 – c. $1,900 d. $5,600

> Lakeside Software began January with $3,900 of merchandise inventory. During January, Lakeside made the following entries for its inventory transactions: How much was Lakeside’s inventory at the end of January? a. $4,300 b. $9,900 c. $

> Which of the following statements is false? a. A contingent liability should be disclosed in the notes to the financial statements if there is a reasonable possibility that a loss (or expense) will occur. b. All contingent liabilities should be reported

> Blue Jay, Inc., manufactures and sells computer monitors with a three-year warranty. Warranty costs are expected to average 7% of sales during the warranty period. The following table shows the sales and actual warranty payments during the first two year

> Lexter Corporation borrows cash by signing a $90,000, 8%, eight-month note on December 1 with its local bank. The total cash paid for interest (only) at the maturity of the note by Lexter will be a. $600. b. $3,600. c. $4,800. d. $7,200.

> Gravel Corporation borrowed $250,000 from a bank on January 1, 2019, by signing a 10%, six-month note. The journal entry made by Gravel on January 1, 2019, will debit a. Interest Expense for $25,000 and credit Interest Payable for $25,000. b. Cash for $2

> A company reports purchases of $388,000, a beginning accounts payable balance of $27,000, and an ending accounts payable balance of $48,000. All purchases were on account. The company’s accounts payable turnover would be closest to: a. 7.26 b. 8.33 c. 10

> Suppose a Target store in Chicago, Illinois, ended November 2018 with 500,000 units of merchandise that cost $8.00 each. Suppose the store then sold 110,000 units for $960,000 during December. Further, assume the store made two large purchases during Dec

> On November 1, 2018, Sigma Inc. invests in $1,000,000 of 5%, 10-year bonds issued by Microsoft Corporation, intending to hold the bonds until their maturity. The bonds pay interest each January 1 and July 1. What account related to the bonds will be on S

> Consolidation accounting a. eliminates all liabilities. b. reports the receivables and payables of the parent company only. c. combines the accounts of the parent company and its subsidiary companies. d. all of the above

> Jackson Bank lends Jabbour Clothing Company $125,000 on September 1. Jabbour signs a $125,000, 6%, six-month note. The journal entry made by Jabbour on December 31, its fiscal year-end, is a. debit Interest Payable and credit Interest Expense for $2,500.

> Reliable Networks owns the following long-term equity investments (it does not have significant influence over any of its investments) Reliable’s income statement for the year should report a. investments of $68,800. b. an unrealized

> Reliable Networks owns the following long-term equity investments (it does not have significant influence over any of its investments) Reliable’s balance sheet at year-end should report a. investments of $100,000. b. an unrealized loss

> Refer to the Continental data in E-Q-32. On December 31, Continental’s balance sheet should report a. dividend revenue of $37,000. b. investment in equity securities of $554,000. c. investment in equity securities of $550,000. d. an unrealized gain o

> Continental Bank, a nationwide banking company, owns many types of investments. Continental paid $550,000 for equity securities on December 5. Continental owns less than 10% of the stock of the companies in which it invests. Two weeks later, Continental

> The beginning balance sheet of Homesby Corporation included the following long-term asset: Homesby completed the following investment transactions during the year: At year-end, the fair values of Homesby’s investments were as follows:

> Oregon Exchange Company completed the following long-term investment transactions during 2018: At year-end, the fair value of the Columbus stock is $30,100. The fair value of the Nashua stock is $658,000. Requirements: 1. For which investment is fair

> During the fourth quarter of 2018, Rainbarrel, Inc. generated excess cash, which the company invested in equity securities as follows: Requirements: 1. Open T-accounts for Cash (including its beginning balance of $23,000), Investment in Equity Securitie

> Paulson’s specializes in sound equipment. Company records indicate the following data for a line of speakers: Requirements: 1. Determine the amounts that Paulson’s should report for cost of goods sold and ending inven

> Selected data from Switzer Furniture, Inc., follows. Industry averages have been gathered for several ratios. Requirements: 1. Perform a trend analysis on Switzer’s sales revenue, inventory, and receivables over the past three years, u

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to either Border Corporation stock or Celebration Company stock and have assembled the following data for the two companies. Selected income statement data

> Comparative financial statement data of Stow Optical Mart follow: Other information: 1. Market price of Stow Optical Mart common stock: $122.91 at December 31, 2018, and $165.75 at December 31, 2017 2. Common shares outstanding: 13,000 during 2018 and 8

> Financial statement data of Highland Engineering include the following items: Requirements: 1. Calculate Highland’s current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. 2. Calculate the three rati

> Top managers of Ryan Products, Inc., have asked you to compare the company’s profit performance and financial position with the average for the industry. The company’s accountant has given you the businessâ€

> Net sales, net income, and total assets for Suburban Shipping, Inc., for a five-year period follow: Requirements: 1. Calculate trend percentages for each item for 2015 through 2018. Use 2014 as the base year and round to the nearest percent. 2. Calcul

> Selected data from Tompkin Furniture, Inc., follows. Requirements: 1. Perform a trend analysis on Tompkin’s sales revenue, inventory, and receivables over the past three years, using 2015 as the base. Is the trend in each of these are

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to either Edge Corporation stock or GoBee Company stock and have assembled the following data for the two companies. Selected income statement data for the

> Comparative financial statement data of Hamden Optical Mart follow: Other information: 1. Market price of Hamden Optical Mart common stock: $48.15 at December 31, 2018, and $39.96 at December 31, 2017 2. Common shares outstanding: 17,000 during 2018 a

> Financial statement data of Greatland Engineering include the following items: Requirements: 1. Calculate Great land’s current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. 2. Calculate the three r

> Sherwood Company’s inventory records for the most recent year contain the following data Sherwood Company sold a total of 19,800 units during the year. Requirements: 1. Using the average-cost method, compute the cost of goods sold and

> Top managers of Caffrey Products, Inc., have asked you to compare the company’s profit performance and financial position with the average for the industry. The company’s accountant has given you the businessâ

> Net sales, net income, and total assets for Azul Shipping, Inc., for a five-year period follow: Requirements: 1. Calculate trend percentages for each item for 2015 through 2018. Use 2014 as the base year and round to the nearest percent. 2. Calculate t

> The comparative balance sheets of Mary McGuire Design Studio, Inc., at June 30, 2018, and 2017, and transaction data for fiscal 2018, are as follows: Transaction data for the year ended June 30, 2018, follows: a. Net income, $71,000 b. Depreciation expe

> To prepare the statement of cash flows, accountants for Dartmouth Electric Company have summarized 2018 activity in two accounts: Requirements: 1. Prepare the statement of cash flows of Dartmouth Electric for the year ended December 31, 2018, using the

> Ballinger Furniture Gallery, Inc., provided the following data from the company’s records for the year ended August 31, 2019: a. Credit sales, $574,400 b. Loan to another company, $13,000 c. Cash payments to purchase plant assets, $37,600 d. Cost of goo

> Use the Mercedes Supply Corp. data from P11-70B. Requirements: 1. Prepare the company’s 2018 statement of cash flows using the direct method. 2. How can the concepts used in this problem help you evaluate an investment? Data from p11-

> The 2018 and 2017 comparative balance sheets and 2018 income statement of Mercedes Supply Corp. follow: Mercedes Supply had no noncash investing and financing transactions during 2018. During the year, there were no sales of land or equipment, no payme

> The comparative balance sheets of Shaw Movie Theater Company at June 30, 2018 and 2017, reported the following: Shaw’s transactions during the year ended June 30, 2018, included the following: Requirements: 1. Prepare Shaw Movie Theat

> Fortune Software Corp. has assembled the following data for the years ending December 31, 2018 and 2017: Requirement: 1. Prepare Fortune’s statement of cash flows using the indirect method to report operating activities. Include a sch

> Use the Vintage Motors data from P11-66B. Requirements: 1. Prepare Vintage’s income statement for the year ended December 31, 2018. Use the singlestep format, with all revenues listed together and all expenses together. 2. Prepare Vintage’s balance shee

> Use the data for Spear Corporation in illustrate Spear’s income tax advantage from using LIFO over FIFO. Sales revenue is $10,080, operating expenses are $800, and the income tax rate is 25%. How much in taxes would Spear Corporation save by using the LI

> Vintage Motors, Inc., was formed on January 1, 2018. The following transactions occurred during 2018:On January 1, 2018, Vintage issued its common stock for $430,000. Early in January, Vintage made the following cash payments: a. $160,000 for equipment b

> The comparative balance sheets of American-Davis Design Studio, Inc., at June 30, 2018, and 2017, and transaction data for fiscal 2018, are as follows: Transaction data for the year ended June 30, 2018, follows: a. Net income, $60,500 b. Depreciation ex

> To prepare the statement of cash flows, accountants for Ronklin Electric Company have summarized 2018 activity in two accounts: Ronklin Electric’s 2018 income statement and balance sheet data follow: Requirements: 1. Prepare the state

> Rourke Furniture Gallery, Inc., provided the following data from the company’s records for the year ended March 31, 2019: a. Credit sales, $583,800 b. Loan to another company, $10,000 c. Cash payments to purchase plant assets, $89,300 d. Cost of goods so

> Use the Queen Supply Corp. data from P11-61A. Requirements: 1. Prepare the company’s 2018 statement of cash flows using the direct method. 2. How can the concepts used in this problem help you evaluate an investment? Data from p11-61A

> The 2018 and 2017 comparative balance sheets and 2018 income statement of Queen Supply Corp. follow: Queen Supply had no noncash investing and financing transactions during 2018. During the year, there were no sales of land or equipment, no payment of

> The comparative balance sheets of Bedford Movie Theater Company at November 30, 2018, and 2017, reported the following: Bedford’s transactions during the year ended November 30, 2018, included: Requirements: 1. Prepare Bedford Movie T

> Use the Coleman Motors data from P11-57A. Requirements: 1. Prepare Coleman’s income statement for the year ended December 31, 2018. Use the single-step format, with all revenues listed together and all expenses together. 2. Prepare Coleman’s balance she

> Coleman Motors, Inc., was formed on January 1, 2018. The following transactions occurred during 2018On January 1, 2018, Coleman issued its common stock for $350,000. Early in January, Coleman made the following cash payments: a. $140,000 for equipment b.

> Use the data for Spear Corporation in E6-30B to answer the following. Requirements 1. Compute cost of goods sold and ending inventory using each of the following methods: a. Specific identification, with seven $160 units and four $170 units still on hand

> Patterson Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2018: Requirements: Answer these questions about Patterson’s stockholders’ equity

> Medical Goods is embarking on a massive expansion. Assume the plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the company’s existing locations, offering more items of inventory and with more e

> The following accounts and related balances of Cardinal Designers, Inc., as of December 31, 2018, are arranged in no particular order: Requirements: 1. Prepare Cardinal’s classified balance sheet in the account format at December 31, 2

> Assume Dotty Cakes, Inc., completed the following transactions during 2018, the company’s 10th year of operations: Requirements: 1. Analyze each transaction in terms of its effect on the accounting equation of Dotty Cakes. 2. What impa

> Madrid Jewelry Company reported the following summarized balance sheet at December 31, 2018 During 2019, Madrid Jewelry completed these transactions that affected stockholders’ equity: Requirements: 1. Journalize Madrid Jewelryâ

> Superior Outdoor Furniture Company included the following stockholders’ equity on its year-end balance sheet at February 28, 2019: Requirements: 1. Identify the different issues of stock that Superior Outdoor Furniture Company has out

> Doorman Corp. has the following stockholders’ equity information: Doorman’s charter authorizes the company to issue 9,000 shares of 8% preferred stock with par value of $120 and 700,000 shares of no-par common stock. The company issued 1,800 shares of

> The partners who own Crew Kayaks Co. wished to avoid the unlimited personal liability of the partnership form of business, so they incorporated as Crew Kayaks, Inc. The charter from the state of Nevada authorizes the corporation to issue 125,000 shares o

> Ahuja Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2018: Requirements: Answer these questions about Ahuja’s stockholders’ equity transact

> Sullivan Medical Goods is embarking on a massive expansion. Assume plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the company’s existing locations, offering more items of inventory and with m

> On September 30, 2018, Rittex, Inc., purchased 5% bonds of McPhee Corporation at 97 as a long-term, held-to-maturity investment. The maturity value of the bonds will be $46,000 on September 30, 2023. The bonds pay interest on March 31 and September 30. R

> Haddock Corp. purchased fifteen $1,000 7% bonds of Galvan Corporation when the market rate of interest was 8%. Interest is paid semiannually, and the bonds will mature in nine years. Using the PV function in Excel®, compute the price Haddock paid (the pr

> The following accounts and related balances of Eagle Designers, Inc., as of December 31, 2018, are arranged in no particular order: Requirements: 1. Prepare Eagle’s classified balance sheet in the account format at December 31, 2018.

> Assume Dessert Corner, Inc., completed the following transactions during 2018, the company’s 10th year of operations: Requirements: 1. Analyze each transaction in terms of its effect on the accounting equation of Dessert Corner. 2. Wha

> Jubilee Jewelry Company reported the following summarized balance sheet at December 31, 2018: During 2019, Jubilee Jewelry completed these transactions that affected stockholders’ equity: Requirements: 1. Journalize Jubilee Jewelry&a

> Seasonal Outdoor Furniture Company included the following stockholders’ equity on its year-end balance sheet at March 31, 2019: Requirements: 1. Identify the different issues of stock that Seasonal Outdoor Furniture Company has outsta

> Lima Corp. has the following stockholders’ equity information: Lima’s charter authorizes the company to issue 4,000 shares of 11% preferred stock with par value of $200 and 700,000 shares of no-par common stock. The company issued 1,000 shares of the pre

> The partners who own Jefferson Rafts Co. wished to avoid the unlimited personal liability of the partnership form of business, so they incorporated as Jefferson Rafts, Inc. The charter from the state of Vermont authorizes the corporation to issue 200,000

> The accounting records of Brigham Foods, Inc., include the following items at December 31, 2018: Requirements: 1. Show how each relevant item would be reported on the Brigham Foods classified balance sheet. Include headings and totals for current liabi

> On December 31, 2018, Herndon Corporation issues 6%, 10-year convertible bonds payable with a face value of $1,000,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 7%. Herndon amortizes bond discounts using the

> The notes to the Thorson Ltd. financial statements reported the following data on December 31, Year 1 (end of the fiscal year): Thorson amortizes bond discounts using the effective-interest method and pays all interest amounts at December 31. Require

> 1. Journalize the following transactions of Laporte Communications, Inc.: 2. At December 31, 2018, after all year-end adjustments have been made, determine the carrying amount of Laporte’s bonds payable, net. 3. For the six months ende

> Conroy Financial paid $530,000 for a 20% investment in the common stock of Maverick, Inc. For the first year, Maverick reported net income of $270,000, and at year-end declared and paid cash dividends of $115,000. On the balance-sheet date, the fair valu

> On February 28, 2018, Dolphin Corp. issued 10%, 20-year bonds payable with a face value of $2,100,000. The bonds pay interest on February 28 and August 31. The company amortizes bond discount using the straight-line method. Requirements: 1. If the marke

> The board of directors of Canterbury Plus authorized the issue of $9,000,000 of 7%, 15-year bonds payable. The semiannual interest dates are May 31 and November 30. The bonds are issued on May 31, 2018, at par. Requirements: 1. Journalize the following

> Greco Lake Resort reported the following on its balance sheet at December 31, 2018: On July 1, 2019, the resort expanded operations and purchased additional equipment for cash at a cost of $109,000. The company depreciates buildings using the straight-

> Lancey Supply, Inc., opened an office in Ypsilanti, Michigan. Lancey incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: The company depreciates buildings over 50 years, land

> Parker Corporation reported the following related to property and equipment (all in millions): From the balance sheets Requirements: 1. Draw T-accounts for Property and Equipment and Accumulated Depreciation. Enter the information as presented and solve

> One Stop Shop Corporation operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending December 31, 2017: Requirements: 1. Compute the net profit margin ratio for O

> At the end of 2017, Stretch Energy had total assets of $17.3 billion and total liabilities of $9.7 billion. Included among the assets were property, plant, and equipment with a cost of $4.9 billion and accumulated depreciation of $2.7 billion. Stretch En

> Pacific Energy Company’s balance sheet includes the asset Iron Ore Rights. Pacific Energy paid $3.0 million cash for the right to work a mine that contained an estimated 240,000 tons of ore. The company paid $70,000 to remove unwanted buildings from t

> Savanaugh Stores, Inc., sells electronics and appliances. The excerpts that follow are adapted from Savanaugh’s financial statements for 2018 and 2017. Requirements: 1. How much was Savanaugh’s cost of plant assets at

> On January 3, 2018, Pawnee Company paid $230,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,000, sales tax of $6,000, and $28,000 for a special platform on which to place the computer. Pawnee’s mana

> Without making journal entries, record the transactions of E-E-27B directly in the McCloud T-account, Equity-method Investment. Assume that after all the noted transactions took place, McCloud sold its entire investment in Brown for cash of $1,400,000. H

> Blair, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Blair completed the following transactions: Requirement: 1. Record the transactions in B

> Forest Lake Resort reported the following on its balance sheet at December 31, 2018: On July 1, 2019, the resort expanded operations and purchased additional equipment for cash at a cost of $109,000. The company depreciates buildings using the straight

> Becker Supply, Inc., opened an office in White Bear Lake, Minnesota. Becker incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building The company depreciates buildings over 30 years,

> Walker Corporation reported the following related to property and equipment (all in millions) Requirements: 1. Draw T-accounts for Property and Equipment and Accumulated Depreciation. Enter the information as presented and solve for the unknown in each

> Bargain Basement Corporation operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending December 31, 2017: Requirements: 1. Compute the net profit margin ratio fo

> At the end of 2017, Solar Power had total assets of $17.8 billion and total liabilities of $9.1 billion. Included among the assets were property, plant, and equipment with a cost of $4.5 billion and accumulated depreciation of $3.4 billion. Solar Power c

> Atlantic Energy Company’s balance sheet includes the asset Iron Ore Rights. Atlantic Energy paid $2.9 million cash for the right to work a mine that contained an estimated 225,000 tons of ore. The company paid $68,000 to remove unwanted buildings from th

> Caribbean Sales, Inc., sells electronics and appliances. The excerpts that follow are adapted from Caribbean’s financial statements for 2018 and 2017 Requirements: 1. How much was Caribbean’s cost of plant assets at A

> On January 2, 2018, Jupiter Company paid $270,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,800, sales tax of $6,900, and $31,300 for a special platform on which to place the computer. Jupiter’s ma

> Mayfield, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Mayfield completed the following transaction. Requirement: 1. Record the transactions

> McCloud Corporation owns equity-method investments in several companies. McCloud paid $1,800,000 to acquire a 30% investment in Brown Software Company. Brown reported net income of $660,000 for the first year and declared and paid cash dividends of $460,

> The accounting records of Boston Home Store show these data (in millions): The shareholders are very happy with Boston’s steady increase in net income. However, auditors discovered that the ending inventory for 2016 was understated by

> Eddie’s Convenience Stores’ income statement for A1 the year ended December 31, 2017, and its balance sheet as of December 31, 2017, are as follows: The business is organized as a proprietorship, so it pays no corporat

> Ross Company, a camera store, lost some inventory in a fire on December 15. To file an insurance claim, the company must estimate its December 15 inventory using the gross profit method. For the past two years, Ross Company’s gross pr