Question: Snead Company uses the aging method to

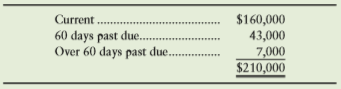

Snead Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. At December 31, 2016, the balance of accounts receivable is $210,000 and the allowance for uncollectible accounts has a credit balance of $3,000 (before adjustment). An analysis of accounts receivable produced the following age groups:

Based on past experience, Snead estimates that the percentage of accounts that will prove to be uncollectible within the three age groups is 4%, 10%, and 18%, respectively. Based on these facts, the adjusting entry for uncollectible accounts should be made in the amount of

a. $14,960.

b. $11,960.

c. $8,960.

d. $15,960.

Transcribed Image Text:

$160,000 43,000 7,000 $210,000 Current 60 days past due.. Over 60 days past due. ..... ....

> The starting point in accounting for all investments is a. market value on the balance-sheet date. b. cost minus dividends. c. equity value. d. cost.

> Dividends received on an equity-method investment a. increase dividend revenue. b. increase the investment account. c. decrease the investment account. d. increase owners’ equity.

> Assume that Clear Networks owns the following long-term available-for-sale investments: Suppose that, before year-end, Clear sells the Harper stock for $74 per share. Journalize the sale. Number Cost per Year-end Fair Dividend Company of Shares Sh

> Assume that Clear Networks owns the following long-term available-for-sale investments: Clear’s income statement for the year should report a. gain on sale of investment of $14,600. b. investments of $72,850. c. dividend revenue of

> Assume that Clear Networks owns the following long-term available-for-sale investments: Clear’s balance sheet at year-end should report a. investments of $58,250. b. dividend revenue of $2,365. c. investments of $72,850. d. unreal

> Data World, Inc., reported sales revenue of $480,000, net income of $36,000, and average total assets of $300,000. Data World’s return on assets is a. 7.5%. b. 1.6%. c. 62.5%. d. 12.0%.

> Harper, Inc., was reviewing its assets for impairment at the end of the current year. Information about one of its assets is as follows: Harper should report an impairment loss for the current year of a. $0. b. $230,000. c. $25,000. d. $255,000.

> Suppose AmerEx pays $72 million to buy Lone Star Overnight. The fair value of Lone Star’s assets is $86 million, and the fair value of its liabilities is $21 million. How much goodwill did AmerEx purchase in its acquisition of Lone Star Overnight? a. $7

> A company purchased mineral assets costing $889,000 with estimated residual value of $70,000 and holding approximately 260,000 tons of ore. During the first year, 53,000 tons are extracted and sold. What is the amount of depletion for the first year? a.

> Hamilton Company purchased a machine for $11,800 on January 1, 2016. The machine has been depreciated using the straight-line method over a four-year life with a $1,600 residual value. Hamilton sold the machine on January 1, 2018, for $8,000. What gain o

> Hamilton Company purchased a machine for $11,800 on January 1, 2016. The machine has been depreciated using the straight-line method over a four-year life with a $1,600 residual value. Hamilton sold the machine on January 1, 2018, for $8,000. What is str

> Which of the following costs are reported on a company’s income statement and balance sheet? Income statement……………………………Balance sheet a. Cost of goods sold………...Accumulated depreciation b. Accumulated deprecation…………………………….Land c. Goodwill………………………………….

> Acton, Inc., uses the double-declining-balance method for depreciation on its computers. Which item is not needed to compute depreciation for the first year? a. Estimated residual value b. Expected useful life in years c. Original cost d. All the items

> Kline Company failed to record depreciation of equipment. How does this omission affect Kline’s financial statements? a. Net income is understated and assets are overstated. b. Net income is overstated and assets are understated. c. Net income is unde

> Tulsa Corporation acquired a machine for $27,000 and has recorded depreciation for two years using the straight-line method over a five-year life and $9,000 residual value. At the start of the third year of use, Tulsa revised the estimated useful life t

> At the beginning of last year, Brentwood Corporation purchased a piece of heavy equipment for $88,000. The equipment has a life of five years or 100,000 hours. The estimated residual value is $8,000. Brentwood used the equipment for 19,000 hours last yea

> Which statement about depreciation is false? a. Depreciation is a process of allocating the cost of an asset to expense over its useful life. b. A major objective of depreciation accounting is to allocate the cost of using an asset against the revenues

> Suppose you buy land for $3,000,000 and spend $1,500,000 to develop the property. You then divide the land into lots as follows: How much did each Hilltop lot cost you? a. $60,000 b. $50,000 c. $575,000 d. $240,000 Category 15 Hilltop lots.... 1

> Which of the following items should be accounted for as a capital expenditure? a. Costs incurred to repair leaks in the building roof b. Maintenance fees paid with funds provided by the company’s capital c. Taxes paid in conjunction with the purchase

> A capital expenditure a. is expensed immediately. b. is a credit like capital (owners’ equity). c. adds to an asset. d. records additional capital.

> An error understated Grand Company’s December 31, 2016, ending inventory by $27,000. What effect will this error have on net income for 2017? a. Understate b. No effect c. Overstate

> An error understated Bowerston Corporation’s December 31, 2016, ending inventory by $54,000. What effect will this error have on total assets and net income for 2016? Assets…………………….Net income a. No effect…………………Overstate b. No effect…………………No effect c.

> Crystal Aquarium Supplies had the following beginning inventory, net purchases, net sales, and gross profit percentage for the first quarter of 2016: By the gross profit method, the ending inventory should b

> Trudell, Inc., reported the following data: Trudell’s gross profit percentage is a. 51.0. b. 48.0. c. 49.0. d. 55.7. Freight in . Purchases Beginning inventory . Purchase discounts . $ 26,000 207,000 52,000 4,300

> Sales are $500,000 and cost of goods sold is $320,000. Beginning and ending inventories are $28,000 and $38,000, respectively. How many times did the company turn its inventory over during this period? a. 9.7 times b. 6.4 times c. 15.2 times d. 5.5 t

> Two financial ratios that clearly distinguish a discount chain such as Walmart from a high-end retailer such as Gucci are the gross profit percentage and the rate of inventory turnover. Which set of relationships is most likely for Gucci? Gross profit perce

> Patterson Company ended the month of March with inventory of $20,000. Patterson expects to end April with inventory of $13,000 after selling goods with a cost of $93,000. How much inventory must Patterson purchase during April in order to accomplish thes

> The following data come from the inventory records of Dapper Company: Based on these facts, the gross profit for Dapper Company is a. $224,000. b. $193,000. c. $150,000. d. $203,000. Net sales revenue.. Beginning inventory Ending inventory.. Ne

> The sum of ending inventory and cost of goods sold is a. gross profit. b. cost of goods available (or cost of goods available for sale). c. net purchases. d. beginning inventory.

> The word market as used in “the lower of cost or market” generally means a. liquidation price. b. original cost. c. retail market price. d. current replacement cost.

> The income statement for Good Heart Foods shows gross profit of $149,000, operating expenses of $124,000, and cost of goods sold of $218,000. What is the amount of net sales revenue? a. $342,000 b. $491,000 c. $367,000 d. $273,000

> In a period of rising prices, a. cost of goods sold under LIFO will be less than under FIFO. b. LIFO inventory will be greater than FIFO inventory. c. gross profit under FIFO will be higher than under LIFO. d. net income under LIFO will be higher than

> If Leading Edge Frame Shop uses the LIFO method, cost of goods sold will be a. $27,450. b. $32,850. c. $32,700. d. $32,400. Units Unit Cost Total Cost $18.00 Jun 1 4 Beginning inventory Purchase 2,400 1,500 $43,200 27,450 $18.30 9. Sale (1,800)

> If Leading Edge Frame Shop uses the FIFO method, the cost of the ending inventory will be a. $32,400. b. $27,450. c. $32,700. d. $38,250.

> When does the cost of inventory become an expense? a. When inventory is delivered to a customer b. When inventory is purchased from the supplier c. When payment is made to the supplier d. When cash is collected from the customer

> What was Riverview’s gross profit for January? a. $ − 0 – b. $5,200 c. $7,300 d. $2,100

> Riverview Software began January with $3,700 of merchandise inventory. During January, Riverview made the following entries for its inventory transactions: How much was Riverview’s inventory at the end of January? a. $5,100 b. $ &aci

> A company sells on credit terms of 2/10, n/30 and has days’ sales in accounts receivable of 31 days. Its days’ sales outstanding is a. about right. b. too high. c. too low. d. not able to be evaluated from the data given.

> A company with net credit sales of $1,017,000, beginning net receivables of $90,000, and ending net receivables of $120,000 has days’ sales outstanding of a. 48 days. b. 44 days. c. 41 days. d. 38 days.

> Which of the following is included in the calculation of the quick (acid-test) ratio? a. Inventory and prepaid expenses b. Prepaid expenses and cash c. Inventory and short-term investments d. Cash and accounts receivable

> On August 1, 2016, Azore, Inc., sold equipment and accepted a six-month, 8%, $30,000 note receivable. Azore’s year-end is December 31. Write the journal entry on the maturity date (February 1, 2017).

> On August 1, 2016, Azore, Inc., sold equipment and accepted a six-month, 8%, $30,000 note receivable. Azore’s year-end is December 31. Which of the following accounts will Azore, Inc., credit in the journal entry at maturity on February 1, 2017, assumin

> On August 1, 2016, Azore, Inc., sold equipment and accepted a six-month, 8%, $30,000 note receivable. Azore’s year-end is December 31. How much interest does Azore, Inc., expect to collect on the maturity date (February 1, 2017)? a. $1,200 b. $2,400

> On August 1, 2016, Azore, Inc., sold equipment and accepted a six-month, 8%, $30,000 note receivable. Azore’s year-end is December 31. If Azore, Inc., fails to make an adjusting entry for the accrued interest on December 31, 2016, a. net income will be

> On August 1, 2016, Azore, Inc., sold equipment and accepted a six-month, 8%, $30,000 note receivable. Azore’s year-end is December 31. How much interest revenue should Azore accrue on December 31, 2016? a. $1,550 b. $2,400 c. $1,200 d. $1,000

> Refer to questions 5-42 and 5-43. The following year, Milo Company wrote off $2,000 of old receivables as uncollectible. What is the balance in the Allowance account now?

> Refer to Q5-42. The balance of Allowance for Doubtful Accounts, after adjustment, will be a. $1,000. b. $4,000. c. $3,000. d. $7,000.

> Milo Company uses the percent-of-sales method to estimate uncollectibles. Net credit sales for the current year amount to $100,000, and management estimates 4% will be uncollectible. Allowance for Doubtful Accounts prior to adjustment has a credit balanc

> Refer to Q5-40. The net receivables on the balance sheet as of December 31, 2016, are _______.

> Under the allowance method for uncollectible receivables, the entry to record uncollectible-account expense has what effect on the financial statements? a. Decreases net income and decreases assets b. Increases expenses and increases owners’ equity c.

> Refer to the USA National Bank data in Q5-37. At December 31, USA National Bank’s balance sheet should report a. investment in trading securities of $650,000. b. unrealized gain of $7,000. c. investment in trading securities of $657,000. d. dividend

> USA National Bank, the nationwide banking company, owns many types of investments. Assume that USA National Bank paid $650,000 for trading securities on December 5. Two weeks later, USA National Bank received a $40,000 cash dividend. At December 31, thes

> Jubilee’s Bakery is budgeting cash for 2017. The cash balance at December 31, 2016, was $6,000. Jubilee’s Bakery budgets 2017 cash receipts at $81,000. Estimated cash payments include $44,000 for inventory, $34,000 for operating expenses, and $15,000 to

> Before paying an invoice for goods received on account, the controller or treasurer should ensure that a. the company is paying for the goods it actually received. b. the company has not already paid this invoice. c. the company is paying for the good

> In a bank reconciliation, interest revenue earned on your bank balance is a. deducted from the book balance. b. added to the bank balance. c. added to the book balance. d. deducted from the bank balance.

> If a bank reconciliation included a deposit in transit of $790, the entry to record this reconciling item would include a. a credit to Prepaid insurance for $790. b. a debit to Cash for $790. c. a credit to Cash for $790. d. No entry is required.

> If a bookkeeper mistakenly recorded a $34 deposit as $43, the error would be shown on the bank reconciliation as a a. $9 addition to the book balance. b. $43 deduction from the book balance. c. $43 addition to the book balance. d. $9 deduction from t

> Salary Payable at the beginning of the month totals $28,000. During the month, salaries of $126,000 were accrued as expense. If ending Salary Payable is $12,000, what amount of cash did the company pay for salaries during the month? a. $166,000 b. $139

> Unadjusted net income equals $5,000. Calculate what net income will be after the following adjustments: 1. Salaries payable to employees, $700 2. Interest due on note payable at the bank, $130 3. Unearned revenue that has been earned, $750 4. Supplie

> Selected data for the Dublin Company follow: Based on these facts, what are Dublin’s current ratio and debt ratio? Current ratio………….Debt ratio a. 1.213&

> A major purpose of preparing closing entries is to a. zero out the liability accounts. b. adjust the asset accounts to their correct current balances. c. close out the Supplies account. d. update the Retained Earnings account.

> Which of the following accounts would not be included in the closing entries? a. Retained Earnings b. Depreciation Expense c. Service Revenue d. Accumulated Depreciation

> For 2016, Nestor Company had revenues in excess of expenses. Which statement describes Nestor’s closing entries at the end of 2016 (assume there is only one closing entry for both revenue and expenses)? a. Revenues will be debited, expenses will be cred

> What is the effect on the financial statements of recording depreciation on equipment? a. Net income is not affected, but assets and stockholders’ equity are decreased. b. Net income, assets, and stockholders’ equity are all decreased. c. Net income a

> The Unearned Revenue account of Berry Incorporated began 2016 with a normal balance of $3,000 and ended 2016 with a normal balance of $19,000. During 2016, the Unearned Revenue account was credited for $22,000 that Berry will earn later. Based on these f

> On April 1, 2016, Jiminee Insurance Company sold a one-year insurance policy covering the year ended March 31, 2017. Jiminee collected the full $1,800 on April 1, 2016. Jiminee made the following journal entry to record the receipt of cash in advance:

> An adjusting entry recorded June salary expense that will be paid in July. Which statement best describes the effect of this adjusting entry on the company’s accounting equation? a. Assets are not affected, liabilities are increased, and stockholders’ e

> What effect does the adjusting entry in question 3-47 have on Bamber’s net income for February? a. Decrease by $500 b. Increase by $500 c. Decrease by $250 d. Increase by $250

> Assume the same facts as in question 3-46. Bamber’s adjusting entry at the end of February should include a debit to Rent Expense in the amount of a. $0. b. $1,500. c. $500. d. $250. From 3-46: On January 1 of the current year, B

> On January 1 of the current year, Bamber Company paid $1,500 rent to cover six months (January–June). Bamber recorded this transaction as follows: Bamber adjusts the accounts at the end of each month. Based on these facts, the adjusti

> Using the accrual basis, in which month should revenue be recorded? a. In the month that goods are shipped to the customer b. In the month that the invoice is mailed to the customer c. In the month that goods are ordered by the customer d. In the mon

> Kelsey Allerton began a music business in July 2016. Allerton prepares monthly financial statements and uses the accrual basis of accounting. The following transactions are Allerton Company’s only activities during July t

> Kelsey Allerton began a music business in July 2016. Allerton prepares monthly financial statements and uses the accrual basis of accounting. The following transactions are Allerton Company’s only activities during July t

> Kelsey Allerton began a music business in July 2016. Allerton prepares monthly financial statements and uses the accrual basis of accounting. The following transactions are Allerton Company’s only activities during July t

> Which statement is false? a. A trial balance can verify the equality of debits and credits. b. A trial balance lists all the accounts with their current balances. c. A trial balance can be taken at any time. d. A trial balance is the same as a balanc

> If the credit to record the payment of an account payable is not posted, a. expenses will be understated. b. cash will be understated. c. liabilities will be understated. d. cash will be overstated.

> The journal entry to record a payment on account will a. debit Accounts Payable and credit Retained Earnings. b. debit Cash and credit Expenses. c. debit Expenses and credit Cash. d. debit Accounts Payable and credit Cash.

> If the credit to record the purchase of supplies on account is not posted, a. liabilities will be understated. b. assets will be understated. c. stockholders’ equity will be understated. d. expenses will be overstated.

> The journal entry to record the purchase of supplies on account a. debits Supplies Expense and credits Supplies. b. credits Supplies and debits Cash. c. credits Supplies and debits Accounts Payable. d. debits Supplies and credits Accounts Payable.

> The journal entry to record the receipt of land and a building and issuance of common stock a. debits Land and Building and credits Common Stock. b. debits Land, Building, and Common Stock. c. debits Common Stock and credits Land and Building. d. deb

> Which of the following is not an asset account? a. Salary Expense b. Common Stock c. Service Revenue d. None of the listed accounts is an asset.

> Where do we first record a transaction? a. Ledger b. Account c. Journal d. Trial balance

> Which of the following transactions will increase an asset and increase stockholders’ equity? a. Performing a service on account for a customer b. Borrowing money from a bank c. Collecting cash from a customer on an account receivable d. Purchasing s

> Which of the following transactions will increase an asset and increase a liability? a. Payment of an account payable b. Purchasing office equipment for cash c. Issuing stock d. Buying equipment on account

> What is the effect on total assets and stockholders’ equity of paying the telephone bill as soon as it is received each month? Total assets…………Stockholders’ equity a. Decrease………………………..Decrease b. No effect………………………..Decrease c. Decrease………………………..No ef

> Purchasing a building for $80,000 by paying cash of $25,000 and signing a note payable for $55,000 will a. decrease total assets and increase total liabilities by $25,000. b. increase both total assets and total liabilities by $55,000. c. increase bot

> Purchasing computer equipment for cash will a. decrease both total liabilities and stockholders’ equity. b. increase both total assets and total liabilities. c. have no effect on total assets, total liabilities, or stockholders’ equity. d. decrease b

> Receiving cash from a customer on account will a. decrease liabilities. b. have no effect on total assets. c. increase stockholders’ equity. d. increase total assets.

> NextTalk, a new company, completed these transactions. 1. Stockholders invested $51,000 cash and inventory with a fair value of $30,000. 2. Sales on account, $22,000. What will NextTalk’s total assets equal? a. $51,000 b. $103,000 c. $81,000 d. $73

> A business’s receipt of a $115,000 building, with a $75,000 mortgage payable, and issuance of $40,000 of common stock will a. increase assets by $40,000. b. increase stockholders’ equity by $115,000. c. increase stockholders’ equity by $40,000. d. de

> Smith Company had the following on the dates indicated: Smith had no stock transactions in 2016; thus, the change in stockholders’ equity for 2016 was due to net income and dividends. If dividends were $70,000, how much was Smith&acir

> The stockholders’ equity of Voronsky Company at the beginning and end of 2016 totaled $119,000 and $138,000, respectively. Assets at the beginning of 2016 were $144,000. If the liabilities of Voronsky Company increased by $74,000 in 2016, how much were t

> Cash paid to purchase a building appears on the statement of cash flows among the a. stockholders’ equity. b. operating activities. c. financing activities. d. investing activities.

> Net income appears on which financial statement(s)? a. Balance sheet b. Statement of retained earnings c. Income statement d. Both b and c

> Thompson Instruments had retained earnings of $340,000 at December 31, 2015. Net income for 2016 totaled $185,000, and dividends declared for 2016 were $85,000. How much retained earnings should Thompson report at December 31, 2016? a. $425,000 b. $340

> Dobson Corporation began the year with cash of $143,000 and land that cost $41,000. During the year, Dobson earned service revenue of $230,000 and had the following expenses: salaries, $185,000; rent, $83,000; and utilities, $26,000. At year-end, Dobson’

> Another name for the balance sheet is the a. statement of financial position. b. statement of earnings. c. statement of operations. d. statement of profit and loss.

> The financial statement that reports revenues and expenses is called the a. income statement. b. balance sheet. c. statement of retained earnings. d. statement of cash flows.

> Revenues are a. increases in paid-in capital resulting from the owners investing in the business. b. increases in retained earnings resulting from selling products or performing services. c. decreases in liabilities resulting from paying off loans. d

> All of the following are current assets except a. accounts payable. b. inventory. c. accounts receivable. d. prepaid expenses.