Question: Sorrell, CPA, is auditing the financial statements

Sorrell, CPA, is auditing the financial statements of Van Dyke as of December 31, 2017. Sorrell’s substantive procedures and other tests indicated that Van Dyke’s financial statements were prepared in accordance with generally accepted accounting principles and, accordingly, Sorrell expressed an unqualified opinion on those financial statements. Because Van Dyke’s securities are registered with the Securities and Exchange Commission, Van Dyke is subject to the reporting requirements of AS 2201. During its assessment of internal control over financial reporting, Van Dyke’s management identified material weaknesses related to (1) the method of accounting for sales commissions and (2) separation of duties related to purchase transactions. Sorrell was able to gather sufficient evidence and did not encounter limitations with respect to the evaluation of Van Dyke’s internal control over financial reporting. Sorrell prepared the following draft report on Van Dyke’s internal control over financial reporting:

Required:

Identify the deficiencies in the audit report drafted by Sorrell. Group the deficiencies by paragraph and in the order in which they appear. Do not rewrite the report. Cite the relevant sections from the professional standards.

Transcribed Image Text:

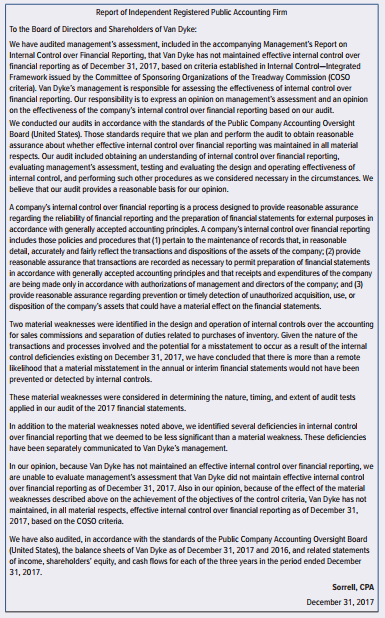

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Van Dyke: We have audited management's assessment, included in the accompanying Management's Report on Internal Control over Financial Reporting, that Van Dyke has not maintained effective internal control over financial reporting as of December 31, 2017, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COso criterial. Van Dyke's management is responsible for assessing the effectiveness of intermal control over financial reporting. Our responsibility is to express an opinion on management's assessment and an opinion on the effectiveness of the company's internal control over financial reporting based on our audit. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, evaluating management's assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounfing principles. A company's internal control over financial reporting indudes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company. (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company, and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. Two material weaknesses were identified in the design and operation of internal contros over the accounting for sales commissions and separation of duties related to purchases of inventory. Given the nature of the transactions and processes involved and the potential for a misstatement to occur as a result of the internal control deficiencies existing on December 31, 2017, we have concluded that there is more than a remote likelihood that a material misstatement in the annual or interim financial statements would not have been prevented or detected by internal controls. These material weaknesses were considered in determining the nature, timing, and extent of audit tests applied in our audit of the 2017 financial statements. In addition to the material weaknesses noted above, we identified several deficiencies in internal control over financial reporting that we deemed to be less significant than a material weakness. These deficiencies have been separately communicated to Van Dyke's management. In our opinion, because Van Dyke has not maintained an effective internal control over financial reporting, we are unable to evaluate management's assessment that Van Dyke did not maintain effective internal control over financial reporting as of December 31, 2017. Also in our opinion, because of the effect of the material weaknesses described above on the achievement of the objectives of the control criteria, Van Dyke has not maintained, in all material respects, effective internal control over financial reporting as of December 31, 2017, based on the Coso criteria. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the balance sheets of Van Dyke as of December 31, 2017 and 2016, and related statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2017. Sorrell, CPA December 31, 2017

> Confirmations of accounts receivable provide evidence primarily about which two assertions? a. Completeness and valuation. b. Valuation and rights and obligations. c. Existence and rights and obligations. d. Existence and completeness.

> Refer to the website of the Public Company Accounting Oversight Board (PCAOB) (www. pcaobus.org), review the information under “Inspections,” and select the most current inspection report for one of the Big Four firms (Deloitte, EY, KPMG, and PwC). Requ

> When auditing the existence assertion for an asset, auditors proceed from the a. Financial statement amounts back to the potentially unrecorded items. b. Potentially unrecorded items forward to the financial statement amounts. c. General ledger back to t

> An audit plan contains a. Specifications of audit standards relevant to the financial statements being audited. b. Specifications of procedures the auditors believe appropriate for the financial statements under audit. c. Documentation of the assertions

> Describe the major components of the auditors’ standard, unqualified report on internal control over financial reporting.

> What is the purpose of risk assessment for an entity?

> Prior to accepting a new audit engagement, a public accounting firm should a. Attempt to contact the predecessor auditors. b. Evaluate the integrity of management. c. Assess the firm’s resources to ensure that they are sufficient to permit the firm to ac

> Which of the following procedures would most likely be performed during planning? a. Surprise counting of the client’s petty cash fund. b. Reporting internal control deficiencies to the audit committee. c. Performing a search for unrecorded liabilities.

> Which of the following communications is most likely to be written before the balance-sheet date? a. A report to the audit committee on the results of testing of internal control over cash receipts. b. Confirmation letters to vendors confirming the amoun

> Which of the following engagement planning procedures would most likely assist the auditor in identifying related-party transactions before the balance-sheet date? a. Interviewing internal auditors about their reporting responsibilities. b. Reviewing acc

> When auditing Vandalay Jewelry, Costanza, CPA, was not familiar with the quality and cut of the company’s precious jewel inventory. To address this shortcoming, Costanza hired Benes, an expert in jewel valuation, to assist as an audit specialist for the

> An audit engagement letter should normally include which of the following matters of agreement between the auditor and the client? a. Schedules and analyses to be prepared by the client’s employees. b. Methods of statistical sampling the auditor will use

> A primary advantage of using CAATs in the audit of an advanced computerized system is that it enables the auditor to a. Substantiate the accuracy of data through self-checking digits and hash totals. b. Utilize the speed and accuracy of the computer. c.

> Firms auditing public entities are required to have periodic inspections conducted by the PCAOB. Required: a. What are the major characteristics of PCAOB inspections? b. What types of firms typically have PCAOB inspections? How frequently are these eval

> Which of the following is an advantage of computer-assisted audit techniques (CAATs)? a. All the CAATs programs are written in one computer language. b. The software can be used for audits of clients that use differing computer equipment and file formats

> Define professional skepticism and professional judgment. During what stages of the audit are auditors required to demonstrate these characteristics?

> Indicate whether each of the following audit procedures is a test of controls, a substantive test, or a dual-purpose test. Next, indicate the financial statement assertion most closely related to each audit procedure. Required: a. Vouch recorded sales

> Distinguish between independence in fact and independence in appearance. Can auditors be independent in fact yet not be perceived to be independent in appearance?

> What reports (other than auditors’ report) on internal control do audit teams give to an entity’s management, board of directors, or audit committee?

> Identify the three fundamental principles underlying GAAS.

> Identify the role of the following bodies in the auditing standards-setting process: (1) the AICPA; (2) the PCAOB; (3) the SEC.

> Define generally accepted auditing standards (GAAS). What is the purpose of GAAS?

> How frequently are firms required to have PCAOB inspections?

> Provide examples of procedures that firms have used to monitor their quality control policies and procedures.

> What factors should auditors consider in deciding whether to accept or continue the engagement with a particular client? What should firms do if they decide to withdraw from an engagement?

> Comment upon each of the following statements you heard in a conversation between two newly hired staff auditors. a. “Of course, I’m qualified to be assigned to this engagement. I have an accounting degree from a top university and was an honors graduate

> What is a system of quality control? Identify the six elements of a system of quality control.

> Your small business client, Phillip’s Computer Repair Shop, is experiencing financial difficulties and has to lay off one of its four employees in the accounting area. Phillip has asked you to determine what duties should be assigned to the three remaini

> What are the four types of audit opinions? What is the conclusion of each one?

> What is a financial reporting framework? How is it related to the auditors’ reporting responsibilities?

> How are the sufficiency and appropriateness of evidence related to detection risk?

> What options are available to the auditor for presenting reports on the entity’s financial statements and internal control over financial reporting?

> Distinguish between relevance and reliability as these concepts relate to audit evidence. How are relevance and reliability associated with the appropriateness of audit evidence?

> Define external, external-internal, and internal documentary evidence.

> What is the basic relationship between the effectiveness of the client’s internal control and the necessary effectiveness of substantive procedures?

> What is materiality? During what stages of the audit do auditors consider materiality?

> Define reasonable assurance. How does the audit team provide reasonable assurance in the engagement?

> Identify which of the major fundamental principles (responsibilities, performance, or reporting) is most closely related to each of the following: a. The need for auditors to consider their financial relationships with prospective clients. b. An auditor

> Auditors are required to obtain a sufficient understanding of each component of a client’s internal control. This understanding is used to assess control risk and plan the audit of the client’s financial statements. Required: a. For what purposes should

> The primary purpose for obtaining an understanding of the entity’s environment (including its internal control) in a financial statement audit is a. To determine the nature, timing, and extent of substantive procedures to be performed. b. To make consult

> Which of the following best demonstrates the concept of professional skepticism? a. Relying more extensively on external evidence rather than internal evidence. b. Focusing on items that have a more significant quantitative effect on the entity’s financi

> One of an accounting firm’s basic objectives is to provide professional services that conform to professional standards. Reasonable assurance of achieving this objective can be obtained by following a. Generally accepted auditing standards. b. Standards

> Which of the following categories of principles is most closely related to gathering audit evidence? a. Performance. b. Reasonable assurance. c. Reporting. d. Responsibilities.

> Which of the following principles is most closely associated with the auditors’ conclusion as to the fair presentation of the entity’s financial statements? a. Communication principle. b. Performance principle. c. Reporting principle. d. Responsibilities

> What are (a) an internal control deficiency, (b) a significant deficiency, and (c) a material weakness?

> Which of the following opinions would be issued if auditors believed that the entity’s financial statements were not presented in conformity with GAAP? a. Adverse opinion. b. Disclaimer of opinion. c. Qualified opinion. d. Unmodified opinion.

> Which of the following best describes the general contents of the introductory paragraph of the auditors’ report? a. A description of an audit examination, including the fact that the audit was conducted under standards established by the PCAOB. b. The a

> Which of the following combinations of standards and types of audits are most closely related to the activities of the Public Company Accounting Oversight Board? a. Develop Auditing Standards for the audits of nonpublic entities. b. Develop Auditing Stan

> The particular and specialized actions that auditors take to obtain evidence during a specific engagement are known as a. Audit procedures. b. Audit standards. c. Interpretive publications. d. Statements on Auditing Standards.

> In each of the following, identify which of the elements of the fundamental principles is most applicable. In addition, discuss what action(s) (if any) you believe auditors should take with respect to these issues. a. An entity has contacted you about pe

> Which of the following is true with respect to PCAOB inspections of accounting firms? a. All firms performing audits of public companies are required to have annual inspections conducted by the PCAOB. b. PCAOB inspections review a sample of audits conduc

> The reporting principle requires auditors to express their opinion through the issuance of a written report. Required: a. What is the purpose of the auditors’ opinion and report? b. What are the major paragraph(s) in the auditors’ report on the examinat

> Respond to each of the following comments that you heard related to the audit of Swan Company, a public entity. a. “We don’t need to consider the risk of material misstatement in our work because we really can’t do anything to reduce that risk.” b. “Beca

> Identify how each of the following statements relates to the performance principle by considering which element(s) of the principle are related to that statement. (A statement may be related to more than one element.) Use the following elements in provid

> You have accepted the engagement of auditing the financial statements of the C. Reis Company, a small manufacturing firm that has been your client for several years. Because you were busy writing the report for another engagement, you sent a staff accoun

> Generally accepted auditing standards (the performance principle) require auditors to gather sufficient appropriate evidence on which to base an opinion. Required: a. Briefly define the characteristics “sufficient” and “appropriate” as they relate to au

> Your public accounting practice is located in a city of 15,000 people. The majority of your work, conducted by you and two assistants, consists of compiling clients’ monthly statements and preparing income tax returns for individuals from cash data and p

> Which of the following is not related to ethical requirements of auditors? a. Due care. b. Independence in appearance. c. Independence in fact. d. Professional judgment.

> Which of the following statements is not true with respect to the performance principle? a. Auditors are required to prepare a written audit plan during the planning stages of initial audits but are not required to do so in continuing audits. b. Audit te

> Assume that the local newspaper just ran the following headline and article: "Audit Results: Airport executives from Kentucky racked up $500K in lavish expenses, concert tickets, and even gentlemen’s club tabs" LEXINGTON, Ky. (AP)—A small commercial airp

> Which of the following concepts is least related to the standard of due care? a. Independence in fact. b. Professional skepticism. c. Prudent auditor. d. Reasonable assurance.

> Which of the following is most closely related to the relevance of audit evidence? a. Auditors decide to physically inspect investment securities held by a custodian instead of obtaining confirmations from the custodian. b. In addition to confirmations o

> AMI International is a large office products company. Headquarters management imposed pressure on operating division managers to meet profit forecasts. The division managers met these profit goals using several accounting manipulations involving the reco

> What is the difference between document examination and reperformance when conducting tests of controls?

> North, CPA, is planning an independent audit of the financial statements of General Company. In determining the nature, timing, and extent of the audit procedures, North is considering General’s internal audit function, which is staffed by Tyler. Requir

> You are a CPA in a regional public accounting firm that has 10 offices in three states. Mr. Shine has approached you with a request for an audit. He is president of Hitech Software and Games Inc., a five-year-old company that has recently grown to $500 m

> The president of Allpurpose Loan Company had a genuine dislike for external auditors. Almost any conflict generated a towering rage. Consequently, the company changed auditors often. The firm of Wells & Ratley (W&R), CPAs, was recently hired to audit the

> Assume that Smith & Smith, CPAs, audited Apollo Shoes Inc., last year. Now CEO Larry Lancaster wishes to engage Anderson, Olds, and Watershed, CPAs (AOW) to audit its annual financial statements. Lancaster is generally pleased with the services provided

> The preparation of audit documentation is an integral part of an auditor’s examination of financial statements. On a recurring engagement, auditors review the audit plans and audit documentation from the prior audit while planning the current audit to de

> What are some of the limitations to practicing public accounting across state and national boundaries?

> For each of the following situations, describe how the auditors’ report on internal control over financial reporting would be modified from the standard, unqualified report. Do not write the actual reports. a. The auditors have identified a material weak

> A CPA accumulates various types of evidence on which to base the opinion on financial statements. Among this evidence are confirmations from third parties. Required: a. What is an audit confirmation? b. What characteristics of the confirmation process a

> Auditors use different types of audit procedures to gather the evidence necessary to conclude that the risk of material misstatement for each relevant assertion has been reduced to an acceptably low level. List eight different types of procedures auditor

> Which of the following combinations would provide the auditor the most reliable evidence? Source of Evidence Effectiveness of Internal Control a. Internal More effective b. Internal Less effective c. External More effective d. External Less effectiv

> The eight general audit procedures produce evidence about the principal management assertions in financial statements. However, some procedures are useful for producing evidence about certain assertions, and other procedures are useful for producing evid

> Name some other types of auditors in addition to external, internal, and governmental auditors.

> What are the advantages and disadvantages of documenting internal control by using (1) an internal control questionnaire, (2) a narrative memorandum, and (3) a flowchart?

> Define what is meant by compliance auditing.

> What is operational auditing? How does the AICPA view operational auditing?

> What are some examples of assurance services performed on nonfinancial information?

> Why should auditors act as though there is always a potential conflict of interest between the auditor and the management of the enterprise under audit?

> Refer to the internal control questionnaire on a payroll system (Exhibit 5.15). a. Assume that the answer to each question is no. Prepare a table matching the questions to errors or frauds that could occur because of the absence of the control. Your colu

> What are the defining characteristics of (a) white-collar crime, (b) employee fraud, (c) embezzlement, (d) larceny, (e) defalcation, (f) management fraud, and (g) errors?

> What is the auditor’s responsibility regarding fraud risk?

> What is the primary difference between a material misstatement due to fraud or error?

> What is meant by the terms nature, timing, and extent of further audit procedures?

> How is the audit risk model used to plan the audit?

> Which of the following procedures would provide the most reliable audit evidence? a. Inquiries of the client’s internal audit staff. b. Inspection of prenumbered client purchase orders filed in the vouchers payable department. c. Inspection of vendor sal

> What are the components of the risk of material misstatement (RMM)? What are the components of the audit risk model?

> Define audit risk.

> What is the control environment?

> What is the purpose of an audit strategy memorandum? What information should it contain?

> How do the professional audit standards differ for (a) errors, (b) frauds, (c) direct-effect noncompliance, and (d) indirect-effect noncompliance?

> When are analytical procedures required, and when are they optional?

> What are some of the ratios that can be used in preliminary analytical procedures?

> What are the five steps involved with the use of preliminary analytical procedures?

> What is the purpose of performing preliminary analytical procedures in audit planning?

> What are some types of knowledge and understanding about a client’s business and industry that an auditor is expected to obtain? What are some of the methods and sources of information for understanding a client’s business and industry?

> The most reliable evidence regarding the existence of newly acquired computer equipment is a. Inquiry of management. b. Documentation prepared externally. c. Evaluation of the client’s procedures. d. Physical observation.

> What is the major concern for auditors related to evidence obtained from related parties?