Question: Sous‐Chef Inc. is an employment agency

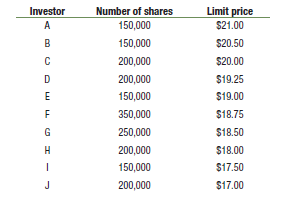

Sousâ€Chef Inc. is an employment agency that specializes in the restaurant industry. The company intends to sell 800,000 shares in its IPO and the investment dealers working on the issue have been seeking expressions of interest in the shares from various investors (pension plans, mutual funds, and so on). As the dealers sit down with the company’s management to price the issue, the “book†looks like this:

a. What is the highest issue price that the shares can command if all the investors live up to their intentions as shown in the table?

b. Suppose the investment dealers want to set the price so that the issue is twoâ€times oversubscribed. That is, all the shares will sell even if the investors only purchase half the number of shares indicated in the table. At what price should the shares be issued?

c. Assume the IPO was priced at $18.00 and will trade on the Toronto Stock Exchange. If the amount of underpricing is the same as the historical average for Canadian shares, what do you expect the price of the share to be at the end of its first day of trading? What would its price be if the firstâ€day return is the same as what is typically seen in the United States?

Transcribed Image Text:

Limit price $21.00 Investor Number of shares A 150,000 B 150,000 $20.50 200,000 $20.00 200,000 $19.25 150,000 $19.00 350,000 $18.75 G 250,000 $18.50 H 200,000 $18.00 150,000 $17.50 J 200,000 $17.00

> GiS Inc. has the following four projects on hand: Note the cash flow in the table is accumulative. Assume that R F = 5%, ER M = 12%, firm‐beta = 1.2, after‐tax cost of debt = 6.5%. The firm is financed by 40â

> A project has an NPV of $55,000. Calculate the cost of capital of this project if it generates the following cash flows for six years after an initial investment of $200,000: Year 1: $40,000 Year 2: $60,000 Year 3: $80,000 Year 4: $70,000 Year 5: $60,000

> Westlake Corp. has a capital structure that has 60‐ percent debt at a cost of 10 percent and 40‐percent equity. Westlake’s stock has a beta of 1.6, market risk premium of 7 percent, and risk‐free rate of 3 percent. The firm has a potential project on han

> Longlife Company is considering an investment in Ponce Leon Mineral Baths. The investment has the same risk characteristics as the firm. It is assumed that all cash flows are perpetuities and that there are no taxes. Currently the firm has cash flows of

> Malcolm, a very junior reporter, has asked for your help with his first article for a major national newspaper. He has provided you with the following excerpt from his article and would like your comments: The BathGate Group, one of the few all‐equity fi

> Project X has a cost of capital of 10 percent and the following cash flows: investment of $20,000 in year 0, cash inflows of $8,500, $6,400, and $11,200 in years 1, 2, and 3. a. What is the IRR? What is the assumption of IRR on reinvesting cash? b. Suppo

> Estimate the change in NI, CFO, and CFF if the economic life of the lease described in Practice Problem 16 is seven years instead of six years.

> Assume that SK Inc. has a capital budget of $250,000. In addition, it has the following projects for evaluation. Determine which project(s) should be chosen, assuming k is 15 percent. Project Initial CF CF, CF, CF, A -120,000 90,000 90,000 B -100,000

> Redo Practice Problem 61 using the EANPV approach.

> Refer to the information for BigCo Manufacturing Company in Table 1. BigCo is debating whether to invest in Project H (a three‐year project) or Project D. Project H has cash flow of −$3,500, $1,800, $1,400, and $1,000 (all $million) in years 0, 1, 2, and

> Solve Practice Problem 59 using EANPV.

> BathGate Group has just completed its analysis of a project. The CFO has presented the following information to the board of directors: The initial cost of the project is $15,000. Sales are expected to be 10,000 units in year 1 and are expected to grow b

> MedCo, a large manufacturing company, currently uses a large printing press in its operations and is considering two replacements: the PDX341 and PDW581. The PDX costs $400,000 and has annual maintenance costs of $10,000 for the first 5 years and $15,000

> Consider the following scenario and calculate the beginning UCC, CCA, ending UCC, CCA tax shield, and after-tax incremental cash flow for each and every year of the project.. Assume the asset class is closed on termination of the project. Decide whether

> A consultant has presented the following statement to the board of directors of BigCo: When comparing two mutually exclusive projects, we only need to consider the NPV. When the two projects have different lives, we recommend comparing the NPV/life (i.e.

> The CFO of CanGold Company is considering investing in a gold mine in Mongolia. The mine will cost $200 million to get into production and will last for one year. At the end of one year, it is expected to produce 1 million ounces of gold. The price of go

> AK Radio has hired a consultant to help in the assessment of a project to launch a satellite to deliver a 24/7 infomercial radio station to the world. The satellite costs $400 million and has a CCA rate of 30 percent. The satellite is expected to last 10

> A firm decides to enter into a lease agreement. The lease term is five years, while the economic life of the asset is six years. The annual lease payment is $12,000 at the beginning of each year, and the appropriate discount rate is 7 percent. There is n

> You are evaluating a project for a small manufacturing firm. The firm has provided the following data: the initial cost of the project is $2,500; the CCA rate is 10 percent; the tax rate is 25 percent; and the cash flow in the first year is $700. Cash fl

> The analysis of a two‐division company (DV2) has indicated that the beta of the entire company is 1.35. The company is 100‐percent equity funded. The company has two divisions: Major League TV (MLTV) and Minor League Shipping (MLS), which have very diffe

> Calculate the NPV of the project described in Practice Problem 49, but assume that the discount rate has changed based on the following information: RF = 3.4%; project beta = 1.2; the market risk premium = 5.5%; and the firm is financed entirely by equit

> Repeat Practice Problem 48 assuming that the project would generate annual revenue of $70,000 and annual costs of $40,000 for six years. Also, the asset class will be closed at the end of six years.

> Repeat Practice Problem 48 assuming that the project would generate annual revenue of $70,000 and annual costs of $40,000 for six years. Also, assume the asset class will remain open.

> GG Inc. has a project that requires purchases of capital assets costing $60,000 and additional raw material inventory of $3,000. Shipping and installation costs are $1,800. GG Inc. estimated that the project would generate an annual operating after-tax c

> You have been hired as consultants to XrayGlasses Corporation (XGC). XGC is in the process of deciding whether to invest in a new production facility. The new facility will enable it to produce and sell X-ray machines to airports. The manufacturing and m

> Calculate the NPV in Practice Problem 45 assuming a best case of the following: project life = 10 years; project beta = 0.8; SVn = $100,000; Rev1 = $500,000.

> Brigid Co. has the following potential project: Machine price = $1,800,000; additional inventory requirement = $150,000. Cash flows will be generated at year end. Rev1 = $400,000 and grows at 5 percent each year for five years, while Cost1 = $125,000 and

> You are trying to decide whether to continue renting an apartment or to buy a house. In 20 years, you plan on leaving Canada and moving to a warm tropical island and would like to have as much money as possible. You have just won $25,000 in the lottery a

> Briefly discuss the possible motivation for firms to enter into IPOs, and relate these motivations to the five stages of firm development discussed by Myers (1999).

> You are trying to decide whether or not to go to graduate school. If you get a job right after you get your bachelor’s degree, you expect to earn $40,000 a year, and you expect your salary to increase by 5 percent a year for the next 40 years. If you go

> KRZ Company has hired you to help evaluate several projects. The firm’s tax rate is 40 percent and the appropriate discount rate is 15 percent. Each asset class is small and will be terminated at the end of each project. KRZ is not capital constrained. T

> KRZ Company has hired you to help evaluate several projects. The firm ’ s tax rate is 40 percent and the appropriate discount rate is 10 percent. Each asset class is small and will be terminated at the end of each project. KRZ is not capital constrained.

> Java Cafe’s tax rate is 40 percent and the appropriate discount rate is 12 percent. It is considering another project. Each asset class consists only of the project asset and will be terminated at the end of the project. Java Café is not capital constrai

> Java Cafe’s tax rate is 45 percent and the appropriate discount rate is 8 percent. It is considering another project. Each asset class consists only of the project asset and will be terminated at the end of the project. Java Café is not capital constrain

> Complete the following balance sheet for the post‐merger firm B‐T. The bidder acquired the target for $8,000 in cash. Target (Fair В-T Target (book Market value) (post- merger) Bidder Value) Current 25,000 4,500 4,

> Why do banks typically impose debt covenants on their borrowing customers?

> GG Inc. is now considering replacing some old equipment. The market price of the old equipment is $50,000 and the salvage value at the end of five years is $15,000. The new equipment will cost $100,000 and could be sold at the end of five years for $35,0

> Based on the cash flows given below, calculate the PI of a project that has a required rate of return of 15 percent. Also, indicate whether the project should be accepted. Year 0: −$90,000 Year 1: $20,000 Year 2: $40,000 Year 3: −$15,000 Year 4: $100,000

> The balance sheets of a bidder and target companies are as follows: The tax rate for both companies is 25 percent. The acquisition will be accounted for using the purchase method. Prior to the acquisition, the bidding firm had 10,000 shares outstanding,

> Why are prospectuses so important for public market issues?

> Which type of lease, operating or financial, gives a higher asset turnover ratio?

> Calculate the after-tax operating cash flow NPV break-even point for the project described in Practice Problem 48 by using a 12-percent discount rate. Also, the asset class will be closed at the end of six years.

> Calculate the market price of the firm’ s common shares using a relative valuation approach. (Round your answer to one decimal.)

> Why don’t the probabilities of going up and down affect the options value?

> What is a hedge ratio?

> Sometimes, bonds are completely worthless when a company defaults on payments. However, in practice, bonds typically have some market value (recovery rate) even after a default. Collingwood’s bonds are unsecured, but are senior to any other debt. Use the

> Rather than take a term loan from the bank, Collingwood Corp. has decided to issue $25 million of 10‐year bonds. DBRS has assigned a rating of “BB” to this bond issue. a. Determine the probability that no default occurs during the life of these bonds, ba

> In Practice Problem 29, if the time value is $5, calculate the intrinsic value.

> Winnipeg Water & Gas Co. recently issued a series of bonds; the gross proceeds were $25 million. The underwriting fees were 2.8 percent, and additional issuance costs were $150,000. How much did the company actually receive from the sale? As a percentage

> What is the waiting period?

> Calculate the initial cash flows (CF0) for the following projects. Which project has a larger CF0? a. Project A: equipment purchase price = $195,000; installation cost = $4,500; extra working capital requirement = $30,500; opportunity cost = $18,000 b. P

> What is the lock‐up period?

> FinCorp Inc. has both a call option and a put option with exercise prices of $50. Both expire in one year. The call is currently selling for $10 per share, while the put is currently selling for $2 per share. If the risk‐free rate is 5 percent per year,

> Briefly explain the pure play method for estimating beta.

> An investment has the following cash inflows: $2,500 at the end of the first year, $2,000 at the end of the second year, and $1,500 at the end of the third year. What is the discounted payback period if the discount rate is 0 percent and the initial cash

> Collingwood Corp. has a revolving line of credit on which it owes $25 million. One of the restrictions imposed with this financing arrangement is that the company must maintain a minimum interest coverage ratio of 2. If this is the only borrowing, and th

> As the newly appointed treasurer for Collingwood Corp., you have to decide how to raise $25 million in short‐term financing. You believe you could issue commercial paper with a promised yield of 10 percent. However, your bank will charge a commitment fee

> Collingwood Corp’s 60‐day commercial paper has a promised yield of 10 percent per year, but the expected yield is just 1.5 percent due to the risk of default. If the current 60‐day T‐bill yield is 1 percent, what is the yield spread on this commercial pa

> Determine the selling price of a Government of Canada treasury bill that has a quoted annual interest rate of 1.2 percent and will mature in 90 days. Assume a par value of $1,000.

> Pills4u.com and Drugs‐R‐Us Co. both sell prescription medications over the Internet. Each company has recently announced an IPO at $20 per share. At this price, one of the companies is undervalued by $3, while the other is overvalued by $2. Unfortunately

> State the three basic tests the CRA uses to ensure interest payments are tax deductible.

> Briefly describe three motivations for leasing.

> Contrast top down and bottom up analysis.

> What are irrevocable investment decisions? Why are they important for capital budgeting?

> Explain how to estimate the intrinsic value and time value for a call option.

> Explain why the payoff from a call option is non-linear.

> Briefly summarize the evidence regarding how well debt ratings work.

> Briefly describe the main factors DBRS considers in determining its debt ratings.

> Explain how firms should decide which projects to accept and which to reject when capital rationing exists.

> What complications arise when firms are rationed in terms of their available capital budget?

> The little company you and your friend started in your parents ’ garage has grown so much that you are now ready to take the firm public. In your discussions with one of the top investment dealers, you have been given a choice between two alternatives: P

> List and briefly describe some possible reasons for the existence of IPO underpricing.

> Differentiate investment-grade debt from junk debt.

> A firm is considering two mutually exclusive projects, as follows. Determine which project should be accepted if the discount rate is 15 percent. Use the chain replication approach. Assume both projects can be replicated. After-Tax After-Tax After-Ta

> Why are securities legislation and corporate laws essential for markets to perform properly?

> Why can increases in interest rates not be used to solve the “lemons problem” in markets?

> GiS Inc. now has the following two projects available: Assume that R F 4%, r isk premium 8%, and b eta 1.25. Use the chain replication approach to determine which project GiS Inc. should choose if they are mutually exclusive. After-Tax After-Tax Afte

> Why is it reasonable to assume that most firms will have a banking relationship?

> What is a creeping takeover?

> What is a takeover circular?

> What is a tender?

> What financial synergies are possible in an M&A transaction?

> Lansdowne Ltd. needs to raise $20 million and intends to sell additional shares. The company ’ s existing shares are trading on the Toronto Stock Exchange for $54. However, the investment dealer hired by Lansdowne has cited investors’ concerns about info

> What is an extension M&A, an overcapacity M&A, and a geographic roll-up M&A?

> What is the difference between vertical and horizontal mergers?

> 1. Which of the following statements about due diligence is false? a. It is designed to ensure the legitimacy of securities offered to the public. b. It is designed to ensure that there is no misleading information when companies issue shares. c. It is e

> 1. Which of the following statements about an operating lease is false ? a. The lessor is responsible for maintaining the asset. b. The lessee is responsible for maintaining the asset. c. An operating lease is usually a full‐service lease. d. Payments of

> 1. Which of the following statements about takeovers is false? a. Mergers create a new firm, while acquisitions do not. b. Both mergers and acquisitions require two‐thirds votes from both firms. c. In the tender offer, the acquiring firm makes a public o

> 1. Which of the following statements is false? a. CCA recapture occurs when the salvage value is greater than the ending UCC for the asset or asset class. b. Capital gains occur when the salvage value is greater than the original cost of the asset. c. CC

> 1. When making capital expenditure decisions, firms should not consider which of the following? a. After-tax incremental cash flows b. Additional working capital requirements c. Sunk costs d. Salvage value 2. Which of the following will yield the same c

> 1. Which of the following statements about IRR and NPV is incorrect? a. NPV and IRR yield the same ranking when evaluating projects. b. NPV assumes that cash flows are reinvested at the cost of capital of the firm. c. A project may have multiple IRRs whe

> 1. What will probably happen if a firm does not invest effectively? a. The firm could still maintain its competitive advantage. b. The cost of capital of the firm will be unchanged. d. The short‐term performance will be unaffected. 2. Which of the follo

> 1. Which of the following statements about a call option is false? a. A call option is the right, not the obligation, to buy the underlying asset. b. A call option is in the money if the asset price is less than the strike price. c. A call option is at t

> Assume two bonds in the market—bond A and bond B—have the same rating and the same YTM. Discuss three reasons that might make one bond preferable to the other.

> 1. Which of the following is not one of the three types of merger? a. Vertical M&A b. Horizontal M&A c. Proxy contest d. Conglomerate 2. Which of the following M&As is valid? a. VA T $400,000; VA $200,000; VT $205,000 b. VA T $390,000; VA $200,000; VT $

> 1. Which of the following statements about debt is incorrect? a. Interest payments and principal payments are fixed commitments. b. Interest payments are not tax deductible. c. Bond holders are paid a series of fixed periodic amounts before the maturity

> If you were opening a copy centre, do you think you would lease or borrow to buy the equipment and why?

> Why do you think that the major market for leasing is often SMEs, rather than large corporations?

> Why are leases often more flexible than a borrow-purchase option?

> What is a sale and leaseback agreement (SLB)?