Question: Spamela Hamderson Inc. reports the following pretax

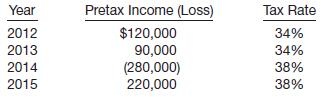

Spamela Hamderson Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. (Assume the carryback provision is used for a net operating loss.)

The tax rates listed were all enacted by the beginning of 2012.

Instructions

(a) Prepare the journal entries for the years 2012–2015 to record income tax expense (benefit) and income taxes payable (refundable) and the tax effects of the loss carryback and carryforward, assuming that at the end of 2014 the benefits of the loss carryforward are judged more likely than not to be realized in the future.

(b) Using the assumption in (a), prepare the income tax section of the 2014 income statement beginning with the line “Operating loss before income taxes.â€

(c) Prepare the journal entries for 2014 and 2015, assuming that based on the weight of available evidence, it is more likely than not that one-fourth of the benefits of the loss carryforward will not be realized.

(d) Using the assumption in (c), prepare the income tax section of the 2014 income statement beginning with the line “Operating loss before income taxes.â€

Transcribed Image Text:

Year Pretax Income (Loss) Tax Rate $120,000 90,000 (280,000) 220,000 2012 34% 2013 34% 2014 38% 2015 38%

> On January 1, 2013, Nichols Corporation granted 10,000 options to key executives. Each option allows the executive to purchase one share of Nichols’ $5 par value common stock at a price of $20 per share. The options were exercisable within a 2-year perio

> How might differences in presentation of comparative data under GAAP and IFRS affect adoption of IFRS by U.S. companies?

> The accounting staff of Usher Inc. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks r

> Meyer reported the following pretax financial income (loss) for the years 2012–2016. Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 34% for 2012 and 2013, and 40%

> Gottschalk Company sponsors a defined benefit plan for its 100 employees. On January 1, 2014, the company’s actuary provided the following information. The average remaining service period for the participating employees is 10 years. Al

> Briefly describe some of the similarities and differences between GAAP and IFRS with respect to the accounting for dilutive securities, stock-based compensation, and earnings per share.

> Taylor Marina has 300 available slips that rent for $800 per season. Payments must be made in full at the start of the boating season, April 1, 2015. Slips for the next season may be reserved if paid for by December 31, 2014. Under a new policy, if payme

> The following are two independent situations. Situation 1: Conchita Cosmetics acquired 10% of the 200,000 shares of common stock of Martinez Fashion at a total cost of $13 per share on March 18, 2014. On June 30, Martinez declared and paid a $75,000 cash

> On January 1, 2015, Wilke Corp. had 480,000 shares of common stock outstanding. During 2015, it had the following transactions that affected the common stock account. February 1 Issued 120,000 shares March 1 Issued a 10% stock dividend May 1 Acquired 10

> An article in Barron’s noted the following. Okay. Last fall, someone with a long memory and an even longer arm reached into that bureau drawer and came out with a moldy cheese sandwich and the equally moldy notion of corporate forecasts. We tried to fin

> Mortonson Company has not yet prepared a formal statement of cash flows for the 2014 fiscal year. Comparative balance sheets as of December 31, 2013 and 2014, and a statement of income and retained earnings for the year ended December 31, 2014, are prese

> Botticelli Inc. was organized in late 2012 to manufacture and sell hosiery. At the end of its fourth year of operation, the company has been fairly successful, as indicated by the following reported net incomes. aIncludes a $10,000 increase because of ch

> What is the difference between a future taxable amount and a future deductible amount? When is it appropriate to record a valuation account for a deferred tax asset?

> Identify the lease classifications for lessors and the criteria that must be met for each classification.

> George Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $278,072, and its unguaranteed residual value at the end of

> Presented below is an excerpt from the financial statements of H. J. Heinz Company. Segment and Geographic Data The company is engaged principally in one line of business—processed food products—which represents over 9

> What is meant by “past service cost”? When is past service cost recognized as pension expense?

> Keeton Company sponsors a defined benefit pension plan for its 600 employees. The company’s actuary provided the following information about the plan. The average remaining service life per employee is 10.5 years. The service cost compo

> The information shown below and on page 1170 was disclosed during the audit of Elbert Inc. 1. 2. On January 1, 2014, equipment costing $600,000 is purchased. For financial reporting purposes, the company uses straight-line depreciation over a 5-year life

> Discuss and illustrate how a correction of an error in previously issued financial statements should be handled.

> The residual value is the estimated fair value of the leased property at the end of the lease term. (a) Of what significance is (1) an unguaranteed and (2) a guaranteed residual value in the lessee’s accounting for a capitalized-lease transaction? (b) Of

> If pension expense recognized in a period exceeds the current amount funded by the employer, what kind of account arises, and how should it be reported in the financial statements? If the reverse occurs—that is, current funding by the employer exceeds th

> What are some of the reasons that the components of income tax expense should be disclosed and a reconciliation between the effective tax rate and the statutory tax rate be provided?

> Hayes Company sold 10,000 shares of Kenyon Co. common stock for $27.50 per share, incurring $1,770 in brokerage commissions. These securities were classified as trading and originally cost $260,000. Prepare the entry to record the sale of these securitie

> Olga Conrad, a financial writer, noted recently, “There are substantial arguments for including earnings projections in annual reports and the like. The most compelling is that it would give anyone interested something now available to only a relatively

> Presented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences existing at December 31, 2014. 1. Mooney Co. has developed the following schedule of future taxable and deductible amount

> Explain how the amount of cash payments to suppliers is computed under the direct method.

> Paul Dobson Stores sell appliances for cash and also on the installment plan. Entries to record cost of sales are made monthly. Repossessions recorded during the year are summarized as follows. Instructions From the trial balance and accompanying inform

> Beilman Inc. reports the following pretax income (loss) for both book and tax purposes. (Assume the carryback provision is used where possible for a net operating loss.) The tax rates listed were all enacted by the beginning of 2012. Instructions (a) Pre

> Distinguish between counterbalancing and noncounter balancing errors. Give an example of each.

> Alice Foyle, M.D. (lessee), has a noncancelable 20-year lease with Brownback Realty, Inc. (lessor) for the use of a medical building. Taxes, insurance, and maintenance are paid by the lessee in addition to the fixed annual payments, of which the present

> Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2014, Hamilton began work under contract #E2-D2, which provided for a contract price of $2,200,000. Other details follow: Instructions (a) What portion of the total

> What are “liability gains and losses,” and how are they accounted for?

> Differentiate between “accounting for the employer” and “accounting for the pension fund.”

> Addison Co. has one temporary difference at the beginning of 2014 of $500,000. The deferred tax liability established for this amount is $150,000, based on a tax rate of 30%. The temporary difference will provide the following taxable amounts: $100,000 i

> What are the two basic methods of accounting for long term construction contracts? Indicate the circumstances that determine when one or the other of these methods should be used.

> At the end of the year, Falabella Co. has pretax financial income of $550,000. Included in the $550,000 is $70,000 interest income on municipal bonds, $25,000 fine for dumping hazardous waste, and depreciation of $60,000. Depreciation for tax purposes is

> Briefly describe some of the similarities and differences between GAAP and IFRS with respect to income tax accounting.

> Warren Co. purchased a put option on Echo common shares on January 7, 2014, for $360. The put option is for 400 shares, and the strike price is $85 (which equals the price of an Echo share on the purchase date). The option expires on July 31, 2014. The f

> The board of directors of Gifford Corp. declared cash dividends of $260,000 during the current year. If dividends payable was $85,000 at the beginning of the year and $90,000 at the end of the year, how much cash was paid in dividends during the year?

> Simms Corp. controlled four domestic subsidiaries and one foreign subsidiary. Prior to the current year, Simms Corp. had excluded the foreign subsidiary from consolidation. During the current year, the foreign subsidiary was included in the financial sta

> Metheny Corporation’s lease arrangements qualify as sales-type leases at the time of entering into the transactions. How should the corporation recognize revenues and costs in these situations?

> On June 3, Hunt Company sold to Ann Mount merchandise having a sales price of $8,000 with terms of 2/10, n/60, f.o.b. shipping point. An invoice totaling $120, terms n/30, was received by Mount on June 8 from the Olympic Transport Service for the freight

> What is meant by “prior service cost”? When is prior service cost recognized as pension expense?

> Assume the same information as in E17-19 for Lilly Company. In addition, assume that the investment in the Woods Inc. stock was sold during 2015 for $195,000. At December 31, 2015, the following information relates to its two remaining investments of com

> Using the information in E20-22, In E20-22 Prepare a worksheet inserting January 1, 2014, balances, showing December 31, 2014, balances, and the journal entry recording postretirement benefit expense. Service cost $ 90,000 Prior service cost amortiz

> What date or event does the profession believe should be used in determining the value of a stock option? What arguments support this position?

> Your roommate is puzzled. During the last year, the company in which she is a stockholder reported a net loss of $675,000, yet its cash increased $321,000 during the same period of time. Explain to your roommate how this situation could occur.

> How should consolidated financial statements be reported this year when statements of individual companies were presented last year?

> Seaver Company uses the installment-sales method in accounting for its installment sales. On January 1, 2014, Seaver Company had an installment account receivable from Jan Noble with a balance of $1,800. During 2014, $500 was collected from Noble. When n

> Interest on municipal bonds is referred to as a permanent difference when determining the proper amount to report for deferred taxes. Explain the meaning of permanent differences, and give two other examples.

> Walker Company is a manufacturer and lessor of computer equipment. What should be the nature of its lease arrangements with lessees if the company wishes to account for its lease transactions as sales-type leases?

> Explain the difference between service cost and prior service cost.

> Identify and explain the different types of classifications for investments in equity securities.

> Cordero Corporation has an employee stock-purchase plan which permits all full-time employees to purchase 10 shares of common stock on the third anniversary of their employment and an additional 15 shares on each subsequent anniversary date. The purchase

> The controller for Lafayette Inc. recently commented, “If I have to disclose our segments individually, the only people who will gain are our competitors and the only people that will lose are our present stockholders.” Evaluate this comment.

> Arantxa Corporation made the following cash purchases of securities during 2014, which is the first year in which Arantxa invested in securities. 1. On January 15, purchased 10,000 shares of Sanchez Company’s common stock at $33.50 per share plus commiss

> The Simon Corporation issued 10-year, $5,000,000 par, 7% callable convertible subordinated debentures on January 2, 2014. The bonds have a par value of $1,000, with interest payable annually. The current conversion ratio is 14:1, and in 2 years it will i

> What is the purpose of the statement of cash flows? What information does it provide?

> Where can authoritative IFRS be found related to dilutive securities, stock-based compensation, and earnings per share?

> In recent years, the Wall Street Journal has indicated that many companies have changed their accounting principles. What are the major reasons why companies change accounting methods?

> Cardinal Paz Corp. carries an account in its general ledger called Investments, which contained debits for investment purchases, and no credits, with the following descriptions. Instructions (a) Prepare entries necessary to classify the amounts into prop

> What are the major lessor groups in the United States? What advantage does a captive have in a leasing arrangement?

> What is a private pension plan? How does a contributory pension plan differ from a noncontributory plan?

> Explain the current environment regarding revenue recognition.

> The financial statements of Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://annualreport.marksandspencer.com/_assets/downloads/Marksand-Spencer-Annual-report-and-financial-statements-2012.pdf. Instr

> Your client, Cascade Company, is planning to invest some of its excess cash in 5-year revenue bonds issued by the county and in the shares of one of its suppliers, Teton Co. Teton’s shares trade on the over-the-counter market. Cascade plans to classify t

> Collinsworth Co. reported sales on an accrual basis of $100,000. If accounts receivable increased $30,000 and the allowance for doubtful accounts increased $9,000 after a write-off of $2,000, compute cash sales.

> The financial statements of Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://annualreport.marksandspencer.com/_assets/downloads/Marks-and-Spencer-Annual-report-and-financial-statements-2012.pdf. Ins

> Komissarov Company has a debt investment in the bonds issued by Keune Inc. The bonds were purchased at par for $400,000 and, at the end of 2014, have a remaining life of 3 years with annual interest payments at 10%, paid at the end of each year. This deb

> Presented below is information related to the purchases of common stock by Lilly Company during 2014. Instructions (Assume a zero balance for any Fair Value Adjustment account.) (a) What entry would Lilly make at December 31, 2014, to record the investme

> For each of the following subsequent events, indicate whether a company should (a) adjust the financial statements, (b) disclose in notes to the financial statements, or (c) neither adjust nor disclose. ________ 1. Settlement of a tax case at a cost cons

> Newton Inc. uses a calendar year for financial reporting. The company is authorized to issue 9,000,000 shares of $10 par common stock. At no time has Newton issued any potentially dilutive securities. Listed below is a summary of Newton’

> Assume that Amazon.com has a stock-option plan for top management. Each stock option represents the right to purchase a share of Amazon $1 par value common stock in the future at a price equal to the fair value of the stock at the date of the grant. Amaz

> On April 1, 2014, Dougherty Inc. entered into a cost plus fixed-fee contract to construct an electric generator for Altom Corporation. At the contract date, Dougherty estimated that it would take 2 years to complete the project at a cost of $2,000,000. T

> Employees at your company disagree about the accounting for sales returns. The sales manager believes that granting more generous return provisions and allowing customers to order items on a bill and hold basis can give the company a competitive edge and

> On December 21, 2014, Zurich Company provided you with the following information regarding its trading investments. During 2015, Carolina Company shares were sold for $9,500. The fair value of the shares on December 31, 2015, was Stargate Corp. shares&ac

> Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2014, Hamilton began work under contract #E2-D2, which provided for a contract price of $2,200,000. Other details are as follows. Instructions (a) What portion of t

> Assume the same information as in IFRS17-12 except that Roosevelt has an active trading strategy for these bonds. The fair value of the bonds at December 31 of each year-end is as follows. Instructions (a) Prepare the journal entry at the date of the bon

> Use the information from IFRS18-6, but assume Turner uses the cost-recovery method. In IFRS18-6 Turner, Inc. began work on a $7,000,000 contract in 2014 to construct an office building. During 2014, Turner, Inc. incurred costs of $1,700,000, billed its

> Roosevelt Company purchased 12% bonds, having a maturity value of $500,000, for $537,907.40. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2014, and mature January 1, 2019, with interest receivable December 31 of each year

> Using the information in E20-13 about Erickson Company’s defined benefit pension plan, prepare a 2014 pension worksheet with supplementary schedules of computations. In E20-13 Prepare the journal entries at December 31, 2014, to record

> Presented below is summarized information for Johnston Co., which sells merchandise on the installment basis. Instructions (a) Compute the realized gross profit for each of the years 2014, 2015, and 2016. (b) Prepare all entries required in 2016, applyin

> Erickson Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. Instructions (a) Compute the actual return on the plan assets in 2014. (b) Compute the amount of the

> Teri Hatcher Inc., in its first year of operations, has the following differences between the book basis and tax basis of its assets and liabilities at the end of 2013. It is estimated that the warranty liability will be settled in 2014. The difference i

> Presented below are three revenue recognition situations. (a) Grupo sells goods to MTN for $1,000,000, payment due at delivery. (b) Grupo sells goods on account to Grifols for $800,000, payment due in 30 days. (c) Grupo sells goods to Magnus for $500,000

> Unlike the other major financial statements, the statement of cash flows is not prepared from the adjusted trial balance. From what sources does the information to prepare this statement come, and what information does each source provide?

> On December 21, 2013, Bucky Katt Company provided you with the following information regarding its trading securities. During 2014, Colorado Company stock was sold for $9,400. The fair value of the stock on December 31, 2014, was Clemson Corp. stock&acir

> On January 1, 2015, Titania Inc. granted stock options to officers and key employees for the purchase of 20,000 shares of the company’s $10 par common stock at $25 per share. The options were exercisable within a 5-year period beginning January 1, 2017,

> You are compiling the consolidated financial statements for Winsor Corporation International. The corporation’s accountant, Anthony Reese, has provided you with the segment information shown on the next page. Note 7: Major Segments of B

> Data for Anita Baker Company are presented in E23-18. Instructions Prepare entries in journal form for all adjustments that should be made on a worksheet for a statement of cash flows. E23-20 (Worksheet Analysis of Selected Transactions) The transactions

> The before-tax income for Lonnie Holdiman Co. for 2014 was $101,000 and $77,400 for 2015. However, the accountant noted that the following errors had been made: 1. Sales for 2014 included amounts of $38,200 which had been received in cash during 2014, bu

> Assume the same information as in P21-4. In P21-4 The collectibility of the lease payments is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor. The lessee assumes responsibility for a

> Ferreri Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2014. The service cost component of pension

> Andy McDowell Co. establishes a $100 million liability at the end of 2014 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2015. Also, at the end of 2014

> Shaw Company sells goods that cost $300,000 to Ricard Company for $410,000 on January 2, 2014. The sales price includes an installation fee, which is valued at $40,000. The fair value of the goods is $370,000. The installation is expected to take 6 month

> The following information is available for Barkley Company at December 31, 2014, regarding its investments. Instructions (a) Prepare the adjusting entry (if any) for 2014, assuming the securities are classified as trading. (b) Prepare the adjusting entry

> Lenexa State Bank has followed the practice of capitalizing certain marketing costs and amortizing these costs over their expected life. In the current year, the bank determined that the future benefits from these costs were doubtful. Consequently, the b

> On November 1, 2014, Columbo Company adopted a stock-option plan that granted options to key executives to purchase 30,000 shares of the company’s $10 par value common stock. The options were granted on January 2, 2015, and were exercisable 2 years after

> At December 31, 2014, Coburn Corp. has assets of $10,000,000, liabilities of $6,000,000, common stock of $2,000,000 (representing 2,000,000 shares of $1 par common stock), and retained earnings of $2,000,000. Net sales for the year 2014 were $18,000,000,