Question: Sponsor Corporation reports short-term investments

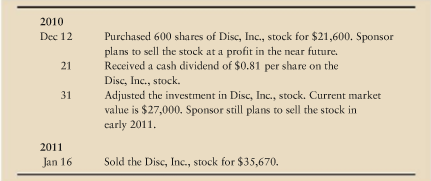

Sponsor Corporation reports short-term investments on its balance sheet. Suppose a division of Sponsor completed the following short-term investment transactions during 2010:

Requirement

1. Prepare T-accounts for Cash, Short-Term Investment, Dividend Revenue, Unrealized Gain (Loss) on Investment, and Gain on Sale of Investment. Show the effects of Sponsors investment transactions. Start with a cash balance of $97,000; all the other accounts start at zero.

Transcribed Image Text:

2010 Dec 12 Purchased 600 shares of Disc, Inc., stock for $21,600. Sponsor plans to sell the stock at a profit in the near future. Received a cash dividend of $0.81 per share on the Disc, Inc., stock. Adjusted the investment in Disc, Inc., stock. Current market value is $27,000. Sponsor still plans to sell the stock in carly 2011. 21 31 2011 Jan 16 Sold the Disc, Inc., stock for $35,670.

> Ten Flags over Georgia paid $100,000 for a concession stand. Ten Flags started out depreciating the building straight-line over 20 years with zero residual value. After using the concession stand for three years, Ten Flags determines that the building wi

> Assume that on September 30, 2010, LoganAir, the national airline of Switzerland, purchased an Airbus aircraft at a cost of *45,000,000 (* is the symbol for the euro). LoganAir expects the plane to remain useful for six years (4,500,000 miles) and to hav

> This exercise uses the assumed Northeast USA data from Short Exercise 7-5. Assume Northeast USA is trying to decide which depreciation method to use for income tax purposes. The company can choose from among the following methods: (a) straight-line, (b

> Use the Northeast USA data in Short Exercise 7-5 to compute Northeast USAs third-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining balance from 7-5: Assume that at the beginning of

> Assume that at the beginning of 2010, Northeast USA, a FedEx competitor, purchased a used Boeing 737 aircraft at a cost of $53,000,000. Northeast USA expects the plane to remain useful for five years (six million miles) and to have a residual value of $5

> This chapter lists the costs included for the acquisition of land on pages 411 412. First is the purchase price of the land, which is obviously included in the cost of the land. The reasons for including the other costs are not so obvious. For example, p

> Vector, Inc., dominates the snack-food industry with its Tangy-Chip brand. Assume that Vector, Inc., purchased Concord Snacks, Inc., for $8.8 million cash. The market value of Concord Snacks assets is $15 million, and Concord Snacks has liabilities of $8

> North Coast Petroleum, the giant oil company, holds reserves of oil and gas assets. At the end of 2010, assume the cost of North Coast Petroleums mineral assets totaled $120 billion, representing 10 billion barrels of oil in the ground. 1. Which depreci

> Examine Round Rocks assets. 1. What is Round Rocks largest category of assets? List all 2011 assets in the largest category and their amounts as reported by Round Rock. 2. What was Round Rocks cost of property and equipment at May 31, 2011? What was th

> This exercise tests your understanding of the four inventory methods. List the name of the inventory method that best fits the description. Assume that the cost of inventory is rising. 1. Generally associated with saving income taxes. 2. Results in a c

> Identify the internal control weakness in the following situations. State how the person can hurt the company. a. Jason Monroe works as a security guard at CITY parking in Dayton. Monroe has a master key to the cash box where customers pay for parking.

> Smith Saxophone Company is nearing the end of its worst year ever. With two weeks until year-end, it appears that net income for the year will have decreased by 25% from last year. Joe Smith, the president and principal stockholder, is distressed with th

> It is December 31, end of the year, and the controller of Reed Corporation is applying the lower of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments Reed reports the following data: Reed determines that the replacement cost of

> Microdata.com uses the LIFO method to account for inventory. Microdata is having an unusually good year, with net income well above expectations. The company’s inventory costs are rising rapidly. What can Microdata do immediately before the end of the ye

> This exercise should be used in conjunction with Short Exercise 6-4. Jefferson is a corporation subject to a 30% income tax. Compute Jeffersons income tax expense under the average, FIFO, and LIFO inventory costing methods. Which method would you select

> Jeffersons Copy Center uses laser printers. Assume Jefferson started the year with 92 containers of ink (average cost of $9.00 each, FIFO cost of $8.90 each, LIFO cost of $8.05 each). During the year, Jefferson purchased 680 containers of ink at $9.80 an

> Determine whether each of the following actions in buying, selling, and accounting for inventories is ethical or unethical. Give your reason for each answer. 1. In applying the lower-of-cost-or-market rule to inventories, Tewksbury Financial Industries

> Short Exercise 5-14, show how the Green Interstate Bank will report the following: a. Whatever needs to be reported on its classified balance sheet at June 30, 2011. b. Whatever needs to be reported on its income statement for the year ended June 30, 2

> Norbert Medical Service reported the following items, (amounts in thousands): Requirements 1. Classify each item as (a) income statement or balance sheet and as (b) debit balance or credit balance. 2. How much net income (or net loss) did Norbert re

> West Highland Clothiers reported the following amounts in its 2011 financial statements. The 2010 amounts are given for comparison. Requirements 1. Compute West Highlands acid-test ratio at the end of 2011. Round to two decimal places. How does the aci

> Gretchen Rourke, an accountant for Dublin Limited, discovers that her supervisor, Billy Dunn, made several errors last year. In total, the errors overstated the company’s net income by 25%. It is not clear whether the errors were deliberate or accidental

> Record the following note receivable transactions in the journal of Aegean Realty. How much interest revenue did Aegean earn this year? Use a 365-day year for interest computations, and round interest amounts to the nearest dollar. Loaned $15,000 cas

> On August 31, 2010, Nancy Thompson borrowed $2,000 from Green Interstate Bank. Thompson signed a note payable, promising to pay the bank principal plus interest on August 31, 2011. The interest rate on the note is 10%. The accounting year of Green Inters

> 1. Compute the amount of interest during 2010, 2011, and 2012 for the following note receivable: On April 30, 2010, BCDE Bank lent $170,000 to Carl Abbott on a two-year, 7% note. 2. Which party has a (an) a. note receivable? b. note payable? c. inter

> Use the information from the following journal entries of Turning Leaves Furniture Restoration to answer the questions below: Requirements 1. Start with Accounts Receivables beginning balance ($38,000) and then post to the Accounts Receivable T-accou

> Answer these questions about receivables and uncollectibles. For the true-false questions, explain any answers that turn out to be false. 1. True or false? Credit sales increase receivables. Collections and write-offs decrease receivables. 2. Which rec

> Perform the following accounting for the receivables of Evans and Tanner, a law firm, at December 31, 2010. Requirements 1. Start with the beginning balances for these T-accounts: Accounts Receivable, $97,000 Allowance for Uncollectible Accounts, $5,

> During 2011, Turning Leaves Furniture Restoration completed these transactions: 1. Sales revenue on account, $1,000,000 2. Collections on account, $870,000 3. Write-offs of uncollectibles, $12,000 4. Uncollectible-account expense, 4% of sales revenue

> The Cash account of Randell Corp. reported a balance of $2,400 at October 31. Included were outstanding checks totaling $500 and an October 31 deposit of $200 that did not appear on the bank statement. The bank statement, which came from Park Bank, liste

> Crow Company requires that all documents supporting a check be cancelled by punching a hole through the packet. Why is this practice required? What might happen if it were not?

> During its first year of operations, Turning Leaves Furniture Restoration, Inc., had sales of $312,000, all on account. Industry experience suggests that Turning Leaves Furniture Restorations uncollectibles will amount to 4% of credit sales. At December

> As a recent college graduate, you land your first job in the customer collections department of Countryroads Publishing. Zach Peters, the manager, asked you to propose a system to ensure that cash received from customers by mail is handled properly. Draf

> At December 31, 2010, Darcis Travel has an accounts receivable balance of $88,000. Allowance for Doubtful Accounts has a credit balance of $900 before the year-end adjustment. Service revenue for 2010 was $900,000. Darcis Travel estimates that doubtful-a

> Identify the other control procedures usually found in a company’s system of internal control besides separation of duties, and tell why each is important.

> Continental Sporting Goods started April with an inventory of nine sets of golf clubs that cost a total of $1,260. During April Continental purchased 25 sets of clubs for $4,000. At the end of the month, Continental had 8 sets of golf clubs on hand. The

> Summer Kluxon, Inc., purchased inventory costing $120,000 and sold 75% of the goods for $150,000. All purchases and sales were on account. Kluxon later collected 30% of the accounts receivable 1. Journalize these transactions for Kluxon, which uses the p

> Define fraud. List and briefly discuss the three major components of the fraud triangle.

> For each of the following situations, identify the inventory method that you would use or, given the use of a particular method, state the strategy that you would follow to accomplish your goal: a. Inventory costs are increasing. Your company uses LIFO a

> Toyland prepares budgets to help manage the company. Toyland is budgeting for the fiscal year ended January 31, 2010. During preceding year ended January 31, 2009, sales totaled $9,700 million and cost of goods sold was $6,200 million. At January 31, 200

> Assume Birch Leaf Foods, Inc., experienced the following revenue and accounts receivable write-offs: Suppose Birch Leaf estimates that 1% of revenues will become uncollectible. Requirement 1. Journalize service revenue (all on account), bad-debt expen

> Assume Dans Drums borrowed $19 million from Need It Now Bank and agreed to (a) pay an interest rate of 7.1% and (b) maintain a compensating balance amount equal to 5.8% of the loan. Determine Dans Drums actual effective interest rate on this loan.

> On November 16, SRO, Inc., paid $98,000 for an investment in the stock of Northwest Pacific Railway (NPR). SRO intends to account for these shares as trading securities. On December 12, SRO received a $700 cash dividend from NPR. It is now December 31, a

> The following items appear on a bank reconciliation. Classify each item as (a) an addition to the bank balance, (b) a subtraction from the bank balance, (c) an addition to the book balance, or (d) a subtraction from the book balance. 1. ___ Outstandi

> Green Grass Golf Company manufactures a popular line of golf clubs. Green Grass Golf employs 188 workers and keeps their employment records on time sheets that show how many hours the employee works each week. On Friday the shop foreman collects the time

> Toys Plus prepares budgets to help manage the company. Toys Plus is budgeting for the fiscal year ended January 31, 2010. During the preceding year ended January 31, 2009, sales totaled $9,300 million and cost of goods sold was $6,500 million. At January

> Assume Port City Credit Union completed these transactions: Show what the company would report for these transactions on its 2010 and 2011 balance sheets and income statements. 2010 Apr 1 Loaned $125,000 to Lee Franz on a one-year, 12% note. Dec 31

> Assume Lennys Lanes borrowed $14 million from Greenback Bank and agreed to (a) pay an interest rate of 7.7% and (b) maintain a compensating balance amount equal to 5.7% of the loan. Determine Lennys Lanes actual effective interest rate on this loan.

> Assume Dogwood Leaf Foods, Inc., experienced the following revenue and accounts receivable write-offs: Suppose Dogwood Leaf estimates that 1% of revenues will become uncollectible. Requirement 1. Journalize service revenue (all on account), bad-debt e

> On November 16, ACA, Inc., paid $95,000 for an investment in the stock of American Pacific Railway (APR). ACA plans to account for these shares as trading securities. On December 12, ACA received a $400 cash dividend from APR. It is now December 31, and

> The following items appear on a bank reconciliation: 1. ___ Outstanding checks 2. ___ Bank error: The bank credited our account for a deposit made by another bank customer. 3. ___ Service charge 4. ___ Deposits in transit 5. ___ NSF check 6. ___ Ban

> Use the data for Kens in Exercise 6-16A to illustrate Kens income tax advantage from using LIFO over FIFO. Sales revenue is $6,600, operating expenses are $1,500, and the income tax rate is 35%. How much in taxes would Kens save by using the LIFO method

> Assume Candy Corner, Inc., purchased conveyor-belt machinery . Classify each of the following expenditures as a capital expenditure or an immediate expense related to machinery: a. Sales tax paid on the purchase price b. Transportation and insurance whi

> Suppose Timely Delivery pays $64 million to buy Guaranteed Overnight. Guaranteeds assets are valued at $74 million, and its liabilities total $16 million. How much goodwill did Timely Delivery purchase in its acquisition of Guaranteed Overnight? a. $48 m

> McCall stores use point-of-sale terminals as cash registers. The register shows the amount of each sale, the cash received from the customer, and any change returned to the customer. The machine also produces a customer receipt but keeps no record of tra

> A company purchased mineral assets costing $840,000, with estimated residual value of $30,000, and holding approximately 300,000 tons of ore. During the first year, 48,000 tons are extracted and sold. What is the amount of depletion for the first year? a

> Hill Company purchased a machine for $8,600 on January 1, 2010. The machine has been depreciated using the straight-line method over a 10-year life and $600 residual value. Hill sold the machine on January 1, 2012, for $7,700. What is straight-line depr

> Hill Company purchased a machine for $8,600 on January 1, 2010. The machine has been depreciated using the straight-line method over a 10-year life and $600 residual value. Hill sold the machine on January 1, 2012, for $7,700. Journalize Hills sale of th

> Hill Company purchased a machine for $8,600 on January 1, 2010. The machine has been depreciated using the straight-line method over a 10-year life and $600 residual value. Hill sold the machine on January 1, 2012, for $7,700. What gain or loss should Hi

> An error understated Regan Corporations December 31, 2010, ending inventory by $42,000. What effect will this error have on total assets and net income for 2010? Assets………………….Net income a. Understate………..No effect b. No effect……………No effect c. Unders

> Shipley Tank Company had the following beginning inventory , net purchases, net sales, and gross profit percentage for the first quarter of 2010: By the gross profit method, the ending inventory should be a. $80,000. b. $78,000. c. $81,000. d. $79,00

> Trigger, Inc., reported the following data: Triggers gross profit percentage is a. 46.3. b. 52.7. c. 47.3. d. 57.4. Freight in.. Purchases $ 25,000 208,000 57,000 $ 7,000 6,200 450,000 Sales returns..... . Purchase returns...... ...... Beginning i

> Sales are $540,000 and cost of goods sold is $330,000. Beginning and ending inventories are $29,000 and $34,000, respectively . How many times did the company turn its inventory over during this period? a. 17.1 times b. 6.7 times c. 7.2 times d. 10.5

> Two financial ratios that clearly distinguish a discount chain such as Kmart from a high-end retailer such as Saks Fifth Avenue are the gross profit percentage and the rate of inventory turnover. Which set of relationships is most likely for Saks Fifth A

> Eleanor Barker Cosmetics ended the month of May with inventory of $25,000. Eleanor Barker expects to end June with inventory of $12,000 after cost of goods sold of $102,000. How much inventory must Eleanor Barker purchase during June in order to accompli

> Use the data from Exercise 4-21 to make the journal entries that Root should record on April 30 to update his Cash account. Include an explanation for each entry. From 21: Evan Root operates a bowling alley. He has just received the monthly bank stateme

> An error understated Regan Corporations December 31, 2010, ending inventory by $42,000. What effect will this error have on net income for 2011? a. Overstate b. Understate c. No effect

> A company sells on credit terms of net 30 days and has days’ sales in account receivable of 30 days. Its days sales in receivables is a. too high. b. too low. c. about right. d. cannot be evaluated from the data given.

> A company with net sales of $1,017,000, beginning net receivables of $110,000, and ending net receivables of $120,000, has days’ sales in accounts receivable of a. 38 days. b. 47 days. c. 41 days. d. 44 days.

> Which of the following is included in the calculation of the acid-test ratio? a. Prepaid expenses and cash b. Cash and accounts receivable c. Inventory and prepaid expenses d. Inventory and short-term investment

> On August 1, 2010, Botores, Inc., sold equipment and accepted a six-month, 12%, $50,000 note receivable. Botores year-end is December 31. Write the journal entry on the maturity date (February 1, 2011).

> On August 1, 2010, Botores, Inc., sold equipment and accepted a six-month, 12%, $50,000 note receivable. Botores year-end is December 31. Which of the following accounts will Botores credit in the journal entry at maturity on February 1, 2011, assuming

> On August 1, 2010, Botores, Inc., sold equipment and accepted a six-month, 12%, $50,000 note receivable. Botores year-end is December 31. How much interest does Botores, Inc., expect to collect on the maturity date (February 1, 2011)? a. $3,000 b. $6,0

> The journal entry on the maturity date to record the payment of $500,000 of bonds payable that were issued at a $50,000 discount includes a. a debit to Bonds Payable for $500,000. b. a credit to Cash for $550,000. c. a debit to Discount on Bonds Payab

> Using the facts in the preceding question, McPartlins journal entry to record the interest expense on July 1, 2010 will include a a. debit to Bonds Payable. b. credit to Discount on Bonds Payable. c. credit to Interest Expense. d. debit to Premium on

> McPartlin Corporation issued $300,000 of 10%, 10-year bonds payable on January 1, 2010, for $236,370. The market interest rate when the bonds were issued was 14%. Interest is paid semiannually on January 1 and July 1. The first interest payment is July

> Evan Root operates a bowling alley. He has just received the monthly bank statement at April 30 from City National Bank, and the statement shows an ending balance of $565. Listed on the statement are an EFT rent collection of $320, a service charge of $7

> Spring Company sells $200,000 of 12%, 10-year bonds for 96 on April 1, 2010. The market rate of interest on that day is 12.5%. Interest is paid each year on April 1. Write the journal entry requirements at April 1, 2011.

> Spring Company sells $200,000 of 12%, 10-year bonds for 96 on April 1, 2010. The market rate of interest on that day is 12.5%. Interest is paid each year on April 1. Write the adjusting entry required at December 31, 2010.

> Spring Company sells $200,000 of 12%, 10-year bonds for 96 on April 1, 2010. The market rate of interest on that day is 12.5%. Interest is paid each year on April 1. Spring Company uses the straight-line amortization method. The amount of interest expens

> Spring Company sells $200,000 of 12%, 10-year bonds for 96 on April 1, 2010. The market rate of interest on that day is 12.5%. Interest is paid each year on April 1. The entry to record the sale of the bonds on April 1 would be a. Cash Discount on Bo

> A bond with a face amount of $10,000 has a current price quote of 104.885. What is the bonds price? a. $10,488.50 b. $1,048,850 c. $1,048.85 d. $10,104.89

> Yesterdays Fashions has a debt that has been properly reported as a long-term liability up to the present year (2010). Some of this debt comes due in 2010. If Yesterdays Fashions continues to report the current position as a long-term liability , the eff

> Alexander, Inc., manufactures and sells computer monitors with a three-year warranty . Warranty costs are expected to average 7% of sales during the warranty period. The following table shows the sales and actual warranty payments during the first two ye

> FastscarsWarehouse operates in a state with a 5.5% sales tax. For convenience, Fastscars Warehouse credits Sales Revenue for the total amount (selling price plus sales tax) collected from each customer. If Fastscars Warehouse fails to make an adjustment

> Which of the following items is reported on the balance sheet? a. Gain on disposal of equipment b. Accumulated depreciation c. Cost of goods sold d. Net sales revenue

> Which of the following costs is reported on a companys income statement? a. Land b. Accumulated depreciation c. Depreciation expense d. Accounts payable

> D. J. Hunters checkbook lists the following: The June bank statement shows Requirement 1. Prepare Hunters bank reconciliation at June 30. Date Check No. Item Check Deposit Balance 6/1 $ 525 4 622 Art Cafe $ 30 495 9. Dividends received $ 110 605 1

> A fire during 2010 destroyed most of the accounting records of Clearview Cablevision, Inc. The only accounting data for 2010 that Clearview can come up with are the following balances at December 31, 2010. The general manager also knows that bad-debt exp

> Jimmys DVD, Inc., uses the double-declining-balance method for depreciation on its computers. Which item is not needed to compute depreciation for the first year? a. Original cost b. Expected useful life in years c. Estimated residual value d. All the

> King Company failed to record depreciation of equipment. How does this omission affect Kings financial statements? a. Net income is overstated and assets are understated. b. Net income is overstated and assets are overstated. c. Net income is understat

> Boston Corporation acquired a machine for $33,000 and has recorded depreciation for two years using the straight-line method over a five-year life and $6,000 residual value. At the start of the third year of use, Boston revised the estimated useful life

> Boston Corporation acquired a machine for $33,000 and has recorded depreciation for two years using the straight-line method over a five-year life and $6,000 residual value. At the start of the third year of use, Boston revised the estimated useful life

> Which statement about depreciation is false? a. Depreciation should not be recorded in years that the market value of the asset has increased. b. Depreciation is a process of allocating the cost of an asset to expense over its useful life. c. A major o

> Suppose you buy land for $2,900,000 and spend $1,200,000 to develop the property . You then divide the land into lots as follows: How much did each hilltop lot cost you? a. $246,000 b. $175,715 c. $234,285 d. $410,000 Sale Price per Lot Catergory

> Which of the following items should be accounted for as a capital expenditure? a. The monthly rental cost of an office building b. Taxes paid in conjunction with the purchase of office equipment c. Maintenance fees paid with funds provided by the compa

> A capital expenditure a. adds to an asset. b. is expensed immediately . c. is a credit like capital (owners equity). d. records additional capital.

> The following data come from the inventory records of Draper Company: Based on these facts, the gross profit for Draper Company is a. $130,000. b. $163,000. c. $134,000. d. Some other amount. Net sales revenue... $623,000 64,000 Beginning invent

> The sum of (a) ending inventory and (b) cost of goods sold is a. beginning inventory . b. goods available. c. net purchases. d. gross profit.

> Northern Corporation, the investment banking company, often has extra cash to invest. Suppose Northern buys 800 shares of Andy, Inc., stock at $54 per share. Assume Northern expects to hold the Andy stock for one month and then sell it. The purchase occu

> The word market as used in the lower of cost or market generally means a. retail market price. b. Replacement cost. c. Retail market price. d. Liquidation price.