Question: St. Paul Co. does business in the

St. Paul Co. does business in the United States and New Zealand. In attempting to assess its economic exposure, it compiled the following information.

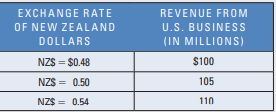

St. Paul’s U.S. sales are somewhat affected by the value of the New Zealand dollar (NZ$) because it faces competition from New Zealand exporters. It forecasts the U.S. sales based on the following three exchange rate scenarios:

Its New Zealand dollar revenues on sales to New Zealand invoiced in New Zealand dollars are expected to be NZ$600 million.

Its anticipated cost of materials is estimated at $200 million from the purchase of U.S. materials and NZ$100 million from the purchase of New Zealand materials.

Fixed operating expenses are estimated at $30 million.

Variable operating expenses are estimated at 20 percent of total sales (after including New Zealand sales, translated to a dollar amount).

Interest expense is estimated at $20 million on existing U.S. loans, and the company has no existing New Zealand loans. Forecast net cash flows for St. Paul Co. under each of the three exchange rate scenarios. Explain how St. Paul’s net cash flows are affected by possible exchange rate movements. Explain how it can restructure its operations to reduce the sensitivity of its net cash flows to exchange rate movements without reducing its volume of business in New Zealand.

> Carson Co. is considering a 10-year project in Hong Kong, where the Hong Kong dollar is tied to the U.S. dollar. Carson Co. uses sensitivity analysis that allows for alternative exchange rate scenarios. Why would Carson use this approach rather than usin

> A project in South Korea requires an initial investment of 2 billion South Korean won. The project is expected to generate net cash flows to the subsidiary of 3 billion won and 4 billion won in the two years of operation, respectively. The project has no

> What is the major limitation of using point estimates of exchange rates in the capital budgeting analysis? List the various techniques for adjusting risk in multinational capital budgeting. Describe any advantages or disadvantages of each technique. Expl

> When considering the implementation of a project in one of various possible countries, what types of tax characteristics should be assessed among the countries? (See the chapter appendix.

> Assume that Fordham Co. was evaluating a project in Thailand (to be financed with U.S. dollars). All cash flows generated from the project were to be reinvested in Thailand for several years. Explain how the Asian crisis in 1997 would have affected the e

> PepsiCo recently decided to invest more than $300 million for expansion in Brazil. Brazil offers considerable potential because it has 150 million people and their demand for soft drinks is increasing. However, the soft drink consumption is still only ab

> Assume that a less developed country called LDC encourages direct foreign investment (DFI) in an effort to reduce its unemployment rate, currently at 15 percent. Also assume that several MNCs are likely to consider DFI in this country. The inflation rate

> Santa Monica Co., a U.S.-based MNC, was considering establishing a consumer products division in Germany, which would be financed by German banks. Santa Monica completed its capital budgeting analysis in August. Then, in November, the government leadersh

> Ventura Corp., a U.S.-based MNC, plans to establish a subsidiary in Japan. It is confident that the Japanese yen will appreciate against the dollar over time. The subsidiary will retain only enough revenues to cover expenses and will remit the rest to th

> Brower, Inc., just constructed a manufacturing plant in Ghana. The construction cost 9 billion Ghanaian cedi. Brower intends to keep the plant open for three years. During the three years of operation, cedi cash flows are expected to be 3 billion cedi, 3

> Recall that Blades, Inc., the U.S. manufacturer of roller blades, generates most of its revenue and incurs most of its expenses in the United States. However, the company has recently begun exporting roller blades to Thailand. The company has an agreemen

> Flagstaff Corp. is a U.S.-based firm with a subsidiary in Mexico. It plans to reinvest its earnings in Mexican government securities for the next 10 years because the interest rate earned on these securities is so high. Then, after 10 years, it will remi

> Lehigh Co. established a subsidiary in Switzerland that was performing below the cash flow projections developed before the subsidiary was established. Lehigh anticipated that future cash flows would also be lower than the original cash flow projections.

> Athens, Inc., established a subsidiary in the United Kingdom that was independent of its operations in the United States. The subsidiary’s performance significantly exceeded expectations. Consequently, when a British firm approached Athens about the poss

> Why should capital budgeting for subsidiary projects be assessed from the parent’s perspective? Which additional factors that normally are not relevant for a purely domestic project deserve consideration in multinational capital budgeting?

> Bronco Corp. has decided to establish a subsidiary in Taiwan that will produce MP3 players and sell them there. It expects that its cost of producing these MP3 players will be onethird the cost of producing the devices in the United States. Assuming that

> Ohio, Inc., considers establishing a manufacturing plant in central Asia, which would be used to cover its exports to Japan and Hong Kong. If Ohio is concerned about possible terrorism, how might this factor affect the estimated expenses of the plant?

> Offer your opinion on why the economies of some less developed countries with strict restrictions on international trade and DFI are somewhat independent from the economies of other countries. Why would MNCs desire to enter such countries? If these count

> Some MNCs establish a manufacturing facility where there is a relatively low cost of labor, but they sometimes close the facility later when the cost advantage dissipates. Why do you think the relative cost advantage of these countries is reduced over ti

> If the United States imposed long-term restrictions on imports, would the amount of DFI by non-U.S. MNCs in the United States increase, decrease, or be unchanged? Explain.

> Raider Chemical Co. and Ram, Inc., had similar intentions to reduce the volatility of their cash flows. Raider implemented a long-range plan to establish 40 percent of its business in Canada. Ram implemented a long-range plan to establish 30 percent of i

> The Sports Exports Company receives British pounds each month as payment for the footballs that it exports. It anticipates that the pound will depreciate over time against the U.S. dollar. 1. How can the Sports Exports Company use currency futures contra

> Bear Co. and Viking, Inc., are automobile manufacturers that desire to benefit from economies of scale. Bear has decided to establish distributorship subsidiaries in various countries, whereas Viking has decided to establish manufacturing subsidiaries in

> Packer, Inc., a U.S. producer of tablet computers, plans to establish a subsidiary in Mexico in an effort to penetrate the Mexican market. Packer’s executives believe that the Mexican peso’s value is relatively strong and will weaken against the dollar o

> Myzo Co. (based in the United States) sells basic household products that many other U.S. firms produce at the same quality level; these other U.S. firms have approximately the same production costs as Myzo. Myzo is considering DFI. It believes that the

> Trak Co. (of the United States) presently serves as a distributor of products by purchasing them from other U.S. firms and selling them in Japan. It wants to purchase a manufacturer in India that could produce similar products at a low cost (due to low l

> Decko Co. is a U.S. firm with a Chinese subsidiary that produces smartphones in China and sells them in Japan. This subsidiary pays its wages and its rent in Chinese yuan, which is stable relative to the dollar. The smartphones sold to Japan are denomina

> Friendly Stores, a U.S. retailer, has recognized numerous opportunities to expand in foreign countries and has assessed many foreign markets, including Brazil, Greece, Mexico, Portugal, Singapore, and Thailand. It has opened new stores in Europe, Asia, a

> Why would foreign governments provide MNCs with incentives to undertake DFI there?

> Once an MNC establishes a subsidiary, DFI remains an ongoing decision. What does this statement mean?

> What potential benefits do you think were most important in the decision of the Walt Disney Co. to build a theme park in France?

> Starter Corp. of New Haven, Connecticut, produces sportswear that is licensed by professional sports teams. It recently decided to expand in Europe. What are the potential benefits for this firm from using DFI?

> Blades, Inc. needs to order supplies two months ahead of the delivery date. It is considering an order from a Japanese supplier that requires a payment of 12.5 million yen payable as of the delivery date. Blades has two choices: Purchase two call option

> This chapter concentrates on possible benefits to a firm that increases its international business. a. What are some risks of international business that may not exist for local business? b. What does this chapter reveal about the relationship between an

> Describe some potential benefits to an MNC as a result of direct foreign investment (DFI). Elaborate on each type of benefit. Which motives for DFI do you think encouraged Nike to expand its footwear production in Latin America?

> Carlton Co. and Palmer, Inc., are U.S.- based MNCs with subsidiaries in Mexico that distribute medical supplies (produced in the United States) to customers throughout Latin America. Both subsidiaries purchase the products at cost and sell the products a

> Would a more established MNC or a less established MNC be better able to effectively hedge its given level of translation exposure? Why?

> Bartunek Co. is a U.S.-based MNC that has European subsidiaries and wants to hedge its translation exposure to fluctuations in the euro’s value. Explain some limitations when this MNC hedges translation exposure.

> Explain how a firm can hedge its translation exposure.

> Explain how a U.S.-based MNC’s consolidated earnings are affected by depreciation of foreign currencies.

> When an MNC restructures its operations to reduce its economic exposure, it may sometimes forgo economies of scale. Explain

> Albany Corp. is a U.S.-based MNC that has a large government contract with Australia. The contract will continue for several years and generate more than half of Albany’s total sales volume. The Australian government pays Albany in Australian dollars. Ap

> UVA Co. is a U.S.-based MNC that obtains 40 percent of its foreign supplies from Thailand. It also borrows Thailand’s currency (the baht) from Thai banks and converts the baht to dollars to support its U.S. operations. It currently receives about 10 perc

> Because the Sports Exports Company (a U.S. firm) receives payments in British pounds every month and converts those pounds into dollars, it needs to closely monitor the value of the British pound in the future. Jim Logan, owner of the Sports Exports Comp

> Nashville Co. presently incurs costs of approximately 12 million Australian dollars (A$) per year for research and development expenses in Australia. It sells the products that are designed each year, and all of the products sold each year are invoiced i

> Lola Co. (a U.S. firm) expects to receive 10 million euros in one year. It does not plan to hedge this transaction with a forward contract or other hedging techniques. This transaction is its only international business, and the firm is not exposed to an

> Laguna Co. (a U.S. firm) will be receiving 4 million British pounds in one year. It will need to make a payment of 3 million Polish zloty in one year. It has no other exchange rate risk at this time. However, it needs to buy supplies and can purchase the

> Clearlake, Inc., produces its products in its factory in Texas and exports most of the products to Mexico each month. The exports are denominated in pesos. Clearlake recognizes that hedging on a monthly basis does not really offer any protection against

> Alaska, Inc., plans to create and finance a subsidiary in Mexico that produces computer components at a low cost and exports them to other countries. It has no other international business. The subsidiary will produce computers and export them to Caribbe

> Nelson Co. is a U.S. firm with annual export sales to Singapore of about S$800 million. Its main competitor is Mez Co., also based in the United States, with a subsidiary in Singapore that generates about S$800 million in annual sales. Any earnings gener

> Colorado, Inc., is a U.S.-based MNC that obtains 10 percent of its supplies from European manufacturers. Sixty percent of its revenues are due to exports to Europe, where its products are invoiced in euros. Explain how Colorado can attempt to reduce its

> Assume that Suffolk Co. negotiated a forward contract to purchase 200,000 British pounds in 90 days. The 90-day forward rate was $1.40 per British pound. The pounds to be purchased were to be used to purchase British supplies. On the day the pounds were

> If hedging is expected to be more costly than not hedging, why would a firm even consider hedging?

> As the chief financial officer of Blades, Inc., Ben Holt is pleased that his current system of exporting “Speedos” to Thailand seems to be working well. Blades’ primary customer in Thailand, a retaile

> Assume that Loras Corp. imported goods from New Zealand and needs 100,000 New Zealand dollars 180 days from now. It is trying to determine whether to hedge this position. Loras has developed the following probability distribution for the New Zealand doll

> Explain how a U.S. corporation could hedge net receivables in Malaysian ringgit with a forward contract. Explain how a U.S. corporation could hedge payables in Canadian dollars with a forward contract.

> Grady Co. is a manufacturer of hockey equipment in Chicago, and it will need 3 million Swiss francs in one year to pay for imported supplies. The U.S. oneyear interest rate is 2 percent, versus 7 percent for Switzerland’s one-year interest rate. The spot

> Assume that the country of Dreeland has a currency (called the dree) that tends to move in tandem with the Chilean peso and is expected to continue to move in tandem with the Chilean peso in the future. Indianapolis Co., a U.S. firm, has a large amount o

> The one-year U.S. interest rate is presently higher than the Japanese interest rate. Assume a real rate of interest of 0 percent in each country. Assume that interest rate parity exists. You believe in purchasing power parity (PPP). You have receivables

> Today the spot rate of the euro is $1.20 and the oneyear forward rate is $1.16. A one-year call option on euros exists with a premium of $0.04 per unit and an exercise price of $1.17. You think the spot rate is the best forecast of future spot rates. You

> San Fran Co. imports products. It will pay 5 million Swiss francs for imports in one year. Mateo Co. will also pay 5 million Swiss francs for imports in one year. San Fran Co. and Mateo Co. will also need to pay 5 million Swiss francs for imports arrivin

> Rebel Co. (a U.S. firm) has a contract with the government of Spain and will receive payments of 10,000 euros in exchange for consulting services at the end of each of the next 10 years. The annualized interest rate in the United States is 6 percent rega

> Assume that interest rate parity exists. Today the one-year interest rate in Japan is the same as the one-yearinterest rate in the United States. You use the international Fisher effect when forecasting how exchange rates will change over the next year.

> Narto Co. (a U.S. firm) exports to Switzerland and expects to receive 500,000 Swiss francs in one year. The one-year U.S. interest rate is 5 percent when investing funds and 7 percent when borrowing funds. The one-year Swiss interest rate is 9 percent wh

> Each month, the Sports Exports Company (a U.S. firm) receives an order for footballs from a British sporting goods distributor. The monthly payment for the footballs is denominated in British pounds, as requested by the British distributor. Jim Logan, ow

> Assume that interest rate parity exists. The annualized interest rate is presently 5 percent in the United States for any term to maturity and is 13 percent in Mexico for any term to maturity. Dokar Co. (a U.S. firm) has an agreement under which it will

> Visor, Inc. (a U.S. firm), has agreed to purchase supplies from Argentina and will need 1 million Argentine pesos in one year. Interest rate parity presently exists. The annual interest rate in Argentina is 19 percent, versus 6 percent in the United Stat

> Explain how a U.S. corporation could hedge net receivables in euros with futures contracts. Explain how a U.S. corporation could hedge net payables in Japanese yen with futures contracts

> You own a U.S. exporting firm that will receive 10 million Swiss francs in one year. Assume that interest parity exists. Assume zero transaction costs. Today the oneyear interest rate in the United States is 7 percent, and the one-year interest rate in S

> Refer to the previous problem. Assume that Brooks believes the cost of a long straddle is too high. However, call options with an exercise price of $0.105 and a premium of $0.002 and put options with an exercise price of $0.09 and a premium of $0.001 are

> Brooks, Inc., imports wood from Morocco. The Moroccan exporter invoices these products in Moroccan dirham. The current exchange rate of the dirham is $0.10. Brooks just purchased wood for 2 million dirham and should pay for the wood in three months. It i

> Marson, Inc., has some customers in Canada and frequently receives payments denominated in Canadian dollars (C$). The current spot rate for the Canadian dollar is $0.75. Two call options on Canadian dollars are available. The first option has an exercise

> Evar Imports, Inc., buys chocolate from Switzerland and resells it in the United States. It just purchased chocolate invoiced at SF62,500; payment for the invoice is due in 30 days. Assume that the current exchange rate of the Swiss franc is $0.74. Also

> Assume interest rate parity exists. Today the one-year interest rate in Canada is the same as the one-year interest rate in the United States. Utah Co. uses the forward rate to forecast the future spot rate of the Canadian dollar that will exist in one y

> Red River Co. (a U.S. firm) purchases imports that have a price of 400,000 Singapore dollars; it has to pay for the imports in 90 days. The firm will use a 90-day forward contract to cover its payables. Assume that interest rate parity exists. This morni

> Ever since Jim Logan began his Sports Exports Company, he has been concerned about his exposure to exchange rate risk. The firm produces footballs and exports them to a distributor in the United Kingdom, with the exports being denominated in British poun

> Tampa Co. will build airplanes and export them to Mexico for delivery in three years. The total payment to be received in three years for these exports is 900 million pesos. Today the peso’s spot rate is $0.10. The annual U.S. interest rate is 4 percent,

> Denver Co. is about to order supplies from Canada that are denominated in Canadian dollars (C$). It has no other transactions in Canada and will not have any other transactions in the future. The supplies will arrive in one year, at which time payment wi

> Indiana Co. expects to receive 5 million euros in one year from exports, and it wants to consider hedging its exchange rate risk. The spot rate of the euro as of today is $1.10. Interest rate parity exists. Indiana Co. uses the forward rate as a predicto

> Why should an MNC identify net exposure before hedging?

> Virginia Co. has subsidiaries in both Hong Kong and Thailand. Assume that the Hong Kong dollar (HK$) is pegged at $0.13 per Hong Kong dollar and will remain pegged. The Thai baht fluctuates against the U.S. dollar and is presently worth $0.03. Virginia C

> You apply a regression model to annual data in which the annual percentage change in the British pound is the dependent variable, and INF (defined as annual U.S. inflation minus U.K. inflation) is the independent variable. A regression analysis produces

> Assume that Calumet Co. will receive 10 million pesos in 15 months. It does not have a relationship with a bank at this time and, therefore, cannot obtain a forward contract to hedge its receivables at this time. However, in three months, it will be able

> You believe that IRP presently exists. The nominal annual interest rate in Mexico is 14 percent, whereas the nominal annualinterest rate in the United States is 3 percent. You expect that annual inflation will be about 4 percent in Mexico and 5 percent i

> As treasurer of Tempe Corp., you are confronted with the following problem. Assume the one-year forward rate of the British pound is $1.59. You plan to receive 1 million pounds in one year. A one-year put option is available; it has an exercise price of

> If you were a U.S. importer of products from Europe, explain whether a weak U.S. economy would cause you to hedge your payables (denominated in euros) due a few months later if you expected that the weak economy would cause a major reduction in U.S. inte

> Recall from Chapter 20 that the new Thailand subsidiary of Blades, Inc., received a one-time order from a customer for 120,000 pairs of Speedos, Blades’ primary product. There is a six-month lag between the time when Blades needs funds to purchase materi

> SMU Corp. has future receivables of 4 million New Zealand dollars (NZ$) in one year. It must decide whether to use options or a money market hedge to hedge this position. Use any of the following information to make the decision. Verify your answer by de

> Assume that Carbondale Co. expects to receive S$500,000 in one year. The existing spot rate of the Singapore dollar is $0.60. The one-year forward rate of the Singapore dollar is $0.62. Carbondale created the following probability distribution for the fu

> Describe how a crisis in Asia could reduce the cash flows of a U.S. firm that exports products (denominated in U.S. dollars) to Asian countries. How could a U.S. firm that exports products (denominated in U.S. dollars) to Asia insulate itself from any cu

> Because Obisbo, Inc., conducts much business in Japan, it is likely to have cash flows in yen that will periodically be remitted by its Japanese subsidiary to the U.S. parent. What are the limitations of hedging these remittances one year in advance over

> Assume that Hampshire Co. has net payables of 200,000 Mexican pesos in 180 days. The Mexican interest rate is 7 percent over 180 days, and the spot rate of the Mexican peso is $0.10. Suggest how the U.S. firm could implement a money market hedge. Be prec

> St. Louis, Inc., which relies on exporting, denominates its exports in pesos and receives pesos every month. It expects the peso to weaken over time. St. Louis recognizes the limitations of monthly hedging. It also recognizes that it could eliminate its

> Wedco Technology of New Jersey exports plastics products to Europe. Wedco decided to price its exports in dollars. Telematics International, Inc. (of Florida), exports computer network systems to the United Kingdom (denominated in British pounds) and oth

> Malibu, Inc., is a U.S. company that imports British goods. It plans to use call options to hedge payables of 100,000 pounds in 90 days. Three call options are available that have an expiration date 90 days from now. Fill in the number of dollars needed

> Cornell Co. purchases computer chips denominated in euros on a monthly basis from a Dutch supplier. To hedge its exchange rate risk, this U.S. firm negotiates a three-month forward contract three months before the next order will arrive. In other words,

> Explain how a Malaysian firm can use the forward market to hedge periodic purchases of U.S. goods denominated in U.S. dollars. Explain how a French firm can use forward contracts to hedge periodic sales of goods to U.S. importers that are invoiced in dol

> At the current time, the Sports Exports Company focuses on producing footballs and exporting them to a distributor in the United Kingdom. The exports are denominated in British pounds. Jim Logan, the company’s owner, plans to develop other sporting goods

> During the Asian crisis, some local firms in Asia borrowed U.S. dollars rather than local currency to support their local operations. Why would they borrow dollars when they really needed their local currency to support operations? Why did this strategy

> Your firm exports goods to the United Kingdom, and you believe that today’s forward rate of the British pound substantially underestimates the future spot rate. Company policy requires you to hedge your British pound receivables in some way. Would a forw