Question: Steve Drake sells a rental house on

Steve Drake sells a rental house on January 1, 2016, and receives $120,000 cash and a note for $45,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $35,000. Steve’s original cost for the house was $180,000 and accumulated depreciation was $30,000 on the date of sale. He collects only the $120,000 down payment in the year of sale.

a. If Steve elects to recognize the total gain on the property in the year of sale, calculate the taxable gain.

b. Assuming Steve uses the installment sale method, complete Form 6252 for the year of the sale.

c. Assuming Steve collects $5,000 (not including interest) of the note principal in the year following the year of sale, calculate the amount of income recognized in that year under the installment sale method.

e/

Transcribed Image Text:

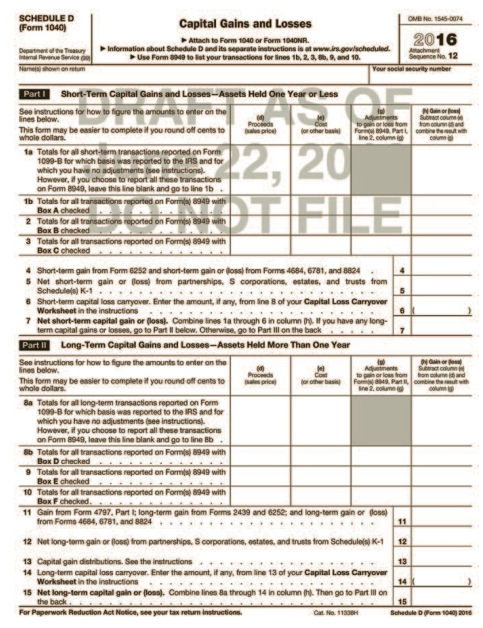

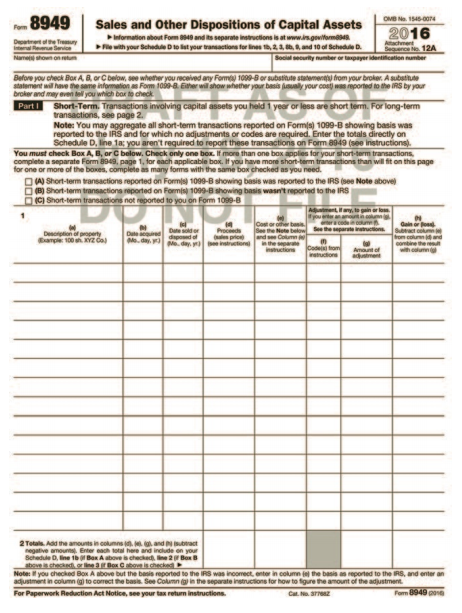

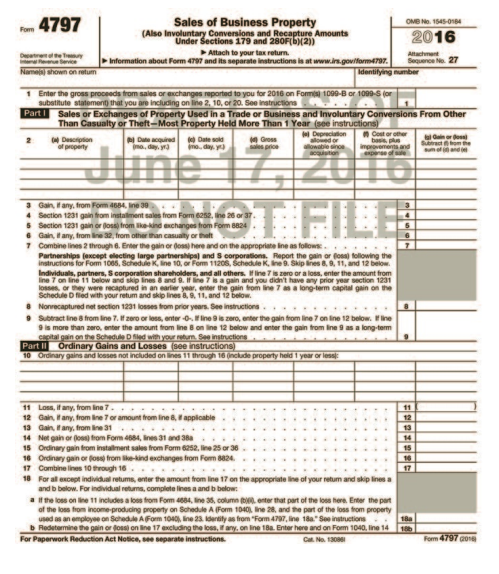

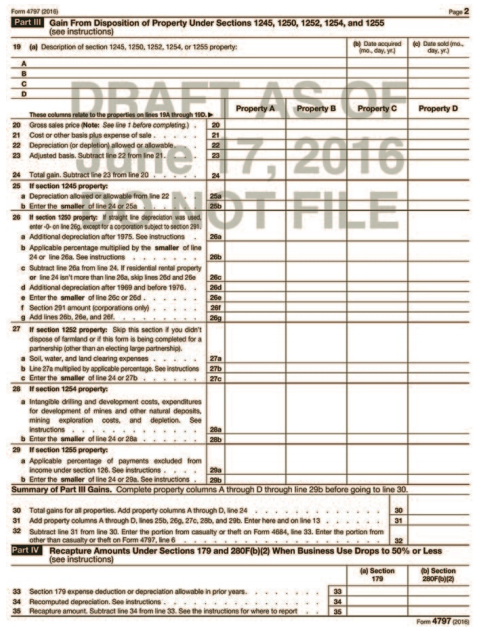

SCHEDULE D (Form 1040) OMB No. 1545-004 Capital Gains and Losses 2016 Attach to Form 1040 or Form 104ONR. Departnet oe Treuy Information about Schedule Dand its separate instructions is at www.irsgovischeduled. intemal Revenenice d Use Form 940 to ist your transactions for lines tb, 2.3, . 9, and 10. ceN 12 Namets shown on retum Your social soity umber OF 라2,120 ENDTIFILEI Part I Short-Term Capital Gains and Losses-Assets Held One Year or Less See instructions for how to figure the amounts to enter on the Gao atcolume colunn mbine thet colum ines below. rocs This form may be easier to complete it you round off cents to whole dollars. or oher bas Form 40, Part L ine 2. oolumn ig ales price 1a Totals for all short-tem transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this ine blank and go to line 1b. 1b Totals for all transactions reported on Form 8949 with Box A checked 2 Totals for all transactions reported on Forms 8949 with Box B checked Totals for all transactions reported on Forms) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 5 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedules) K-1 6 Short-term capital loss caryover. Enter the amount, if any, from ine 8 of your Capital Loss Carryover Worksheet in the instructions 7 Net short-term Capital Gain or (loss). Combine lines ta through 6 in column . t you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part Il on the back Part Long-Term Capital Gains and Losses-Assets Held More Than One Year See instructions for how to figure the amounts to enter on the ines below. Nan oo Procede mokum This form may be easier to complete it you round off cents to whole dollars. 8a Totals for all long-term transactions reported on Form 1099-B for which besis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b Totals for all transactions reported on Forms) 8949 with Box D checked .. Totals for all transactions reported on Forms) 8949 with Box E checked 10 Totals for all transactions reported on Forms) 8949 with Box F checked. 11 Gain from Form 4797, Part t long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 ... 11 12 Net long-term gain or (loss) trom partnerships, S corporations, estates, and trusts from Schedulels) K-1 12 13 Capital gain distributions. See the irstructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h. Then go to Part Il on the back. For Paperwork Reduction Act Notice, see your tax return instructions. 15 Cat. No. 11 Schedule DForm 1o) 201e Schedle DFom 1040) 2016 Part I Summary Page 2 16 Combine lines 7 and 15 and enter the result 16 F line 16 is a gain, enter the amount from line 16 on Form 1040, line 13, or Form 1040NR, line 14. Then go to ine 17 below. If ine 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete ine 22. If line 16 is zero, skip lines 17 through 21 below and enter -0- on Form 1040, line 13, or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? O Yes. Go to line 18. O No. Skip lines 18 through 21. and go to ine 22. me-22, 201 18 Enter the amount, if any, from line 7 of the 20% Rate Gain Worksheet in the instructions =DO NOTF 19 Enter the amount, line 18 of the Section 1250 Gain Worksheet in the instructions 20 Are lines 18 and 19 both zero or blank? O Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 104ONR, line 42). Don't complete lines 21 and 22 below. O No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 Fine 16 is a los, enter here and on Form 1040, line 13, or Form 104ONR, Iine 14, the smaller ot The loss on line 16 or *(53,000), or if mared fiing separately, 81,500) Note: When figuring which amount is amaller, treat both amounts as positive numbers. 22 Do you have qualfied dividends an Form 1040, Ine 9b, or Form 1040NR, ine 10b? O Yes. Complete the Qualified Dividends and Capital Gain Tax Workshoet in the instructions for Form 1040, ine 44 (or in the instructions for Form 104ONR, line 42). O No. Completo the rest of Form 1040 or Form 104ONR. Schedule Dom 104 2018 8949 OMB Na. 1545-004 Sales and Other Dispositions of Capital Assets 2016 formation about Fom 40 and its separate instructions is at www.sgewifomas Datree Tey Fie with your Schedule Dto lat your transactions for lines t, 21, , and 10 of Schedle D. Beparc 12A Social security mumber or tapayer identication number Name shown on retun Before you check BoxAB or C below, see whether you received any Form 1099-8 or substitute statement from your broker. A subattute statement wil have the same information as Form 1009-a. Eher wil show whether your basit broker and may even tell you which bar to check your cost) dto the RS by your Short-Term. Transactions involving capital assets you held 1 year or less are short term. For long-term transactions, see page 2. Note: You may aggregate all short-term transactions reported on Formis) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 1a; you aren't required to report these transactions on Fom 8949 (see instructions). You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions. complete a separate Form 8949, page 1, for each applicable box. It you have more short-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. OW Short-term transactions reported on Formis 1099-B showing basis was reported to the IRS (see Note abovel OB) Short-term transactions reported on Formis 1099-B showing basis wasn't reported to the IRS (C) Short-term transactions not reported to you on Form 1099-8 Part I Gan Intructions at u Pocd Deon of poperty ample 100 h. YZ da) Dute a ent 2 Totals. Add the amounts in columns i. , and Nbact negative amounts Enter each total here and indude on your Schedule D, line 1b Bax Aabove checked e 2BoxB above checked or line a Box Cabove is checked Note: you checked Box A above but the basis reported to the IRS was incomect, enter in column ie the basis as reported to the IRS, and enter an adjustment in column g to correct the basis. See Column gin the separate instructions for how to figure the amount of the adjustment. For Paperwork Reduction Act Notion, see your tax retun instructions. Cat. Narre Fam 8949 pone FomO po Aachme ence No 12A Nameshown ontum. Namend SSN ortpyerdeiction anet reuiedshown on other side Social security mumber ortapyer dentcation umber Before you check Box D, E, or Fbelow, see whether you received any Forms 1099-8 or substitute statementis from your broker. A subatitute statement will have the same information as Form 1099-B. Either wil show whether your basis usualy your cost was eported to the IRS by your broker and may even tel you which box to check Part I Long-Term. Transactions involving capital assets you held more than 1 year are long term. For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Forms) 1o99-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions You must check Box D, E, or Fbelow. Check only one box. If more than one boK applies for your long-term transactions, ocomplete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than wili fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. OD) Long-term transactions reported on Forms) 1099-B showing basis was reponed to the IRS (see Note above) (E) Long-term trarsactions reported on Formis) 1099-B showing basis wasn't reported to the IRS OA Long-term transactions not reported to you on Form 1099-B below Desoription of ample column atment 2Tota. Adhe amounts in coume. and t negative amoun Enterech total here and incude on your Schedule D. line b Box Dabove is checked. line BanE aboveis checked or ne 10 BonFabovechecked Note: you checked Box Dabove but the basis reported to the RS was incomect, enter in column e the basis as reported to the IRS, and enter an adjustment in column to corect the basis. See Column gin the separate instructions for how to figure the amount of the adjustment. Fam 8949 p0e Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2) OMB No. 1545-014 4797.haי 2016 Detree y Revenue Bervice Attach to your tax roturn. Information about Form 4797 and its separate instructions is at www.irs.goviform797. Altacte Seuerce 27 Namea) shown on retum Identifying numbe Enter the gross proceeds from sales or exchanges reported to you for 2016 on Forms 1099-B or 1099s (or subatitute statement) that you are including on line 2, 10, or 20. See instructions Part Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) Depreciation Date sold mo. day y n Cost or other basi p improvements and pene Ganode Date acquired Ima, day, yra Gross ales price 2 Descipton of property allowable since acquisition 3 Gain, fany, from Form 4684, Ine 39 4 Section 1231 gain from instalments 5 Section 1231 gain or Joss) from ike-ind echang 註 O from sthom Form 8824 6 Gan, any, from line 32, from other than casuality or thalt 7 Combine lines 2 through 6. Enter the gain or doss) here and on the appropriate ine as follows. Partnerships (except electing large partnershipal and S corporations. Report the gain or fosa following the instructions for Form 1005, Schedule K, ine 10, or Fom 11206, Schedule K, ine9. Skip ines 8,9, 11, and 12 below. Individuals, partners, S corporation shareholders, and all others. H line 7s zero or a loss, enter the amount from Ine 7 on line 11 below and skip lines 8 and 9. If line 7sa gain and you didn't have any prior year section 1231 losses, or they were recaptured in an earlier year,. enter the gain from ine 7 as a long-term capital gain on the Schedule D filed with your retum and skip lines 8,9. 11, and 12 below. 8 Nonrecaptured net section 1231 losses trom prior years. See instructions... • Subract ine 8 from line 7. f zero or less, enter -0.Fine 9 is zero, enter the gain from line 7 on line 12 below. Fine 9is more than zero, enter the amount from ine 8 on ine 12 below and enter the gain trom ine 9 as a long-term capital gain on the Schedule Dfiled with your returm. See instructions Part I Ordinary Gains and Losses (see instructions) 10 Ordinary gains and losses not included on lines 11 through 16 inckude property heid 1 year or less 11 Loss, if any, from ine 7. 12 Gain, Hany, from ine 7 or amount from ine 8, Fapplicable 13 Gain, any, from line 31 11 12 13 14 Net gain or loss) from Form 4684, ines 31 and 38a 15 Ordinary gain from instalment sales from Form 6252, line 25 or 36 16 Ordinary gain or foss) trom like-kind exchanges from Fom 8824. 14 15 16 17 Combine lines 10 trough 16. 17 18 For all except individual retums, enter the amount from line 17 on the appropriate ine of your retum and skip lines a and b below. For individual retums, complete lines a and b below: a the loss on line 11 includes a loss from Form 484, ine 36, column bn. enter that part of the loss here. Enter the part of the loss from income-producing property on Schedule A Form 1040). Ine 28, and the part of the loss from property used as an employee on Schedule A Form 1040, line 23. identity as from "Form 4797, ine 18a" See instructions. 18a b Redetermine the pain or foss) on line 17 excluding the loss, any, on ine 18a. Enter here and on Form 1040, line 14 18b For Paperwork Reduction Act Notice, see separate instructions. Ca. No. 13 Form 4797 go1a Fom 479 201 Page 2 Part II Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) NDate quad mo, day. e Date sold mo day, y) 19 Description of section 1245, 1250, 1252, 1254, or 1255 property: DRAET AS. OF fhe 7,2016 NOT FILE Property Property C Property D These columna relute to the properties on lines 1A through 190. 20 Gross sales price Note: See ine 1 before completing) 21 Cost or other basis plus expense of sale. 22 Depreciation (or depletion alowed or allowable. 23 Adjusted basis. Subtract ine 22 from Iine 21. 20 21 24 Total gain. Subtract line 23 from line 20 25 fsection 1246 property a Depreciation allowed or allowable from ine 22 b Enter the smaller of line 24 or 25a 26 section 1200 propertyaight ne depreciation was enter -0- on ine 26g except for a corporation subject to section 291. a Adstional depreciation after 1975. See instructions b Applicable percentage multiplied by the smaller of ine 26a 24 or line 26a. See instructions e Subtract line 26a from line 24. If residental rental property or ine 24 ian't more than line 20a, skip ines 2d and 20e d Addtional depreciation after 1969 and before 1976. • Enter the smaller of line 26c or 26d. I Section 201 amount corporations only 9 Add ines 26, 20e, and 20. 260 26d 26e 261 26g 27 f section 1252 property: Skip this section you didn't diepose of farmland ort this fom is being completed for a parnership (other than an electing large partnership. a Soll, water, and land clearing expenses. 27a D Line 27a multipled by applicable percentage. See instructions 27b 27 e Enter the smaller of line 24 or 276 28 section 1254 property: a Intangible driling and development costs, expenditures for development of mines and other natural deposits, mining exploration costs. and depletion. See Instructions b Enter the smaller of line 24 or 28a. 29 section 1256 property Applicable percentage of payments excluded from 28a 28b income under section 126. See instructions. b Enter the smaller of line 24 or 28a. See instructions Summary of Part III Gains. Complete property columns A through D through line 29b before going to line 30. 30 Total gains for all properties. Add property columne A through D, ine 24 31 Add property columns A through D, Ines 25b, 26g. 270, 28, and 296. Enter here and on line 13 32 Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, Ine 33. Enter the portion from other than casuaty or theft on Form 4797, Ine6 Part IV Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to 50% or Less 30 31 32 (see instructions) Section 179 Section 280F 33 Section 179 expense deduction or depreciation allowable in prior years. 34 Recomputed depreciation. See instructions. 35 Recapture amount. Subtract line 34 from line 33. See the instructions for where to report 33 34 35 Fom 4797 go1e

> For its current tax year, Ilex Corporation has ordinary income of $240,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporation’s tax liability for the current year.

> Ulmus Corporation has $1,230,000 in taxable income for the current tax year. Calculate the corporation’s income tax liability for the current tax year.

> On May 8, 2016, Holly purchased a residential apartment building. The cost basis assigned to the building is $800,000. Holly also owns another residential apartment building that she purchased on October 15, 2016, with a cost basis of $500,000. a. Calcul

> Quince Corporation has taxable income of $450,000 for its calendar tax year. Calculate the corporation’s income tax liability for the year before tax credits.

> Describe one advantage and one disadvantage of doing business as an LLC.

> Van makes an investment in a partnership in 2016. Van’s capital contributions to the partnership consisted of $30,000 cash and a building with an adjusted basis of $70,000, subject to a nonrecourse liability (seller financing) of $20,000. a. Calculate th

> Louise owns 45 percent of a partnership, and her brother owns the remaining 55 percent interest. During the current tax year, Louise sold a building to the partnership for $160,000 to be used for the partnership’s office. She had held the building for 3

> Quince Interests is a partnership with a tax year that ends on September 30, 2016. During that year, Potter, a partner, received $3,000 per month as a guaranteed payment, and his share of partnership income after guaranteed payments was $23,000. For Octo

> Walter receives cash of $18,000 and land with a fair market value of $75,000 (adjusted basis of $50,000) in a current distribution. His basis in his partnership is $16,000. a. What amount of gain must Walter recognize as a result of the current distribut

> L&J Interests is a partnership with two equal partners, Linda and Joanne. The partnership has income of $75,000 for the year before guaranteed payments. Guaranteed payments of $45,000 are paid to Linda during the year. Calculate the amount of income that

> Go to the IRS website (www.irs.gov) and print pages 1 and 2 of Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc. Review the different elements of income which must be passed through to each partner and be reported as separate

> Wilson has a 40 percent interest in the assets and income of the CC&W Partnership, and the basis in his partnership interest is $45,000 at the beginning of 2016. During 2016, the partnership’s net loss is $60,000 and Wilson’s share of the loss is $24,000

> Jay contributes property with a fair market value of $16,000 and an adjusted basis of $5,000 to a partnership in exchange for an 8 percent partnership interest. a. Calculate the amount of gain recognized by Jay as a result of the transfer of the property

> Mike purchases a heavy-duty truck (5-year class recovery property) for his delivery service on April 30, 2016. The truck is not considered a passenger automobile for purposes of the listed property and luxury automobile limitations. The truck has a depre

> Larry and Jessica form the L&J Partnership. Larry contributes property with an adjusted basis of $70,000, a fair market value of $200,000, and subject to a liability of $80,000 in exchange for a 40 percent interest in the partnership. Jessica receives a

> Elaine’s original basis in the Hornbeam Partnership was $30,000. Her share of the taxable income from the partnership since she purchased the interest has been $90,000, and Elaine has received $80,000 in cash distributions from the partnership. Elaine di

> Nan contributes property with an adjusted basis of $60,000 to a partnership. The property has a fair market value of $75,000 on the date of the contribution. What is the partnership’s basis in the property contributed by Nan?

> Hal, Steve, and Lew form a partnership to operate a grocery store. For each of the following contributions by the partners, indicate (1) the amount of income or gain recognized, if any, by the partner, and (2) the partner’s basis in the partnership int

> Debbie and Alan open a web-based bookstore together. They have been friends for so long that they start their business on a handshake after discussing how they will share both work and profits or losses from the business. Have Debbie and Alan formed a re

> Married taxpayers Otto and Ruth are both self-employed. Otto earns $352,000 of selfemployment income and Ruth has a self-employment loss of $13,500. How much Medicare surtax for high-income taxpayers will Otto and Ruth have to pay with their 2016 income

> Ann hires a nanny to watch her two children while she works at a local hospital. She pays the 19-year-old nanny $165 per week for 46 weeks during the current year. a. What is the employer’s portion of Social Security and Medicare tax for the nanny that A

> Sally hires a maid to work in her home for $260 per month. The maid is 25 years old and not related to Sally. During 2016, the maid worked 10 months for Sally. a. What is the amount of Social Security tax Sally must pay as the maid’s em

> Thomas is an employer with one employee, Sarah. Sarah’s wages are $19,450, and the state unemployment tax rate is 5.4 percent. Calculate the following amounts for Thomas: a. FUTA tax before the state tax credit b. State unemployment tax c. FUTA tax aft

> Stewart Beauf is a self-employed surfboard maker in 2016. His Schedule C net income is $115,000 for the year. He also has a part-time job and earns $9,100 in wages subject to FICA taxes. Calculate Stewart’s self-employment tax for 2016 using Schedule SE.

> Is it possible to depreciate a residential rental building when it is actually increasing in value? Why?

> Fly-By-Night (P.O. Box 1234, Dallas, TX 75221, EIN 12-9876543) paid George Smith, an employee who lives at 432 Second Street, Garland, TX 75040, wages of $24,300. The income tax withholding amounted to $5,320 and the FICA tax was $1,858.95 ($1,506.60 for

> Philcon Corporation (P.O. Box 4563, Anchorage, AK 99508; EIN 12-3456789) paid Louise Chugach, an employee who lives at 5471 East Tudor Road, Anchorage, AK 99508, wages of $124,554 in 2016. The income tax withholding for the year amounted to $16,050.40, a

> For each of the following payments, indicate the form that should be used to report the payment: a. Interest of $400 paid by a bank b. Payment of $400 in dividends by a corporation to a shareholder c. Periodic payments from a retirement plan d. Salary as

> Jan has two jobs during 2016. One employer withheld and paid Social Security taxes on $70,000 of Jan’s salary, and the other employer withheld and paid Social Security taxes on $49,500 in salary paid to Jan. Calculate the amount of Jan’s overpayment of S

> Yolanda earns $123,000 in 2016. Calculate the FICA tax that must be paid by: Yolanda: Social Security Medicare Yolanda's Employer: Social Security Medicare Total FICA Tax $-

> Jenny earns $44,500 in 2016. Calculate the FICA tax that must be paid by: Jenny: Social Security Medicare Jenny's Employer: Social Security Medicare $. Total FICA Tax $.

> Go to the IRS website (www.irs.gov) and redo Problem 5 using the most recent interactive Form 1040-ES. Print out the completed Form 1040-ES.

> Alice West (Social Security number 785-23-9873) lives at 13234 Madison Street, Milwaukee, WI 53214, and is self-employed for 2016. She estimates her required annual estimated tax payment for 2016 to be $6,816. She had a $576 overpayment of last year&acir

> Big Bull restaurant employs twenty-three employees who receive tips. During the current year, Big Bull has $410,000 in gross revenues, and its employees do not report any tip income. In what ways may the restaurant allocate the tip income to the employee

> Sophie is a single taxpayer. For the first payroll period in October 2016, she is paid wages of $3,280.50 monthly. Sophie claims three allowances on her Form W-4. a. Use the percentage method to calculate the amount of Sophie’s withholding for a monthly

> Is land allowed to be depreciated? Why or why not?

> Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph earns a total of $39,000 and estimates their itemized deductions to be $16,000 for the year. Kathy is not employed. Use Form W-4 to determine the number of withholding allowance

> Phan Mai is single with two dependent children under age 17. Phan estimates her wages for the year will be $36,000, will have $5,700 of dependent care expenses, and her itemized deductions will be $11,000. Assuming Phan files as head of household, use Fo

> Go to the IRS website (www.irs.gov) and redo Problem 7 using the most recent Form 6252, Installment Sale Income. Print out the completed Form 6252.

> On July 1, 2016, Ted, age 73 and single, sells his personal residence of the last 30 years for $368,000. Ted’s basis in his residence is $42,000. The expenses associated with the sale of his home total $22,000. On December 15, 2016, Ted purchases and occ

> Larry Gaines, a single taxpayer, age 42, sells his personal residence on November 12, 2016, for $148,000. He lived in the house for 7 years. The expenses of the sale are $9,000, and he has made capital improvements of $7,000. Larry’s cost basis in his re

> Teresa’s manufacturing plant is destroyed by fire. The plant has an adjusted basis of $270,000, and Teresa receives insurance proceeds of $410,000 for the loss. Teresa reinvests $420,000 in a replacement plant. a. Calculate Teresa’s recognized gain if sh

> Carey exchanges real estate for other real estate in a qualifying like-kind exchange. Carey’s basis in the real estate given up is $120,000, and the property has a fair market value of $165,000. In exchange for her property, Carey receives real estate wi

> Rebecca has a $6,400 casualty loss, before any limitations, as a result of the complete destruction of personal-use property. She also receives $1,200 of insurance proceeds for the destruction of a second item of personal-use property which was damaged i

> An office machine used by Josie in her accounting business was completely destroyed by fire. The adjusted basis of the machine was $8,000 (original basis of $14,000 less accumulated depreciation of $6,000). The machine was not insured. Calculate the amou

> William sold Section 1245 property for $25,000 in 2016. The property cost $37,000 when it was purchased 5 years ago. The depreciation claimed on the property was $17,000. a. Calculate the adjusted basis of the property. b. Calculate the recomputed basis

> Amy is a calendar-year taxpayer reporting on the cash basis. Please indicate how she should treat the following items for 2016: a. She makes a deductible contribution to an IRA on April 15, 2017. b. She has made an election to accrue the increase in va

> In 2016, Michael has net short-term capital losses of $1,500, a net long-term capital loss of $27,000, and other ordinary taxable income of $45,000. a. Calculate the amount of Michael’s deduction for capital losses for 2016. b. Calculate the amount and n

> 8. Elvin, a single taxpayer 45 years of age, sells his residence in 2016. He receives $35,000 in cash, and the buyer assumes his $100,000 mortgage. Elvin also pays $8,100 in commissions and transfer costs. a. Calculate the amount realized on the sale. b.

> Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $19,000 when purchased on July 1, 2014. Nadia has claimed $3,000 in depreciation and sells the asset for $13,000 with no selling costs. Sale of la

> Chrissy receives 200 shares of Chevron stock as a gift from her father. The stock cost her father $9,000 10 years ago and is worth $10,500 at the date of the gift. a. If the stock is sold for $12,500, calculate the amount of the gain or loss on the sale.

> Jocasta owns an apartment complex that she purchased 6 years ago for $750,000. Jocasta has made $60,000 of capital improvements on the complex, and her depreciation claimed on the building to date is $137,500. Calculate Jocasta’s adjusted basis in the bu

> Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2016 None of the stock is qualified small business stock. The stock basis was reported to the IRS. Calculate Charu’s net capital gain or loss

> During 2016, Tom sold Sears stock for $10,000. The stock was purchased 4 years ago for $13,000. Tom also sold Ford Motor Company bonds for $35,000. The bonds were purchased 2 months ago for $30,000. Home Depot stock, purchased 2 years ago for $1,000, was

> 1. Martin sells a stock investment for $26,000 on August 2, 2016. Martin’s adjusted basis in the stock is $15,000. a. If Martin acquired the stock on November 15, 2015, calculate the amount and the nature of the gain or loss. b. If Martin had acquired th

> JBC Corporation is owned 20 percent by John, 30 percent by Brian, 30 percent by Charlie, and 20 percent by Z Corporation. Z Corporation is owned 80 percent by John and 20 percent by an unrelated party. Brian and Charlie are brothers. Answer each of the f

> Geraldine is an accrual basis taxpayer who has the following transactions during the current calendar tax year: Accrued business income (except rent) …………………………………...$220,000 Accrued business expenses (except rent) …………………………………. 170,000 Rental income on

> Annie develops a successful tax practice. She sells the practice to her friend Carol for $54,000 and moves to Florida to retire. The tax practice has no assets except intangible benefits such as the goodwill and going-concern value Annie has developed ov

> Derek purchases a small business from Art on July 1, 2016. He paid the following amounts for the business: Fixed assets ………………………………. $220,000 Goodwill …………………………………... 50,000 Covenant not to compete …………... 55,000 Total ………………………………………. $325,00

> Deborah purchases a new $32,000 car in 2016 to use exclusively in her business. If Deborah does not elect to expense but does take bonus depreciation in 2016 and holds the car until it is fully depreciated, how many years will this take? Please show your

> Tom has a successful business with $100,000 of taxable income before the election to expense in 2016. He purchases one new asset in 2016, a new machine which is 7-year MACRS property and costs $25,000. If you are Tom’s tax advisor, how would you advise T

> Go to the IRS website (www.irs.gov) and assuming bonus depreciation is used, redo Problem 15, using the most recent interactive Form 4562, Depreciation and Amortization. Print out the completed Form 4562.

> During 2016, Palo Fiero purchases the following property for use in his calendar year-end manufacturing business: Palo uses the accelerated depreciation method under MACRS, if available, and does not make the election to expense or take bonus depreciat

> On September 14, 2016, Jay purchased a passenger automobile that is used 75 percent in his accounting business. The automobile has a basis for depreciation purposes of $43,000, and Jay uses the accelerated method under MACRS. Jay does not elect to expens

> On February 2, 2016, Alexandra purchases a personal computer for her home. The computer cost $2,800. Alexandra uses the computer 80 percent of the time in her accounting business, and the remaining 20 percent of the time for various personal uses. Calcul

> During 2016, William purchases the following capital assets for use in his catering business: New passenger automobile (September 30) ………. $21,500 Baking equipment (June 30) …………………………………6,500 Assume that William decides to use the election to expense

> The Au Natural Clothing Factory has changed its year-end from a calendar year-end to March 31, with permission from the IRS. The income for its short period from January 1 to March 31 is $24,000. Calculate the tax for this short period.

> Rocky Jackson, a friend of yours, just started a new job. He is attempting to fill out Form W-4 and has asked for your help. He would like to receive a large refund when he files his return and would therefore like to claim as few allowances as possible.

> Charlie’s Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2016 customer billings for lawn care into the next year. In addition, he is thinking about paying some of the bills in la

> 1. Jim has a house payment of $2,000 per month of which $1,700 is deductible interest and real estate taxes with the remaining $300 representing a repayment of the principal balance of the note. Jim’s marginal tax rate is 30 percent. What is Jim’s after-

> 1. Which of the following have privileged communication with a client in a noncriminal tax matter? a. CPAs b. Enrolled agents c. Attorneys d. a and c e. a, b, and c 2. The burden of proof remains on the taxpayer for corporations, trusts, and partnership

> 1. Which of the following is a responsibility of a local office of the IRS? a. Advising the Treasury Department on legislation b. Intelligence operations c. Appellate procedures d. Developing IRS rules and regulations e. None of the above 2. Which of th

> 1. Carl transfers land with a fair market value of $120,000 and basis of $30,000, to a new corporation in exchange for 85 percent of the corporation’s stock. The land is subject to a $40,000 liability, which the corporation assumes. What amount of gain m

> 1. Ironwood Corporation has ordinary taxable income of $40,000 in the current tax year, and a long-term capital loss of $20,000. What is the corporation’s tax liability for the current year? a. $4,500 d. $10,000 b. $6,000 e. None of the above c. $7,500

> 1. A loss from the sale or exchange of property will be disallowed in which of the following situations? a. A transaction between a partnership and a partner who owns 40 percent of the partnership capital b. A transaction between a partnership and a part

> 1. Which of the following is not a partnership for tax purposes? a. Willis and James purchase and operate a shoe store. b. Sharon and Gary operate an accounting practice together. c. Lillian and Don purchase real estate together as an investment, not as

> Calculate the following: a. The first year of depreciation on a residential rental building costing $200,000purchased June 2, 2016. b. The second year of depreciation on a computer costing $1,500 purchased in May 2015, using the half-year convention and

> Yolanda is a cash basis taxpayer with the following transactions during the year: Cash received from sales of products……………………………………. $66,000 Cash paid for expenses (except rent and interest) …………………...40,000 Rent prepaid on a leased building for 18 mon

> Calculate the amount of the child and dependent care credit allowed for 2016 in each of the following cases, assuming the taxpayers had no income other than the stated amounts. a. William and Carla file a joint tax return. Carla earned $26,000 during the

> What is the maximum investment income a taxpayer is allowed to have and still be allowed to claim the earned income credit? Please speculate as to why there is an investment income limit in the tax law.

> While preparing Massie Miller’s 2016 Schedule A, you review the following list of possible charitable deductions provided by Massie: Cash contribution to a family whose house burned down ………………………………. $1,000 Time while working as a volunteer at Food Ban

> In 2016, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade at the local high school. Gale and Cathy did not claim

> Margaret and David Simmons are married and file a joint income tax return. They have two dependent children, Margo, 5 years old (Social Security number 316-31-4890), and Daniel, who was born during the year (Social Security number 316-31-7894). Margaret’

> Your supervisor has asked you to research the following situation concerning Scott and Heather Moore. Scott and Heather are married and file a joint return. Scott works full-time as a wildlife biologist, and Heather is a full-time student enrolled at Onl

> 1.Which of the following is correct for Qualified Tuition Programs? a. Contributions are deductible, and qualified educational expense distributions are tax free. b. Contributions are not deductible, and qualified educational expense distributions are ta

> 1. Which of the following donations are not deductible as a charitable contribution? a. A donation of clothing to Goodwill Industries b. A cash contribution to a church c. A contribution of stock to a public university d. A contribution of a taxpayer’s t

> 1. The cost of which of the following expenses is not deductible as a medical expense on Schedule A, before the 10 percent of adjusted gross income limitation? a. A psychiatrist b. Botox treatment to reduce wrinkles around eyes c. Acupuncture d. Expense

> 1. In 2016, Irene, an unmarried individual, pays $6,500 in qualified adoption expenses to an adoption agency for the final adoption of an eligible child who is not a child with special needs. In the same year, the individual’s employer, under a qualified

> 1. The American Opportunity tax credit is 100 percent of the first of tuition and fees paid and 25 percent of the next . a. $600; $1,200 b. $1,100; $550 c. $2,000; $2,000 d. $1,100; $5,500 e. None of the above 2. Jane graduates from high school in June

> 1. Russ and Linda are married and file a joint tax return claiming their three children, ages 4, 7, and 18, as dependents. Their adjusted gross income for 2016 is $105,300. What is Russ and Linda’s total child credit for 2016? a. $600 b. $1,000 c. $2,000

> Steve and Sue are married with three dependent children. Their 2016 joint income tax return shows $389,000 of AGI and $60,000 of itemized deductions made up of $30,000 of state income taxes and $30,000 of charitable contributions. Calculate the following

> In 2016, Van receives $20,000 (of which $4,000 is earnings) from a qualified tuition program. He uses the funds to pay for his college tuition and other qualified higher education expenses. How much of the $20,000 is taxable to Van?

> Jose paid the following amounts for his son to attend Big State University in 2016: Tuition ……………………………………. $6,400 Room and board………………………. 4,900 Books………………………………………….967 A car to use at school…………………1,932 Student football tickets………………...237 Spending

> Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2016, Diane’s wages are $17,700 and she receives dividend income of $700. Calculate Diane’s earned income credit us

> Josh is a judge employed by the county. He must purchase and maintain his judicial robes. The total cost of purchasing a new robe and dry cleaning for the current year is $750, which is not reimbursed by his employer. How much may he deduct on his tax re

> George is employed as a sales manager for a computer manufacturer. His employer does not have an accountable expense reimbursement plan. George is reimbursed by his employer for $3,000 of travel expenses. How will the travel expenses and reimbursement be

> During the 2016 tax year, Irma incurred the following expenses: Union dues……………………â

> Jim is fired from his job as a waiter and decides to take an extended trip to Europe. After touring Europe for 3 months, Jim returns to look for a new job as a waiter. Are his job-hunting expenses deductible for 2016? Please explain:

> Dan has a 20-year-old vintage car behind his residence. He has rarely used it. This year he discovers that it has been completely destroyed by rust. The car originally cost $5,000 and had a fair market value of that amount before the rust destroyed it. D

> Kerry’s car is totaled in an auto accident. The car originally cost $18,000, but is worth $7,500 at the time of the accident. Kerry’s insurance company gives her a check for $7,500. Kerry has $30,000 of adjusted gross income. How much can Kerry claim as