Question: Stuart Company issued bonds with a $150,

Stuart Company issued bonds with a $150,000 face value on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a five-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 103. The straight line method is used for amortization.

Required:

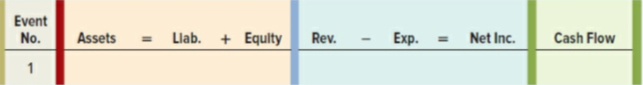

a. Use a financial statements model like the one shown next to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the premium and the cash payment, affect the company’s financial statements. Use + for increase, − for decrease, and NA for not affected.

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Transcribed Image Text:

Event No. Assets Llab. + Equlty Rev. Еxp. Net Inc. Cash Flow %3D 1

> The number and frequency of Atlantic hurricanes annually from 1940 through 2012 is shown here.Number _________Frequency0 …………………………………………. 51 …………………………………………. 162 …………………………………………. 193 …………………………………………. 144 …………………………………………. 35 …………………………………………. 56 …………

> Suppose that a company offers quantity discounts. If up to 1000 units are purchased, the unit price is $10; if more than 1000 and up to 5000 units are purchased, the unit price is $9; and if more than 5000 units are purchased, the unit price is $7.50. De

> A financial consultant has an average of 7 customers he consults with each day, which are assumed to be Poisson distributed. The consultant’s overhead requires that he consult with at least 5 customers in order that fees cover expenses. Find the probabil

> A telephone call center where people place marketing calls to customers has a probability of success of 0.08. The manager is very harsh on those who do not get a sufficient number of successful calls. Find the number of calls needed to ensure that there

> A popular resort hotel has 300 rooms and is usually fully booked. About 6% of the time a reservation is canceled before the 6:00 p.m. deadline with no penalty. What is the probability that at least 280 rooms will be occupied? Use the binomial distributio

> During 1 year, a particular mutual fund has outperformed the S&P 500 index 33 out of 52 weeks. Find the probability that this performance or better would happen again

> If a cell phone company conducted a telemarketing campaign to generate new clients and the probability of successfully gaining a new customer was 0.07, what is the probability that contacting 50 potential customers would result in at least 5 new customer

> The Excel file Call Center Data shows that in a sample of 70 individuals, 27 had prior call center experience. If we assume that the probability that any potential hire will also have experience with a probability of 27/70, what is the probability that a

> An airline tracks data on its flight arrivals. Over the past 6 months, 50 flights on one route arrived early, 150 arrived on time, 25 were late, and 45 were canceled.a. What is the probability that a flight is early? On time? Late? Canceled?b. Are these

> Students in the new MBA class at a state university has the following specialization profile:Finance—67Marketing—45Operations and Supply Chain Management—51Information Systems—18Find the probability that a student is either a finance or marketing major.

> Roulette is played at a table similar to the one in Figure 5.36. A wheel with the numbers 1 through 36 (evenly distributed with the colors red and black) and two green numbers 0 and 00 rotates in a shallow bowl with a curved wall. A small ball is spun on

> Refer to the coin scenario described in Problem 3.a. Let A be the event “exactly 2 heads.” Find P(A).b. Let B be the event “at most 1 head.” Find P(B).c. Let C be the event “at least 2 heads.” Find P(C).d. Are the events A and B mutually exclusive? Find

> Use INDEX and MATCH functions to fill in a table that extracts the amounts shipped between each pair of cities in the Excel file General Appliance Corporation. Your table should display as follows, and the formula for the amount should reference the name

> The Excel file Science and Engineering Jobs shows the number of jobs in thousands in the year 2000 and projections for 2010 from a government study. Use the Excel file to compute the projected increase from the 2000 baseline and also the percentage incre

> On October 1, Year 1, Nicholes Corporation declared a $50,000 cash dividend to be paid on December 15 to shareholders of record on November 1. Required: a. Record the events occurring on October 1, November 1, and December 15 in a horizontal statements

> Rice Corporation issued 10,000 shares of no-par common stock for $25 per share. Rice also issued 3,000 shares of $40 par, 6 percent noncumulative preferred stock at $42 per share. Required: a. Record these events in a horizontal statements model like th

> Cascade Industries has the following account balances: The company wishes to raise $50,000 in cash and is considering two financing options: Cascade can sell $50,000 of bonds payable, or it can issue additional common stock for $50,000. To help in the

> The following information is available for three companies: Required: a. Determine the annual before-tax interest cost for each company in dollars. b. Determine the annual after tax interest cost for each company in dollars. c. Determine the annual aft

> On January 1, Year 1, Wright and Associates issued bonds with a face value of $800,000, a stated rate of interest of 8 percent, and a 20-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9

> On January 1, Year 1, Reese Incorporated issued bonds with a face value of $120,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 7 p

> On January 1, Year 1, Omega Company issued bonds with a face value of $200,000, a stated rate of interest of 6 percent, and a 10-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 5 percent

> On January 1, Year 1, Valley Enterprises issued bonds with a face value of $60,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 pe

> On January 1, Year 1, Seaside Condo Association issued bonds with a face value of $250,000, a stated rate of interest of 8 percent, and a 10-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest wa

> On January 1, Year 1, Chen Company issued $300,000 of five-year, 6 percent bonds at 101. Interest is payable annually on December 31. The premium is amortized using the straight-line method. Required: Prepare the journal entries to record the bond trans

> Listed here are the stockholders’ equity sections of three public companies for years ending in 2015 and 2016: Required: a. Divide the class in three sections and divide each section into groups of three to five students. Assign each

> Ramsey Company issued bonds of $300,000 face value on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a 10-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 101½.

> On January 1, Year 1, Files Co. issued $400,000 of five-year, 6 percent bonds at 97. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Required: Prepare the journal entries to record the bond transact

> Dixon Construction, Inc. issued $300,000 of 10-year, 6 percent bonds on July 1, Year 1, at 96. Interest is payable in cash semiannually on June 30 and December 31. Dixon uses the straight-line method of amortization. Required: a. Prepare the journal ent

> Frey Company issued bonds of $300,000 face value on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a 10-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. Frey uses the stra

> The following information pertains to Ming Corp. at January 1, Year 1: Ming Corp. completed the following transactions during Year 1: 1. Issued 2,000 shares of $10 par common stock for $16 per share. 2. Repurchased 500 shares of its own common stock fo

> Earles Corporation repurchased 4,000 shares of its own stock for $30 per share. The stock has a par value of $10 per share. A month later, Earles resold 2,500 shares of the treasury stock for $35 per share. Required: a. Record the two events in general

> Carroll Corporation was formed when it issued shares of common stock to two of its shareholders. Carroll issued 10,000 shares of $5 par common stock to R. Flowler in exchange for $80,000 cash (the issue price was $8 per share). Carroll also issued 3,500

> Compute the cash proceeds from bond issues under the following terms. For each case, indicate whether the bonds sold at a premium or discount: a. Hett, Inc. issued $400,000 of 8-year, 8 percent bonds at 101. b. Holt Co. issued $250,000 of 4-year, 6 perce

> Jupiter Co. issued bonds with a face value of $150,000 on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a five-year term. The bonds were issued at face value. Required: a. What total amount of interest will Jupiter pay in Year

> Tyler Co. issued $250,000 of 6 percent, 10-year, callable bonds on January 1, Year 1, at their face value. The call premium was 2 percent (bonds are callable at 102). Interest was payable annually on December 31. The bonds were called on December 31, Yea

> Interest rates in the United States were at historic lows for much of the period from 2013 through 2016. The economy was slowly recovering from the recession of 2008 and 2009, and the Federal Reserve kept interest rates low to encourage this recovery. Be

> On January 1, Year 1, Hazman Corp. issued $200,000 of 10year, 6 percent bonds at their face value. Interest is payable on December 31 of each year with the first payment due December 31, Year 1. Required: Prepare all the general journal entries related

> Pluto Company issued $300,000 of 20-year, 6 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Pluto immediately invested the proceeds from the bond issue in land. The land wa

> Colson Company has a line of credit with Federal Bank. Colson can borrow up to $800,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed an

> A partial amortization schedule for a five-year note payable that Mercury Co. issued on January 1, Year 1, is shown next: Required: a. What rate of interest is Mercury Co. paying on the note? b. Using a financial statements model like the one shown nex

> Lek Hood started a business by issuing a $70,000 face-value note to State National Bank on January 1, Year 1. The note had a 6 percent annual rate of interest and a 10-year term. Payments of $9,581 are to be made each December 31 for 10 years. Required:

> An accountant for Southern Manufacturing Companies (SMC) computed the following information by making comparisons between SMC’s Year 1 and Year 2 balance sheets. Further information was determined by examining the company’s Year 2 income statement. 1. Th

> On January 1, Year 1, the Christie Companies issued bonds with a face value of $500,000, a stated rate of interest of 10 percent, and a 20-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was

> On January 1, Year 1, Hart Company issued bonds with a face value of $150,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 7 percent

> On January 1, Year 1, Young Company issued bonds with a face value of $300,000, a stated rate of interest of 7 percent, and a 10-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 6 percent

> On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percen

> Dana Harbert recently started a very successful small business. Indeed, the business had grown so rapidly that she was no longer able to finance its operations by investing her own resources in the business. She needed additional capital but had no more

> On January 1, Year 1, the Diamond Association issued bonds with a face value of $300,000, a stated rate of interest of 6 percent, and a 10-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was

> On January 1, Year 1, Sayers Company issued $280,000 of five-year, 6 percent bonds at 102. Interest is payable semiannually on June 30 and December 31. The premium is amortized using the straight-line method. Required: Prepare the journal entries to rec

> On January 1, Year 1, Price Co. issued $190,000 of five-year, 6 percent bonds at 96½. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Required: Prepare the journal entries to record the bond transac

> The Square Foot Grill, Inc. issued $200,000 of 10-year, 6 percent bonds on July 1, Year 1, at 102. Interest is payable in cash semiannually on June 30 and December 31. The straight-line method is used for amortization. Required: a. Prepare the journal e

> Diaz Company issued bonds with a $180,000 face value on January 1, Year 1. The bonds had a 7 percent stated rate of interest and a five-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. The straight

> The following information pertains to JAE Corp. at January 1, Year 1: JAE Corp. completed the following transactions during Year 1: 1. Issued 3,000 shares of $10 par common stock for $25 per share. 2. Repurchased 500 shares of its own common stock for

> A sole proprietorship was started on January 1, Year 1, when it received $60,000 cash from Marlin Jones, the owner. During Year 1, the company earned $35,300 in cash revenues and paid $16,200 in cash expenses. Jones withdrew $1,000 cash from the business

> Tom Yuppy, a wealthy investor, exchanged a plot of land that originally cost him $25,000 for 1,000 shares of $10 par common stock issued to him by Leuig Corp. On the same date, Leuig Corp. issued an additional 2,000 shares of stock to Yuppy for $25 per s

> Compute the cash proceeds from bond issues under the following terms. For each case, indicate whether the bonds sold at a premium or discount: a. Pear, Inc. issued $400,000 of 10-year, 8 percent bonds at 103. b. Apple, Inc. issued $200,000 of five-year,

> Mack Company plans to invest $50,000 in land that will produce annual rent revenue equal to 15 percent of the investment, starting on January 1, 2016. The revenue will be collected in cash at the end of each year, starting December 31, 2016. Mack can obt

> Milan Company issued bonds with a face value of $200,000 on January 1, Year 1. The bonds had a 7 percent stated rate of interest and a six-year term. The bonds were issued at face value. Interest is payable on an annual basis. Required: Write a memo exp

> Nivan Co. issued $500,000 of 5 percent, 10-year, callable bonds on January 1, Year 1, at their face value. The call premium was 3 percent (bonds are callable at 103). Interest was payable annually on December 31. The bonds were called on December 31, Yea

> On January 1, Year 1, Bell Corp. issued $180,000 of 10-year, 6 percent bonds at their face amount. Interest is payable on December 31 of each year with the first payment due December 31, Year 1. Required: Prepare all the general journal entries related

> Doyle Company issued $500,000 of 10-year, 7 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land wa

> Singer Company has a line of credit with United Bank. Singer can borrow up to $400,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and

> A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next: Required: a. Using a financial statements model like the one shown next, record the appropriate amounts for the following two events: (1) January 1,

> Dan Dayle started a business by issuing an $80,000 face-value note to First State Bank on January 1, Year 1. The note had an 8 percent annual rate of interest and a five-year term. Payments of $20,037 are to be made each December 31 for five years. Requ

> On January 1, Year 1, Beatie Co. borrowed $200,000 cash from Central Bank by issuing a five year, 6 percent note. The principal and interest are to be paid by making annual payments in the amount of $47,479. Payments are to be made December 31 of each ye

> Compute the specified ratios using Duluth Company’s balance sheet for Year 3: The average number of common stock shares outstanding during Year 3 was 880 shares. Net income for the year was $40,000. Required: Compute each of the foll

> During Year 3, Blue Ridge Corporation reported after-tax net income of $4,150,000. During the year, the number of shares of stock outstanding remained constant at 15,000 of $100 par, 9 percent preferred stock and 400,000 shares of common stock. The compa

> The following data are for the 2016 fiscal year of Alphabet, Inc., which is the parent company of Google, Inc., and Facebook, Inc. All dollar amounts are in thousands. Required: a. Calculate the EBIT for each company. b. Calculate each companyâ&#

> The December 31, Year 4, balance sheet for Burdette Corporation is presented here. These are the only accounts on Burdette’s balance sheet. Amounts indicated by question marks (?) can be calculated using the following additional informa

> On June 30, Year 3, Franza Company’s total current assets were $900,000 and its total current liabilities were $360,000. On July 1, Year 3, Franza issued a short-term note to a bank for $72,000 cash. Required: a. Compute Franza’s working capital before

> Income statements for Burch Company for Year 3 and Year 4 follow: Required: Round all percentages to one decimal point. a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Per

> On January 1, Year 1, Bacco Company had a balance of $72,350 in its Delivery Equipment account. During Year 1, Bacco purchased delivery equipment that cost $22,100. The balance in the Delivery Equipment account on December 31, Year 1, was $69,400. The Ye

> On January 1, Year 1, Shelton Company had a balance of $325,000 in its Land account. During Year 1, Shelton sold land that had cost $106,500 for $132,000 cash. The balance in the Land account on December 31, Year 1, was $285,000. Required: a. Determine

> The following accounts and corresponding balances were drawn from Jogger Company’s Year 2 and Year 1 year-end balance sheets: The Year 2 income statement is shown next: Required: a. Prepare the operating activities section of the st

> Expert Electronics, Inc. (EEI) recognized $3,800 of sales revenue on account and collected $2,100 of cash from accounts receivable. Further, EEI recognized $900 of operating expenses on account and paid $700 cash as partial settlement of accounts payable

> The following accounts and corresponding balances were drawn from Marinelli Company’s Year 2 and Year 1 year-end balance sheets: The Year 2 income statement is shown next: Required: a. Use the direct method to compute the amount of c

> The following accounts and corresponding balances were drawn from Avia Company’s Year 2 and Year 1 year-end balance sheets: During the year, $46,000 of unearned revenue was recognized as having been earned. Rent expense for Year 2 was

> Shim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shim’s Year 2 and Year 1 yearend balance sheets: The income statement reported a $1,500 gai

> Bojangels’, Inc. operates Cajun-themed fast-food restaurants. As of December 25, 2016, Bojangels’ had 309 company operated restaurants and 404 domestic franchised restaurants located in 11 states, and 3 franchised rest

> Alfonza Incorporated presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from the company’s Year 2 and Year 1 year-end balance sheets: The Year 2 income statemen

> The following accounts and corresponding balances were drawn from Dexter Company’s Year 2 and Year 1 year-end balance sheets: Other information drawn from the accounting records: 1. Dividends paid during the period amounted to $50,000

> On January 1, Year 1, Hardy Company had a balance of $150,000 in its Common Stock account. During Year 1, Hardy paid $20,000 to purchase treasury stock. Treasury stock is accounted for using the cost method. The balance in the Common Stock account on Dec

> On January 1, Year 1, DIBA Company had a balance of $450,000 in its Bonds Payable account. During Year 1, DIBA issued bonds with a $200,000 face value. There was no premium or discount associated with the bond issue. The balance in the Bonds Payable acco

> The following accounts and corresponding balances were drawn from Delsey Company’s Year 2 and Year 1 year-end balance sheets: Other information drawn from the accounting records: 1. Delsey incurred a $6,000 loss on the sale of investm

> Eastport Inc. was organized on June 5, Year 1. It was authorized to issue 300,000 shares of $10 par common stock and 50,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $50 per share. The following stock

> When Crossett Corporation was organized in January Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earnings history is as follows: Year 1, net loss of $35,000; Ye

> The stockholders’ equity section of Creighton Company’s balance sheet is shown as follows: Required: a. Assuming the preferred stock was originally issued for cash, determine the amount of cash that was collected whe

> Enscoe Enterprises, Inc. (EEI) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of treasury stock. At this point, EEI has $780,000 of assets. $180,000 liabilities, $360,000 of common stock, and $240,000 of retained earnings. Furthe

> Faith Busby and Jeremy Beatty started the B&B partnership on January 1, Year 1. The business acquired $44,000 cash from Busby and $66,000 from Beatty. During Year 1, the partnership earned $42,000 in cash revenues and paid $18,400 for cash expenses. Busb

> Advance Auto Parts, Inc. is “a leading automotive aftermarket parts provider in North America. We were founded in 1929 as Advance Stores Company. As of January 2, 2016, we operated 5,171 total stores and 122 branches primarily under the

> Write a memo explaining why one company’s P/E ratio may be higher than another company’s P/E ratio.

> Lake Inc. and River, Inc. reported net incomes of $800,000 and $1,000,000, respectively, for the most recent fiscal year. Both companies had 200,000 shares of common stock issued and outstanding. The market price per share of Lake’s stock was $50, while

> Discount Drugs (one of the three largest drug makers) just reported that its Year 2 third-quarter profits are essentially the same as the Year 1 third-quarter profits. In addition to this announcement, the same day, Discount Drugs also announced that the

> On May 1, Year 1, Love Corporation declared a $50,000 cash dividend to be paid on May 31 to shareholders of record on May 15. Required: a. Record the events occurring on May 1, May 15, and May 31 in a horizontal statements model like the following one.

> What is the concept of financial leverage?

> Does depreciation expense affect net cash flow? Explain.

> What is the difference between return on investment and return on equity?

> What is the function of the stock certificate?

> What environmental factors must be considered in analyzing companies?

> What is meant by the phrase separate legal entity? To which type of business organization does it apply?