Question: T J International was founded in 1969

T J International was founded in 1969 as Trus Joist International. The firm, a manufacturer of specialty building products, has its headquarters in Boise, Idaho. The company, through its partnership in the Trus Joist MacMillan joint venture, develops and manufactures engineered lumber. This product is a high- quality substitute for structural lumber, and uses lower-grade wood and materials formerly considered waste. The company also is majority owner of the Outlook Window Partnership, which is a consortium of three wood and vinyl window manufacturers.

Following is T J International’s adapted income statement and information concerning inventories from its annual report.

T J International

Sales …………………………………………………………….. $618,876,000

Cost of goods sold …………………………………………… 475,476,000

Gross profit ……………………………………………………. 143,400,000

Selling and administrative expenses ………………….. 102,112,000

Income from operations ……………………………………. 41,288,000

Other expense …………………………………………………… 24,712,000

Income before income tax …………………………………. 16,576,000

Income taxes …………………………………………………….. 7,728,000

Net income ……………………………………………………. $ 8,848,000

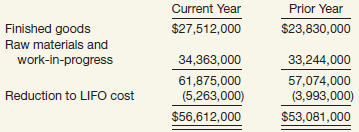

Inventories. Inventories are valued at the lower of cost or market and include material, labor, and production overhead costs. Inventories consisted of the following:

The last-in, first-out (LIFO) method is used for determining the cost of lumber, veneer, Microllam lumber, TJI joists, and open web joists. Approximately 35 percent of total inventories at the end of the current year were valued using the LIFO method. The first-in, first-out (FIFO) method is used to determine the cost of all other inventories.

Instructions

(a) How much would income before taxes have been if FIFO costing had been used to value all inventories?

(b) If the income tax rate is 46.6%, what would income tax have been if FIFO costing had been used to value all inventories? In your opinion, is this difference in net income between the two methods material? Explain.

(c) Does the use of a different costing system for different types of inventory mean that there is a different physical flow of goods among the different types of inventory? Explain.

Transcribed Image Text:

Current Year Prior Year Finished goods $27,512,000 $23,830,000 Raw materials and work-in-progress 34,363,000 33,244,000 61,875,000 57,074,000 Reduction to LIFO cost (5,263,000) (3,993,000) $56,612,000 $53,081,000

> Dover Company began operations in 2012 and determined its ending inventory at cost and at lower-of-cost-or-market at December 31, 2012, and December 31, 2013. This information is presented below. Instructions (a) Prepare the journal entries required at

> Lyle O’Keefe invests $30,000 at 8% annual interest, leaving the money invested without withdrawing any of the interest for 8 years. At the end of the 8 years, Lyle withdrew the accumulated amount of money. Instructions (a) Compute the amount Lyle would

> In addition to the list of topics identified in footnote 1 on page 310, identify three areas in which present value is used as a measurement basis. Briefly describe one topic related to: (a) Assets. (b) Liabilities. (c) Revenues or expenses.

> Sedato Company follows the practice of pricing its inventory at the lower-of-cost-or-market, on an individual-item basis. Instructions From the information above, determine the amount of Sedato Company’s inventory. Cost Cost of Co

> Riegel Company uses the lower-of-cost-or-market method, on an individual-item basis, in pricing its inventory items. The inventory at December 31, 2013, consists of products D, E, F, G, H, and I. Relevant per-unit data for these products appear below.

> The inventory of Oheto Company on December 31, 2013, consists of the following items. Instructions (a) Determine the inventory as of December 31, 2013, by the lower-of-cost-or-market method, applying this method directly to each item. (b) Determine the

> Mueller Ltd., a local retailing concern in the Bronx, N.Y., has decided to change from the conventional retail inventory method to the LIFO retail method starting on January 1, 2013. The company recomputed its ending inventory for 2012 in accordance with

> Springsteen Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2011. At that time the inventory had a cost of $54,000 and a retail price of $100,000. The following information is available. The price index at January 1, 201

> Mander Corporation began operations on January 1, 2012, with a beginning inventory of $34,300 at cost and $50,000 at retail. The following information relates to 2012. ______________________________Retail Net purchases ($108,500 at cost) ………………. $150,000

> Presented below is information related to Atrium Corporation. Instructions Compute the ending inventory under the dollar-value LIFO method at December 31, 2013. The cost-to-retail ratio for 2013 was 55%. Price LIFO Index Cost Retail Inventory on De

> You assemble the following information for Dillon Department Store, which computes its inventory under the dollar-value LIFO method. Instructions Compute the cost of the inventory on December 31, 2012, assuming that the inventory at retail is (a) $294,

> Robinson Company began operations late in 2012 and adopted the conventional retail inventory method. Because there was no beginning inventory for 2012 and no markdowns during 2012, the ending inventory for 2012 was $14,000 under both the conventional ret

> Brewster Company began operations on January 1, 2012, adopting the conventional retail inventory system. None of the company’s merchandise was marked down in 2012 and, because there was no beginning inventory, its ending inventory for 2

> Assuming the same facts as those in E6-18 except that the payments must begin now and be made on the first day of each of the 15 years, what payment method would you recommend? In E6-18 Assume that Sonic Foundry Corporation has a contractual debt outsta

> The financial statements of General Mills, Inc.’s 2010 annual report disclose the following information. Instructions Compute General Mills’s (a) Inventory turnover and (b) The average days to sell inventory for 2010

> The records of Mandy’s Boutique report the following data for the month of April. Instructions Compute the ending inventory by the conventional retail inventory method. $95,000 Purchases (at cost) Purchases (at sales price) Purcha

> Presented below is information related to Kuchinsky Company. Instructions Compute the inventory by the conventional retail inventory method. Cost Retail $ 200,000 $ 280,000 2,140,000 95,000 15,000 Beginning inventory Purchases 1,425,000 Markups Mar

> Presented below is information related to McKenna Company. Instructions (a) Compute the ending inventory at retail. (b) Compute a cost-to-retail percentage (round to two decimals) under the following conditions. (1) Excluding both markups and markdowns

> Presented below is information related to Jerrold Corporation for the current year. Instructions Compute the ending inventory, assuming that (a) Gross profit is 40% of sales; (b) Gross profit is 60% of cost; (c) Gross profit is 35% of sales; and (d) Gr

> Sliver Lumber Company handles three principal lines of merchandise with these varying rates of gross profit on cost. Lumber ………………&aci

> You are called by Kevin Garnett of Celtic Co. on July 16 and asked to prepare a claim for insurance as a result of a theft that took place the night before. You suggest that an inventory be taken immediately. The following data are available. Inventory,

> Fosbre Corporation’s April 30 inventory was destroyed by fire. January 1 inventory was $150,000, and purchases for January through April totaled $500,000. Sales for the same period were $700,000. Fosbre’s normal gross profit percentage is 35% on sales. U

> In its 2010 annual report, Wal-Mart reported inventory of $33,160 million on January 31, 2010, and $34,511 million on January 31, 2009, cost of sales of $304,657 million for fiscal year 2010, and net sales of $405,046 million. Compute Wal-Mart’s inventor

> What modifications to the conventional retail method are necessary to approximate a LIFO retail flow?

> Calder, Inc. is a furniture manufacturing company with 50 employees. Recently, after a long negotiation with the local labor union, the company decided to initiate a pension plan as a part of its compensation plan. The plan will start on January 1, 2012.

> Under what circumstances is relative sales value an appropriate basis for determining the price assigned to inventory?

> What factors might call for inventory valuation at sales prices (net realizable value or market price)?

> Why are inventories valued at the lower-of-cost-or-market? What are the arguments against the use of the LCM method of valuing inventories?

> Explain the rationale for the ceiling and floor in the lower-of-cost-or-market method of valuing inventories.

> Where there is evidence that the utility of inventory goods, as part of their disposal in the ordinary course of business, will be less than cost, what is the proper accounting treatment?

> Deere and Company reported inventory in its balance sheet as follows: Inventories ……………………….. $1,999,100,000 What additional disclosures might be necessary to present the inventory fairly?

> The conventional retail inventory method yields results that are essentially the same as those yielded by the lower-of-cost-or-market method. Explain. Prepare an illustration of how the retail inventory method reduces inventory to market.

> Adriana Co., with annual net sales of $5 million, maintains a markup of 25% based on cost. Adriana’s expenses average 15% of net sales. What is Adriana’s gross profit and net profit in dollars?

> Distinguish between gross profit as a percentage of cost and gross profit as a percentage of sales price. Convert the following gross profit percentages based on cost to gross profit percentages based on sales price: 25% and 33 1/3%. Convert the followin

> At December 31, 2012, Ashley Co. has outstanding purchase commitments for 150,000 gallons, at $6.20 per gallon, of a raw material to be used in its manufacturing process. The company prices its raw material inventory at cost or market, whichever is lower

> Stephen Bosworth, a super salesman contemplating retirement on his fifty-fifth birthday, decides to create a fund on an 8% basis that will enable him to withdraw $25,000 per year on June 30, beginning in 2016 and continuing through 2019. To develop this

> Based on increased competition for one of its key products, Tutaj Company is concerned that it will not be able to sell its products at a price that would cover its costs. Since the company is already having a bad year, the sales manager proposes writing

> Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition of inventory? (b) What is the definition of market as it relates to inventory? (c) What is the definition of net realizable value?

> What is the nature of the SEC guidance concerning inventory disclosures?

> What are the provisions for subsequent measurement of inventory in the context of a hedging transaction?

> Due to rising fuel costs, your client, Overstock.com, is considering adding a charge for shipping and handling costs on products sold through its website. What is the authoritative guidance for reporting these costs?

> Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition provided for inventory? (b) What is a customer? (c) Under what conditions is a distributor considered a customer? (d) What is a product financing arrangement? Wha

> What is the nature of the SEC guidance concerning the reporting of LIFO liquidations?

> What guidance does the Codification provide concerning reporting inventories above cost?

> In this simulation, you are asked to address questions regarding inventory valuation and measurement. Prepare responses to all parts. KWW_Professional_Simulation Inventory Valuation Time Remaining 2 hours 0 minutes Unsplit Split Horiz Spit Vertical

> In conducting year-end inventory counts, your audit team is debating the impact of the client’s right of return policy both on inventory valuation and revenue recognition. The assistant controller argues that there is no need to worry about the return po

> Recently, property/casualty insurance companies have been criticized because they reserve for the total loss as much as 5 years before it may happen. The IRS has joined the debate because it says the full reserve is unfair from a taxation viewpoint. What

> Englehart Company sells two types of pumps. One is large and is for commercial use. The other is smaller and is used in residential swimming pools. The following inventory data is available for the month of March. Accounting (a) Assuming Englehart uses

> Noven Pharmaceuticals, Inc., headquartered in Miami, Florida, describes itself in a recent annual report as follows. Noven Pharmaceuticals, Inc. Noven is a place of ideas—a company where scientific excellence and state-of-the-art manufacturing combine to

> SUPERVALU reported the following data in its annual report. (a) Compute SUPERVALU’s inventory turnover ratios for 2009 and 2010, using: (1) Cost of sales and LIFO inventory. (2) Cost of sales and FIFO inventory. (b) Some firms calcula

> In January 2012, Susquehanna Inc. requested and secured permission from the commissioner of the Internal Revenue Service to compute inventories under the last-in, first-out (LIFO) method and elected to determine inventory cost under the dollar-value LIFO

> Frank Erlacher, an inventory control specialist, is interested in better understanding the accounting for inventories. Although Frank understands the more sophisticated computer inventory control systems, he has little knowledge of how inventory cost is

> Wilkens Company uses the LIFO method for inventory costing. In an effort to lower net income, company president Lenny Wilkens tells the plant accountant to take the unusual step of recommending to the purchasing department a large purchase of inventory a

> Harrisburg Company is considering changing its inventory valuation method from FIFO to LIFO because of the potential tax savings. However, the management wishes to consider all of the effects on the company, including its reported performance, before mak

> Jane Yoakam, president of Estefan Co., recently read an article that claimed that at least 100 of the country’s largest 500 companies were either adopting or considering adopting the last-in, first-out (LIFO) method for valuing inventories. The article s

> Norman’s Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2012, Norman adopted dollar-value LIFO and decided to use a single inventory pool. The company’s Janu

> Assume that Sonic Foundry Corporation has a contractual debt outstanding. Sonic has available two means of settlement: It can either make immediate payment of $3,500,000, or it can make annual payments of $400,000 for 15 years, each payment due on the la

> The management of Tritt Company has asked its accounting department to describe the effect upon the company’s financial position and its income statements of accounting for inventories on the LIFO rather than the FIFO basis during 2012

> Ehlo Company is a multiproduct firm. Presented below is information concerning one of its products, the Hawkeye. Instructions Compute cost of goods sold, assuming Ehlo uses: (a) Periodic system, FIFO cost flow. (b) Perpetual system, FIFO cost flow. (c)

> Some of the information found on a detail inventory card for Slatkin Inc. for the first month of operations is as follows. Instructions (a) From these data compute the ending inventory on each of the following bases. Assume that perpetual inventory rec

> Hull Company’s record of transactions concerning part X for the month of April was as follows. Instructions (a) Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory records are kept in unit

> Some of the transactions of Torres Company during August are listed below. Torres uses the periodic inventory method. August 10 Purchased merchandise on account, $12,000, terms 2/10, n/30. 13 Returned part of the purchase of August 10, $1,200, and receiv

> Dimitri Company, a manufacturer of small tools, provided the following information from its accounting records for the year ended December 31, 2012. Inventory at December 31, 2012 (based on physical count of goods in Dimitri’s plant, a

> The following independent situations relate to inventory accounting. 1. Kim Co. purchased goods with a list price of $175,000, subject to trade discounts of 20% and 10%, with no cash discounts allowable. How much should Kim Co. record as the cost of thes

> Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using dollar-value LIFO pools. The clerk who accounts for inventories does not understand how to value the inventory pools using this new me

> Presented below is information related to Kaisson Corporation for the last 3 years. Instructions Compute the ending inventories under the dollar-value LIFO method for 2011, 2012, and 2013. The base period is January 1, 2011, and the beginning inventory

> On January 1, 2012, Bonanza Wholesalers Inc. adopted the dollar-value LIFO inventory method for income tax and external financial reporting purposes. However, Bonanza continued to use the FIFO inventory method for internal accounting and management purpo

> Answer the following questions. (a) On May 1, 2012, Goldberg Company sold some machinery to Newlin Company on an installment contract basis. The contract required five equal annual payments, with the first payment due on May 1, 2012. What present value c

> Thomason Company makes the following errors during the current year. (In all cases, assume ending inventory in the following year is correctly stated.) 1. Both ending inventory and purchases and related accounts payable are understated. (Assume this purc

> Chippewas Company sells one product. Presented below is information for January for Chippewas Company. Chippewas uses the FIFO cost flow assumption. All purchases and sales are on account. Instructions (a) Assume Chippewas uses a periodic system. Prep

> Wizard Industries purchased $12,000 of merchandise on February 1, 2012, subject to a trade discount of 10% and with credit terms of 3/15, n/60. It returned $3,000 (gross price before trade or cash discount) on February 4. The invoice was paid on February

> Presented below are transactions related to Guillen, Inc. May 10 Purchased goods billed at $20,000 subject to cash discount terms of 2/10, n/60. 11 Purchased goods billed at $15,000 subject to terms of 1/15, n/30. 19 Paid invoice of May 10. 24 Purchased

> Two or more items are omitted in each of the following tabulations of income statement data. Fill in the amounts that are missing. 2011 2012 2013 $ ? $290,000 6,000 Sales revenue $410,000 Sales returns and allowances 13,000 347,000 32,000 ? Net sale

> Werth Company asks you to review its December 31, 2012, inventory values and prepare the necessary adjustments to the books. The following information is given to you. 1. Werth uses the periodic method of recording inventory. A physical count reveals $23

> Bradford Machine Company maintains a general ledger account for each class of inventory, debiting such accounts for increases during the period and crediting them for decreases. The transactions below relate to the Raw Materials inventory account, which

> Assume that in an annual audit of Webber Inc. at December 31, 2012, you find the following transactions near the closing date. 1. A special machine, fabricated to order for a customer, was finished and specifically segregated in the back part of the ship

> In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items were all excluded from the $441,000. 1. Merchandise of $61

> Presented below is a list of items that may or may not be reported as inventory in a company’s December 31 balance sheet. 1. Goods sold on an installment basis (bad debts can be reasonably estimated). 2. Goods out on consignment at another company’s stor

> Alex Hardaway borrowed $90,000 on March 1, 2010. This amount plus accrued interest at 12% compounded semiannually is to be repaid March 1, 2020. To retire this debt, Alex plans to contribute to a debt retirement fund five equal amounts starting on March

> The following information relates to the Choctaw Company. Instructions Use the dollar-value LIFO method to compute the ending inventory for Choctaw Company for 2009 through 2013. Ending Inventory (End-of-Year Prices) $ 70,000 Price Date Index Decem

> Presented below is information related to Martin Company. Instructions Compute the ending inventory for Martin Company for 2009 through 2014 using the dollar-value LIFO method. Ending Inventory (End-of-Year Prices) $ 80,000 Price Date Index Decembe

> The dollar-value LIFO method was adopted by King Corp. on January 1, 2012. Its inventory on that date was $160,000. On December 31, 2012, the inventory at prices existing on that date amounted to $151,200. The price level at January 1, 2012, was 100, and

> Sisko Company has used the dollar-value LIFO method for inventory cost determination for many years. The following data were extracted from Sisko’s records. Instructions Calculate the index used for 2012 that yielded the above results

> Belanna Corporation began operations on December 1, 2012. The only inventory transaction in 2012 was the purchase of inventory on December 10, 2012, at a cost of $20 per unit. None of this inventory was sold in 2012. Relevant information is as follows.

> The following example was provided to encourage the use of the LIFO method. In a nutshell, LIFO subtracts inflation from inventory costs, deducts it from taxable income, and records it in a LIFO reserve account on the books. The LIFO benefit grows as inf

> Tom Brady Shop began operations on January 2, 2012. The following stock record card for footballs was taken from the records at the end of the year. A physical inventory on December 31, 2012, reveals that 110 footballs were in stock. The bookkeeper inf

> You are the vice president of finance of Mickiewicz Corporation, a retail company that prepared two different schedules of gross margin for the first quarter ended March 31, 2012. These schedules appear below. The computation of cost of goods sold in e

> The board of directors of Oksana Corporation is considering whether or not it should instruct the accounting department to change from a first-in, first out (FIFO) basis of pricing inventories to a last-in, first-out (LIFO) basis. The following informati

> The following is a record of Cannondale Company’s transactions for Boston Teapots for the month of May 2012. Instructions (a) Assuming that perpetual inventories are not maintained and that a physical count at the end of the month sho

> Derek Lee just received a signing bonus of $1,000,000. His plan is to invest this payment in a fund that will earn 6%, compounded annually. Instructions (a) If Lee plans to establish the DL Foundation once the fund grows to $1,898,000, how many years un

> Presented below is information related to radios for the Couples Company for the month of July. Instructions (a) Assuming that the periodic inventory method is used, compute the inventory cost at July 31 under each of the following cost flow assumption

> Esplanade Company was formed on December 1, 2011. The following information is available from Esplanade’s inventory records for Product BAP. A physical inventory on March 31, 2012, shows 1,500 units on hand. Instructions Prepare sche

> LoBianco Company’s record of transactions for the month of April was as follows. Instructions (a) Assuming that periodic inventory records are kept, compute the inventory at April 30 using (1) LIFO and (2) Average cost. (b) Assuming t

> Inventory information for Part 311 of Seminole Corp. discloses the following information for the month of June. Instructions (a) Assuming that the periodic inventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and

> The net income per books of Adamson Company was determined without knowledge of the errors indicated below. Instructions Prepare a worksheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors.

> At December 31, 2012, Dwight Corporation reported current assets of $390,000 and current liabilities of $200,000. The following items may have been recorded incorrectly. Dwight uses the periodic method. 1. Goods purchased costing $22,000 were shipped f.o

> Arna, Inc. uses the dollar-value LIFO method of computing its inventory. Data for the past 3 years follow. Instructions Compute the value of the 2012 and 2013 inventories using the dollar-value LIFO method. Year Ended December 31 Inventory at Curre

> Bienvenu Enterprises reported cost of goods sold for 2012 of $1,400,000 and retained earnings of $5,200,000 at December 31, 2012. Bienvenu later discovered that its ending inventories at December 31, 2011 and 2012, were overstated by $110,000 and $35,000

> On December 31, 2011, the inventory of Powhattan Company amounts to $800,000. During 2012, the company decides to use the dollar-value LIFO method of costing inventories. On December 31, 2012, the inventory is $1,053,000 at December 31, 2012, prices. Usi

> What is the dollar-value method of LIFO inventory valuation? What advantage does the dollar-value method have over the specific goods approach of LIFO inventory valuation? Why will the traditional LIFO inventory costing method and the dollar-value LIFO i