Question: Teasdale Inc. manufactures and sells commercial and

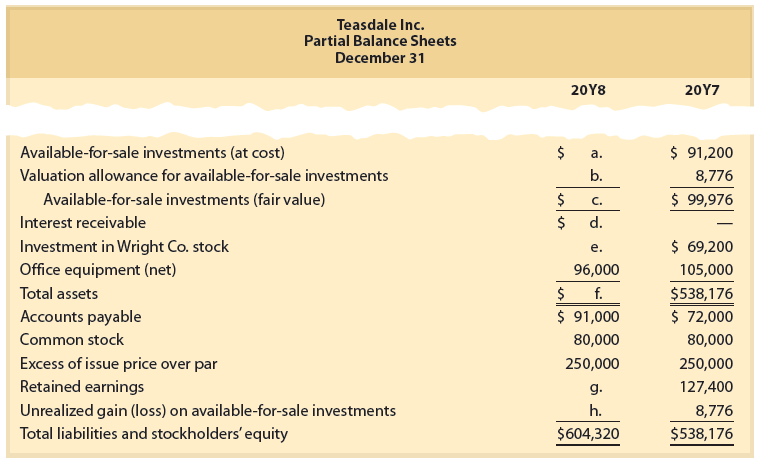

Teasdale Inc. manufactures and sells commercial and residential security equipment. The partial balance sheets for December 31, 20Y7 and 20Y8 are as follows:

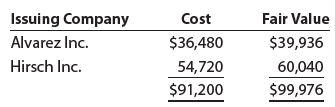

The available-for-sale investments at cost and fair value on December 31, 20Y7, are as follows:

The Investment in Wright Co. stock represents 30% of the outstanding shares of Wright Co. The following selected investment transactions occurred during 20Y8:

Jan. 2. Purchased $32,000 of Richter Inc. 5%, 10-year bonds at face value as an availablefor- sale investment. The bonds pay interest on June 30 and December 31.

June 30. Received interest for 6 months on the Richter Inc. bonds purchased on January 2.

July 12. Dividends of $12,000 are received on the Wright Co. investment.

Oct. 1. Purchased $24,000 of Toon Co. 4%, 10-year bonds at face value as an availablefor- sale investment. The bonds pay interest on October 1 and April 1.

Dec. 31. Wright Co. reported a total net income of $80,000 for 20Y8, which Teasdale Inc. recorded using the equity method.

31. Received interest for 6 months on the Richter Inc. bonds purchased on January 2.

31. Accrued interest for 3 months on the Toon Co. bonds purchased on October 1.

31. The fair values of the available-for-sale investments are as follows:

Issuing Company …………….. Fair Value

Alvarez Inc. ……………………….. $39,840

Hirsch Inc. ………………………….. 49,400

Richter Inc. ………………………… 38,400

Toon Co. …………………………….. 24,240

For the year ending December 31, 20Y8, Teasdale Inc. reported net income of $51,240 and paid no dividends.

Instructions:

Determine the missing amounts by letter in the partial balance sheets.

> Prior to liquidating their partnership, Kim and Cheyenne had capital accounts of $304,000 and $190,000, respectively. Prior to liquidation, the partnership had no cash assets other than what was realized from the sale of assets. These partnership assets

> Melissa Shallowford contributed a patent, accounts receivable, and $15,000 cash to a partnership. The patent had a book value of $6,000. However, the technology covered by the patent appeared to have significant market potential. Thus, the patent was app

> The payroll register of Clapton Co. indicates $11,340 of social security withheld and $2,835 of Medicare tax withheld on total salaries of $189,000 for the period. Earnings of $19,000 are subject to state and federal unemployment compensation taxes at th

> The payroll register of Shortman Co. indicates $3,240 of social security withheld and $810 of Medicare tax withheld on total salaries of $54,000 for the period. Retirement savings withheld from employee paychecks were $3,500 for the period. Federal withh

> The payroll register of Clapton Co. indicates $11,340 of social security withheld and $2,835 of Medicare tax withheld on total salaries of $189,000 for the period. Federal withholding for the period totaled $37,420. Provide the journal entry for the peri

> Candy Cane’s weekly gross earnings for the week ended May 23 were $1,370, and her federal income tax withholding was $187.88. Assuming that the social security rate is 6% and Medicare is 1.5% of all earnings, what is Cane’s net pay?

> Stan Stately’s weekly gross earnings for the week ended April 22 were $2,400, and his federal income tax withholding was $407.58. Assuming that the social security rate is 6% and Medicare is 1.5% of all earnings, what is Stately’s net pay?

> Candy Cane’s weekly gross earnings for the present week were $1,370. Cane has one exemption. Using the wage bracket withholding table in Exhibit 2 with an $81 standard withholding allowance for each exemption, what is Caneâ€&

> Stan Stately’s weekly gross earnings for the present week were $2,400. Stately has two exemptions. Using the wage bracket withholding table in Exhibit 2 with an $81 standard withholding allowance for each exemption, what is Stately&acir

> On January 26, McMaster Co. borrowed cash from Quantum Bank by issuing a 45-day note with a face amount of $324,000. a. Determine the proceeds of the note, assuming that the note carries an interest rate of 10%. b. Determine the proceeds of the note, ass

> TearLab Corp. is a health care company that specializes in developing diagnostic devices for eye disease. TearLab reported the following data (in thousands) for three recent years: 1. Determine the monthly cash expenses for Year 3, Year 2, and Year 1. R

> Aloha Company reported the following current assets and liabilities for December 31 for two recent years: a. Compute the quick ratio on December 31 of both years. b. Interpret the company’s quick ratio. Is the quick ratio improving or

> Basted Company reported the following current assets and liabilities for December 31 for two recent years: a. Compute the quick ratio on December 31 of both years. b. Interpret the company’s quick ratio. Is the quick ratio improving or

> Gupta Industries sold $436,000 of consumer electronics during July under a nine-month warranty. The cost to repair defects under the warranty is estimated at 4.5% of the sales price. On November 11, a customer was given $480 cash under terms of the warra

> Fitzpatrick Co. sold $391,000 of equipment during January under a one-year warranty. The cost to repair defects under the warranty is estimated at 3% of the sales price. On August 15, a customer required a $110 part replacement plus $55 of labor under th

> Vandiver Company provides its employees with vacation benefits and a defined benefit pension plan. Employees earned vacation pay of $62,000 for the period. The pension formula indicated a pension cost of $342,920. Only $298,000 was contributed to the pen

> Nakajima Company provides its employees with vacation benefits and a defined contribution pension plan. Employees earned vacation pay of $25,500 for the period. The pension plan requires a contribution to the plan administrator equal to 6% of employee sa

> The payroll register of Shortman Co. indicates $3,240 of social security withheld and $810 of Medicare tax withheld on total salaries of $54,000 for the period. Earnings of $5,000 are subject to state and federal unemployment compensation taxes at the fe

> On May 15, Franklin Co. borrowed cash from Dakota Bank by issuing a 90-day note with a face amount of $180,000. a. Determine the proceeds of the note, assuming that the note carries an interest rate of 8%. b. Determine the proceeds of the note, assuming

> On February 14, Foster Associates Co. paid $4,700 to repair the transmission on one of its delivery vans. In addition, Foster paid $920 to install a GPS system in its van. Journalize the entries for the transmission and GPS system expenditures.

> A truck with a cost of $123,000 has an estimated residual value of $24,000, has an estimated useful life of 12 years, and is depreciated by the straight-line method. (a) Determine the amount of the annual depreciation. (b) Determine the book value at the

> Costco Wholesale Corporation operates membership warehouses that sell a variety of branded and private label products. Headquartered in Issaquah, Washington, it also sells merchandise online in the United States (Costco.com) and in Canada (Costco.ca). Fo

> Equipment with a cost of $304,000 has an estimated residual value of $41,600, has an estimated useful life of 16 years, and is depreciated by the straight-line method. (a) Determine the amount of the annual depreciation. (b) Determine the book value at t

> Equipment acquired at the beginning of the year at a cost of $540,000 has an estimated residual value of $40,000 and an estimated useful life of 10 years. Determine (a) The double-declining- balance rate and (b) The double-declining-balance depreciation

> A building acquired at the beginning of the year at a cost of $1,193,000 has an estimated residual value of $220,000 and an estimated useful life of 40 years. Determine (a) The double-declining-balance rate and (b) The double-declining-balance depreciati

> A tractor acquired at a cost of $678,000 has an estimated residual value of $48,000, has an estimated useful life of 45,000 hours, and was operated 3,330 hours during the year. Determine (a) The depreciable cost, (b) The depreciation rate, and (c) The un

> A truck acquired at a cost of $202,800 has an estimated residual value of $18,000, has an estimated useful life of 440,000 miles, and was driven 113,000 miles during the year. Determine (a) The depreciable cost, (b) The depreciation rate, and (c) The uni

> Equipment acquired at the beginning of the year at a cost of $470,000 has an estimated residual value of $62,000 and an estimated useful life of five years. Determine (a) The depreciable cost, (b) The straight-line rate, and (c) The annual straight-line

> Financial statement data for years ending December 31 for Xiong Company follow: a. Determine the fixed asset turnover ratio for Year 1 and Year 2. b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unfa

> Financial statement data for years ending December 31 for Dennis Company follow: a. Determine the fixed asset turnover ratio for Year 1 and Year 2. b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unf

> On December 31, it was estimated that goodwill of $1,600,000 was impaired. In addition, a patent with an estimated useful economic life of 15 years was acquired for $594,000 on August 1. a. Journalize the adjusting entry on December 31 for the impaired g

> On December 31, it was estimated that goodwill of $4,700,000 was impaired. In addition, a patent with an estimated useful economic life of 12 years was acquired for $1,260,000 on April 1. a. Journalize the adjusting entry on December 31 for the impaired

> Apple Inc. designs, manufactures, and markets personal computers and related personal computing and communicating solutions for sale primarily to education, creative, consumer, and business customers. Substantially all of the company’s

> Poff Mining Co. acquired mineral rights for $195,650,000. The mineral deposit is estimated at 559,000,000 tons. During the current year, 22,900,000 tons were mined and sold. a. Determine the depletion rate. b. Determine the amount of depletion expense fo

> Snowcap Mining Co. acquired mineral rights for $342,720,000. The mineral deposit is estimated at 306,000,000 tons. During the current year, 55,600,000 tons were mined and sold. a. Determine the depletion rate. b. Determine the amount of depletion expense

> Equipment was acquired at the beginning of the year at a cost of $287,100. The equipment was depreciated using the straight-line method based on an estimated useful life of nine years and an estimated residual value of $27,000. a. What was the depreciati

> Equipment was acquired at the beginning of the year at a cost of $280,000. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 16 years and an estimated residual value of $14,000. a. What was the d

> On August 7, Blue Ocean Inflatables Co. paid $2,800 to install a hydraulic lift and $70 for an air filter for one of its delivery trucks. Journalize the entries for the new lift and air filter expenditures.

> A building acquired at the beginning of the year at a cost of $1,630,000 has an estimated residual value of $340,000 and an estimated useful life of 10 years. Determine (a) The depreciable cost, (b) The straight-line rate, and (c) The annual straight-lin

> Linstrum Company received a 60-day, 9% note for $56,000, dated July 23, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the no

> At the end of the current year, Accounts Receivable has a balance of $4,770,000, Allowance for Doubtful Accounts has a debit balance of $17,230, and sales for the year total $63,800,000. Using the aging method, the balance of Allowance for Doubtful Accou

> The financial statements for Nike, Inc., are presented in Appendix C at the end of the text. Use the following additional information (in millions): Accounts receivable at May 31, 2018 …………………… $ 3,498 Inventories at May 31, 2018 ………………………………….. 5,261 To

> Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y5, were as follows: a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. b. Issued 4,000 shares of $80 par preferred $1 stock at $100

> At the end of the current year, Accounts Receivable has a balance of $2,450,000, Allowance for Doubtful Accounts has a credit balance of $14,860, and sales for the year total $31,600,000. Using the aging method, the balance of Allowance for Doubtful Acco

> McMullen Company purchased tool sharpening equipment on May 1 for $162,000. The equipment was expected to have a useful life of three years, or 12,000 operating hours, and a residual value of $3,600. The equipment was used for 2,400 hours during Year 1,

> Glacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, 20Y3. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31, 20Y3: Jan. 25.

> Black Bear Bike Corp. manufactures mountain bikes and distributes them through retail outlets in California, Oregon, and Washington. Black Bear Bike Corp. has declared the following annual dividends over a six-year period ended December 31 of each year:

> For 20Y2, Gerhardt Inc. reported a significant increase in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative income statement: Instructions: 1. Prepare a comparative income statement wit

> The comparative balance sheet of Suffridge Inc. for December 31, 20Y4 and 20Y3, is as follows: The income statement for the year ended December 31, 20Y4, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y4

> Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, 20Y5. The following are bond (held-to-maturity) transactions by Rekya Mart Inc., which has a fiscal year ending on December 31: 20Y5 Apr. 1. Purchased $90,000 of

> Zeus Investments Inc. is a regional freight company that began operations on January 1, 20Y8. The following transactions relate to trading securities acquired by Zeus Inc., which has a fiscal year ending on December 31: 20Y8 Feb. 14. Purchased 4,800 shar

> The following transactions were completed by Almeda Inc., whose fiscal year is the calendar year: Year 1 July 1. Issued $75,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $85,659,600. Int

> Black and Shannon have decided to form a partnership. They have agreed that Black is to invest $360,000 and that Shannon is to invest $120,000. Black is to devote one-half time to the business, and Shannon is to devote full time. The following plans for

> At the end of the current year, Accounts Receivable has a balance of $4,770,000, Allowance for Doubtful Accounts has a debit balance of $17,230, and sales for the year total $63,800,000. Bad debt expense is estimated at 3⁄4 of 1% of sales. Determine (a)

> Best Buy is a specialty retailer of consumer electronics, including personal computers, entertainment software, and appliances. Best Buy operates retail stores in addition to the Best Buy, Media Play, On Cue, and Magnolia Hi-Fi websites. For two recent y

> The cash account for Norwegian Medical Co. at April 30 indicated a balance of $403,784. The bank statement indicated a balance of $468,460 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed

> The following items were selected from among the transactions completed by Shin Co. during the current year: Jan. 10. Purchased merchandise on account from Beckham Co., $420,000, terms n/30. Feb. 9. Issued a 30-day, 6% note for $420,000 to Beckham Co., o

> The following transactions were completed by Emmanuel Company during the current fiscal year ended December 31: Jan. 29. Received 40% of the $17,000 balance owed by Jankovich Co., a bankrupt business, and wrote off the remainder as uncollectible. Apr. 18

> The comparative balance sheet of Iglesias Inc. for December 31, 20Y3 and 20Y2, is as follows: The income statement for the year ended December 31, 20Y3, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3

> The comparative balance sheet of Orange Angel Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income,

> The comparative balance sheet of Iglesias Inc. for December 31, 20Y3 and 20Y2, is shown as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $210,000 cash. b. Eq

> O’Brien Industries Inc. is a book publisher. The partial balance sheets for December 31, 20Y4 and 20Y5 are as follows: The available-for-sale investments at cost and fair value on December 31, 20Y4, are as follows: The investment in J

> Soto Industries Inc. is an athletic footware company that began operations on January 1, 20Y3. The following are bond (held-to-maturity) transactions by Soto Industries Inc., which has a fiscal year ending on December 31: 20Y3 Apr. 1. Purchased $100,000

> Forte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, 20Y6. The following transactions relate to securities acquired by Forte Inc., which has a fiscal year ending on December 31, 20Y6: Jan. 10. Purchas

> Rios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected transactions relate to investments acquired by Rios Co., which has a fiscal year ending on December 31: 20Y2 Feb. 1. Purchased 7,500 shares of Caldw

> At the end of the current year, Accounts Receivable has a balance of $2,450,000, Allowance for Doubtful Accounts has a credit balance of $14,860, and sales for the year total $31,600,000. Bad debt expense is estimated at 1⁄2 of 1% of sales. Determine (a)

> O’Halloran, Inc., produces and sells outdoor equipment. On July 1, Year 1, O’Halloran, Inc., issued $32,000,000 of 6-year, 8% bonds at a market (effective) interest rate of 7%, receiving cash of $33,546,022. Interest on the bonds is payable semiannually

> On July 1, Year 1, Khatri Industries Inc. issued $18,000,000 of 10-year, 5% bonds at a market (effective) interest rate of 6%, receiving cash of $16,661,102. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the

> O’Halloran Inc. produces and sells outdoor equipment. On July 1, Year 1, O’Halloran Inc. issued $32,000,000 of six-year, 8% bonds at a market (effective) interest rate of 7%, receiving cash of $33,546,022. Interest on the bonds is payable semiannually on

> On July 1, Year 1, Khatri Industries Inc. issued $18,000,000 of 10-year, 5% bonds at a market (effective) interest rate of 6%, receiving cash of $16,661,102. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the

> The following selected accounts appear in the ledger of Upscale Construction Inc. at the beginning of the current year: Preferred 2% Stock, $80 par (200,000 shares authorized, 65,000 shares issued) … $ 5,200,000 Paid-In Capital in Excess of Par—Preferred

> The partners have capital balances of $69,000, $85,000, and $12,000, respectively. The cash balance is $38,000, the book values of noncash assets total $152,000, and liabilities total $24,000. The partners share income and losses in the ratio of 2:2:1.

> On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor: Preferred 2% Stock, $50 par (250,000 shares authorized, 80,000 shares issued) ……………………………………. $ 4,000,000 Paid-In Capita

> Journalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $77,000

> MGM Resorts International owns and operates hotels and casinos including the MGM Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, MGM reported accounts receivable of $747,981,000 and allowance for doubtful accounts of $90,775,000. Johnso

> Boeing is one of the world’s major aerospace firms with operations involving commercial aircraft, military aircraft, missiles, satellite systems, and information and battle management systems. As of a recent year, Boeing had $1,877 million of receivables

> Journalize the following transactions, using the allowance method of accounting for Uncollectible receivables: Oct. 2. Received $1,140 from Elita Ramirez and wrote off the remainder owed of $2,570 as uncollectible. Dec. 20. Reinstated the account of Elit

> The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days’ sales in receivables. Round

> PepsiCo, Inc., the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one

> The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: a. Determine for each year (1) The working capital, (2) The current ratio, and (3) The quick ratio. Round ratios to one decimal place. b. Wh

> The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: a. Determine the price-earnings ratio and dividend yield for the three companies. Round ratios and percentages to one decima

> The following information was taken from the financial statements of Zeil Inc. for December 31 of the current fiscal year: Common stock, $20 par (no change during the year) …………….. $8,000,000 Preferred $3 stock, $50 par (no change during the year) …………..

> The balance sheet for Quigg Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% ……………………. $7,500,000 Preferred $4 stock, $50 par …………. 3,750,000 Common stock, $10 par ………………. 7,500,000 Income before income tax expense wa

> The following comparative income statement (in thousands of dollars) for two recent fiscal years was adapted from the annual report of Speedway Motorsports, Inc., owner and operator of several major motor speedways, such as the Atlanta, Texas, and Las Ve

> The following data were taken from the financial statements of Loveseth Inc. for the current Fiscal year. Assuming that total assets were $6,000,000 at the beginning of the current fiscal year, determine the following: (a) Ratio of fixed assets to long-

> Ralph Lauren Corporation sells apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (in thousands): Assume that the apparel industry average return on total assets is 11.4% and the average return on stockhol

> Three major segments of the transportation industry are motor carriers such as YRC Worldwide, railroads such as Union Pacific, and transportation logistics services such as C.H. Robinson Worldwide, Inc. Recent financial statement information for these th

> Maggiano Supply Company received a 120-day, 6% note for $420,000, dated June 12, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment

> Recent balance sheet information for two companies in the food industry, Mondelez International, Inc., and The Hershey Company, is as follows (in thousands): a. Determine the ratio of liabilities to stockholders’ equity for both compan

> Hasbro, Inc., and Mattel, Inc., are the two largest toy companies in North America. Condensed liabilities and stockholders’ equity from a recent balance sheet are shown for each company as follows (in thousands): The income from operat

> The following data were extracted from the income statement of Shriver Inc.: a. Determine for each year (1) the inventory turnover and (2) the number of days’ sales in inventory. Round to the nearest dollar and one decimal place. b. Wh

> Selected data derived from the income statement and balance sheet of National Beverage Co. for a recent year are as follows: Income statement data (in thousands): Net income …………………………………………………..………………. $149,774 Loss on disposal of property …………………………………

> The income statement disclosed the following items for the year: Depreciation expense …………………. $ 57,000 Gain on di

> The net income reported on the income statement for the current year was $290,000. Depreciation recorded on equipment and a building amounted to $150,500 for the year. Balances of the current asset and current liability accounts at the beginning and end

> The net income reported on the income statement for the current year was $73,600. Depreciation recorded on store equipment for the year amounted to $27,400. Balances of the current asset and current liability accounts at the beginning and end of the year

> The income statement for Stallion Company for the current year ended June 30 and balances of selected accounts at the beginning and end of the year are as follows: Prepare the Cash Flows from (used for) Operating Activities section of the statement of c

> State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $300,000 of bonds, on which there was $4,000 of unamortized discount, for $303,000. b. Sold 40,000 shares of $

> The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: The following additional information is taken from the records: 1. Land was sold for $153. 2. Equipment was acquired for cash. 3. There were no disp

> Financial statement data for years ending December 31 for Cinderella Company follow: a. Determine the accounts receivable turnover for 20Y9 and 20Y8. Round accounts receivable turnover to one decimal place. b. Determine the days’ sales

> On its income statement for a recent year, Tesla, Inc., reported a net loss of $1,063 million from operations. On its statement of cash flows, it reported $2,098 million of net cash flows from operating activities. Explain this apparent contradiction bet