Question: The accounting records of Jet Away Airlines

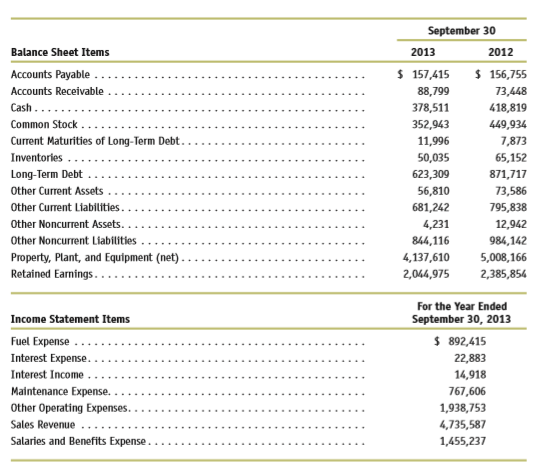

The accounting records of Jet Away Airlines reveal the following. The fiscal year ends on September 30 and amounts are in thousands of US$:

a. Prepare a comparative balance sheet for JetAway Airlines as of September 30, 2013, and September 30, 2012, in the format. Classify each balance sheet item into one of the following categories: current assets, noncurrent assets, current liabilities, noncurrent liabilities, and shareholders’ equity.

b. Prepare an income statement for JetAway Airlines for the year ended September 30, 2013.

c. Prepare a schedule explaining the change in retained earnings between September 30, 2012, and September 30, 2013. JetAway declared and paid dividends during fiscal 2013.

Transcribed Image Text:

September 30 Balance Sheet Items 2013 2012 Accounts Payable . $ 157,415 $ 156,755 Accounts Receivable 88,799 73,448 378,511 352,943 Cash.. 418,819 Common Stock 449,934 Current Maturities of Long-Term Debt. 11,996 7,873 Inventories .. 50,035 65,152 Long-Term Debt 623,309 871,717 Other Current Assets 56,810 73,586 Other Current Liabilities. 681,242 795,838 Other Noncurrent Assets. 4,231 12,942 Other Noncurrent Liabilities 844,116 984,142 Property, Plant, and Equipment (net) Retained Earnings.. 4,137,610 2,044,975 5,008,166 2,385,854 For the Year Ended Income Statement Items September 30, 2013 Fuel Expense . $ 892,415 Interest Expense.. Interest Income .. 22,883 14,918 Maintenance Expense. Other Operating Expenses.. 767,606 1,938,753 Sales Revenue 4,735,587 Salaries and Benefits Expense. 1,455,237

> Consider a continuous-time version of the Taylor model, so that p(t)=(1/T )T τ=0 x(t−τ)dτ, where T is the interval between each firm’s price changes and x(t−τ) is the price set by firms that set their prices at time t−τ. Assume that φ =1, so that p∗ i (t

> Consider an economy like that of the Caplin Spulber model. Suppose, however, that m can either rise or fall, and that firms therefore follow a simple two-sided Ss policy: if pi − p∗ t reaches either S or −S, firm i changes pi sothat pi−p∗ t equals 0. As

> Consider the experiment described at the beginning of Section 7.4. Specifically, a Calvo economy is initially in long-run equilibrium with all prices equal to m, which we normalize to zero. In period 1, there is a one-time, permanent increase in m to m1.

> Repeat Problem 7.4 using lag operators. Data from Problem 7.4: Consider the Taylor model with the money stock white noise rather than a random walk; that is, mt =εt, where εt is serially uncorrelated. Solve the model using the method of undetermined co

> Consider the Taylor model with the money stock white noise rather than a random walk; that is, mt =εt, where εt is serially uncorrelated. Solve the model using the method of undetermined coefficients.

> Consider the Taylor model. Suppose, however, that every other period all the firms set their prices for that period and the next. That is, in period t prices are set for t and t +1; in t +1, no prices are set; in t +2, prices are set for t+2 and t+3; and

> Suppose there are two sectors. Jobs in the primary sector pay wp; jobs in the secondary sector pay ws. Each worker decides which sector to be in. All workers who choose the secondary sector obtain a job. But there are a fixed number, Np, of primary-secto

> Consider the efficiency-wage model analyzed in equations (11.12) (11.17). Suppose, however, that fraction f of workers belong to unions that are able to obtain a wage that exceeds the nonunion wage by proportion μ. Thus, wu = (1+μ)wn, where wu and wn den

> Moulton Corporation engaged in the following seven transactions during December, Year 12, in preparation for opening the business on January 1, Year 13. We continue with data for Moulton Corporation in Chapter 3, Problem 3.22. You will not need some of t

> Express the following transactions of Winkle Grocery Store, Inc., in journal entry form. If an entry is not required, indicate the reason. You may omit explanations for the journal entries. The store: (1) Receives $30,000 from John Winkle in return for 1

> Assume that during Year 14, Inheritance Brands, a U.S. manufacturer and distributor, engaged in the following five transactions. Inheritance Brands applies U.S. GAAP and reports its results in millions of U.S. dollars ($). You may round to one significan

> Assume that during Year 15, Bullseye Corporation, a U.S. retailer, engages in the following six transactions. Bullseye Corporation applies U.S. GAAP and reports its results in millions of U.S. dollars ($). Do not be concerned that after these transaction

> GAAP classifies items on the balance sheet in one of the following ways: Asset (A) Liability (L) Shareholders’ equity (SE) Item that would not appear on the balance sheet as conventionally prepared under GAAP. (N/A) Using the abbreviations, indicate the

> GAAP classifies items on the balance sheet in one of the following ways: Asset (A) Liability (L) Shareholders’ equity (SE) Item that would not appear on the balance sheet as conventionally prepared under GAAP. (N/A) Using the abbreviations, indicate the

> When will a firm’s fiscal year differ from a calendar year?

> Cement Plus, a firm specializing in building materials, engaged in the following four transactions during 2014: (1) purchased and received inventory costing $14,300 million, of which $12,000 million was on account with the rest paid in cash; (2) purchase

> This chapter introduces both U.S. GAAP and International Financial Reporting Standards (IFRS). Which of these systems may U.S. firms use, and which may non-U.S. firms that list and trade their securities in the United States use?

> Consider the following information reported by DairyLamb, a New Zealand firm; all figures are in millions of New Zealand dollars ($). The firm reported revenues of $13,882, cost of goods sold of $11,671, interest and other expenses of $2,113, and tax exp

> Financial statements include amounts in units of currency. What is the most common determinant of a firm’s choice of currency for financial reporting?

> Heckle Group began operations as an engineering consulting firm, on June 1, 2013. On that date it issued 100,000 shares of common stock for €920,000. During June, Heckle used €600,000 of the proceeds to purchase office equipment. It acquired a patent for

> Kenton Limited began retail operations on January 1, 2013. On that date it issued 10,000 shares of common stock for £50,000. On January 31, Kenton used £48,000 of the proceeds to rent a store, paying in advance for the next two years. Kenton also purchas

> The statement of cash flows for Buenco, a firm in Argentina, showed a net cash inflow from operations of Ps427,182 and a net cash outflow for financing of Ps21,806. The comparative balance sheets showed a beginning balance in cash of Ps32,673 and an endi

> The statement of cash flows for Bargain Purchase, a retailer, showed a net cash inflow from operations of $4,125, a net cash outflow for investing of $6,195, and a net cash inflow for financing of $3,707. The balance sheet showed a beginning-of-year bala

> The balance sheet of Delvico, an Indian firm, showed retained earnings of Rs26,575 at the start of a year and Rs70,463 at the end of that year. The firm declared dividends during the year of Rs3,544. All amounts are in millions of Indian rupees (Rs). Com

> The balance sheet of Veldt, a South African firm, showed a balance in retained earnings of R5,872.4 at the end of 2013 and R4,640.9 at the end of 2012. Net income for the year was R2,362.5 million. All amounts are in millions of South African rand (R). C

> The income statement of AutoCo, a U.S. automotive manufacturer, reported revenues of $207,349, cost of sales of $164,682, other operating expenses, including income taxes, of $50,335, and net financing income, after taxes, of $5,690. Amounts are in milli

> Fresh Foods Group, a European food retailer that operates supermarkets in seven countries, engaged in the following three transactions during 2013: (1) purchased and received inventory costing €678 million on account from various suppliers; (2) returned

> The income statement of GrandRider, a U.K. automotive manufacturer, reported revenues of £7,435, cost of sales of £6,003, other operating expenses of £918, a loss of £2 on the sale of a business, and ne

> The balance sheet of GoldRan, a South African mining company, shows current assets of R6,085.1, noncurrent assets of R49,329.8, noncurrent liabilities of R13,948.4, and current liabilities of R4,360.1. GoldRan reports in millions of South African rand (R

> The balance sheet of EuroTel, a European Union communications firm, shows current assets of €20,000 million, current liabilities of €15,849 million, shareholders’ equity of €17,154 million, and noncurrent assets of €29,402 million. What is the amount of

> A firm recorded various transactions with the journal entries shown below. Using the notation O/S (overstated), U/S (understated), or No (no effect), indicate the effects on assets, liabilities, and shareholders’ equity of any errors in

> Refer to Exhibit 1.10, which contains income statement information that is based on the financial report of Capcion, an Austrian paper and packaging manufacturer. Capcion reports all amounts in thousands of euros (€). Answer the followin

> Refer to Exhibit 1.9, which contains balance sheet information from the financial report of Palmer Coldgate, a U.S. consumer products manufacturer. This firm reports all amounts in millions of U.S. dollars ($). Answer the following questions that pertain

> Using the notation O/S (overstated), U/S (understated), or No (no effect), indicate the effects on assets, liabilities, and shareholders’ equity of failing to record or recording incorrectly each of the following transactions or events. For example, a fa

> Whitley Products Corporation begins operations on April 1. The firm engages in the following transactions during April: (1) Issues 25,000 shares of $10 par value common stock for $15 per share in cash. (2) Acquires land costing $25,000 and a building cos

> Veronica Regaldo creates a new business in Mexico on January 1, Year 8, to operate a retail store. Transactions of Regaldo Department Stores during January Year 8 in preparation for opening its first retail store in February Year 8 appear below. Regaldo

> Patterson Corporation begins operations on January 1, Year 13. See the assumptions given at the end of the list. Problem 3.23 continues this problem. The firm engages in the following transactions during January: (1) Issues 15,000 shares of $10 par value

> Who prepares a firm’s financial statements?

> Why does every accounting transaction have two effects?

> Investing activities pertain to the acquisition of productive capacity to enable a firm to carry out its activities. Examples of this capacity include (1) land, buildings, and equipment and (2) patents and licenses. How are these two kinds of capacity th

> In what sense are a firm’s accounts receivable a source of financing for that firm’s customers?

> In what sense can suppliers of raw materials, merchandise, or labor services (employees) also be sources of financing for firms?

> What is the purpose of using contra accounts? What is the alternative to using them?

> What is involved in an audit by an independent external auditor?

> Once upon a time many, many years ago, a feudal landlord lived in a small province of central Europe. The landlord, called the Red-Bearded Baron, lived in a castle high on a hill. This benevolent fellow took responsibility for the well-being of many peas

> The photographic analogy for a balance sheet is a snapshot, and for the income statement and the statement of cash flows it is a motion picture.” Explain.

> The ABC Company starts the year in fine shape. The firm makes widgets—just what the customer wants. It makes them for $0.75 each and sells them for $1.00. The ABC Company keeps an inventory equal to shipments of the past 30 days, pays its bills promptly,

> Dina Richards opens a high-end stationery store, Stationery Plus, on November 1, 2013. She finances the store by investing $80,000 in cash in exchange for all the common stock of the firm. She also obtains a bank loan for $100,000, which she promises to

> Jack Block opens a tax and bookkeeping services business, Block’s Tax and Bookkeeping Services, on July 1, 2013. He invests $40,000 for all the common stock of the business, and the firm borrows $20,000 from the local bank, promising to repay the loan on

> Selected data from the statement of cash flows for Jackson Corporation for the years ended October 31, 2013, 2012, and 2011 appear as follows (amounts in millions of US$): Prepare a statement of cash flows for each of the three years 2013, 2012 and 201

> The following information is based on data reported in the statement of cash flows for AB Brown, a Swedish firm. All amounts are in millions of Swedish kronor (SEK). Prepare a statement of cash flows for AB Brown for the three years presented using the

> Selected income statement information for Yankee Fashion, a U.S. clothing retailer, appears next. All amounts are in millions of U.S. dollars ($). Compute the missing amounts. 2013 2012 2011 Net Revenues.. $4,295.4 $3,746.3 $3,305.4 Cost of Goods So

> Selected income statement information for Easton Home, a U.S. consumer products manufacturer, appears next. All amounts are in millions of U.S. dollars ($). Compute the missing amounts. 2013 2012 2011 Sales.... $13,790 ? $11,397 Cost of Goods Sold ?

> Selected balance sheet amounts for SinoTwelve, a Chinese manufacturer, appear next. All amounts are in thousands of U.S. dollars ($). Compute the missing amounts. 2013 2012 Total Assets. $5,450,838 Current Liabilities . Current Assets Total Liabilit

> Selected balance sheet amounts for ComputerCo, a manufacturer located in Singapore, appear next. All amounts are in millions of Singapore dollars ($). Compute the missing amounts. 2013 2012 Total Assets $199,824 Noncurrent Liabilities 7,010 2013 201

> The chapter describes four activities common to all entities: setting goals and strategies, financing activities, investing activities, and operating activities. How would these four activities likely differ for a charitable organization versus a busines

> The following information is based on the financial statements of Hewston, a large manufacturing firm. Annual revenues are $66,387 million and net expenses (including income taxes) are $62,313 million. During the year, the firm collected $65,995 million

> Information based on and adapted from the statement of cash flows of Seller Redbud, a U.S. retailer, appears in Exhibit 1.11. This firm reports all amounts in thousands of U.S. dollars ($). Answer the following questions that pertain to the information i

> What is the advantage of the accrual basis of accounting, relative to the cash basis of accounting, for measuring performance?

> What is the purpose of the FASB’s and IASB’s conceptual frameworks?

> What distinguishes noncurrent assets from current assets?

> What is the role of the following participants in the financial reporting process: the U.S. Securities and Exchange Commission (SEC); the Financial Accounting Standards Board (FASB); the International Accounting Standards Board (IASB)?

> How does an income statement connect two successive balance sheets? How does a statement of cash flows connect two successive balance sheets?

> The measurement basis for reporting items on a firm’s balance sheet can be either historical amounts or current amounts. What is the difference between these two measurement bases?

> Assets and liabilities appear on balance sheets as either current or noncurrent. What is the difference between a current item and a noncurrent item? Why would users of financial statements likely be interested in this distinction?

> What is the relation between a T-account and a journal entry?

> Review the meaning of the terms and concepts listed in Key Terms and Concepts.

> Select the best answer for each of the following items: 1. In accordance with the marshaling of assets provision of the Uniform Partnership Act, rank the following liabilities of a partnership in order of payment. (1) $20,000 loan from B. Barry who is a

> The unsuccessful partnership of the Jones Brothers is about to undergo liquidation. They have asked you to estimate the amount of cash that each brother will receive. They share profits and losses equally. Both Doug and Dave are personally solvent, but

> The guidance for segmental reporting is located in which general topic area (i.e., 100–general principles, 200–presentation, 300–assets, etc.)? List the specific topic number (i.e., ASC XXX).

> The following information is available for Bailey Company for 2014: 1. On January 2, 2014, Bailey paid property taxes amounting to $60,000 on its plant and equipment for the calendar year 2014. In late March 2014 Bailey made major repairs to its machiner

> Use the information provided in Exercise 13-4. Exercise 13-4: On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a p

> Select the best answer for each of the following. 1. A forward contract is a hedge of an identifiable foreign currency commitment if (a) The forward contract is designated as, and is effective as, a hedge of a foreign currency commitment. (b) The foreign

> On December 1, 2014, Tuscano Corp. entered into a transaction to import raw materials from a foreign company. The account is to be settled on February 1 with the payment of 60,000 foreign currency units (FCU). On December 1, Tuscano also entered into a f

> A U.S. firm carried a receivable for 100,000 yen. Assuming that the direct exchange rate declined from $.009 at the date of the transaction to $.006 at the balance sheet date, compute the transaction gain or loss. What balance would be reported for the r

> LAX Inc. has the following income before income tax and estimated effective annual income tax rates for the first three quarters of 2014. Required: What should be LAX’s income tax provision in the third-quarter income statement? (AICP

> Select the best answer for each of the following. 1. A sale of goods by a U.S. company was denominated in a foreign currency. The sale resulted in a receivable that was fixed in terms of the amount of foreign currency that would be received. Exchange rat

> Select the best answer for each of the following items: 1. Which of the following should be included in the current funds revenue of a not-for-profit private university? 2. The current funds group of a not-for-profit private university includes which o

> During 2015 volunteer pinstripers donated their services to General Hospital at no cost. The staff at General Hospital was in control of the pinstripers’ duties. If regular employees had provided the services rendered by the volunteers, their salaries wo

> Select the best answer for each of the following items: 1. An unrestricted pledge from an annual contributor to a not-for-profit hospital made in December 2014 and paid in cash in March 2015 would generally be credited to (a) Nonoperating revenue in 2014

> Select the best answer for each of the following items: 1. Which NNOs must record depreciation on exhaustible assets? (a) Hospitals. (b) VHWOs. (c) ONNOs. (d) All of the above. 2. Which statement relating to VHWOs is most nearly correct? (a) Use modified

> Mane Company operates in five identifiable segments, V, W, X, Y, and Z. During the past year, sales to unaffiliated customers and intersegment sales for each segment were as follows: Required: Applying the revenue test, determine which of the segments

> Select the best answer for each of the following items: 1. Cura Foundation, a voluntary health and welfare organization, supported by contributions from the general public, included the following costs in its statement of functional expenses for the year

> Select the best answer choice for each of the following items: 1. Which of the following receipts is properly recorded as unrestricted current funds on the books of a university? (a) Tuition. (b) Student laboratory fees. (c) Housing fees. (d) Research gr

> A $36,000 cash gift was received by a college during the year. Required: A. In which fund should the gift be recorded if there were no restrictions on the use of the cash? B. In which fund should the gift be recorded if the donor specified that the cash

> Select the best answer for each of the following: 1. Premiums received on general obligation bonds are generally transferred to what fund or group of accounts? (a) Debt Service. (b) General. (c) Special Revenue. 2. Of the items listed below, those most l

> Select the best answer for each of the following: 1. The activities of a municipal golf course that receives three-fourths of its total revenue from a special tax levy should be accounted for in (a) An Enterprise Fund. (b) The General Fund. (c) A Trust F

> Select the best answer for each of the following: 1. The City of Apache should use a Capital Projects Fund to account for (a) Structures and improvements constructed with the proceeds of a special assessment. (b) Special Revenue funds set aside to acquir

> The following transactions take place: 1. A commitment was made to transfer general revenues to the entity in charge of providing transportation for all government agencies. 2. Construction bonds were issued at a premium. The premium is to be included in

> In 2015, Bay City purchased supplies valued at $350,000. At the end of the year, $65,000 of the supplies were still in the inventory. No supplies were on hand at the beginning of the year. The city uses the purchases method to account for supplies. Requ

> The preclosing trial balance for the General Fund of the City of Springfield is presented below. Note 1: Includes $35,000 of encumbrances from 2014. Required: Prepare the closing entries for the General Fund. City of Springfield The General Fund G

> Select the best answer for each of the following items: 1. When used in fund accounting, the term “fund” usually refers to (a) A sum of money designated for a special purpose. (b) A liability to other governmental units. (c) The equity of a municipality

> The following transactions take place: 1. A cement mixer was purchased with resources of the general fund. 2. A contract was signed for the construction of a new civic center. 3. Bonds were issued to finance the construction of the new civic center. 4. C

> The administrators of the City of Lyons have obtained approval from the City Council to centralize the computer facility as of January 1, 2015. An internal service fund is created to account for the activities of the computer facility. The City Council h

> The City of Dayville has undertaken a sidewalk construction project. The project is being financed by the proceeds from the issue on July 1, 2015, of $500,000 of 7% special assessment debt. One quarter of the principal plus interest is payable on June 30

> The Town of Green River authorized a municipal building to be constructed at a cost of $175,000. The construction will be financed from the proceeds from the issue of $175,000 of 6% bonds. Any difference between the par value of the bonds and the proceed

> On January 1, 2007, the city of Nashvegas issued an 8% annual, 10-year, $10,000 bond for $11,472 (an effective yield of 6%). The bonds become due on December 31, 2016. On June 30, 2015, the city of Nashvegas issued an 8% annual, 10-year, $10,000 bond to

> Circus City issued an 8%, 10-year $2,000,000 bond to build a monorail mass transit system. The city received $1,754,217 cash from the bond issuance on January 1, 2015. The bond yield is 10%. Interest is paid annually on December 31 of each year. Disclosu

> The following information is available about Gotham’s City government funds. Required: Using the information about the government’s funds, determine which funds qualify as “major”

> The City of Minden entered into the following transactions during the year 2016. 1. A bond issue was authorized by vote to provide funds for the construction of a new municipal building, which it was estimated would cost $1,000,000. The bonds are to be p