Question: The accounts listed below appeared in the

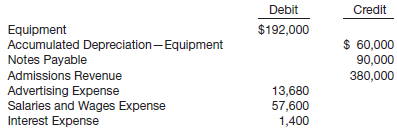

The accounts listed below appeared in the December 31 trial balance of the Savard Theater.

Instructions

(a) From the account balances listed above and the information given below, prepare the annual adjusting entries necessary on December 31. (Omit explanations.)

(1) The equipment has an estimated life of 16 years and a salvage value of $24,000 at the end of that time. (Use straight-line method.)

(2) The note payable is a 90-day note given to the bank October 20 and bearing interest at 8%. (Use 360 days for denominator.)

(3) In December, 2,000 coupon admission books were sold at $30 each. They could be used for admission any time after January 1.

(4) Advertising expense paid in advance and included in Advertising Expense $1,100.

(5) Salaries and wages accrued but unpaid $4,700.

(b) What amounts should be shown for each of the following on the income statement for the year?

(1) Interest expense.

(2) Admissions revenue.

(3) Advertising expense.

(4) Salaries and wages expense.

Transcribed Image Text:

Debit Credit $192,000 Equipment Accumulated Depreciation-Equipment Notes Payable $ 60,000 90,000 380,000 Admissions Revenue Advertising Expense Salaries and Wages Expense Interest Expense 13,680 57,600 1,400

> Christine Ewing is a licensed CPA. During the first month of operations of her business (a sole proprietorship), the following events and transactions occurred. April 2 Invested $30,000 cash and equipment valued at $14,000 in the business. 2 Hired a secr

> The following information was taken from the records of Gibson Inc. for the year 2012: income tax applicable to income from continuing operations $119,000; income tax applicable to loss on discontinued operations $25,500; income tax applicable to extraor

> Bryant Co. reports the following information for 2012: sales revenue $750,000; cost of goods sold $500,000; operating expenses $80,000; and an unrealized holding loss on available-for-sale securities for 2012 of $50,000. It declared and paid a cash divid

> Armstrong Corporation reported the following for 2012: net sales $1,200,000; cost of goods sold $720,000; selling and administrative expenses $320,000; and an unrealized holding gain on available-for-sale securities $15,000. Instructions Prepare a state

> Zehms Company began operations in 2010 and adopted weighted-average pricing for inventory. In 2012, in accordance with other companies in its industry, Zehms changed its inventory pricing to FIFO. The pretax income data is reported below. Instructions

> At December 31, 2011, Schroeder Corporation had the following stock outstanding. 8% cumulative preferred stock, $100 par, 107,500 shares ………………………. $10,750,000 Common stock, $5 par, 4,000,000 shares ………………………………………………. 20,000,000 During 2012, Schroeder

> McEntire Corporation began operations on January 1, 2009. During its first 3 years of operations, McEntire reported net income and declared dividends as follows. The following information relates to 2012. Income before income tax …&

> Presented below are selected ledger accounts of Woods Corporation at December 31, 2012. Woods’s effective tax rate on all items is 34%. A physical inventory indicates that the ending inventory is $686,000. Instructions Prepare a cond

> The stockholders’ equity section of Sosa Corporation appears below as of December 31, 2012. Net income for 2012 reflects a total effective tax rate of 34%. Included in the net income figure is a loss of $12,000,000 (before tax) as a r

> In 2012, Hollis Corporation reported net income of $1,000,000. It declared and paid preferred stock dividends of $250,000. During 2012, Hollis had a weighted average of 190,000 common shares outstanding. Compute Hollis’s 2012 earnings per share.

> Vandross Company has recorded bad debt expense in the past at a rate of 1½% of net sales. In 2012, Vandross decides to increase its estimate to 2%. If the new rate had been used in prior years, cumulative bad debt expense would have been $380,000 instead

> Briefly describe how the organization of the FASB Codification corresponds to the elements of financial statements.

> During 2012, Williamson Company changed from FIFO to weighted-average inventory pricing. Pretax income in 2011 and 2010 (Williamson’s first year of operations) under FIFO was $160,000 and $180,000, respectively. Pretax income using weighted-average prici

> Stacy Corporation had income before income taxes for 2012 of $6,300,000. In addition, it suffered an unusual and infrequent pretax loss of $770,000 from a volcano eruption. The corporation’s tax rate is 30%. Prepare a partial income statement for Stacy b

> Finley Corporation had income from continuing operations of $10,600,000 in 2012. During 2012, it disposed of its restaurant division at an after-tax loss of $189,000. Prior to disposal, the division operated at a loss of $315,000 (net of tax) in 2012. Fi

> On January 1, 2012, Richards Inc. had cash and common stock of $60,000. At that date, the company had no other asset, liability, or equity balances. On January 2, 2012, it purchased for cash $20,000 of equity securities that it classified as available-fo

> Using the information from BE4-9, prepare a retained earnings statement for the year ended December 31, 2012. Assume an error was discovered: land costing $80,000 (net of tax) was charged to maintenance and repairs expense in 2009. In BE4-9 Portman Corp

> Portman Corporation has retained earnings of $675,000 at January 1, 2012. Net income during 2012 was $1,400,000, and cash dividends declared and paid during 2012 totaled $75,000. Prepare a retained earnings statement for the year ended December 31, 2012.

> What are the three ways that other comprehensive income may be displayed (reported)?

> How should correction of errors be reported in the financial statements?

> What major types of items are reported in the retained earnings statement?

> On January 30, 2011, a suit was filed against Frazier Corporation under the Environmental Protection Act. On August 6, 2012, Frazier Corporation agreed to settle the action and pay $920,000 in damages to certain current and former employees. How should t

> Briefly describe FASB/IASB convergence process and the principles that guide their convergence efforts.

> What is meant by “tax allocation within a period”? What is the justification for such practice?

> Qualls Corporation reported 2012 earnings per share of $7.21. In 2013, Qualls reported earnings per share as follows. On income before extraordinary item ………………… $6.40 On extraordinary item ………………………………………… 1.88 On net income …………………………………………………. $8.28

> Cooper Investments reported an unusual gain from the sale of certain assets in its 2012 income statement. How does intraperiod tax allocation affect the reporting of this unusual gain?

> You run into Greg Norman at a party and begin discussing financial statements. Greg says, “I prefer the single-step income statement because the multiple-step format generally overstates income.” How should you respond to Greg?

> Indicate where the following items would ordinarily appear on the financial statements of Boleyn, Inc. for the year 2012. (a) The service life of certain equipment was changed from 8 to 5 years. If a 5-year life had been used previously, additional depre

> What is the basis for distinguishing between operating and nonoperating items?

> What are the advantages and disadvantages of the single-step income statement?

> State some of the more serious problems encountered in seeking to achieve the ideal measurement of periodic net income. Explain what accountants do as a practical alternative.

> Generally accepted accounting principles usually require the use of accrual accounting to “fairly present” income. If the cash receipts and disbursements method of accounting will “clearly reflect” taxable income, why does this method not usually also “f

> Enyart Company experienced a catastrophic loss in the second quarter of the year. The loss meets the criteria for extraordinary item reporting, but Enyart’s controller is unsure whether this item should be reported as extraordinary in the second quarter

> Presented below is information related to Viel Company at December 31, 2012, the end of its first year of operations. Sales revenue …………………………………………………………….. $310,000 Cost of goods sold ………………………………………………………… 140,000 Selling and administrative expenses …

> What distinguishes an item that is “unusual in nature” from an item that is considered “extraordinary”?

> What guidance does the SEC provide for public companies with respect to the reporting of the “effect of preferred stock dividends and accretion of carrying amount of preferred stock on earnings per share”?

> What are the characteristics of high-quality information in a company’s first IFRS financial statements?

> The financial statements of Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://corporate.marksandspencer.com/documents/publications/2010/Annual_Report_2010. Instructions Refer to M&S’s financial statem

> How is the date of transition and the date of reporting determined in first-time adoption of IFRS?

> Becker Ltd. is planning to adopt IFRS and prepare its first IFRS financial statements at December 31, 2013. What is the date of Becker’s opening balance sheet, assuming one year of comparative information? What periods will be covered in Becker’s first I

> In this simulation, you are asked to address questions regarding the accounting information system. Prepare responses to all parts. KWW_Professional_Simulation Accounting Information System Time Remaining 3 hours 50 minutes Unsplit Split Horiz Split

> Recording transactions in the accounting system requires knowledge of the important characteristics of the elements of financial statements, such as assets and liabilities. In addition, accountants must understand the inherent uncertainty in accounting m

> The Amato Theater is nearing the end of the year and is preparing for a meeting with its bankers to discuss the renewal of a loan. The accounts listed below appeared in the December 31, 2012, trial balance. Additional information is available as follow

> Kellogg Company has its headquarters in Battle Creek, Michigan. The company manufactures and sells ready-to-eat breakfast cereals and convenience foods including cookies, toaster pastries, and cereal bars. Selected data from Kellogg Companyâ€&

> What might explain the fact that different accounting standard-setters have developed accounting standards that are sometimes quite different in nature?

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) Which company had the greater percentage increase in total assets from 2008 to 2009? (b) Using the

> The financial statements of P&G are presented in Appendix 5B or can be accessed at the book’s companion website, www.wiley.com/college/kieso. Instructions Refer to these financial statements and the accompanying notes to answer the following questions.

> Rolling Hills Golf Inc. was organized on July 1, 2012. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30 are shown here. Instructions (a) Journalize the adjusting entries that were made. (b) Prepa

> Presented below are the trial balance and the other information related to Yorkis Perez, a consulting engineer. 1. Fees received in advance from clients $6,000. 2. Services performed for clients that were not recorded by December 31, $4,900. 3. Bad deb

> The trial balance of Bellemy Fashion Center contained the following accounts at November 30, the end of the company’s fiscal year. Adjustment data: 1. Supplies on hand totaled $1,500. 2. Depreciation is $15,000 on the equipment. 3. In

> A review of the ledger of Baylor Company at December 31, 2012, produces the following data pertaining to the preparation of annual adjusting entries. 1. Salaries and Wages Payable $0. There are eight employees. Salaries and wages are paid every Friday fo

> Mason Advertising Agency was founded in January 2008. Presented below are adjusted and unadjusted trial balances as of December 31, 2012. Instructions (a) Journalize the annual adjusting entries that were made. (Omit explanations.) (b) Prepare an incom

> On January 1, 2012, Norma Smith and Grant Wood formed a computer sales and service enterprise in Soapsville, Arkansas, by investing $90,000 cash. The new company, Arkansas Sales and Service, has the following transactions during January. 1. Pays $6,000 i

> Presented below is the December 31 trial balance of New York Boutique. Instructions (a) Construct T-accounts and enter the balances shown. (b) Prepare adjusting journal entries for the following and post to the T-accounts. (Omit explanations.) Open add

> In this simulation, you are asked questions regarding accounting principles. Prepare responses to all parts. KWW_Professional_Simulation Generally Accepted Accounting Principles Time Remaining 4 hours 30 minutes Unsplit Split Horiz Spit Vertical Spr

> Presented below is the trial balance of the Crestwood Golf Club, Inc. as of December 31. The books are closed annually on December 31. Instructions (a) Enter the balances in ledger accounts. Allow five lines for each account. (b) From the trial balance

> Vedula Advertising Agency was founded by Murali Vedula in January 2007. Presented below are both the adjusted and unadjusted trial balances as of December 31, 2012. Instructions (a) Journalize the annual adjusting entries that were made. (b) Prepare an

> Latta Corp. maintains its financial records on the cash basis of accounting. Interested in securing a long-term loan from its regular bank, Latta Corp. requests you as its independent CPA to convert its cash-basis income statement data to the accrual bas

> Corinne Dunbar, M.D., maintains the accounting records of Dunbar Clinic on a cash basis. During 2012, Dr. Dunbar collected $142,600 from her patients and paid $60,470 in expenses. At January 1, 2012, and December 31, 2012, she had accounts receivable, un

> Snyder Miniature Golf and Driving Range Inc. was opened on March 1 by Mickey Snyder. The following selected events and transactions occurred during March. Mar. 1 Invested $60,000 cash in the business in exchange for common stock. 3 Purchased Michelle Wie

> Letterman Co. prepares monthly financial statements from a worksheet. Selected portions of the January worksheet showed the following data. During February no events occurred that affected these accounts, but at the end of February the following inform

> The adjusted trial balance for Madrasah Co. is presented in the following worksheet for the month ended April 30, 2012. Instructions Complete the worksheet and prepare a classified balance sheet. MADRASAH co. Worksheet (PARTIAL) For The Month Ended

> Presented below are selected accounts for Acevedo Company as reported in the worksheet at the end of May 2012. Instructions Complete the worksheet by extending amounts reported in the adjusted trial balance to the appropriate columns in the worksheet.

> When the accounts of Constantine Inc. are examined, the adjusting data listed below are uncovered on December 31, the end of an annual fiscal period. 1. The prepaid insurance account shows a debit of $6,000, representing the cost of a 2-year fire insuran

> Using the data in BE3-3, journalize the entry on July 1 and the adjusting entry on December 31 for Zubin Insurance Co. Zubin uses the accounts Unearned Service Revenue and Service Revenue. In BE3-3 On July 1, 2012, Crowe Co. pays $15,000 to Zubin Insura

> Discuss the appropriate treatment in the income statement for the following items: (a) Loss on discontinued operations. (b) Non-controlling interest allocation.

> On July 1, 2012, Crowe Co. pays $15,000 to Zubin Insurance Co. for a 3-year insurance policy. Both companies have fiscal years ending December 31. For Crowe Co., journalize the entry on July 1 and the adjusting entry on December 31.

> Dresser Company’s weekly payroll, paid on Fridays, totals $8,000. Employees work a 5-day week. Prepare Dresser’s adjusting entry on Wednesday, December 31, and the journal entry to record the $8,000 cash payment on Friday, January 2.

> Assume that on February 1, Procter & Gamble (P&G) paid $720,000 in advance for 2 years’ insurance coverage. Prepare P&G’s February 1 journal entry and the annual adjusting entry on June 30.

> Indicate whether each of the items below is a real or nominal account and whether it appears in the balance sheet or the income statement. (a) Prepaid Rent. (b) Salaries and Wages Payable. (c) Inventory. (d) Accumulated Depreciation—Equipment. (e) Equipm

> Distinguish between cash-basis accounting and accrual-basis accounting. Why is accrual-basis accounting acceptable for most business enterprises and the cash-basis unacceptable in the preparation of an income statement and a balance sheet?

> Midwest Enterprises made the following entry on December 31, 2012. What entry would Anaheim National Bank make regarding its outstanding loan to Midwest Enterprises? Explain why this must be the case. Interest Expense Interest Payable 10,000 10,000

> Jay Hawk, maintenance supervisor for Boston Insurance Co., has purchased a riding lawnmower and accessories to be used in maintaining the grounds around corporate headquarters. He has sent the following information to the accounting department. Compute

> Give an example of a transaction that results in: (a) A decrease in an asset and a decrease in a liability. (b) A decrease in one asset and an increase in another asset. (c) A decrease in one liability and an increase in another liability.

> “A worksheet is a permanent accounting record, and its use is required in the accounting cycle.” Do you agree? Explain.

> Employees are paid every Saturday for the preceding work week. If a balance sheet is prepared on Wednesday, December 31, what does the amount of wages earned during the first three days of the week (12/29, 12/30, 12/31) represent? Explain.

> As a newly enrolled accounting major, you are anxious to better understand accounting institutions and sources of accounting literature. As a first step, you decide to explore the FASB Conceptual Framework. Instructions If your school has a subscription

> Andrea Pafko, a fellow student, contends that the double-entry system means that each transaction must be recorded twice. Is Andrea correct? Explain.

> Name the accounts debited and credited for each of the following transactions. (a) Billing a customer for work done. (b) Receipt of cash from customer on account. (c) Purchase of office supplies on account. (d) Purchase of 15 gallons of gasoline for the

> As discussed in Chapter 1, the International Accounting Standards Board (IASB) develops accounting standards for many international companies. The IASB also has developed a conceptual framework to help guide the setting of accounting standards. While the

> After the presentation of your report on the examinationof the financial statements to the board of directors of Piper Publishing Company, one of the new directors expresses surprise that the income statement assumes that an equal proportion of the reven

> Homer Winslow and Jane Alexander are discussing various aspects of the FASB’s concepts statement on the objective of financial reporting. Homer indicates that this pronouncement provides little, if any, guidance to the practicing professional in resolvin

> Anderson Nuclear Power Plant will be “mothballed” at the end of its useful life (approximately 20 years) at great expense. The expense recognition principle requires that expenses be matched to revenue. Accountants Ana Alicia and Ed Bradley argue whether

> Recently, your Uncle Carlos Beltran, who knows that you always have your eye out for a profitable investment, has discussed the possibility of your purchasing some corporate bonds. He suggests that you may wish to get in on the “ground floor” of this dea

> Presented below are the assumptions, principles, and constraints used in this chapter. 1. Economic entity assumption 2. Going concern assumption 3. Monetary unit assumption 4. Periodicity assumption 5. Historical cost principle 6. Fair value principl

> The qualitative characteristics that make accounting information useful for decision-making purposes are as follows. Relevance Faithful representation Predictive value Confirmatory value Neutrality Completeness Timeliness Materiality Verifiability Unde

> What are some of the differences in elements in the IASB and FASB conceptual frameworks?

> Presented below is information related to Anderson, Inc. Instructions Comment on the appropriateness of the accounting procedures followed by Anderson, Inc. (a) Depreciation expense on the building for the year was $60,000. Because the building was incr

> Presented below are a number of facts related to Weller, Inc. Assume thatno mention of these facts was made in the financial statements and the related notes. Instructions Assume that you are the auditor of Weller, Inc. and that you have been asked to e

> What accounting constraint is illustrated by the items below? (a) Greco’s Farms, Inc. reports agricultural crops on its balance sheet at fair value. (b) Rafael Corporation discloses fair value information on its loans because it already gathers this info

> Vande Velde Company made three investments during 2012: (1) It purchased 1,000 shares of Sastre Company, a start-up company. Vande Velde made the investment based on valuation estimates from an internally developed model. (2) It purchased 2,000 shares of

> Describe the major constraint inherent in the presentation of accounting information.

> Mogilny Company paid $135,000 for a machine. TheAccumulated Depreciation account has a balance of $46,500 at the present time. The company could sell the machine today for $150,000. The company president believes that the company has a “right to this gai

> Statement of Financial Accounting Concepts No 5identifies four characteristics that an item must have before it is recognized in the financial statements. What are these four characteristics?

> The treasurer of Landowska Co. has heard that conservatism is a doctrine that is followed in accounting and, therefore, proposes that several policies be followed that is conservative in nature. State your opinion with respect to each of the policies lis

> When revenue is generally recognized? Why has that date been chosen as the point at which to recognize the revenue resulting from the entire producing and selling process?

> What is the fair value option? Explain how use of the fairvalue option reflects application of the fair value principle.

> In this simulation, you are asked to address questions regarding the FASB conceptual framework. Prepare responses to all parts. KWW_Professional_Simulation Conceptual Framework Time Remaining 4 hours 10 minutes Unsplit Split Horiz Split Vartical Spr

> In January 2013, Janeway Inc. doubled the amount of its outstanding stock by selling on the market an additional 10,000 shares to finance an expansion of the business. You propose that this information be shown by a footnote on the balance sheet as of De

> Briefly describe the types of information concerning financial position, income, and cash flows that might be provided: (a) Within the main body of the financial statements, (b) In the notes to the financial statements, (c) As supplementary information.