Question: The accounts of Grand Pool Service, Inc.,

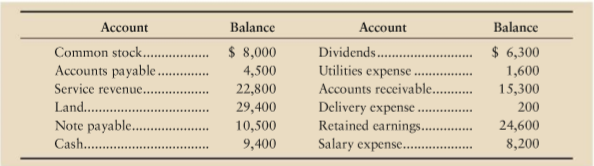

The accounts of Grand Pool Service, Inc., follow with their normal balances at June 30, 2010. The accounts are listed in no particular order.

Requirements

1. Prepare the companys trial balance at June 30, 2010, listing accounts in proper sequence, as illustrated in the chapter. For example, Accounts Receivable comes before Land. List the expense with the largest balance first, the expense with the next largest balance second, and so on.

2. Prepare the financial statement for the month ended June 30, 2010, that will tell the company the results of operations for the month.

Transcribed Image Text:

Account Balance Account Balance Common stock.. $ 8,000 Dividends. $ 6,300 Accounts payable . Utilities expense Accounts receivable.. Delivery expense . Retained earnings.. Salary expense... 4,500 1,600 Service revenue.. 22,800 15,300 Land. . 29,400 10,500 200 Note payable.. 24,600 8,200 Cash.. 9,400

> What are some of the regulatory issues marketers must take into consideration in developing contest, sweepstakes and other types of promotions that will be offered online or through social media?

> Discuss how the Do-Not-Call Registry developed by the Federal Trade Commission is impacting the direct marketing industry. What arguments might direct marketers use in trying to have this program rescinded?

> Do you think the U.S. Food and Drug Administration should consider adopting the type of cigarette packaging being used in Australia that requires graphic images and removes all branding elements? How effective do you think this type of packaging would be

> Ethical Perspective 20-1 discusses the controversy surrounding the direct-to-consumer (DTC) advertising of prescription drugs. Evaluate the arguments both for and against pharmaceutical companies being allowed to advertise their drug products directly to

> Evaluate the charges the Federal Trade Commission brought against Volkswagen Group of America for deceptive advertising. How might this issue affect consumer perceptions of Volkswagen and how should the company handle this controversy?

> Find several examples of advertising claims or slogans that are based on puffery rather than substantiated claims. Discuss whether you feel these advertising claims can be defended on the basis of puffery.

> IMC Perspective 20-1 discusses how Skechers and Reebok were fined for making advertising claims for their toning shoes that the Federal Trade Commission argues were false, misleading and unsubstantiated. Evaluate the claims made by these companies in the

> Do you agree with the DISCUS argument that advertising for hard liquor should be treated the same as advertising for beer and wine? Should advertising for spirits be confined to late-night programs on the networks or should the ads be permitted to run ea

> Where in the consumer decision process would personal selling likely be most effective? Explain why.

> Discuss the role the Advertising Self-Regulatory Council plays in the self-regulation of advertising. Discuss the arguments for and against self-regulation as an effective way of protecting consumers from misleading or deceptive advertising as well as co

> Discuss the need for regulation of advertising and other IMC tools. Do you advocate more or less regulation of advertising and other forms of promotion by governmental agencies such as the Federal Trade Commission and the Food and Drug Administration?

> The chapter opener discusses the rules and regulations the Federal Trade Commission (FTC) uses for online endorsements. Do you agree with the new guidelines from the FTC requiring bloggers and endorsers to disclose any material connection to a company wh

> Discuss how advertising can affect product costs and the prices consumers pay for products and services.

> With which position do you agree? “Advertising determines American consumers’ tastes and values and is responsible for creating a materialistic society.” “Advertising is a reflection of society and mirrors its tastes and values”

> Discuss the role of ethics in advertising and promotion. How do ethical considerations differ from legal considerations in developing an integrated marketing communications program?

> Discuss the arguments for and against advertiser influence and/or control over the media. How might a newspaper or magazine avoid being influenced by advertisers?

> The Campaign for Real Beauty is an integrated marketing communication program that Unilever has been using for its Dove brand since 2004. Do you view this campaign as movement in a positive direction with regard to the portrayal of women in advertising o

> Economists argue that advertising can be a barrier to entry for many companies that simply cannot come up with the money required to initiate an effective advertising campaign. At the same time, SPANX has succeeded without spending any money to promote t

> Discuss how attitudes toward the use of sex in advertising differ between men and women. Discuss the implications of these attitudinal differences for marketers who are developing ads for each sex.

> It has been said that the importance of the sales force varies at various stages in the communication hierarchies. Discuss this idea, providing examples to support your position.

> Groups such as Commercial Alert are concerned about the intrusion of advertising and other types of marketing messages into all aspects of consumers’ lives. Discuss some of the reasons consumer watchdog groups are critical of advertising and other types

> There are conflicting positions as to whether the government should get involved in issues regarding issues such as obesity, cigarette smoking, and vaping by passing regulations, restrictions, and/or taxes. Present both sides of the argument and take a p

> The use of ads that use interracial and gay and lesbian themes appear to be on the increase. There seems to be a relaxed atmosphere regarding the use of these groups in advertising. Explain the benefits and pitfalls inherent in this strategy.

> Companies like Old Navy and Cheerios have employed the use of interracial ads, and have stirred up both controversy and support. Comments have been made that while some believe that we are in a post racism era, whereas others disagree. Provide arguments

> The CEOs of Abercrombie & Fitch and American Apparel have both been variously characterized as either manipulators of the media for their ability to generate publicity for their companies or petulant. Both have lost their jobs in the face of declining sa

> The chapter discusses how many marketers are struggling with their multicultural marketing efforts and suggests that one reason may be the lack of diversity in advertising agencies. What are some of the reasons for the low number of minorities, such as A

> The chapter discussed the empowerment of females in advertising. Give examples of some of the companies that have used this form of advertising. Why do you think they have done this? Is it for altruism or financial gain?

> What are some of the different ways companies use shock ads? Do you think they are designed to create sales, or to bring attention to specific issues? Do they work? Give examples.

> Describe some of the criteria used to evaluate qualitative aspects of the effectiveness of the salesperson. How might these be used to support the IMC program?

> Discuss some of the advantages and disadvantages of personal selling versus other media—both traditional and nontraditional.

> Describe the various forms of cooperative advertising and the reasons they are used by marketers.

> What is a slotting allowance or fee? Evaluate the arguments for and against retailers charging slotting fees to manufacturers.

> Discuss how samples and coupons can be used to generate trial of a new product or increase consumption of an established brand.

> CRM is not new to marketers. However, the text shows that the definition as well as the requirements of CRM have changed over the years. Explain the differences in the way companies employ CRM now versus previous years.

> The growth of the Internet has brought about many changes that have had a direct impact on the sales force. Give examples of these and discuss how salespeople have had to react.

> This problem can be used in conjunction with Problem 2-61A. Refer to Problem 2-61A. Requirements 1. Journalize the June transactions of Mason Resources, Inc. Explanations are not required. 2. Prepare T-Accounts for each account. Insert in each T-accou

> The following amounts summarize the financial position of Mason Resources, Inc., on May 31, 2010: During June 2010, Mason Resources completed these transactions: a. The business received cash of $9,200 and issued common stock. b. Performed services fo

> The trial balance of Luxury Specialties, Inc., follows. Ashley Richards, your best friend, is considering investing in Luxury Specialties, Inc. Ashley seeks your advice in interpreting this information. Specifically , she asks how to use this trial bala

> During the first month of operations (March 2010), Silver Entertainment Corporation completed the following selected transactions: a. The business received cash of $32,000 and a building valued at $52,000. The corporation issued common stock to the stoc

> During the first month of operations, OShea Plumbing, Inc., completed the following transactions: Requirements 1. Record each transaction in the journal. Key each transaction by date. Explanations are not required. 2. Post the transactions to the T-ac

> During December, Swanson Auction Co. completed the following transactions Swansons business uses the following accounts: Cash, Accounts Receivable, Supplies, Land, Accounts Payable, Notes Payable, Common Stock, Dividends, Service Revenue, Salary Expense

> Smith Real Estate Co. experienced the following events during the organizing phase and its first month of operations. Some of the events were personal for the stockholders and did not affect the business. Others were transactions of the business. Requir

> This problem can be used in conjunction with Problem 2-68B. Refer to Problem 2-68B. Requirements 1. Journalize the transactions of Rodriguez Resources, Inc. Explanations are not required. 2. Prepare T-accounts for each account. Insert in each T-accoun

> Summarized versions of Espinola Corporations financial statements follow for two recent years // Requirement 1. Complete Espinola Corporations financial statements by determining the missing amounts denoted by the letters.

> The following data come from the financial statements of The High Tide Company at the year ended May 31, 2011 (in millions). Requirements 1. Prepare a cash flows statement for the year ended May 31, 2011. Not all the items given appear on the cash flow

> This and similar cases in each chapter are based on the consolidated financial statements of Foot Locker, Inc., given in Appendix B at the end of this book. As you work with Foot Locker, Inc., you will develop the ability to analyze the financial stateme

> During the first month of operations (November 2010), Stein Services Corporation completed the following selected transactions: a. The business received cash of $28,000 and a building valued at $52,000. The corporation issued common stock to the stockho

> Jeana Hart is a realtor. She organized her business as a corporation on September 16, 2011. The business received $95,000 from Hart and issued common stock. Consider these facts as of September 30, 2011. a. Hart has $15,000 in her personal bank account

> Refer to Exercise 2-34B. Requirements 1. Prepare the trial balance of Linda Conway , Attorney , at January 31, 2010. Use the T-accounts that have been prepared for the business. 2. How well did the business perform during its first month? Compute net

> This exercise should be used in conjunction with Exercises 1-36B through 1-38B. The owner of Carson Copy Center now seeks your advice as to whether he should cease operations or continue the business. Complete the report giving him your opinion of net in

> Refer to the data in Exercises 1-36B and 1-37B. Requirement 1. Prepare the statement of cash flows of Carson Copy Center, Inc., for the month ended July 31, 2011. Also explain the relationship among income statement, statement of retained earnings, ba

> Refer to the data in Exercise 1-36B. Requirement 1. Prepare the balance sheet of Carson Copy Center, Inc., at July 31, 2011. From exercise 36: Assume a Carson Copy Center ended the month of July 2011 with these data: Payments of cash: Acquisition

> Fortune, Inc., began 2010 with $83,000 in cash. During 2010, Fortune earned net income of $440,000, and adjustments to reconcile net income to net cash provided by operations totaled $60,000, a positive amount. Investing activities used cash of $390,000,

> Green Tree Cellular, Inc., completed the following transactions during April 2010, its first month of operations: Requirement 1. Record the transactions in the journal of Green Tree Cellular, Inc. Key transactions by date and include an explanation fo

> Compute the missing amount in the accounting equation for each company (amounts in billions): Which company appears to have the strongest financial position? Explain your reasoning. Assets Liabilities Owners' Equity DJ Video Rentals Ernie's Bank $ ?

> Refer to the Foot Locker, Inc., financial statements in Appendix B at the end of the book. Suppose you are an investor considering buying Foot Locker, Inc., common stock. The following questions are important: Show amounts in millions and round to the ne

> Assume T. Crew opened a store in San Diego, starting with cash and common stock of $90,000. Barbara Breen, the store manager, then signed a note payable to purchase land for $91,000 and a building for $120,000. Breen also paid $62,000 for equipment and $

> Assume Facebook is expanding into Ireland. The company must decide where to locate and how to finance the expansion. Identify the financial statement where these decision makers can find the following information about Facebook, Inc. In some cases, more

> Refer to Exercise 2-18A. Requirements 1. After journalizing the transactions of Exercise 2-18A, post the entries to the ledger, using T-accounts. Key transactions by date. Date the ending balance of each account April 30. 2. Prepare the trial balance

> Brent Landry Company reported these ratios at December 31, 2010 (dollar amounts in millions): Brent Landry Company completed these transactions during 2011: a. Purchased equipment on account, $6 b. Paid long-term debt, $11 c. Collected cash from cust

> Refer to Exercise 3-46B. Requirements 1. Use the data in the partial worksheet to prepare Wallace Production Companys classified balance sheet at December 31 of the current year. Use the report format. First you must compute the adjusted balance for s

> The unadjusted trial balance and income statement amounts from the December 31 adjusted trial balance of Wallace Production Company follow. Requirement 1. Journalize the adjusting and closing entries of Wallace Production Company at December 31. There

> Prepare the closing entries from the following selected accounts from the records of East Shore Corporation at December 31, 2010: How much net income did East Shore earn during 2010? Prepare a T-account for Retained Earnings to show the December 31, 201

> Direct, the British wireless phone service provider, collects cash in advance from customers. All amounts are in millions of pounds sterling ( ), the British monetary unit. Assume Direct collected 400 in advance during 2010 and at year end still owed cus

> This question deals with the items and the amounts that two entities, Mother Elizabeth Hospital (Mother Elizabeth) and City of Portland (Portland) should report in their financial statements. Fill in the blanks. Requirements 1. On July 1, 2010, Mother

> The adjusted trial balances of Victory Corporation at March 31, 2010, and March 31, 2009, include these amounts (in millions): Victory completed these transactions during the year ended March 31, 2010. Compute the amount of sales revenue, insurance exp

> Scruffy Murphy is the president and principal stockholder of Scruffys Bar & Grill, Inc. To expand, the business is applying for a $250,000 bank loan. To get the loan, Murphy is considering two options for beefing up the owners equity of the business: Opt

> The adjusted trial balance of Holiday Hams, Inc., follows. Requirement 1. Prepare Holiday Hams, Inc.s income statement and statement of retained earnings for the year ended December 31, 2010, and its balance sheet on that date. Draw the arrows linking

> The accounting records of Harris Publishing Company include the following unadjusted balances at May 31: Accounts Receivable, $1,200; Supplies, $300; Salary Payable, $0; Unearned Service Revenue, $800; Service Revenue, $4,400; Salary Expense, $1,900; Sup

> Folton Motor Company faced the following situations. Journalize the adjusting entry needed at December 31, 2010, for each situation. Consider each fact separately. a. The business has interest expense of $9,200 that it must pay early in January 2011. b

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $800. Payments for insurance during the period, $2,400. Prepaid insurance, ending, $1,600. b. Interest revenue accrued, $1,0

> During 2010 Carlton Network, Inc., which designs network servers, earned revenues of $740 million. Expenses totaled $560 million. Carlton collected all but $24 million of the revenues and paid $580 million on its expenses. Carltons top managers are evalu

> During 2010 Nebula Corporation made sales of $4,800 (assume all on account) and collected cash of $4,900 from customers. Operating expenses totaled $1,100, all paid in cash. At year end, 2010, Nebula customers owed the company $300. Nebula owed creditors

> Ben Williams Company reported these ratios at December 31, 2010 (dollar amounts in millions): Ben Williams Company completed these transactions during 2011: a. Purchased equipment on account, $8 b. Paid long-term debt, $11 c. Collected cash from cust

> Refer to Exercise 3-31A. Requirements 1. Use the data in the partial worksheet to prepare Draper Production Companys classified balance sheet at December 31 of the current year. Use the report format. First you must compute the adjusted balance for se

> The unadjusted trial balance and income statement amounts from the December 31 adjusted trial balance of Draper Production Company follow. Requirement 1. Journalize the adjusting and closing entries of Draper Production Company at December 31. There wa

> Prepare the closing entries from the following selected accounts from the records of Sunnydale Corporation at December 31, 2010: How much net income did Sunnydale earn during 2010? Prepare a T-account for Retained Earnings to show the December 31, 2010,

> Part a. You have received your grade in your first accounting course, and to your amazement, it is an A. You feel the instructor must have made a big mistake. Your grade was a B going into the final, but you are sure that you really bombed the exam, whic

> Nanofone, the British wireless phone service provider, collects cash in advance from customers. All amounts are in millions of pounds sterling ( ), the British monetary unit. Assume Nanofone collected 460 in advance during 2010 and at year end still owed

> The adjusted trial balances of Dickens Corporation at March 31, 2010, and March 31, 2009, include these amounts (in millions): Dickens completed these transactions during the year ended March 31, 2010. Compute the amount of sales revenue, insurance exp

> The adjusted trial balance of Delicious Hams, Inc., follows. Requirement 1. Prepare Delicious Hams, Inc.s income statement and statement of retained earnings for the year ended December 31, 2010, and its balance sheet on that date. Delicious Hams,

> The accounting records of Fletcher Publishing Company include the following unadjusted balances at May 31: Accounts Receivable, $1,600; Supplies, $600; Salary Payable, $0; Unearned Service Revenue, $900; Service Revenue, $4,800; Salary Expense, $2,500; S

> Jenkins Motor Company faced the following situations. Journalize the adjusting entry needed at December 31, 2010, for each situation. Consider each fact separately. a. The business has interest expense of $9,500 that it must pay early in January 2011.

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $500. Payments for insurance during the period, $1,500. Prepaid insurance, ending, $1,000. b. Interest revenue accrued, $1,1

> During 2010, Carson Network, Inc., which designs network servers, earned revenues of $800 million. Expenses totaled $590 million. Carson collected all but $28 million of the revenues and paid $610 million on its expenses. Carsons top managers are evaluat

> During 2010 Galaxy Corporation made sales of $4,100 (assume all on account) and collected cash of $4,900 from customers. Operating expenses totaled $1,400, all paid in cash. At year end, 2010, Galaxy customers owed the company $700. Galaxy owed creditors

> The accounts of Greatbrook Company prior to the year-end adjustments follow. Adjusting data at the end of the year include which of the following? a. Unearned service revenue that has been earned, $1,620 b. Accrued service revenue, $32,000 c. Supplie

> Worthy Hills Corporation reported the following current accounts at December 31, 2010 (amounts in thousands): During 2011, Worthy Hills completed these selected transactions: Sold services on account, $8,700 Depreciation expense, $700 Paid for expens

> Stanley Williams has owned and operated SW Advertising, Inc., since its beginning 10 years ago. Recently , Williams mentioned that he would consider selling the company for the right price. Assume that you are interested in buying this business. You obta

> The first seven transactions of Portman Advertising, Inc., have been posted to the companys accounts as follows: Requirement 1. Prepare the journal entries that served as the sources for the seven transactions. Include an explanation for each entry . A

> Refer to Exercise 2-29B. Requirements 1. Post the entries to the ledger, using T-accounts. Key transactions by date. Date the ending balance of each account April 30. 2. Prepare the trial balance of Green Tree Cellular, Inc., at April 30, 2010. 3. Ho

> Refer to Exercise 2-27B. Requirement 1. Record the transactions in the journal of Kyle Cohen, P .C. List the transactions by date and give an explanation for each transaction. From exercise 27: Kyle Cohen opened a medical practice specializing in sur

> Kyle Cohen opened a medical practice specializing in surgery . During the first month of operation (July), the business, titled Kyle Cohen, Professional Corporation (P .C.), experienced the following events: Requirements 1. Analyze the effects of these

> The following selected events were experienced by either Simple Solutions, Inc., a corporation, or Bob Gallagher, the major stockholder. State whether each event (1) increased, (2) decreased, or (3) had no effect on the total assets of the business. Iden

> Refer to Exercise 2-23A. 1. After recording the transactions in Exercise 2-23A, prepare the trial balance of Linda Oxford, Attorney , at May 31, 2010. Use the T-accounts that have been prepared for the business. 2. How well did the business perform dur

> Set up the following T-accounts: Cash, Accounts Receivable, Office Supplies, Office Furniture, Accounts Payable, Common Stock, Dividends, Service Revenue, Salary Expense, and Rent Expense. Record the following transactions directly in the T-accounts with

> The first seven transactions of Fournier Advertising, Inc., have been posted to the companys accounts as follows: Requirement 1. Prepare the journal entries that served as the sources for the seven transactions. Include an explanation for each entry. A

> Harris Tree Cellular, Inc., completed the following transactions during April 2010, its first month of operations: Requirement 1. Record the transactions in the journal of Harris Tree Cellular, Inc. Key transactions by date and include an explanation f

> Refer to Exercise 2-16A. Requirement 1. Record the transactions in the journal of Harry Samson, P .C. List the transactions by date and give an explanation for each transaction. From exercise 16: Harry Samson opened a medical practice specializing in

> On October 1, Lou Marks opened Eagle Restaurant, Inc. Marks is now at a crossroads. The October financial statements paint a glowing picture of the business, and Marks has asked you whether he should expand the business. To expand the business, Marks wan