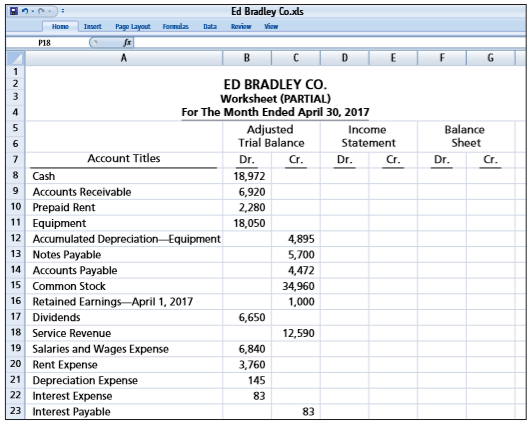

Question: The adjusted trial balance for Ed Bradley

The adjusted trial balance for Ed Bradley Co. is presented in the following worksheet for the month ended April 30, 2017.

Instructions

Complete the worksheet and prepare a classified balance sheet.

Transcribed Image Text:

Ed Bradley Co.xls Home Insert Page Layout Formulas Data Roview Viow Р18 ED BRADLEY CO. Worksheet (PARTIAL) For The Month Ended April 30, 2017 Adjusted Trial Balance Balance Sheet Income Statement 7 Account Titles Dr. Cr. Dr. Cr. Dr. Cr. 8 Cash 18,972 6,920 9 Accounts Receivable 10 Prepaid Rent 2,280 11 Equipment 12 Accumulated Depreciation Equipment 13 Notes Payable 18,050 4,895 5,700 14 Accounts Payable 4,472 15 Common Stock 34,960 1,000 16 Retained Earnings–April 1, 2017 17 Dividends 6,650 18 Service Revenue 12,590 19 Salaries and Wages Expense 20 Rent Expense 21 Depreciation Expense 22 Interest Expense 23 Interest Payable 6,840 3,760 145 83 83

> Name the requirements that must be met for an invention to receive a patent.

> When does the fair use doctrine apply to copyrighted works?

> Give several examples of literary, creative, or artistic works for which a company may be granted a copyright.

> Explain the way the court distributes the estate of someone who dies intestate.

> Charges of undue influence are frequently made by those who are denied benefits in a will. What steps might a testator take, while still alive, to reduce the likelihood of these charges being made?

> Explain both the duty of loyalty and the duty of care as these pertain to corporate directors and officers.

> Explain why the law requires the testator to have testamentary capacity.

> Explain each of the requirements of a valid will.

> Discuss types of legacies, bequests, and devises covered by a will.

> Discuss the reasons a person prepares a will.

> Explain how liability for injuries suffered by a tenant’s guests in common areas is determined and whether the landlord or tenant is likely to be found liable.

> Should a tenant have the right to remove fixtures he or she has added to the premises? Why or why not?

> If a landlord should fail to make the repairs promised in the lease, what recourse does the tenant have?

> If a tenant chooses to use leased premises for purposes other than the one stipulated in the lease, why would a new agreement be required?

> Discuss the difference between a lease and a license and state the advantages and disadvantages of each.

> Discuss constructive bailments and explain how they differ from other kinds of bailments.

> Differentiate among corporate shareholders, directors, and officers.

> Discuss the six typical reasons for transferring goods and creating a bailment.

> Identify and provide examples of rights in real property.

> Discuss both inter vivos gifts and gifts causa mortis.

> Distinguish between real and personal property.

> State statutes usually declare that commercial paper that is given for gambling transactions or at usurious rates of interest is void. Can a person pay off an illegal gambling debt by check?

> What is the difference between a contract and a negotiable instrument as it concerns consideration?

> Describe the defenses against payment of commercial paper that are concerned with the acts or circumstances leading to the issue of the paper rather than to the paper itself.

> What kind of an endorsement allows an endorser to avoid liability for payment even if the maker or drawer defaults on the instrument?

> Under what circumstances are a minor’s checks valid?

> Why would a person who receives a check want to limit its negotiability, and how would this be done?

> Identify two advantages and two disadvantages of organizing as a partnership.

> What are the benefits and drawbacks to the consumer of using electronic funds transfers, automated teller machines, and point-of-sale systems?

> Discuss circumstances that might require stopping payment on a check.

> If a checkbook is stolen and checks are written by the thief and cashed, who bears the loss?

> Explain the two ways in which commercial paper differs from ordinary contracts.

> Describe the process used in a Chapter 11 bankruptcy.

> List some examples of priority debts under a Chapter 13 bankruptcy.

> List some examples of exempt property under Chapter 7 of the federal bankruptcy law.

> Explain the differences between a limited partnership and other partnerships.

> Identify the four forms in which businesses are generally organized.

> Explain how an agency may be terminated.

> Name four advantages and two disadvantages of organizing as a sole proprietorship.

> Describe the requirement of probable cause under the Fourth Amendment.

> Cite some examples of how unethical behavior in our world has negatively affected business practices.

> Andy Roddick is the new owner of Ace Computer Services. At the end of August 2017, his first month of ownership, Roddick is trying to prepare monthly financial statements. Below is some information related to unrecorded expenses that the business incurre

> Maher Inc. reported income from continuing operations before taxes during 2017 of $790,000. Additional transactions occurring in 2017 but not considered in the $790,000 are as follows. 1. The corporation experienced an uninsured flood loss in the amount

> Using the appropriate interest table, provide the solution to each of the following four questions by computing the unknowns. a. What is the amount of the payments that Ned Winslow must make at the end of each of 8 years to accumulate a fund of $90,000 b

> Using the appropriate interest table, answer each of the following questions. (Each case is independent of the others.) a. What is the future value of $7,000 at the end of 5 periods at 8% compounded interest? b. What is the present value of $7,000 due 8

> In your audit of Jose Oliva Company, you find that a physical inventory on December 31, 2017, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items were all excluded from the $441,000. 1. Merchandise o

> C. Reither Co. reports the following information for 2017: sales revenue $700,000, cost of goods sold $500,000, operating expenses $80,000, and an unrealized holding loss on available-for-sale securities for 2017 of $60,000. It declared and paid a cash d

> Eddie Zambrano Corporation began operations on January 1, 2017. During its first 3 years of operations, Zambrano reported net income and declared dividends as follows. The following information relates to 2017. Income before income taxâ€&br

> Jurassic Park Co. prepares monthly financial statements from a worksheet. Selected portions of the January worksheet showed the following data. During February, no events occurred that affected these accounts. But at the end of February, the following i

> The following are selected ledger accounts of Spock Corporation at December 31, 2017. Spock’s effective tax rate on all items is 34%. A physical inventory indicates that the ending inventory is $686,000. Instructions Prepare a cond

> The stockholders’ equity section of Hendly Corporation appears below as of December 31, 2017. Net income for 2017 reflects a total effective tax rate of 34%. Included in the net income figure is a loss of $18,000,000 (before tax) as a

> Wayne Rogers Corp. maintains its financial records on the cash basis of accounting. Interested in securing a long-term loan from its regular bank, Wayne Rogers Corp. requests you as its independent CPA to convert its cash-basis income statement data to t

> Jill Accardo, M.D., maintains the accounting records of Accardo Clinic on a cash basis. During 2017, Dr. Accardo collected $142,600 from her patients and paid $55,470 in expenses. At January 1, 2017, and December 31, 2017, she had accounts receivable, un

> The following information was taken from the records of Roland Carlson Inc. for the year 2017: income tax applicable to income from continuing operations $187,000, income tax applicable to loss on discontinued operations $25,500, and unrealized holding g

> Presented below are selected account balances for Homer Winslow Co. as of December 31, 2017. Instructions Prepare closing entries for Homer Winslow Co. on December 31, 2017. (Omit explanations.) $ 60,000 75,000 45,000 18,000 12,000 15,000 410,000 I

> Arna, Inc. uses the dollar-value LIFO method of computing its inventory. Data for the past 3 years follow. Compute the value of the 2017 and 2018 inventories using the dollar-value LIFO method. Year Ended December 31 Inventory at Current-Year Cost

> Roxanne Carter Corporation reported the following for 2017: net sales $1,200,000, cost of goods sold $750,000, selling and administrative expenses $320,000, and an unrealized holding gain on available-for-sale securities $18,000. Instructions Prepare a

> Tim Mattke Company began operations in 2015 and for simplicity reasons, adopted weighted-average pricing for inventory. In 2017, in accordance with other companies in its industry, Mattke changed its inventory pricing to FIFO. The pretax income data is r

> At December 31, 2016, Shiga Naoya Corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,500 shares………$10,750,000 Common stock, $5 par, 4,000,000 shares………………………………..20,000,000 During 2017, Shiga Naoya did not i

> Santo Design was founded by Thomas Grant in January 2011. Presented below is the adjusted trial balance as of December 31, 2017. Instructions a. Prepare an income statement and a statement of retained earnings for the year ending December 31, 2017, an

> The adjusted trial balance of Anderson Cooper Co. as of December 31, 2017, contains the following. Instructions a. Prepare an income statement. b. Prepare a statement of retained earnings. c. Prepare a classified balance sheet. ANDERSON COOPER CO.

> Greco Resort opened for business on June 1 with eight air-conditioned units. Its trial balance on August 31 is as follows. Other data: 1. The balance in prepaid insurance is a one-year premium paid on June 1, 2017. 2. An inventory count on August 31

> Selected accounts of Urdu Company are shown below. Instructions From an analysis of the T-accounts, reconstruct (a) the October transaction entries, and (b) the adjusting journal entries that were made on October 31, 2017. Prepare explanations for each

> A partial adjusted trial balance of Piper Company at January 31, 2017, shows the following. Instructions Answer the following questions, assuming the year begins January 1. a. If the amount in Supplies Expense is the January 31 adjusting entry, and $8

> Presented below are a number of operational guidelines and practices that have developed over time. Instructions Select the assumption, principle, or constraint that most appropriately justifies these procedures and practices. (Do not use qualitative c

> The following balances were taken from the books of Alonzo Corp. on December 31, 2017. Assume the total effective tax rate on all items is 34%. Instructions Prepare a multiple-step income statement; 100,000 shares of common stock were outstanding du

> Academic access to the FASB Codification is available through university subscriptions, obtained from the American Accounting Association (at http://aaahq.org/FASB/Access.cfm), for an annual fee of $150. This subscription covers an unlimited number of st

> Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step format. The discussion involves the following 2017 information related to P. Bride Company ($000 omitt

> The financial records of LeRoi Jones Inc. were destroyed by fire at the end of 2017. Fortunately, the controller had kept certain statistical data related to the income statement as follows. 1. The beginning merchandise inventory was $92,000 and decrease

> Presented below are certain account balances of Paczki Products Co. Instructions From the foregoing, compute the following: (a) total net revenue, (b) net income, (c) dividends declared, and (d) income attributable to controlling stockholders.

> The following trial balance of Wanda Landowska Company does not balance. Your review of the ledger reveals the following. (a) Each account had a normal balance. (b) The debit footings in Prepaid Insurance, Accounts Payable, and Property Tax Expense wer

> Presented below are changes in all the account balances of Fritz Mayhew Furniture Co. during the current year, except for retained earnings. Instructions Compute the net income for the current year, assuming that there were no entries in the Retained

> Cruise Industries purchased $10,800 of merchandise on February 1, 2017, subject to a trade discount of 10% and with credit terms of 3/15, n/60. It returned $2,500 (gross price before trade or cash discount) on February 4. The invoice was paid on February

> Two or more items are omitted in each of the following tabulations of income statement data. Fill in the amounts that are missing. 2016 2017 2018 Sales revenue $ ? $290,000 11,000 $410,000 Sales returns and allowances 13,000 347,000 32,000 ? Net sal

> Craig Company asks you to review its December 31, 2017, inventory values and prepare the necessary adjustments to the books. The following information is given to you. 1. Craig uses the periodic method of recording inventory. A physical count reveals $2

> Assume that in an annual audit of Harlowe Inc. at December 31, 2017, you find the following transactions near the closing date. 1. A special machine, fabricated to order for a customer, was finished and specifically segregated in the back part of the sh

> At December 31, 2016, Stacy McGill Corporation reported current assets of $370,000 and current liabilities of $200,000. The following items may have been recorded incorrectly. 1. Goods purchased costing $22,000 were shipped f.o.b. shipping point by a su

> Trout Company uses the LIFO method for financial reporting purposes but FIFO for internal reporting purposes. At January 1, 2017, the LIFO reserve has a credit balance of $1,300,000. At December 31, 2017, Trout’s internal reports indicated that the FIFO

> The following information relates to the Jimmy Johnson Company. Instructions Use the dollar-value LIFO method to compute the ending inventory for Johnson Company for 2013 through 2017. Ending Inventory (End-of-Year Prices) $ 70,000 90,300 95,120 1

> Presented below is information related to Dino Radja Company. Instructions Compute the ending inventory for Dino Radja Company for 2014 through 2019 using the dollar-value LIFO method. Ending Inventory (End-of-Year Prices) $ 80,000 115,500 108,000

> The dollar-value LIFO method was adopted by Enya Corp. on January 1, 2017. Its inventory on that date was $160,000. On December 31, 2017, the inventory at prices existing on that date amounted to $140,000. The price level at January 1, 2017, was 100, and

> Tori Amos Corporation began operations on December 1, 2016. The only inventory transaction in 2016 was the purchase of inventory on December 10, 2016, at a cost of $20 per unit. None of this inventory was sold in 2016. Relevant information is as follows.

> Johnny Football Shop began operations on January 2, 2017. The following stock record card for footballs was taken from the records at the end of the year. A physical inventory on December 31, 2017, reveals that 100 footballs were in stock. The bookkeepe

> You are the vice president of finance of Sandy Alomar Corporation, a retail company that prepared two different schedules of gross margin for the first quarter ended March 31, 2017. These schedules appear below. The computation of cost of goods sold in

> The following is a record of Pervis Ellison Company’s transactions for Boston Teapots for the month of May 2017. Instructions a. Assuming that perpetual inventories are not maintained and that a physical count at the end of the month

> Shania Twain Company was formed on December 1, 2016. The following information is available from Twain’s inventory records for Product BAP. A physical inventory on March 31, 2017, shows 1,600 units on hand. Instructions Prepare sche

> Duncan Company reports the following financial information before adjustments. Instructions Prepare the journal entry to record Bad Debt Expense assuming Duncan Company estimates bad debts at (a) 5% of accounts receivable and (b) 5% of accounts rece

> Jim Carrie Company shows a balance of $181,140 in the Accounts Receivable account on December 31, 2017. The balance consists of the following. Installment accounts due in 2018……………………………. $23,000 Installment accounts due after 2018…………………………. 34,000 Ove

> Using the information provided in BE4-2, prepare a condensed multiple-step income statement for Brisky Corporation. From BE 4-2: Brisky Corporation had net sales of $2,400,000 and interest revenue of $31,000 during 2017. Expenses for 2017 were cost of g

> On December 31, 2017, Conchita Martinez Company signed a $1,000,000 note to Sauk City Bank. The market interest rate at that time was 12%. The stated interest rate on the note was 10%, payable annually. The note matures in 5 years. Unfortunately, because

> On December 31, 2017, Iva Majoli Company borrowed $62,092 from Paris Bank, signing a 5-year, $100,000 zero-interest-bearing note. The note was issued to yield 10% interest. Unfortunately, during 2019, Majoli began to experience financial difficulty. As a

> Logan Bruno Company has just received the August 31, 2017, bank statement, which is summarized below. The general ledger Cash account contained the following entries for the month of August. Deposits in transit at August 31 are $3,800, and checks out

> Use the information for Jones Company as presented in E7-20. Jones is planning to factor some accounts receivable at the end of the year. Accounts totaling $25,000 will be transferred to Credit Factors, Inc. with recourse. Credit Factors will retain 5% o

> Presented below is information for Jones Company. 1. Beginning-of-the-year Accounts Receivable balance was $15,000. 2. Net sales (all on account) for the year were $100,000. Jones does not offer cash discounts. 3. Collections on accounts receivable du

> Presented below are a number of independent situations. Instructions For each individual situation, determine the amount that should be reported as cash. If the item(s) is not reported as cash, explain the rationale. 1. Checking account balance $925,0

> Beyoncé Corporation factors $175,000 of accounts receivable with Kathleen Battle Financing, Inc. on a with recourse basis. Kathleen Battle Financing will collect the receivables. The receivables records are transferred to Kathleen Battle Financing on Aug

> The trial balance before adjustment for Phil Collins Company shows the following balances. Instructions Using the data above, give the journal entries required to record each of the following cases. (Each situation is independent.) 1. To obtain additi

> On December 31, 2015, Ed Abbey Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Abbey Co. agreed to accept a $200,000 zero-interest-bearing note due December 31, 2017, as payment in full. Hayduke is somewhat

> On July 1, 2017, Agincourt Inc. made two sales. 1. It sold land having a fair value of $700,000 in exchange for a 4-year zero-interest-bearing promissory note in the face amount of $1,101,460. The land is carried on Agincourt’s books at a cost of $590,0

> Stacy Corporation had income from operations of $7,200,000. In addition, it suffered an unusual and infrequent pretax loss of $770,000 from a volcano eruption, interest revenue of $17,000, and a write-down on buildings of $53,000. The corporation’s tax r