Question: The bookkeeper at Wood Company has not

The bookkeeper at Wood Company has not reconciled the bank statement with the Cash account, saying, “I don’t have time.†You have been asked to prepare a reconciliation and review the procedures with the bookkeeper.

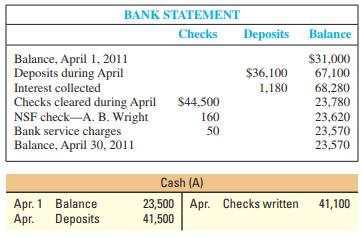

The April 30, 2011, bank statement and the April ledger accounts for cash showed the following

(summarized):

A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $4,100. No deposits in transit were carried over from March, but a deposit was in transit at the end of April.

Required:

1. Prepare a detailed bank reconciliation for April.

2. Give any required journal entries as a result of the reconciliation. Why are they necessary?

3. What was the balance in the cash account in the ledger on May 1, 2011?

4. What total amount of cash should be reported on the balance sheet at the end of April?

Transcribed Image Text:

BANK STATEMENT Checks Deposits Balance Balance, April 1, 2011 Deposits during April $31,000 67,100 68,280 23,780 23,620 23,570 23,570 $36,100 Interest collected 1,180 Checks cleared during April NSF check-A. B. Wright Bank service charges Balance, April 30, 2011 $44,500 160 50 Cash (A) Apr. 1 Balance Apr. Checks written 41,100 23,500 41,500 Apr. Deposits

> Parson Company was formed on January 1, 2012, and is preparing the annual financial statements dated December 31, 2012. Ending inventory information about the four major items stocked for regular sale follows: Required: 1. Compute the valuation that s

> Jones Company is preparing the annual financial statements dated December 31, 2012. Ending inventory information about the five major items stocked for regular sale follows: Required: Compute the valuation that should be used for the 2012 ending inven

> Following is partial information for the income statement of Lumber Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cos

> Complete the following table by entering either the word increases or decreases in each column. Debit Credit Assets Liabilities Stockholders' equity

> Daniel Company uses a periodic inventory system. Data for 2012: beginning merchandise inventory (December 31, 2011), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $194,500; ending inventory per physical count at De

> Beck Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 2: Required: 1. Prepare a separate income statement through pretax income

> Element Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 2: Required: 1. Prepare a separate income statement through pretax i

> Hamilton Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 1: Required: Compute ending inventory and cost of goods sold under

> Abercrombie and Fitch is a leading retailer of casual apparel for men, women, and children. Assume that you are employed as a stock analyst and your boss has just completed a review of the new Abercrombie annual report. She provided you with her notes, b

> Supply the missing dollar amounts for the income statement for each of the following independent cases: Pretax Sales Beginning Total Ending Inventory Goods Sold Profit Expenses Cost of Gross Income Cases Revenue Inventory $ 650 Purchases Available (

> The matching principle controls a. Where on the income statement expenses should be presented. b. When costs are recognized as expenses on the income statement. c. The ordering of current assets and current liabilities on the balance sheet. d. How co

> Supply the missing dollar amounts for the income statement for each of the following independent cases. Case A Case B Case C Net sales revenue $7.500 2$ $6,000 Beginning inventory $11,200 $ 6,500 $ 4,000 Purchases 5,000 9,500 Goods available for sal

> In its annual report, Caterpillar, Inc., a major manufacturer of farm and construction equipment, reported the following information concerning its inventories: Inventories are stated at the lower of cost or market. Cost is principally determined using t

> Dana Holding Corporation designs and manufactures component parts for the vehicular, industrial, and mobile off-highway original equipment markets. In a recent annual report, Dana’s inventory note indicated the following: Dana changed its method of acco

> A recent press release for Seneca Foods (licensee of the Libby’s brand of canned fruits and vegetables) included the following information: The current year’s net earnings were $8,019,000 or $0.65 per diluted share, compared with $32,067,000 or $2.63 pe

> For each of the following transactions of Pitt Inc. for the month of January 2012, indicate the accounts, amounts, and direction of the effects on the accounting equation. A sample is provided. a. (Sample) Borrowed $20,000 from a local bank. b. Lent $7

> Refer to AP2-3 . Ethan Allen Interiors, Inc., is a leading manufacturer and retailer of home furnishings in the United States and abroad. The following is adapted from Ethan Allen’s June 30, 2008, annual financial report. Dollars are i

> Micro Warehouse was a computer software and hardware online and catalog sales company. A Wall Street Journal article disclosed the following: Its Form 10-Q quarterly report filed with the Securities and Exchange Commission two days before indicated tha

> Refer to the financial statements of American Eagle Outfitters given in Appendix B at the end of this book. Required: 1. How much inventory does the company hold at the end of the most recent year? 2. Estimate the amount of merchandise that the compan

> Refer to the financial statements of American Eagle Outfitters (Appendix B) and Urban Outfitters (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the inventory turnover ratio for both companies for t

> Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book. Required: 1. The company uses lower of cost or market to account for its inventory. At the end of the year, do you expect the company to write its invent

> Which of the following is not one of the four criteria that normally must be met for revenue to be recognized according to the revenue principle for accrual basis accounting? a. Cash has been collected. b. Services have been performed. c. The price is

> The income statements for four consecutive years for Colca Company reflected the following summarized amounts: Subsequent to development of these amounts, it has been determined that the physical inventory taken on December 31, 2012, was understated by

> Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic

> At the end of January 2012, the records of NewRidge Company showed the following for a particular item that sold at $16 per unit: Required: 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit

> Dixon Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2011, the accounting records for the most popular item in inventory showed the following: Required: Compute the cost of (a) goods available for s

> Under the gross method of recording sales discounts discussed in this chapter, is the amount of sales discount taken recorded (a) at the time the sale is recorded or (b) at the time the collection of the account is recorded?

> The following are accounts of Rosa-Perez Company: In the space provided, classify each as it would be reported on a balance sheet. Use: (1) Accounts Payable (2) Accounts Receivable (9) Long-Term Investments (10) Notes Payable (due in three years)

> Which of the following is not a specific account in a company’s chart of accounts? a. Gains b. Revenue c. Net Income d. Unearned Revenue

> Differentiate accounts receivable from notes receivable.

> What are the purposes of a bank reconciliation? What balances are reconciled?

> Why should cash-handling and cash-recording activities be separated? How is this separation accomplished?

> Summarize the primary characteristics of an effective internal control system for cash.

> Match each definition with its related term by entering the appropriate letter in the space provided. There should be only one definition per term (that is, there are more definitions than terms). Term Definition (1) Journal entry (2) A = L + SE, an

> This period a company collects $100 cash on an account receivable from a customer for a sale last period. How would the receipt of cash impact the following two financial statements this period? Income Statement..............................Statement of

> Briefly explain how the total amount of cash reported on the balance sheet is computed.

> At what point should revenue be recognized in each of the following independent cases? Case A. For Christmas presents, a Wendy’s restaurant sells coupon books for $15. Each of the $1 coupons may be used in the restaurant any time during the following 12

> Use the data presented in P6-2, which were selected from the records of Sykes Company for the year ended December 31, 2011. Data from P6-2: The following data were selected from the records of Sykes Company for the year ended December 31, 2011. Balanc

> The August 2011 bank statement for Allison Company and the August 2011 ledger account for cash follow: Outstanding checks at the end of July were for $270, $430, and $320. No deposits were in transit at the end of July. Required: 1. Compute the depo

> Tungsten Company, Inc., sells heavy construction equipment. There are 10,000 shares of capital stock outstanding. The annual fiscal period ends on December 31. The following condensed trial balance was taken from the general ledger on December 31, 2011:

> Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three time periods as follow

> Match each definition with its related term by entering the appropriate letter in the space provided. There should be only one definition per term (that is, there are more definitions than terms). Term Definition (1) Separate-entity assumption A. =

> Peet’s Coffee & Tea, Inc., is a specialty coffee roaster and marketer of branded fresh roasted whole bean coffee. It recently disclosed the following information concerning the Allowance for Doubtful Accounts on its Form 10-K Annual

> Cash payments for salaries are reported in what section of the Statement of Cash Flows? a. Operating. b. Investing. c. Financing. d. None of the above.

> Stacey’s Piano Rebuilding Company has been operating for one year (2010). At the start of 2011, its income statement accounts had zero balances and its balance sheet account balances were as follows: Required: 1. Create T-accounts fo

> The following data presented in income statement order were taken from the year-end records of Berugu Export Company. Fill in all of the missing amounts and show computations. Independent Cases Income Statement Items Case A Case B Gross sales revenu

> The following data were selected from the records of Sykes Company for the year ended December 31, 2011. Balances January 1, 2011 Accounts receivable (various customers)....................................$115,000 Allowance for doubtful accounts........

> Which of the following is not a component of net sales? a. Sales returns and allowances b. Sales discounts c. Cost of goods sold d. Credit card discounts

> Which of the following best describes the proper presentation of accounts receivable in the financial statements? a. Gross accounts receivable plus the allowance for doubtful accounts in the asset section of the balance sheet. b. Gross accounts receivabl

> When using the allowance method, as bad debt expense is recorded, a. Total assets remain the same and stockholders’ equity remains the same. b. Total assets decrease and stockholders’ equity decreases. c. Total assets increase and stockholders’ equity

> Which of the following is not a step toward effective internal control over cash? a. Require signatures from a manager and one financial officer on all checks. b. Require that cash be deposited daily at the bank. c. Require that the person responsible

> Upon review of the most recent bank statement, you discover that you recently received an “insufficient funds check” from a customer. Which of the following describes the actions to be taken when preparing your bank reconciliation? Balance per Books....

> You have determined that Company X estimates bad debt expense with an aging of accounts receivable schedule. Company X’s estimate of uncollectible receivables resulting from the aging analysis equals $250. The beginning balance in the allowance for doubt

> When a company using the allowance method writes off a specific customer’s $100,000 account receivable from the accounting system, which of the following statements are true? 1. Total stockholders’ equity remains the same. 2. Total assets remain the sa

> Calculate the current ratio for Sal’s Pizza Company at the end of 2007 and 2008, based on the following data: What does the result suggest about the company over time? What can you say about Sal’s Pizza Companyâ

> You have observed that the total asset turnover ratio for a retail chain has increased steadily over the last three years. The most likely explanation is which of the following? a. Salaries for upper management as a percentage of total expenses have decr

> A company has been successful in reducing the costs of its manufacturing process by relocating the factory to another locale. What effect will this factor have on the company’s gross profit percentage ratio, all other things equal? a. The ratio will not

> Gross sales total $250,000, one-half of which were credit sales. Sales returns and allowances of $15,000 apply to the credit sales, sales discounts of 2% were taken on all of the net credit sales, and credit card sales of $100,000 were subject to a credi

> Sales discounts with terms 2/10, n/30 mean: a. 10 percent discount for payment within 30 days. b. 2 percent discount for payment within 10 days, or the full amount (less returns) due within 30 days. c. Two-tenths of a percent discount for payment with

> Prepare journal entries for each transaction listed. a. During the period, bad debts are written off in the amount of $19,000. b. At the end of the period, bad debt expense is estimated to be $13,000.

> Merchandise invoiced at $8,500 is sold on terms 1/10, n/30. If the buyer pays within the discount period, what amount will be reported on the income statement as net sales?

> Indicate whether the following items would be added (+) or subtracted (−) from the company’s books or the bank statement during the construction of a bank reconciliation. Reconciling Item Company's Books Bank Stat

> Indicate the most likely effect of the following changes in credit policy on the receivables turnover ratio (+ for increase, − for decrease, and NE for no effect). a. Granted credit with shorter payment deadlines. b. Increased effectiveness of collection

> Using the following categories, indicate the effects of the following transactions. Use + for increase and − for decrease and indicate the accounts affected and the amounts. a. At the end of the period, bad debt expense is estimated to

> Net sales for the period was $45,000 and cost of sales was $28,000. Compute the gross profit percentage for the current year. What does this ratio measure?

> Total gross sales for the period include the following: Credit card sales (discount 3%).............................$ 9,400 Sales on account (2/15, n/60)...............................$10,500 Sales returns related to sales on account were $500. All ret

> Which of the following is the entry to be recorded by a law firm when it receives a $2,000 retainer from a new client at the initial client meeting? a. Debit to Cash, $2,000; credit to Legal Fees Revenue, $2,000. b. Debit to Accounts Receivable, $2,000

> For the transactions in M2-5, identify each as an investing (I) activity or financing (F) activity on the statement of cash flows. In M2-5, For each of the following transactions of Pitt Inc. for the month of January 2012, indicate the accounts, amount

> Indicate the most likely time you expect sales revenue to be recorded for each of the listed transactions. Indicate the most likely time you expect sales revenue to be recorded for each of the listed transactions. Transaction Point A Point B a. Sale

> A sale is made for $8,000; terms are 2/10, n/30. At what amount should the sale be recorded under the gross method of recording sales discounts? Give the required entry. Also give the collection entry, assuming that it is during the discount period.

> Microsoft develops, produces, and markets a wide range of computer software, including the Windows operating system. On its recent financial statements, Microsoft reported the following information about net sales revenue and accounts receivable (amounts

> Siemens is one of the world’s largest electrical engineering and electronics companies. Headquartered in Germany, the company has been in business for over 160 years and operates in 190 countries. In a recent annual report, it disclosed

> Frederick Company uses the aging approach to estimate bad debt expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $275,000, (2) up to 120 days past due, $50,000, and (3) more than 12

> Casilda Company uses the aging approach to estimate bad debt expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $50,000, (2) up to 180 days past due, $14,000, and (3) more than 180 d

> Gary’s Dairy uses the aging approach to estimate bad debt expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $16,000, (2) up to 120 days past due, $5,500, and (3) more than 120 days pas

> During 2012, Giatras Electronics recorded credit sales of $680,000. Based on prior experience, it estimates a 3.5 percent bad debt rate on credit sales. Required: 1. Prepare journal entries for each of the following transactions. a. The appropriate ba

> Using the following categories, indicate the effects of the transactions listed in E6-9. Use + for increase and − for decrease and indicate the accounts affected and the amounts. Assets Liabilities Stockholders' Equity

> During 2011, CliffCo Inc. incurred operating expenses of $200,000, of which $150,000 was paid in cash; the balance will be paid in January 2012. Transaction analysis of operating expenses for 2011 should reflect only the following: a. Decrease stockholde

> The following summarized data were provided by the records of Slate, Incorporated, for the year ended December 31, 2012: Sales of merchandise for cash............................................................$233,000 Sales of merchandise on credit....

> For each of the following events, which ones result in an exchange transaction for Dittman Company (Y for yes and N for no)? (1) Dittman Company purchased a machine that it paid for by signing a note payable. (2) The founding owner, Megan Dittman,

> Wolverine World Wide Inc. prides itself as being the “world’s leading marketer of U.S. branded nonathletic footwear.” It competes in many markets with Deckers, often offering products at a lower price point. Its brands include Wolverine, Bates, Sebago, a

> Brazen Shoe Company records Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts as contra-revenues. Complete the following tabulation, indicating the effect (+ for increase, − for decrease, and NE for no effect) and

> The following transactions were selected from among those completed by Hailey Retailers in 2010: Nov. 20 Sold two items of merchandise to Customer B, who charged the $450 sales price on her Visa credit card. Visa charges Hailey a 2 percent cr

> The September 30, 2011, bank statement for Bennett Company and the September ledger accounts for cash are summarized here: No outstanding checks and no deposits in transit were carried over from August; however, there are deposits in transit and checks

> Jackson Company’s June 30, 2011, bank statement and June ledger accounts for cash are summarized below: Required: 1. Reconcile the bank account. A comparison of the checks written with the checks that have cleared the bank shows out

> Stride Rite Corporation manufactures and markets shoes under the brand names Stride Rite, Keds, and Sperry Top-Sider. Three recent years produced a combination of declining sales revenue and net income culminating in a net loss of $8,430,000. Each year,

> A recent annual report for Dell, Inc., contained the following data: Required: 1. Determine the receivables turnover ratio and average day’s sales in receivables for the current year. 2. Explain the meaning of each number. (dol

> A recent annual report for FedEx contained the following data: Required: 1. Determine the receivables turnover ratio and average day’s sales in receivables for the current year. 2. Explain the meaning of each number. (dollars in

> On January 1, 2011, Anson Company started the year with a $250,000 credit balance in Retained Earnings and a $300,000 balance in Contributed Capital. During 2011, the company earned net income of $50,000, declared a dividend of $15,000, and issued more s

> During 2011, Dorothy’s Ceramics Shop had sales revenue of $70,000, of which $25,000 was on credit. At the start of 2011, Accounts Receivable showed a $4,000 debit balance, and the Allowance for Doubtful Accounts showed a $300 credit balance. Collections

> During 2012, Robby’s Camera Shop had sales revenue of $170,000, of which $75,000 was on credit. At the start of 2012, Accounts Receivable showed a $16,000 debit balance, and the Allowance for Doubtful Accounts showed a $900 credit balance. Collections of

> Zeber Company has been operating for one year (2011). You are a member of the management team investigating expansion ideas that will require borrowing funds from banks. At the start of 2012, Zeber’s T-account balances were as follows:

> A recent annual report for Target contained the following information (dollars in thousands) at the end of its fiscal year: A footnote to the financial statements disclosed that uncollectible accounts amounting to $811,000 and $428,000 were written off

> During the months of January and February, Silver Corporation sold goods to three customers. The sequence of events was as follows: Jan. 6 Sold goods for $850 to S. Green and billed that amount subject to terms 2/10, n/30. 6 Sold good

> During 2011, Soto Electronics, Incorporated, recorded credit sales of $790,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a. The appropriate bad debt expe

> During 2011, Crandell Productions, Inc., recorded credit sales of $800,000. Based on prior experience, it estimates a 1 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a. The appropriate bad debt expense

> The following transactions were selected from among those completed by Cadence Retailers in 2011: Nov. 20 Sold 20 items of merchandise to Customer B at an invoice price of $5,500 (total); terms 3/10, n/30. 25 Sold two items of merchandi

> The following transactions were selected from the records of OceanView Company: July 12 Sold merchandise to Customer R, who charged the $3,000 purchase on his Visa credit card. Visa charges OceanView a 2 percent credit card fee. 15 Sold me

> When companies involved in long-term construction projects can estimate the percentage of work completed and the total expected costs with reasonable accuracy, GAAP allows them to recognize revenues based on the incurred contract costs to date divided by

> The following data are from annual reports of Jen’s Jewelry Company: Compute Jen’s total asset turnover ratio for 2012 and 2011. What do these results suggest to you about Jen’s Jewelry Company?