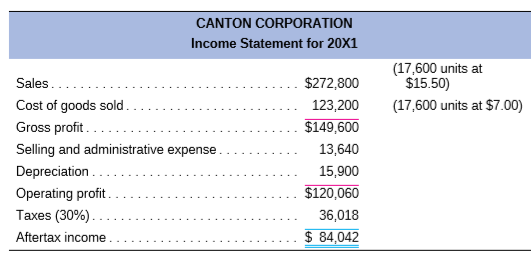

Question: The Canton Corporation shows the following income

The Canton Corporation shows the following income statement. The firm uses FIFO inventory accounting.

a. Assume in 20X2 that the same 17,600-unit volume is maintained, but that the sales price increases by 10 percent. Because of FIFO inventory policy, old inventory will still be charged off at $7 per unit. Also assume selling and administrative expense will be 5 percent of sales and depreciation will be unchanged. The tax rate is 30 percent. Compute after tax income for 20X2.

b. In part a, by what percent did after tax income increase as a result of a 10 percent increase in the sales price? Explain why this impact took place.

c. Now assume that in 20X3 the volume remains constant at 17,600 units, but the sales price decreases by 15 percent from its year 20X2 level. Also, because of FIFO inventory policy, cost of goods sold reflects the inflationary conditions of the prior year and is $7.50 per unit. Further, assume selling and administrative expense will be 5 percent of sales and depreciation will be unchanged. The tax rate is 30 percent. Compute the after tax income.

Transcribed Image Text:

> Ultra vision Inc. anticipates sales of $290,000 from January through April. Materials will represent 50 percent of sales, and because of level production, material purchases will be equal for each month during the four months of January, February, March,

> Philip Morris expects the sales for his clothing company to be $550,000 next year. Philip notes that net assets (Assets – Liabilities) will remain unchanged. His clothing firm will enjoy a 12 percent return on total sales. He will start the year with $15

> Watt’s Lighting Stores made the following sales projection for the next six months. All sales are credit sales. Sales in January and February were $38,000 and $37,000, respectively. Experience has shown that of total sales, 10 percent

> Simpson Glove Company has made the following sales projections for the next six months. All sales are credit sales. Sales in January and February were $41,000 and $39,000, respectively. Experience has shown that of total sales receipts 10 percent are un

> J. Lo’s Clothiers has forecast credit sales for the fourth quarter of the year as: Experience has shown that 30 percent of sales are collected in the month of sale, 60 percent in the following month, and 10 percent are never collected

> Sprint Shoes Inc. had a beginning inventory of 9,250 units on January 1, 20X1. Costs associated with the inventory: During 20X1, the firm produced 43,000 units with the following costs: Sales for the year were 47,350 units at $44.60 each. Sprint Shoe

> The Bradley Corporation produces a product with the following costs as of July 1, 20X1: Beginning inventory at these costs on July 1 was 3,250 units. From July 1 to December 1, 20X1, Bradley produced 12,500 units. These units had a material cost of $5,

> Convex Mechanical Supplies produces a product with the following costs as of July 1, 20X1: Beginning inventory at these costs on July 1 was 5,000 units. From July 1 to December 1, Convex produced 15,000 units. These units had a material cost of $10 per

> At the end of January, Mineral Labs had an inventory of 775 units, which cost $12 per unit to produce. During February, the company produced 900 units at a cost of $16 per unit. If the firm sold 1,500 units in February, what was the cost of goods sold? a

> At the end of January, Higgins Data Systems had an inventory of 650 units, which cost $16 per unit to produce. During February, the company produced 950 units at a cost of $19 per unit. If the firm sold 1,150 units in February, what was its cost of goods

> What is the difference between a bond agreement and a bond indenture?

> On December 31 of last year, Wolfson Corporation had an inventory of 450 units of its product, which cost $22 per unit to produce. During January, the company produced 850 units at a cost of $25 per unit. Assuming that Wolfson Corporation sold 800 units

> Delsing Plumbing Company has beginning inventory of 16,500 units, will sell 55,000 units for the month, and desires to reduce ending inventory to 25 percent of beginning inventory. How many units should Delsing produce?

> Eli Lilly is very excited because sales for his nursery and plant company are expected to double from $600,000 to $1,200,000 next year. Eli notes that net assets (Assets — Liabilities) will remain at 50 percent of sales. His firm will enjoy an 8 percent

> Network Communications has total assets of $1,500,000 and current assets of $612,000. It turns over its fixed assets three times a year. It has $319,000 of debt. Its return on sales is 8 percent. What is its return on stockholders’ equity?

> Easter Egg and Poultry Company has $2,000,000 in assets and $1,400,000 of debt. It reports net income of $200,000. a. What is the firm’s return on assets? b. What is its return on stockholders’ equity? c. If the firm has an asset turnover ratio of 2.5 ti

> The Haines Corp. shows the following financial data for 20X1 and 20X2. For each year, compute the following and indicate whether it is increasing or decreasing profitability in 20X2 as indicated by the ratio. a. Cost of goods sold to sales. b. Selling

> Dr. Zhivà go Diagnostics Corp. income statements for 20X1 are as follows: a. Compute the profit margin for 20X1. b. Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep a

> Billy’s Crystal Stores Inc. has assets of $5,960,000 and turns over its assets 1.9 times per year. Return on assets is 8 percent. What is the firm’s profit margin (return on sales)?

> Polly Esther Dress Shops Inc. can open a new store that will do an annual sales volume of $837,900. It will turn over its assets 1.9 times per year. The profit margin on sales will be 8 percent. What would net income and return on assets (investment) be

> Quantum Moving Company has the following data. Industry information also is shown. As an industry analyst comparing the firm to the industry, are you likely to praise or criticize the firm in terms of the following: a. Net income/Total assets. b. Debt/

> Discuss the advantages and disadvantages of debt.

> Jolie Foster Care Homes Inc. shows the following data: a. Compute the ratio of net income to total assets for each year and comment on the trend. b. Compute the ratio of net income to stockholders’ equity and comment on the trend. Exp

> In January 2007, the Status Quo Company was formed. Total assets were $544,000, of which $306,000 consisted of depreciable fixed assets. Status Quo uses straight-line depreciation of $30,600 per year, and in 2007 it estimated its fixed assets to have use

> A firm has net income before interest and taxes of $193,000 and interest expense of $28,100. a. What is the times-interest-earned ratio? b. If the firm’s lease payments are $48,500, what is the fixed charge coverage?

> Using the income statement for Times Mirror and Glass Co., compute the following ratios: a. The interest coverage. b. The fixed charge coverage. The total assets for this company equal $80,000. Set up the equation for the Du Pont system of ratio analysis

> The Lancaster Corporation’s income statement is given next. a. What is the times-interest-earned ratio? b. What would be the fixed-charge-coverage ratio?

> The balance sheet for Stud Clothiers is shown next. Sales for the year were $2,400,000, with 90 percent of sales sold on credit. Compute the following ratios: a. Current ratio. b. Quick ratio. c. Debt-to-total-assets ratio. d. Asset turnover. e. Averag

> Jim Short’s Company makes clothing for schools. Sales in 20X1 were $4,820,000. Assets were as follows: a. Compute the following: 1. Accounts receivable turnover. 2. Inventory turnover. 3. Fixed asset turnover. 4. Total asset turnover.

> Perez Corporation has the following financial data for the years 20X1 and 20X2: a. Compute inventory turnover based on ratio number 6, Sales/Inventory, for each year. b. Compute inventory turnover based on an alternative calculation that is used by man

> Database Systems is considering expansion into a new product line. Assets to support expansion will cost $380,000. It is estimated that Database can generate $1,410,000 in annual sales, with an 8 percent profit margin. What would net income and return on

> Martin Electronics has an accounts receivable turnover equal to 15 times. If accounts receivable are equal to $80,000, what is the value for average daily credit sales?

> Explain how the zero-coupon rate bond provides a return to the investor. What are the advantages to the corporation?

> A firm has sales of $3 million, and 10 percent of the sales are for cash. The year-end accounts receivable balance is $285,000. What is the average collection period? (Use a 360-day year.)

> Assume the following data for Cable Corporation and Multi-Media Inc. a. Compute the return on stockholders’ equity for both firms using ratio 3a. Which firm has the higher return? b. Compute the following additional ratios for both fi

> Jerry Rice and Grain Stores has $4,780,000 in yearly sales. The firm earns 4.5 percent on each dollar of sales and turns over its assets 2.7 times per year. It has $123,000 in current liabilities and $349,000 in long-term liabilities. a. What is its retu

> Using the Du Pont method, evaluate the effects of the following relationships for the Butters Corporation: a. Butters Corporation has a profit margin of 7 percent and its return on assets (investment) is 25.2 percent. What is its assets turnover? b. If t

> Gates Appliances has a return-on-assets (investment) ratio of 8 percent. a. If the debt-to-total-assets ratio is 40 percent, what is the return on equity? b. If the firm had no debt, what would the return-on-equity ratio be?

> All State Trucking Co. has the following ratios compared to its industry for last year. Explain why the return-on-assets ratio is so much more favorable than the return-on-sales ratio compared to the industry. No numbers are necessary; a one-sentence a

> Baker Oats had an asset turnover of 1.6 times per year. a. If the return on total assets (investment) was 11.2 percent, what was Baker’s profit margin? b. The following year, on the same level of assets, Baker’s assets turnover declined to 1.4 times and

> Fondren Machine Tools has total assets of $3,310,000 and current assets of $879,000. It turns over its fixed assets 3.6 times per year. Its return on sales is 4.8 percent. It has $1,750,000 of debt. What is its return on stockholders’ equity?

> Given the financial statements for Jones Corporation and Smith Corporation shown here: a. To which one would you, as credit manager for a supplier, approve the extension of (short-term) trade credit? Why? Compute all ratios before answering. b. In which

> Using the financial statements for the Snider Corporation, calculate the 13 basic ratios found in the chapter.

> Explain how the bond refunding problem is similar to a capital budgeting decision.

> How does the SML react to changes in the rate of interest, changes in the rate of inflation, and changing investor expectations?

> The following information is from Harrelson Inc.’s, financial statements. Sales (all credit) were $28.50 million for last year. Fill in the balance sheet:

> We are given the following information for the Pettit Corporation. Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items. a. Accounts receivable. b. Marketable securi

> The Griggs Corporation has credit sales of $1,200,000. Given these ratios, fill in the following balance sheet.

> Construct the current assets section of the balance sheet from the following data. (Use cash as a plug figure after computing the other values.)

> Omni Technology Holding Company has the following three affiliates: a. Which affiliate has the highest return on sales? b. Which affiliate has the lowest return on assets? c. Which affiliate has the highest total asset turnover? d. Which affiliate has

> The Global Products Corporation has three subsidiaries. a. Which division has the lowest return on sales? b. Which division has the highest return on assets? c. Compute the return on assets for the entire corporation. d. If the $8,760,000 investment in

> Refer to the following financial statements for Crosby Corporation: a) Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in Table 2–10. b) Describe the general relationship between net i

> For December 31, 20X1, the balance sheet of Baxter Corporation was as follows: Sales for 20X2 were $245,000, and the cost of goods sold was 60 percent of sales. Selling and administrative expense was $24,500. Depreciation expense was 8 percent of plant

> Vriend Software Inc.’s book value per share is $15.20. Earnings per share is $1.88, and the firm’s stock trades in the stock market at 3.5 times book value per share, what will the P/E ratio be? (Round to the nearest whole number.)

> Bonds of different risk classes will have a spread between their interest rates. Is this spread always the same? Why?

> Amigo Software Inc. has total assets of $889,000, current liabilities of $192,000, and long-term liabilities of $154,000. There is $87,000 in preferred stock outstanding. Thirty thousand shares of common stock have been issued. a. Compute book value (ne

> The Holtzman Corporation has assets of $400,000, current liabilities of $50,000, and long-term liabilities of $100,000. There is $40,000 in preferred stock outstanding; 20,000 shares of common stock have been issued. a. Compute book value (net worth) per

> Landers Nursery and Garden Stores has current assets of $220,000 and fixed assets of $170,000. Current liabilities are $80,000 and long-term liabilities are $140,000. There is $40,000 in preferred stock outstanding and the firm has issued 25,000 shares o

> Nova Electrics anticipates cash flow from operating activities of $6 million in 20X1. It will need to spend $1.2 million on capital investments to remain competitive within the industry. Common stock dividends are projected at $.4 million and preferred s

> The Rogers Corporation has a gross profit of $880,000 and $360,000 in depreciation expense. The Evans Corporation also has $880,000 in gross profit, with $60,000 in depreciation expense. Selling and administrative expense is $120,000 for each company. Gi

> Identify whether each of the following items increases or decreases cash flow: Increase in accounts receivable…………….Decrease in prepaid expenses Increase in notes payable…………………………….……Increase in inventory Depreciation expense……………………………………….….Dividend

> Stilley Corporation had earnings after taxes of $436,000 in 20X2 with 200,000 shares outstanding. The stock price was $42.00. In 20X3, earnings after taxes declined to $206,000 with the same 200,000 shares outstanding. The stock price declined to $27.80.

> Botox Facial Care had earnings after taxes of $370,000 in 20X1 with 200,000 shares of stock outstanding. The stock price was $31.50. In 20X2, earnings after taxes increased to $436,000 with the same 200,000 shares outstanding. The stock price was $42.00.

> Quantum Technology had $669,000 of retained earnings on December 31, 20X2. The company paid common dividends of $35,500 in 20X2 and had retained earnings of $576,000 on December 31, 20X1. How much did Quantum Technology earn during 20X2, and what would e

> Elite Trailer Parks has an operating profit or $200,000. Interest expense for the year was $10,000; preferred dividends paid were $18,750; and common dividends paid were $30,000. The tax was $61,250. The firm has 20,000 shares of common stock outstanding

> What is the difference between the following yields: coupon rate, current yield, and yield to maturity?

> Arrange the following items in proper balance sheet presentation:

> Fill in the blank spaces with categories 1 through 7: 1. Balance sheet (BS) 2. Income statement (IS) 3. Current assets (CA) 4. Fixed assets (FA) 5. Current liabilities (CL) 6. Long-term liabilities (LL) 7. Stockholders’ equity (SE)

> Low Carb Diet Supplement Inc. has two divisions. Division A has a profit of $156,000 on sales of $2,010,000. Division B is able to make only $28,800 on sales of $329,000. Based on the profit margins (returns on sales), which division is superior?

> Lemon Auto Wholesalers had sales of $1,000,000 last year and cost of goods sold represented 78 percent of sales. Selling and administrative expenses were 12 percent of sales. Depreciation expense was $11,000 and interest expense for the year was $8,000.

> Stein Books Inc. sold 1,900 finance textbooks for $250 each to High Tuition University in 20X1. These books cost $210 to produce. Stein Books spent $12,200 (selling expense) to convince the university to buy its books. Depreciation expense for the year w

> Precision Systems had sales of $820,000, cost of goods of $510,000, selling and administrative expense of $60,000, and operating profit of $103,000. What was the value of depreciation expense? Set this problem up as a partial income statement, and determ

> Prepare an income statement for Virginia Slim Wear. Take your calculations all the way to computing earnings per share.

> Prepare in good form an income statement for Franklin Kite Co. Inc. Take your calculations all the way to computing earnings per share.

> Given the following information, prepare in good form an income statement for Jonas Brothers Cough Drops.

> Given the following information, prepare an income statement for the Dental Drilling Company.

> How does a leveraged buyout work? What does the debt structure of the firm normally look like after a leveraged buyout? What might be done to reduce the debt?

> Elizabeth Tailors Inc. has assets of $8,940,000 and turns over its assets 1.9 times per year. Return on assets is 13.5 percent. What is the firm’s profit margin (returns on sales)?

> Rod Fishing Supplies had sales of $2,500,000 and cost of goods sold of $1,710,000. Selling and administrative expenses represented 10 percent of sales. Depreciation was 6 percent of the total assets of $4,680,000. What was the firm’s operating profit?

> a. Swank Clothiers had sales of $383,000 and cost of goods sold of $260,000. What is the gross profit margin (ratio of gross profit to sales)? b. If the average firm in the clothing industry had a gross profit of 25 percent, how is the firm doing?

> Sosa Diet Supplements had earnings after taxes of $800,000 in the year 20X1 with 200,000 shares of stock outstanding. On January 1, 20X2, the firm issued 50,000 new shares. Because of the proceeds from these new shares and other operating improvements, e

> You are the vice president of finance for Exploratory Resources, headquartered in Houston, Texas. In January 20X1, your firm’s Canadian subsidiary obtained a six-month loan of 150,000 Canadian dollars from a bank in Houston to finance the acquisition of

> A Peruvian investor buys 150 shares of a U.S. stock for $7,500 ($50 per share). Over the course of a year, the stock goes up by $4 per share. a. If there is a 10 percent gain in the value of the dollar versus the nuevo sol, what will be the total percent

> An investor in the United States bought a one-year Brazilian security valued at 195,000 Brazilian reals. The U.S. dollar equivalent was 100,000. The Brazilian security earned 16 percent during the year, but the Brazilian real depreciated 5 cents against

> From the base price level of 100 in 1981, Saudi Arabian and U.S. price levels in 2010 stood at 250 and 100, respectively. Assume the 1981 $/riyal exchange rate was $.46/riyal. Suggestion: Using the purchasing power parity, adjust the exchange rate to com

> From the base price level of 100 in 1979, Saudi Arabian and U.S. price levels in 2008 stood at 200 and 410, respectively. If the 1979 $/riyal exchange rate was $0.26/riyal, what should the exchange rate be in 2008? Suggestion: Using purchasing power pari

> The Wall Street Journal reported the following spot and forward rates for the Swiss franc ($/SF): a. Was the Swiss franc selling at a discount or premium in the forward market? b. What was the 30-day forward premium (or discount)? c. What was the 90-da

> What are the disadvantages to being public?

> Al Simpson helped start Excel Systems several years ago. At the time, he purchased 116,000 shares of stock at $1 per share. Now he has the opportunity to sell his interest in the company to Folsom Corp. for $50 a share in cash. His capital gains tax rate

> The Hollings Corporation is considering a two-step buyout of the Norton Corporation. The latter firm has 2.5 million shares outstanding and its stock price is currently $40 per share. In the two-step buyout, Hollings will offer to buy 51 percent of Norto

> The Jeter Corporation is considering acquiring the A-Rod Corporation. The data for the two companies are as follows: a. The Jeter Corp. is going to give A-Rod Corp. a 60 percent premium over A-Rod’s current market value. What price wi

> Assume the following financial data for the Noble Corporation and Barnes Enterprises: a. If all the shares of the Noble Corporation are exchanged for those of Barnes Enterprises on a share-for-share basis, what will post merger earnings per share be fo

> Assume the following financial data for Rembrandt Paint Co. and Picasso Art Supplies: a. If all the shares of Rembrandt Paint Co. are exchanged for those of Picasso Art Supplies on a share-for-share basis, what will post merger earnings per share be f

> Worldwide Scientific Equipment is considering a cash acquisition of Medical Labs for $1.6 million. Medical Labs will provide the following pattern of cash inflows and synergistic benefits for the next 25 years. There is no tax loss carryforward. The co

> J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $4,500,000. Patterson will provide the following pattern of cash inflows and synergistic benefits for the next 20 years. There is no tax loss carryforward. The cost

> Assume that Western Exploration Corp. is considering the acquisition of Ogden Drilling Company. The latter has a $470,000 tax loss carryforward. Projected earnings for the Western Exploration Corp. are as follows: a. How much will the total taxes of We

> General Meters is considering two mergers. The first is with Firm A in its own volatile industry, the auto speedometer industry, while the second is a merger with Firm B in an industry that moves in the opposite direction (and will tend to level out perf

> Assume the Knight Corporation is considering the acquisition of Day Inc. The expected earnings per share for the Knight Corporation will be $4.00 with or without the merger. However, the standard deviation of the earnings will go from $2.40 to $1.60 with

> Discuss the benefits accruing to a company that is traded in the public securities markets.

> Chicago Savings Corp. is planning to make an offer for Ernie’s Bank & Trust. The stock of Ernie’s Bank & Trust is currently selling for $44 a share. a. If the tender offer is planned at a premium of 50 percent over market price, what will be the value of