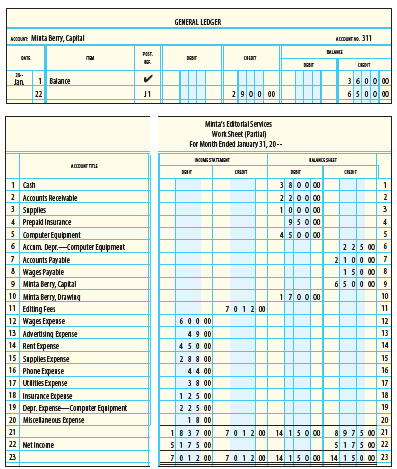

Question: The capital account for Minta’s Editorial

The capital account for Minta’s Editorial Services, including an additional investment, and a partial work sheet are shown below.

REQUIRED

Prepare a statement of owner’s equity.

Transcribed Image Text:

GENERAL LEDGER r. Minta Berny, Captal Aur. 311 POT. er CIROIT 1 Balance 22 3600 00 6 500 00 Jan 2900 00 Minta's Edtortal Services Work Sheet (Partial) For Month Ended January31, 20-- ar CRT 1 Cash 2 Accounts Recevble 3 Sapples 3 80 0 c0 2 200 c0 1000 00 950 00 4500 00 1 2 3 4 Prepakd Insurance 5 Computer Equpnent 6 Accam. Depr.-Computer Equipment 7 Accounts Payable 8 Wages Payatle 9 Minta Berry, Captal 4 5 225 00 6 2100 00 7 150 00 8 6 50 0 00 9 10 Mnta Bary, Drawiag 1700 00 10 7012 00 11 Editing Fees 12 Wages Expense 13 Advertiing Expense 14 Rent Expense 15 Sapples Expense 16 Phone Expense 17 Rlles Expense 18 Insurance Expene 19 Depr. Expense-Conputer Equipment 20 Mkcelanecus Expense 11 600 00 12 49 00 450 00 28 8 00 44 00 3800 125 00 13 14 15 16 17 18 225 00 19 18 00 20 18 37 00 5175 00 7012 00 14 1 5 0 0 8975 00 21 5175 00 22 14 1 50 00 23 21 22 Netincone 23 7012 00 7012 00 14 150 00

> What steps are followed in posting purchases returns and allowances from the general journal to the general ledger and accounts payable ledger?

> Owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales. July 1 Sale No. 101 to Saga, Inc., $1,200 plus sales tax. 8 Sale No. 102 to Vinnie Ward, $2,100 plus sales tax. 15 Sale No

> From the accounts receivable ledger shown, prepare a schedule of accounts receivable for Gelph Co. as of November 30, 20--. ACCOUNTS RECEIVABLE LEDGER James L. Adams Co. AME A 24481 MCAdams Rad, Dallr, TX T7001-3465 BALII 3180 00 3000 00 3200 00 Nov

> Enter the following transactions in a general journal: Nov. 1 Jean Haghighat made payment on account, $750. 12 Marc Antonoff made payment on account, $464. 15 Cash sales were $3,763. 18 Will Mossein made payment on account, $241. 25 Cash sales were $2,64

> Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is $3

> Enter the following transactions in a general journal. Use a 5% sales tax rate. Sept. 1 Sold merchandise on account to K. Smith, $1,800 plus sales tax. Sale No. 228. 3 Sold merchandise on account to J. Arnes, $3,100 plus sales tax. Sale No. 229. 5 Sold m

> Prepare journal entries for the following transactions. Oct. 5 Sold merchandise on account to B. Farnsby for $280 plus sales tax of 4%. 8 Sold merchandise on account to F. Preetee for $240 plus sales tax of 4%, with 2/10, n/30 cash discount terms. 11 F.

> Based on the following information, compute net sales: Gross sales $2,880 Sales returns and allowances 322 Sales discounts 56

> Using T accounts for Cash, Accounts Receivable, Sales Tax Payable, Sales, Sales Returns and Allowances, and Sales Discounts, enter the following sales transactions. Use a new set of accounts for each part, 1–5. 1. No sales tax. (a) Merchandise is sold fo

> Based on the information provided in Problem 10-11B, Problem 10-11B: Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. Apr. 1 Sale on account No. 111 to O. L. Meyers, $2,1

> Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. Apr. 1 Sale on account No. 111 to O. L. Meyers, $2,100 plus sales tax. 3 Sale on account No. 112 to Andrew Plaa, $1,000 plus

> What steps are followed in posting purchases from the general journal to the accounts payable ledger?

> Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. Jan. 1 Received payment on account from Ray Boyd, $880. 3 Received payment on account from Clint Hassell, $271. 5 Cash sales for the week were $2

> Indicate whether each of the following documents or procedures is for a retail business or for a wholesale business, as described in the chapter. 1. A cash register receipt is given to the customer. 2. Credit approval is required since sales are almost a

> Multnomah Manufacturing estimated that its total payroll for the coming year would be $540,000. The workers’ compensation insurance premium rate is 0.2%. REQUIRED 1. Calculate the estimated workers’ compensation insurance premium and prepare the journal

> Oxford Company has five employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: REQUIRED 1. Journalize the preceding transactions using a general journal

> Selected information from the payroll register of Wray’s Drug Store for the week ended July 14, 20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. Social Security tax on

> Columbia Industries estimated that its total payroll for the coming year would be $385,000. The workers’ compensation insurance premium rate is 0.2%. REQUIRED 1. Calculate the estimated workers’ compensation insurance premium and prepare the journal ent

> Francis Baker owns a business called Baker Construction Co. She does her banking at the American National Bank in Seattle, Washington. The amounts in her general ledger for payroll taxes and employees’ withholding of Social Security, Medicare, and federa

> Goodson employs Eduardo Gonzales at a salary of $46,000 a year. Goodson is subject to employer Social Security taxes at a rate of 6.2% and Medicare taxes at a rate of 1.45% on Gonzales’s salary. In addition, Goodson must pay SUTA tax at a rate of 5.4% an

> Selected information from the payroll register of Howard’s Cutlery for the week ended October 7, 20--, is presented below. Social Security tax is 6.2% on the first $118,500 of earnings for each employee. Medicare tax is 1.45% on gross e

> Earnings for several employees for the week ended April 7, 20--, are as follows: Calculate the employer’s payroll taxes expense and prepare the journal entry as of April 7, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social

> What steps are followed in posting purchases from the general journal to the general ledger?

> Name the types of cash flows associated with investing activities.

> Insert the dollar amounts where the net income or net loss would appear on the work sheet. Income Statement Balance Sheet Debit Credit Debit Credit Net Income: $2,500 Net Loss: $1,900

> Listed below are the weekly cash register tape amounts for service fees and the related cash counts during the month of July. A change fund of $200 is maintained. REQUIRED 1. Prepare the journal entries to record the cash service fees and cash short and

> Karen’s Cupcakes in Problem 8-9B keeps employee earnings records. Problem 8-9B: Karen Jolly operates a bakery called Karen’s Cupcakes. She has five employees, all of whom are paid on a weekly basis. Karenâ

> Portions of the payroll register for Kathy’s Cupcakes for the week ended June 21 are shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. The Social Security tax rate is 6.2% on th

> Karen Jolly operates a bakery called Karen’s Cupcakes. She has five employees, all of whom are paid on a weekly basis. Karen’s Cupcakes uses a payroll register, individual employee earnings records, and a general journ

> Elyse Lin works for Columbia Industries. Her rate of pay is $9 per hour, and she is paid 1½ times the regular rate for all hours worked in excess of 40 per week. During the last week of January of the current year, she worked 46 hours. Lin is married and

> Journalize the following data taken from the payroll register of Himes Bakery as of June 12, 20: Regular earnings ………………………………….. $6,520.00 Overtime earnings …………………………………….. 950.00 Deductions: Federal income tax …………………………………….. 782.00 Social Securit

> On November 30, the payroll register of Webster & Smith indicated the following information: Determine the amount of Social Security and Medicare taxes to be withheld and record the journal entry for the payroll, crediting Cash for the net pay.

> Tom Hallinan works for a company that pays its employees 1½ times the regular rate for all hours worked in excess of 40 per week. Hallinan’s pay rate is $12 per hour. His wages are subject to deductions for federal income

> Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $118,500 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations: Cumul. Pay Before Current

> How are cost of goods sold and gross profit computed?

> Using the table in Figure 8-4 on pages 288 and 289, Figure 8-4: determine the amount of federal income tax an employer should withhold weekly for employees with the following marital status, earnings, and withholding allowances: SINGLE Persons-W

> Fritz receives a regular salary of $3,250 a month and is paid 1½ times the regular hourly rate for hours worked in excess of 40 per week. (a) Calculate Fritz’s overtime rate of pay. (Compute to the nearest half cent.) (b) Calculate Fritz’s total gross we

> Manuel Soto’s regular hourly rate is $12. He receives 1½ times the regular rate for hours worked in excess of 40 a week and double the rate for work on Sunday. During the past week, Soto worked 8 hours each day Monday through Thursday, 11 hours on Friday

> The book balance in the checking account of Tori’s Health Center as of April 30 is $4,690.30. The bank statement shows an ending balance of $3,275.60. By examining last month’s bank reconciliation, comparing the deposits and checks written per books and

> The book balance in the checking account of Kyri Enterprises as of November 30 is $2,964. The bank statement shows an ending balance of $2,525. The following information is discovered by (1) comparing last month’s deposits in transit a

> Based on the following information, prepare the weekly entries for cash receipts from service fees and cash short and over. A change fund of $100 is maintained. Cash Register Receipt Amount $330.00 Actual Cash Change Fund $100 Date Counted June 1 $43

> Based on the following petty cash information, prepare (a) the journal entry to establish a petty cash fund, and (b) the journal entry to replenish the petty cash fund. On October 1, 20--, a check was written in the amount of $200 to establish a petty

> Based on the following bank reconciliation, prepare the journal entries: Ruggero Celini Associates Bank Reconciliation July 31, 20- Bank statement balance, July 31 Add deposits in transit $1 7 8 4 00 $ 4 18 50 100 50 519 00 $2 303 00 Deduct outstand

> In a format similar to the following, indicate whether the action at the left will result in an addition to (+) or subtraction from (–) the ending bank balance or the ending checkbook balance. Ending Bank Ending Checkbook Balance B

> Based on the following information, prepare a check and stub: Date: Balance brought forward: Deposit: Check to: Amount: November 15, 20- $3,181 (from Excrcise 7-2B) R. J. Smith Co. $120 For: Payment on account Sign your name Signature:

> Describe how each of the following accounts is used: (1) Purchases, (2) Purchases Returns and Allowances, (3) Purchases Discounts, and (4) Freight-In.

> Based on the following information, prepare a deposit ticket: Date: November 15, 20-- Currency: $283 Coin: 19 Checks: No. 3-22 201 No. 19-366 114 No. 3-2 28

> On July 1, a petty cash fund was established for $100. The following vouchers were issued during July: REQUIRED 1. Prepare the journal entry to establish the petty cash fund. 2. Record the vouchers in the petty cash record. Total and rule the petty cash

> Match the following words with their definitions: 1. Banking number used to identify checks for deposit tickets 2. A card filled out to open a checking a. bank statement b. deposit ticket c. signature card d. internal control c. check stub f. ATM асc

> Refer to the wor sheet for Juanita’s Consulting in Problem 6-7B. The trial balance amounts (before adjustments) have been entered in the ledger accounts provided in the working papers. If you are not using the working papers that accomp

> A work sheet for Juanita’s Consulting is shown on the following page. There were no additional investments made by the owner during the month. REQUIRED 1. Prepare an income statement. 2. Prepare a statement of owner’s equity. 3. Prepare a balance sheet.

> Using the following partial listing of T accounts, prepare closing entries in general journal form dated June 30, 20--. Then post the closing entries to the T accounts. Accum. Depr.- Office Equip Bal. Wages Еxpense Bal. 1,080 Utilities Expense 102

> Using the following partial listing of T accounts, prepare closing entries in general journal form dated May 31, 20--. Then post the closing entries to the T accounts. Supplies Expense Income Cash 101 Summary 313 524 Bal. 600 Bal. 900 Accounts Lawn

> Set up T accounts for Adams’ Shoe Shine based on the work sheet above and the chart of accounts provided below. Enter the existing balance for each account. Prepare closing entries in general journal form. Then post the closing entries

> From the partial work sheet on the next page, prepare a balance sheet for Adams’ Shoe Shine. Adams' Shoe Shine Work Sheet (Partial) For Month Ended June 30, 20 -- IMOME STATEMENT BALANCESHEET ACCOUNT ITLE DEBIT CREDIT DEBT CREDT 1

> What is the purpose of a credit memo?

> From the partial work sheet on the next page, prepare a statement of owner’s equity, assuming no additional investment was made by the owner.

> Indicate with an “X” whether each account total should be extended to the Income Statement Debit or Credit or to the Balance Sheet Debit or Credit columns on the work sheet. Income Statement Balance Sheet Debit Cre

> From the Adjustments columns in Exercise 5-9B, Exercise 5-9B: A partial work sheet for Jasmine Kah’s Auto Detailing is shown below. Indicate by letters (a) through (d) the four adjustments in the Adjustments columns of the work sheet

> From the partial work sheet for Adams’ Shoe Shine on the next page, prepare an income statement.

> A partial work sheet for Jasmine Kah’s Auto Detailing is shown below. Indicate by letters (a) through (d) the four adjustments in the Adjustments columns of the work sheet, properly matching each debit and credit. Complete the Adjustmen

> Two adjusting entries are shown in the following general journal. Post these adjusting entries to the four general ledger accounts. The following account numbers were taken from the chart of accounts: 145, Prepaid Insurance; 183.1, Accumulated Deprecia

> Analyze each situation and indicate the correct dollar amount for the adjusting entry. 1. Amount of insurance expired (used) is $830. (Balance Sheet) Prepaid Insurance (Income Statement) Insurance Expense TB 960 Bal. 2. Amount of unexpired (remaining

> Analyze each situation and indicate the correct dollar amount for the adjusting entry. 1. Ending inventory of supplies is $95. (Balance Sheet) Supplies (Income Statement) Supplies Expense TB 540 Bal. 2. Amount of supplies used is $280. (Balance Shee

> A depreciable asset was acquired for $5,760. The asset has an estimated useful life of four years (48 months) and no salvage value. Use the straight-line depreciation method to calculate the book value as of July 1, 20--.

> Delivery equipment was purchased for $4,320. The delivery equipment has an estimated useful life of three years (36 months) and no salvage value. Using the straight-line depreciation method, analyze the necessary adjusting entry as of July 31 (one month)

> List the five steps taken in preparing a work sheet.

> The trial balance shows wages expense of $800. An additional $150 of wages was earned by the employees but has not yet been paid. Analyze the required adjustment using T accounts, and then formally enter this adjustment in the general journal.

> A six-month liability insurance policy was purchased for $750. Analyze the required adjustment as of July 31 using T accounts, and then formally enter this adjustment in the general journal.

> The trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of $430. A physical count of the supplies inventory shows that $120 of supplies remain. Analyze the adjustment for supplies using T accounts, and then form

> Benito Mendez opened Mendez Appraisals. He rented office space and has a part-time secretary to answer the phone and make appraisal appointments. His chart of accounts is as follows: Mendez’s transactions for the first month of business

> Mary Smith purchased $350 worth of office equipment on account. The following entry was recorded on April 6. Find the error(s) and correct it (them) using the ruling method. On April 25, after the transactions had been posted, Smith discovered the follow

> From the following trial balance taken after one month of operation, prepare an income statement, a statement of owner’s equity, and a balance sheet. AT Speaker's Bureau Trial Balance March 31, 20 -- ACCOUNT NO. ACCDUNT E DEBIT BA

> From the information in Exercises 4-4B and 4-5B, Exercises 4-4B and 4-5B: Sengel Moon opened The Bike Doctor. Journalize the following transactions that occurred during the month of October of the current year. Use the following journal pages: October

> Set up general ledger accounts using the chart of accounts provided in Exercise 4-4B. Exercise 4-4B: Sengel Moon opened The Bike Doctor. Journalize the following transactions that occurred during the month of October of the current year. Use the follo

> Sengel Moon opened The Bike Doctor. Journalize the following transactions that occurred during the month of October of the current year. Use the following journal pages: October 1–12, page 1, and October 14–29, page 2.

> Set up T accounts for each of the general ledger accounts needed for Exercise 4-2B and post debits and credits to the accounts. Exercise 4-2B: For each of the following transactions, list the account to be debited and the account to be credited in the

> Name and describe six areas of specialization for a managerial accountant.

> For each of the following transactions, list the account to be debited and the account to be credited in the general journal. 1. Invested cash in the business, $1,000. 2. Performed services on account, $200. 3. Purchased office equipment on account, $500

> Prepare an income statement for David Segal for the month of October 20--.

> Label each of the following accounts as an asset (A), liability (L), or owner’s equity (OE) using the following format. Account Classification Cash Accounts Payable Supplics Bill Jones, Drawing Prepaid Insurance Accounts Receivable

> Refer to the trial balance in Problem 3-13B and to the analysis of the change in owner’s equity in Problem 3-14B. REQUIRED 1. Prepare an income statement for Jantz Plumbing Service for the month ended August 31, 20--. 2. Prepare a statement of owner’s e

> Refer to the trial balance of Jantz Plumbing Service in Problem 3-13B to determine the following information. Use the format provided below. 1. a. Total revenuc for the month b. Total expenscs for the month c. Net income for the month 2. a. Suc Jant

> Sue Jantz started a business in August 20-- called Jantz Plumbing Service. Jantz hired a part-time college student as an administrative assistant. Jantz has decided to use the following accounts: The following transactions occurred during August: (a) In

> From the information in the trial balance presented for Bill’s Delivery Service on page 80, prepare a balance sheet for Bill’s Delivery Service as of September 30, 20--.

> Assuming that all entries have been posted, prepare correcting entries for each of the following errors. 1. The following entry was made to record the purchase of $400 in equipment on account: Supplies 142 400 Cash 101 400 2. The following entry was

> Ann Taylor owns a suit tailoring shop. She opened business in September. She rented a small work space and has an assistant to receive job orders and process claim tickets. Her trial balance shows her account balances for the first two months of business

> what type of information is found on each of the following source documents? 1. Cash register tape 2. Sales ticket (issued to customer) 3. Purchase invoice (received from supplier or vendor) 4. Check stub

> List the 10 steps in the accounting cycle.

> The following accounts have normal balances. Prepare a trial balance for Betty’s Cleaning Service as of September 30, 20--. $14,000 8,000 1,200 1,800 18,000 6,000 Cash Betty Par, Capital Betty Par, Drawing Delivery Fees Wages Expens

> Based on the transactions recorded in Exercise 3-7B, prepare a trial balance for Nickie’s Neat Ideas as of January 31, 20--.

> Nicole Lawrence opened a business called Nickie’s Neat Ideas in January 20--. Set up T accounts for the following accounts: Cash; Accounts Receivable; Office Supplies; Computer Equipment; Office Furniture; Accounts Payable; Nicole Lawrence, Capital; Nico

> Foot and balance the T accounts prepared in Exercise 3-5B if necessary. Exercise 3-5B: George Atlas started a business on June 1, 20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the t

> George Atlas started a business on June 1, 20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount

> Indicate the normal balance (debit or credit) for each of the following accounts: 1. Cash 2. Rent Expense 3. Notes Payable 4. Owner’s drawing 5. Accounts Receivable 6. Owner’s Capital 7. Tools

> Roberto Alvarez began a business called Roberto’s Fix-It Shop. 1. Create T accounts for Cash; Supplies; Roberto Alvarez, Capital; and Utilities Expense. Identify the following transactions by letter and place them on the proper side of the T accounts: (a

> Complete the following statements using either “debit” or “credit”: (a) The asset account Prepaid Insurance is increased with a _________. (b) The owner’s drawing account is increased with a _________. (c) The asset account Accounts Receivable is decreas

> From the information in the trial balance presented above, prepare a statement of owner’s equity for Bill’s Delivery Service for the month ended September 30, 20--.

> From the information in the trial balance presented above, prepare an income statement for Bill’s Delivery Service for the month ended September 30, 20--.

> What is the purpose of the post-closing trial balance?