Question: The Castillo Products Company described in Problem

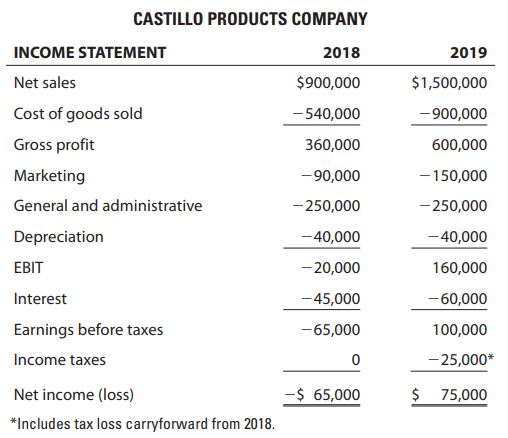

The Castillo Products Company described in Problem 6 had a very difficult operating year in 2018, resulting in a net loss of $65,000 on sales of $900,000. In 2019, sales jumped to $1,500,000, and a net profit after taxes was earned. The firm’s income statements are shown in the following table.

A. Calculate each income statement item for 2018 as a percentage of the 2018 sales level. Make the same calculations for 2019. Determine which cost or expense items varied directly with sales for the two-year period.

B. Use the information in Part A to classify specific expense items as being either variable or fixed expenses. Then estimate Castillo’s EBDAT breakeven in terms of survival revenues if interest expenses had remained at the 2018 level ($45,000) in 2019.

C. Estimate the dollar amount of survival revenues actually needed by the Castillo Products Company to reach EBDAT breakeven in 2019, given that more debt was obtained and interest expenses increased to $60,000.

> Refer to the financial statement data provided below for Safety-First, Inc. A. Calculate the net profit margin, the sales-to-total-assets ratio, and the equity multiplier for both 2018 and 2019 using year-end (rather than average) balance sheet data. B.

> Use the financial statement data for Castillo Products presented in Problem 6. A. Calculate the net profit margin in 2018 and 2019 and the sales-to-total-assets ratio using year-end data for each of the two years. B. Use your calculations from Part A to

> The Castillo Products Company was started in 2017. The company manufactures components for personal digital assistant (PDA) products and for other hand-held electronic products. A difficult operating year, 2018, was followed by a profitable 2019. However

> Following are two years of income statements and balance sheets for the Munich Exports Corporation. A. Calculate the cash build, cash burn, and net cash burn or build for Munich Exports in 2019. B. Assume that 2020 will be a repeat of 2019. If your answe

> Use the financial statement data for the Bike-With-Us Corporation provided in Problem 3 to make the following calculations: A. Calculate the operating return on assets. B. Determine the effective interest rate paid on the long-term debt. C. Calculate the

> LeAnn Sands has reason to believe that 2020 will be a replication of 2019 (see Problem 8) except that cost of goods sold is expected to be 65 percent of the estimated $450,000 in revenues. Other income statement relationships are expected to remain the s

> LeAnn Sands wants to conduct revenue breakeven analyses of Salza Technology Corporation for 2019. Income statement information is shown in Problem 8. For 2019, the firm’s cost of goods sold is considered to be variable costs, and operating expenses are c

> Rework Problem 2 under the assumption that, in addition to your venture’s taxable income of $50,000, you expect to personally earn another $10,000 from a second job. Data from Problem 2: Assume your new venture, organized as a proprietorship, is in its

> In early 2013, Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry’s Frozen Yogurt Company, which was based on the idea of applying the microbrew or micro batch strategy to the production and sale of frozen yogurt. They began producing small quanti

> The EnCal Corporation is a small, West Coast-based power company specializing in power generation methods that use clean-burning fuels and renewable natural resources. However, due to a complex and confusing power-pricing structure, EnCal is reeling from

> Following are the financial statements for the Chenhai Manufacturing Corporation for 2018 and 2019. The venture is in financial distress and hopes to turn around its financial performance in the near future. A. Calculate the sale-to-cash conversion perio

> New information for Gamma Systems Manufacturing Corporation has been brought to management’s attention. Use the financial statement information in Problem 5 and take into consideration that sales will grow at a 15 percent rate in 2020 and at a 10 percent

> Gamma Systems Manufacturing Corporation has reached its maturity stage, and its net sales are expected to grow at a 6 percent compound rate for the foreseeable future. Management believes that, as a mature venture, the appropriate equity discount rate fo

> Benito Gonzalez founded and grew the BioSystems Manufacturing Corporation over a several-year period. However, Benito has decided to harvest or exit BioSystems now at the end of 2019 with the intention of starting a new entrepreneurial venture. The Fuji

> Rework Problem 8 assuming that the earnings before interest and taxes are only $320,000 while capital expenditures (CAPEX) are $110,000. Assume the other information remains the same. Data from Problem 8: Find the enterprise valuation cash flow expected

> Show how your answers for Problem 3 would change if the new offering price was $0.80 for 1,500 shares. Assume other things remain the same. Data from Problem 3: Calculate the conversion price formula (CPF) and market price formula (MPF) prices for an of

> The Datametrix Corporation has been in operation for one full year (2019). Financial statements are shown below. Sales are expected to grow at a 30 percent annual rate for each of the next three years (2020, 2021, and 2022) before settling down to a long

> Why is the market value of currently issued debt subtracted from the enterprise value (in a debt-and-equity-only firm) to arrive at the value of equity? Why are future debt issues ignored in this subtraction?

> Suppose you are considering a venture conducting a current financing round involving an issue of 100,000 new shares at $3. The existing number of shares outstanding is 200,000. What are the related pre-money and post-money valuations?

> Jen and Larry’s frozen yogurt venture described in Problem 3 required some investment in bricks and mortar. Initial specialty equipment and the renovation of an old warehouse building in lower downtown, referred to as LoDo, cost $450,000 at the beginning

> Rework the two-stage example of Section 11.5 with first- and second-round required returns of 55 percent and 40 percent (instead of the original 50 percent and 25 percent). Interpret your results as they relate to the founders’ ownership and the feasibil

> Rework the two-stage example of Section 11.5 with 1,000,000 initial founders’ shares (instead of the original 2,000,000 shares). What changes? Data from Example 11.5: For most early-stage ventures, there are at least two strong motives for having an equ

> Return to the discussion of the FrothySlope venture at the beginning of the chapter. Formulate an answer for each of the five questions that are posed under the heading “What Is a Venture Worth?”

> Following are financial statements (historical and forecasted) for the Global Products Corporation. A. Assume that the cash account includes only required cash. Determine the dollar amount of equity valuation cash flow for 2020. B. Now assume that Global

> Ben Toucan, owner of The Aspen Restaurant, wants to determine the present value of his investment. The Aspen Restaurant is currently in the development stage but Toucan hopes to “begin” operations early next year. After-tax cash flows during the next fiv

> Following are two years of income statements and balance sheets for the Munich Exports Corporation. A. Munich has a target dividend payout of 40 percent of net income. Based on the 2019 financial statements relationships, estimate the sustainable sales g

> The Minoso Corporation anticipates a 20 percent increase in sales for 2020 over its 2019 level. Minoso is currently operating at full capacity and thus expects to increase its investment in both current and fixed assets in order to support the increase i

> Petal Providers Corporation, described, is interested in estimating its additional financing needed to support a rapid increase in sales next year. Last year, revenues were $1 million; net profit was $50,000; investment in assets was $750,000; payables a

> Two Rules (504 and 506) under Reg D relate to the (a) amount of offerings and (b) number of investors. Match Rules 504, 506, or “none” with each of the following: A. $5 million offering limit (in a twelve-month period) B. $1 million offering limit (in a

> Assume that BKAngel’s initial investments in the three ventures had been Venture 1 5 $500,000, Venture 2 5 $300,000, and Venture 3 5 $200,000, with each investment having achieved the same cash flows and ending values. A. Calculate the percentage rate of

> Refer to the Mini Case at the end of the chapter involving Jen and Larry’s Frozen Yogurt Company. A. Calculate the dollar amount of NOPAT if Jen and Larry’s venture achieves the forecasted $1.2 million in sales in 2020. What would NOPAT be as a percent o

> Refer to Problem 13 for Voice River, Inc. A. Estimate the WACC if the cost of common equity capital is 20 percent. B. Estimate the WACC if the cost of common equity capital is at the representative target rate of 25 percent for typical ventures in their

> Castillo Products Company, described below, improved its operations from a net loss in 2018 to a net profit in 2019. While the founders, Cindy and Rob Castillo, are happy about these developments, they are concerned about how long the firm took to comple

> Two years of financial statement data for the Munich Export Corporation are shown below. A. Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Munich Exports for 2019. B. Calculate the length of Munich Exports&a

> Artero Corporation is a traditional toy products retailer that recently started an Internet-based subsidiary that sells toys online. A markup is added on goods the company purchases from manufacturers for resale. Swen Artero, the company president, is pr

> What is the purpose of the U.S. Bankruptcy Code? What are some of the characteristics of ventures that use instead of private liquidation?

> From the Headlines—Boom Supersonic: Comment on Boom Supersonic’s potential to eventual provide liquidity to its investors through an IPO or a sale. Which one seems more likely to you? Why?

> What is the enterprise (entity) method of valuation, and how does it differ from the other equity methods?

> From the Headlines—Excaliard: What ingredients would you need to conduct a VCSC valuation for Excaliard? Does your calculation suggest that a $15.5 million Series A round is reasonable?

> What rates of return at various horizons have venture capitalists earned, on average, in recent years? How do these returns compare with the average venture capital returns over the past twenty years?

> From the Headlines—PopSockets: Briefly describe the market PopSockets seeks to address and how PopSockets’ initial device addresses that market. Give some examples of how PopSockets can expand its market and tap additional sources of capital.

> Refer to Problems 9 and 10 in the chapter involving the Salza Technology Corporation (see Problem 8 for the firm’s financial statements). A. Calculate Salza’s NOPAT breakeven in terms of NOPAT breakeven revenues for 2019. B. Calculate the NOPAT breakeven

> From the Headlines—Competing to Let the Light Shine: Describe three financial performance measures that d.light could use when comparing itself to other potential competitors.

> From the Headlines—Foursquare: What ingredients would you need to conduct a traditional equity method valuation for Foursquare? If you had the necessary projections, do you think that Foursquare would qualify as a “Unicorn” with a valuation in excess of

> From the Headlines—Automox: Describe how cash budgets and projected financial statements could be used in estimating how far $9 million could take Automox after its Series A round.

> From the Headlines—bext 360: Discuss the variable and fixed costs in a single installation and continuing operation of a “bextmachine.” What are the critical factors in getting to “breakeven?”

> What is Chapter 11 bankruptcy and how is it used by ventures?

> Refer to the Salza Technology Corporation in Problem 1. A. Using average balance sheet account data, calculate the (a) current ratio, (b) quick ratio, (c) total-debt-to-total-assets ratio, and (d) the interest coverage ratio for 2019. B. Repeat the ratio

> Salza Technology Corporation increased its sales from $375,000 in 2018 to $450,000 in 2019 as shown in the firm’s income statements presented below. LeAnn Sands, chief executive officer and founder of the firm, expressed concern that th

> Discuss what you believe would have been the strategic outlook for Spatial (product lines, licensing, competitors, etc.) at the time and what you believe would have been the financial market’s view of a publicly traded Spatial Technology.

> Take a position on whether you would recommend the $5 IPO. Take a position on whether, as an investor, you would have purchased shares in the $5 IPO.

> Prepare an executive summary discussing the events and decisions (technological and financial) leading to its situation, the options it had, and your recommendations for Spatial’s future. Would (could) you have done anything differently?

> Discuss the $5 and $10 IPO prices for Spatial within the context of comparable firms and their multiples.

> Using the provided financial statements as a starting point: 1. Prepare and present a discounted cash flow valuation and pro forma financials with five years of explicit forecasts using license fees and royalties’ growth rates consistent with recent hist

> In mid-2008, Eco-Products’ management sought to quickly (hopefully) raise an additional $2 million in external financing through a single private equity investment. The term sheet prepared by Greenmont Capital is presented in Appendix B. 1. After conside

> Cindy and Robert (Rob) Castillo founded the Castillo Products Company in 2018. The company manufactures components for personal decision assistant products and for other handheld electronic products. Year 2018 proved to be a test of the Castillo Products

> Evaluate the compound return on investments made at startup, Round A, Round B, Round C, and Round D if the acquired shares eventually sell at $10 and $5. Evaluate the compound return on all investments of each existing investor. Analyze the incentives of

> Explain Eco-Products’ supply chain model that existed in early 2008. Describe the strengths and weaknesses of such a model from an operations viewpoint. What are the implications of this supply chain model on Eco-Products’ working capital financing needs

> Describe the IPO market conditions in 1996 and discuss possible reasons why the proposed IPO at a price of about $10 per share planned for October 1996 and involving Dain Bosworth as lead underwriter failed.

> Identify and discuss the factors and developments that led to the previously unexpected revenue growth during the first-half of 2008 by Eco-Products. Is such growth likely to be sustainable in the near future? What possible developments might interrupt o

> Discuss possible reasons why Spatial Technology’s plan for an IPO of common stock at the end of 1992 was withdrawn.

> Eco-Products’ management developed a confidential private placement memorandum (PPM) dated October 16, 2007, in an attempt to raise $3,500,000. Appendix A contains excerpts from the PPM. 1. What is meant by a Regulation D offering? What is an accredited

> Use the cash flow statements for Spatial Technology, Inc., to determine whether the venture has been building or burning cash, as well as possible trends in building or burning cash.

> In mid-2007, Eco-Products’ management prepared a five-year (2007–2011) projection of revenues and expenses (see Table 1). What annual rates of growth were projected for net sales? Make a “back-of-the-envelope” estimate of the amounts of additional assets

> Conduct a ratio analysis of Spatial Technology’s past income statements and balance sheets. Note any performance strengths and weaknesses and discuss any ratio trends.

> Describe the early rounds of financing that occurred from Eco-Products’ inception in 1990 through 2006. Beginning in 2007, the need for external financing began to increase. Describe the sources, amounts, and types of financing obtained during 2007 and t

> Identify some of the types of securities that are exempt from registration with the SEC.

> Refer to Problem 5 in the chapter involving the SubRay Corporation. A. Estimate the NOPAT breakeven amount in terms of revenues necessary for the SubRay Corporation to break even next year. B. Assume that the product selling price is $50 per unit. Calcul

> Exponential Families of Distributions. For each of the following distributions, determine whether it is an exponential family by examining the log-likelihood function. Then identify the sufficient statistics. a. Normal distribution with mean and varian

> Using the results in Example 13.5, estimate the asymptotic covariance matrix of the method of moments estimators of P and based on m( and m( . [Note: You will need to use the data in Example C.1 to estimate V.]

> For the normal distribution /. Use this result to analyze the two estimators, Use the delta method to obtain the asymptotic variances and covariance of these two functions, assuming the data are drawn from a normal distribution with mean m and varian

> Compare the fully parametric and semiparametric approaches to estimation of a discrete choice model such as the multinomial logit model discussed in Chapter 17. What are the benefits and costs of the semiparametric approach?

> If the panel has T = 2 periods, the LSDV (within groups) estimator gives the same results as first differences. Prove this claim.

> Prove plim /

> In Section 11.4.5, we found that the group means of the time-varying variables would work as a control function in estimation of the fixed effects model. That is, although regression of y on X is inconsistent for , the Mundlak estimator, regression of y

> Two-way random effects model. We modify the random effects model by the addition of a time-specific disturbance. Thus, where Write out the full disturbance covariance matrix for a data set with n = 2 and T = 2.

> A two-way fixed effects model. Suppose that the fixed effects model is modified to include a time-specific dummy variable as well as an individual-specific variable. Then / . At every observation, the individual- and time- specific dummy variables sum to

> What are the probability limits of (1/n) LM, where LM is defined in (11-42) under the null hypothesis that 2u = 0 and under the alternative that 2u ≠ 0?

> The National Institute of Standards and Technology (NIST) has created a Web site that contains a variety of estimation problems, with data sets, designed to test the accuracy of computer programs. (The URL is http://www.itl.nist.gov/div898/strd/.) One of

> Unbalanced design for random effects. Suppose that the random effects model of Section 11.5 is to be estimated with a panel in which the groups have different numbers of observations. Let Ti be the number of observations in group i. a. Show that the pool

> Suppose that the fixed effects model is formulated with an overall constant term and n - 1 dummy variables (dropping, say, the last one). Investigate the effect that this supposition has on the set of dummy variable coefficients and on the least squares

> The following is a panel of data on investment (y) and profit (x) for n = 3 firms over T = 10 periods. a. Pool the data and compute the least squares regression coefficients of the model b. Estimate the fixed effects model of (11-11), and then test the

> Obtain the reduced form for the model in Exercise 8 under each of the assumptions made in parts a and in parts b(1) and b(9).

> Consider the following two-equation model: a. Verify that, as stated, neither equation is identified. b. Establish whether or not the following restrictions are sufficient to identify (or partially identify) the model:

> For the model Assume that yi2 + yi3 = 1 at every observation. Prove that the sample covariance matrix of the least squares residuals from the three equations will be singular, thereby precluding computation of the FGLS estimator. How could you proceed i

> Consider the system The disturbances are freely correlated. Prove that GLS applied to the system leads to the OLS estimates of 1 and 2 but to a mixture of the least squares slopes in the regressions of y1 and y2 on x

> Consider the two-equation system Assume that the disturbance variances and covariance are known. Now suppose that the analyst of this model applies GLS but erroneously omits x3 from the second equation. What effect does this specification error have on t

> Prove that in the model generalized least squares is equivalent to equation-by-equation ordinary least squares if X1 = X2. The general case is considered in Exercise 14.

> The model satisfies all the assumptions of the seemingly unrelated regressions model. All variables have zero means. The following sample second-moment matrix is obtained from a sample of 20 observations: a. Compute the fGLS estimates of ï&c

> For the model in Application 1, test the hypothesis that = 0 using a Wald test and a Lagrange multiplier test. Note that the restricted model is the cobb–Douglas log linear model. The LM test statistic is shown in (7-22). To carry out the test, you wil

> Consider estimation of the following two-equation model: A sample of 50 observations produces the following moment matrix: a. Write the explicit formula for the GLS estimator of [1, 2]. What is the asymptotic covaria

> Prove the general result in point 2 in Section 10.2.2, if the X matrices in (10-1) are identical, then full GLS is equation-by-equation OLS. Hints: If all the Xm matrices are identical, then the inverse matrix in (10-10) is /. Also, Use these results

> Prove that an under identified equation cannot be estimated by 2SLS.

> Prove that

> For the model show that there are two restrictions on the reduced form coefficients. Describe a procedure for estimating the model while incorporating the restrictions.

> The following model is specified: All variables are measured as deviations from their means. The sample of 25 observations produces the following matrix of sums of squares and cross products: a. Estimate the two equations by OLS. b. Estimate the parame

> A sample of 100 observations produces the following sample data: The underlying seemingly unrelated regressions model is a. Compute the OLS estimate of , and estimate the sampling variance of this estimator. b. Compute the FGLS estimate

> Suppose that the regression model is yi =  + i, where a. Given a sample of observations on yi and xi, what is the most efficient estimator of m? What is its variance? b. What is the OLS estimator of , an

> Suppose that the regression model is y =  + , where has a zero mean, constant variance, and equal correlation, , across observations. Then if i ≠j. Prove that the least squares estim

> Suppose that y has the pdf And For this model, prove that GLS and MLE are the same, even though this distribution involves the same parameters in the conditional mean function and the disturbance variance.