Question: The comparative balance sheet of Olson-Jones

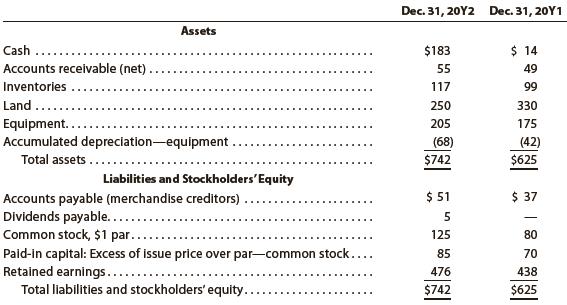

The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, is as follows:

The following additional information is taken from the records:

1. Land was sold for $120.

2. Equipment was acquired for cash.

3. There were no disposals of equipment during the year.

4. The common stock was issued for cash.

5. There was a $62 credit to Retained Earnings for net income.

6. There was a $24 debit to Retained Earnings for cash dividends declared.

a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

b. Was Olson-Jones Industries Inc.’s net cash flow from operations more or less than net income? What is the source of this difference?

Transcribed Image Text:

Dec. 31, 20Y2 Dec. 31, 20Y1 Assets Cash $183 $ 14 Accounts receivable (net) . 55 49 Inventories 117 99 Land .... 250 330 Equipment... Accumulated depreciation-equipment 205 175 (68) (42) Total assets.. $742 $625 Liabilities and Stockholders'Equity $ 51 $ 37 Accounts payable (merchandise creditors) Dividends payable.... Common stock, $1 par... Paid-in capital: Excess of issue price over par-common stock.... Retained earnings...... Total liabilities and stockholders' equity.. ..... 125 80 85 70 476 438 $742 $625

> Explain whether Colston Company correctly reported the following items in the financial statements: a. In a recent year, the company discovered a clerical error in the prior year’s accounting records. As a result, the reported net income for the previous

> Apex Inc. reports the following for a recent year: Income from continuing operations before income tax ……………… $1,000,000 Loss from discontinued operations …………………………………………… $240,000* Weighted average number of shares outstanding …………………………….. 20,000 Appl

> The net income reported on the income statement of Cutler Co. was $4,000,000. There were 500,000 shares of $10 par common stock and 100,000 shares of $2 preferred stock outstanding throughout the current year. The income statement included a gain on disc

> The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: a. Determine the price-earnings ratio and dividend yield for the three companies. Round ratios and percentages to one decim

> The following information was taken from the financial statements of Tolbert Inc. for December 31 of the current fiscal year: Common stock, $20 par (no change during the year) ………………… $10,000,000 Preferred $4 stock, $40 par (no change during the year) ……

> The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% ……………………………………… $5,000,000 Preferred $4 stock, $50 par …………………………… 2,500,000 Common stock, $10 par …………………………………. 5,000,000 Income before

> Berkshire Hathaway, the investment holding company of Warren Buffett, reports its “less than 20% ownership” investments according to generally accepted accounting principles. However, it also provides additional disclosures that it terms “look-through” e

> The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Assuming that total assets were $7,000,000 at the beginning of the current fiscal year, determine the following: (a) Ratio of fixed assets to long-te

> Ralph Lauren Corporation sells apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (in thousands): Assume that the apparel industry average return on total assets is 8.0% and the average return on stockhol

> Dillip Lachgar is the president and majority shareholder of Argon Inc., a small retail chain store. Recently, Dillip submitted a loan application for Argon Inc. to Compound Bank. It called for a $600,000, 9%, 10-year loan to help finance the construction

> In groups of three or four, find the latest annual report for Microsoft Corporation. The annual report can be found on the company’s website at www.microsoft.com/msft/default.mspx. The notes to the financial statements include details of Microsoft’s inve

> A company’s current year net income (after income tax) is 25% larger than that of the preceding year. Does this indicate improved operating performance? Why or why not?

> You are considering an investment in a new start-up company, Giraffe Inc., an Internet service provider. A review of the company’s financial statements reveals a negative retained earnings. In addition, it appears as though the company has been running a

> Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, Year 1, were as follows: a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. b. Issued 4,000 shares of $80 par preferred 5% stock at $1

> Tidewater Inc., a retailer, provided the following financial information for its most recent fiscal year: Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $945,000 Re

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> The comparative balance sheet of Harris Industries Inc. at December 31, 20Y4 and 20Y3, is as follows: An examination of the income statement and the accounting records revealed the following additional information applicable to 20Y4: a. Net income, $52

> The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: a. Equipment and land were acquired for cash. b. T

> The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is as follows: The income statement for the year ended December 31, 20Y9, is as follows: Additional data obtained from an examination of the accounts in the ledger for

> The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: The income statement for the year ended December 31, 20Y4, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y

> The comparative balance sheet of Coulson, Inc. at December 31, 20Y2 and 20Y1, is as follows: The noncurrent asset, noncurrent liability, and stockholders’ equity accounts for 20Y2 are as follows: Instructions Prepare a statement of

> The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows: The noncurrent asset, noncurrent liability, and stockholders’ equity accounts for 20Y2 are as follows: Instructions Prepare a statement of ca

> The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income,

> The comparative balance sheet of Navaria Inc. for December 31, 20Y3 and 20Y2, is shown as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $175,000 cash. b. Eq

> Zeus Investments Inc. is a regional investment company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Zeus Investments Inc., which has a fiscal year ending on December 31: Year 1 Feb. 14. P

> The comparative balance sheet of Navaria Inc. for December 31, 20Y3 and 20Y2, is as follows: The income statement for the year ended December 31, 20Y3, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3

> The comparative balance sheet of Canace Products Inc. for December 31, 20Y6 and 20Y5, is as follows: The income statement for the year ended December 31, 20Y6, is as follows: Additional data obtained from an examination of the accounts in the ledger

> On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. Balance 156,000 Feb. 10 Purchased for cash

> On the basis of the following stockholders’ equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year.

> On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 868,000 972,300 Jan. 1 Balance Mar. 12 Purchased

> An analysis of the general ledger accounts indicates that delivery equipment, which cost $200,000 and on which accumulated depreciation totaled $60,000 on the date of sale, was sold for $132,500 during the year. Using this information, indicate the items

> An analysis of the general ledger accounts indicates that office equipment, which cost $202,500 and on which accumulated depreciation totaled $84,375 on the date of sale, was sold for $101,250 during the year. Using this information, indicate the items t

> The board of directors declared cash dividends totaling $585,000 during the current year. The comparative balance sheet indicates dividends payable of $167,625 at the beginning of the year and $146,250 at the end of the year. What was the amount of cash

> The income statement disclosed the following items for the year: Depreciation expense …………………………….. $ 65,000 Gain on disposal of equipment …………………… 27,500 Net income .……………………………………………. 620,000 The changes in the current asset and liability accounts for

> The net income reported on the income statement for the current year was $185,000. Depreciation recorded on equipment and a building amounted to $96,000 for the year. Balances of the current asset and current liability accounts at the beginning and end o

> Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Year 1 Apr. 1. Purchased

> The net income reported on the income statement for the current year was $73,600. Depreciation recorded on store equipment for the year amounted to $27,400. Balances of the current asset and current liability accounts at the beginning and end of the year

> State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $400,000 of bonds, on which there was $3,000 of unamortized discount, for $411,000. b. Sold 20,000 shares of $

> On its income statement for a recent year, American Airlines Group, Inc., the parent company of American Airlines, reported a net loss of $1,834 million from operations. On its statement of cash flows, it reported $675 million of cash flows from operatin

> Lovato Motors Inc. has cash flows from operating activities of $720,000. Cash flows used for investments in property, plant, and equipment totaled $440,000, of which 85% of this investment was used to replace existing capacity. Determine the free cash fl

> The financial statements for Nike, Inc., are provided in Appendix C at the end of the text. a. Determine the free cash flow for the most recent fiscal year. Assume that 90% of the additions to property, plant, and equipment were used to maintain producti

> Sweeter Enterprises Inc. has cash flows from operating activities of $539,000. Cash flows used for investments in property, plant, and equipment totaled $210,000, of which 75% of this investment was used to replace existing capacity. a. Determine the fre

> The income statement for Rhino Company for the current year ended June 30 and balances of selected accounts at the beginning and the end of the year are as follows: Prepare the Cash flows from operating activities section of the statement of cash flows

> The income statement of Booker T Industries Inc. for the current year ended June 30 is as follows: Changes in the balances of selected accounts from the beginning to the end of the current year are as follows: _________________________________________I

> Selected data taken from the accounting records of Ginis Inc. for the current year ended December 31 are as follows: During the current year, the cost of merchandise sold was $1,031,550 and the operating expenses other than depreciation were $179,400.

> The cost of merchandise sold for Kohl’s Corporation for a recent year was $12,265 million. The balance sheet showed the following current account balances (in millions): Determine the amount of cash payments for merchandise. Balan

> Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 are provided below. Selected missing balances are shown by letters. Note 1. Investments a

> The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following: a. If sales for the current year were $753,500 and accounts receivable decreased by $48,400 during the year, what was the

> The following statement of cash flows for Shasta Inc. was not correctly prepared: a. List the errors you find in the statement of cash flows. The cash balance at the beginning of the year was $240,000. All other amounts are correct, except the cash bal

> Selected data derived from the income statement and balance sheet of National Beverage Co. for a recent year are as follows: Income statement data (in thousands): Net income ……….…………………………………………………..………..……………… $49,311 Gain on disposal of property ………………

> Curwen Inc. reported net cash flow from operating activities of $357,500 on its statement of cash flows for a recent year ended December 31. The following information was reported in the Cash flows from operating activities section of the statement of ca

> On the basis of the details of the following bonds payable and related discount accounts, indicate the items to be reported in the financing activities section of the statement of cash flows, assuming no gain or loss on retiring the bonds: ACCOUNT B

> A long-term investment in bonds with a cost of $500,000 was sold for $600,000 cash. (a) What was the gain or loss on the sale? (b) What was the effect of the transaction on cash flows? (c) How would the transaction be reported on the statement of cash fl

> If salaries payable was $100,000 at the beginning of the year and $75,000 at the end of the year, should the $25,000 decrease be added to or deducted from income to determine the amount of cash flows from operating activities by the indirect method? Expl

> What is the principal advantage and the principal disadvantage of the direct method of reporting cash flows from operating activities?

> Financial assets include stocks and bonds. These are fairly simple securities that can often be valued using quoted market prices. However, there are more complex financial instruments that do not have quoted market prices. These complex securities must

> Glacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31: Year 1 Jan.

> On January 6, Year 1, Bulldog Co. purchased 34% of the outstanding stock of Gator Co. for $212,000. Gator Co. paid total dividends of $24,000 to all shareholders on June 30. Gator had a net loss of $56,000 for Year 1. a. Journalize Bulldog’s purchase of

> On January 4, Year 1, Ferguson Company purchased 480,000 shares of Silva Company directly from one of the founders for a price of $30 per share. Silva has 1,200,000 shares outstanding, including the Daniels shares. On July 2, Year 1, Silva paid $750,000

> At a total cost of $5,600,000, Herrera Corporation acquired 280,000 shares of Tran Corp. common stock as a long-term investment. Herrera Corporation uses the equity method of accounting for this investment. Tran Corp. has 800,000 shares of common stock o

> Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24. Acquired 1,000 shares of Tett Co. stock for $85 per share plus a $150 brokerage commi

> Yerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during a recent year: Feb. 2. Purchased for cash 5,300 shares of Wong Inc. stock for $20 per sh

> The following equity investment transactions were completed by Romero Company during a recent year: Apr. 10. Purchased 5,000 shares of Dixon Company for a price of $25 per share plus a brokerage commission of $75. July 8. Received a quarterly dividend of

> On February 22, Stewart Corporation acquired 12,000 shares of the 400,000 outstanding shares of Edwards Co. common stock at $50 plus commission charges of $120. On June 1, a cash dividend of $1.40 per share was received. On November 12, 4,000 shares were

> On February 1, Hansen Company purchased $120,000 of 5%, 20-year Knight Company bonds at their face amount plus one month’s accrued interest. The bonds pay interest on January 1 and July 1. On October 1, Hansen Company sold $40,000 of the Knight Company b

> The following bond investment transactions were completed during a recent year by Starks Company: Year 1 Jan. 31. Purchased 75, $1,000 government bonds at 100 plus accrued interest of $375 (one month). The bonds pay 6% annual interest on July 1 and Janua

> Pecan Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Pecan Theatre has declared the following annual dividends over a six-year period: Year 1, $80,000; Year 2, $90,000; Year 3, $150,000; Year 4, $150,000; Year 5, $160,000;

> Bocelli Co. purchased $120,000 of 6%, 20-year Sanz County bonds on May 11, Year 1, directly from the county, at their face amount plus accrued interest. The bonds pay semiannual interest on April 1 and October 1. On October 31, Year 1, Bocelli Co. sold $

> Torres Investments acquired $160,000 of Murphy Corp., 5% bonds at their face amount on October 1, Year 1. The bonds pay interest on October 1 and April 1. On April 1, Year 2, Torres sold $60,000 of Murphy Corp. bonds at 102. Journalize the entries to rec

> Gonzalez Company acquired $200,000 of Walker Co., 6% bonds on May 1 at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, Gonzalez Company sold $70,000 of the bonds for 97. Journalize entries to record the following

> On December 31, Year 1, Valur Co. had the following available-for-sale investment disclosure within the Current Assets section of the balance sheet: Available-for-sale investments (at cost) ………………………………………………. $145,000 Plus valuation allowance for availa

> On May 12, Year 1, Chewco Co. purchased 2,000 shares of Jedi Inc. for $112 per share, including the brokerage commission. The Jedi investment was classified as an available-for-sale security. On December 31, Year 1, the fair value of Jedi Inc. was $124 p

> eBay Inc. developed a web-based marketplace at www.ebay.com, in which individuals can buy and sell a variety of items. eBay also acquired PayPal, an online payments system that allows businesses and individuals to send and receive online payments securel

> The market price for Microsoft Corporation closed at $55.48 and $46.45 on December 31, current year, and previous year, respectively. The dividends per share were $1.24 for current year and $1.12 for previous year. a. Determine the dividend yield for Mic

> During Year 2, Copernicus Corporation held a portfolio of available-for-sale securities having a cost of $185,000. There were no purchases or sales of investments during the year. The market values at the beginning and end of the year were $225,000 and $

> During Year 1, its first year of operations, Galileo Company purchased two available-fors-ale investments as follows: Assume that as of December 31, Year 1, the Hawking Inc. stock had a market value of $50 per share and the Pavlov Co. stock had a marke

> Storm, Inc. purchased the following available-for-sale securities during Year 1, its first year of operations: The market price per share for the available-for-sale security portfolio on December 31, Year 1, was as follows: ___________________Market Pr

> Selected transactions completed by ATV Discount Corporation during the current fiscal year are as follows: Jan. 5. Split the common stock 4 for 1 and reduced the par from $20 to $5 per share. After the split, there were 4,000,000 common shares outstandin

> Hurricane Inc. purchased a portfolio of available-for-sale securities in Year 1, its first year of operations. The cost and fair value of this portfolio on December 31, Year 1, was as follows: On June 12, Year 2, Hurricane purchased 1,450 shares of Rog

> The investments of Steelers Inc. include a single investment: 33,100 shares of Bengals Inc. common stock purchased on September 12, Year 1, for $13 per share including brokerage commission. These shares were classified as available-for-sale securities. A

> Highland Industries Inc. makes investments in available-for-sale securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative balance sheets, are as follows: There were no dividend

> The income statement for Delta-tec Inc. for the year ended December 31, Year 2, was as follows: Delta-tec Inc. Income Statement (selected items) For the Year Ended December 31, Year 2 Income from operations …………………………………… $299,700 Gain on sale of invest

> Last Unguaranteed Financial Inc. purchased the following trading securities during Year 1, its first year of operations: The market price per share for the trading security portfolio on December 31, Year 1, was as follows: _______________________Market

> Gruden Bancorp Inc. purchased a portfolio of trading securities during Year 1. The cost and fair value of this portfolio on December 31, Year 1, was as follows: On May 10, Year 2, Gruden Bancorp Inc. purchased 1,200 shares of Carroll Inc. at $29 per sh

> The investments of Charger Inc. include a single investment: 14,500 shares of Raiders Inc. common stock purchased on February 24, Year 1, for $38 per share including brokerage commission. These shares were classified as trading securities. As of the Dece

> JED Capital Inc. makes investments in trading securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative balance sheets, are as follows: There were no dividends. Determine the mi

> Hawkeye Company’s balance sheet reported, under the equity method, its long-term investment in Raven Company for comparative years as follows: In addition, the Year 2 Hawkeye Company income statement disclosed equity earnings in the R

> What causes a gain or loss on the sale of a bond investment?

> Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders’ equity accounts of Morrow Enterprises Inc., with balances on January 1, 20Y5, are as follows: Common Stock, $20 stated value (500,000 shares authorized, 375,000 shares issued). . .

> Why might a business invest cash in temporary investments?

> How are the balance sheet and income statement affected by fair value accounting?

> What are the factors contributing to the trend toward fair value accounting?

> What is the major difference in the accounting for a portfolio of trading securities and a portfolio of available-for-sale securities?

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> CEG Capital Inc. is a large holding company that uses long-term debt extensively to fund its operations. At December 31, the company reported total assets of $100 million, total debt of $55 million, and total equity of $45 million. In January, the compan

> The following financial data (in thousands) were taken from recent financial statements of Staples, Inc.: 1. Determine the times interest earned ratio for Staples in Year 3, Year 2, and Year 1? Round your answers to one decimal place. 2. Evaluate this

> You hold a 25% common stock interest in YouOwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $26,000,000. Two alternative plans have been suggested

> Xentec Inc. has decided to expand its operations to owning and operating golf courses. The following is an excerpt from a conversation between the chief executive officer, Peter Kilgallon, and the vice president of finance, Dan Baron: Peter: Dan, have yo

> Alex Kelton recently won the jackpot in the Colorado lottery while he was visiting his parents. When he arrived at the lottery office to collect his winnings, he was offered the following three payout options: a. Receive $100,000,000 in cash today. b. Re

> The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $75 par (100,000 shares authorized, 80,000 shares issued) . . $ 6,000,000 Paid-In Capital in Excess of Par—Preferred