Question: The controller of Boom Box Sounds Inc.

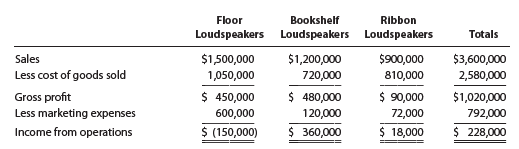

The controller of Boom Box Sounds Inc. prepared the following product profitability report for management, using activity-based costing methods for allocating both the factory overhead and the marketing expenses. As such, the controller has confidence in the accuracy of this report.

In addition, the controller interviewed the vice president of marketing, who indicated that the floor loudspeakers were an older product that was highly recognized in the marketplace.

The ribbon loudspeakers were a new product that was recently launched. The ribbon loudspeakers

are a new technology that have no competition in the marketplace, and it is hoped that they will become an important future addition to the company’s product portfolio. Initial indications are that the product is well received by customers. The controller believes that the manufacturing costs for all three products are in line with expectations.

1. Calculate the gross profit and income from operations to sales ratios for each product.

2. Write a memo using the product profitability report and the calculations in (1) to make recommendations to management with respect to strategies for the three products.

Transcribed Image Text:

Floor Bookshelf Ribbon Loudspeakers Loudspeakers Loudspeakers Totals $1,500,000 1,050,000 Sales $1,200,000 $900,000 $3,600,000 Less cost of goods sold 720,000 810,000 2,580,000 $ 480,000 120,000 $ 90,000 72,000 $ 450,000 Gross profit Less marketing expenses $1,020,000 600,000 792,000 Income from operations $ (150,000) $ 360,000 $ 18,000 $ 228,000

> The centralized computer technology department of Lee Company has expenses of $264,000. The department has provided a total of 2,500 hours of service for the period. The Retail Division has used 1,125 hours of computer technology service during the perio

> Magnolia Candle Inc. projected sales of 75,000 candles for 2016. The estimated January 1, 2016, inventory is 3,500 units, and the desired December 31, 2016, inventory is 2,700 units. What is the budgeted production (in units) for 2016?

> Weidner Company sells 22,000 units at $30 per unit. Variable costs are $24 per unit, and fixed costs are $40,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.

> On April 6, Almerinda Company purchased on account 60,000 units of raw materials at $12 per unit. On April 21, raw materials were requisitioned for production as follows: 25,000 units for Job 50 at $10 per unit and 27,000 units for Job 51 at $12 per unit

> The following data are taken from the financial statements of Krawcheck Inc. Terms of all sales are 2/10, n/55. a. For 2015 and 2016, determine (1) the accounts receivable turnover and (2) the number of days’ sales in receivables. Rou

> Keystone Steel Company has two departments, Casting and Rolling. In the Rolling Department, ingots from the Casting Department are rolled into steel sheet. The Rolling Department received 8,500 tons from the Casting Department. During the period, the Rol

> The total factory overhead for Diva-nation is budgeted for the year at $180,000, divided into two departments: Cutting, $60,000, and Sewing, $120,000. Diva-nation manufactures two types of men’s pants: jeans and khakis. The jeans require 0.04 direct labo

> Addai Company has provided the following comparative information: You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for t

> The following is a list of costs incurred by several businesses: a. Cost of fabric used by clothing manufacturer b. Maintenance and repair costs for factory equipment c. Rent for a warehouse used to store work in process and finished products d. Wages of

> During the first month of operations ended March 31, 2016, Hip and Conscious Clothing Company produced 55,500 designer cowboy hats, of which 51,450 were sold. Operating data for the month are summarized as follows: During April, Hip and Conscious Cloth

> The demand for solvent, one of numerous products manufactured by Mac n’ Cheese Industries Inc., has dropped sharply because of recent competition from a similar product. The company’s chemists are currently completing

> Eclectic Ergonomics Company manufactures designer furniture. Eclectic Ergonomics uses a job order cost system. Balances on April 1 from the materials ledger are as follows: The materials purchased during April are summarized from the receiving reports

> Partial balance sheet data for Flat Top Company at December 31, 2016, are as follows: Prepare the Current Assets section of Flat Top Company’s balance sheet at December 31, 2016. Finished goods inventory $ 40,250 Supplies Material

> Michigan Company sells 10,000 units at $100 per unit. Variable costs are $75 per unit, and fixed costs are $125,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.

> Which of the following are features of a lean manufacturing system? a. Production pace matches demand b. Centralized work in process inventory locations c. Push scheduling d. Receive raw materials directly to manufacturing cells

> Claxon Company owns a machine with a cost of $305,000 and accumulated depreciation of $65,000 that can be sold for $262,000, less a 5% sales commission. Alternatively, the machine can be leased by Claxon Company for three years for a total of $272,000, a

> The following information is available for Ethtridge Manufacturing Company for the month ending January 31, 2016: Determine Ethtridge’s cost of goods manufactured for the month ended January 31, 2016. Cost of direct materials used

> Rextacular Manufacturing Company reported the following materials data for the month ending June 30, 2016: Determine the cost of direct materials used in production by Rextacular during the month ended June 30, 2016. Materials purchased $828,000 Ma

> The increases to Work in Process—Roasting Department for Highlands Coffee Company for May 2016 as well as information concerning production are as follows: Prepare a cost of production report, using the average cost method. Work i

> A summary of the time tickets for the current month follows: Journalize the entry to record the factory labor costs. Job No. Amount Job No. Amount 100 $ 3,860 Indirect $ 6,340 101 4,300 24,500 111 7,120 7,400 32,000 104 115 108 18,600 117

> Digital River Inc. provides cable TV and Internet service to the local community. The activities and activity costs of Digital Light are identified as follows: Prepare a Pareto chart of these activities. Activities . Activity Cost Billing error cor

> For the current year ended March 31, Benatar Company expects fixed costs of $1,250,000, a unit variable cost of $140, and a unit selling price of $100. a. Compute the anticipated break-even sales (units). b. Compute the sales (units) required to realize

> Silicon Solutions Inc. manufactures RAM memory chips for personal computers. An activity analysis was conducted, and the following activity costs were identified with the manufacture and sale of memory chips: Prepare a Pareto chart of these activities.

> The chief cost accountant for Fizzy Fruit Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning April 1 would be $147,000, and total direct labor costs would be $105,000. During April, th

> Ever-Brite Lighting Inc. manufactures lighting fixtures, using lean manufacturing methods. Style BB-01 has a materials cost per unit of $45. The budgeted conversion cost for the year is $193,200 for 2,100 production hours. A unit of Style BB-01 requires

> Income statement information for Axiom Corporation follows: Prepare a vertical analysis of the income statement for Axiom Corporation. Sales . $725,000 Cost of goods sold 391,500 Gross profit. 333:500

> The Cutting Department of Karachi Carpet Company provides the following data for January 2016. Assume that all materials are added at the beginning of the process. a. Prepare a cost of production report for the Cutting Department. b. Compute and evalua

> Right Now Video Inc. uses a lean manufacturing strategy to manufacture DVR (digital video recorder) players. The company manufactures DVR players through a single product cell. The budgeted conversion cost for the year is $420,000 for 2,000 production ho

> Currently, the unit selling price of a product is $160, the unit variable cost is $120, and the total fixed costs are $725,000. A proposal is being evaluated to increase the unit selling price to $170. a. Compute the current break-even sales (units). b.

> Lilac Skin Care Company consists of two departments, Blending and Filling. The Filling Department received 45,000 ounces from the Blending Department. During the period, the Filling Department completed 42,800 ounces, including 4,000 ounces of work in pr

> Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. $ 22,400 156,800 $ 50,400 Work in process inventory, August 1 Total ma

> Anheuser-Busch InBev Companies, Inc., reported the following operating information for a recent year (in millions): In addition, assume that Anheuser-Busch InBev sold 320 million barrels of beer during the year. Assume that variable costs were 70% of t

> Based on the data in Exercise 23-10 assume that management has established a 10% minimum acceptable rate of return for invested assets. Exercise 23-10: The income from operations and the amount of invested assets in each division of Magnetic Zero Indus

> The income from operations and the amount of invested assets in each division of Magnetic Zero Industries are as follows: a. Compute the rate of return on investment for each division. b. Which division is the most profitable per dollar invested? I

> a. Segar Company budgets sales of $3,200,000, fixed costs of $700,000, and variable costs of $2,240,000. What is the contribution margin ratio for Segar Company? b. If the contribution margin ratio for Domino Company is 35%, sales were $2,100,000, and fi

> Dash Industries Inc. manufactures recreational vehicles. Dash uses a job order cost system. The time tickets from April jobs are summarized as follows: Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $25 per direct

> The following data are accumulated by Dillon Company in evaluating the purchase of $39,600 of equipment, having a four-year useful life: a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table

> A project has estimated annual net cash flows of $118,600. It is estimated to cost $616,720. Determine the cash payback period. Round to one decimal place.

> Quigley Inc. manufactures memory chips for electronic toys within a relevant range of 200,000 to 600,000 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Complete the cost schedu

> Fidelity Bancorp Inc. is evaluating two capital investment proposals for a drive-up ATM kiosk, each requiring an investment of $280,000 and each with an eight-year life and expected total net cash flows of $448,000. Location 1 is expected to provide equa

> On December 31, the end of the first year of operations, Frankenreiter Inc. manufactured 25,600 units and sold 24,000 units. The following income statement was prepared, based on the variable costing concept: Determine the unit cost of goods manufactur

> The following information is available for the first month of operations of Kellman Inc., a manufacturer of art and craft items: Using this information, determine the following missing amounts: a. Cost of goods sold b. Direct materials cost c. Direct l

> During April, Almerinda Company accumulated 20,000 hours of direct labor costs on Job 50 and 24,000 hours on Job 51. The total direct labor was incurred at a rate of $20.00 per direct labor hour for Job 50 and $22.00 per direct labor hour for Job 51. Jou

> Tiny Biggs Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hour

> The following data are accumulated by Chem Lab Inc. in evaluating two competing capital investment proposals: Determine the expected average rate of return for each proposal. Testing Equlpment $86,000 Vehicle Amount of investment $30,000 8 years Us

> For a manufacturer, what is the description of the account that is comparable to a merchandising business’s cost of merchandise sold?

> H. Jeckel Manufacturing Company allows employees to purchase, at cost, manufacturing materials, such as metal and lumber, for personal use. To purchase materials for personal use, an employee must complete a materials requisition form, which must then be

> Rambotix Company has two divisions, the Semiconductor Division and the X-ray Division. The X-ray Division may purchase semiconductors from the Semiconductor Division or from outside suppliers. The Semiconductor Division sells semiconductor products both

> The centralized employee travel department of Camtro Company has expenses of $528,000. The department has serviced a total of 6,000 travel reservations for the period. The Southeast Division has made 2,400 reservations during the period, and the Pacific

> Wells Fargo Insurance Services (WFIS) is an insurance brokerage company that classified Insurance products as either “easy” or “difficult.” Easy and difficult products were defined a

> Beachside Beverages Company manufactures soft drinks. Information about two products is as follows: It is known that both products have the same direct materials and direct labor costs per case. Beachside Beverages allocates factory overhead to product

> In one group, find a local business, such as a copy shop, that rents time on desktop computers for an hourly rate. Determine the hourly rate. In the other group, determine the price of a mid-range desktop computer at www.dell.com. Combine this informatio

> Municipal governments are discovering that you can control only what you measure. As a result, many municipal governments are introducing nonfinancial performance measures to help improve municipal services. In a group, use the Google search engine to pe

> The Norsk Division of Gridiron Concepts Inc. has been experiencing revenue and profit growth during the years 2014–2016. The divisional income statements follow: Assume that there are no charges from service departments. The vice pres

> a. Based upon the data in Exercise 18.7 determine the following: Exercise 18.7: The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. 1. Direct ma

> Product TS-20 has revenue of $102,000, variable cost of goods sold of $52,500, variable selling expenses of $21,500, and fixed costs of $35,000, creating a loss from operations of$7,000. Prepare a differential analysis as of September 12 to determine if

> Salvo Inc., a specialized equipment manufacturer, uses a job order costing system. The overhead is allocated to jobs on the basis of direct labor hours. The overhead rate is now $1,500 per direct labor hour. The design engineer thinks that this is illogi

> BendOR, Inc. manufactures control panels for the electronics industry and has just completed its first year of operations. The following discussion took place between the controller, Gordon Merrick, and the company president, Matt McCray: Matt: I’ve been

> Lo-bed Company produces a product that requires four standard hours per unit at a standard hourly rate of $28.00 per hour. If 4,000 units required 16,750 hours at an hourly rate of $28.40 per hour, what is the direct labor (a) rate variance, (b) time var

> In a group, find the home page of the state in which you presently live. The home page will be of the form www.statename.gov. For example, the state of Tennessee would be found at www.tennessee.gov. At the home page site, search for annual budget informa

> Jellnick Equipment Inc. manufactures and sells kitchen cooking products throughout the state. The company employs four salespersons. The following contribution margin by salesperson analysis was prepared: 1. Calculate the manufacturing margin as a perc

> Dash Riprock is a cost analyst with Safe Insurance Company. Safe is applying standards to its claims payment operation. Claims payment is a repetitive operation that could be evaluated with standards. Dash used time and motion studies to identify an idea

> Trans Sport Company sells sporting goods to retailers in three different states—Florida, Georgia, and Tennessee. The following profit analysis by state was prepared by the company: The following fixed costs have also been provided:

> The controller of the plant of Minsky Company prepared a graph of the unit costs from the job cost reports for Product One. The graph appeared as follows: How would you interpret this information? What further information would you request? $40 $35

> Craig Company is a family-owned business in which you own 20% of the common stock and your brothers and sisters own the remaining shares. The employment contract of Craig’s new president, Ajay Pinder, stipulates a base salary of $140,00

> In papermaking operations for companies such as International Paper Company, wet pulp is fed into paper machines, which press and dry pulp into a continuous sheet of paper. The paper is formed at very high speeds (60 mph). Once the paper is formed, the p

> The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. a. Determine the number of units in work in process inventory at the end of the month. b. Dete

> How is “yield” determined for a process manufacturer?

> The American textile industry has moved much of its operations offshore in the pursuit of lower labor costs. Textile imports have risen from 2% of all textile production in 1962 to over 70% in 2012. Offshore manufacturers make long runs of standard mass-

> My Life Chronicles Inc. projected sales of 240,000 diaries for 2016. The estimated January 1, 2016, inventory is 19,900 units, and the desired December 31, 2016, inventory is 18,800 units. What is the budgeted production (in units) for 2016?

> The condensed income statements through income from operations for Dell Inc. and Apple Inc. for recent fiscal years follow (numbers in millions of dollars): Prepare comparative common-sized statements, rounding percents to one decimal place. Interpret

> “For a student, a grade of 65 percent is nothing to write home about. But for the airline . . . [industry], filling 65 percent of the seats . . . is the difference between profit and loss. The [economy] might be just strong enough to sustain all the car

> Banks have a variety of products, such as savings accounts, checking accounts, certificates of deposit (CDs), and loans. Assume that you were assigned the task of determining the administrative costs of “checking and savings accounts” as a complete produ

> Aldin Aster, president of Teldar Tech Inc., was reviewing the product profitability reports with the controller, Francie Newburn. The following conversation took place: Aldin: I’ve been reviewing the product profitability reports. Our high-volume calcula

> Pryor Company prepared the following factory overhead report from its general ledger: The management of Pryor Company was dissatisfied with this report and asked the controller to prepare an activity analysis of the same information. This activity anal

> Maxxim Inc. prepared the following performance graphs for the prior year: Total Manufacturing Lead Time Total Inventory Dollars (In 000s) Percent of Sales Orders Filled on Time 70 $160 100%- 60 - 140 90 50 - 120 - 80 40 100 - 70 30 - 80 - 60 20 60 -

> Reliant Products Inc. manufactures electric space heaters. While the CEO, Lynn Jennings, is visiting the production facility, the following conversation takes place with the plant manager, Aaron Clark: Lynn: As I walk around the facility, I can’t help no

> Genuine Spice Inc. began operations on January 1, 2016. The company produce eight- ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in 12-bottle cases for $100 per case. There is a selling commission of $20 per ca

> The total factory overhead for Diva-nation Inc. is budgeted for the year at $180,000. Diva-nation manufactures two types of men’s pants: jeans and khakis. The jeans and khakis each require 0.10 direct labor hour for manufacture. Each product is budgeted

> Matt’s Music Inc. makes three musical instruments: trumpets, tubas, and trombones. The budgeted factory overhead cost is $188,000. Factory overhead is allocated to the three products on the basis of direct labor hours. The products have

> Crosby Company has provided the following comparative information: You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for

> Volt-Gear Inc. manufactures power equipment. Volt-Gear has two primary products— generators and air compressors. The following report was prepared by the controller for Volt-Gear senior marketing management for the year ended December 3

> The Texas Jean Company manufactures jeans in the cutting and sewing process. Jeans are manufactured in 100-jean batch sizes. The cutting time is 11 minutes per jean. The sewing time is 8 minutes per jean. It takes 15 minutes to move a batch of jeans from

> The following information is available for Crouching Alligator Manufacturing Company for the month ending October 31, 2016: For the month ended October 31, 2016, determine Crouching Alligator’s (a) cost of goods sold, (b) gross profit

> Car Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,900. The freight and installation costs for the equipment are $515. If purchased, annual repairs and maintenance are estimated to be $410 per ye

> The following selected data were taken from the financial statements of Robinson Inc. for December 31, 2016, 2015 and 2014: The 2016 net income was $372,000, and the 2015 net income was $492,000. No dividend son common stock was declared between 2014 a

> A company is considering replacing an old piece of machinery, which cost $600,000 and has $350,000 of accumulated depreciation to date, with a new machine that has a purchase price of $545,000. The old machine could be sold for $231,000. The annual varia

> Wild Sun Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: The service department charge rate for the service department costs was based

> Reincarnation Bicycle Company manufactures commuter bicycles from recycled materials. The following data for April of the current year are available: a. Determine the direct labor rate variance, time variance, and total direct labor cost variance. b. H

> On July 31, the end of the first month of operations, Del Ray Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing. Del Ray Equipment Company Variable

> The following data were taken from the balance sheet of Gostkowski Company at the end of two recent fiscal years: a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. b.

> A partial list of The Grand Hotel’s costs follows: a. Cost to mail a customer survey b. Wages of convention setup employees c. Pay-per-view movie rental costs (in rooms) d. Cost of food e. Cost of room mini-bar supplies f. Training for hotel restaurant s

> The following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 2016: Prepare divisional income statements for Jersey Coast Construction Company. Cost of goods sold: Service departmen

> Englert Hospital began using standards to evaluate its Admissions Department. The standard was broken into two types of admissions as follows: The unscheduled admission took longer because name, address, and insurance information needed to be determine

> Partially completed budget performance reports for Saskatoon Company, a manufacturer of light duty motors, follow: a. Complete the budget performance reports by determining the correct amounts for the lettered spaces. b. Compose a memo to Robin Mooney,

> At the beginning of the period, the Fabricating Department budgeted direct labor of $9,280 and equipment depreciation of $2,300 for 640 hours of production. The department actually completed 600 hours of production. Determine the budget for the departmen

> Based on the data in Exercise 21-7 and assuming that the average compensation per hour for staff is $45 and for partners is $140, prepare a professional labor cost budget for each department for Rollins and Cohen, CPAs, for the year ending December 31, 2

> True Tab Inc. produces a small and large version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows: The finished goods inventory estimated for July 1, 2017, for the small and large scale models is

> Wood You Lie To Me Furniture Company manufactures designer home furniture. Wood You Lie To Me uses a standard cost system. The direct labor, direct materials, and factory overhead standards for an unfinished dining room table are as follows: a. Determi

> The controller of Ming Ware Ceramics Inc. wishes to prepare a cost of goods sold budget for September. The controller assembled the following information for constructing the cost of goods sold budget: Use the preceding information to prepare a cost o