Question: The fiscal year for Pine Valley Skiing

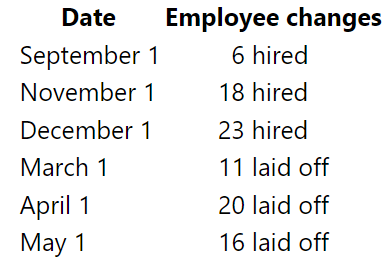

The fiscal year for Pine Valley Skiing Ltd., the owner of a downhill skiing facility, ends on June 30. The company began the recently completed fiscal year with its summer maintenance crew of seven employees. During the fiscal year, employees were hired or laid off on various dates as shown.

What was the average number of employees working for Pine Valley during the fiscal year?

> Express each of the following ratios in its lowest terms. 1. 0.18 : 0.60 : 0.45 2. 9 8 : 3 4 : 3 2 3. 1 6 : 1 3 : 1 9 4. 6 1 4 : 5 : 8 3 4

> In a downtown Edmonton office building, 42% of its employees smoke. If 11% of the smokers join a stop-smoking group and the group has 17 members, how many employees are in the office building? Round your answer to the nearest whole person.

> Solve each of the following: 1. What amount is 17.5% more than $29.43? 2. What amount reduced by 80% leaves $100? 3. What amount reduced by 15% equals $100? 4. What is $47.50 after an increase of 320%? 5. What amount when decreased by 62% equals $213.56?

> Use P V = P M T [ 1 − ( 1 + i ) − n i ] , to obtain PMT if PV = $6595.20, n = 20, and i = 0.06.

> How many dollars is 350% of 62¢?

> 450 grams is what percentage of 2 kg?

> $150 is 200% of what amount?

> Fifteen minutes is what percentage of two hours?

> 3 4 % of what amount is $1.00?

> An $8600 investment was worth only $7900 one year later. If the rate of total return for the year was −5%, how much income was received from the investment during the year?

> Gabriel received $200 of income from an investment during the past year. This represents an income yield of 4%. If the capital gain yield for the year was 10%, what was the value of the investment (not including income) at the end of the year?

> Through a calculation on Canadian individual tax returns known as the Old Age Security (OAS) clawback, an individual receiving OAS benefits must repay an increasing portion of these benefits to the federal government as the individual’s net income rises

> Bricks and Mortar Building Inc. has retail locations in five provinces. 1. Calculate the market shares for each province for 2018 and 2019. 2. Calculate the year-on-year market growth for each location.

> Home improvement stores in Ontario had sales of $12.8B in 2019, which represents 31.5% of the Canadian home improvement and building supplies industry. 1. What were the total Canadian industry sales for 2019? 2. What is the dollar value of industry sale

> Use F V = P M T [ ( 1 + i ) n − 1 i ] , to obtain PMT if FV = $1508.54, n = 4, and i = 0.05.

> 80% of what amount is $100?

> One of the more volatile mutual funds in recent years has been the AGF China Focus Fund. The fund’s annual returns in successive years from 2007 to 2012 inclusive were 30.53%, −41.67%, 27.75%, 1.27%, −20.71%, and 17.0%, respectively. What was the fund’s

> A portfolio earned −13%, 18%, 5%, 24%, and −5% in five successive years. What was the portfolio’s total rate of return for the five-year period?

> A company’s annual report states that its common shares had price gains of 23%, 10%, −15%, and 5% during the preceding four fiscal years. The share price stood at $30.50 after last year’s 5% gain. 1. What was the price of the shares at the beginning of t

> One year ago, Christos bought 1000 units of the Dominion Aggressive Growth Fund at $20.35 per unit. Today a unit’s value is $19.10. During the year, the fund made a distribution of $0.40 per unit. On this investment, what is Christos’s: 1. Income yield?

> Albion Distributors’ revenues and expenses for the fiscal year just completed were $2,347,000 and $2,189,000, respectively. 1. If in the current year revenues rise by 10% but expense increases are held to 5%, what will be the percent increase in profit?

> Barry recently sold some stock after holding it for two years. The stock’s price rose 150% during the first year, but fell 40% in the second year. At what price did he buy the stock if he sold it for $24 per share?

> Two years ago the shares of Diamond Strike Resources traded at a price of $3.40 per share. One year later the shares were at $11.50, but then they declined in value by 35% during the subsequent year. Calculate: 1. The percent change in the share price du

> Yellowknife Mining sold 34,300 oz. of gold in Year 1 at an average price of $1160 per ounce. Production was down to 23,750 oz. in Year 2 because of a strike by the miners, but the average price obtained was $1280 per ounce. What was the percent change fr

> A Toyota Corolla could be purchased new in 1970 for $1686, while the more current 2019 model had a base price of $16,790. For this 49-year time period: 1. What is the percent increase in the base price? 2. If sales tax in 1970 was 5% and the current GST

> Use the formula FV = PV(1 + i1)(1 + i2)(1 + i3) to determine i1 if PV = $1000, FV = $1094.83, i2 = 0.03, and i3 = 0.035.

> Arctic sea ice has thinned in recent decades. In the mid-1960s the average thickness was 3.1 m. This dropped to an average thickness of 1.8 m in the mid-1990s. What was the percent reduction in ice thickness for this 30-year period?

> What percent of $6.39 is $16.39?

> Evaluate the following expressions to six-figure accuracy. 1. (1.0075)24 2. (1.05)1/6 – 1 3. ( 1 + 0.0075 ) 36 − 1 0.0075 4. 1 − ( 1 + 0.045 ) − 12 0.045

> Simplify: ( − 2 x 2 3 ) − 2 ( 5 2 6 x 3 ) ( − 15 x 5 ) −1

> Simplify: 1. (− 3x2) 3(2x − 2)6x 5 2. (− 2a3) − 2( 4 b 4 )3/2(− 2b3)(0.5a)3

> Evaluate each of the following expressions for the given values of the variables. The answer should be accurate to the cent. 1. L(1 – d1)(1 – d2)(1 – d3) for L = $340, d1 = 0.15, d2 = 0.08, d3 = 0.05 2. R i [ 1 − 1 ( 1 + i ) n ] for R = $575, i = 0.085,

> Evaluate: P ( 1 + i ) n + S1 + r t accurate to the cent for P = $2500, i = 0.1025, n = 2, S = $1500, r = 0.09, and t 93 365.

> Perform the indicated multiplication and division, and combine the like terms. 1. 6(4y – 3)(2 – 3 y) – 3(5 – y)(1 + 4 y) 2. 5 b − 4 4 − 25 − b 1.25 + 78 b 3. x 1 + 0.085 × 63 365 + 2 x ( 1 + 0.085 × 151 365 ) 4. 96 nm2 − 72 n2 m2 48n2m

> Simplify and collect the like terms. 1. 9 y − 7 3 − 2.3 ( y − 2 ) 2. P ( 1 + 0.095 × 135 365 ) + 2 P 1 + 0.095 × 75 365

> Multiply and collect the like terms: 4(3a + 2b)(2b – a) – (2a – b)(a + 3b)

> Use N = L(1 – d1)(1 – d2)(1 – d3), to calculate d2 if N = $70.29, L = $99.99, d1 = 0.20, and d3 = 0.05.

> The profits from a partnership are to be distributed so that Grace receives 20% more than Kajsa, and Mary Anne receives five-eighths as much as Grace. How much should each receive from a total distribution of $36,000?

> The annual net income of the Todd Bros. partnership is distributed so that Ken receives $15,000 more than 80% of Hugh’s share. How should a net income of $98,430 be divided between the partners?

> Norman’s Gourmet Tea wants to prepare a custom tea blend using a mixture of mint tea leaves that cost $0.202 per gram and chamomile tea leaves that cost $0.158 per gram. Norman’s wants to prepare 2 kg of the mint-chamomile blend and price it at $0.179 pe

> Rearrange the formula NI = (CM)X – FC to isolate CM.

> Rearrange the formula FV = PV(1 + i1)(1 + i2) to isolate i1.

> Use the formula Vf = Vi(1 + c1)(1 + c2)(1 + c3) to determine c2 if Vf = $586.64, Vi = $500, c1 = 0.17, and c3 = 0.09.

> Use Formula (5-2), N = L(1 – d1)(1 – d2)(1 – d3), to calculate d2 if N = $324.30, L = $498, d1 = 0.20, and d3 = 0.075. Data from Formula 5-2: N = L(1 − d1)(1 − d2)(1 − d3)

> Solve the following equations for x to five-figure accuracy and verify the solution. 1. x 1.08 3 + x 2 ( 1.08 ) 4 = $ 850 2. 2 x ( 1 + 0.085 × 77 365 ) + x 1 + 0.085 × 132 365 = $ 1565.70

> Solve the following equations for x to five-figure accuracy. 1. 2 x 1 + 0.13 × 92 365 + x ( 1 + 0.13 × 59 365 ) = $ 831 2. 3 x ( 1.03 5 ) + x 1.03 3 + x = $ 2500 1.03 2

> Evaluate the following expressions to six-figure accuracy. 1. ( 1.00 6 ¯ ) 240 − 1 0.00 6 ¯ 2. (1 + 0.025)1/3 – 1

> Use I = Prt, to calculate P if r = 0.05, I = $6.25, and t = 0.25.

> Multiply and collect the like terms: 4(3a + 2b) – 5a(2 – b)

> Anthony began the year with $96,400 already invested in his Snow ’n Ice retail store. He withdrew $14,200 on March 1 and another $21,800 on April 1. On August 1, he invested $23,700, and on November 1, he contributed another $19,300. What was his average

> One year ago Helga allocated the funds in her portfolio among five securities in the amounts listed in the following table. The rate of return on each security for the year is given in the third column of the table. Calculate the average rate of return f

> Ms. Yong invested a total of $73,400 in three mutual funds as shown in the following table. The third column shows the change in value of each fund during the subsequent six months. What was the percent change in value of Ms. Yong’s ove

> Souvenirs and Such” is a gift shop in Niagara Falls. Last year 22% of its revenue came from the sale of clothing, 18% from food items, 32% from novelty items, and the remainder from special services the shop provided for tourists. This past year the shop

> Havel signed a listing agreement with a real estate agent. The commission rate is 4% on the first $200,000 of the selling price, and 2.5% on the remainder. 1. What commission will Havel pay if he sells his home for $289,000? 2. What is the average commis

> Lauren’s gross pay for July was $3188.35 on net sales totaling $88,630. If her base salary is $1000 per month, what is her rate of commission on sales exceeding her monthly quota of $40,000?

> Marion receives a monthly base salary of $1000. On the first $10,000 of sales above her monthly quota of $20,000, she is paid a commission of 8%. On any additional sales, the commission rate is 10%. What were her gross earnings for the month of August, i

> Sonja is paid $42.50 per hour as a veterinarian. She is paid 1 1 2 times the regular rate for all time exceeding 7 1 2 hours in a day or 37 1 2 hours per week. Work on a statutory holiday is paid at double time. What were her gross earnings for a week i

> Solve the equations. 8 – 0.5(x + 3) = 0.25(x – 1)

> Istvan earns an annual salary of $61,000 as an executive with a provincial utility. He is paid biweekly. During a strike, he worked 33 hours more than the regular 75 hours for a two-week pay period. What was his gross pay for that period if the company a

> Luther is paid an annual salary of $56,600 based on a 37.5-hour workweek. 1. What is his equivalent hourly wage? (Assume that a year has exactly 52 weeks.) 2. What would be his total remuneration for a biweekly pay period of that year if he worked 4.5 ho

> Renalda sold Westel stock that she purchased at $2.20 per share one year ago for a 35% gain. At what price did she sell the stock?

> The profit forecast for the most recent fiscal quarter is $23,400. The actual profit is 90% of the forecast profit. What is the actual profit?

> Two equal payments, 50 days and 150 days after the date of the loan, paid off a $3000 loan at 10 1 4 % . What was the amount of each payment?

> A $1000 loan at 5.5% was repaid by two equal payments made 30 days and 60 days after the date of the loan. Determine the amount of each payment.

> A $3000 loan on March 1 was repaid by payments of $500 on March 31, $1000 on June 15, and a final payment on August 31. What was the third payment if the interest rate on the loan was 8 1 4 % ?

> The interest rate on a $3000 loan advanced on March 1 was 5.2%. What must the first payment on April 13 be in order that two subsequent payments of $1100 on May 27 and $1100 on July 13 settle the loan?

> $5000 was borrowed at 9 1 2 % on March 1. On April 1 and June 1, the borrower made payments of $2000 each. What payment was required on August 1 to pay off the loan’s balance?

> A $3000 loan at 6% was made on March 1. Two payments of $1000 each were made on May 1 and June 1. What payment on July 1 will pay off the loan?

> Solve the equations. 3y – 4 = 3(y + 6) – 2(y + 3)

> A capital project would require an immediate investment of $150,000 and a further investment of $40,000 on a date four years from now. On the operating side, the project is expected to lose $30,000 in the first year and $10,000 in the second, to break ev

> A mortgagee wishes to sell his interest in a closed mortgage contract that was written 21 months ago. The original loan was for $60,000 at 6.8% compounded semiannually for a five-year term. Monthly payments are being made on a 20-year amortization schedu

> The vendor of a property agrees to take back a $55,000 mortgage at a rate of 7.5% compounded semiannually with monthly payments of $500 for a two-year term. Calculate the market value of the mortgage if financial institutions are charging 9.5% compounded

> The vendor of a residential property accepted a $40,000 take-back mortgage to facilitate the sale. The agreement calls for quarterly payments to amortize the loan over 10 years at an interest rate of 7% compounded semiannually. What was the cash value (o

> Calculate the effective annual cost of borrowing for each of the following three financing alternatives. All interest rates are for a seven-year term and all mortgages use a 20-year amortization to calculate the monthly payments. Bank B will lend $90,000

> A borrower has the choice between two mortgage loans. Both are to be amortized by monthly payments over 10 years. A mortgage broker will charge a fee of $2200 for an $82,200 face value loan at 10.25% compounded semiannually. A trust company will grant an

> A local mortgage broker has arranged a mortgage loan with a face value of $77,500, which included a finder’s fee of $2500. The loan is to be amortized by monthly payments over 20 years at 7% compounded semiannually. What is the actual cost of borrowing,

> A borrower has arranged a $105,000 face value, bonused mortgage loan with a broker at an interest rate of 10.8% compounded semiannually. Monthly payments are based on a 15-year amortization. A $5000 placement fee will be retained by the broker. What is t

> A mortgage loan having a face value of $63,000 is arranged by a mortgage broker. From this face value, the broker deducted her fee of $3000. The mortgage is written at a contract rate of 8% compounded semiannually for a five-year term. Monthly payments a

> A $75,000 mortgage loan at 9% compounded semiannually has a five-year term and a 25-year amortization. Prepayment of the loan at any time within the first five years leads to a penalty equal to the greater of 1. three months’ interest on the balance. 2.

> The Phams are almost two years into the first five-year term of a 25-year $80,000 mortgage loan at 7.5% compounded semiannually. Interest rates on three-year term mortgage loans are now 6% compounded semiannually. A job transfer necessitates the sale of

> Solve the equations. 12x – 4(2x – 1) = 6(x + 1) – 3

> You are interested in purchasing a house listed for $180,000. The owner seems quite determined to stay at the asking price, but you think that the true market value is $165,000. It may be that the owner would accept an offer whose nominal value is the ps

> The owner of a property listed at $145,000 is considering two offers. Offer C is for $140,000 cash. Offer M is for $50,000 cash and a mortgage back to the vendor for $100,000 at a rate of 8% compounded semiannually and payments of $750 per month for the

> What is the equivalent cash value of the offer if the vendor financing arrangement is for the same 10-year amortization but with 1. a five-year term? 2. a one-year term?

> A property is listed for $175,000. A potential purchaser makes an offer of $170,000, consisting of $75,000 cash and a $95,000 mortgage back to the vendor bearing interest at 8% compounded semiannually with monthly payments for a 10-year term and a 10-yea

> An investor is considering the purchase of an existing closed mortgage that was written 20 months ago to secure a $45,000 loan at 10% compounded semiannually paying $500 per month for a four-year term. What price should the investor pay for the mortgage

> The Gills have arranged a second mortgage loan with a face value of $21,500 at an interest rate of 6.5% compounded monthly. The face value is to be fully amortized by equal monthly payments over a five-year period. The Gills received only $20,000 of the

> If Gayle contributes $1000 to her RRSP at the end of every quarter for the next 10 years and then contributes $1000 at each month’s end for the subsequent 15 years, how much will she have in her RRSP at the end of the 25 years? Assume that the RRSP earns

> Canadian Pacific Class B preferred shares have just paid their quarterly $1.00 dividend and are trading on the Toronto Stock Exchange at $50. What will the price of the shares have to be three years from now for a current buyer of the shares to earn 7% c

> Interprovincial Distributors Ltd. is planning to open a distribution centre in Calgary in five years. It can purchase suitable land now for the distribution warehouse for $450,000. Annual taxes on the vacant land, payable at the end of each year, would b

> Mr. Palmer wants to retire in 20 years and purchase a 25-year annuity that will make end-of-quarter payments. The payment size is to be the amount which, 20 years from now, has the purchasing power of $6000 today. If he already has $54,000 in his RRSP, w

> Solve the equations. x – 0.025x = 341.25

> Natalie’s RRSP is currently worth $133,000. She plans to contribute for another seven years, and then let the plan continue to grow through internal earnings for an additional three years. If the RRSP earns 5.25% compounded annually, how much must she co

> What amount is required to purchase an annuity that pays $5000 at the end of each quarter for the first 10 years and then pays $2500 at the beginning of each month for the subsequent 10 years? The rate of return on the invested funds is 6% compounded qua

> Sheila already has $67,000 in her RRSP. How much longer must she contribute $4000 at the end of every six months to accumulate a total of $500,000 if the RRSP earns 5% compounded quarterly? (Round the time required to the next higher month.)

> Martha’s RRSP is currently worth $97,000. She plans to contribute $5000 at the beginning of every six months until she reaches age 58, 12 years from now. Then she intends to use half of the funds in the RRSP to purchase a 20-year annuity making month-end

> The monthly payments on a $30,000 loan at 10.5% compounded monthly were calculated to repay the loan over a 10-year period. After 32 payments were made, the borrower became unemployed and, with the approval of the lender, missed the next three payments.

> RentalTown advertised a television at a cash price of $599.99 and at a rent-to-own rate of $14.79 at the beginning of each week for 78 weeks. What effective rate of interest is a customer paying to acquire the television in a rent-to-own transaction? (As

> A major car manufacturer is developing a promotion offering new car buyers the choice between “below market” four-year financing at 1.9% compounded monthly or a cash rebate. On the purchase of a $35,000 car, what cash rebate would make a car buyer indiff

> Cynthia currently has $55,000 in her RRSP. She plans to contribute $7000 at the end of each year for the next 17 years and then use the accumulated funds to purchase a 20-year annuity making end-of-month payments. 1. Assume that her RRSP earns 8.75% comp