Question: The following 20X2 consolidated statement of cash

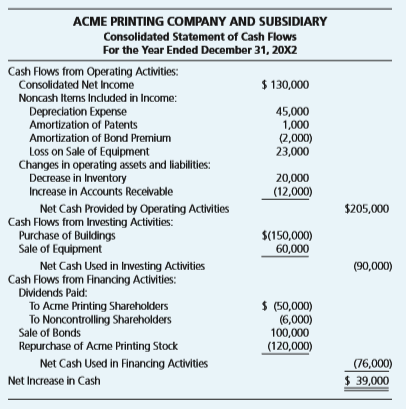

The following 20X2 consolidated statement of cash flows is presented for Acme Printing Company and its subsidiary, Jones Delivery:

Acme Printing acquired 60 percent of the voting shares of Jones in 20X1 at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Jones Delivery.

Required:

Determine the amount of dividends paid by Jones in 20X2.

Explain why the amortization of bond premium is treated as a deduction from net income in arriving at net cash flows from operating activities.

Explain why an increase in accounts receivable is treated as a deduction from net income in arriving at net cash flows from operating activities.

Explain why dividends to noncontrolling stockholders are not shown as a dividend payment in the retained earnings statement but are shown as a distribution of cash in the consolidated cash flow statement.

Did the loss on the sale of equipment included in the consolidated statement of cash flows result from a sale to an affiliate or a nonaffiliate? How do you know?

Transcribed Image Text:

ACME PRINTING COMPANY AND SUBSIDIARY Consolidated Statement of Cash Flows For the Year Ended December 31, 20x2 Cash Flows from Operating Activities: Consolidated Net Income $ 130,000 Noncash Items Incduded in Income: Depreciation Expense Amortization of Patents 45,000 1,000 (2,000) 23,000 Amortization of Bond Premium Loss on Sale of Equipment Changes in operating assets and liabilities: Decrease in Inventory Increase in Accounts Receivable 20,000 (12,000) Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Purchase of Buldings Sale of Equipment $205,000 $(150,000) 60,000 (90,000) Net Cash Used in Investing Activities Cash Flows from Financing Activities: Dividends Paid: To Acme Printing Shareholders To Noncontrolling Shareholders Sale of Bonds $ (50,000) (6,000) 100,000 (120,000) Repurchase of Acme Printing Stock Net Cash Used in Financing Activities (76,000) Net Increase in Cash $ 39,000

> Research in the gaming industry showed that 10% of all slot machines in the United States stop working each year. Short’s Game Arcade has 60 slot machines and only 3 failed last year. At the .05 significance level, test whether these data contradict the

> IBM Inc. is going to award a contract for fine-line pens to be used nationally in its offices. Two suppliers, Bic and Pilot, have submitted bids. To determine the preference of office personnel, a preference test was conducted using a randomly selected s

> Refer to the Baseball 2016 data, which report information on the 30 Major League Baseball teams for the 2016 season. Let the number of games won be the dependent variable and the following variables be independent variables: team batting average, team Ea

> According to a study by the American Pet Food Dealers Association, 63% of U.S. households own pets. A report is being prepared for an editorial in the San Francisco Chronicle. As a part of the editorial, a random sample of 300 households showed 210 own p

> Think about the figures from the previous exercise. Add a new variable that describes the potential interaction between the loan amount and the number of payments made. Then do a test of hypothesis to check if the interaction is significant. In Previous

> Cellulon, a manufacturer of home insulation, wants to develop guidelines for builders and consumers on how the thickness of the insulation in the attic of a home and the outdoor temperature affect natural gas consumption. In the laboratory, it varied the

> Suppose Texas A & M University—Commerce has five scholarships available for the women’s basketball team. The head coach provided the two assistant coaches with the names of 10 high school players with potential to

> The director of special events for Sun City believed that the amount of money spent on fireworks displays for the 4th of July was predictive of attendance at the Fall Festival held in October. She gathered the following data to test her suspicion. Dete

> Advertising expenses are a significant component of the cost of goods sold. Listed below is a frequency distribution showing the advertising expenditures for 60 manufacturing companies located in the Southwest. The mean expense is $52.0 million and the s

> The Conch Café, located in Gulf Shores, Alabama, features casual lunches with a great view of the Gulf of Mexico. To accommodate the increase in business during the summer vacation season, Fuzzy Conch, the owner, hires a large number of serv

> Many regions in North and South Carolina and Georgia have experienced rapid population growth over the last 10 years. It is expected that the growth will continue over the next 10 years. This has motivated many of the large grocery store chains to build

> Rutter Nursery Company packages its pine bark mulch in 50-pound bags. From a long history, the production department reports that the distribution of the bag weights follows the normal distribution and the standard deviation of the packaging process is 3

> A market researcher is studying on-line subscription services. She is particularly interested in what variables relate to the number of subscriptions for a particular on-line service. She is able to obtain the following sample information on 25 on-line s

> A recent national survey found that parents read an average (mean) of 10 books per month to their children under five years old. The population standard deviation is 5. The distribution of books read per month follows the normal distribution. A random sa

> In recent times, with mortgage rates at low levels, financial institutions have had to provide more customer convenience. One of the innovations offered by Coastal National Bank and Trust is online mortgage applications. Listed below are the times, in mi

> A regional planner is studying the demographics of nine counties in the eastern region of an Atlantic seaboard state. She has gathered the following data: a. Is there a linear relationship between the median income and median age? b. Which variable is

> A sample of 64 observations is selected from a normal population. The sample mean is 215, and the population standard deviation is 15. Conduct the following test of hypothesis using the .025 significance level. H0: μ ≥ 220 H1: μ < 220 (a) Is this a one-

> Mike Wilde is president of the teachers’ union for Otsego School District. In preparing for upcoming negotiations, he is investigating the salary structure of classroom teachers in the district. He believes there are three factors that

> Hugger Polls contends that an agent conducts a mean of 53 in-depth home surveys every week. A streamlined survey form has been introduced, and Hugger wants to evaluate its effectiveness. The number of in-depth surveys conducted during a week by a random

> Nine observations were randomly selected from population A and eight observations were randomly selected from population B. The populations are not normally distributed. Use the .05 significance level, a two-tailed test, and the Wilcoxon rank-sum test to

> Suppose that the sales manager of a large automotive parts distributor wants to estimate the total annual sales for each of the company’s regions. Five factors appear to be related to regional sales: the number of retail outlets in the

> Toyota USA is studying the effect of regular versus high-octane gasoline on the fuel economy of its new high-performance, 3.5-liter, V6 engine. Ten executives are selected and asked to maintain records on the number of miles traveled per gallon of gas. T

> In a multiple regression analysis, k = 5 and n = 20, the MSE value is 5.10, and SS total is 519.68. At the .05 significance level, can we conclude that any of the regression coefficients are not equal to 0?

> Assembly workers at Coastal Computers Inc. assemble just one or two subassemblies and insert them in a frame. The executives at CC think that the employees would have more pride in their work if they assembled all of the subassemblies and tested the comp

> The research department at the home office of New Hampshire Insurance conducts on-going research on the causes of automobile accidents, the characteristics of the drivers, and so on. A random sample of 400 policies written on single persons revealed 120

> GfK Research North America conducted identical surveys 5 years apart. One question asked of women was “Are most men basically kind, gentle, and thoughtful?” The earlier survey revealed that, of the 3,000 women surveyed, 2,010 said that they were. The lat

> A real estate developer wishes to study the relationship between the size of home a client will purchase (in square feet) and other variables. Possible independent variables include the family income, family size, whether there is a senior adult parent l

> Out of 110 diesel engines tested, a rework and repair facility found 9 had leaky water pumps, 15 had faulty cylinders, 4 had ignition problems, 52 had oil leaks, and 30 had cracked blocks. Draw a Pareto chart to identify the key problem in the engines.

> Upon arrival at the international airport in the country of Canteberry, Charles Alt exchanged $200 of U.S. currency into 1,000 florins, the local currency unit. Upon departure from Canteberry’s international airport on completion of his

> On November 1, 20X6, Smith Imports Inc. contracted to purchase teacups from England for £30,000. The teacups were to be delivered on January 30, 20X7, with payment due on March 1, 20X7. On November 1, 20X6, Smith entered into a 120-day forwa

> Jerber Electronics Inc. sold electrical equipment to a Dutch company for 50,000 guilders (G) on May 14, with collection due in 60 days. On the same day, Jerber entered into a 60-day forward contract to sell 50,000 guilders at a forward rate of G1Â&

> Choose the correct answer for each of the following questions. 1. On November 15, 20X3, Chow Inc., a U.S. company, ordered merchandise FOB shipping point from a German company for €200,000. The merchandise was shipped and invoi

> Alman Company sold pharmaceuticals to a Swedish company for 200,000 kronor (SKr) on April 20, with settlement to be in 60 days. On the same date, Alman entered into a 60-day forward contract to sell 200,000 SKr at a forward rate of 1Â SKr&Acir

> Marko Company sold spray paint equipment to Spain for 5,000,000 pesetas (P) on October 1, with payment due in six months. The exchange rates were Required: Did the dollar strengthen or weaken relative to the peseta during the period from October 1 to

> Select the correct answer for each of the following questions. Dale Inc., a U.S. company, bought machine parts from a German company on March 1, 20X1, for €30,000, when the spot rate for euros was $0.4895. Dale’s

> Pumped Up Company purchased equipment from Switzerland for 140,000 francs on December 16, 20X7, with payment due on February 14, 20X8. On December 16, 20X7, Pumped Up also acquired a 60-day forward contract to purchase francs at a forward rate of SFr 1&A

> Select the correct answer for each of the following questions. 1. The following information applies to Denton Inc.’s sale of 10,000 foreign currency units under a forward contract dated November 1, 20X5, for delivery on January

> Suppose the direct foreign exchange rates in U.S. dollars are 1 British pound = $1.60 1 Canadian dollar = $0.74 Required: What are the indirect exchange rates for the British pound and the Canadian dollar? B How many pounds must

> Nick Andros of Streamline Company suggested that the company speculate in foreign currency as a partial hedge against its operations in the cattle market, which fluctuates like a commodity market. On October 1, 20X1, Streamline bought a 180-day forward c

> On December 1, 20X1, Sycamore Company acquired a 90-day speculative forward contract to sell €120,000 at a forward rate of €1 = $0.58. The rates are as follows: Required: a. Prepare a schedul

> Eagle Corporation holds 80 percent of Standard Company’s common shares. The companies report the following balance sheet data for December 31, 20X1: An 8 percent annual dividend is paid on the Eagle preferred stock and a 12 percent di

> Crystal Corporation owns 60 percent of Evans Company’s common shares. Balance sheet data for the companies on December 31, 20X2, are as follows: The bonds of Crystal Corporation and Evans Company pay annual interest of 8 percent and

> Amber Corporation holds 70 percent of Newtop Company’s voting common shares but none of its preferred shares. Summary balance sheets for the companies on December 31, 20X1, are as follows: Neither of the preferred issues is convertible

> Winter Corporation owns 80 percent of Ray Guard Corporation’s stock and 90 percent of Block Company’s stock. The companies file a consolidated tax return each year and in 20X5 paid a total tax of $80,000. Each company

> Springdale Corporation holds 75 percent of the voting shares of Holiday Services Company. During 20X7, Springdale sold inventory costing $60,000 to Holiday Services for $90,000, and Holiday Services resold one-third of the inventory in 20X7. The remainin

> Springdale Corporation holds 75 percent of the voting shares of Holiday Services Company. Assume Springdale accounts for this investment using the equity method. During 20X7, Springdale sold inventory costing $60,000 to Holiday Services for $90,000, and

> Power Corporation acquired 100 percent of Light Corporation in a nontaxable transaction. The following selected information is available for Light Corporation at the acquisition date: Light Corporation has never recorded an allowance for doubtful accou

> Highbeam Corporation paid $319,500 to acquire 90 percent ownership of Copper Company on April 1, 20X2. At that date, the fair value of the noncontrolling interest was $35,500. On January 1, 20X2, Copper reported these stockholders’ equi

> Yarn Manufacturing Corporation issued stock with a par value of $67,000 and a market value of $503,500 to acquire 95 percent of Spencer Corporation’s common stock on August 30, 20X1. At that date, the fair value of the noncontrolling in

> Using the data presented in E10-5, prepare a statement of cash flows for Consolidated Enterprises Inc. using the direct method of computing cash flows from operating activities. Data from E10-5: The accountant for Consolidated Enterprises Inc. has

> The accountant for Consolidated Enterprises Inc. has just finished preparing a consolidated balance sheet, income statement, and statement of changes in retained earnings for 20X3. The accountant has asked for assistance in preparing a statement of cash

> Merchant Company had the following foreign currency transactions: On November 1, 20X6, Merchant sold goods to a company located in Munich, Germany. The receivable was to be settled in European euros on February 1, 20X7, with the receipt of &ac

> The Hi-Stakes Company has a number of importing and exporting transactions. Importing activities result in payables and exporting activities result in receivables. (LCU represents the local currency unit of the foreign entity.) Required: If the d

> Becon Corporation’s controller has just finished preparing a consolidated balance sheet, income statement, and statement of changes in retained earnings for the year ended December 31, 20X4. Becon owns 60 percent of Handy Corporation’s stock, which it ac

> In its consolidated cash flow statement for the year ended December 31, 20X2, Lamb Corporation reported operating cash inflows of $284,000, financing cash outflows of $230,000, $80,000 for investing cash outflows, and an ending cash balance of $57,000. L

> Mardi Gras Corporation operates a group of specialty shops throughout the southeastern United States. The shops have traditionally stocked and sold kitchen and bath products manufactured in the United States. This year, Mardi Gras established a business

> Search online to obtain and or prepare charts of the monthly average direct exchange rates for the past two years for the U.S. dollar versus (1) the Japanese yen, (2) the European euro, (3) the British pound, and (4) the Mexican peso. Your four charts sh

> On November 30, 20X5, Bow Company received goods with a cost denominated in pounds. During December 20X5, the dollar’s value declined relative to the pound. Bow believes that the original exchange rate will be restored by the time payment is due in 20X6.

> Since the early 1970s, the U.S. dollar has both increased and decreased in value against other currencies such as the Japanese yen, the Swiss franc, and the British pound. The value of the U.S. dollar, as well as the value of currencies of other countrie

> Rainy Day Insurance Company maintains an extensive portfolio of bond investments classified as available-for-sale securities under ASC 320. The bond investments have a variety of fixed interest rates and have maturity dates ranging from 1 to 15 years. R

> Avanti Corporation is a small Midwestern company that manufactures wooden furniture. Tim Martin, Avanti’s president, has decided to expand operations significantly and has entered into a contract with a German company to purchase specialty equipment for

> The consolidated cash flows from operations of Jones Corporation and its subsidiary Short Manufacturing for 20X2 decreased quite substantially from 20X1 despite the fact that consolidated net income increased slightly in 20X2. Required: What

> Johnson Corporation purchased 100 percent ownership of Freelance Company at book value on March 3, 20X2. Johnson, which makes frequent inventory purchases from Freelance, uses the equity method in accounting for its investment in Freelance. Both companie

> Cowl Company, a public company, has been reporting losses for the last three years and has been unable to pay its bills from cash generated from its operations. On December 31, 20X4, Cowl’s president instructed its treasurer to transfer a large amount of

> Mighty Corporation holds 80 percent of Longfellow Company’s common stock. The following balance sheet data are presented for December 31, 20X7: Longfellow reported net income of $115,000 in 20X7 and paid dividends o

> Branch Manufacturing Corporation owns 80 percent of the common shares of Short Retail Stores. The companies’ balance sheets as of December 31, 20X4, were as follows: Short Retail’s 8 percent preferred stock is conver

> Hardtack Bread Company holds 70 percent of the common shares of Custom Pizza Corporation. Trial balances for the two companies on December 31, 20X7, are as follows: At the beginning of 20X7, Hardtack held inventory purchased from Custom Pizza contai

> Broom Manufacturing used cash to acquire 75 percent of the voting stock of Satellite Industries on January 1, 20X3, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Satellite’s book value. B

> Acme Powder Corporation acquired 70 percent of Brown Company’s stock on December 31, 20X7, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 30 percent of Brown Company’

> Peace Corporation acquired 100 percent of Harmony Inc. in a nontaxable transaction on December 31, 20X1. The following balance sheet information is available immediately following the transaction: Additional Information: The current and future effectiv

> Famous Products Corporation acquired 90 percent ownership of Sanford Company on October 20, 20X2, through an exchange of voting shares. Famous Products issued 8,000 shares of its $10 par stock to acquire 27,000 shares of Sanford’s $5 pa

> Blase Company operates on a calendar-year basis, reporting its results of operations quarterly. For the first quarter of 20X1, Blase reported sales of $240,000 and operating expenses of $180,000 and paid dividends of $10,000. On April 1, 20X1, Mega Theat

> Detecto Corporation purchased 60 percent of Strand Company’s outstanding shares on January 1, 20X1, for $24,000 more than book value. At that date, the fair value of the noncontrolling interest was $16,000 more than 40 percent of Strand

> Following are the consolidated balance sheet accounts of Brimer Inc. and its subsidiary, Dore Corporation, as of December 31, 20X6 and 20X5. Additional Information: On January 20, 20X6, Brimer issued 10,000 shares of its common stock for land having a

> Using the data presented in P10-22, prepare a worksheet to develop a consolidated statement of cash flows using the direct method for computing cash flows from operations. Data from P10-22: Sun Corporation was created on January 1, 20X2, and quickly

> Sun Corporation was created on January 1, 20X2, and quickly became successful. On January 1, 20X6, its owner sold 80 percent of the stock to Weatherbee Company at underlying book value. At the date of that sale, the fair value of the remaining shares was

> Using the data presented in P10-20: Prepare a worksheet to develop a consolidated statement of cash flows for 20X4 using the direct method of computing cash flows from operations. Prepare a consolidated statement of cash flows for 20X4.

> Using the data presented in P10-18: Prepare a worksheet to develop a consolidated statement of cash flows for 20X3 using the direct method of computing cash flows from operations. Prepare a consolidated statement of cash flows for 20X3. Da

> Metal Corporation acquired 75 percent ownership of Ocean Company on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of the book value of Ocean Company. Consolidated balance sh

> Car Corporation owns 70 percent of the voting common stock of Bus Company. At December 31, 20X1, the companies reported the following: During 20X1, Bus sold inventory costing $70,000 to Car for $100,000, and Car resold 40 percent of the inventory prior

> What are some ways a U.S. company can manage the risk of changes in the exchange rates for foreign currencies?

> Sun Company, a U.S. corporation, has an account payable of $200,000 denominated in Canadian dollars. If the direct exchange rate increases, will Sun experience a foreign currency transaction gain or loss on this payable?

> How are assets and liabilities denominated in a foreign currency measured on the transaction date? On the balance sheet date?

> What is the direct exchange rate if a U.S. company receives $1.3623 in Canadian currency in exchange for $1.00 in U.S. currency?

> What effect does the presence of a noncontrolling interest have on the computation of consolidated EPS?

> How are rights, warrants, and options of subsidiary companies treated in the computation of consolidated EPS?

> When a subsidiary’s convertible bond is treated as common stock in computing the subsidiary’s diluted EPS, how is the interest on the bond treated in computing diluted consolidated EPS

> What factors may cause a subsidiary’s income contribution to consolidated EPS to be different from its contribution to consolidated net income?

> Why is it not possible simply to add the separately computed EPS amounts of individual affiliates in deriving consolidated EPS?

> A forward exchange contract may be used (a) to manage an exposed foreign currency position, (b) to hedge an identifiable foreign currency commitment, (c) to hedge a forecasted foreign currency transaction, or (d) to speculate in foreign currency ma

> How do interperiod income tax allocation procedures affect consolidation entries in the period in which intercompany profits unrealized as of the beginning of the period are realized?

> How do interperiod income tax allocation procedures affect consolidation entries in the period in which unrealized intercompany profits arise?

> How do unrealized profits on intercompany transfers affect the amount reported as income tax expense in the consolidated financial statements?

> Why do companies that file consolidated tax returns often choose to allocate tax expense to the individual affiliates?

> Explain why a difference usually exists between a currency’s spot rate and forward rate. Give two reasons this difference is usually positive when a company enters into a contract to receive foreign currency at a future date.

> What factors would cause an acquirer to include deferred tax assets and liabilities in the net identifiable assets acquired?

> How do the consolidation entries at the end of the year change when an acquisition occurs at midyear rather than at the beginning of the year?

> How are dividends declared by an acquired company prior to the date of a midyear acquisition treated in the consolidated financial statements?

> Explain the difference between indirect and direct exchange rates.

> How is an increase in inventory included in the amounts reported as cash flows from operating activities under (a) the indirect method and (b) the direct method?