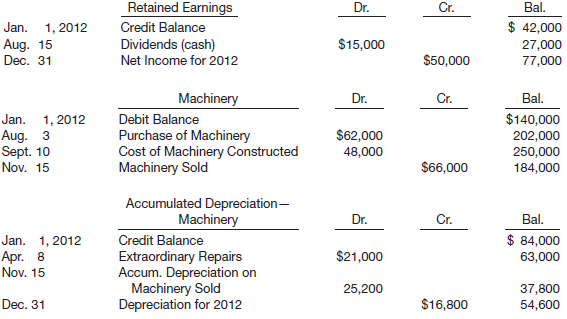

Question: The following accounts appear in the ledger

The following accounts appear in the ledger of Popovich Company

Instructions

From the postings in the accounts above, indicate how the information is reported on a statement of cash flows by preparing a partial statement of cash flows using the indirect method. The loss on sale of equipment (November 15) was $5,800.

Transcribed Image Text:

Retained Earnings Dr. Cr. Bal. $ 42,000 27,000 77,000 Jan. 1, 2012 Credit Balance Aug. 15 Dec. 31 $15,000 Dividends (cash) Net Income for 2012 $50,000 Machinery Cr. Bal. Dr. 1, 2012 Aug. 3 Sept. 10 Nov. 15 Debit Balance Purchase of Machinery Cost of Machinery Constructed Machinery Sold Jan. $140,000 $62,000 202,000 250,000 184,000 48,000 $66,000 Accumulated Depreciation- Machinery Dr. Cr. Bal. $ 84,000 63,000 Jan. 1, 2012 Credit Balance Apr. 8 Nov. 15 $21,000 Extraordinary Repairs Accum. Depreciation on Machinery Sold Depreciation for 2012 25,200 37,800 54,600 Dec. 31 $16,800

> How are operating expenses (not included in cost of goods sold) handled under the installment-sales method of accounting? What is the justification for such treatment?

> Hayes Co. reported the following pretax financial income (loss) for the years 2011–2015. 2011 …………………………. $240,000 2012 …………………………… 350,000 2013 ……………………………… 90,000 2014 …………………………. (550,000) 2015 ……………………………. 180,000 Pretax financial income (loss) and

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) What are the amounts of Coca-Cola’s and PepsiCo’s provision for income taxes for the year 2009? Of

> A headline in the Wall Street Journal stated, “Firms Increasingly Tap Their Pension Funds to Use Excess Assets.” What is the accounting issue related to the use of these “excess assets” by companies?

> In calculating inventory turnover, why is cost of goods sold used as the numerator? As the inventory turnover increases, what increasing risk does the business assume?

> Describe the installment-sales method of accounting.

> On January 1, 2012, Wetzel Company sold property for $250,000. The note will be collected as follows: $120,000 in 2012, $90,000 in 2013, and $40,000 in 2014. The property had cost Wetzel $150,000 when it was purchased in 2010. Instructions (a) Compute t

> The accounting staff of Holder Inc. has prepared the postretirement benefit worksheet on page 1262. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the

> Nielson Inc. reports the following pretax income (loss) for both book and tax purposes. (Assume the carryback provision is used where possible for a net operating loss.) The tax rates listed were all enacted by the beginning of 2011. Instructions (a)

> Distinguish between ratio analysis and percentage analysis relative to the interpretation of financial statements. What is the value of these two types of analyses?

> Determine the meaning of the following terms. (a) Contributory plan. (b) Vested benefits. (c) Retroactive benefits. (d) Years-of-service method.

> What is the nature of an installment sale? How do installment sales differ from ordinary credit sales?

> Sondgeroth Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. (Assume the carryback provision is used for a net operating loss.) The tax rates listed were all enacted by the beginning of 2011. Instr

> Gamble Corp. was a 30% owner of Sabrina Company, holding 210,000 shares of Sabrina’s common stock on December 31, 2012. The investment account had the following entries. On January 2, 2013, Gamble sold 126,000 shares of Sabrina for $3

> Using the information in E20-22, prepare a worksheet inserting January 1, 2012, balances, showing December 31, 2012, balances, and the journal entry recording postretirement benefit expense. In E20-22 Englehart Co. provides the following information abo

> A close friend of yours, who is a history major and who has not had any college courses or any experience in business, is receiving the financial statements from companies in which he has minor investments (acquired for him by his now-deceased father). H

> Describe the reporting of pension plans for a company with multiple plans, some of which are underfunded and some of which are overfunded.

> Boey Company reported net income of $25,000 in 2013. It had the following amounts related to its pension plan in 2013: Actuarial liability gain $10,000; Unexpected asset loss $14,000; Accumulated other comprehensive income (G/L) (beginning balance), zero

> The differences between the book basis and tax basis of the assets and liabilities of Morgan Corporation at the end of 2012 are presented below. It is estimated that the litigation liability will be settled in 2013. The difference in accounts receivabl

> On January 1, 2012, Sandburg Co. purchased 25,000 shares (a 10% interest) in Yevette Corp. for $1,400,000. At the time, the book value and the fair value of Yevette’s net identifiable assets were $13,000,000. On July 1, 2013, Sandburg p

> What is the deposit method and when might it be applied?

> “The significance of financial statement data is not in the amount alone.” Discuss the meaning of this statement.

> Equipment was purchased on January 2, 2012, for $24,000, but no portion of the cost has been charged to depreciation. The corporation wishes to use the straight-line method for these assets, which have been estimated to have a life of 10 years and no sal

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) (1) Whatspecifi c items does Coca-Cola discuss in its Note 1—Accounting Policies? (Prepare a list

> Basler Corporation, which began business on January 1, 2012, appropriately uses the installment-sales method of accounting. The following data were obtained for the years 2012 and 2013. Instructions (a) Compute the balance in the deferred gross profit

> When the records of Archibald Corporation were reviewed at the close of 2013, the errors listed below were discovered. For each item, indicate by a check mark in the appropriate column whether the error resulted in an overstatement, an understatement, or

> Flynn Inc. has two temporary differences at the end of 2012. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Flynn’s accounting department has developed a schedule of

> Below is the comparative balance sheet for Lowenstein Corporation. Dividends in the amount of $10,000 were declared and paid in 2012. Instructions From this information, prepare a worksheet for a statement of cash flows. Make reasonable assumptions as

> Why is it desirable to use a worksheet when preparing a statement of cash flows? Is a worksheet required to prepare a statement of cash flows?

> What is the nature of a “sale-leaseback” transaction?

> Macinski Inc., in its first year of operations, has the following differences between the book basis and tax basis of its assets and liabilities at the end of 2012. It is estimated that the warranty liability will be settled in 2013. The difference in

> The before-tax income for Fitzgerald Co. for 2012 was $101,000 and $77,400 for 2013. However, the accountant noted that the following errors had been made. 1. Sales for 2012 included amounts of $38,200 which had been received in cash during 2012, but for

> Using the information in E20-19, prepare a worksheet inserting January 1, 2012, balances, and showing December 31, 2012, balances. Prepare the journal entry recording postretirement benefit expense. In E20-19 Kreter Co. provides the following informatio

> The transactions below took place during the year 2012. 1. Convertible bonds payable with a par value of $300,000 were exchanged for unissued common stock with a par value of $300,000. The market price of both types of securities was par. 2. The net inco

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) What method of computing net cash provided by operating activities does Coca-Cola use? What method

> Access the glossary (“Master Glossary”) to answer the following. (a) What is a change in accounting estimate? (b) What is a change in accounting principle? (c) What is a restatement? (d) What is the definition of “retrospective application”?

> An entry to record Purchases and related Accounts Payable of $13,000 for merchandise purchased on December 23, 2013, was recorded in January 2014. This merchandise was not included in inventory at December 31, 2013. What effect does this error have on re

> On January 2, 2012, $100,000 of 11%, 10-year bonds were issued for $97,000. The $3,000 discount was charged to Interest Expense. The bookkeeper, Mark Landis, records interest only on the interest payment dates of January 1 and July 1. What is the effect

> Shamess Co. establishes a $90 million liability at the end of 2012 for the estimated litigation settlement for manufacturing defects. All related costs will be paid and deducted on the tax return in 2013. Also, at the end of 2012, the company has $50 mil

> A partial trial balance of Dickinson Corporation is as follows on December 31, 2012. Additional adjusting data: 1. A physical count of supplies on hand on December 31, 2012, totaled $1,100. 2. Through oversight, the Salaries and Wages Payable account w

> Kreter Co. provides the following information about its postretirement benefit plan for the year 2012. Service cost ……………………………………………………………………………………..…… $ 45,000 Contribution to the plan ………………………………………………………………………….... 10,000 Actual and expected return

> Data for Popovich Company are presented in E23-18. In E23-18 The following accounts appear in the ledger of Popovich Company Instructions Prepare entries in journal form for all adjustments that should be made on a worksheet for a statement of cash fl

> During 2012, Simms Company redeemed $2,000,000 of bonds payable for $1,880,000 cash. Indicate how this transaction would be reported on a statement of cash flows, if at all.

> What controversy relates to the accounting for net operating loss carryforwards?

> Berstler Construction Company began operations in 2012. Construction activity for the first year is shown below. All contracts are with different customers, and any work remaining at December 31, 2012, is expected to be completed in 2013. Instructions

> Emerson Tool Company’s December 31 year-end financial statements contained the following errors. An insurance premium of $60,000 was prepaid in 2011 covering the years 2011, 2012, and 2013. The entire amount was charged to expense in

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo Inc. (a) Identify the changes in accounting principles reported by Coca-Cola during the 3 years covered by i

> The accounting staff of Usher Inc. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks r

> During 2012, Graham Co.’s first year of operations, the company reports pretax financial income of $250,000. Graham’s enacted tax rate is 40% for 2012 and 35% for all later years. Graham expects to have taxable income

> Stan Conner and Mark Stein were discussing the presentation format of the statement of cash flows of Bombeck Co. At the bottom of Bombeck’s statement of cash flows was a separate section entitled “Noncash investing and financing activities.” Give three e

> In January 2012, installation costs of $6,000 on new machinery were charged to Maintenance and Repairs Expense. Other costs of this machinery of $30,000 were correctly recorded and have been depreciated using the straight line method with an estimated li

> What methods are used in practice to determine the extent of progress toward completion? Identify some “input measures” and some “output measures” that might be used to determine the extent of progress.

> Yanmei Construction Company began operations January 1, 2012. During the year, Yanmei Construction entered into a contract with Lundquist Corp. to construct a manufacturing facility. At that time, Yanmei estimated that it would take 5 years to complete t

> Keeton Company sponsors a defined benefit pension plan for its 600 employees. The company’s actuary provided the following information about the plan. The average remaining service life per employee is 10.5 years. The service cost com

> Taxable income and pretax financial income would be identical for Jones Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. The tax rates in effect

> The reported net incomes for the first 2 years of Sinclair Products, Inc., were as follows: 2012, $147,000; 2013, $185,000. Early in 2014, the following errors were discovered. 1. Depreciation of equipment for 2012 was overstated $19,000. 2. Depreciation

> Go to the book’s companion website or the company websites and use information found there to answer the following questions related to UAL, Inc. and Southwest Airlines. (a) What types of leases are used by Southwest and on what assets are these leases p

> Ochoa Inc., had the following condensed balance sheet at the end of operations for 2011. During 2012, the following occurred. 1. A tract of land was purchased for $11,000. 2. Bonds payable in the amount of $20,000 were retired at par. 3. An additional

> Elliott Corp. failed to record accrued salaries for 2011, $2,000; 2012, $2,100; and 2013, $3,900. What is the amount of the overstatement or understatement of Retained Earnings at December 31, 2014?

> Differentiate between “loss carryback” and “loss carryforward.” Which can be accounted for with the greater certainty when it arises? Why?

> Sue’s Construction is in its fourth year of business. Sue performs long-term construction projects and accounts for them using the completed-contract method. Sue built an apartment building at a price of $1,100,000. The costs and billin

> Goring Dairy leases its milking equipment from King Finance Company under the following lease terms. 1. The lease term is 10 years, noncancelable, and requires equal rental payments of $30,300 due at the beginning of each year starting January 1, 2012. 2

> Sharrer Inc.’s only temporary difference at the beginning and end of 2012 is caused by a $2 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current ass

> You have been engaged to review the financial statements of Longfellow Corporation. In the course of your examination, you conclude that the bookkeeper hired during the current year is not doing a good job. You notice a number of irregularities as follow

> Presented below are four independent situations. (a) On December 31, 2012, Beard Inc. sold computer equipment to Barber Co. and immediately leased it back for 10 years. The sales price of the equipment was $560,000, its carrying amount is $400,000, and i

> The actuary for the pension plan of Gustafson Inc. calculated the following net gains and losses. Incurred during the Year ______(Gain) or Loss 2012 ……………

> The balance sheet data of Wyeth Company at the end of 2012 and 2011 are shown on page 1488. Land was acquired for $30,000 in exchange for common stock, par $30,000, during the year; all equipment purchased was for cash. Equipment costing $13,000 was so

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) What kind of pension plans do Coca-Cola and PepsiCo provide their employees? (b) What net periodic

> What are interim reports? Why are balance sheets often not provided with interim data?

> Prior to 2012, Heberling Inc. excluded manufacturing overhead costs from work in process and finished goods inventory. These costs have been expensed as incurred. In 2012, the company decided to change its accounting methods for manufacturing inventories

> The net income for Letterman Company for 2012 was $320,000. During 2012, depreciation on plant assets was $124,000, amortization of patent was $40,000, and the company incurred a loss on sale of plant assets of $21,000. Compute net cash flow from operati

> You are auditing the December 31, 2012, financial statements of Hockney, Inc., manufacturer of novelties and party favors. During your inspection of the company garage, you discovered that a used automobile not listed in the equipment subsidiary ledger i

> In 2012, Gurney Construction Company agreed to construct an apartment building at a price of $1,200,000. The information relating to the costs and billings for this contract is shown below. Instructions (a) Assuming that the percentage-of-completion me

> Assume that on January 1, 2012, Elmer’s Restaurants sells a computer system to Liquidity Finance Co. for $510,000 and immediately leases the computer system back. The relevant information is as follows. 1. The computer was carried on Elmer’s books at a v

> Latoya Company provides the following selected information related to its defined benefit pension plan for 2012. Pension asset/liability (January 1) …………………………………………… $ 25,000 Cr. Accumulated benefit obligation (December 31) ….…………………………… 400,000 Actual

> Assume the same information as E19-14, except that at the end of 2012, Callaway Corp. had a valuation account related to its deferred tax asset of $40,000. In E19-14 Callaway Corp. has a deferred tax asset account with a balance of $150,000 at the end o

> The first audit of the books of Fenimore Company was made for the year ended December 31, 2012. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the beginn

> Presented below are data taken from the records of Morganstern Company. Additional information: 1. Held-to-maturity securities carried at a cost of $43,000 on December 31, 2011, were sold in 2012 for $34,000. The loss (not extraordinary) was incorrectl

> As stated in the chapter, notes to the financial statements are the means of explaining the items presented in the main body of the statements. Common note disclosures relate to such items as accounting policies, segmented information, and interim report

> Youngman Corporation has temporary differences at December 31, 2012, that result in the following deferred taxes. Deferred tax liability—current ………………….……… $38,000 Deferred tax asset—current………………………….. $(62,000) Deferred tax liability—noncurrent ………………

> The following comment appeared in the financial press: “Inadequate financial disclosure, particularly with respect to how management views the future and its role in the marketplace, has always been a stone in the shoe. After all, if you don’t know how a

> Addison Co. has one temporary difference at the beginning of 2012 of $500,000. The deferred tax liability established for this amount is $150,000, based on a tax rate of 30%. The temporary difference will provide the following taxable amounts: $100,000 i

> Saprano Company, on January 2, 2012, entered into a contract with a manufacturing company to purchase room-size air conditioners and to sell the units on an installment plan with collections over approximately 30 months with no carrying charge. For incom

> Elton Co. has the following postretirement benefit plan balances on January 1, 2012. Accumulated postretirement benefit obligation ……………â€&brvb

> On April 1, 2012, Dougherty Inc. entered into a cost-plus-fixed-fee contract to construct an electric generator for Altom Corporation. At the contract date, Dougherty estimated that it would take 2 years to complete the project at a cost of $2,000,000. T

> Below is the net income of Benchley Instrument Co., a private corporation, computed under the three inventory methods using a periodic system. Instructions (Ignore tax considerations.) (a) Assume that in 2013 Benchley decided to change from the FIFO me

> On February 20, 2012, Hooke Inc., purchased a machine for $1,200,000 for the purpose of leasing it. The machine is expected to have a 10-year life, no residual value, and will be depreciated on the straight-line basis. The machine was leased to Sage Comp

> Callaway Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2012 due to a single cumulative temporary difference of $375,000. At the end of 2013, this same temporary difference has increased to a cumulative amount of $500,000

> Data for Andrews Inc. are presented in E23-13. In E23-13 Andrews Inc., a greeting card company, had the following statements prepared as of December 31, 2012. ANDREWS INC. INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2012 Sales â€&brvb

> The financial statements of P&G are presented in Appendix 5B or can be accessed at the book’s companion website, www.wiley.com/college/kieso. Instructions Refer to P&G’s financial statements and the accompanying notes to answer the following questions.

> At December 31, 2012, Grinkov Corporation had the following account balances. Installment Accounts Receivable, 2011 ………………………. $ 65,000 Installment Accounts Receivable, 2012 …………………….….. 110,000 Deferred Gross Profit, 2011 …………………………………………… 23,400 Deferr

> Use the information for Rode Inc. given in BE19-13. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2012. In BE19-13 Rod

> Distinguish between counterbalancing and noncounterbalancing errors. Give an example of each.

> Metheny Corporation’s lease arrangements qualify as sales-type leases at the time of entering into the transactions. How should the corporation recognize revenues and costs in these situations?

> The financial statements of Marks and Spencer plc Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://corporate.marksandspencer.com/documents/publications/2010/Annual_Report_2010. Instructions Refer to

> The financial statements of Marks and Spencer plc (M&S) Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://corporate.marksandspencer.com/documents/publications/2010/Annual_Report_2010. Instructions Ref

> Hollenbeck Foods Inc. sponsors a postretirement medical and dental benefit plan for its employees. The following balances relate to this plan on January 1, 2012. Plan assets ……………………………………………………………….……………..… $200,000 Expected postretirement benefit oblig

> In 2012, Steinrotter Construction Corp. began construction work under a 3-year contract. The contract price was $1,000,000. Steinrotter uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is b

> Bryant Construction Company began operations in 2011 and changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2012. For tax purposes, the company employs the completed contra

> On January 1, 2012, a machine was purchased for $900,000 by Floyd Co. The machine is expected to have an 8-year life with no salvage value. It is to be depreciated on a straight-line basis. The machine was leased to Crampton Inc. on January 1, 2012, at a