Question: The following incomplete balance sheet for the

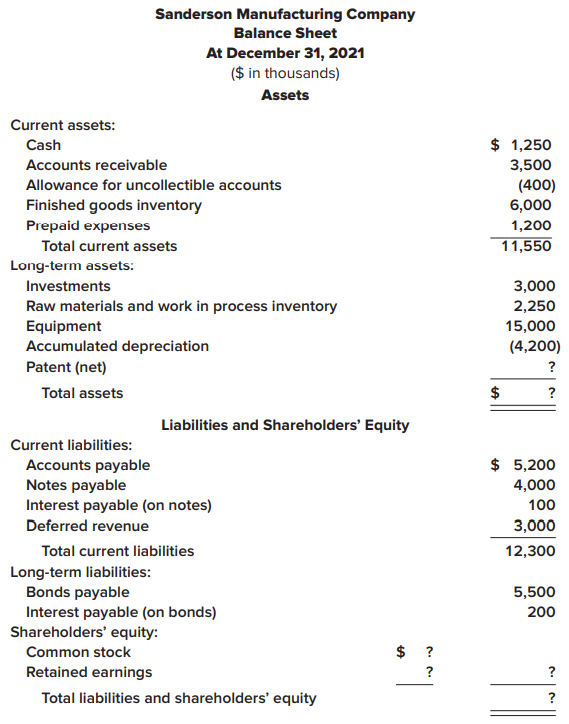

The following incomplete balance sheet for the Sanderson Manufacturing Company was prepared by the company’s controller. As accounting manager for Sanderson, you are attempting to reconstruct and revise the balance sheet.

Additional Information ($ in thousands):

1. Certain records that included the account balances for the patent and shareholders’ equity items were lost. However, the controller told you that a complete, preliminary balance sheet prepared before the records were lost showed a debt-to-equity ratio of 1.2. That is, total liabilities are 120% of total shareholders’ equity.

Retained earnings at the beginning of the year was $4,000. Net income for 2021 was $1,560 and $560 in cash dividends were declared and paid to shareholders.

2. Management intends to sell the investments in the next six months.

3. Interest on both the notes and the bonds is payable annually.

4. The notes payable are due in annual installments of $1,000 each.

5. Deferred revenue will be recognized as revenue equally over the next two fiscal years.

6. The common stock represents 400,000 shares of no par stock authorized, 250,000 shares issued and outstanding.

Required:

Prepare a complete, corrected, classified balance sheet. Include headings for each classification, as well as titles for each classification’s subtotal. An example of a classified balance sheet can be found in the Concept Review Exercise at the end of Part A of this chapter.

> Cast Iron Grills, Inc., manufactures premium gas barbecue grills. The company reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. Cast Iron’s December 31, 2021, fiscal year-end inventory

> Cansela Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company began 2021 with inventory of 4,500 units of its only product. The beginning inventory balance of $64,000 consisted of th

> The following facts apply to Walken Company during December 2021: a. Walken began December with an accounts receivable balance (net of bad debts) of €25,000. b. Walken had credit sales of €85,000. c. Walken had cash collections of €30,000. d. Walken fact

> Samson Wholesale Beverage Company regularly factors its accounts receivable with the Milpitas Finance Company. On April 30, 2021, the company transferred $800,000 of accounts receivable to Milpitas. The transfer was made without recourse. Milpitas remits

> Lonergan Company occasionally uses its accounts receivable to obtain immediate cash. At the end of June 2021, the company had accounts receivable of $780,000. Lonergan needs approximately $500,000 to capitalize on a unique investment opportunity. On July

> Cypress Oil Company’s December 31, 2021, balance sheet listed $645,000 of notes receivable and $16,000 of interest receivable included in current assets. The following notes make up the notes receivable balance: Note 1: Dated 8/31/2021, principal of $300

> Avon Products, Inc., located in New York City, is one of the world’s largest producers of beauty and related products. The company’s consolidated balance sheets for the 2016 and 2015 fiscal years included the following

> Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company’s fiscal year-end. The 2020 balance sheet disclosed the following: Current

> Refer to the situation described in BE 11–14. Assume that instead of changing the useful life and residual value, in 2021 the company switched to the double-declining-balance depreciation method. How should Robotics account for the change? What is deprec

> Nike, Inc., is a leading manufacturer of sports apparel, shoes, and equipment. The company’s 2017 financial statements contain the following information ($ in millions): A note disclosed that the allowance for uncollectible accounts had

> EMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report, the balance sheet included the following information ($ in millions): In addition, the income statement reported sales revenue of $24,704 ($ in millio

> Rothschild Chair Company, Inc., was indebted to First Lincoln Bank under a $20 million, 10% unsecured note. The note was signed January 1, 2011, and was due December 31, 2024. Annual interest was last paid on December 31, 2019. At January 1, 2021, Rothsc

> El Gato Painting Company maintains a checking account at American Bank. Bank statements are prepared at the end of each month. The November 30, 2021, reconciliation of the bank balance is as follows: The company’s general ledger checkin

> The bank statement for the checking account of Management Systems Inc. (MSI) showed a December 31, 2021, balance of $14,632.12. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks were $1,320.25. b. Th

> Chamberlain Enterprises Inc. reported the following receivables in its December 31, 2021, year-end balance sheet: Current assets: Accounts receivable, net of $24,000 in allowance for uncollectible accounts = $218,000 Interest receivable = 6,800 Notes rec

> Descriptors are provided below for six situations involving notes receivable being discounted at a bank. In each case, the maturity date of the note is December 31, 2021, and the principal and interest are due at maturity. For each, determine the proceed

> Evergreen Company sells lawn and garden products to wholesalers. The company’s fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred: Feb. 28: Sold merchandise to Lennox, Inc., for $10,000 and accepted a

> Swathmore Clothing Corporation grants its customers 30 days’ credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amount

> Tran Technologies licenses its functional intellectual property to Lyon Industries. Terms of the arrangement require Lyon to pay Tran $500,000 on April 1, 2021, when Lyon first obtains access to Tran’s intellectual property, and then in the future to pay

> At the beginning of 2019, Robotics Inc. acquired a manufacturing facility for $12 million. $9 million of the purchase price was allocated to the building. Depreciation for 2019 and 2020 was calculated using the straight-line method, a 25-year useful life

> Supply Club, Inc., sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During July 2021 it started a loyalty program through which qualifying customers can accumulate points and redeem those

> Assume the same facts as in P 6–2, except that customer must pay $75 to purchase the extended warranty if they don’t purchase it with the $50 coupon that was included in the Protab Package. Creative estimates that 40% of customers will use the $50 coupon

> Citation Builders, Inc., builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10–20 homes and are typically so

> Curtiss Construction Company, Inc., entered into a fixed-price contract with Axelrod Associates on July 1, 2021, to construct a four-story office building. At that time, Curtiss estimated that it would take between two and three years to complete the pro

> Complete the requirements of P 6–10 assuming that Westgate Construction’s contract with Santa Clara County does not qualify for revenue recognition over time. Data from P 6-10: In 2021, the Westgate Construction Compa

> In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: Westgate recognizes revenue over time accord

> Fit & Slim (F&S) is a health club that offers members various gym services. Required: 1. Assume F&S offers a deal whereby enrolling in a new membership for $700 provides a year of unlimited access to facilities and also entitles the member to receive a v

> On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest bearing note requiring five annual payments of $20,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $100,000 on Dece

> On January 1, 2021, the Montgomery Company agreed to purchase a building by making six payments. The first three are to be $25,000 each, and will be paid on December 31, 2021, 2022, and 2023. The last three are to be $40,000 each and will be paid on Dece

> Johnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. 1. On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $10,000 o

> On September 30, 2021, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2022, and the program was available for release on April 30, 2022.

> On the last day of its fiscal year ending December 31, 2021, the Sedgwick & Reams (S&R) Glass Company completed two financing arrangements. The funds provided by these initiatives will allow the company to expand its operations. 1. S&R issued 8% stated r

> Lowlife Company defaulted on a $250,000 loan that was due on December 31, 2021. The bank has agreed to allow Lowlife to repay the $250,000 by making a series of equal annual payments beginning on December 31, 2022. Required: Calculate the amount at which

> The Diversified Portfolio Corporation provides investment advice to customers. A condensed income statement for the year ended December 31, 2021, appears below: The following balance sheet information also is available: In addition, the following transac

> Duke Company’s records show the following account balances at December 31, 2021: Income tax expense has not yet been determined. The following events also occurred during 2021. All transactions are material in amount. 1. $300,000 in res

> The following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2021 ($ in thousands): sales revenue, $15,300; cost of goods sold, $6,200; selling expenses, $1,300; general

> Rembrandt Paint Company had the following income statement items for the year ended December 31, 2021 ($ in thousands): In addition, during the year, the company completed the disposal of its plastics business and incurred a loss from operations of $1.6

> Refer to the information presented in P 4–4. Prepare a revised income statement for 2021 reflecting the additional facts. Use a multiple-step format similar to Illustration 4–4 of this chapter to prepare income from co

> The preliminary 2021 income statement of Alexian Systems, Inc., is presented below: Additional Information: 1. Selling and administrative expense includes $26 million in restructuring costs. 2. Included in other income is $120 million in income from a di

> For the year ending December 31, 2021, Olivo Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should b

> The following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2021 and 2020: On October 15, 2021, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The div

> Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $6 million. Of this amount, $4 million was spent before technological feasibility was established. Excali

> Branson Electronics Company is a small, publicly traded company preparing its first quarter interim report to be mailed to shareholders. The following information for the quarter has been compiled: Fixed operating expenses include payments of $50,000 to

> Cadux Candy Company’s income statement for the year ended December 31, 2021, reported interest expense of $2 million and income tax expense of $12 million. Current assets listed in its balance sheet include cash, accounts receivable, an

> Financial statements for Askew Industries for 2021 are shown below (in thousands): Required: Calculate the following ratios for 2021. 1. Inventory turnover ratio 2. Average days in inventory 3. Receivables turnover ratio 4. Average collection period 5. A

> Presented below are the 2021 income statement and comparative balance sheets for Santana Industries. Additional information for the 2021 fiscal year ($ in thousands): 1. Cash dividends of $1,000 were declared and paid. 2. Equipment costing $4,000 was pur

> The chief accountant for Grandview Corporation provides you with the company’s 2021 statement of cash flows and income statement. The accountant has asked for your help with some missing figures in the company’s compar

> Selected information about income statement accounts for the Reed Company is presented below (the company’s fiscal year ends on December 31). On July 1, 2021, the company adopted a plan to discontinue a division that qualifies as a comp

> Presented below is the balance sheet for HHD, Inc., at December 31, 2021. The captions shown in the summarized statement above include the following: a. Current assets: cash, $150,000; accounts receivable (net), $200,000; inventory, $225,000; and prepaid

> The following balance sheet for the Hubbard Corporation was prepared by the company: Additional Information: 1. The buildings, land, and machinery are all stated at cost except for a parcel of land that the company is holding for future sale. The land or

> The following is the ending balances of accounts at December 31, 2021, for the Vosburgh Electronics Corporation. Additional Information: 1. The common stock represents 1 million shares of no-par stock authorized, 500,000 shares issued and outstanding. 2.

> Huebert Corporation and Winslow Corporation reported the following information: Calculate each companies fixed-asset turnover ratio and determine which company utilizes its fixed assets most efficiently to generate sales.

> The following is the ending balances of accounts at June 30, 2021, for Excell Company. Additional Information: 1. The short-term investments account includes $18,000 in U.S. treasury bills purchased in May. The bills mature in July, 2021. 2. The accounts

> The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing Company. Additional Information: 1. Prepaid expenses include $120,000 paid on December 31, 2021, for a two-year lease on the building that houses both th

> The following is a December 31, 2021, post-closing trial balance for Almway Corporation. Additional Information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $30,000 which management inte

> The data listed below are taken from a balance sheet of Trident Corporation at December 31, 2021. Some amounts, indicated by question marks, have been intentionally omitted. Required: 1. Determine the missing amounts. 2. Prepare Trident’

> Melody Lane Music Company was started by John Ross early in 2021. Initial capital was acquired by issuing shares of common stock to various investors and by obtaining a bank loan. The company operates a retail store that sells records, tapes, and compact

> Pastina Company sells various types of pasta to grocery chains as private label brands. The company’s reporting year-end is December 31. The unadjusted trial balance as of December 31, 2021, appears below. Information necessary to prepa

> The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31, 2020. The following transactions occurred during January 2021: Jan. 1 Sold merchandise for cash, $3,500. The cost of the merchandise was $2,000.

> Halogen Laminated Products Company began business on January 1, 2021. During January, the following transactions occurred: 1. Issued common stock in exchange for $100,000 cash. 2. Purchased inventory on account for $35,000 (the perpetual inventory system

> Using the information from P 2–8, prepare and complete a worksheet. Use the information in the worksheet to prepare an income statement and a statement of shareholders’ equity for 2021 and a balance sheet as of Decembe

> Zambrano Wholesale Corporation maintains its records on a cash basis. At the end of each year the company’s accountant obtains the necessary information to prepare accrual basis financial statements. The following cash flows occurred du

> On June 30, 2021, Kimberly Farms purchased custom-made harvesting equipment from a local producer. In payment, Kimberly signed a noninterest-bearing note requiring the payment of $60,000 in two years. The fair value of the equipment is not known, but an

> Selected balance sheet information for the Wolf Company at November 30, and December 31, 2021, is presented below. The company uses the perpetual inventory system and all sales to customers are made on credit. The following cash flow information also is

> McGuire Corporation began operations in 2021. The company purchases computer equipment from manufacturers and then sells to retail stores. During 2021, the bookkeeper used a check register to record all cash receipts and cash disbursements. No other jour

> The unadjusted trial balance as of December 31, 2021, for the Bagley Consulting Company appears below. December 31 is the company’s reporting year-end. Required: 1. Enter the account balances in T-accounts. 2. From the trial balance and

> Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2021, appears below. December 31 is the company’s reporting year-end. The company uses the perpetual inventory system. Infor

> The information necessary for preparing the December 31, 2021 year-end adjusting entries for Vito’s Pizza Parlor appears below. a. On July 1, 2021, purchased $10,000 of IBM Corporation bonds at face value. The bonds pay interest twice a year on January 1

> The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances: The following is a summary of the transactions for the year: a. Service revenue, $100,000, of which $30,000 was on account and t

> Howarth Company’s reporting year-end is December 31. Below are the unadjusted and adjusted trial balances for December 31, 2021. Required: Prepare the adjusting journal entries that were recorded at December 31, 2021.

> What is the effect on interest of an interest rate swap?

> What transactions are included in income from continuing operations? Briefly explain why it is important to segregate income from continuing operations from other transactions affecting net income.

> Hines Moving Company held a fixed-rate debt of $2 million. The company wanted to hedge its fair value exposure with an interest rate swap. However, the only notional available at the time, on the type of swap it desired, was $2.5 million. What will be th

> Maltese Laboratories incurred the following research and developments costs related to its pharmaceutical business: Internal projects (salaries, supplies, overhead for R&D facilities) = $620,000 Payment to acquire R&D from a third party related to a spec

> Should gains and losses on a fair value hedge be recorded as they occur, or should they be recorded to coincide with losses and gains on the item being hedged?

> One of the advantages of leasing rather than purchasing an asset is that leasing offers flexibility and a lower cost when disposing of the asset. Explain.

> The issuance of stock and the issuance of bonds are reported as financing activities. Are payments of dividends to shareholders and payments of interest to bondholders also reported as financing activities? Explain.

> Southeast Steel, Inc., changed from the FIFO inventory costing method to the LIFO method during 2020. How would this change likely be reported in the 2021 comparative financial statements?

> Sugarbaker Designs Inc. changed from the FIFO inventory costing method to the average cost method during 2021. Which items from the 2020 financial statements should be restated on the basis of the average cost method when reported in the 2021 comparative

> If merchandise inventory is understated at the end of 2020, and the error is not discovered, how will net income be affected in 2021?

> Describe the process of correcting an error when it’s discovered in a subsequent reporting period.

> How does IFRS differ from current U.S. GAAP with respect to accounting for Impairments?

> Answer Q12–26 but assume that the investment is classified as AFS. Data from Q12-26: When market rates of interest rise after a fixed-rate security is purchased, the value of the now below-market, fixed-interest payments decline, so the market value of

> Suppose the Environmental Protection Agency is in the process of investigating Ozone Ruination Limited for possible environmental damage but has not proposed a penalty as of December 31, 2020, the company’s fiscal year-end. Describe the two-step process

> Garrett Corporation began operations in 2021. To maintain its accounting records, Garrett entered into a two-year agreement with Accurite Company. The agreement specifies that Garrett will pay $35,000 to Accurite immediately, and in return, Accurite will

> The EPBO for Branch Industries at the end of 2021 was determined by the actuary to be $20,000 as it relates to employee Will Lawson. Lawson was hired at the beginning of 2007. He will be fully eligible to retire with health care benefits after 15 more ye

> Northwest Carburetor Company established a fund in 2018 to accumulate money for a new plant scheduled for construction in 2021. How should this special purpose fund be reported in Northwest’s balance sheet?

> At December 31, the end of the reporting period, the analysis of a loss contingency indicates that an obligation is only reasonably possible, though its dollar amount is readily estimable. During February, before the financial statements are issued, new

> Marshall Companies, Inc., holds a note receivable from a former subsidiary. Due to financial difficulties, the former subsidiary has been unable to pay the previous year’s interest on the note. Marshall agreed to restructure the debt by both delaying and

> In late 2017 the federal tax rate for subsequent years was decreased from 35% to 21%. How would this affect an existing deferred tax liability? How would the change be reflected in net income?

> On January 1, 2021, Brandon Electronics issued $85 million of 11.5% bonds, dated January 1. The market yield for bonds of maturity issued by similar firms in terms of riskiness is 12.25%. How can Brandon sell debt paying only 11.5% in a 12.25% market?

> Superior Company owns 40% of the outstanding stock of Bernard Company. During 2021, Bernard paid a $100,000 cash dividend on its common shares. What effect did this dividend have on Superior’s 2021 financial statements?

> Describe the typical approach for recording inventory write-downs.

> It is discovered in 2021 that ending inventory in 2019 was understated. What is the effect of the understatement on the following? 2019: Cost of goods sold Net income Ending retained earnings 2020: Net purchases Cost of goods sold Net income Ending retai

> Identify any differences between U.S. GAAP and International Financial Reporting Standards in the methods allowed to value inventory

> In March 2021, Price Company began developing a new software system to be used internally for managing its inventory. The software integrates customer orders with inventory on hand to automatically place orders for additional inventory when needed. The s

> Prepare the necessary adjusting entries for Johnstone Controls at the end of its December 31, 2021, fiscal yearend for each of the following situations. No adjusting entries were recorded during the year. 1. On March 31, 2021, the company lent $50,000 to

> Deferred revenues represent liabilities recorded when cash is received from customers in advance of providing a good or service. What adjusting journal entry is required at the end of a period to recognize the amount of deferred revenues that were recogn

> Compute the required annual payment in Question 5–13. Data from Question 5-13: Assume that you borrowed $500 from a friend and promised to repay the loan in five equal annual installments beginning one year from today. Your friend wants to be reimbursed

> Briefly explain the difference between the income statement approach and the balance sheet approach to estimating bad debts.