Question: The following information comes from the 2009

The following information comes from the 2009 financial statements of McDonald’s Corporation.

Conventional franchise arrangements generally include a lease and a license and provide for payment of initial fees, as well as continuing rent and royalties to the Company based upon a percent of sales with minimum rent payments that parallel the Company’s underlying leases and escalations (on properties that are leased). Under this arrangement, franchisees are granted the right to operate a restaurant using the McDonald’s System and, in most cases, the use of a restaurant facility, generally for a period of 20 years. These franchisees pay related occupancy costs including property taxes, insurance and maintenance. Affiliates and developmental licensees operating under license agreements pay a royalty to the Company based upon a percent of sales and may pay initial fees.

The results of operations of restaurant businesses purchased and sold in transactions with franchisees were not material to the consolidated financial statements for periods prior to purchase and sale.

Revenues from franchised restaurants consisted of:

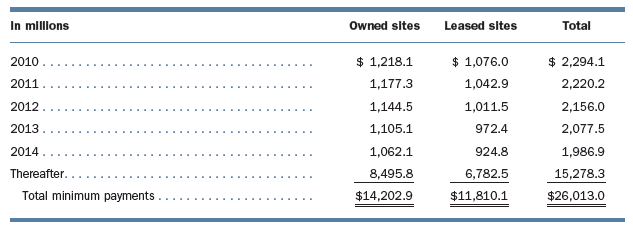

Future minimum rent payments due to the Company under existing franchise arrangements are:

This $26.0 billion amount represents the future minimum payments that McDonald’s expected to receive from its franchisees as of December 31, 2009.

1. Using the element definition from the conceptual framework, should this $26.0 billion be recorded as an asset in McDonald’s 2009 balance sheet? Why or why not?

2. If your answer in part (1) is yes, what measurement attribute should be used in reporting the asset?

Transcribed Image Text:

In millons 2009 2008 2007 Rents. $4,841.0 $4,612.8 $4,177.2 Royalties 2,379.8 2,275.7 1,941.1 Initial fees 65.4 73.0 57.3 Revenues from franchised restaurants $7,286.2 $6,961.5 $6,175.6 In millions Owned sites Leased sites Total 2010. $ 1,218.1 $ 1,076.0 $ 2,294.1 2011 1,177.3 1,042.9 2,220.2 2012 1,144.5 1,011.5 2,156.0 2013 1,105.1 972.4 2,077.5 2014. 1,062.1 924.8 1,986.9 Thereafter. 8,495.8 6,782.5 15,278.3 Total minimum payments $14,202.9 $11,810.1 $26,013.0

> Lily Company has historically reported a bad debt expense amount of between 1% and 4% of sales. The percentage for any given year is a function of both the business conditions for the year and whether recent experience suggests that the estimates in past

> Joseph Han has $10 million that he wishes to invest. He has identified two candidate companies: Company A and Company B. Both companies are privately held and have never yet released external financial statements. Joseph Han has some familiarity with the

> What is the importance of the term probable in the definition of an asset?

> Refer back to the section of the chapter entitled “Preparing Adjusting Entries.” Who determines how long buildings and furniture and equipment are to last? Who determines the dollar amount of accounts receivable that are doubtful? Suppose we were to chan

> The financial position of St. Charles Ranch is summarized in the following letter to the corporation’s accountant. Dear Dallas: The following information should be of value to you in preparing the balance sheet for St. Charles Ranch as of December 31, 20

> Some accounting students feel that the mechanics of accounting (journal entries and T-accounts) are for bookkeepers. Because these students are training to be accountants, they see no need to spend a great deal of time studying these mechanics. In one pa

> The following balance sheet was prepared by the accountant for Midway Company. Instructions: Prepare a corrected classified balance sheet using appropriate account titles. Midway Company Balance Sheet June 30, 2013 Assets Cash 2$ 44,500 Investment

> Locate the 2009 financial statements for Lockheed Martin Corporation on the Internet. Reconstruct the company’s adjusted trial balance as of December 31, 2009.

> (a) What role does the EITF play in establishing accounting standards? (b) Why can it meet this role more efficiently than the FASB?

> The accountant for Sierra Corp. prepared the following schedule of liabilities as of December 31, 2013. Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 85,000 Notes

> Julie is successful in her position as a consultant for Worldwide Enterprises. She has selectively invested her money in stocks of several companies. She receives the annual reports and faithfully analyzes them as she was taught in her university account

> Adjusted account balances and supplemental information for Brockbank Research Corp. as of December 31, 2013, are as follows: Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> The Boston Celtics are the most successful team in professional basketball history. Teams led by Bill Russell, Larry Bird, and Kevin Garnett have won a total of 17 NBA championships. The Celtics are also an unusual professional sports team because owners

> Computers have drastically altered the way accounting records are maintained. Almost all businesses now keep the bulk of their accounting records on computers. However, the financial statements are still prepared methodically on only a quarterly and annu

> Following is a list of account titles and balances for Pennington Investment Corporation as of January 31, 2013. Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 92,

> Alice Guth operates a low-impact aerobics studio. Alice has been in business for three years and has always had her financial statements prepared on a cash basis. This year, Alice’s accountant has suggested that accrual-based financial statements would g

> Denton Equipment Inc. furnishes you with the following list of accounts. Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 66,000 Accounts Receivable . . . .

> Jim Price and Elaine Bijard are taking an accounting systems course at their local university. They are intrigued with the rapid advances in technology and communication that are occurring in the computer world. Today’s lecture was especially thought pro

> The following information relates to two companies, designated Company A and Company B. One of the companies is a traditional steel manufacturer. The other is a successful Internet retailer. Using the following information, identify which is which, and e

> Explain why each of the following hypothetical events would not be recorded in a journal entry. 1. A famous and much-beloved movie star is secretly filmed by an investigative news team using your company’s product when she in fact has an endorsement cont

> Describe the nature and purpose of a work sheet.

> The following information was used to prepare the financial statements for Delta Chemical Company. Prepare the necessary notes to accompany the statements. Delta uses the LIFO inventory method on its financial statements. If the FIFO method were used, th

> Consider the following account of a veterinarian attempting to hire his first bookkeeper: Miss Harbottle, the prospective bookkeeper, paused at the desk, heaped high with incoming and outgoing bills and circulars from drug firms with here and there stray

> Research has discovered a phenomenon common to both capitalist managers in the West and socialist managers in China. What is this phenomenon?

> For each of the following items, indicate whether the item should be reflected in the 2013 financial statements for Tindall Company. If the item should be reflected, indicate whether it should be reported in the financial statements themselves or by note

> The following account balances are taken from the general ledger of Whitni Corporation on December 31, 2013, the end of its fiscal year. The corporation was organized January, 2005. Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> The following events occurred after the end of the company’s fiscal year but before the annual audit was completed. Classify each event as to its impact on the financial statements, that is, (1) Reported by changing the amounts in the financial statement

> Frank Elsholz is the new chief executive officer (CEO) of Kearl Street Company. You are the controller for Kearl Street; you have been with the company for 15 years. In connection with the preparation of this year’s financial statements (the first prepar

> Schlofman Company has the following assets. Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 20,000 Accounts receivable . . . . . . . . . . . . . . . . . . .

> Data for adjustments at December 31, 2013, are as follows: (a) Taipei International uses a perpetual inventory system. (b) An analysis of Accounts Receivable reveals that the appropriate year-end balance in Allowance for Bad Debts is $750. (c) Equipment

> The following data are from the financial statements of Riverton Company. Current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 55,000 Total assets . . . . . . . . . .

> Account balances taken from the ledger of Builders’ Supply Corporation on December 31, 2013, before adjustment, follow information relating to adjustments on December 31, 2013: (a) Allowance for Bad Debts is to be increased to a balance of $3,000. (b) Bu

> What characteristics of the standard-setting process are designed to increase the acceptability of standards established by the FASB?

> In its annual report to stockholders, Hakobe Inc. presents a condensed balance sheet with detailed data provided in supplementary schedules. 1. From the adjusted trial balance of Hakobe, prepare the following sections of the balance sheet, properly class

> Locate the 2009 financial statements for The Walt Disney Company on the Internet. 1. Compute a current ratio for Disney as of October 3, 2009. How does this current ratio compare with the prior year’s current ratio? 2. Compute Disney’s asset turnover for

> Gee Enterprises records all transactions on the cash basis. Greg Gee, company accountant, prepared the following income statement at the end of the company’s first year of operations: You have been asked to prepare an income statement

> Use the information in Practice 3-3 to compute the debt ratio. Assume that the list includes all liability and equity items. In Practice 3-3 Accrued Income Taxes Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,000 Notes Payable (

> The bookkeeper for Joe’s Hardware Co. records all revenue and expense items in nominal accounts during the period. The following balances, among others, are listed on the trial balance at the end of the fiscal period, December 31, 2013, before accounts h

> The following balance sheet was prepared for Jared Corporation as of December 31, 2013. The following additional information relates to the December 31, 2013, balance sheet. (a) Cash includes $4,000 that has been restricted to the purchase of manufactu

> The accountant for Save More Company made the following adjusting entries on December 31, 2013. Further information is provided as follows: (a) Annual rent is paid in advance every October 1. (b) Advertising materials are purchased at one time (June 1)

> From the following data, compute the working capital for Hales Shipping Co. at December 31, 2013. Cash in general checking account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 34,000 Cash in fund to be used

> On December 31, Trinkets Supply Company noted the following transactions that occurred during 2013, some or all of which might require adjustment to the books. (a) Payment of $4,300 to suppliers was made for purchases on account during the year and was n

> Accounting standards place limits on the set of allowable alternative accounting treatments, but the accountant must still exercise judgment to choose among the remaining alternatives. In making those choices, which of the following should the accountant

> Using the format provided, identify for each account, including an asterisk for contra accounts: 1. Whether the account will appear on a balance sheet (B/S), income statement (I/S), or neither (N) 2. Whether the account is an asset (A), liability (L), ow

> Payment of insurance in advance may be recorded in either (a) An expense account or (b) An asset account. Which method would you recommend? What periodic entries are required under each method?

> General Electric has long been known as a company that smoothes its reported earnings. What is it about General Electric that makes it possible for the company to smooth earnings?

> FASB Concepts Statement No. 1 states, “The primary focus of financial reporting is information about an enterprise’s performance provided by measures of earnings and its components.” Why is it unwise for users of financial statements to focus too much at

> Imagine that you have been selected to compete with students from other universities in presenting a case considering whether the FASB should be abolished and its standard setting role taken over by the SEC. Prepare a one-page summary outlining the major

> Selfish Gene Company is a merchandising firm. The following events occurred during the month of May. (Note: Selfish Gene maintains a perpetual inventory system.) May 1 Received $40,000 cash as new stockholder investment. 3 Purchased inventory costing $8,

> Spilker Aviation, Inc., failed to make year-end adjustments to record accrued salaries and recognize interest receivable on investments over the last three years as follows: What impact would the correction of these errors have on the net income for th

> Locate the 2009 financial statements for The Walt Disney Company on the Internet and consider the following questions: 1. How well did Disney do financially during the year ended October 3, 2009? 2. Comment on the level of detail in Disney’s balance shee

> An analysis of Goulding, Inc., disclosed changes in account balances for 2013 and the following supplementary data. From these data, calculate the net income or loss for 2013. Goulding sold 4,000 shares of its $5 par stock for $8 per share and received

> The existence of just four large CPA firms that service virtually all of the major industrial and financial companies and thus dominate the accounting profession has led to criticism through the years. 1. What dangers do you see from the dominance of a f

> The following balance sheet information represents actual data for 2013 and forecasted data for 2014: The actual income statement for 2013 is as follows: Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> In the 1970s, a leader in the accounting profession proposed that there really needed to be only one underlying standard to govern the establishment of generally accepted accounting principles. That standard was identified as fairness. Financial statemen

> Contrast the roles of an accountant and an auditor.

> Bohr Company has a credit agreement with a syndicate of banks. In order to impose some limitations on Bohr’s financial riskiness, the credit agreement requires Bohr to maintain a current ratio of at least 1.4 and a debt ratio of 0.55 or less. The followi

> What is the difference between a code law country and a common law country?

> Accounting has been defined as a service activity. Who is served by accounting and how do they benefit?

> Refer to Exercises 2, 4, and 6. Compute the expected value of perfect information. In Exercises 2, 4, and 6 Wilhelms Cola Company plans to market a new lime-flavored cola this summer. The decision is whether to package the cola in returnable or in

> Refer to Exercises 2 and 4. Compute the expected opportunity losses. In Exercises 2 and 4 Wilhelms Cola Company plans to market a new lime-flavored cola this summer. The decision is whether to package the cola in returnable or in nonreturnable bott

> Refer to Exercise 2, involving Wilhelms Cola Company. Develop an opportunity loss table, and determine the opportunity loss for each decision. In Exercise 2 Wilhelms Cola Company plans to market a new lime-flavored cola this summer. The decision is

> You’re about to drive to New York. If your car’s engine is out of tune, your gas cost will increase by $100. Having the engine tested will cost $20. If it’s out of tune, repairs will cost $60. Before testing, the probability is 30% th

> Wilhelms Cola Company plans to market a new lime-flavored cola this summer. The decision is whether to package the cola in returnable or in nonreturnable bottles. Currently, the state legislature is considering eliminating nonreturnable bottles. Tybo W

> Refer to Exercise 2. Reverse the probabilities; that is, let P(S1) = .30 and P(S2) = .70 and use Expected Monetary Value to evaluate the decision. Does this alter your decision? In Exercise 2 Wilhelms Cola Company plans to market a new lime-flavore

> Steele Breakfast Foods Inc. produces a popular brand of raisin bran cereal. The package indicates it contains 25.0 ounces of cereal. To ensure the product quality, the Steele inspection department makes hourly checks on the production process. As a par

> Refer to Exercise 7. In Exercise 7 A new industrial oven has just been installed at Piatt Bakery. To develop experience regarding the oven temperature, an inspector reads the temperature at four different places inside the oven each half hour start

> Samples of size 5 are selected from a manufacturing process. The mean of the sample ranges is .50. What is the estimate of the standard deviation of the population?

> Charter National Bank has a staff of loan officers located in its branch offices throughout the Southwest. Robert Kerns, vice president of consumer lending, would like some information on the typical amount of loans and the range in the amount of the l

> Determine the probability of accepting lots that are 10%, 20%, 30%, and 40% defective using a sample of size 14 and an acceptance number of 3.

> Dave Christi runs a car wash chain with outlets scattered throughout Chicago. He is concerned that some local managers are giving away free washes to their friends. He decides to collect data on the number of “voided” sales receipts. Of cou

> During the process of producing toilet paper, Scott Paper randomly selects a toilet paper roll 5 times throughout the day and subjects each roll to a stress test to see how often the paper tears. Over a 3-day period, the testing of 15 rolls found the f

> Inter-State Moving and Storage Company is setting up a control chart to monitor the proportion of residential moves that result in written complaints due to late delivery, lost items, or damaged items. A sample of 50 moves is selected for each of the l

> It appears that the imports of carbon black have been increasing by about 10% annually. a. Determine the logarithmic trend equation. b. By what percent did imports increase, on the average, during the period? c. Estimate imports for the year

> The sales by Walker’s Milk and Dairy Products in millions of dollars for the period from 2011 to 2017 are reported in the following table. Determine the least squares regression trend equation. Estimate the sales for 2019.

> Listed below are the net sales in $ million for Home Depot Inc. and its subsidiaries from 1993 to 2015. Remember to code the years starting at 1 for year 1993. Determine the least squares equation. On the basis of this information, what are th

> Early Morning Delivery Service guarantees delivery of small packages by 10:30 a.m. Of course, some of the packages are not delivered by 10:30 a.m. For a sample of 200 packages delivered each of the last 15 working days, the following numbers of package

> Reported below are the amounts spent on advertising ($ millions) by a large firm from 2007 to 2017. a. Determine the logarithmic trend equation. b. Estimate the advertising expenses for 2020. c. By what percent per year did advertising expen

> Listed below is the number of movie tickets sold at the Library Cinema-Complex, in thousands, for the period from 2004 to 2016. Compute a five-year weighted moving average using weights of .1, .1, .2, .3, and .3, respectively. Describe the trend in yie

> Refer to Exercise 10, regarding sales at Appliance Center. Use the seasonal indexes you computed to determine the deseasonalized sales. Determine the linear trend equation based on the quarterly data for the 4 years. Forecast the seasonally adjusted sa

> Team Sports Inc. sells sporting goods to high schools and colleges via a nationally distributed catalog. Management at Team Sports estimates it will sell 2,000 Wilson Model A2000 catcher’s mitts next year. The deseasonalized sales are projected t

> Appliance Center sells a variety of electronic equipment and home appliances. For the last 4 years, 2013 through 2016, the following quarterly sales (in$ millions) were reported. Determine a typical seasonal index for each of the four quarters

> Following are the quantities and prices for the years 2000 and 2017 for Kinzua Valley Geriatrics. Use 2000 as the base period. a. Determine the simple price indexes. b. Determine the simple aggregate price index for the two years. c. Determi

> Fruit prices and the amounts consumed for 2000 and 2017 are below. Use 2000 as the base. a. Determine the simple price indexes. b. Determine the simple aggregate price index for the two years. c. Determine Laspeyres price index. d. Determin

> Determine a value index for 2016 using 1990 as the base period. Use the following price information for selected items for 1990 and 2016. Production figures for those two periods are also given.

> Compute a simple aggregate price index. Use 1990 as the base period. Use the following price information for selected items for 1990 and 2016. Production figures for those two periods are also given.

> A sample of employees at a large chemical plant was asked to indicate a preference for one of three pension plans. The results are given in the following table. Does it seem that there is a relationship between the pension plan selected and the job cla

> Far West University offers both day and evening classes in business administration. A survey of students inquires how they perceive the prestige associated with eight careers. A day student was asked to rank the careers from 1 to 8, with 1 having the m

> Determine a value index for 2016 using 2000 as the base period. Use the following price information for selected foods for 2000 and 2016 given in the following table.

> A study regarding the relationship between age and the amount of pressure sales personnel feel in relation to their jobs revealed the following sample information. At the .01 significance level, is there a relationship between job pressure and age?

> Compute Paasche’s index for 2016 using 2000 as the base period. Use the following price information for selected foods for 2000 and 2016 given in the following table.

> Compute a simple aggregate price index. Use 2000 as the base period. Use the following price information for selected foods for 2000 and 2016 given in the following table.

> Determine a value index for 2016 using 2000 as the base period. Use the following information. Betts Electronics purchases three replacement parts for robotic machines used in its manufacturing process. Information on the price of the replacement part

> The following table gives information on the Consumer Price Index (Base = 1982–84) and the monthly take-home pay of Bill Martin, an employee at Ford Motor Corporation. a. What is the purchasing power of the dollar in 2016, based on the p

> Compute Paasche’s index for 2016 using 2000 as the base period. Use the following information. Betts Electronics purchases three replacement parts for robotic machines used in its manufacturing process. Information on the price of the replacemen

> Compute a simple aggregate price index for 2016. Use 2000 as the base period. Use the following information. Betts Electronics purchases three replacement parts for robotic machines used in its manufacturing process. Information on the price of the re

> Determine a value index for 2016 using 2000 as the base period. Use the following information on food items for the years 2000 and 2016.

> An insurance company, based on past experience, estimates the mean damage for a natural disaster in its area is $5,000. After introducing several plans to prevent loss, it randomly samples 200 policyholders and finds the mean amount per claim was $4,80

> A new machine has just been installed to produce printed circuit boards. One of the critical measurements is the thickness of the resistance layer. The quality control inspector randomly selects five boards each half-hour, measures the thickness, and r

> Compute Paasche’s index for 2016 using 2000 as the base period. Use the following information on food items for the years 2000 and 2016.