Question: The following information is taken from the

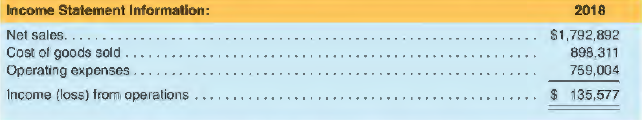

The following information is taken from the March 31, 2018 annual report of Take-Two Interactive Software, Inc., a maker and distributor of video games. All amounts are in thousands of U.S. dollars.

Information from the Management Discussion, Balance Sheet and Note 8:

Software Development Costs and Licenses

Capitalized software development costs include direct costs incurred for internally developed titles and payments made to third-party software developers under development agreements. We capitalize internal software development costs (including stock-based compensation, specifically identifiable employee payroll expense and incentive compensation costs related to the completion and release of titles), third-party production and other content costs, subsequent to establishing technological feasibility of a software title. Technological feasibility of a product includes the completion of both technical design documentation and game design documentation. Significant management judgments and estimates are utilized in the assessment of when technological feasibility is established. For products where proven technology exists, this may occur early in the development cycle. Technological feasibility is evaluated on a product by product basis. Amortization of capitalized software development costs and licenses commences when a product is released and is recorded on a title-by-title basis in cost of goods sold. For capitalized software development costs, amortization is calculated using (1) the proportion of current year revenues to the total revenues expected to be recorded over the life of the title or (2) the straight-line method over the remaining estimated useful life of the title, whichever is greater. For capitalized licenses, amortization is calculated as a ratio of (1) current period revenues to the total revenues expected to be recorded over the remaining life of the title or (2) the contractual royalty rate based on actual net product sales as defined in the licensing agreement, whichever is greater. We evaluate the future recoverability of capitalized software development costs and licenses on a quarterly basis. Recoverability is primarily assessed based on the actual title's performance. For products that are scheduled to be released in the future, recoverability is evaluated based on the expected performance of the specific products to which the cost or license relates. We utilize a number of criteria in evaluating expected product performance, including: historical performance of comparable products developed with comparable technology; market performance of comparable titles; orders for the product prior to its release; general market conditions; and, past performance of the franchise. When we determine that the value of the title is unlikely to be recovered by product sales, capitalized costs are charged to cost of goods sold in the period in which such determination is made.

Assume an income tax rate of 25% where necessary.

REQUIRED

You wish to compare the performance of Take-Two with one of its competitors, Electronic Arts, Inc. However, Electronic Arts does not capitalize any significant amounts of its software development costs. Estimate Take-Two's 2018 Income from operations if it did not capitalize any software development costs. Briefly explain your adjustment(s).

> What single payment six months from now would be economically equivalent to payments of $500 due (but not paid) four months ago and $800 due in 12 months? Assume money can earn 2.5% compounded monthly.

> What payment 2 1 4 years from now would be a fair substitute for the combination of $1500 due (but not paid) nine months ago and $2500 due in 4 1 2 years if money can earn 9% compounded quarterly?

> What amount would have to be invested today for the future value to be $10,000 after 20 years if the rate of return is: 1. 5% compounded quarterly? 2. 7% compounded quarterly? 3. 9% compounded quarterly?

> Mohinder has financial obligations of $1000 due in 3 1 2 years and $2000 due in 5 1 2 years. He wishes to settle the obligations sooner with a single payment one year from now. If money is worth 2.75% compounded semiannually, what amount should the payee

> Ramon wishes to replace payments of $900 due today and $500 due in 22 months by a single equivalent payment 18 months from now. If money is worth 5% compounded monthly, what should that payment be?

> Daniella’s gross monthly earnings are based on commission rates of 4% on the first $40,000 of sales, 5% on the next $50,000, and 6% on all additional sales for the month. What is her sales total for a month in which she earns $5350?

> What single amount, paid three years from now, would be economically equivalent to the combination of $1400 due today and $1800 due in five years if funds can be invested to earn 3% compounded quarterly?

> Mustafa can receive a $77 discount if he pays his property taxes early. Alternatively, he can pay the full amount of $2250 when payment is due in nine months. Which alternative is to his advantage if he can earn 6% compounded monthly on short-term invest

> What amount 15 months ago is equivalent to $2600 one and a half years from now? Assume money can earn 5.4% compounded monthly.

> A payment of $1300 is scheduled for a date 3 1 2 years from now. What would be an equivalent payment nine months from now if money is worth 5.5% compounded quarterly?

> What amount 1 1 2 years from now is equivalent to $7000 due in 8 years if money can earn 6.2% compounded semiannually?

> You owe $6000 payable three years from now. What alternative amount should your creditor be willing to accept today if she can earn 4.2% compounded monthly on a low-risk investment?

> Your client has a choice of either receiving $5000 two years from now or receiving a lump payment today. If your client can earn 5.4% compounded semiannually, what amount received today is equivalent to $5000 in two years?

> Ross has just been notified that the combined principal and interest on an amount that he borrowed 27 months ago at 11% compounded quarterly is now $2297.78. How much of this amount is principal and how much is interest?

> If money can be invested to earn 2.5% compounded annually, how much would have to be invested today to grow to $10,000 after: 1. 10 years? 2. 20 years? 3. 30 years?

> By calculating the maturity value of $100 invested for one year at each rate, determine which rate of return an investor would prefer. 1. 3.0% compounded monthly 2. 3.1% compounded quarterly 3. 3.2% compounded semiannually 4. 3.3% compounded annually

> Jason’s gross pay for August is $3296.97 on sales totalling $151,342. If his base salary is $1500 per month, what is his rate of commission on sales exceeding his monthly quota of $100,000?

> Rocky Mountain Bus Tours needs an additional bus for three years. It can lease a bus for $2100 payable at the beginning of each month, or it can buy a similar bus for $120,000, using financing at the rate of 7.5% compounded monthly. The bus’s resale valu

> One year ago, Jasmin and Derek opened investment accounts with a discount broker. In their C$ account, they purchased 300 Bank of Montreal (BMO) shares at C$54.20 per share and six Government of Canada bonds (GoCs) at C$1063 per bond. In their US$ accoun

> Wyland Consulting, a firm started three years ago by Reyna Wyland, offers consulting services for material handling and plant layout. Its balance sheet at the close of 2018 is as follows. Earlier in the year Wyland obtained a bank loan of $30,000 cash fo

> Explain how a reduction in operating expenses as a percentage of sales can produce a short-term gain at the cost of long-term performance.

> Seaside Surf Shop began operations on July I, 2019, with an initial investment of $50,000. During the initial 3 months of operations, the following cash transactions were recorded in the firm's checking account. Additional information 1. Most sales were

> Gross profit margin [(Sales revenue - Cost of goods sold)/Sales revenue] is an important determinant of profit margin. Identify two factors that can cause gross profit margin to decline. ls a reduction in the gross profit margin always bad news? Explain.

> From the first quarter 2018 I 0-Q of Groupon, Inc.: Groupon operates online local commerce marketplaces throughout the world that connect merchants to consumers by offering goods and services, generally at a discount. Consumers access those marketplaces

> (a) Explain how an increase in financial leverage can increase a company's ROE. (b) Given the potentially positive relation between financial leverage and ROE, why don't we see companies with 100% financial leverage (entirely nonowner financed)?

> Companies are aware that analysts focus on profitability in evaluating financial performance. Managers have historically utilized a number of methods to improve reported profitability that are cosmetic in nature and do not affect "real" operating perform

> Explain the concept of liquidity and why it is crucial to company survival.

> Increasing net operating asset turnover requires some combination of increasing sales and/or decreasing net operating assets. For the latter, many companies consider ways to reduce their investment in working capital (current assets less current liabilit

> What insights do we gain from the graphical relation between profit margin and asset turnover?

> On May 1, 2019, Ott, Inc. sold merchandise to Fox Inc. Fox signed a non-interest bearing note requiring payment of $60,000 annually for 7 years. The first payment is due May 1, 2020. The prevailing rate for similar notes on that date is 9%. What amount s

> One way to increase overall profitability is to increase gross profit. This can be accomplished by raising prices and/or by reducing manufacturing costs. REQUIRED a. Will raising prices and/or reducing manufacturing costs unambiguously increase gross pro

> Why is it important to disaggregate ROA into profit margin (PM) and asset turnover (AD?

> Jackie Hardy, CPA, has a brother, Ted. in the retail clothing business. Ted ran the business as its sole owner for IO years. During this I 0-year period. Jackie helped Ted with various accounting matters. For example, Jackie designed the accounting syste

> Explain in general terms the concept of return on investment. Why is this concept important in the analysis of financial performance?

> Paula Seale is negotiating the purchase of an extermination firm called Total Pest Control. Seale has been employed by a national pest control service and knows the technical side of the business. However, she knows little about accounting data and finan

> In determining net cash flow from operating activities using the indirect method, why must we add depreciation back to net income? Give an example of another item that is added back to net income under the indirect method.

> Data from the financial statements of JetBlue Airways and Southwest Airlines are presented below. REQUIRED a. Compute the return on equity ratio for JetBlue and Southwest for 2017. Which company earned the higher return for its shareholders? b. Compute t

> What is the difference between the direct method and the indirect method of presenting net cash flow from operating activities?

> Data from the financial statements of The Gap, Inc., and Nordstrom, Inc., are presented below. REQUIRED a. Compute the return on equity ratio for The Gap and Nordstrom for 2017. Which company earned the higher return for its shareholders? b. Compute the

> Why is a statement of cash flows a useful financial statement?

> In 2019, Cart Inc. adopted a plan to accumulate funds for environmental remediation beginning July 2, 2024 at an estimated cost of $20 million. Cart plans to make five equal annual payments into a fund earning 6% interest compounded annually. The first d

> Starbucks Corporation reported the following data in its 2018 and 2017 10-K reports. REQUIRED a. Prepare income statements for Starbucks for the years ended September 30, 2018, and October 1, 2017. Use the format illustrated in Exhibit 1.8. b. Compute St

> Why are noncash investing and financing transactions disclosed as supplemental information to a statement of cash flows?

> DowDuPont Inc. provides the following footnote disclosures in its 10-K report relating to its pension plans. REQUIRED a. How much pension expense (revenue) does Dow DuPont report in its 2018 income statement? b. Dow DuPont reports a $2,846 million expect

> Traverse Company acquired a $3,000,000 building by issuing $3,000,000 worth of bonds payable. In terms of cash flow reporting, what type of transaction is this? What special disclosure requirements apply to a transaction of this type?

> Record the effect of each of the following independent transactions using the financial statements effects template provided. Confirm that Assets = Liabilities + Equity for each transaction.

> In which of the three activity categories of a statement of cash flows would each of the following items appear? Indicate for each item whether it represents a cash inflow or a cash outflow: a. Cash purchase of equipment. b. Cash collection on loans. c.

> In the last quarter of 2014, DreamWorks Animation SKG Inc. recorded a loss. Part of this loss was due to impairment charges. In its annual report the company stated: We are required to amortize capitalized production costs over the expected revenue strea

> What are the three major types of activities classified on a statement of cash flows? Give an example of a cash inflow and a cash outflow in each classification.

> Why are cash equivalents included with cash in a statement of cash flows?

> Sandy Nguyen just graduated from college and has $40,000 in student loans. The loans bear interest at a rate of 8% and require quarterly payments. a. What amount should Sandy pay each quarter if she wishes to pay off her student loans in six years? b. Sa

> Return on a company's net operating assets is commonly used to evaluate financial performance. One way to increase performance is to focus on operating assets. REQUIRED Indicate how this might be done in relation to the following asset categories. Indica

> What separate disclosures are required for a company that reports a statement of cash flows using the indirect method?

> General Mills, Inc. is a global consumer foods company. The firm manufactures and sells a wide range of branded products and is a major supplier to the foodservice and baking industries. The company's core product areas are ready-to-eat cereal, super-pre

> Describe the accounting for a convertible bond. Would this accounting ever result in the recognition of a gain in the income statement'!

> What is a stock option vesting period? How does the vesting period affect the recognition of compensation expense for stock options?

> What items are typically reported under the stockholders' equity category of other comprehensive income (OCI)?

> What information is reported in a statement of stockholders equity'?

> Employee stock options have a potentially dilutive effect on earnings per share (EPS) that is recognized in the diluted EPS computation. What can companies do to offset these dilutive effects and how might this action affect the balance sheet?

> What is the difference between the accounting for a small stock dividend and the accounting for a large stock dividend?

> Brownlee Company borrowed money by issuing a 20-year mortgage note payable. The note will be repaid in equal monthly installments. The interest expense component of each payment decreases with each payment. Why?

> On April 30, 2019. one year before maturity. Weber Company retired $200.000 of 9% bonds payable at 101 . The book value of the bonds on April 30 was $197,600. Bon d interest was last paid on April 30 , 2019. What is the gain or loss on the retirement of

> How should premium and discount on bonds payable be presented in the balance sheet?

> A firm uses the indirect method. Using the following information, what is its net cash flow from operating activities?

> If the effective interest amortization method is used for bonds payable how does the periodic interest expense change over the life of the bonds when they are issued (a) at a discount and (b) at a premium?

> Regardless of whether premium or discount is involved. what generalization can be made about the change in the book value of bonds payable during the period in which they are outstanding?

> Identify at least two factors that limit the usefulness of ratio analysis.

> How is the operating cash flow to capital expenditures ratio calculated? Explain its use.

> How is the operating cash flow to current liabilities ratio calculated? Explain its use.

> What separate disclosures are required for a company that reports a statement of cash flows using the direct method?

> Rusk Company sold equipment for $5,100 cash that had cost $35,000 and had $29,000 of accumulated depreciation. How is this event reported in a statement of cash flows using the direct method?

> A firm reports $43,000 advertising expense in its income statement. If beginning and ending prepaid advertising are $6,000 and $7,600, respectively, what is the amount of cash paid for advertising?

> A firm reports $86,000 wages expense in its income statement. If beginning and ending wages payable are $3,900 and $2,800, respectively, what is the amount of cash paid to employees?

> A firm is converting its accrual revenues to corresponding cash amounts using the direct method. Sales on the income statement are $925,000. Beginning and ending accounts receivable on the balance sheet are $58,000 and $44,000, respectively. What is the

> Bai man Corporation commences operations at the beginning of January. It provides its services on credit and bills its customers $30,000 for January sales to be collected in February. Its employees also earn January wages of $12,000 that are not paid unt

> If a business had a net loss for the year, under what circumstances would the statement of cash flows show a positive net cash flow from operating activities?

> Dehning Corporation is an international manufacturer of films and industrial identification products. Included among its prepaid expenses is an account titled Prepaid Catalog Costs; in recent years, this account's size has ranged between $2.500.000 and $

> What is the purpose of a post-closing trial balance? Which of the following accounts should not appear in the post-closing trial balance: Cash; Unearned Revenue; Prepaid Rent; Depreciation Expense; Utilities Payable; Supplies Expense; and Retained Earnin

> What are the two major steps in the closing process?

> Which groups of accounts are closed at the end of the accounting year?

> The Bayou Company earns interest amounting to $360 per month on its investments. The company receives the interest every six months, on December 31 and June 30. Monthly financial statements are prepared. What adjusting entry should be made on January 3 I

> Globe Travel Agency pays an employee $475 in wages each Friday for the live-day workweek ending on that day. The last Friday of January falls on January 27. What adjusting entry should he made on January 31, the fiscal year-end?

> The publisher of l111ema1io11af View, a monthly magazine, received two-year subscriptions totaling $9,720 on January I. (a) What entry should be made to record the receipt of the $9,720? (b) What entry should be made at the end of January before financi

> At the beginning of January, the first month of the accounting year. the supplies account had a debit balance of $825. During January, purchases of $260 worth of supplies were debited to the account. Although only $630 of supplies were still available at

> On December 31, 2018, Miller Company had $700,000 in total assets and owed $220,000 to creditors. If this corporation's common stock totaled $300,000, what amount of retained earnings is reported on its December 3 1, 2018, balance sheet?

> Vista Company sold for $98,000 cash land originally costing $70,000. The company recorded a gain on the sale of $28,000. How is this event reported in a statement of cash flows using the indirect method?

> What are the two fundamental qualitative characteristics and the six enhancing qualitative characteristics of accounting information? Explain how each characteristic improves the quality of accounting disclosures.

> What are the objectives of financial accounting? Which of the financial statements satisfies each of these objectives?

> What is the primary function of the auditor? To what does the auditor attest in its opinion'!

> What are International Financial Reporting Standards (IFRS)? Why are IFRS needed? What potential issues can you see with requiring all public companies to prepare financial statements using IFRS?

> What are generally accepted accounting principles and what organization presently establishes them?

> Business decision makers external to the company increasingly demand more financial information on business activities of companies. Discuss the reasons why companies have traditionally opposed the efforts of regulatory agencies like the SEC to require m

> The current asset section of the 2017 and 2016 fiscal year end balance sheets of The Kroger Co. are presented in the accompanying table: In addition, Kroger provides the following footnote describing its inventory accounting policy (assume the following

> Caterpillar Inc., consists of two business units: the manufacturing company (parent corporation) and a wholly owned finance subsidiary. These two units are consolidated in Caterpillar's 2018 10-K report. Following is a supplemental disclosure that Caterp

> Columbia Company began operations in 20 19 and by year-end (December 31) had made six bond investments. Year-end information on these bond investment follows. REQUIRED a. At what total amount will the trading bond investments be reported in the December

> Vireo Manufacturing Corp. provided the following note in its annual report for the year ended January 31, 2011: On January 31, 2011, the Company elected to change its costing method for the material component of raw materials, work in process, and finish

> On January 1, 2016, Gem Company purchased for $392,000 cash a 70% stock interest in Alpine, Inc., which then had common stock of $420,000 and retained earnings of $ 140,000. Balance sheets of the two companies immediately after the acquisition were as fo

> Following is a portion of the investments footnote 8 from MetLife lnc.'s 2017 I 0-K report. Investment earnings are a crucial component of the financial performance of insurance companies such as MetLife, and investments comprise a large part of its asse

> The 2017 and 2018 statements of stockholders' equity for Alphabet Inc. are presented below along with portions on Notes LO and 12 relating to stockholders' equity and equity-based compensation. Note 10: Stockholders' Equity Convertible Preferred Stock Ou

> Following is the stockholders' equity section of the balance sheet for The Procter & Gamble Company along with selected earnings and dividend data. For simplicity, balances for non-controlling interests have been left out of income and shareholders'