Question: The following information related to accounting for

The following information related to accounting for inventory was taken from the 2019 annual report of Costco Wholesale Corporation.

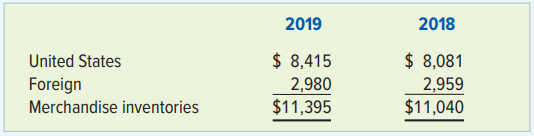

Merchandise inventories consist of the following at the end of 2019 and 2018.

Merchandise inventories are valued at the lower of cost or market, as determined primarily by the retail inventory method, and are stated using the last-in, first-out (LIFO) method for substantially all U.S. merchandise inventories. Merchandise inventories for all foreign operations are primarily valued by the retail inventory method and are stated using the first-in, first-out (FIFO) method.

Required:

Write a brief report explaining the reason(s) that best explain why Costco uses the LIFO cost flow method for its inventories in the United States, but the FIFO cost method for its other inventories.

> Visit the IT department at your school or at a local company and determine whether the systems were developed in-house or purchased. If packages were acquired, find out what customizing was done, if any. Write a brief memo describing the results.

> As more companies outsource systems development, will there be less need for in-house systems analysts? Why or why not?

> Many financial tools are developed using Microsoft Excel. Identify three applications built using Excel and describe how they are used in an organization.

> Investigate the ROI of cloud-based software development environments.

> Prepare a report on at least three tools that provide UML support. Use the tools’ capabilities for creating class diagrams and sequence diagrams as a key requirement.

> Investigate business process modeling languages, such as BPEL.

> Draw an activity diagram showing the actions and events involved in depositing a check to a bank account using a mobile app.

> Create a presentation explaining O-O analysis, including definitions of basic terms, including objects, attributes, methods, messages, and classes.

> Contact the IT staff at your school or at a local business to learn if they use O-O programming languages. If so, determine what languages and versions are used, how long they have been in use, and why they were selected.

> Explore the use of Structured English to describe processes in fields other than systems analysis.

> Create a decision table with three conditions. You can make one up or use a scenario from everyday life. Either way, be sure to show all possible outcomes.

> Draw a context diagram and a diagram 0 DFD that represents the information system at a typical library.

> Provide an example of technical obsolescence and explain how it can be a threat to an information system.

> Explore three CASE tools that provide the ability to draw the four basic DFD symbols and describe what you liked and disliked about each tool.

> The data flow symbols shown in Figure 5-1 were designed by Ed Yourdon, who was a well-known IT author, lecturer, and consultant. Many IT professionals consider him to be among the most influential men and women in the software field. Learn more about Mr.

> A desirable characteristic of a requirement is that it be both consistent and complete. Examine several requirements engineering CASE tools and document how (if at all) they support automated consistency analysis for validating and verifying requirements

> Create an FDD similar to the one in Figure 4-15 but showing your school instead of the library example.

> Design a questionnaire to learn what students think of the registration process at your school. Apply the guidelines you learned in this chapter.

> Prepare a presentation summarizing JAD and RAD. Explain how they differ from traditional fact-finding methods. What are the main advantages of team-based methods?

> Use the requirements gathering techniques of document review, observation, brainstorming, sampling, and research to capture the requirements of a typical elevator control system. Use natural language and the UML to represent the situation where people on

> Perform an Internet research to learn more about project risk management and write a summary of the results. Be sure to search for the classic book titled Waltzing with Bears: Managing Risk on Software Projects, by Tom Demarco and Timothy Lister.

> Go to the websites for project management tools (besides Microsoft Project), such as Apptivo (www.apptivo.com), Gantt Project (www.ganttproject.biz), Gantter (www.gantter.com), smart sheet (www.smartsheet.com/product-tour/gantt-charts), Monday (www.monda

> Many of today’s projects involve team members scattered across different time zones and in different physical locations. Moreover, the projects may have adopted an agile methodology, which reduces cycle time dramatically. Write a brief report that summar

> How has the proliferation of mobile devices affected IT professionals?

> One of your coworkers says, “Mission statements are nice, but they really don’t change things down here where the work gets done.” How would you reply?

> Fill in the blanks (indicated by the alphabetic letters in parentheses) in the following financial statements. Assume the company started operations January 1, Year 1, and all transactions involve cash.

> Each of the following independent events requires a year-end adjusting entry. Show how each event and its related adjusting entry affect the accounting equation. Assume a December 31 closing date. a. Paid $6,000 cash in advance on April 1 for a one-year

> On January 1, Year 1, Mason Corp. sold $100,000 of its own 6 percent, 10-year bonds. Interest is payable annually on December 31. The bonds were sold to yield an effective interest rate of 5 percent. Mason Corp. uses the effective interest rate method. T

> Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,

> The following financial statements apply to Karl Company: Required: Calculate the following ratios for Year 1 and Year 2. When data limitations prohibit computing averages, use year-end balances in your calculations. Round computations to two decimal poi

> The following selected accounts and account balances were taken from the records of Nowell Company. Except as otherwise indicated, all balances are as of December 31, Year 2, before the closing entries were recorded. Consulting revenue = $18,200 Cash = 3

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.comusing the instructions in Appendix B, and use it to answer the following questions: a. Which accounts on Target’s balance sheet

> Each of the following independent events requires a year-end adjusting entry. Show how each event and its related adjusting entry affect the accounting equation. Assume a December 31 closing date. a. Paid $4,800 cash in advance on October 1 for a one-yea

> Accounting is commonly divided into two sectors. One sector is called public accounting. The other sector is called private accounting. Required: a. Identify three areas of service provided by public accountants. b. Describe the common duties performed b

> Resource owners provide three types of resources to businesses that transform the resources into products or services that satisfy consumer demands. Required: Identify the three types of resources. Write a brief memo explaining how resource owners select

> Corrugated Boxes Inc. is a U.S.-based company that develops its financial statements under GAAP. The total amount of the company’s assets shown on its balance sheet for the current year was approximately $305 million. The president of Corrugated is consi

> Pet Partners experienced the following events during its first year of operations, Year 1: 1. Acquired cash by issuing common stock. 2. Borrowed cash from a bank. 3. Signed a contract to provide services in the future. 4. Purchased land with cash. 5. Pai

> The following note related to accounting for inventory was taken from the 2019 annual report of Costco Wholesale Corp.: Inventories Merchandise inventories are stated at the lower of cost or market. U.S. merchandise inventories are valued by the cost me

> On January 1, Year 2, Palmer, a fast-food company, had a balance in its Cash account of $32,000. During the Year 2 accounting period, the company had (1) net cash inflow from operating activities of $15,600, (2) net cash outflow for investing activities

> Lakeside, Inc. purchased land in January Year 1 at a cost of $250,000. The estimated market value of the land is $425,000 as of December 31, Year 8. Required: a. Name the December 31, Year 8, financial statement(s) on which the land will be shown. b. At

> Petre Company was started on January 1, Year 1. During Year 1, the company experienced the following accounting events: (1) Issued $25,000 in common stock, (2) earned cash revenues of $14,500, (3) paid cash expenses of $9,200, and (4) paid a $500 cash di

> The December 31, Year 1, balance sheet for James Company showed total stockholders’ equity of $200,000. Total stockholders’ equity increased by $80,000 between December 31, Year 1, and December 31, Year 2. During Year 2, James Company acquired $30,000 ca

> The following data are based on information in the 2019 annual reports of H&R Block, Inc. and Intuit, Inc. Dollar amounts are in millions. H&R Block, Inc. has subsidiaries that provide tax, investment, retail banking, accounting, and business con

> a. Identify which of the following accounts are temporary (will be closed to Retained Earnings at the end of the year) and which are permanent: (1) Service Revenue (2) Dividends (3) Common Stock (4) Notes Payable (5) Cash (6) Rent Expense (7) Accounts Re

> For each of the following T-accounts, indicate the side of the account that should be used to record an increase or decrease in the financial statement element.

> For each of the following situations, fill in the blank with FIFO, LIFO, or weighted average: a. _____ would produce the highest amount of net income in an inflationary environment. b. _____ would produce the highest amount of assets in an inflationary e

> For each of the following T-accounts, indicate the side of the account that should be used to record an increase or decrease in the account balance.

> Complete the following table by indicating whether a debit or credit is used to increase or decrease the balance of accounts belonging to each category of financial statement elements. The appropriate debit/credit terminology has been identified for the

> Holloway Company earned $18,000 of service revenue on account during Year 1. The company collected $14,000 cash from accounts receivable during Year 1. Required: Based on this information alone, determine the following for Holloway Company. a. The balanc

> On January 1, Year 2, Moore, a fast-food company, had a balance in its Cash account of $45,800. During the Year 2 accounting period, the company had (1) net cash inflow from operating activities of $24,800, (2) net cash outflow from investing activities

> Sung Company purchased land in April Year 1 at a cost of $500,000. The estimated market value of the land is $800,000 as of December 31, Year 7. Sung purchased marketable equity securities (bought the common stock of a company that is independent of Sung

> Majka Company was started on January 1, Year 1. During Year 1, the company experienced the following accounting events: (1) Issued 50,000 worth of common stock, (2) earned cash revenues of $33,700, (3) paid cash expenses of $14,900, and (4) paid a $3,200

> The following data are based on information in the 2019 annual reports of Abercrombie & Fitch, Co. and American Eagle Outfitters, Inc. Dollar amounts are in millions. Abercrombie & Fitch is a specialty retailer of apparel and accessories for men,

> The December 31, Year 1, balance sheet for Deen Company showed total stockholders’ equity of $156,000. Total stockholders’ equity increased by $65,000 between December 31, Year 1, and December 31, Year 2. During Year 2, Deen Company acquired $20,000 cash

> The financial condition of two companies is expressed in the following accounting equation. Required a. Based on this information alone, can White pay a $2,000 dividend? Why or why not? b. Reconstruct the accounting equation for each company using percen

> The trial balance of Pacilio Security Services, Inc. as of January 1, Year 4, had the following normal balances. In Year 4, Pacilio Security Services decided to expand its business to sell security systems and offer 24-hour alarm monitoring services. It

> The trial balance of Pacilio Security Services, Inc. as of January 1, Year 5, had the following normal balances. During Year 5, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 4. 2. On January 15,

> Refer to the data in ATC 13-6. Required Construct a spreadsheet to conduct vertical analysis for both years, Year 4 and Year 3. Data from ATC 13-6: Tomkung Corporation’s income statements are presented in the following spreadsheet. Req

> In 2019, Uber Technologies, Inc. reported a net loss, although it had a net profit in 2018. It reported negative cash flows from operating activities in both 2019 and 2018. Using the company’s Form 10-K for the fiscal year ended December 31, 2019, comple

> Tesla, Inc. began operations in 2003 but did not begin selling its stock to the public until June 28, 2010. It has lost money every year it has been in existence, and by December 31, 2019, it had total lifetime losses of approximately $6.1 billion. In ad

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. For the year ended February 1, 2020 (20

> Annette’s Accessories had the following stock issued and outstanding at January 1, 2019. 150,000 shares of $1 par common stock 10,000 shares of $50 par, 8%, cumulative preferred stock On March 5, 2019, Annette’s declared a $100,000 cash dividend to be pa

> There were over 38,000 McDonald’s Company restaurants in 120 countries as of December 31, 2019. Shake Shack, Inc., a much newer fast-food restaurant company, began operations as a hot dog cart in 2001. It incorporated on September 23, 2

> The following information was drawn from the annual report of Symphony Harp Builders (SHB). Required: a. Compute the percentage of growth in net income from Year 1 to Year 2. Can stockholders expect a similar increase between Year 2 and Year 3? b. Assumi

> General Motors Company (GM) is one of the world’s largest automobile manufacturing companies. The following data were taken from the company’s 2019 annual report. Required: a. Compute GM’s price-earni

> Listed here are data for five companies. These data are for the companies’ 2019 fiscal years. The market price per share is the closing price of the companies’ stock the day after they announced their 2019 earnings. Ex

> Listed here are the stockholders’ equity sections of three public companies for 2017 and 2018. Note that for General Mills these data are for the fiscal years ended on May 26, 2019 (2018) and May 27, 2018 (2017). Required: a. Divide the

> Complete requirement a of Problem 11-22A using an Excel spreadsheet. Data from Problem 11-22A: Cascade Company was started on January 1, Year 1, when it acquired $60,000 cash from the owners. During Year 2, the company earned cash revenues of $35,000 an

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What is the par value per share of Targ

> Interest rates in the United States were at historic lows for much of the period from 2013 through 2019. The economy was slowly recovering from the recession of 2008 and 2009, and the Federal Reserve kept interest rates low to encourage this recovery. Be

> FedEx Corporation provides a broad range of transportation, e-commerce and business services. The following data were taken from the company’s 2019 annual report. All dollar amounts are in millions. Required: a. Calculate the EBIT for e

> American Airlines, Inc. “. . . our airline operates an average of nearly 6,700 flights per day to nearly 350 destinations in more than 50 countries through hubs and gateways in Charlotte, Chicago, Dallas/Fort Worth, London Heathrow, Los

> Wise Company was started on January 1, Year 1, when it issued 20-year, 10 percent, $200,000 face-value bonds at a price of 90. Interest is payable annually at December 31 of each year. Wise immediately purchased land with the proceeds (cash received) fro

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was the average interest rate on T

> The following cash transactions occurred in five real-world companies. 1. During the third quarter of 2019 (July 1 through September 30), Snap, Inc. the company that produces Snapchat, borrowed $1.3 billion using notes payable. 2. In August, 2019, Occide

> The following information is available for Lumberton Co. for the week ending June 28, Year 1. All employees are paid time and one-half for all hours over 40. Each employee has a cumulative salary of over $7,000, but less than $110,000. Assume the Social

> Scott Putman owns and operates a lawn care company. Like most companies in the lawn care business, his company experiences a high level of employee turnover. However, he finds it relatively easy to replace employees because he pays above-market wages. He

> Nancy, who graduated from State University in June Year 1, has just landed her first real job. She is excited because her salary is $4,000 per month. Nancy is single and has been planning all month about how she will spend her $4,000. When she received h

> Advanced Micro Devices, Inc. (AMD) is “a global semiconductor company with facilities around the world.” AMD began operations in 1969. Texas Instruments, Inc. is the company that invented the integrated circuit over 50

> Stanley Black & Decker, Inc. (SBD) was founded in 1843. Its 2018 annual report states that “the Company is a diversified global provider of hand tools, power tools and related accessories, engineered fastening systems and products,

> In the liabilities section of its 2018 balance sheet, Bank of America reported “noninterest-bearing deposits” in U.S. offices of over $412 billion. Bank of America is a very large banking company. In the liabilities section of its 2018 balance sheet, New

> Refer to Exercise 9-17A. Complete Requirements a, b, c, and d using an Excel spreadsheet. Refer to Chapter 1, Problem ATC 1-8, for ideas on how to structure the spreadsheet. Data from Exercise 9-17A: Sheldon Jones borrowed money by issuing two notes on

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s current ratio for its

> Crist Company operates a lawn-mowing service. Crist has chosen to depreciate its equipment for financial statement purposes using the straight-line method. However, to save cash in the short run, Crist has elected to use the MACRS method for income tax r

> Electronic Arts, Inc. better known to consumers as EA Sports, is in the digital interactive entertainment business. Its products include Madden NFL and The Sims. Union Pacific Corporation is one of the largest railway networks in the nation. The followin

> Verizon Communications, Inc. is one of the world’s largest providers of communication services. The following information, taken from the company’s annual reports, is available for the years 2018, 2017, and 2016. Dolla

> The following ratios are for four companies in different industries. Some of these ratios have been discussed in the textbook, others have not, but their names explain how the ratio was computed. These data are for the companies’ 2018 f

> Short Company purchased a computer on January 1, Year 1, for $5,000. An additional $100 was paid for delivery charges. The computer was estimated to have a life of five years or 10,000 hours. Salvage value was estimated at $300. During the five years, th

> AutoZone, Inc. claims to be the nation’s leading auto parts retailer. It sells replacement auto parts directly to the consumer. BorgWarner, Inc. has over 30,000 employees and produces automobile parts, such as transmissions and cooling

> The following data were taken from The Hershey Company’s 2018 annual report. All dollar amounts are in millions. Required: a. Compute Hershey’s accounts receivable turnover ratios for 2018 and 2017. b. Compute Hershey&

> Presented here are the average days to collect accounts receivable for four companies in different industries. The data are for 2018. Required: Write a brief memorandum that provides possible answers to each of the following questions: a. Why would a com

> Anyone who has shopped at Target Corporation knows that many of its customers use a credit card to pay for their purchases. There is even a Target brand credit card. However, Target did not report any accounts receivables or credit card receivables on it

> The accounting firm of Brooke & Doggett, CPAs, recently completed the audits of three separate companies. During these audits, the following events were discovered, and Brooke & Doggett is trying to decide if each event is material. If an item is materia

> The following excerpt was taken from Alphabet, Inc.’s 10-K report for its 2019 fiscal year. Alphabet, Inc. is the parent company of Google, Inc. CONTROLS AND PROCEDURES Evaluation of Disclosure Controls and Procedures Our management, with the participati

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. Who are the independent auditors for Ta

> Domino’s Pizza, Inc. had 5,486 franchised restaurants in the United States and 85 in international markets as of December 30, 2018. Signet Jewelers Limited claims to be the world’s largest retailer of diamond jewelry.

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s net income for 2019 (

> Costco Wholesale Corporation operated 787 stores as of September 1, 2019. The following data were taken from the company’s annual report. All dollar amounts are in millions. Required: a. Compute Costco’s inventory turn

> The following data were extracted from the 2018 financial statements of Penske Automotive Group, Inc. This company operates automobile dealerships, mostly in the United States, Canada, and Western Europe, and commercial truck dealerships in Australia, Ne

> The accounting records of Blue Bird Co. showed the following balances at January 1, Year 2. Transactions for Year 2 were as follows. Required a. Organize the class into three sections, and divide each section into groups of three to five students. Assign