Question: The following information relates to Hudson City

The following information relates to Hudson City for its fiscal year ended December 31, 2017.

• During the year, retailers in the city collected $1,700,000 in sales taxes owed to the city. As of

December 31, retailers have remitted $1,100,000. $200,000 is expected in January 2018, and the remaining $400,000 is expected in April 2018.

• On December 31, 2016, the Foundation for the Arts pledged to donate $1, up to a maximum of $1 million, for each $3 that the museum is able to collect from other private contributors. The funds are to finance construction of the city-owned art museum. During 2017, the city collected $600,000 and received the matching money from the Foundation. In January and February 2018 it collected an additional $2,400,000 and also received the matching money.

• During the year the city imposed license fees on street vendors. All vendors were required to purchase the licenses by September 30, 2017. The licenses cover the one-year period from October 1, 2017, through September 30, 2018. During 2017 the city collected $240,000 in license fees.

• The city sold a fire truck for $40,000 that it had acquired five years earlier for $250,000. At the time of sale the city had charged $225,000 in depreciation.

• The city received a grant of $2 million to partially reimburse costs of training police officers. During the year the city incurred $1,500,000 of allowable costs and received $1,200,000. It expects to incur an additional $500,000 in allowable costs in January 2018 and to be reimbursed for all allowable costs by the end of February 2018.

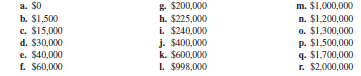

Refer to the two lists that follow. Select the appropriate amounts from the lettered list for each item in the numbered list. An amount may be selected once, more than once, or not at all.

1. Amount of sales tax revenue that the city should recognize in its funds statements

2. Amount of sales tax revenue the city should recognize as revenue in government-wide statements

3. Increase in deferred inflows in funds statements from sales tax revenues not yet received

4. Contribution revenue from Foundation for the Arts to be recognized in funds statements

5. Contribution revenue from Foundation for the Arts to be recognized in government-wide statements

6. Revenue from license fees to be recognized in funds statements

7. Increase in general fund balance owing to sale of fire engine

8. Increase in net position (government-wide statements) owing to sale of fire engine

9. Revenue in fund statements from police training grant

10. Revenue in government-wide statements from police training grant

Transcribed Image Text:

a. $0 b. $1,500 c. $15,000 d. $30,000 E $200,000 h. $225,000 i. $240,000 j. $400,000 k. $600,000 L $998,000 m. $1,000,000 n. $1,200,000 a. $1,300,000 p. $1.500,000 q. $1,700,000 r. $2,000,000 e. $40,000 f. $60,000

> Do encumbrances that remain outstanding at year‐end lapse? That is, do the amounts that will be expended in the following year, when the goods or services are received, have to be rebudgeted in the following year? How can you tell?

> The following schedule shows the amounts related to general purpose supplies that a city debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entries. The organization r

> At the start of its fiscal year on October 1, Fox County reported the following (all dollar amounts in thousands): Fund balance: Committed for encumbrances……………………………. $200 Unassigned…………………………………………………………. 400 Total fund balance……………………………………………... $600

> London Township began Year 1 with a balance of $10 million in its bridge repair fund, a capital projects fund. The fund balance is classified as restricted. At the start of the year, the governing council appropriated $6 million for the repair of two bri

> The budgeted and actual revenues and expenditures of Seaside Township for a recent year (in millions) were as presented in the schedule that follows. 1. Prepare journal entries to record the budget. 2. Prepare journal entries to record the actual revenue

> Wickliffe County authorized the issuance of bonds and contracted with the USA Construction Company (UCC) to build a new sports complex. During 2014, 2015, and 2016 the county engaged in the transactions that follow. All were recorded in a capital project

> Kilbourne County engaged in the following transactions in summary form during its fiscal year. All amounts are in millions. You need not be concerned with the category of funds balances to which reserves for encumbrances are classified on the fund balanc

> Select the best answer. 1. Upon ordering supplies a government should a. Debit encumbrances and credit reserve for encumbrances b. Debit reserve for encumbrances and credit encumbrances c. Debit expenditures and credit encumbrances d. Debit expenditures

> What are the key elements of program budgets as exemplified by a zero‐base budget decision package for an activity?

> In what way do the reporting standards of the GAO differ from those of the AICPA as to (1) public dissemination of the reports and (2) tests of compliance and internal controls?

> Select the best answer. 1. Appropriation budgets are typically concerned with a. The details of appropriated expenditures b. Long‐term revenues and expenditures c. Current operating revenues and expenditures d. Capital outlays 2. Which of the following

> The following is a recommendation from Against the Grain, a series of proposals by the State Comptroller of Texas on how the state could enhance revenues and decrease expenditures: Amend the Lottery Act to Abolish the Lottery Stabilization Fund The sta

> The following is an excerpt (with dates changed) from Against the Grain, a series of recommendations by the State Comptroller of Texas on how to “save” $4.5 billion and thereby balance the state’s budget: Require an Annual August Remittance of One-Half o

> Shown below is an excerpt from a city’s subsidiary ledger for the first two months of its fiscal year. Missing is the column that explains or references each of the entries. 1. Prepare the journal entries that were most likely made in the account, adding

> Review the budget note to the Smith City’s financial statements presented in the previous problem. Assume that the city engaged in the following transactions in 2017 and 2018: • In 2017 it signed a service contract wit

> A city’s note to its financial statements provides considerable insight into its budget practices. Shown below is an excerpt from a note, headed Budgets, from the Smith City, annual report for the fiscal year ended June 30. 1. The note

> The data presented below were taken from the books and records of the village of Denaville. All amounts are in millions. The village encumbers all outlays. As is evident from the data, some goods or services that were ordered and encumbered have not yet

> The following information was drawn from a county’s general fund budgets and accounts for a particular year (in millions): You also learn the following: • For purposes of budgeting, the county recognizes encumbrances a

> The transactions that follow relate to the Danville County Comptroller’s Department over a two‐year period. Year 1 • The county appropriated $12,000 for employee education and training. • The department signed contracts with outside consultants to cond

> A city prepares its budget in traditional format, classifying expenditures by fund and object. In 2010, amid considerable controversy, the city authorized the sale of $20 million in bonds to finance construction of a new sports and special events arena.

> In what key ways do program budgets more directly link expenditures to organizational goals than do conventional object classification budgets?

> A city’s visitors’ bureau, which promotes tourism and conventions, is funded by an 8 percent local hotel occupancy tax (a tax on the cost of a stay in a hotel). Because the visitors’ bureau is supported entirely by the occupancy tax, it is accounted for

> The following schedule shows the amounts related to supplies that a city debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entries. The city records its budget, encum

> The following schedule shows the amounts (in thousands) related to expenditures that a city welfare department debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entri

> Your government is permitted to amend the budget even after the end of the year. When presenting the final actual‐to‐budget comparisons, is it permitted to include the amendments that were adopted after the year‐end?

> In your government, appropriations for goods and services that remain encumbered at year‐end are automatically carried forward to the next year. Thus, the budget for the following year must include the amounts required to pay for the goods that were encu

> The GASB requires a government to prepare budgetary comparisons for its general fund and major special revenue funds that have a legally adopted annual budget. The city for which you work does not have a legally adopted budget prepared specifically for i

> What is the total fund balance in the general fund? Can this amount be appropriated and spent for any purpose? Explain.

> What is the government’s property tax rate?

> How are revenues from property taxes accounted for, i.e., as a single amount, or in multiple categories? Identify the various categories and indicate the percentage breakdown (e.g., residential property taxes are 50 percent of the total property tax reve

> Did the government generate revenue from traffic fines? As best you can tell, are these revenues reported in the government-wide statements as program revenues (e.g., associated with police or public safety) or as general revenues?

> Why may an organization foment conflict merely by establishing specific objectives?

> How is reserve for encumbrances reported on a year‐end balance sheet?

> By what percentage did each of the three largest sources of tax revenue increase over the last ten years?

> When are property taxes due? When do interest and penalties begin to accrue?

> At what percentage of fair market value is real property assessed?

> What are allotments? What purpose do they serve?

> Does the government’s government-wide statement of net position or governmental-fund balance sheet report “deferred revenue” (or deferred inflows of resources)? If so, what is the most likely reason this amount has been deferred?

> Does the report discuss the accounting basis for recognizing revenues?

> Which of the entity’s governmental functions or activities had the greatest amount of directly identifiable revenues?

> Why do many governments consider it unnecessary to prepare appropriation budgets for, and incorporate budgetary entries into the accounts of, their capital project funds?

> The following relate to three grants that the town of College Hills received from the state during its fiscal year ending December 31, 2018. Prepare journal entries to record the three grants. 1. A cash grant of $200,000 that must be used to repair roads

> The “object classification” budget of a fire department includes the following expense categories: • Salaries • Employee benefits • Supplies • Equipment • Station maintenance, utilities, etc. • Vehicle maintenance, gas, etc. • Dues and subscriptions Base

> In August 2018, the last month of its fiscal year, Goldwaithe Township issued $88,000 worth of tickets for parking and traffic violations. Of these, the township collected $45,000. It expects to collect an additional $20,000 within 60 days of the close o

> A state requires “large” merchants (i.e., those with sales over a specified dollar amount) to report and remit their sales taxes within 15 days of the end of each month. It requires “small” merchants to report and remit their taxes within 15 days of the

> Green Hills County received the following two contributions during a year: • A developer (in exchange for exemptions to zoning restrictions) donated several acres of land that the county intended to convert to a park. The land had cost the developer $1.7

> Preston Village engaged in the following transactions: 1. It issued $20 million in bonds to purchase a new municipal office building. The proceeds were recorded in a capital projects fund. 2. It acquired the building for $20 million. 3. It recognized, as

> Columbus City was awarded a state reimbursement grant of $150,000 to assist its adult literacy program. The following were significant events relating to the grant: • The city, which is on a calendar year, was notified of the award in November 2017. • Du

> The fiscal year of Duchess County ends on December 31. Property taxes are due March 31 of the year in which they are levied. 1. Prepare journal entries (excluding budgetary and closing entries) to record the following property tax related transactions in

> Select the best answer. 1. Under the modified accrual basis of accounting, revenues cannot be recognized a. Until cash has been collected b. Unless they will be collected within 60 days of year-end c. Until they are subject to accrual d. Until they are

> A school district is awarded a cash grant to conduct a teacher-training program. As part of the grant, the district is given, rent-free, both office space and training facilities in the building of the state education department. How, if at all, should t

> Going 70 mph in a 60-mph zone, you’ve just been caught in the infamous Goldwaithe Township speed trap. You pay your fine of $150. In the government-wide statement of activities, revenues must be associated with the specific programs (e.g., public safety)

> The city manager of Midfield summoned the city’s sanitation commissioner. He had compared the service efforts and accomplishments data for the sanitation department with those for Lowville, a nearby city of comparable size and population. Midfield fared

> The Lewiston School District receives a $200,000 grant from the Bates Foundation to upgrade its high school computer labs. Total cost of the upgrade is estimated at $450,000. Because the grant is restricted, it accounts for the grant in a special revenue

> The Hensley School District was notified by the state education department that it has been awarded a $2 million grant to implement a unique elementary school reading program. The district has met all eligibility requirements for the grant. As of the end

> You are the independent auditor of various governments. You have been asked for your advice on how the following transactions should be accounted for and reported. Characteristic of each transaction is ambiguity as to whether it is an exchange or a nonex

> A student comments: “A government destroys a recently acquired car, sells the remains for scrap, and its general fund surplus for the year increases. That’s ridiculous. Government accounting makes so much less sense than private-sector accounting.” Expla

> What are pass-through grants? Under what circumstances must a recipient government report them as both a revenue and an expenditure?

> A private citizen makes an unrestricted pledge of $5 million to a city’s museum. The city is confident that the donor will fulfill her pledge. However, the cash will not be received for at least two years. How will the amount of revenue recognized differ

> Explain the distinction between reimbursement grants and entitlements. How does this distinction affect the way each type of grant is accounted for?

> What is the earliest point in the sales tax collection process that revenue may be recognized? How can you justify recognizing revenue on the basis of this event?

> What is the earliest point in the sales tax collection process that revenue may be recognized? How can you justify recognizing revenue on the basis of this event?

> What is meant by “deferred inflow of resources?” Provide an example of when a government might credit such an account.

> The Granite Falls Detention Center is a boot camp for criminal offenders aged 18 to 25. “Campers” spend one year at the camp, during which time they take vocational courses (mainly in the construction trades), engage in vigorous physical exercise, and re

> What is the general rule for recognizing property taxes as revenues? How would property taxes be accounted for differently in the fund statements, as opposed to in the government-wide statements?

> What criteria must be met before revenues can be recognized on a modified accrual basis? What is the rationale for these criteria?

> What are the main categories of revenues per GASB Statement No. 33, Accounting and Financial Reporting for Nonexchange Transactions?

> What is the difference between an exchange and a nonexchange transaction?

> What types of other financing sources and uses does the governmental entity report in the general fund? What effect do these items have on the net change in fund balance for the year?

> Does the entity report depreciation as an expense in its government‐wide statements? If not, why not?

> Explain the nature of any governmental‐fund balance sheet classifications related to expenditures.

> To and from which funds or component units have there been general fund transfers?

> On what basis does it account for insurance or other prepaid items in its governmental funds? How can you tell?

> During its fiscal year ending June 30, 2017, the Parkville Independent School District enters into a two-year lease for office space covering the period May 1, 2017, through April 30, 2019. Annual rent is $60,000. The lease specifies that the entire rent

> The Mount Eden Medical Center is considering establishing a screening program for a virulent form of cancer. If the program were established, the center would have to acquire equipment that would cost $8.2 million. Thereafter, the center would incur oper

> Prepare general fund journal entries to record the following cash transfers that a city made from its general fund to other funds. Be sure your entry reflects the nature of the transfer. 1. $4,000,000 to provide start‐up capital to a newly established in

> Lemon County permits employees to accumulate any sick leave that they do not take. If employees do not use accumulated sick leave, then they will be paid for those days upon retirement or termination (up to a maximum of 45 days). In 2018 employees earned

> In 2018, employees of Pecos River County earned $5 million in vacation pay. They were paid for $4.2 million but deferred taking the balance of their earned vacations until subsequent years. Also, employees were paid $0.7 million for vacation earned in pr

> In a recent year Ives Township acquired six police cars at a total cost of $200,000. The vehicles are expected to have a useful life of four years. 1. Prepare the journal entries that the township would make in its general fund in the year of acquisition

> The schedule that follows reports the beginning balances and activity during the year in a town’s supplies fund (a governmental fund). The government accounts for supplies on a purchases basis (in thousands). Fund balance (unassigned), January 1………………………

> The following schedule shows the amounts related to supplies that a city debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entries. The organization records its budge

> The Boyd School District began a recent fiscal year with $3,000 of supplies in stock. During its fiscal year, it engaged in the following transactions relating to supplies: • It purchased supplies at a cost of $22,000. • It paid for $19,000 of the suppli

> A city prepares its budget on a cash basis. For each of the following indicate the amount (if any) of an expenditure/expense that the city would be recognize in (1) its budget, (2) its fund statements, and (3) its government‐wide statements. Provide a

> The Eaton School District engaged in the following transactions during its fiscal year ending August 31, 2018. • It established a purchasing department, which would be accounted for in a new internal service fund, to purchase supplies and distribute them

> Select the best answer. Assume that Nolanville’s fiscal year ends on December 31. 1. Nolanville’s payroll for one of its departments is $15,000 per week. It pays its employees on the Thursday of the week following that in which the wages and salaries ar

> A city is weighing the costs and benefits of a new convention center. The center would be accounted for in an enterprise fund. It would cost $20 million and would be funded from the proceeds of 20‐year revenue bonds. Officials estimate that the center wo

> On what basis does the government account for its inventories (purchases or consumption)? Does the City maintain a “fund balance‐nonspendable” amount for inventories?

> A state government provided several grants to school districts and local governments during its fiscal year ending August 31. 1. On August 1, 2018, it announced a $2 million grant to a local school district for the purchase of computers. The district can

> As indicated in Chapter 2, the GASB defines assets as “resources with present service capacity that the government presently controls.” It explains that present service capacity of an asset is its capability to enable the government to provide services a

> Highbridge County imposes a motor fuel tax to finance road maintenance. It therefore accounts for all road maintenance in a special revenue fund, the entire fund balance of which is legally restricted. The fund’s statement of revenues,

> The following information was abstracted from a note, headed “Interfund Transactions,” to the financial statements of Independence, Missouri. Interfund Charges for Support Services Interfund charges for support servi

> A town plans to borrow about $10 million and is considering three alternatives. A town official requests your guidance on the economic cost of each of the arrangements and advice as to how they would affect the town’s reported expenditures. 1. For each o

> The Mainor School District is about to establish a 30‐machine computer lab. It is considering six alternative means of acquiring and financing the machines: 1. Buy the machines outright; cost will be $60,000. 2. Buy the machines and finance them with a $

> A city is having fiscal problems in 2018. It expects to report a deficit in its general fund, the only fund that is statutorily required to be balanced. To eliminate the anticipated deficit, the city opts to “sell” its city hall—to itself—for $5 million.

> The following is an excerpt from a note to the financial statements of the city of Dallas (dates changed): The city prepares its annual appropriated general fund, debt service fund, and proprietary operating funds budgets on a basis (budget basis) which

> The following schedule indicates selected accounts from a city’s preclosing 2018 and postclosing 2017 general fund trial balances: All the amounts shown relate only to supplies. All purchases during the year were paid in cash. 1. Assume

> To enhance security in Riverside Park, a city is considering whether it should install a high‐tech security system. The system would not only reduce the cost of police patrols but would also deter crime. The city has received offers from two contractors

> The Allendale School District recently signed a contract with its teachers’ union. The contract provides that all teachers will receive a one‐semester sabbatical leave after seven continuous years of employment. The preamble to the contract provision str

> A city has adopted the following plan for compensated time off: • City employees are entitled to a specified number of days each year for holidays and vacation. The number depends on length of service (20 days for employees with fewer than 5 years of ser

> A city on the coast of Florida has incurred losses (including impairment of assets, clean‐up costs, additional public safety costs, etc.) of $50 million owing to a recent hurricane. This was the third time in as many years in which the city was hit by ma