Question: The following information was taken from the

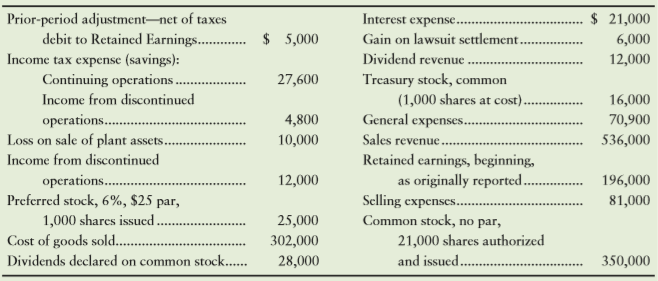

The following information was taken from the records of Daughtry Cosmetics, Inc., at December 31, 2016:

Requirements

1. Using the End-of-Chapter Summary Problem as an example, prepare Daughtry Cosmetics’ single-step income statement, which lists all revenues together and all expenses together, for the fiscal year ended December 31, 2016. Include earnings-per-share data. For purposes of earnings per share, assume dividends have been declared on preferred stock as of December 31.

2. Evaluate income for the year ended December 31, 2016. Daughtry’s top managers hoped to earn income from continuing operations equal to 7% of sales.

Transcribed Image Text:

$ 21,000 Prior-period adjustment–net of taxes debit to Retained Earnings . Interest expense.. $ 5,000 Gain on lawsuit settlement. 6,000 Income tax expense (savings): Dividend revenue 12,000 Treasury stock, common (1,000 shares at cost). General expenses. Continuing operations. 27,600 Income from discontinued 16,000 operations. Loss on sale of plant assets. 4,800 70,900 10,000 Sales revenue.. 536,000 Income from discontinued Retained earnings, beginning, as originally reported. Selling expenses.. Common stock, no par, operations.. Preferred stock, 6%, $25 par, 12,000 196,000 81,000 1,000 shares issucd. 2.5,000 Cost of goods sold. . Dividends declared on common stock... 302,000 21,000 shares authorized 28,000 and issued . 350,000

> How many items enter the computation of Sheehan’s net cash flow from financing activities for 2016? a. 2 b. 7 c. 3 d. 5 A1 Sheehan's Income Statement for 2016 1 2 Sales revenue 3 Gain on sale of equ

> The book value of equipment sold during 2016 was $20,000. Sheehan’s net cash flow from investing activities for 2016 was a. net cash used of $52,000. b. net cash used of $58,000. c. net cash used of $24,500. d. net ca

> How many items enter the computation of Sheehan’s net cash provided by operating activities? a. 2 b. 7 c. 5 d. 3 A1 Sheehan's Income Statement for 2016 1 2 Sales revenue 3 Gain on sale of equipment 4 Cost of goods sold 5 Deprecia

> A company uses the direct method to prepare the statement of cash flows. Select an activity for each of the following transactions: 1. Receiving cash dividends is a/an _____ activity. 2. Paying cash dividends is a/an _____ activity.

> On an indirect method statement of cash flows, a gain on the sale of plant assets would be a. reported in the investing activities section. b. deducted from net income in the operating activities section. c. ignored, since the gain did not generate any

> On an indirect method statement of cash flows, an increase in accounts payable would be a. reported in the financing activities section. b. added to net income in the operating activities section. c. deducted from net income in the operating activities

> On an indirect method statement of cash flows, an increase in a prepaid insurance would be a. added to increases in current assets. b. added to net income. c. deducted from net income. d. included in payments to suppliers.

> Which of the following terms appears on a statement of cash flows—indirect method? a. Depreciation expense b. Collections from customers c. Cash receipt of interest revenue d. Payments to suppliers

> Selling equipment for cash is reported on the statement of cash flows under a. operating activities. b. noncash investing and financing activities. c. investing activities. d. financing activities.

> Pinkerton Stores is authorized to issue 13,000 shares of common stock. During a two-month period, Pinkerton completed these stock-issuance transactions Requirements 1. Journalize the transactions. 2. Prepare the stockholders’ equity

> The sale of inventory for cash is reported on the statement of cash flows under a. noncash investing and financing activities. b. operating activities. c. investing activities. d. financing activities.

> Paying off bonds payable is reported on the statement of cash flows under a. investing activities. b. noncash investing and financing activities. c. financing activities. d. operating activities

> Dellanova Company’s net income and net sales are $25,000 and $1,150,000, respectively, and average total assets are $120,000. What is Dellanova’s return on assets? a. 20.8% b. 2.8% c. 9.8% d. 22.8%v

> Which of the following statements is not true about a 3-for-1 stock split? a. Par value is reduced to one-third of what it was before the split. b. Retained Earnings remains the same. c. Total stockholders’ equity increases. d. The market price of ea

> A company declares a 5% stock dividend. The debit to Retained Earnings is an amount equal to a. the market value of the shares to be issued. b. the excess of the market price over the original issue price of the shares to be issued. c. the par value of

> Which of the following is not true about a 10% stock dividend? a. Retained Earnings decreases. b. The market value of the stock is needed to record the stock dividend. c. Total stockholders’ equity remains the same. d. Par value decreases. e. Paid-i

> Assume the same facts as in Q10-66. What is the amount of dividends per share on common stock? a. $12.00 b. $6.00 c. $3.00 d. $18.00 e. None of these From Q10-66 A corporation has 50,000 shares of 12% preferred stock outstanding. Also, there are 5

> A corporation has 50,000 shares of 12% preferred stock outstanding. Also, there are 50,000 shares of common stock outstanding. Par value for each is $100. If a $900,000 dividend is paid, how much goes to the preferred stockholders? a. None b. $600,000

> Paul’s Foods has outstanding 500 shares of 9% preferred stock, $100 par value; and 1,700 shares of common stock, $20 par value. Paul’s declares dividends of $20,500. Which of the following is the correct entry? A1

> Stockholders are eligible for a dividend if they own the stock on the date of a. issuance. b. payment. c. record. d. declaration.

> Athens Holding Company operates numerous businesses, including motel, auto rental, and real estate companies. The year 2016 was interesting for Athens, which reported the following on its income statement (in millions): During 2016, Athens had the foll

> A company purchased 100 shares of its common stock at $46 per share. It then sells 45 of the treasury shares at $76 per share. The entry to sell the treasury stock includes a a. credit to Retained Earnings for $3,000. b. debit to Retained Earnings for

> When treasury stock is sold for less than its cost, the entry should include a debit to a. Gain on Sale of Treasury Stock. b. Loss on Sale of Treasury Stock. c. Retained Earnings. d. Paid-in Capital in Excess of Par.

> A company paid $28 per share to purchase 900 shares of its common stock as treasury stock. The stock was originally issued at $12 per share. Which of the following is the journal entry to record the purchase of the treasury stock? A1 A Treasury Stoc

> These account balances at December 31 relate to Sportstuff, Inc.: Sportstuff’s net income for the period is $119,200 and beginning common stockholders’ equity is $681,700. Sportstuff’s return on com

> These account balances at December 31 relate to Sportstuff, Inc.: What is total stockholders’ equity for Sportstuff, Inc.? a. $742,300 b. $677,000 c. $748,200 d. $754,100 e. None of the above Accounts Payable. $ 51,600 Paid-i

> These account balances at December 31 relate to Sportstuff, Inc.: What is total paid-in capital for Sportstuff, Inc.? (Assume that treasury stock does not reduce total paid-in capital.) a. $682,900 b. $671,100 c. $748,200 d. $677,000 e. None of th

> Which of the following classifications represents the most shares of common stock? a. Issued shares b. Outstanding shares c. Treasury shares d. Unissued shares e. Authorized shares

> Preferred stock is least likely to have which of the following characteristics? a. The right of the holder to convert to common stock b. Preference as to dividends c. Preference as to voting d. Preference as to assets on liquidation of the corporatio

> The paid-in capital portion of stockholders’ equity does not include a. Paid-in Capital in Excess of Par Value. b. Common Stock. c. Retained Earnings. d. Preferred Stock. e. both c and d.

> Par value a. may exist for common stock but not for preferred stock. b. is an arbitrary amount that establishes the legal capital for each share. c. represents the original selling price for a share of stock. d. is established for a share of stock af

> Altar Loan Company’s balance sheet at December 31, 2016, reports the following: During 2016, Altar Loan earned net income of $6,200,000. Compute Altar Loan’s earnings per common share (EPS) for 2016; round EPS to two

> United Parcel Service (UPS), Inc., had the following stockholders’ equity amounts on December 31, 2016 (adapted, in millions): Common stock and additional paid-in capital; 1,135 shares issued............... $ 278 Retained earnings.....................

> Fair Play, Inc., issues 250,000 shares of no-par common stock for $5 per share. The journal entry is which of the following? A1 A Cash Common Stock Gain on the Sale of Stock 1 a. 1,250,000 250,000 1,000,000 2 4 Б. Сash Common Stock 250,000 250,000 7

> Which of the following is a characteristic of a corporation? a. Limited liability of stockholders b. No income tax c. Mutual agency d. Both b and c

> How many items enter the computation of Sheehan’s net cash flow from investing activities for 2016? a. 5 b. 3 c. 7 d. 2 A1 Sheehan's Income Statement for 2016 1 2 Sales revenue 3 Gain on sale of equipment 4 Cost o

> Sheehan’s net cash provided by operating activities during 2016 was a. $55,000. b. $58,000. c. $61,000. d. $52,000. A1 Sheehan's Income Statement for 2016 1 2 Sales revenue 3 Gain on sale of equipment 4 Cost of goods sold 5 Depr

> How do accounts receivable affect Sheehan’s cash flows from operating activities for 2016? a. Increase in cash provided by operating activities b. Decrease in cash provided by operating activities c. They donâ

> How do Sheehan’s accrued liabilities affect the company’s statement of cash flows for 2016? a. Increase in cash used by financing activities b. They don’t because the ac

> Which statement is true? a. Management audits the financial statements. b. Auditors of public companies audit financial statements as well as internal controls. c. GAAP requires companies to issue reports on corporate social responsibility (CSR). d. In

> Innovations Camera Co. sold equipment with a cost of $18,000 and accumulated depreciation of $6,000 for an amount that resulted in a gain of $4,000. What amount should Innovations report on the statement of cash flows as “proceeds from sale of plant asset

> The following information was taken from the records of Clark Cosmetics, Inc., at December 31, 2016: Requirements 1. Using the End-of-Chapter Summary Problem as an example, prepare Clark Cosmetics’ single-step income statement, which

> The accounting (not the income tax) records of Elemental Publications, Inc., provide the income statement for the year ended December 31, 2016. 2016 Total revenue...................

> During 2016, the Martell Heights Corp. income statement reported income of $320,000 before tax. The company’s income tax return filed with the IRS showed taxable income of $280,000. During 2016, Martell Heights was subject to an income tax rate of 25%.

> Megan Hodge, accountant for Natural Foods, Inc., was injured in a skiing accident. While she was recuperating, another, inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2016: The individua

> Better Ventures, Ltd. (BVL), specializes in taking underperforming companies to a higher level of performance. BVL’s capital structure at December 31, 2015, included 12,000 shares of $2.20 preferred stock and 130,000 shares of common stock. During 2016,

> Suppose Lyndell Corporation completed the following international transactions: Requirements 1. Record these transactions in Lyndell’s journal and show how to report the foreign-currency transaction gain or loss on the income stateme

> Daughtry Cosmetics in P11-48A holds significant promise for carving a niche in its industry. A group of Irish investors is considering purchasing the company’s outstanding common stock. Daughtry’s stock is currently selling for $24 per share. A BetterLife

> Use the data in P11-48A to prepare the Daughtry Cosmetics statement of retained earnings for the year ended December 31, 2016. Use the Statement of Retained Earnings in the End-of-Chapter Summary Problem as a model. From P11-48A The following informati

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to Disc.com and Holiday Shops and have assembled the following data. Selected income statement data for current year: Selected balance-sheet and market pric

> Comparative financial statement data of Arch Optical Mart follow: Other information: 1. Market price of Arch common stock: $88.17 at December 31, 2016, and $77.01 at December 31, 2015 2. Common shares outstanding: 18,000 during 2016 a

> Financial statement data of Eastland Engineering include the following items: Requirements 1. Compute Eastland’s current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. 2. Compute the three ratios

> You are evaluating two companies as possible investments. The two companies, which are similar in size, are commuter airlines that fly passengers up and down the West Coast. All other available information has been analyzed, and your inves

> For each of the situations listed, identify which of three principles (integrity, objectivity and independence, or due care) from the AICPA Code of Professional Conduct that is violated. Assume all persons listed in the situations are members of the AICP

> Top managers of Gordon Products, Inc., have asked for your help in comparing the company’s profit performance and financial position with the average for the industry. The accountant has given you the compa

> Net sales, net income, and total assets for Urbana Shipping, Inc., for a five-year period follow: Requirements 1. Compute trend percentages for each item for 2013 through 2016. Use 2012 as the base year and round to the nearest percent.

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to Star.com and Westlake Shops and have assembled the following data. Selected income statement data for the current year: Selected balance-sheet and market

> Comparative financial statement data of Sanfield Optical Mart follow: Other information: 1. Market price of Sanfield common stock: $89.38 at December 31, 2016, and $85.67 at December 31, 2015 2. Common shares outstandin

> Financial statement data of Morgan Engineering include the following items: Requirements 1. Compute Morgan’s current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. 2. Compute the three ratios afte

> To prepare the statement of cash flows, accountants for Franklin Electric Company have summarized 2016 activity in two accounts: Franklin Electric’s 2016 income statement and balance sheet data follow: Requirements 1

> The following accounts and related balances of Ginger Designers, Inc., as of December 31, 2016, are arranged in no particular order: Requirements 1. Prepare Ginger’s classified balance sheet in the account format at December 31, 2016

> Fall River Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2016: Requirements Answer these questions about Fall River Specialties’ stockholdersâ€

> Assume Sweet Treats, Inc., completed the following transactions during 2016, the company’s 10th year of operations: Requirements 1. Analyze each transaction in terms of its effect on the accounting equation of Sweet Treats, Inc. 2.

> Dublin Jewelry Company reported the following summarized balance sheet at December 31, 2016: During 2017, Dublin Jewelry completed these transactions that affected stockholders’ equity: Requirements 1. Journalize Dublin Jewelry&aci

> For each of the situations listed, identify which of three principles (integrity, objectivity and independence, or due care) from the AICPA Code of Professional Conduct is violated. Assume all persons listed in the situations are members of the AICPA. (N

> Classic Outdoor Furniture Company included the following stockholders’ equity on its year-end balance sheet at February 28, 2017: Requirements 1. Identify the different issues of stock that Classic Outdoor Furniture Company has outst

> Jackson Corp. has the following stockholders’ equity information: Jackson’s charter authorizes the company to issue 9,000 shares of 6% preferred stock with par value of $110 and 450,000 shares of no-par common stock. The company issued 2,250 shares of t

> The partners who own Canal Kayaks wished to avoid the unlimited personal liability of the partnership form of business, so they incorporated as Canal Kayaks, Inc. The charter from the state of Nevada authorizes the corporation to issue 125,000 shares of

> Paulus Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2016: Requirements Answer these questions about Paulus Specialties’ stockholders’ e

> The following accounts and related balances of Seagull Designers, Inc., as of December 31, 2016, are arranged in no particular order: Requirements 1. Prepare Seagull’s classified balance sheet in the account format at December 31, 20

> Assume Dairy Freeze, Inc., completed the following transactions during 2016, the company’s 10th year of operations: Requirements 1. Analyze each transaction in terms of its effect on the accounting equation of Dairy Freeze, Inc. 2.

> Walker Jewelry Company reported the following summarized balance sheet at December 31, 2016: During 2017, Walker Jewelry completed these transactions that affected stockholders’ equity: Requirements 1. Journalize Walker Jewelry&aci

> Yoder Outdoor Furniture Company included the following stockholders’ equity on its year-end balance sheet at February 28, 2017: Requirements 1. Identify the different issues of stock that Yoder Outdoor Furniture Company has outstandi

> Rollo Corp. has the following stockholders’ equity information: Rollo’s charter authorizes the company to issue 5,000 shares of 7% preferred stock with par value of $110 and 650,000 shares of no-par common stock. The company issued 2,500 shares of the pr

> The partners who own Lane Rafts wished to avoid the unlimited personal liability of the partnership form of business, so they incorporated as Lane Rafts, Inc. The charter from the state of California authorizes the corporation to issue 160,000 shares of

> For each of the situations listed, identify which of three principles (integrity, objectivity and independence, or due care) from the AICPA Code of Professional Conduct that is violated. Assume all persons listed in the situations are members of the AICP

> The 2016 and 2015 comparative balance sheets and 2016 income statement of Lombardi Supply Corp. follow: Lombardi Supply had no noncash investing and financing transactions during 2016. During the year, there were no sales of land or equ

> The comparative balance sheets of Barberton Movie Theater Company at September 30, 2016 and 2015, reported the following: Barberton’s transactions during the year ended September 30, 2016, included the following: Requirements 1. Pre

> Johnson Software Corp. has assembled the following data for the years ending December 31, 2016 and 2015: Requirement 1. Prepare Johnson Software Corp.’s statement of cash flows using the indirect method to report operating activitie

> Use the Pruitt Motors, Inc., data from P12-67B. Requirements 1. Prepare Pruitt’s income statement for the year ended December 31, 2016. Use the singlestep format, with all revenues listed together and all expenses together. 2. Prepare Pruitt’s balanc

> Pruitt Motors, Inc., was formed on January 1, 2016. The following transactions occurred during 2016: On January 1, 2016, Pruitt issued its common stock for $440,000. Early in January, Pruitt made the following cash payments: a. $180,000 for equipment

> The comparative balance sheets of Donna Dunn Design Studio, Inc., at June 30, 2016, and 2015, and transaction data for fiscal 2016, are as follows: Transaction data for the year ended June 30, 2016, follows: a. Net income, $70,600 b. D

> To prepare the statement of cash flows, accountants for Percy Electric Company have summarized 2016 activity in two accounts: Percy Electric’s 2016 income statement and balance sheet data follow: Requirements 1. Prep

> Crutchfield Furniture Gallery, Inc., provided the following data from the company’s records for the year ended October 31, 2017: a. Credit sales, $584,200 b. Loan to another company, $12,800 c. Cash payments to purchase plant assets, $44,400 d. Cost o

> Use the King Supply Corp. data from P12-62A. Requirements 1. Prepare the 2016 statement of cash flows by using the direct method. 2. How will what you learned in this problem help you evaluate an investment? From P12-62A. The 2016 and 2015 comparati

> The 2016 and 2015 comparative balance sheets and 2016 income statement of King Supply Corp. follow: King Supply had no noncash investing and financing transactions during 2016. During the year, there were no sales of land or equipment,

> George Campbell paid $50,000 for a franchise that entitled him to market Success Associates software programs in the countries of the European Union. Campbell intended to sell individual franchises for the major language groups of western Europe—German,

> The accounting (not the income tax) records of Consolidated Publications, Inc., provide the income statement for the year ended December 31, 2016. 2016 Total revenue....

> Sophie Miller, accountant for Northern Foods, Inc., was injured in a snowboarding accident. While she was recuperating, another, inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2016: The

> Turnover Specialists, Ltd. (TSL), specializes in taking underperforming companies to a higher level of performance. TSL’s capital structure at December 31, 2015, included 11,000 shares of $2.30 preferred stock and 125,000 shares of common stock. During 2

> Suppose Taupe Corporation completed the following international transactions: Requirements 1. Record these transactions in Taupe’s journal and show how to report the foreign-currency transaction gain or loss on the income statement.

> Clark Cosmetics in Problem P11-55B holds significant promise for carving a niche in its industry. A group of Irish investors is considering purchasing the company’s outstanding common stock. Clark’s stoc

> Use the data in P11-55B to prepare the Clark Cosmetics statement of retained earnings for the year ended December 31, 2016. Use the Statement of Retained Earnings in the End-of-Chapter Summary Problem as a model. From P11-55B The following information

> The global economic recession that started in 2007, and that persists in certain sectors, has impacted every business, but it was especially hard on banks, automobile manufacturing, and retail companies. Banks were largely responsible for the recession.

> Use Apple Inc.’s consolidated statement of cash flows along with the company’s other consolidated financial statements, all in Appendix A and online in the filings section of http://www.sec.gov, to answer the following questions. Requirements 1. By which

> Refer to the Apple Inc., consolidated financial statements in Appendix A and online in the filings section of http://www.sec.gov. Requirements 1. Apple Inc.’s consolidated statements of operations do not mention income from continuing operations. Why n

> Apple Inc.’s consolidated financial statements appear in Appendix A and online in the filings section of http://www.sec.gov. Requirements 1. Refer to Apple’s Consolidated Balance Sheets and Note 7 (Shareholders’ Equity). Describe the class of stock that

> Columbia Motors is having a bad year. Net income is only $37,000. Also, two important overseas customers are falling behind in their payments to Columbia, and Columbia’s accounts receivable are ballooning. The company desperately needs a loan. The Columb

> Use the consolidated financial statements and the data in Apple Inc.’s annual report in Appendix A and online in the filings section of http://www.sec.gov to evaluate the company’s comparative performance for 2014 versus 2013. Requirements 1. Perform ho

> This case is based on the consolidated financial statements of Under Armour, Inc., given in Appendix B and online in the filings section of http://www.sec.gov. In particular, this case uses Under Armour, Inc.’s, Consolidated Balance Sheets and Consolidated