Question: The following is a December 31, 2024,

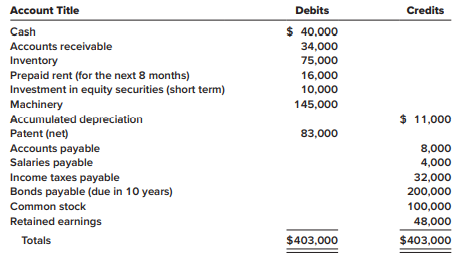

The following is a December 31, 2024, post-closing trial balance for the Jackson Corporation.

Required:

Prepare a classified balance sheet for Jackson Corporation at December 31, 2024, by properly classifying each of the accounts.

> Big Warehouses borrowed $100,000 from a bank and signed a note requiring 20 annual payments of $13,388 beginning one year from the date of the agreement. Required: Determine the interest rate implicit in this agreement.

> Juan purchased a new automobile for $20,000. Juan made a cash down payment of $5,000 and agreed to pay the remaining balance in 30 monthly installments, beginning one month from the date of purchase. Financing is available at a 24% annual interest rate.

> Crell Computers categorizes its accounts receivable into four age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due = $60,000; estimated uncollectible = 5%. 2. Accounts 1–30 days past due = $15,000; estim

> Alec, Daniel, William, and Stephen decide today to save for retirement. Each person wants to retire by age 65 and puts $11,000 into an account earning 10% compounded annually. Calculate how much each person will have accumulated by the age of 65.

> On June 30, 2024, Single Computers issued 6% stated rate bonds with a face amount of $200 million. The bonds mature on June 30, 2039 (15 years). The market rate of interest for similar bond issues was 5% (2.5% semiannual rate). Interest is paid semiannua

> On September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $300 million. The bonds mature on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March

> On April 1, 2024, Antonio purchased appliances from the Acme Appliance Company for $1,200. In order to increase sales, Acme allows customers to pay in installments and will defer any payments for six months. Antonio will make 18 equal monthly payments, b

> A student just graduated from State University with a bachelor’s degree in history. During four years at the university, $12,000 in student loans were accumulated. The student asks for your help in determining the amount of the quarterly loan payment. Th

> For each of the following situations involving annuities, solve for the unknown (?). Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years)

> Parents want to accumulate $100,000 to be used for their child’s college education. The parents would like to have the amount available on December 31, 2029. Assume that the funds will accumulate in an account paying 8% interest compounded annually. Req

> President Company purchased merchandise from Captain Corp. on September 30, 2024. Payment was made in the form of a noninterest-bearing note requiring President to make six annual payments of $5,000 on each September 30, beginning on September 30, 2027.

> 1. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $64,000 cash immediately, (2) $20,000 cash immediately and a six-year annuity of $8,000 beginning one year from today, or (3) a six-year annuity of $13,

> Assuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $5,000 under each of the following situations: 1. The payments are received at the end of each of the five years and interest is compounded annually. 2. T

> At the end of the year, Syer Associates had a debit balance in its allowance for uncollectible accounts of $12,000 before adjustment. The balance in Syer’s gross accounts receivable is $600,000. Syer’s management estimates that 10% of its accounts receiv

> Denzel needs a new car. At the dealership, he finds the car that he likes. The dealership gives him two payment options: (1) pay $35,000 today for the car or (2) pay $4,000 at the end of each quarter for three years. Assuming Denzel uses a discount rate

> The four people below have the following investments. Determine which of the four people will have the greatest investment accumulation in six years.

> On September 17, 2024, Zilch, Inc., entered into an agreement to sell one of its divisions that qualifies as a component of the entity according to generally accepted accounting principles. By December 31, 2024, the company’s fiscal year-end, the divisio

> Kamden Enterprises, Inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined by generally accepted accounting principles. The horse division has been

> Esquire Comic Book Company had income before tax of $1,000,000 in 2024 before considering the following material items: 1. Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting pri

> Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been u

> The following single-step income statement was prepared by the accountant of the Axel Corporation: Required: Prepare a multiple-step income statement applying generally accepted accounting principles. The income tax rate is 25%. Be sure to include appro

> The trial balance for Landor Corporation, a manufacturing company, for the year ended December 31, 2024, included the following accounts: The gain on debt securities is unrealized and classified as other comprehensive income. The trial balance does not i

> The following is a partial trial balance for General Lighting Corporation as of December 31, 2024: Income tax expense has not yet been recorded. The income tax rate is 25% of income before income taxes. Required: 1. Prepare a single-step income stateme

> Shields Company is preparing its interim report for the second quarter ending June 30. The following payments were made during the first two quarters: Required: For each expenditure, indicate the amount that would be reported in the quarterly income sta

> At the end of the year, Breyer Associates had a credit balance in its allowance for uncollectible accounts of $12,000 before adjustment. The balance in Breyer’s gross accounts receivable is $600,000. Breyer’s management estimates that 10% of its accounts

> Opine Laminating Corporation reported income before income taxes during the first three quarters, and management’s estimates of the annual effective tax rate at the end of each quarter as shown below Required: Determine the income tax

> This exercise is based on the Peabody Toys, Inc., data from E 4–27. Required: 1. Determine the following components of the DuPont framework for 2024: a. Profit margin on sales b. Asset turnover c. Equity multiplier d. Return on equity 2. Write an equati

> The following condensed information was reported by Peabody Toys, Inc., for 2024 and 2023: Required: 1. Determine the following ratios for 2024: a. Profit margin on sales b. Return on assets c. Return on equity 2. Determine the amount of dividends paid t

> The following is a partial trial balance for the Green Star Corporation as of December 31, 2024: Required: 1. Prepare a single-step income statement by inserting the amounts above into the appropriate section. 2. Prepare a multiple-step income statement

> The 2024 income statement of Anderson Medical Supply Company reported net sales of $8 million, cost of goods sold of $4.8 million, and net income of $800,000. The following table shows the company’s comparative balance sheets for 2024 a

> Refer to the situation described in E 4–20. Required: Prepare the cash flows from operating activities section of Tiger’s 2024 statement of cash flows using the direct method. Assume that all purchases and sales of inventory are on account, and that the

> Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tiger’s statement of cash flows, using the indirect method to present cash flows from operating activities.

> The statement of cash flows for the year ended December 31, 2024, for Bronco Metals is presented below. Required: Prepare the statement of cash flows assuming that Bronco prepares its financial statements according to International Financial Reporting S

> Chew Corporation prepares its statement of cash flows using the indirect method of reporting operating activities. Net income for the 2024 fiscal year was $1,250,000. Depreciation expense of $140,000 was included with operating expenses in the income sta

> Complex Corporation prepares its statement of cash flows using the indirect method to report operating activities. Net income for the 2024 fiscal year was $624,000. Depreciation and amortization expense of $87,000 was included with operating expenses in

> This exercise is a continuation of BE 9–11. During 2025 (the following year), purchases at cost and retail were $168,000 and $301,000, respectively. Net markups, net markdowns, and net sales for the year were $3,000, $4,000, and $280,000, respectively. T

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available in Connect. This m

> The following transactions occurred during March 2024 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. [These are the same transactions analyzed in Exercise 2–1, when we determined their effect on ele

> The following summary transactions occurred during 2024 for Bluebonnet Bakers: The balance of cash and cash equivalents at the beginning of 2024 was $17,000. Required: Prepare a statement of cash flows for 2024 for Bluebonnet Bakers. Use the direct meth

> The Masood Consulting Group reported net income of $1,354,000 for its fiscal year ended December 31, 2024. In addition, during the year the company experienced a positive foreign currency translation adjustment of $240,000 and an unrealized loss on debt

> The Esposito Import Company had 1 million shares of common stock outstanding during 2024. Its income statement reported the following items: income from continuing operations, $5 million; loss from discontinued operations, $1.6 million. All of these amou

> Pandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2024, year-end trial balance contained the following income statement items: Required: Calculate the company’s operati

> Assume the same facts as in E 4–31, but that Shields Company reports under IFRS. For each expenditure, indicate the amount that would be reported in the quarterly income statements for the periods ending March 31, June 30, September 30, and December 31.

> The following is the balance sheet of Kroger Supply Company at December 31, 2023 (prior year). Transactions during 2024 (current year) were as follows: 1. Sales to customers on account $800,000 2. Cash collected from customers 780,000 3. Purchase of inve

> Cone Corporation is in the process of preparing its December 31, 2024, balance sheet. There are some questions as to the proper classification of the following items: a. $50,000 in cash restricted to pay debt. The debt matures in 2028. b. Prepaid rent of

> The following balance sheet for the Los Gatos Corporation was prepared by a recently hired accountant. In reviewing the statement you notice several errors. Additional Information: 1. Cash includes a $20,000 restricted amount to be used for repayment of

> Presented next are the ending balances of accounts for the Kansas Instruments Corporation at December 31, 2024. Additional Information: 1. The notes receivable, along with any interest receivable, are due on November 22, 2025. 2. The notes payable are du

> On January 1, 2024, Select Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Estimate ending inventory using the dollar-value LIFO retail method and the information provided.

> The following are the ending balances of accounts at December 31, 2024, for the Valley Pump Corporation. Additional Information: 1. The $120,000 balance in the land account consists of $100,000 for the cost of land where the plant and office buildings ar

> The following are the typical classifications used in a balance sheet: a. Current assets b. Investments c. Property, plant, and equipment d. Intangible assets e. Current liabilities f. Long-term liabilities g. Paid-in capital h. Retained earnings Requir

> The following are the typical classifications used in a balance sheet: a. Current assets b. Investments c. Property, plant, and equipment d. Intangible assets e. Current liabilities f. Long-term liabilities g. Paid-in capital h. Retained earnings Requir

> The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: The only asset not listed is short-term investments. The only liabilities not listed are $30,000 notes payable due in two years and

> Refer to E 3–21. Required: How might your answers differ if Canton Corporation prepares its segment disclosure according to International Financial Reporting Standards?

> Best Buy Co, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended February 1, 2020, are shown next. Liquidity and solvency ratios for the industry are as follows: Requi

> The 2024 balance sheet for Hallbrook Industries, Inc., is shown below. The company’s 2024 income statement reported the following amounts ($ in thousands): Required: Determine the following ratios for 2024: 1. Current ratio 2. Acid-test

> Halloran Company produces car and truck batteries that it sells primarily to auto manufacturers. Dorothy Hawkins, the company’s controller, is preparing the financial statements for the year ended December 31, 2024. Hawkins asks for your advice concerni

> The following are typical disclosures that would appear in the notes accompanying financial statements. For each of the items listed, indicate where the disclosure would likely appear—either in (A) the significant accounting policies no

> Robotics Corporation uses a periodic inventory system and the retail inventory method. Accounting records provided the following information for the 2024 fiscal year: The company records sales to employees net of discounts. These discounts totaled $15,00

> On January 1, 2024, JPS Industries borrowed $300,000 from Austin Bank by issuing a three-year, floating rate note based on SOFR, with interest payable semiannually on June 30 and December of each year. ∙ JPS entered into a three-year i

> Cleveland Company is a U.S. firm with a U.S. dollar functional currency that manufactures copper-related products. It forecasts that it will sell 5,000 feet of copper tubing to one of its largest customers at a price of ¥50,000,000. Although t

> Sanctums, Inc., purchases wheat for use in its food manufacturing process. Sanctums operates in a highly competitive industry and is rarely able to increase its sales price. ∙ On January 1, 2024, Sanctums estimates that it only has enou

> Arlington Steel Company is a producer of raw steel and steel-related products. On January 3, 2025, Arlington enters into a firm commitment to purchase 10,000 tons of iron ore pellets from a supplier to satisfy spring production demands. The purchase is

> On March 31, 2024, Wolfson Corporation acquired all of the outstanding common stock of Barney Corporation for $17,000,000 in cash. The book values and fair values of Barney’s assets and liabilities were as follows: Required: Calculate

> In 2024, Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $200,000. Symmetry created the unique design for the equipment. Bratten also pai

> Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,000,000 in 2024 for the mining site and spent an additional $600,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately fo

> On March 1, 2024, Beldon Corporation purchased land as a factory site for $60,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2024. Costs incurred during this period are lis

> The Manguino Oil Company incurred exploration costs in 2024 searching and drilling for oil as follows: It was determined that Wells 104–108 were dry holes and were abandoned. Wells 101, 102, and 103 were determined to have sufficient oi

> Freitas Corporation was organized early in 2024. The following expenditures were made during the first few months of the year: Required: Prepare a summary journal entry to record the $107,000 in cash expenditures.

> Refer to the situation described in BE 9–7. Estimate ending inventory and cost of goods sold using the conventional method and the information provided.

> On September 30, 2024, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2025, and the program was available for release on April 30, 2025.

> Early in 2024, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2024 at a cost of $6 million. Of this amount, $4 million was spent before technological feasibility was established. Excali

> NXS Semiconductor prepares its financial statements according to International Financial Reporting Standards. The company incurred the following expenditures during 2024 related to the development of a chip to be used in mobile devices: The development c

> Janson Pharmaceuticals incurred the following costs in 2024 related to a new cancer drug: The development costs were incurred after technological and commercial feasibility was established and after the future economic benefits were deemed probable. The

> Delaware Company incurred the following research and development costs during 2024: The equipment has a seven-year life and will be used for a number of research projects. Depreciation for 2024 is $120,000. Required: Calculate the amount of research and

> In 2024, Space Technology Company modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures: The equipment will be used on this and other research projects. Depreciation on the equipment for 20

> Thornton Industries began construction of a warehouse on July 1, 2024. The project was completed on March 31, 2025. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding t

> On January 1, 2024, the Highlands Company began construction on a new manufacturing facility for its own use. The building was completed in 2025. The company borrowed $1,500,000 at 8% on January 1 to help finance the construction. In addition to the cons

> On January 1, 2024, the Shagri Company began construction on a new manufacturing facility for its own use. The building was completed in 2025. The only interest-bearing debt the company had outstanding during 2024 was long-term bonds with a book value of

> On January 1, 2024, the Marjlee Company began construction of an office building to be used as its corporate headquarters. The building was completed early in 2025. Construction expenditures for 2024, which were incurred evenly throughout the year, total

> Refer to the situation described in BE 9–7. Estimate ending inventory and cost of goods sold (LIFO) using the information provided.

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Determine the specific eight-digit Codification citation (XXX XX-XX-X) that describes each of the following items: 1. The basic pr

> Assume the same facts as in E 10-16 except that Bronco received $10,000 from the owner of the equipment to complete the exchange. Required: 1. What is the fair value of the equipment? 2. Prepare the journal entry to record the exchange.

> Assume the same facts as in E 10-14, except that the fair value of the old equipment is $170,000. Required: Prepare the journal entry to record the exchange.

> Nvidia Corporation, a global technology company located in Santa Clara, California, reported the following information in its financial statements for the fiscal year ending January 26, 2020 ($ in millions): Required: 1. Calculate the companyâ

> Cranston LTD prepares its financial statements according to International Financial Reporting Standards. In October 2024, the company received a $2 million government grant. The grant represents 20% of the total cost of equipment that will be used to imp

> On February 1, 2024, the Xilon Corporation issued 50,000 shares of its no-par common stock in exchange for five acres of land located in the city of Monrovia. On the date of the acquisition, Xilon’s common stock had a fair value of $18 per share. An offi

> Janzen Corporation acquired all of the outstanding common stock of Steinbeck Corporation for $11,000,000 in cash. The book values and fair values of Steinbeck’s assets and liabilities were the following: Required: 1. Calculate the amou

> National Distributing Company uses a periodic inventory system to track its merchandise inventory and the gross profit method to estimate ending inventory and cost of goods sold for interim periods. Net purchases for the month of August were $31,000. The

> Royal Gorge Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of October was $58,500. The following information for the

> A fire destroyed a warehouse of the Goren Group, Inc., on May 4, 2024. Accounting records on that date indicated the following: The gross profit ratio has averaged 20% of sales for the past four years. Required: Use the gross profit method to estimate t

> Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available at the end of the year: Estimate ending inventory and cost of goods sold (average cost) us

> On November 21, 2024, a fire at Hodge Company’s warehouse caused severe damage to its entire inventory of Product Tex. Hodge estimates that all usable damaged goods can be sold for $12,000. The following information was available from t

> On September 22, 2024, a flood destroyed the entire merchandise inventory on hand in a warehouse owned by the Rocklin Sporting Goods Company. The following information is available from the records of the company’s periodic inventory sy

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Determine each of the following: 1. The specific seven-digit Codification citation (XXX-XX-XX) that contains discussion of the mea

> Tatum Company has four products in its inventory. Information about ending inventory is as follows: The normal profit is 25% of total cost. Required: 1. Determine the carrying value of inventory assuming the lower of cost or market (LCM) rule is applied

> The inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal profit is 30% of sel

> Han Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows: Required: What unit values should Han use for each of its products when applying the lower of cost or market (

> Tatum Company has four products in its inventory. Information about ending inventory is as follows: Required: 1. Determine the carrying value of ending inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual pr

> On January 1, 2024, the general ledger of Big Blast Fireworks included the following account balances: The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2024, Big Blast Fireworks had the following invento

> In March 2024, the Metal Tool Company signed two purchase commitments. The first commitment requires Metal to purchase inventory for $100,000 by June 15, 2024. The second commitment requires the company to purchase inventory for $150,000 by August 20, 20