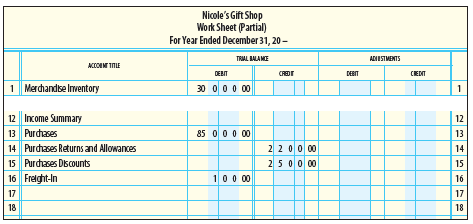

Question: The following partial work sheet is taken

The following partial work sheet is taken from Nicole’s Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is $37,000.

1. Complete the Adjustments columns for the merchandise inventory.

2. Extend the merchandise inventory to the Adjusted Trial Balance and Balance

Sheet columns.

3. Extend the remaining accounts to the Adjusted Trial Balance and Income

Statement columns.

4. Prepare a cost of goods sold section from the partial work sheet.

Transcribed Image Text:

Nicole's Gift Shop Work Sheet (Partial) For Year Ended December 31, 20 - TRIAL BALA ME AIISTMENTS ACCOIN INLE CREDT DEBIT CEDT 1 Merchandse Iventory 30 00 0 00 1 12 Income Summary 13 Purchases 12 85 0 0 0 00 13 2 200 00 2500 00 14 Purchases Returns and Allowances 14 15 Purchases Discounts 15 16 Freight-In 100 00 16 17 17 18 18

> At the end of the year, the following interest is payable, but not yet paid. Record the adjusting entry in the general journal. Interest on $8,000, 90-day, 8% note (for 18 days) $32.00 Interest on $4,500, 60-day, 7% note (for 7 days) 6.13 $38.

> List three items of information about each cash receipt entered in the cash receipts journal.

> What are the distinctive features of ToyJoy’s income statement? Its statement of retained earnings? Its balance sheet?

> Prepare general journal entries for the following transactions: Sept. 15 Borrowed $7,000 cash from the bank, giving a 60-day non-interest-bearing note. The note is discounted 8% by the bank. Nov. 14 Paid the $7,000 note, recognizing the discount as inter

> Prepare general journal entries for the following transactions: June 15 Purchased $6,000 worth of equipment from a supplier on account. July 15 Issued a $6,000, 30-day, 7% note in payment of the account payable. Aug. 14 Paid $600 cash plus interest to th

> At the end of the year, the following interest is earned, but not yet received. Record the adjusting entry in a general journal. Interest on $6,000, 60-day, 5.5% note (for 24 days) $22.00 Interest on $9,000, 90-day, 6% note (for 12 days) 18.00 $40.0

> Prepare general journal entries for the following transactions: Aug. 4 Received a 120-day, 7% note in payment for accounts receivable balance of $4,000. 14 Discounted the note at a rate of 8%. Sept. 5 Received a 30-day, 6% note in payment for accounts re

> Prepare general journal entries for the following transactions: May 22 Received a 30-day, 6% note in payment for merchandise sale of $22,000. June 21 Received $110.00 cash (interest) on the old (May 22) note; the old note is renewed for 30 days at 7%. Ju

> Determine the due date for the following notes. (Assume there are 28 days in February.) Date of Note Term of Note Due Date 45 days July 11 December 23 90 April 18 120 October 3 77 January 1 August 13 180 65

> Using 360 days as the denominator, calculate interest for the following notes using the formula I = P × R × T. Principal Rate Time e Interest $4,000 7.00% 60 days 3,000 6.50 30 7,500 8.00 150 850 7.90 99 2,250 7.55 122 1,900

> Mary’s Travel Agency had the following notes payable transactions: Apr. 1 Borrowed $4,000 from Finance Bank, signing a 90-day, 8% note. 5 Gave a $3,000, 60-day, 7% note to Krenshaw Airline for purchase of merchandise. 10 Paid $400 cash and issued a $1,60

> The following is a list of outstanding notes receivable as of December 31, 20--: REQUIRED 1. Compute the accrued interest at the end of the year. 2. Prepare the adjusting entry in the general journal. Maker Date of Note Term No. of Days Principal $

> Madison Graphics had the following notes receivable transactions: May 1 Sold merchandise on account to L. Carney, $5,600. 20 L. Carney gave a $5,600, 90-day, and 6% note to extend time for payment. 30 L. Carney’s note is discounted at Commercial Bank at

> What steps are followed in posting from the sales journal to the accounts receivable ledger?

> M. L. DiMaurizio had the following notes receivable transactions: 20-3 June 20 Received a $2,400, 30-day, 6% note from K. Lorenzo in payment for sale of merchandise. July 20 K. Lorenzo paid the note plus interest. 25 Sold merchandise on account to R. Boo

> Calculate total time in days for the following notes. (Assume there are 28 days in February.) Date of Note Due Date Time in Days August 17 January 12 July 15 October 10 March 10 September 13 February 1 July 6 December 18 December 3 April 11 October 6

> At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Anderson’s Greeting Cards was $180,000. Credit sales for the year were $1,950,000. REQUIRED Make the necessary adjusting entry in general journal for

> Lewis Warehouse used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--: Feb. 7 Received 70% of the $8,000 balance owed by Luxury Sofas, a bankrupt business, and wrote

> Madonna’s Music Store uses the direct write-off method in accounting for uncollectible accounts. Record the following transactions in general journal form: 20-1 May 5 Wrote off $2,360 owed by Neal Dammond, who has no assets. July 18 Wrote off $1,255 owed

> Brent Mussellman, owner of Brent’s Barbells, uses the direct write-off method in accounting for uncollectible accounts. Record the following transactions in general journal form: July 19 Wrote off $1,935 owed by Arnold Swartz, who has no assets. Oct. 12

> At the end of the current year, the accounts receivable account of Parker’s Nursery Supplies has a debit balance of $350,000. Credit sales are $2,300,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated

> Raynette Ramos, owner of Ramos Rentals, uses the allowance method in accounting for uncollectible accounts. Record the following transactions in general journal form: July 9 Wrote off $6,040 owed by Sue Sanchez, who has no assets. Aug. 15 Wrote off $4,79

> Charlie’s Chevy Sales and Service estimates the amount of uncollectible accounts using the percentage of receivables method. Based on aging the accounts, it is estimated that $3,935 will not be collected. Record the end-of-period adjusting entry on Decem

> Nicole’s Neckties has total credit sales for the year of $380,000 and estimates that 2% of its credit sales will be uncollectible. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated bad debt expense. Assum

> What steps are followed in posting from the sales journal to the general ledger?

> Louie Long started a business called Louie’s Lawn Service. The trial balance as of March 31, after the first month of operation, is as follows: REQUIRED 1. Analyze the following adjustments and enter them on a work sheet. (a) Ending su

> For each journal entry shown below, indicate the accounting method(s) for which the entry would be appropriate. If the journal entry is not appropriate for a particular accounting method, explain the proper accounting treatment for that method. 1. O

> The partial work sheet shown on page 561 is taken from the books of Diamond Music Store, a business owned by Ned Diamond, for the year ended December 31, 20- . REQUIRED 1. Analyze the work sheet and determine the adjusted trial balance and the adjusting

> Lee and Chen Distributors uses the direct write-off method in accounting for uncollectible accounts. 20-1 Feb. 16 Sold merchandise on account to Biggs and Daughters, $16,000. Mar. 23 Sold merchandise on account to Lloyd Place, $12,800. June 8 Received $1

> An analysis of the accounts receivable of Matsushita Company as of December 31, 20--, reveals the following: REQUIRED 1. Prepare an aging schedule as of December 31, 20--, by adding the following column to the three columns shown above: Estimated Amount

> Mary Martin owns a department store that has a $65,200 balance in Accounts Receivable and a $5,175 credit balance in Allowance for Doubtful Accounts. 1. Determine the net realizable value of the accounts receivable. 2. Assume that an account receivable i

> Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was $38,200. REQUIRED Prepare the following financial ratios: (a) Working capital (b) Current ratio (c) Quick

> Backlund Farm Supply completed the work sheet on page 609 for the year ended December 31, 20--. Owner’s equity as of January 1, 20--, was $50,000. The current portion of Mortgage Payable is $1,000. REQUIRED 1. Prepare a multiple-step income statement. 2

> Prepare entries for (a), (b), and (c) listed below using two methods. First, prepare the entries without making a reversing entry. Second, prepare the entries with the use of a reversing entry. Use T-accounts to assist your analysis. (a) Wages paid durin

> From the work sheet in Exercise 15-5B, identify the adjusting entry(ies) that should be reversed and prepare the reversing entry(ies).

> List four items of information about each sale entered in the sales journal.

> From the work sheet on page 607 prepare the following: 1. Closing entries for Balloons and Baubbles in a general journal. 2. A post-closing trial balance.

> Based on the financial statements, shown on pages 605–606, for McDonald Carpeting Co. (income statement, statement of owner’s equity, and balance sheet), prepare the following financial ratios. All sales are credit sales. The balance of Acc

> Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods old section, for Aeito’s Plumbing Supplies for the year ended December 31, 20--. Sales ……………………………………………………… $166,000 Sales Re

> Based on the information that follows, prepare the cost of goods sold section of a multiple-step income statement. Merchandise Inventory, January 1, 20-- ………………………………………………... $13,800 Purchases ……………………………………………………………………………………………. 71,300 Purchases Retur

> The partial work sheet shown below is taken from the books of Burnside Auto Parts, a business owned by Barbara Davis, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted tri

> The trial balance for Darby Kite Store as of December 31, 20-1, is shown on page 610. At the end of the year, the following adjustments need to be made: (a and b) Merchandise inventory as of December 31, $23,600. (c) Unused supplies on hand, $1,050. (d)

> Based on the information that follows, prepare the revenue section of a multiple-step income statement. Sales …………………………………………………… $86,200 Sales Returns and Allowances …………………… 2,280 Sales Discounts ………………………………………… 1,724

> A trial balance for the Basket Corner, a business owned by Linda Palermo, is shown on page 557. Year-end adjustment information is provided below. (a and b) Merchandise inventory costing $24,000 is on hand as of December 31, 20--. (The periodic inventory

> On December 31, Anup Enterprises completed a physical count of its inventory. Although the merchandise inventory account shows a balance of $200,000, the physical count comes to $210,000. Prepare the appropriate adjusting entry under the perpetual invent

> Sunita Computer Supplies entered into the following transactions. Prepare journal entries under the perpetual inventory system. May 1 Purchased merchandise on account from Anju Enterprises, $200,000. 8 Purchased merchandise for cash, $100,000. 15 Sold me

> What steps are followed in posting from the purchases journal to the accounts payable ledger?

> The following partial work sheet is taken from the books of Carmen’s Collies, a local pet kennel, for the year ended December 31, 20--. Journalize the adjustments in a general journal. Carmen's Collies Work Sheet (Partial) For Year

> From the following partial work sheet, indicate the dollar amount of beginning and ending merchandise inventory. ALUSTMENTS ALISTED TRAL BALAWE OME STATEMENT LALANCESHEET ACCOUNT MLE DERT CREDIT DERT CEDIT CREDIT DENT CEIT 1 Merchandise Inventory (b

> Set up T accounts for Cash, Unearned Ticket Revenue, and Ticket Revenue. Post the following two transactions to the appropriate accounts, indicating each transaction by letter: (a) Sold 1,200 season tickets at $20 each, receiving cash of $24,000. (b) An

> Prepare the cost of goods sold section for Havens Gift Shop. The following amounts are known: Beginning merchandise inventory ………………………………... $29,000 Ending merchandise inventory ………………………………………. 27,000 Purchases …………………………………………………………………… 62,000 Purcha

> The trial balance for Oregon Bike Company, a business owned by Craig Moody, is shown below. Year-end adjustment information is provided below. (a and b) Merchandise inventory costing $26,000 is on hand as of December 31, 20--. (The periodic inventory sys

> Sandra Owens owns a business called Sandra’s Sporting Goods. Her beginning inventory as of January 1, 20--, was $33,000, and her ending inventory as of December 31, 20--, was $36,000. Set up T accounts for Merchandise Inventory and Income Summary and per

> The following information is provided by Beverly’s Basket Corner for the last quarter of its fiscal year ending on March 31, 20--: REQUIRED 1. Estimate the ending inventory as of March 31 using the retail inventory method. 2. Estimate

> A flood completely destroyed all the inventory of Bayside Waterworks Company on July 1, 20--. Fortunately, the accounting records were not destroyed in the flood. The following information is provided by Bayside Waterworks for the time period January 1 t

> Company’s beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: REQUIRED 1. Calculate the total amount to be assigned to the ending inventory and cost of goods sold on December 31 under each

> What is the primary purpose of using special journals?

> Boyce Company’s beginning inventory and purchases during the fiscal year ended September 30, 20-2, were as follows: REQUIRED Calculate the total amount to be assigned to the cost of goods sold for the fiscal year ended September 30, 20-

> Bouie Company’s beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: 1. Calculate the total amount to be assigned to the ending inventory under each of the following periodic inventory met

> Danny Steele owns a small specialty store, named Steele’s Storeroom, whose year-end is June 30. Determine the total amount that should be included in Steele’s Storeroom’s year-end inventory. A physica

> Doreen Woods owns a small variety store. The following transactions took place during March of the current year. Journalize the transactions in a general journal using the perpetual inventory method. Mar. 3 Purchased merchandise on account from Corner Ga

> Amy Douglas owns a business called Douglas Distributors. The following transactions took place during January of the current year. Journalize the transactions in a general journal using the periodic inventory method. Jan. 5 Purchased merchandise on accou

> Mueller owns a small retail business called Debbie’s Doll House. The cash account has a balance of $20,000 on July 1. The following transactions occurred during July: July 1 Issued Check No. 314 for July rent, $1,400. 1 Purchased merchandise on account f

> Kay Zembrowski operates a retail variety store. The books include a cash payments journal and an accounts payable ledger. All cash payments (except petty cash) are entered in the cash payments journal. Selected account balances on May 1 are as follows:

> The purchases journal of Ryan’s Rats Nest, a small retail business, is as follows: REQUIRED 1. Post the total of the purchases journal to the appropriate general ledger accounts. Use account numbers as shown in the chapter. 2. Post th

> Assume that in year 1, the ending merchandise inventory is understated by $40,000. If this is the only error in years 1 and 2, indicate which items will be understated, overstated, or correctly stated for years 1 and 2. Year 1 Year 2 Ending merchandi

> Ann Benton, owner of Benton’s Galleria, made the following purchases of merchandise on account during the month of October: Oct. 2 Purchase Invoice No. 321, $1,950, from Boggs Distributors. 7 Purchase Invoice No. 152, $2,915, from Wolfs Wholesaler. 10 Pu

> What steps are followed in posting cash payments from the general journal to the accounts payable ledger?

> Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. Apr. 1 sold merchandise to O. L. Meyers, $2,100, plus sales tax. Sale No. 111. 3 Sold merchandise to Andrew Plaa, $1,000, pl

> Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. Jan. 1 received payment on account from Ray Boyd, $880. 3 Received payment on account from Clint Hassell, $271. 5 Made cash sales for the week, $

> T. M. Maxwell owns a retail business and made the following sales during the month of July 20--. There is a 5% sales tax on all sales. July 1 Sale No. 101 to Saga, Inc., $1,200, plus sales tax. 8 Sale No. 102 to Vinnie Ward, $2,100, plus sales tax. 15 Sa

> Sandcastles Northwest uses a cash payments journal. Prepare a cash payments journal using the same format and account titles as illustrated in the chapter. Record the following payments for merchandise purchased: Apr. 5 Issued Check No. 429 to Standard I

> Enter the following transactions in a purchases journal like the one below. Jan. 3 Purchased merchandise from Feng, $6,000. Invoice No. 416, dated January 1, terms 2/10, n/30. 12 Purchased merchandise from Miranda, $9,000. Invoice No. 624, dated January

> Enter the following transactions in a cash receipts journal: Nov. 1 Jean Haghighat made payment on account, $750. 12 Marc Antonoff made payment on account, $464. 15 Made cash sales, $3,763. 18 Will Mossein made payment on account, $241. 25 Made cash sale

> Enter the following transactions in a sales journal. Use a 5% sales tax rate. Sept. 1 Sold merchandise on account to K. Smith, $1,800, plus sales tax. Sale No. 228. 3 Sold merchandise on account to J. Arnes, $3,100, plus sales tax. Sale No. 229. 5 Sold m

> Identify the journal (sales, cash receipts, purchases, cash payments, or general) in which each of the following transactions should be recorded. (a) Issued credit memo to customer for merchandise returned. (b) Sold merchandise for cash. (c) Purchased me

> Ann Benton, owner of Benton’s Galleria, made the following purchases of merchandise on account during the month of October: Oct. 2 Purchase Invoice No. 321, $1,950, from Boggs Distributors. 7 Purchase Invoice No. 152, $2,915, from Wolfs Wholesaler. 10 Pu

> Crystal’s Candles, a retail business, had the following balances and purchases and payments activity in its accounts payable ledger during November. Prepare a schedule of accounts payable for Crystal’s Candles as of No

> What steps are followed in posting cash receipts from the general journal to the accounts receivable ledger?

> Enter the following cash payments transactions in a general journal: Apr. 5 Issued Check No. 429 to Standard Industries for merchandise purchased March 27, $8,000, terms 2/10, n/30. Payment is made within the discount period. 19 Issued Check No. 430 to F

> Using page 3 of a general journal and the following general ledger accounts and accounts payable ledger accounts, journalize and post the following transactions: Mar. 5 Returned merchandise to Tower Industries, $500. 11 Returned merchandise to A & D

> Journalize the following transactions in a general journal: Jan. 3 purchased merchandise from Feng, $6,000. Invoice No. 416, dated January 1, terms 2/10, n/30. 12 Purchased merchandise from Miranda, $9,000. Invoice No. 624, dated January 10, terms n/30.

> The following data were taken from the accounts of Burnside Bedknobs, a retail business. Determine the gross profit. $116,900 1,100 400 Sales Sales returns and allowances Sales discounts Merchandise inventory, January 1 Purchases during the period P

> Using T accounts for Cash, Accounts Payable, Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight-In, enter the following purchase transactions. Identify each transaction with its corresponding letter. Use a new set of T accounts

> Merchandise was purchased on account from Grant’s Distributors on June 12. The purchase price was $5,000, less a 10% trade discount and credit terms of 3/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calcula

> Based on the information provided in Problem 11-11B, Problem 11-11B: Debbie Mueller owns a small retail business called Debbie’s Doll House. The cash account has a balance of $20,000 on July 1. The following transactions occurred during July: July 1 I

> Debbie Mueller owns a small retail business called Debbie’s Doll House. The cash account has a balance of $20,000 on July 1. The following transactions occurred during July: July 1 Issued Check No. 314 for July rent, $1,400. 1 Purchased merchandise on ac

> Kay Zembrowski operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows: The following transactions are related to cash payments for the month of May: May 1 Is

> A flowchart showing some of the major documents commonly used in the purchasing function of a merchandise business is presented below. Briefly describe each document. 2 3 Purchase Requisiton Purchase Order Recetving Report Purchase Involoe

> What steps are followed in posting purchases returns and allowances from the general journal to the general ledger and accounts payable ledger?

> Owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales. July 1 Sale No. 101 to Saga, Inc., $1,200 plus sales tax. 8 Sale No. 102 to Vinnie Ward, $2,100 plus sales tax. 15 Sale No

> From the accounts receivable ledger shown, prepare a schedule of accounts receivable for Gelph Co. as of November 30, 20--. ACCOUNTS RECEIVABLE LEDGER James L. Adams Co. AME A 24481 MCAdams Rad, Dallr, TX T7001-3465 BALII 3180 00 3000 00 3200 00 Nov

> Enter the following transactions in a general journal: Nov. 1 Jean Haghighat made payment on account, $750. 12 Marc Antonoff made payment on account, $464. 15 Cash sales were $3,763. 18 Will Mossein made payment on account, $241. 25 Cash sales were $2,64

> Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is $3

> Enter the following transactions in a general journal. Use a 5% sales tax rate. Sept. 1 Sold merchandise on account to K. Smith, $1,800 plus sales tax. Sale No. 228. 3 Sold merchandise on account to J. Arnes, $3,100 plus sales tax. Sale No. 229. 5 Sold m

> Prepare journal entries for the following transactions. Oct. 5 Sold merchandise on account to B. Farnsby for $280 plus sales tax of 4%. 8 Sold merchandise on account to F. Preetee for $240 plus sales tax of 4%, with 2/10, n/30 cash discount terms. 11 F.

> Based on the following information, compute net sales: Gross sales $2,880 Sales returns and allowances 322 Sales discounts 56

> Using T accounts for Cash, Accounts Receivable, Sales Tax Payable, Sales, Sales Returns and Allowances, and Sales Discounts, enter the following sales transactions. Use a new set of accounts for each part, 1–5. 1. No sales tax. (a) Merchandise is sold fo

> Based on the information provided in Problem 10-11B, Problem 10-11B: Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. Apr. 1 Sale on account No. 111 to O. L. Meyers, $2,1

> Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. Apr. 1 Sale on account No. 111 to O. L. Meyers, $2,100 plus sales tax. 3 Sale on account No. 112 to Andrew Plaa, $1,000 plus