Question: The following post-closing trial balance was

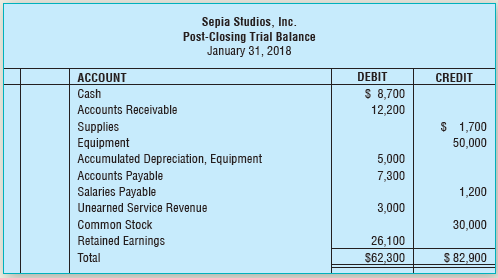

The following post-closing trial balance was prepared for Sepia Studios, Inc., but some balances were entered in the wrong column. Prepare a corrected post-closing trial balance. Assume all accounts have normal balances and the amounts are correct.

> Osborne Organic Foods, Inc., has the following information for the years ending December 31, 2018, and December 31, 2017: Requirements 1. Compute the rate of inventory turnover for Osborne Organic Foods, Inc., for the years ended December 31, 2018, and

> Wild Things, Inc., has the following information as of December 31, 2018: Requirements 1. Compute the rate of inventory turnover for Wild Things, Inc., for the year ended December 31, 2018. Round the result to two decimal places. 2. The rate of invento

> Master Blaster, Inc., sells and installs audio equipment. Master Blaster, Inc.’s entire inventory was destroyed during a recent fire that occurred at its warehouse. Master Blaster, Inc.’s accounting records reflect the following information: Beginning I

> Mike’s Custom Furniture, Inc., reported the following comparative income statements for the years ended April 30, 2018, and April 30, 2017. During 2018, Mike’s Custom Furniture, Inc., discovered that the 2017 ending

> Top Fuel Auto Parts, Inc., had the following FIFO perpetual inventory record for one of its inventory items at November 30, the end of the fiscal year. A physical count of the inventory performed at year’s end revealed $172.20 (28 ite

> Eaton Supply, Inc., has the following account balances at May 31, 2018. The inventory balance was determined using FIFO. Eaton Supply, Inc., has determined that the replacement cost (current market value) of the May 31, 2018, ending inventory is $35,90

> Assume Fisher Tire, Inc., completed the following perpetual inventory transactions for a line of tires. Beginning Inventory 38 tires ……………………………. @ $130 Purchase 16 tires …………………………………………….. @ $135 Sale 43 tires …………………………………………………… @ $224 Requirements

> Refer to the data for Alpine Bikes, Inc., in E5-19A. Requirements 1. Compute the cost of ending inventory under FIFO. 2. Compute the cost of ending inventory under LIFO. 3. Which method results in a higher cost of ending inventory? E5-19A: Assume Alpin

> Assume Alpine Bikes, Inc., bought and sold a line of mountain bikes during October as follows: Alpine Bikes, Inc., uses the perpetual inventory system. Requirements 1. Compute the cost of goods sold under FIFO. 2. Compute the cost of goods sold under

> Refer to the data for E5-16A. However, instead of the FIFO method, assume Golfer’s Delight, Inc., uses the average cost method. Requirements 1. Prepare a perpetual inventory record for the putters on the average cost basis to determine

> Golfer’s Delight, Inc., carries a line of titanium putters. Golfer’s Delight, Inc., uses the FIFO method and a perpetual inventory system. The sale price of each putter is $195. Company records indicate the following a

> This exercise continues with the business of Sensations Salon, Inc., begun in the Continuing Exercise in Chapter 1. Instead of entering the transactions in the accounting equation as you did in Chapter 1, now you will account for Sensations Salon, Inc.&a

> Sunshine Solar, Inc., had sales revenue of $445,000, cost of goods sold of $193,000, and net income of $96,000 for the year. An average of 4,000 shares of common stock were outstanding during the year. Requirement 1. Compute Sunshine Solar, Inc.’s earni

> Use the data for Grease Monkey Auto Supply, Inc., from E4-34B. Requirement 1. Prepare Grease Monkey Auto Supply, Inc.’s classified balance sheet. Use the account format. The balance shown for Retained Earnings represents the balance be

> Use the data for Grease Monkey Auto Supply, Inc., from E4-34B. Requirements 1. Prepare Grease Monkey Auto Supply Inc.’s multistep income statement. 2. Calculate the gross profit percentage. 3. The gross profit percentage for 2017 was 5

> The account balances for Grease Monkey Auto Supply, Inc., for the year ended December 31, 2018, are presented next in random order: Requirements 1. Prepare Grease Monkey Auto Supply, Inc.’s single-step income statement. 2. Would you r

> Consider the following incomplete table of a merchandiser’s profit data: Requirement 1. Complete the table by computing the missing amounts.

> The following transactions occurred during November 2018 for Specialty T-Shirts, Inc.: Requirement 1. Journalize the November transactions for Specialty T-Shirts, Inc., assuming the “net” method is used. No explanati

> Journalize the following transactions for Luna’s Wholesale, Inc., that occurred during the month of September, assuming the “net” method is used. Luna’s Wholesale, Inc.â€&

> On April 14, 2018, Discount Furniture, Inc., sold $4,200 of inventory (cost is $1,350) on account to one of its customers. The terms were 1/10, n/30, FOB destination. On April 16, Discount Furniture, Inc., paid freight charges of $145 related to the deli

> The Country Carver had sales totaling $14,800 during the month of June. Based on experience, company management expects 7 percent of the sales amount will be refunded to customers in the form of sales returns and allowances. The cost to The Country Carve

> Journalize the following transactions for The Roger’s Computer, Inc., that occurred during the month of December. Assume the “net” method is used.

> This exercise is the first exercise in a sequence that begins an accounting cycle. The cycle is continued in Chapter 2 and completed in Chapter 3. Sensations Salon, Inc., was opened by Sharmaine Crosswhite in her home and completed the following transact

> On September 15, 2018, A.D. Wholesale, Inc. purchased $4,200 of inventory on account from one of its suppliers. The terms were 1/15, n/30, FOB shipping point. On September 17, A.D. Wholesale, Inc., paid freight charges of $150 related to the delivery of

> Whole Foods, Inc., had sales revenue of $560,000, cost of goods sold of $224,000, and net income of $84,000 for the year. An average of 8,000 shares of common stock were outstanding during the year. Requirement 1. Compute Whole Foods, Inc.’s earnings pe

> Use the data for Spark’s Electrical Supply, Inc., from E4-22A. Requirements 1. Prepare Spark’s Electrical Supply, Inc.’s multistep income statement. 2. Calculate the gross profit percentage. 3. The g

> The account balances for Spark’s Electrical Supply, Inc., for the year ended August 31, 2018, are presented next in random order: Requirements 1. Prepare Spark’s Electrical Supply, Inc.’s single-ste

> Consider the following incomplete table of a merchandiser’s profit data: Requirement 1. Complete the table by computing the missing amounts.

> The following transactions occurred during June 2018 for Soulful Art, Inc.: Requirement 1. Journalize the June transactions for Soulful Art, Inc., assuming the net method is used. No explanations are required.

> Journalize the following transactions for Bridgeport Audio, Inc., that occurred during the month of November, assuming the “net” method is used. Bridgeport Audio’s cost of inventory is 55 percent of t

> On July 14, 2018, Salem Food Wholesale, Inc., sold $2,700 of inventory (cost is $1,050) on account to one of its customers. The terms were 2/10, n/30, FOB destination. On July 16, Salem Food Wholesale, Inc., paid freight charges of $115 related to the de

> The Knotty Splinter had sales during the month of June that totaled $5,300. Based on experience, company management expects 8 percent of the sales amount will be refunded to customers in the form of sales returns and allowances. The cost to The Knotty Sp

> Journalize the following transactions for Inland Empire Supply, Inc., that occurred during the month of March. Assume the “net” method is used.

> In this exercise, we will continue the accounting for Sensations Salon, Inc. Assume that on September 30, 2018, Sensations Salon, Inc., borrowed $6,500 from State Bank, signing a nine-month, 71∕2 percent note. The fiscal year end is December 31. Require

> On October 15, 2018, Chandler’s Department Store purchased $3,900 of inventory on account from one of its suppliers. The terms were 2/15, n/45, FOB shipping point. On October 17, Chandler’s Department Store paid freight charges of $140 related to the del

> The Inventory account for Kelly’s Florist, Inc., had a balance of $27,300 at the end of its fiscal year. A physical count taken at year end revealed that the value of inventory on hand amounted to $26,950. Requirements 1. Journalize the adjustment for i

> The following is the adjusted trial balance of Health Services, Inc., for December 31, 2018 Requirement 1. Journalize the closing entries at December 31.

> The following post-closing trial balance was prepared for Speedy Prints, Inc., but some balances were entered in the wrong column. Prepare a corrected post-closing trial balance. Assume all accounts have normal balances and the amounts are correct.

> From the following accounts of Done Right Auto Detail, Inc., prepare the business’s statement of retained earnings for the year ended March 31, 2018.

> Prepare McGinty Electrical’s closing entries using the following selected accounts at June 30, 2018 2. What is McGinty Electrical’s ending Retained Earnings balance at June 30, 2018?

> The adjusted trial balance for Sweet Home Catering, Inc., is presented below. Prepare the income statement and statement of retained earnings for Sweet Home Catering, Inc., for the month ended March 31, 2018. Also, prepare the balance sheet at March 31,

> The adjusted trial balances of Anderson Plating Services, Inc., at December 31, 2018, and December 31, 2019, include these amounts: Analysis of the accounts at December 31, 2019, reveals these transactions for the past 12 months: Purchase of supplies

> Certified Security, Inc., began the year with $35,000 of common stock and $32,400 of retained earnings. On May 5, investors bought $8,000 of additional stock in the business. On August 22, the business purchased land valued at $23,000. The income stateme

> The accountant for Castile Construction, Inc., posted adjusting entries (a) through (e) to the accounts at August 31, 2018. Selected balance sheet accounts and all the revenues and expenses of the entity follow in T-account form. Requirements 1. Explai

> This exercise continues our accounting for Sensations Salon, Inc., from previous chapters. In this exercise, we will account for the annual depreciation expense for Sensations Salon, Inc. In the Continuing Exercise in Chapter 2, we learned that Sensation

> The accounting records of Shamrock, Inc. include the following unadjusted balances at June 30: Accounts Receivable, $1,300; Supplies, $825; Prepaid Insurance, $1,600; Accumulated Depreciation, Equipment, $1,500; Salaries Payable, $0; Unearned Service Rev

> The adjusting entries for the following adjustments were omitted at period-end: a. Prepaid rent expired, $1,250 b. Depreciation, $1,100 c. Employee salaries owed for Monday through Wednesday of a five-day workweek, $4,250 d. Supplies used during the peri

> Calculate the missing amounts for each of the Prepaid Insurance situations. For situation A, journalize the adjusting entry. Consider each situation separately.

> The following is the adjusted trial balance of Inland Home Health, Inc., for December 31, 2018. Requirement 1. Journalize the closing entries at December 31, 2018.

> From the following accounts of Classy Restorations, Inc., prepare the business’s statement of retained earnings for the year ended November 30, 2018:

> 1. Prepare Ramirez Electrical, Inc.’s closing entries using the following selected accounts at November 30, 2018: 2. What is Ramirez Electrical, Inc.’s ending Retained Earnings balance at November 30, 2018?

> The adjusted trial balance for Chef on Demand Catering, Inc., is presented below. Prepare the income statement and statement of retained earnings for Chef on Demand Catering, Inc., for the month ended January 31, 2018. Also prepare a balance sheet at Jan

> The adjusted trial balances of Allied Coatings, Inc., at October 31, 2018, and October 31, 2019, include these amounts: Analysis of the accounts at October 31, 2019, reveals these transactions for the past 12 months: Purchase of supplies â€

> Sentry Alarm, Inc., began the year with $19,000 of common stock and $22,600 of retained earnings. On June 5, investors bought $12,000 of additional stock in the business. On September 22, the business purchased land valued at $65,000. The income statemen

> This exercise continues the Sensations Salon, Inc., exercise begun in Chapter 1. Consider the June transactions for Sensations Salon presented in Chapter 4. (Cost data have been removed from the sale transactions.) Refer to the T-accounts for Sensation

> The accountant for Specialty Painting, Inc., posted adjusting entries (a) through (e) to the accounts at May 31, 2018. Selected balance sheet accounts and all the revenues and expenses of the entity follow in T-account form. Requirements 1. Explain the

> The accounting records of Travel Time, Inc., include the following unadjusted balances at November 30: Accounts Receivable, $900; Supplies, $650; Prepaid Insurance, $2,000; Accumulated Depreciation, Equipment, $2,800; Salaries Payable, $0; Unearned Servi

> The adjusting entries for the following adjustments were omitted at period-end: a. Prepaid rent expired, $1,300 b. Depreciation, $1,000 c. Employee salaries owed for Monday through Wednesday of a five-day workweek, $2,200 d. Supplies used during the peri

> Calculate the missing amounts for each of the following Prepaid Insurance situations. For situation A, journalize the adjusting entry. Consider each situation separately.

> James Cyr has trouble keeping his debits and credits equal. During a recent month, James made the following errors: a. James recorded a $750 rent payment by debiting Rent Expense for $75 and crediting Cash for $75. b. In recording a $300 payment on accou

> McGuire Construction, Inc., completed the following transactions during September 2018, its first month of operations: Requirements 1. Open or set up T-accounts in the ledger for the following accounts: Cash, Accounts Receivable, Supplies, Equipment, F

> Julie Denend started a mobile DJ business named Mobile Music, Inc., on November 1, 2018. In the month of November, before providing services to customers, the business incurred six transactions, which have been posted to the accounts as follows: Requir

> White Glove Cleaning, Inc. had the following transactions for the month of September 2018: The following T-accounts have been set up for White Glove Cleaning, Inc., with their beginning balances as of September 1, 2018: Requirements 1. Journalize the

> The transactions for Inspired Design, Inc., for the month of March 2018 are posted in the following T-accounts: Requirements 1. Calculate account balances at March 31, 2018. 2. Prepare the trial balance for Inspired Design, Inc., at March 31, 2018.

> Rudenko & Associates, Inc., completed the following transactions during July 2018, its first month of operations: Requirement 1. Using the steps outlined in the five-step transaction analysis, journalize the transactions of Rudenko & Associates

> Let’s continue our accounting for Sensations Salon, Inc., from Chapter 3. Starting in June, Sensations Salon, Inc., began selling its own brand of shampoo, which it purchases from a wholesaler. During June, Sensations Salon, Inc., compl

> Using the steps outlined in the five-step transaction analysis, record the following transactions in the general journal for Marx Plumbing, Inc. Explanations are not required.

> Advanced Auto, Inc., made six journal entries during the month of May: Requirement 1. For each transaction shown, determine the accounts affected, the type of account, whether the account increases or decreases, and whether it would be recorded in the

> A client notified you that she just closed a deal to purchase an existing business. It’s a pretty hefty purchase. As part of the purchase of the business, she receives the land, the building, all the equipment, and the entire merchandis

> Imagine you are Bill Conan, the owner of Conan Consultants. It’s the end of the month, and cash flow has been a little slow, as it usually is during this time of the accounting period. It just seems to be a little slower than usual this month. You know t

> You own a business, like the Millers of the Bold City Brewery. Your business is called BCS Consultants, Inc. However, your business does not brew beverages; rather, you help individuals start new businesses. It’s late on a Friday aftern

> Think about operating a business like the Millers did when they created the Bold City Brewery. Your business is called BCS Consultants, Inc. You just received your year-end financial statements from your CPA and you notice one very disturbing item. The n

> Like the Millers of the Bold City Brewery, you own a business. Your business has been doing pretty well since you first opened the doors five years ago. For the past six months or so, you’ve been thinking about expanding the business. Some property avail

> You’re the owner of a business, like the Millers of the Bold City Brewery. You’ve made an appointment to take your year-end financial statements to the bank. You know that your banker is usually concerned about two things: your net income and the amount

> You own a business. You are like the Millers of the Bold City Brewery. You’re pretty excited about your business’s cash balance at the end of the month, because you had planned to take a large bonus. With that bonus you were going to make a down payment

> Jill Conway has trouble keeping her debits and credits equal. During a recent month, Jill made the following errors: a. Jill recorded an $800 rent payment by debiting Rent Expense for $80 and crediting Cash for $80. b. In recording a $250 payment on acco

> Think about owning a business like the Bold City Brewery. It’s the end of the year, and your warehouse manager just finished taking a physical count of the inventory on hand. Because you use the perpetual inventory method with a relatively sophisticated

> You are the owner of a business, like the Millers of the Bold City Brewery. The end of the year is approaching. You’re going to meet with your CPA next week to do some end-of-the-year tax planning. In preparation for that meeting, you review last month’s

> Match the term with its definition by placing the corresponding letter in the space provided: ______ 1. A contra-account, related to accounts receivable, that holds the estimated amount of uncollectible receivables ______ 2. A method of accounting for un

> Prepare the current assets section of the balance sheet as of May 31, 2018, for Spices and More, Inc., using the following information: Accounts Receivable .............................................................................................. $5

> Make the necessary journal entries arising from Greenacres Auto Center’s bank reconciliation, presented next. Date each entry May 31 and include an explanation with each entry.

> Suppose A-1 Sports purchases $83,000 of sportswear on account from Outdoor Wear, Inc., on December 1, 2018. Credit terms are 2/10, n/45. A-1 Sports pays Outdoor Wear, Inc., on December 8, 2018. 1. Journalize the transactions for A-1 Sports on December 1,

> Match the accounting term with the corresponding definition. ____ 1. Accumulated depreciation ____ 2. Adjusted trial balance ____ 3. Adjusting entry ____ 4. Book value ____ 5. Contra-account ____ 6. Depreciation ____ 7. Long-term asset a. An account whos

> Match the accounting term with the corresponding definition. ____ 1. Accrual accounting ____ 2. Matching principle ____ 3. Revenue recognition principle ____ 4. Fiscal year a. Any consecutive 12-month period b. Records the impact of a business event as i

> Allison Supply, Inc., is planning to issue long-term bonds payable to fund a major expansion. For each of the following questions, identify whether the bond price involves a discount, a premium, or par value. a. The stated interest rate on the bonds is 6

> Determine whether the following bonds payable will be issued at par, at a premium, or at a discount: a. The market interest rate is 5 percent. Wilson Corp. issues bonds payable with a stated rate of 61∕2 percent. b. Apex, Inc., issued 61∕2 percent bonds

> Willis Construction, Inc., completed the following transactions during June 2018, its first month of operations: Requirements 1. Open, or set up, T-accounts in the ledger for the following accounts: Cash, Accounts Receivable, Supplies, Equipment, Furn

> McCormack Co. purchased a building and issued a $360,000, 6 percent mortgage note on January 1, 2018. Payments of $13,008 are made semiannually on June 30 and December 31 each year. Record the journal entries for (a) issuance of the note on January 1, 20

> Ling Company issued a $280,000, 4 percent mortgage note on January 1, 2018, to purchase a building. Payments of $8,055 are made semiannually. Complete the following amortization schedule (partial) for Ling Company. Round to the nearest dollar.

> Phatboy Motorcycles, Inc., a motorcycle manufacturer, included the following note in its annual report: Requirements 1. Why are product liability losses considered contingent liabilities? 2. How can a contingent liability become a real liability for Ph

> On April 30, 2018, Dawson Co. borrowed $6,000 on a one-year, 9 percent note payable. What amounts would Dawson Co. report for the note payable and the related interest payable on its balance sheet at July 31, 2018, and on its income statement for the yea

> Wildflower Magazine, Inc., includes the following selected accounts in its general ledger at December 31, 2018: Requirement 1. Prepare the liabilities section of Wildflower Magazine’s balance sheet at December 31, 2018, to show how th

> Identify the section of the balance sheet in which the following accounts would be located: Current Assets (CA), Long-Term Assets (LTA), Current Liabilities (CL), or Long- Term Liabilities (LTL). _______ 1. Bonds Payable (due in 4 years) _______ 2. Inter

> Allied Corp. issued at par 8 percent, five-year bonds payable with a maturity value of $50,000 on May 1, 2018. Assume the fiscal year ends December 31. Journalize the following transactions and include an explanation for each entry. Round calculations to

> Allied Corp. issued 8 percent, five-year bonds payable at a price of $52,420 on January 1, 2018; the bonds have a maturity value of $50,000. Journalize the following transactions for Allied Corp. Include an explanation for each entry. a. Issuance of the

> Allied Corp. issued 8 percent, five-year bonds payable at a price of $48,200 on January 1, 2018; these bonds have a maturity value of $50,000. Journalize the following transactions for Allied Corp. Include an explanation for each entry. a. Issuance of th

> Wilson Corp. issued 6.5 percent, 10-year bonds payable with a maturity value of $30,000 on January 1, 2018. Journalize the following transactions and include an explanation for each entry. The market rate of interest equaled the stated rate at the date o

> Chad Simpson started a mobile DJ business named Sounds on Wheels, Inc., on April 1, 2018. In the month of April, before providing services to customers, the business incurred six transactions, which have been posted to the accounts as follows: Requirem

> On August 31, 2018, Freemont Co. purchased $18,000 of inventory with a one-year, 8 percent note payable. Journalize the following for the company: 1. Accrual of interest expense on December 31, 2018 2. Payment of the note plus interest on August 31, 2019

> On March 31, 2018, Titan Trucking purchased a used Kenworth truck at a cost of $52,000. Titan Trucking expects to drive the truck for five years and to have a residual value of $10,000. Compute Titan Trucking’s depreciation expense on the truck for year