Question: The following questions concern the use of

The following questions concern the use of analytical procedures during an audit. Select the best response.

a. Analytical procedures used in planning an audit should focus on identifying

(1) Material weaknesses in internal control.

(2) The predictability of financial data from individual transactions.

(3) The various assertions that are embodied in the financial statements.

(4) Areas that may represent specific risks relevant to the audit.

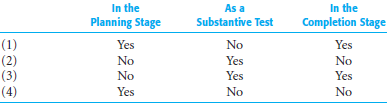

b. For all audits of financial statements made in accordance with auditing standards, the use of analytical procedures is required to some extent

c. Which of the following is least likely to be comparable between similar corporations in the same industry line of business?

(1) Accounts receivable turnover

(2) Earnings per share

(3) Gross profit percent

(4) Return on assets before interest and taxes

d. Which of the following situations has the best chance of being detected when a CPA compares 2011 revenues and expenses with the prior year and investigates all changes exceeding a fixed percent?

(1) An increase in property tax rates has not been recognized in the company's 2011 accrual.

(2) The cashier began lapping accounts receivable in 2011.

(3) Because of worsening economic conditions, the 2011 provision for uncollectible accounts was inadequate.

(4) The company changed its capitalization policy for small tools in 2011.

Transcribed Image Text:

In the Planning Stage In the Completion Stage As a Substantive Test (1) (2) (3) (4) Yes No Yes No Yes No No Yes Yes Yes No No

> Define materiality as it is used in audit reporting. What conditions will affect the auditor's determination of materiality?

> Explain what is meant by determining the degree of correspondence between information and established criteria. What are the information and established criteria for the audit of Jones Company's tax return by an internal revenue agent? What are they for

> Distinguish between a qualified opinion, an adverse opinion, and a disclaimer of opinion, and explain the circumstances under which each is appropriate.

> List the three conditions that require a departure from an unqualified opinion and give one specific example of each of those conditions.

> Distinguish between changes that affect consistency and those that may affect comparability but not consistency. Give an example of each.

> Explain why auditors' reports are important to users of financial statements and why it is desirable to have standard wording.

> Describe what is meant by reports involving the use of other auditors. What are the three options available to the principal auditor and when should each be used?

> In recent years the stock market experienced significant declines, unprecedented since the Great Depression. Why might it be important for you to consider current economic events as part of planning an audit?

> Distinguish between an unqualified report with an explanatory paragraph or modified wording and a qualified report. Give examples when an explanatory paragraph or modified wording should be used in an unqualified opinion.

> What type of opinion should an auditor issue when the financial statements are not in accordance with GAAP because such adherence would result in misleading statements?

> Describe the information included in the introductory, scope, and opinion paragraphs in a separate audit report on the effectiveness of internal control over financial reporting. What is the nature of the additional paragraphs in the audit report?

> What five circumstances are required for a standard unqualified report to be issued?

> What are the purposes of the opinion paragraph in the auditor's report? Identify the most important information included in the opinion paragraph.

> Explain the relationships among audit services, attestation services, and assurance services, and give examples of each.

> What are the purposes of the scope paragraph in the auditor's report? Identify the most important information included in the scope paragraph.

> List the seven parts of a standard unqualified audit report and explain the meaning of each part. How do the parts compare with those found in a qualified report?

> The U.S. Securities and Exchange Commission (SEC) is an independent, nonpartisan, quasi-judicial regulatory agency with responsibility for administering the federal securities laws. Publicly traded companies must electronically file a variety of forms or

> For each engagement described below, indicate whether the engagement is likely to be conducted under international auditing standards, U.S. generally accepted auditing standards, or PCAOB auditing standards. a. An audit of a U.S. private company with no

> Which types of loans to executives are permitted by the Sarbanes- Oxley Act?

> Ray, the owner of a small company, asked Holmes, a CPA, to conduct an audit of the company's records. Ray told Holmes that an audit was to be completed in time to submit audited financial statements to a bank as part of a loan application. Holmes immedia

> The Howard Mobile Home Manufacturing Company is audited by Olson and Riley, CPAs. Howard Mobile Home has decided to issue stock to the public and wants Olson and Riley to perform all the audit work necessary to satisfy the requirements for filing with th

> For each of the following procedures taken from the quality control manual of a CPA firm, identify the applicable element of quality control from Table 2-4. .:. a. Appropriate accounting and auditing research requires adequate technical reference materi

> The following questions concern quality control standards. Choose the best response. a. A CPA firm is reasonably assured of meeting its responsibility to provide services that conform with professional standards by (1) Adhering to generally accepted aud

> State what is meant by the term peer review. What are the implications of peer review for the profession?

> Describe the role of International Standards on Auditing. What is the relationship between International Standards on Auditing and U.S. Generally Accepted Auditing Standards?

> Distinguish among the following three risks: risk-free interest rate, business risk, and information risk. Which one or ones does the auditor reduce by per-forming an audit?

> Generally accepted auditing standards have been criticized by different sources for failing to provide useful guidelines for conducting an audit. The critics believe the standards should be more specific to enable practitioners to improve the quality of

> The first standard of field work requires the performance of the audit by a person or persons having adequate technical training and proficiency as an auditor. What are the various ways in which auditors can fulfill the requirement of the standard?

> Distinguish between generally accepted auditing standards and generally accepted accounting principles, and give two examples of each.

> Define what is meant by a related party. What are the auditor's responsibilities for related parties and related party transactions?

> Who is responsible for establishing auditing standards for audits of U.S. public companies? Who is responsible for establishing auditing standards for U.S. private companies? Explain.

> What roles are played by the American Institute of Certified Public Accountants for its members?

> Describe the role of the SEC in society and discuss its relationship with and influence on the practice of auditing.

> State the four major types of services CPAs perform, and explain each.

> This problem requires the use of ACL software, which is included in the CD attached to the text. Information about installing and using ACL and solving this problem can be found in Appendix. You should read all of the reference material preceding instruc

> Dave Czarnecki is the managing partner of Czarnecki and Hogan, a medium-sized local CPA firm located outside of Chicago. Over lunch, he is surprised when his friend James Foley asks him, "Doesn't it bother you that your clients don't look forward to seei

> Winston Black was an audit partner in the firm of Henson, Davis & Company. He was in the process of reviewing the audit files for the audit of a new client, McMullan Resources. McMullan was in the business of heavy construction. Black was conducting his

> The Internet has dramatically increased global e-commerce activities. Both traditional "brick and mortar" businesses and new dot-com businesses use the Internet to meet business objectives. For example, eBay successfully offers online auctions as well as

> Following are the auditor's calculations of several key ratios for Cragston Star Products. The primary purpose of this information is to understand the client's business and assess the risk of financial failure, but any other relevant conclusions are als

> As part of the analytical procedures of Mahogany Products, Inc., you perform calculations of the following ratios: For each of the preceding ratios: Required a. State whether there is a need to investigate the results further and, if so, the reason for

> An auditor often tries to acquire background knowledge of the client's industry as an aid to audit work. How does the acquisition of this knowledge aid the auditor in distinguishing between obsolete and current inventory?

> In the audit of the Worldwide Wholesale Company, you did extensive ratio and trend analysis. No material exceptions were discovered except for the following: 1. Commission expense as a percent of sales has stayed constant for several years but has increa

> Your comparison of the gross margin percent for Jones Drugs for the years 2008 through 2011 indicates a significant decline. This is shown by the following information: A discussion with Marilyn Adams, the controller, brings to light two possible explana

> Analytical procedures are an important part of the audit process and consist of the evaluation of financial information by the study of plausible relationships among financial and nonfinancial data. Analytical procedures may be done during planning, as a

> The minutes of the board of directors of the Tetonic Metals Company for the year ended December 31, 2011, were provided to you. Meeting of March 5, 2011 The meeting of the board of directors of Tetonic Metals was called to order by the James Cook, chairm

> In your audit of Canyon Outdoor Provision Company's financial statements, the following transactions came to your attention: 1. Canyon Outdoor's operating lease for its main store is with York Properties, which is a real estate investment firm owned by T

> In the normal course of performing their responsibilities, auditors often conduct audits or reviews of the following: 1. Federal income tax returns of an officer of the corporation to determine whether he or she has included all taxable income in his or

> The following are various activities an auditor does during audit planning. 1. Send an engagement letter to the client. 2. Tour the client's plant and offices. 3. Compare key ratios for the company to industry competitors. 4. Review management's risk man

> The following questions concern the planning of the engagement. Select the best response. a. Which of the following is an effective audit planning procedure that helps prevent misunderstandings and inefficient use of audit personnel? (1) Arrange to make

> When a CPA has accepted an engagement from a new client who is a manufacturer, it is customary for the CPA to tour the client's plant facilities. Discuss the ways in which the CPA's observations made during the course of the plant tour will be of help in

> Name the four categories of financial ratios and give an example of a ratio in each category. What is the primary information provided by each financial ratio category?

> At the completion of every audit, Roger Morris, CPA, calculates a large number of ratios and trends for comparison with industry averages and prior-year calculations. He believes the calculations are worth the relatively small cost of doing them because

> Gale Gordon, CPA, has found ratio and trend analysis relatively useless as a tool in conducting audits. For several engagements, he computed the industry ratios included in publications by Standard and Poor's and compared them with industry standards. Fo

> When are analytical procedures required on an audit? What is the primary purpose of analytical procedures during the completion phase of the audit?

> What are the purposes of preliminary analytical procedures? What types of comparisons are useful when performing preliminary analytical procedures?

> Describe top management controls and their relation to client business risk. Give examples of effective management and governance controls.

> Define client business risk and describe several sources of client business risk. What is the auditor's primary concern when evaluating client business risk?

> Five college seniors with majors in accounting are discussing alternative career plans. The first senior plans to become an internal revenue agent because his primary interest is income taxes. He believes the background in tax auditing will provide him w

> A common type of lawsuit against CPAs is for the failure to detect a fraud. State the auditor's responsibility for such discovery. Give authoritative support for your answer.

> Discuss why many CPA firms have willingly settled lawsuits out of court. What are the implications to the profession?

> Distinguish between "fraud" and "constructive fraud."

> How does the prudent person concept affect the liability of the auditor?

> Distinguish between business failure and audit risk. Why is business failure a concern to auditors?

> Lawsuits against CPA firms continue to increase. State your opinion of the positive and negative effects of the increased litigation on CPAs and on society as a whole.

> The SEC Enforcement Division investigates possible violations of securities laws, recommends SEC action when appropriate, either in a federal court or before an administrative law judge, and negotiates settlements. Litigation Releases, which are descript

> Frank Dorrance, a senior audit manager for Bright and Lorren, CPAs, has recently been informed that the firm plans to promote him to partner within the next year or two if he continues to perform at the same high-quality level as in the past. Frank excel

> In 2006, Arnold Diaz was a bright, upcoming audit manager in the South Florida office of a national public accounting firm. He was an excellent technician and a good "people person." Arnold also was able to bring new business into the firm as the result

> Barbara Whitley had great expectations about her future as she sat in her graduation ceremony in May 2010. She was about to receive her Master of Accountancy degree, and next week she would begin her career on the audit staff of Green, Thresher & Co., CP

> Discuss the major factors in today's society that have made the need for independent audits much greater than it was 50 years ago.

> List five examples of specific operational audits that can be conducted by an internal auditor in a manufacturing company.

> The following are situations that may violate the Code of Professional Conduct. Assume, in each case, that the CPA is a partner. 1. Contel, CPA, advertises in the local paper that his firm does the audit of 14 of the 36 largest community banks in the sta

> Ann Archer serves on the audit committee of JKB Communications, Inc., a telecommunications start-up company. The company is currently a private company. One of the audit committee's responsibilities is to evaluate the external auditor's independence in p

> Marie Janes encounters the following situations in doing the audit of a large auto dealership. Janes is not a partner. 1. The sales manager tells her that there is a sale (at a substantial discount) on new cars that is limited to long-established custome

> The national stock exchanges require listed companies to have an independent audit committee. Required a. Describe an audit committee. b. What are the typical functions performed by an audit committee? c. Explain how an audit committee can help an audit

> Each of the following situations involves possible violations of the AICPA's Code of Professional Conduct. For each situation, state whether it is a violation of the Code. In those cases in which it is a violation, explain the nature of the violation and

> Each of the following situations involves a possible violation of the AICPA's Code of Professional Conduct. For each situation, state the applicable section of the rules of conduct and whether it is a violation. a. Emrich, CPA, provides tax services, man

> The following situations involve the provision of nonaudit services. Indicate whether providing the service is a violation of AICPA rules or SEC rules including Sarbanes-Oxley requirements on independence. Explain your answer as necessary. a. Providing b

> State the allowable forms of organization a CPA firm may assume.

> What is the purpose of the AICPA's Code of Professional Conduct restriction on commissions as stated in Rule 503?

> What is the purpose of the client's performance measurement system? How might that system be useful to the auditor? Give examples of key performance indicators for the following businesses: (1) A chain of retail clothing stores; (2) An Internet portal;

> Explain why auditors need an understanding of the client's industry. What information sources are commonly used by auditors to learn about the client's industry?

> What is the purpose of an engagement letter? What subjects should be covered in such a letter?

> What factors should an auditor consider prior to accepting an engagement? Explain.

> What are the responsibilities of the successor and predecessor auditors when a company is changing auditors?

> Identify the eight major steps in planning audits.

> Planning is one of the most demanding and important aspects of an audit. A carefully planned audit increases auditor efficiency and provides greater assurance that the audit team addresses the critical issues. Auditors prepare audit planning documents th

> This problem requires the use of ACL software, which is included in the CD attached to the text. Information about installing and using ACL and solving this problem can be found in Appendix, pages 838-842. You should read all of the reference material pr

> The long-term debt schedule on page 207 (indexed K-1) was prepared by client personnel and audited by AA, an audit assistant, during the calendar year 2011 audit of American Widgets, Inc., a continuing audit client. The engagement supervisor is reviewing

> Grande Stores is a large discount catalog department store chain. The company has recently expanded from 6 to 43 stores by borrowing from several large financial institutions and from a public offering of common stock. A recent investigation has disclose

> You are the in-charge on the audit of Vandervoort Company and are to review the audit schedule shown above. Required a. List the deficiencies in the audit schedule. b. For each deficiency, state how the audit schedule could be improved. c. Prepare an imp

> Analytical procedures consist of evaluations of financial information made by a study of plausible relationships among both financial and nonfinancial data. They range from simple comparisons to the use of complex models involving many relationships and

> Consumers Union is a nonprofit organization that provides information and counsel on consumer goods and services. A major part of its function is the testing of different brands of consumer products that are purchased on the open market and then the repo

> Following are 10 audit procedures with words missing and a list of several terms commonly used in audit procedures. Audit Procedures 1. _____ the unit selling price times quantity on the duplicate sales invoice and compare the total to the amount on the

> The following are nine situations, each containing two means of accumulating evidence: 1. Confirm receivables with consumers versus confirming accounts receivable with business organizations. 2. Physically examine 3-inch steel plates versus examining ele

> The following audit procedures were performed in the audit of inventory to satisfy specific balance-related audit objectives as discussed in Chapter 6. The audit procedures assume that the auditor has obtained the inventory count sheets that list the cli

> The following are various audit procedures performed to satisfy specific transaction-related audit objectives as discussed in Chapter 6. The general transaction-related audit objectives from Chapter 6 are also included. Audit Procedures 1. Trace from re

> As auditor of the Star Manufacturing Company, you have obtained a. A trial balance taken from the books of Star one month before year-end: Dr. (Cr.) Cash in bank â€&brv

> Eight different types of evidence were discussed. The following questions concern the reliability of that evidence: Required a. Explain why confirmations are normally more reliable evidence than inquiries of the client. b. Describe a situation in which

> List two examples of audit evidence the auditor can use in support of each of the following: a. Recorded amount of entries in the acquisitions journal b. Physical existence of inventory c. Accuracy of accounts receivable d. Ownership of fixed assets e. L

> The following are examples of audit procedures: 1. Review the accounts receivable with the credit manager to evaluate their collectibility. 2. Compare a duplicate sales invoice with the sales journal for customer name and amount. 3. Add the sales journal